Fill a Valid 5020 California Form

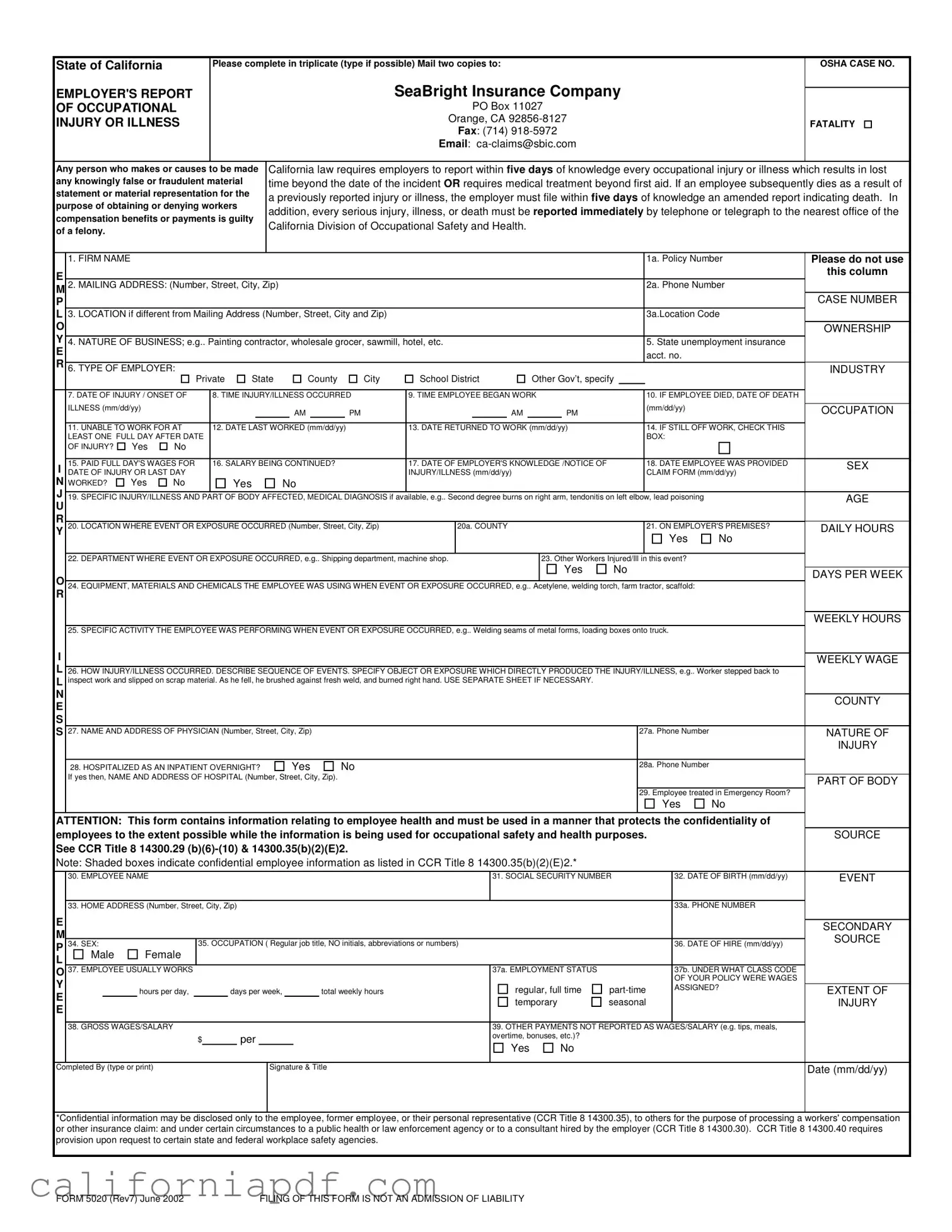

In the State of California, the Employer's Report of Occupational Injury or Illness, known as Form 5020, plays a pivotal role in the landscape of workplace health and safety. This document, which employers are required to complete in triplicate, marks the initial step in formally reporting an injury or illness that occurs in the workplace, ensuring that the matter is officially documented and addressed. Employers must swiftly report, within five working days of gaining knowledge, any occupational injury or illness leading to lost time beyond the day of the incident or requiring medical treatment beyond first aid. An amended report must be filed promptly if an injury or illness leads to death. Moreover, the urgency of reporting escalates for serious injuries, illnesses, or deaths, which must be communicated immediately by phone or telegram to the nearest office of the California Division of Occupational Safety and Health (DOSH). Form 5020 covers a wide array of details, from the basic identifying information of the business and employee involved, to the specific nature and circumstances of the injury or illness, including whether it resulted in fatality, the location and description of the incident, and any medical attention required or received. Significantly, submitting this form does not constitute an admission of liability by the employer, but it is a crucial component in the process of accessing workers' compensation benefits and adhering to state laws designed to protect workers.

Document Example

State of California

EMPLOYER'S REPORT OF OCCUPATIONAL INJURY OR ILLNESS

Please complete in triplicate (type if possible) Mail two copies to:

SeaBright Insurance Company

PO Box 11027

Orange, CA

Fax: (714)

Email:

OSHA CASE NO.

FATALITY

Any person who makes or causes to be made any knowingly false or fraudulent material statement or material representation for the purpose of obtaining or denying workers compensation benefits or payments is guilty of a felony.

California law requires employers to report within five days of knowledge every occupational injury or illness which results in lost time beyond the date of the incident OR requires medical treatment beyond first aid. If an employee subsequently dies as a result of a previously reported injury or illness, the employer must file within five days of knowledge an amended report indicating death. In addition, every serious injury, illness, or death must be reported immediately by telephone or telegraph to the nearest office of the California Division of Occupational Safety and Health.

|

|

1. FIRM NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a. Policy Number |

Please do not use |

||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this column |

|

