Attorney-Approved California Affidavit of Death Document

When a property owner passes away, transferring ownership can present hurdles for the bereaved heirs or beneficiaries. In California, an essential document simplifies this process: the Affidavit of Death form. This legal document serves as a formal declaration, notifying interested parties, including public records or institutions, of the owner's death. It's pivotal in the transfer of property held in the deceased’s name, eliminating the need for a lengthy probate process in many instances. The form requires detailed information, including the deceased's full name, the date of death, and a legal description of the property in question. By submitting an Affidavit of Death, successors can expedite the transfer of assets, such as real estate, to their name. It's crucial for individuals facing the challenge of transferring property after a loss to understand the form's requirements, the submission process, and the legal implications involved. This guide aims to provide a comprehensive overview, ensuring that rights are protected and the transition of ownership is as smooth as possible.

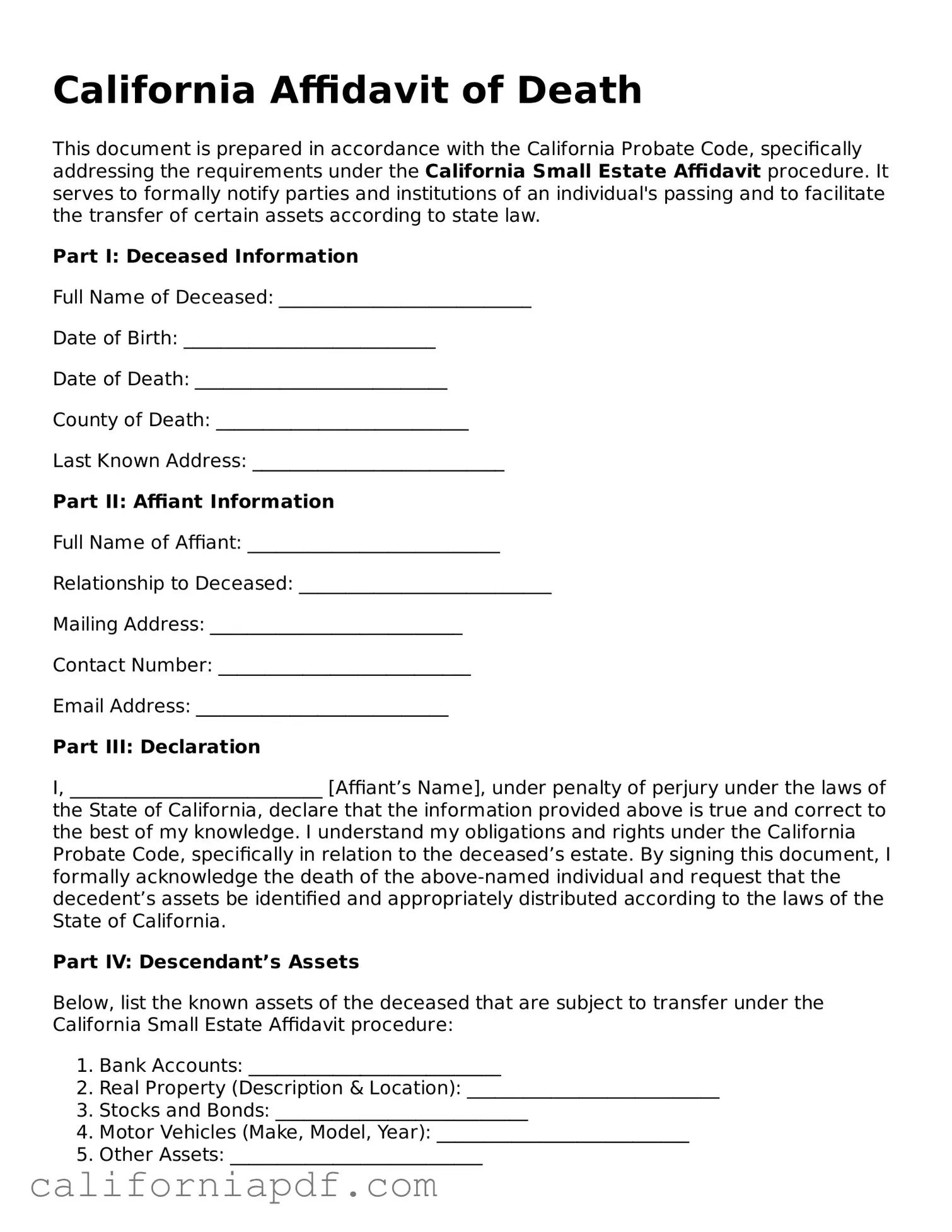

Document Example

California Affidavit of Death

This document is prepared in accordance with the California Probate Code, specifically addressing the requirements under the California Small Estate Affidavit procedure. It serves to formally notify parties and institutions of an individual's passing and to facilitate the transfer of certain assets according to state law.

