Fill a Valid Address Change California Form

Keeping one's address current with the California Board of Accountancy is a crucial step for licensed CPAs, PAs, and accounting firms operating within the state. The Address Change California form serves as a fundamental tool in ensuring that this information is up-to-date, safeguarding the licensee's compliance with state regulations. Each license type requires a separate notice, emphasizing the personalized nature of the process. The form captures detailed information including the licensee's name, the new address of record (which becomes public information), and an alternate address for cases where the address of record is a PO Box or a mail drop. It is important to note that any changes must be reported within 30 days to avoid citations and fines, highlighting the importance of timely submissions. Additionally, the form grants licensees the option to remove their contact information from lists sold for mailing purposes, offering a degree of privacy protection. Understandably, the Address Change form is more than a mere procedural necessity; it is a critical component in maintaining the accuracy of the public record and ensuring smooth communication between the board and the licensees.

Document Example

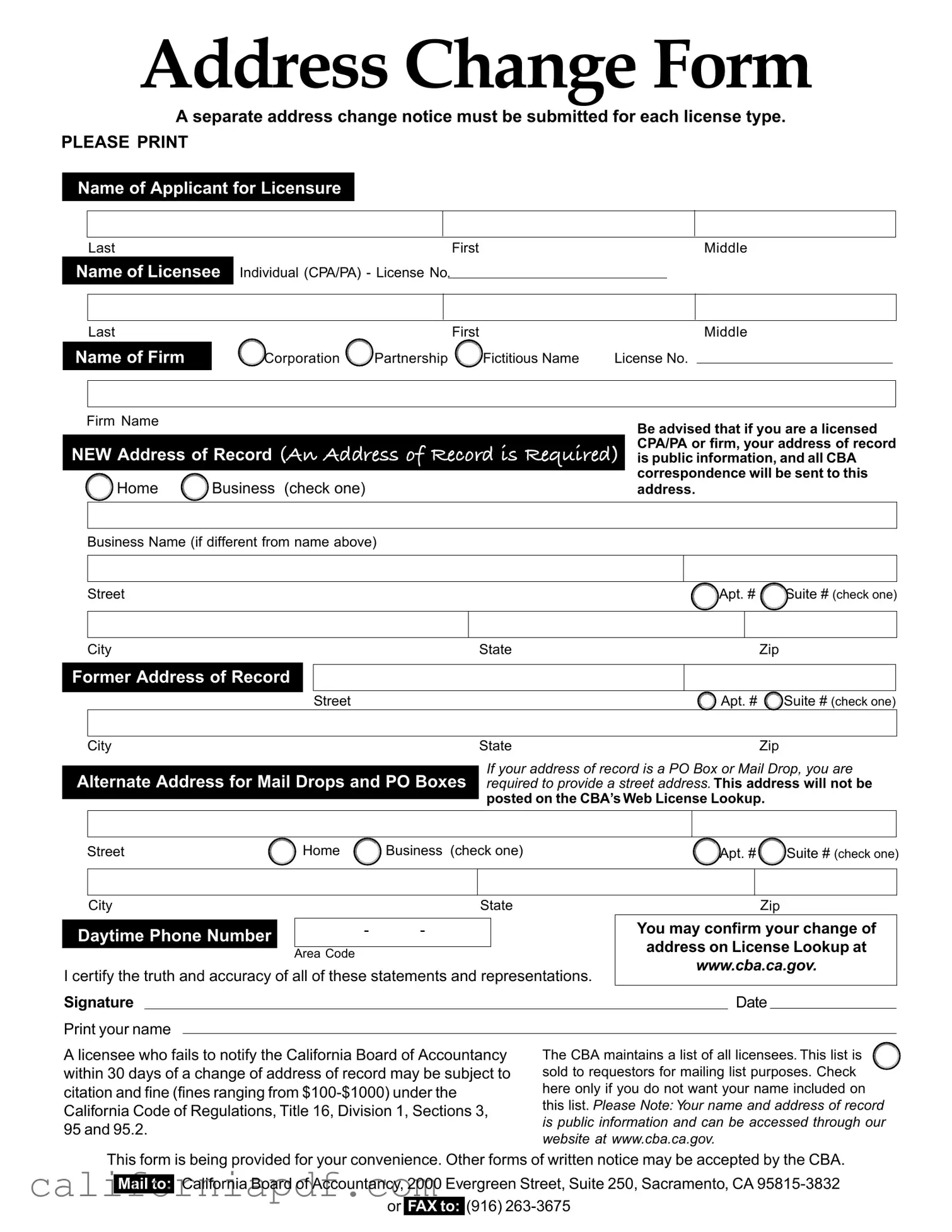

Address Change Form

A separate address change notice must be submitted for each license type.

PLEASE PRINT

Name of Applicant for Licensure

Last

Name of Licensee

First |

Middle |

Individual (CPA/PA) - License No.

Last

Name of Firm

|

|

First |

Middle |

Corporation |

Partnership |

Fictitious Name |

License No. |

FIRM NAME |

|

Be advised that if you are a licensed |

|

|

|

|

|

NEW Address of Record (An Address of Record is Required) |

CPA/PA or firm, your address of record |

||

is public information, and all CBA |

|||

|

Home |

Business (check one) |

correspondence will be sent to this |

|

address. |

||

|

|

|

|

|

|

|

|

Business Name (if different from name above)

Street |

Apt. # |

Suite # (check one) |

City |

State |

Zip |

Former Address of Record |

|

|

Street |

Apt. # Suite # (check one) |

|

City

Alternate Address for Mail Drops and PO Boxes

State |

Zip |

If your address of record is a PO Box or Mail Drop, you are required to provide a street address. This address will not be posted on the CBA’s Web License Lookup.

Street |

Home |

Business (check one) |

Apt. # |

Suite # (check one) |

|

City |

|

State |

Zip |

|

|

Daytime Phone Number |

- |

- |

You may confirm your change of |

||

|

|

address on License Lookup at |

|||

|

Area Code |

|

|||

|

|

www.cba.ca.gov. |

|||

I certify the truth and accuracy of all of these statements and representations. |

|||||

|

|

||||

Signature |

|

|

Date |

|

|

Print your name |

|

|

|

|

|

A licensee who fails to notify the California Board of Accountancy within 30 days of a change of address of record may be subject to citation and fine (fines ranging from

The CBA maintains a list of all licensees. This list is  sold to requestors for mailing list purposes. Check here only if you do not want your name included on this list. Please Note:Your name and address of record is public information and can be accessed through our website at www.cba.ca.gov.

sold to requestors for mailing list purposes. Check here only if you do not want your name included on this list. Please Note:Your name and address of record is public information and can be accessed through our website at www.cba.ca.gov.

This form is being provided for your convenience. Other forms of written notice may be accepted by the CBA.

Mail to:

California Board of Accountancy, 2000 Evergreen Street, Suite 250, Sacramento, CA

OR FAX to: (916)

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Requirement | A separate notice is required for each license type when submitting an address change. |

| Public Information | The address of record for a licensed CPA/PA or firm is public information. |

| Correspondence Address | All CBA correspondence will be sent to the address of record. |

| Alternate Address Provision | If the address of record is a PO Box or Mail Drop, a street address must also be provided, but it will not be posted online. |

| Verification Method | Licensees can confirm their address change on the CBA's License Lookup website. |

| Penalty for Non-compliance | Failure to notify the CBA within 30 days of an address change may result in a citation and fine ranging from $100-$1000, as stipulated by specific sections of the California Code of Regulations. |

| Mailing List Opt-Out | Licensees have the option to opt-out of having their name included on a list sold for mailing list purposes. |