2. MAILING ADDRESS: (Number, Street, City, Zip) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a. Phone Number |

|

|||||||||

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASE NUMBER |

L |

3. LOCATION if different from Mailing Address (Number, Street, City and Zip) |

|

|

|

|

|

|

|

|

|

3a.Location Code |

|

||||||||||||||

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNERSHIP |

|

Y |

|

4. NATURE OF BUSINESS; e.g.. Painting contractor, wholesale grocer, sawmill, hotel, etc. |

|

|

|

|

|

5. State unemployment insurance |

|

|||||||||||||||||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

acct. no. |

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. TYPE OF EMPLOYER: |

Private |

State |

|

County |

City |

School District |

Other Gov’t, specify |

|

|

INDUSTRY |

|||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

7. DATE OF INJURY / ONSET OF |

|

8. TIME INJURY/ILLNESS OCCURRED |

9. TIME EMPLOYEE BEGAN WORK |

|

|

10. IF EMPLOYEE DIED, DATE OF DEATH |

|

|||||||||||||||||

|

|

ILLNESS (mm/dd/yy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yy) |

|

|

|

|

|

|

|

|

|

|

|

|

AM |

|

|

PM |

|

|

|

AM |

|

|

PM |

|

|

|

|

OCCUPATION |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

11. UNABLE TO WORK FOR AT |

|

12. DATE LAST WORKED (mm/dd/yy) |

|

13. DATE RETURNED TO WORK (mm/dd/yy) |

|

|

14. IF STILL OFF WORK, CHECK THIS |

|

||||||||||||||||

|

|

LEAST ONE FULL DAY AFTER DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOX: |

|

|

|

|||

|

|

OF INJURY? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

I |

15. PAID FULL DAY'S WAGES FOR |

|

16. SALARY BEING CONTINUED? |

|

17. DATE OF EMPLOYER'S KNOWLEDGE /NOTICE OF |

|

|

18. DATE EMPLOYEE WAS PROVIDED |

SEX |

|||||||||||||||||

DATE OF INJURY OR LAST DAY |

|

|

|

|

|

|

|

|

|

INJURY/ILLNESS (mm/dd/yy) |

|

|

|

|

|

CLAIM FORM (mm/dd/yy) |

|

|||||||||

N |

WORKED? |

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

J |

|

19. SPECIFIC INJURY/ILLNESS AND PART OF BODY AFFECTED, MEDICAL DIAGNOSIS if available, e.g.. Second degree burns on right arm, tendonitis on left elbow, lead poisoning |

|

|

AGE |

|||||||||||||||||||||

U |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

20. LOCATION WHERE EVENT OR EXPOSURE OCCURRED (Number, Street, City, Zip) |

|

20a. COUNTY |

|

|

|

|

|

21. ON EMPLOYER'S PREMISES? |

DAILY HOURS |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

22. DEPARTMENT WHERE EVENT OR EXPOSURE OCCURRED, e.g.. Shipping department, machine shop. |

|

23. Other Workers Injured/Ill in this event? |

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

||

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYS PER WEEK |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