Part I: Deceased Information

Full Name of Deceased: ___________________________

Date of Birth: ___________________________

Date of Death: ___________________________

County of Death: ___________________________

Last Known Address: ___________________________

Part II: Affiant Information

Full Name of Affiant: ___________________________

Relationship to Deceased: ___________________________

Mailing Address: ___________________________

Contact Number: ___________________________

Email Address: ___________________________

Part III: Declaration

I, ___________________________ [Affiant’s Name], under penalty of perjury under the laws of the State of California, declare that the information provided above is true and correct to the best of my knowledge. I understand my obligations and rights under the California Probate Code, specifically in relation to the deceased’s estate. By signing this document, I formally acknowledge the death of the above-named individual and request that the decedent’s assets be identified and appropriately distributed according to the laws of the State of California.

Part IV: Descendant’s Assets

Below, list the known assets of the deceased that are subject to transfer under the California Small Estate Affidavit procedure:

- Bank Accounts: ___________________________

- Real Property (Description & Location): ___________________________

- Stocks and Bonds: ___________________________

- Motor Vehicles (Make, Model, Year): ___________________________

- Other Assets: ___________________________

Part V: Acknowledgement

State of California

County of ___________________________

On ___________________________ [Date], before me, ___________________________ [Notary’s Name], personally appeared ___________________________ [Affiant’s Name], proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument, and acknowledged to me that he/she executed the same in his/her authorized capacity, and that by his/her signature on the instrument, the individual, or the entity upon behalf of which the individual acted, executed the instrument.

Witness my hand and official seal:

Signature of Notary Public: ___________________________

My Commission Expires: ___________________________

PDF Form Characteristics

| Fact | Detail |

|---|---|

| Purpose | Used to formally notify that a property owner has passed away, and to effectuate the legal transfer of real property in accordance with the decedent's estate plan or the laws of intestate succession. |

| Applicable Law | Governed by the California Probate Code, particularly sections relating to the transfer of real property upon death. |

| Key Requirement | Must be accompanied by a certified copy of the death certificate of the deceased property owner. |

| Filing Location | The completed and notarized form, along with the death certificate, must be filed with the county recorder’s office in the county where the property is located. |

How to Write California Affidavit of Death

When a loved one passes away, handling the formalities can seem overwhelming amidst the grief. One of the steps that may need to be taken is filling out the California Affidavit of Death form. This document is crucial for officially recording the death and facilitating the transfer of certain assets according to the deceased’s estate plan. Completing this form accurately is essential to ensure the process moves smoothly without legal hitches. Here's a clear, step-by-step guide on how to fill out the California Affidavit of Death form to assist you during this challenging time.

- Begin by gathering the necessary information: Before you start filling out the form, make sure you have all the required information, including the full name of the deceased, their date of birth, date of death, and the legal description of the property involved.

- Enter the full legal name of the deceased as it appears on the death certificate in the designated space on the form.

- Provide the date of death and the deceased’s date of birth in the respective fields on the form. This information must match the death certificate.

- Fill in your relationship to the deceased in the section provided. This establishes your legal standing in relation to the form.

- Enter the legal description of the property affected by the death. This description can usually be found on the property’s deed and should be copied accurately to avoid any issues with the property transfer process.

- Sign the form in front of a notary public. The form will require your signature to be notarized to be legally valid. Find a notary public, which can often be done at a bank, lawyer’s office, or shipping centers.

- Attach a certified copy of the death certificate to the form. This is a crucial step as it verifies the death officially.

- Submit the completed form and the attached death certificate to the appropriate county recorder’s office. The office location will depend on the property’s location, and a filing fee may be required.

After submitting the form, the property described will be officially transferred to the rightful heir or beneficiary according to the laws of California. While the process may seem complicated, taking it step by step can make it manageable. It’s also a crucial part of ensuring that your loved one’s wishes are honored and that legal ownership is accurately and officially recorded. If at any point you feel uncertain, consulting with a legal professional can provide guidance and peace of mind.

Listed Questions and Answers

What is an Affidavit of Death form in California?

An Affididavit of Death form in California is a legal document used to officially establish the death of a person. This form is often required by various institutions like banks, title companies, and courts to transfer assets or handle the deceased person's affairs.

Who needs to file an Affidavit of Death in California?

Typically, the executor of the deceased's estate or a surviving family member needs to file an Affidavit of Death. This step is essential in the process of managing and distributing the deceased’s assets according to their will or state law if there is no will.

What information is required on the Affidavit of Death form?

The Affidavit of Death form requires several important pieces of information, including:

- The full name of the deceased person

- The deceased person's date of death

- A certified copy of the death certificate

- The legal description of the property, if applicable

- The relationship of the affiant to the deceased

Where can I obtain an Affidavit of Death form in California?

You can obtain an Affidavit of Death form from a local county recorder's office, an attorney, or online legal document services. Make sure the form complies with California state law requirements.

How do I file an Affidavit of Death in California?

Once completed and signed, the form, along with a certified death certificate, needs to be filed with the appropriate county recorder's office. It's advised to check with the recorder's office for any additional requirements or fees.

Is there a fee to file an Affidavit of Death form in California?

Yes, there is typically a filing fee for submitting an Affidavit of Death form to the county recorder's office. The fee varies by county, so it's important to check the specific amount with the local office where you plan to file the document.

How long does it take for the Affidavit of Death to be processed?

The processing time can vary depending on the county recorder's office workload. Generally, it can take from a few days to a few weeks for the document to be officially recorded.

Can an Affidavit of Death form be used to transfer real estate?

Yes, in many cases, an Affidavit of Death form is used to transfer real estate from the deceased to the beneficiary or heirs. However, the process may vary depending on the specifics of the estate and whether the property was held in a trust, joint tenancy, or other arrangements.

What are the legal implications of filing an Affididavit of Death?

Filing an Affidavit of Death has significant legal implications, including the transfer of property and assets. It also serves as a legal record of the individual's death, which is necessary for closing accounts, claiming benefits, and other legal matters. It's crucial to ensure accuracy and completeness when filling out and submitting the form to avoid legal complications.

Common mistakes

Filing paperwork with any government office requires attention to detail, especially when dealing with something as critical as the California Affidavit of Death form. This form plays a pivotal role in the process of transferring assets according to a will or in the absence of one. However, individuals often make errors due to lack of information or oversight. To help navigate this process more smoothly, here's a rundown of 10 common mistakes and how to avoid them.

Not verifying the form version: The state periodically updates its forms. Using an outdated version can lead to the rejection of the document.

Omitting necessary attachments: Failing to include required attachments, such as a certified copy of the death certificate or proof of authority, can delay the process.

Incorrect property description: If the property is not described accurately and completely, it might not be transferred correctly.

Signatures not notarized: The affidavit requires notarization to validate the identity of the signatory. Overlooking this step invalidates the form.

Using unofficial titles: The person filing the form should clearly identify their relationship to the decedent or their legal standing, using official titles or terms.

Handwritten errors: While handwritten forms are often acceptable, any illegible handwriting can cause misunderstandings or require re-submission.

Incorrect legal terminology: Misusing legal terms can lead to confusion about the document's intent or the assets in question.

Leaving blanks: Every field should be filled out, even if it means entering 'N/A' for not applicable. Empty fields can lead to processing delays.

Failure to provide adequate proof of death: Besides a death certificate, some situations may require additional proof or documentation.

Inaccuracies in personal details: Mistakes in the decedent's name, date of birth, or Social Security number can cause significant delays and complications.

`To sidestep these errors, individuals are advised to:

Double-check the form edition and ensure it's the latest.

Attach all relevant documents as per the instructions on the form or provided by legal counsel.

Describe the property meticulously, referring to official documents for precision.

Sign the form in front of a notary and ensure it gets notarized properly.

Use precise legal or relational terms to define the filer's connection with the decedent.

Fill out the form digitally if possible, or ensure handwriting is clear and legible.

Review legal terminology with a legal advisor to ensure accuracy.

Complete every field, and review the form to confirm there are no unfilled spaces.

Include all necessary proof and documentation concerning the decedent's death.

Triple-check personal details against official documents to eliminate any differences.

By carefully avoiding these common pitfalls, the process of submitting a California Affidavit of Death form can be significantly smoother, helping to expedite the necessary legal processes following a loved one's passing.

Documents used along the form

When dealing with the passing of a loved one in California, the Affidavit of Death form is often just one of many documents needed to manage their estate and finalize personal affairs. This form is essential for legally confirming the death in matters related to property and other assets. Alongside it, several other forms and documents play key roles in this process, helping to ensure that all is handled smoothly and in accordance with the law.

- Certificate of Death: This official document is issued by a government authority and confirms the death of an individual. It is required for many transactions following a death, including the claiming of life insurance, settling estates, and arranging for burials or cremations.