24. EQUIPMENT, MATERIALS AND CHEMICALS THE EMPLOYEE WAS USING WHEN EVENT OR EXPOSURE OCCURRED, e.g.. Acetylene, welding torch, farm tractor, scaffold: |

|

|

|

||||||||||||||||||||||

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEEKLY HOURS

25. SPECIFIC ACTIVITY THE EMPLOYEE WAS PERFORMING WHEN EVENT OR EXPOSURE OCCURRED, e.g.. Welding seams of metal forms, loading boxes onto truck.

I |

WEEKLY WAGE |

|

L26. HOW INJURY/ILLNESS OCCURRED. DESCRIBE SEQUENCE OF EVENTS. SPECIFY OBJECT OR EXPOSURE WHICH DIRECTLY PRODUCED THE INJURY/ILLNESS, e.g.. Worker stepped back to L inspect work and slipped on scrap material. As he fell, he brushed against fresh weld, and burned right hand. USE SEPARATE SHEET IF NECESSARY.

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTY |

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S 27. NAME AND ADDRESS OF PHYSICIAN (Number, Street, City, Zip) |

|

|

|

|

|

|

|

|

27a. Phone Number |

|

|

|

NATURE OF |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INJURY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

28. HOSPITALIZED AS AN INPATIENT OVERNIGHT? |

|

|

Yes |

|

|

No |

|

|

|

|

|

28a. Phone Number |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

If yes then, NAME AND ADDRESS OF HOSPITAL (Number, Street, City, Zip). |

|

|

|

|

|

|

|

|

|

|

|

PART OF BODY |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. Employee treated in Emergency Room? |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

ATTENTION: This form contains information relating to employee health and must be used in a manner that protects the confidentiality of |

|

|

|||||||||||||||||||||||||||

employees to the extent possible while the information is being used for occupational safety and health purposes. |

|

|

|

|

|

SOURCE |

|||||||||||||||||||||||

See CCR Title 8 14300.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Note: Shaded boxes indicate confidential employee information as listed in CCR Title 8 14300.35(b)(2)(E)2.* |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

30. EMPLOYEE NAME |

|

|

|

|

|

|

|

|

|

|

|

|

31. SOCIAL SECURITY NUMBER |

|

|

32. DATE OF BIRTH (mm/dd/yy) |

|

EVENT |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

33. HOME ADDRESS (Number, Street, City, Zip) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33a. PHONE NUMBER |

|

|

|||||||||||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECONDARY |

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOURCE |

|

P |

34. SEX: |

Female |

35. OCCUPATION ( Regular job title, NO initials, abbreviations or numbers) |

|

|

|

|

|

|

|

36. DATE OF HIRE (mm/dd/yy) |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

L |

|

Male |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

37. EMPLOYEE USUALLY WORKS |

|

|

|

|

|

|

|

|

|

|

|

|

37a. EMPLOYMENT STATUS |

|

|

|

|

|

37b. UNDER WHAT CLASS CODE |

|

|

|||||||

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OF YOUR POLICY WERE WAGES |

|

|

||

|

|

|

hours per day, |

|

|

days per week, |

total weekly hours |

regular, full time |

|

ASSIGNED? |

|

EXTENT OF |

|||||||||||||||||

E |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

temporary |

|

seasonal |

|

|

|

|

|

INJURY |

||||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

38. GROSS WAGES/SALARY |

|

|

|

|

|

|

|

|

|

|

|

|

39. OTHER PAYMENTS NOT REPORTED AS WAGES/SALARY (e.g. tips, meals, |

|

|

|||||||||||||

|

|

|

|

|

|

$ |

|

per |

|

|

|

|

|

|

|

overtime, bonuses, etc.)? |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Completed By (type or print) |

|

|

|

|

|

Signature & Title |

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yy) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Confidential information may be disclosed only to the employee, former employee, or their personal representative (CCR Title 8 14300.35), to others for the purpose of processing a workers' compensation or other insurance claim: and under certain circumstances to a public health or law enforcement agency or to a consultant hired by the employer (CCR Title 8 14300.30). CCR Title 8 14300.40 requires provision upon request to certain state and federal workplace safety agencies.