- Will: A will is a legal document in which a person specifies how their property and assets should be distributed after their death. It may also appoint a guardian for any minor children. The existence of a will can significantly impact the administration of an estate.

- Trust Documents: For those who have established living trusts, trust documents are necessary to manage and distribute the estate according to the deceased's wishes without the need for probate court. These documents outline the terms of the trust and the responsibilities of the trustee.

- Property Deeds: Property deeds are essential for transferring real estate owned by the deceased. They provide a legal description of the property and proof of ownership, which is necessary for changing the title and handling other property-related affairs.

- Letters of Administration: If the deceased did not leave a will, letters of administration are issued by a probate court to appoint an administrator for the estate. This document grants the administrator the authority to deal with the deceased's assets according to state laws.

- Notice of Probate: This document is filed with the court to initiate the probate process, which is the legal process for distributing a deceased person's assets. It notifies potential creditors and heirs that the probate process is beginning, giving them an opportunity to make claims against the estate.

Each document plays a crucial role in ensuring the deceased's affairs are settled correctly and according to their wishes or the law. Individuals may find it helpful to consult with legal professionals to understand the specific requirements and implications of each document. Recognizing and preparing these documents in advance can make the process smoother for those handling the affairs of someone who has passed away.

Similar forms

The California Affidavit of Death form shares similarities with the Death Certificate. Both documents serve as official notices of an individual's death. However, the Death Certificate is issued by a governmental authority, primarily for vital statistics purposes, and declares the date, location, and cause of death. In contrast, the Affidavit of Death, often executed by a surviving relative or executor, is used to notify parties such as banks or title companies of the death, particularly to facilitate the transfer of property or to assert claims.

Comparable to the Transfer on Death (TOD) deed, the Affidavit of Death form is instrumental in the seamless transmission of assets upon the owner's death. The TOD deed allows property owners to name beneficiaries, avoiding the probate process. Similarly, an Affididavit of Death can expedite legal and financial transitions by providing necessary validation of the decedent's passing, thereby activating the TOD clause where applicable.

The Executor’s Deed is another document akin to the Affidavit of Death, as it also pertains to the management of the deceased's estate. While the Executor’s Deed is specifically used to transfer title in real property from the estate to the heirs or purchasers, the Affidavit of Death may be required to demonstrate the executor’s authority by substantiating the death of the original owner, thus complementing each other in the process of estate settlement.

Similar to the Last Will and Testament, which articulates the deceased's wishes regarding the distribution of their assets and the care of minors, the Affididavit of Death is a critical step in affirming the decedent's passing, thereby initiating the execution of the will. Though the Affidavit itself does not dictate asset distribution, it is often a prerequisite for executing the deceased’s expressed wishes as outlined in their will.

The Durable Power of Attorney (POA) for Healthcare resembles the Affidavit of Death in its relationship to matters of personal well-being and decision-making authority. The POA for Healthcare designates someone to make critical healthcare decisions if a person becomes incapacitated, whereas the Affidavit of Death is employed posthumously, serving a complementary role in managing the decedent's affairs, including healthcare-related decisions made prior to death.

Trust Certifications are similarly aligned with the Affidavit of Death, especially in scenarios where the deceased was a trustor. Both documents facilitate the administration of the deceased's assets. A Trust Certification confirms the existence of a trust and the trustee's authority, which, when paired with an Affidavit of Death, can streamline the process of asset transfer under the trust, highlighting their interdependent roles in estate planning and execution.

The Small Estate Affidavit, much like the Affididavit of Death, is used to expedite the asset transfer process, but in cases where the deceased’s estate does not meet the threshold for formal probate. While the Small Estate Affidavit facilitates the release of assets to rightful heirs or beneficiaries without probate court proceedings, an Affidavit of Death often complements it by officially evidencing the death, an essential fact for the small estate process to commence.

The Life Insurance Claim Form and the Affidavit of Death share the purpose of acknowledging an individual’s death for the purpose of financial settlements. Beneficiaries file a Life Insurance Claim Form to trigger the payout of the deceased’s policy. The Affidavit of Death may be required by the insurance company as part of the claim process to provide irrefutable proof of the policyholder’s death, thereby enabling the beneficiaries to access the insured benefits.

Dos and Don'ts

When you are faced with the task of completing the California Affidavit of Death form, it is important to approach the process with care and attention to detail. This document is crucial for transferring property ownership upon the death of an individual, and errors can cause delays or legal challenges. To assist in this process, here are key dos and don'ts to consider:

Dos:

- Ensure all information is accurate: Double-check the deceased's personal information, including full name, date of birth, and date of death, to avoid discrepancies.

- Include a certified copy of the death certificate: This is often a requirement for the affidavit to be considered valid and is critical for officially documenting the death.

- Sign the document in the presence of a notary public: This step is mandatory for the affidavit to be legally binding and recognized by courts and property records departments.

- Consult with a legal professional if unsure: Given the complex nature of property laws and estate matters, seeking advice from an attorney can prevent mistakes and ensure the process aligns with legal requirements.

Don'ts:

- Leave sections blank: Incomplete forms may be rejected or result in legal ambiguities. Ensure every applicable section is filled out comprehensively.

- Guess information: If you're unsure about specific details, it's better to verify first rather than provide incorrect data, which can invalidate the document.

- Forget to notify other stakeholders: In cases where property is jointly owned or other parties might be affected, it's important to communicate and disclose the filing of an affidavit.

- Overlook the filing deadline: Timely submission is crucial, as delays can complicate matters further, especially when dealing with estates and property transfers.

Misconceptions

When it comes to the California Affidavit of Death form, a few misconceptions often arise. Clearing up these misunderstandings ensures that people can navigate the process with confidence and understand its importance accurately.

- It's complicated to fill out: Many believe that completing the California Affidavit of Death form requires an extensive legal background or specialized knowledge. The truth is, the form is designed to be straightforward, requiring basic information about the deceased and the person filing the affidavit.

- It serves as a will substitute: Some think that this affidavit can serve as a substitute for a will. However, its primary purpose is to notify entities of a person's death and facilitate the transfer of certain assets according to previously established legal documents, not to distribute assets not already accounted for in a will or trust.

- Any family member can file it: While it might seem that any relative can submit the affidavit, only individuals who are legally recognized as successors to the deceased’s property or those named in the will or trust are typically eligible to file this document.

- It immediately transfers property: Another common misconception is that the affidavit promptly transfers property to the new owner. The reality is that while it helps in the process, other steps, requirements, and legal documents are usually necessary to complete the transfer.

- All assets can be transferred using it: Many people incorrectly believe that all of the deceased's assets can be transferred using the California Affidavit of Death. This form, however, is generally used for specific assets like real estate under a certain value or accounts at financial institutions, excluding personal items, vehicles, or other types of property.

- It's only necessary if you're going through probate: This form is often associated solely with the probate process. While it is an important document for transferring ownership of certain assets without probate, it's also used in cases where probate is not necessary, providing a streamlined way to update records and confirm transitions in ownership.

Key takeaways

When dealing with the California Affidavit of Death form, individuals often find themselves navigating through an emotionally tough period. Understanding the form's requirements can substantially simplify the process of transferring property or addressing legal matters after a loved who has passed away. Below are key takeaways to guide you through filling out and using this form effectively:

- Identify the Correct Form: California provides different Affidavit of Death forms for various scenarios, including but not limited to, the death of a trustee, joint tenant, or for claiming successorship for personal property. Ensure you're using the correct form for your specific need.

- Gather Necessary Documentation: Before filling out the form, collect all required documents such as the death certificate, property deed, and any other pertinent legal paperwork that supports the claim being made.

- Fill Out the Form Completely: Complete all sections of the form with accurate information. This includes providing full legal names, addresses, and describing the property or asset in question clearly.

- Notarization is a Must: The affidavit needs to be notarized to be considered valid. This involves signing the form in front of a notary public, who will then authenticate it.

- File with the County Recorder: After notarization, the affidavit, along with a certified copy of the death certificate, must be filed with the county recorder’s office in the county where the property is located.

- Review by Legal Professionals: It’s highly recommended to have the completed form reviewed by a legal professional before filing. This ensures that any legal considerations are properly addressed and can prevent potential delays or issues.

- Keep Copies: Always keep copies of the completed and filed affidavit, the death certificate, and any other supporting documents for your records.

- Understand the Implications: Filing an Affidavit of Death can have significant legal implications, especially related to property ownership and taxes. It’s important to understand these aspects or consult with a professional for advice specific to your situation.

To navigate this process with as much ease as possible, it is crucial to pay close attention to document details, adhere to California legal requirements, and seek professional guidance when necessary. Timely and accurate handling of the Affidavit of Death form can facilitate a smoother transition during what is often a challenging time.

Create Some Other Templates for California

What Does a Durable Power of Attorney Allow You to Do - This legal instrument is an important part of lifetime planning, providing a mechanism for managing your financial affairs efficiently and according to your wishes.

Divorce Settlement Agreement Template - For couples with complex assets or financial situations, the document provides a framework for delineating specific arrangements.