FORM 5020 (Rev7) June 2002 |

FILING OF THIS FORM IS NOT AN ADMISSION OF LIABILITY |

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | To report occupational injuries or illnesses in California. |

| Submission Requirement | Employers must complete the form and mail two copies to SeaBright Insurance Company or submit via fax or email. |

| Reporting Timeframe | Must be reported within five days of employer's knowledge of the injury or illness. |

| Immediate Reporting | Serious injuries, illnesses, or deaths must be reported immediately by telephone or telegraph to the nearest office of the California Division of Occupational Safety and Health (DOSH). |

| Legal Consequences | Making a knowingly false or fraudulent statement for workers' compensation benefits is a felony. |

| Confidential Information | Contains employee health information that must be used in a way that protects confidentiality while being used for safety and health purposes. |

| Governing Law | California Code of Regulations (CCR) Title 8, Sections 14300.29(b)(6)-(10), 14300.35(b)(2)(E)2, and 14300.40 |

| Form Identification | State of California Employer's Report of Occupational Injury or Illness, Form 5020 (Rev7) June 2002 |

| Disclosure Rules | Confidential information may be disclosed under specific circumstances, including to process a workers' compensation claim, to certain health or law enforcement agencies, or a consultant hired by the employer per CCR Title 8 14300.35 and 14300.30. |

How to Write 5020 California

Filling out the 5020 California form correctly is essential for employers to comply with state requirements following an occupational injury or illness. This detailed report, submitted to SeaBright Insurance Company, is a crucial part of the process for managing workers' compensation benefits and payments. The instructions below are meant to guide you through each step of the form, ensuring that all necessary information is accurately provided to facilitate the handling of your case.

- Enter the FIRM NAME in the designated space.

- Provide the policy number in the field marked "1a. Policy Number".

- Fill in the MAILing ADDRESS, including the street number, city, and ZIP code.

- Add the phone number next to the mailing address in "2a. Phone Number".

- For a different location from the mailing address, enter the details in the "LOCATION" section.

- Specify the NATURE OF BUSINESS, like "Painting contractor" or "Wholesale grocer".

- Enter the State unemployment insurance account number in the appropriate field.

- Indicate the TYPE OF EMPLOYER by selecting the appropriate option.

- Fill in the DATE OF INJURY / ONSET OF ILLNESS and the TIME INJURY/ILLNESS OCCURRED, using the formats MM/DD/YY and AM/PM.

- State the TIME EMPLOYEE BEGAN WORK on the day of the incident.

- If applicable, input the DATE OF DEATH for cases where the employee passed away due to the injury or illness.

- Answer whether the employee was UNABLE TO WORK FOR AT LEAST ONE FULL DAY AFTER DATE OF INJURY by checking "Yes" or "No".

- Provide the DATE LAST WORKED, DATE RETURNED TO WORK, or check the box if the employee is STILL OFF WORK.

- State if the employee was PAID FULL DAY'S WAGES FOR DATE OF INJURY or if the SALARY IS BEING CONTINUED.

- Document the DATE OF EMPLOYER'S KNOWLEDGE/NOTICE OF INJURY/ILLNESS and the DATE EMPLOYEE WAS PROVIDED CLAIM FORM.

- Describe the SPECIFIC INJURY/ILLNESS AND PART OF BODY AFFECTED, with a medical diagnosis if available.

- Specify the LOCATION WHERE EVENT OR EXPOSURE OCCURRED, including the county, and if it was on the employer's premises.

- Input details about the DEPARTMENT WHERE EVENT OR EXPOSURE OCCURRED and if OTHER WORKERS were injured or ill in this event.

- List the EQUIPMENT, MATERIALS, AND CHEMICALS the employee was using at the time of the event or exposure.

- Clarify the SPECIFIC ACTIVITY the employee was performing and explain HOW INJURY/ILLNESS OCCURRED, providing a clear sequence of events.

- Include the NAME AND ADDRESS OF PHYSICIAN and hospital information if the employee was hospitalized overnight.

- Complete the section with the EMPLOYEE'S PERSONAL INFORMATION, including name, social security number, date of birth, home address, phone number, gender, occupation, date of hire, work schedule, employment status, class code under which wages were assigned, gross wages/salary, other payments, and weekly hours.

- Finally, the form must be completed by (type or print), include the signature & title of the person completing the form, and state the date it was filled out.

Once the form is fully completed, make sure to mail two copies to SeaBright Insurance Company or send via fax or email, as provided at the top of the form. Remember, submitting this form is part of fulfilling legal obligations and is not an admission of liability.

Listed Questions and Answers

What is the purpose of the California Form 5020?

The California Form 5020, or Employer's Report of Occupational Injury or Illness, is designed for employers to report work-related injuries or illnesses of their employees. The information helps with the management of workers' compensation claims. Reporting is mandatory for any occupational injury or illness resulting in lost time beyond the date of the incident or requiring medical treatment beyond first aid. Additionally, if an injury or illness leads to death, an amended report must be filed.

How soon must an employer file Form 5020 after learning about an injury or illness?

Employers are required to complete and submit Form 5020 within five days of becoming aware of an occupational injury or illness that results in lost time from work (beyond the incident day) or requires more than first aid treatment.

Where should Form 5020 be submitted?

Two copies of the completed Form 5020 should be mailed to SeaBright Insurance Company at PO Box 11027, Orange, CA 92856-8127. Alternatively, it can be faxed to (714) 918-5972 or emailed to ca-claims@sbic.com.

Is it obligatory to report every injury or just specific cases?

California law mandates the reporting of every occupational injury or illness that necessitates medical treatment beyond first aid or results in missing work beyond the day of the incident. Furthermore, any serious injury, illness, or death must be immediately reported by telephone or telegraph to the nearest office of the California Division of Occupational Safety and Health (DOSH).

Are there penalties for not reporting or late reporting?

Yes, failure to report an occupational injury or illness within the specified timeframe can result in penalties. Employers are obligated to follow these requirements strictly to avoid legal repercussions and potential fines. What should be included in the description of the injury or illness?

The description should include the nature of the injury or illness, the part of the body affected, and, if available, a medical diagnosis. Examples given in the form include "Second-degree burns on right arm," "tendonitis on left elbow," and "lead poisoning."

What information is considered confidential on Form 5020?

Certain information on Form 5020 is deemed confidential, primarily relating to the employee's personal health details. These include, but may not be limited to, the employee's name, social security number, and any medical diagnosis. Confidential information is protected by law and must be handled accordingly.

Can Form 5020 be used for any employment sector?

Yes, Form 5020 is applicable across various employment sectors, including private businesses, state and local government entities, and educational institutions. The form includes options to specify the type of employer, such as private, state, county, city, school district, or other government bodies.

What if the employee was not hospitalized but only treated in an emergency room?

The form asks whether the employee was treated in an emergency room and/or hospitalized as an inpatient overnight. Each scenario must be accurately reported. If the employee received treatment in an emergency room without admission to the hospital, only the relevant section should be completed accordingly.

Is filing Form 5020 considered an admission of liability?

No, filing a Form 5020 is not considered an admission of liability by the employer. It is a procedural requirement to document the occurrence of an occupational injury or illness, and it does not imply that the employer is at fault for the incident.

Common mistakes

Filling out the Form 5020 in California, the Employer's Report of Occupational Injury or Illness, is a crucial step in the workers' compensation process. However, this document can often be mishandled due to several common mistakes. Here are 10 such errors:

- Not reporting in a timely manner: California law mandates that employers report any occupational injury or illness that results in lost time beyond the day of the incident or requires medical treatment beyond first aid within five days.

- Leaving sections blank: Every field in the form should be completed to ensure all necessary details are provided. Missing information can delay the processing of the claim.

- Failure to provide detailed descriptions: Specifically, in the section asking for the "nature of injury/illness" and how the injury/illness occurred. Vague descriptions can complicate the claim.

- Incorrectly identifying the location of the incident: It’s important to specify whether the injury occurred on the employer's premises and to accurately describe the location where the event or exposure happened.

- Misclassification of the employee’s status: Accurately stating whether an employee is full-time, part-time, temporary, or seasonal is essential for the proper handling of their claim.

- Omitting secondary sources of income: All forms of compensation, including tips, meals, overtime, and bonuses, must be reported accurately.

- Using abbreviations or jargon: The form should be filled out in clear, straightforward language that can be understood by all parties involved in processing the claim.

- Forgetting to report all workers injured or ill in the event: If multiple employees are affected, each should be mentioned according to the guidelines specified in the form.

- Failing to update the form if the employee’s condition changes: For instance, if an injury results in death, an amended report indicating the death must be filed within five days of knowledge.

- Not double-checking information for accuracy: Before submitting, review all entries to ensure they are correct and the information provided is consistent.

Avoiding these mistakes not only helps in the timely and efficient processing of workers' compensation claims but also ensures compliance with California’s legal requirements. Keeping clear, detailed records and promptly updating any changes in the employee's status or condition are key practices for responsible reporting.

Documents used along the form

When managing workplace injuries or illnesses in California, the employer's completion of Form 5020 is just the starting point for a more comprehensive process. This document, serving as the Employer's Report of Occupational Injury or Illness, triggers a sequence of actions including further documentation and potential claims processing. Similarly, several other forms and documents are commonly utilized alongside Form 5020 to ensure thorough handling of such events, providing additional details or facilitating various procedural requirements.

- DWC 1 Claim Form: This document is essential for initiating a worker's compensation claim. After an incident is reported via Form 5020, the injured or ill employee uses the DWC 1 form to formally request workers’ compensation benefits. It details the nature and extent of the injury or illness, serving as a formal claim submission to the employer's insurance carrier.

- Doctor's First Report of Occupational Injury or Illness (Form 5021): Upon treating an employee for a workplace injury or illness, the attending physician completes this form. It provides a medical evaluation of the injury or illness, including diagnosis and recommendations for treatment or restrictions at work. This documentation is crucial for the workers' compensation process, both for validating claims and for guiding return-to-work plans.

- Employer’s Wage Statement (Form DE 1870): For determining benefit entitlements under workers' compensation, this form captures detailed information on the injured or ill employee’s earnings. It includes data on wages, allowances, and other payments, which are critical for accurately calculating workers' compensation benefits.

- Notice of Potential Eligibility (e3301): This form is an informational document that employers must provide to employees upon knowledge of a workplace injury or illness. It outlines the employee's potential eligibility for workers' compensation benefits, including medical treatment, disability indemnity, and return-to-work support.

- Cal/OSha Form 300 (Log of Work-Related Injuries and Illnesses): While not always submitted with Form 5020, this log is a crucial document for tracking and analyzing workplace injuries and illnesses over time. Employers use it to record specific details about each incident, helping to identify patterns that might indicate a need for intervention in workplace safety practices.

In concert, these documents form a comprehensive framework for addressing workplace injuries and illnesses. Each plays a unique role in the process, from the initial reporting and claim filing to medical evaluation, benefits calculation, and regulatory compliance. Ensuring these documents are accurately completed and properly managed is essential for protecting the rights and well-being of employees while meeting the employer's legal obligations.

Similar forms

The OSHA Form 300, "Log of Work-Related Injuries and Illnesses," shares striking similarities with the California Form 5020 in terms of its fundamental purpose. Both documents are pivotal for recording and reporting work-related injuries or illnesses. The Form 300 serves as a comprehensive log, providing a year-long account of every reportable workplace injury or illness within a company. Similar to Form 5020, it captures details such as the nature of the injury/illness, where the event occurred, and the outcome for the employee involved. Employers use it to identify hazardous areas or operations and to improve workplace safety measures, aligning closely with the objectives behind the 5020 Form’s detailed reporting requirements.

The First Report of Injury or Illness forms that states other than California use bear resemblance to California's Form 5020 in their purpose and content. While each state has its own specific form and number (e.g., Form IA-1 in Iowa), the overarching goal is to document and notify the relevant state department and worker's compensation insurance carriers about a workplace injury or illness. These forms typically require information about the employer, the injured/ill employee, and details regarding the injury or illness, closely mirroring the 5020 form's structure and type of data collected.

Form DWC-1, "Workers' Compensation Claim Form," acts as a complementary document to the 5020, primarily from the employee's perspective. Though its primary function is for employees to officially claim workers' compensation benefits, it demands similar information about the injury or illness—such as the date of injury, nature of the injury, and parts of the body affected. The 5020 Form and DWC-1 together ensure both employee and employer fulfill their respective reporting obligations under California workers' compensation laws, promoting an efficient and transparent claims process.

The Employer’s Quarterly Federal Tax Return, or Form 941, while primarily a tax document, intersects with Form 5020 in its concern with payroll and employee numbers. Form 941 doesn't capture information on workplace injuries directly but is essential for validating employment and wage data, which can be crucial during workers' compensation claim investigations. The correlation between these documents underscores the broader spectrum of employer responsibilities in managing employee welfare and regulatory compliance.

OSHA Form 301, "Injury and Illness Incident Report," serves as an in-depth companion to OSHA Form 300, much like Form 5020, by providing detailed information on individual injury or illness cases. Employers must fill out a Form 301 or an equivalent document (like Form 5020 when fulfilling California state requirements) for each occupational injury or illness recorded on their OSHA Form 300. This document captures specific details about what happened and how it happened, aiming to identify ways to prevent future incidents, reflecting a closely aligned purpose with that of Form 5020.

The US Department of Labor's Form LS-202, "Employer’s First Report of Injury or Occupational Illness," is used under the Longshore and Harbor Workers' Compensation Act (LHWCA) and operates similarly to Form 5020. It requires employers to report injuries or illnesses that occur on the job to ensure the worker receives appropriate medical care and compensation. Although Form LS-202 is used for maritime employees, the types of information it collects and its intent to safeguard workers' health and financial well-being through prompt reporting and documentation reflect the core objectives of Form 5020.

Form CA-1, "Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation," is required for federal employees experiencing work-related injuries. This form facilitates the claim process for workers' compensation under Federal Employees' Compensation Act (FECA). It closely parallels Form 5020 in gathering detailed information about the injury, including the circumstances that led to it, aimed at processing and evaluating the claim. Despite the different jurisdictions—federal versus state—the mutual goal of supporting injured workers unites these documents.

The California Division of Workers’ Compensation (DWC) Form 5021, "Return-to-Work & Voucher Report," is directly related to Form 5020 in terms of post-injury or illness management. Once an employer completes Form 5020 to report the initial injury or illness, Form 5021 may later be used to document the employee’s return to work status or eligibility for a supplemental job displacement benefit voucher. Although serving different stages in the injury management and recovery process, these forms work in tandem to support both compliance and the injured employee’s journey back to work or to new employment opportunities.

Dos and Don'ts

Completing the 5020 California form, also known as the Employer's Report of Occupational Injury or Illness, demands careful attention to details and an understanding of the reporting requirements. Below are essential dos and don'ts to guide you through the process:

- Do: Make sure to report the injury or illness within five days of knowledge if it results in lost time beyond the date of incident or requires medical treatment beyond first aid. Timeliness is critical to ensure compliance with state regulations.

- Do: Provide a thorough and factual description of how the injury or illness occurred, including the specific part of the body affected. Clarity and accuracy in this section help in the accurate processing of the claim.

- Do: Complete the form in triplicate and type the information if possible, as stated in the instructions. This ensures legibility and reduces the chance of errors during processing.

- Do: Immediately report any serious injury, illness, or death by telephone or telegraph to the nearest office of the California Division of Occupational Safety and Health, in addition to filing this form.

- Do: Include confidential employee information in the shaded boxes as indicated, understanding its sensitivity and the legal obligations to protect the confidentiality of the employee's health information.

- Don’t: Leave sections of the form blank. If a section does not apply, indicate with “N/A” for “Not Applicable.” Incomplete forms can lead to processing delays or even fines for failing to report accurately.

- Don’t: Make or cause to be made any knowingly false or fraudulent statements when completing the form. Remember that doing so is a felony under California law.

- Don’t: Ignore the need to file an amended report if an employee subsequently dies as a result of a previously reported injury or illness. Submitting the amended report within five days of knowledge of death is required by law.

Following these guidelines will help ensure that the Employer's Report of Occupational Injury or Illness (Form 5020) is filed correctly and in a timely manner, fulfilling your obligations under California law while also safeguarding the rights and privacy of employees.

Misconceptions

There are several common misconceptions about the California Form 5020, the Employer's Report of Occupational Injury or Illness, that can confuse employers and employees alike. Addressing these misconceptions is crucial for ensuring that the reporting process is clear and effective.

- Misconception 1: Filing Form 5020 Admits Fault or Liability

One of the main misunderstandings is that filing this form is tantamount to an admission of fault or liability on the part of the employer. However, the form itself clearly states that its filing "IS NOT AN ADMISSION OF LIABILITY." Its purpose is to report an incident as required by law, not to assign blame. - Misconception 2: Only Serious Injuries or Illnesses Need to Be Reported

Some believe that only serious injuries or illnesses must be reported on Form 5020. In truth, California law requires employers to report all occupational injuries or illnesses that result in lost time beyond the date of the incident or that require medical treatment beyond first aid. - Misconception 3: The Form Must Be Filed Only If the Employee Misses Work

There's a misconception that the form must be filed only if the employee misses work following the injury or illness. However, the requirement also includes reporting injuries or illnesses that don't necessarily result in missed work but require medical treatment beyond first aid. - Misconception 4: Reports Can Be Delayed Until the Extent of Injury is Fully Known

Some employers mistakenly believe they can wait to file Form 5020 until they know the full extent of the injury or illness. The law requires the report to be filed within five days of the employer's knowledge of an injury or illness that meets the reporting criteria, regardless of whether all details are known at that time. - Misconception 5: Form 5020 is the Same as Filing a Workers' Compensation Claim

Another common misunderstanding is equating the filing of Form 5020 with the filing of a workers' compensation claim. While related, these are distinct actions. Form 5020 is an employer's report of an injury or illness. In contrast, a workers' compensation claim is a separate process initiated by the employee or their representative to seek benefits.

Clearing up these misconceptions is essential for ensuring accurate and timely reporting of workplace injuries or illnesses, which can ultimately help protect employees and allow for the proper administration of workers' compensation benefits.

Key takeaways

The 5020 California form is a critical document for employers in the State of California, crucial for reporting occupational injuries or illnesses. Understanding the key elements and requirements for completing and utilizing this form can significantly affect the management of workplace safety and workers' compensation claims. Here are four key takeaways:

- Timely Reporting is Mandatory: Employers are required to report any occupational injury or illness that results in lost time beyond the date of the incident or requires medical treatment beyond first aid within five days of becoming aware of it. If the injury or illness results in the employee's death, an amended report indicating the death must be filed within five days of the employer's knowledge.

- Immediate Reporting for Serious Incidents: In cases of serious injury, illness, or death, employers must immediately report the incident by telephone or telegraph to the nearest office of the California Division of Occupational Safety and Health (Cal/OSHA). This requirement highlights the importance of prompt communication to ensure a swift response and the safety of all parties involved.

- Confidentiality Must Be Maintained: The form contains sensitive information related to employee health, and employers must handle it in a manner that maintains employee confidentiality while using the data for occupational safety and health purposes. Specific guidelines are outlined in CCR Title 8 14300.29 (b)(6)-(10) & 14300.35(b)(2)(E)2, emphasizing the protection of personal information.

- Filing Does Not Imply Liability: It is crucial for employers to understand that submitting the Form 5020 is not an admission of liability. The primary purpose of this form is to ensure that occupational injuries or illnesses are properly reported and managed in compliance with state laws, facilitating the appropriate workers' compensation benefits or payments without necessarily attributing fault.

Compliance with the submission guidelines and understanding the significance of the 5020 California form is essential for employers. It not only aids in managing occupational health and safety but also ensures that injuries or illnesses are correctly reported and treated, ultimately contributing to a safer workplace environment.

Different PDF Templates

California 5870A - Includes detailed steps to calculate additional taxes owed due to receiving these distributions.

Reg 262 Dmv - With detailed instructions included, Form REG 262 aids users in correctly completing the document, minimizing errors and legal complications in vehicle reassignment procedures.