Attorney-Approved California Articles of Incorporation Document

For individuals looking to establish a corporation in California, the Articles of Incorporation form serves as a fundamental and mandatory document. This vital piece of paperwork marks the beginning of a corporation's legal life, setting forth essential information such as the corporation's name, purpose, authorized shares, and the address for its principal office, along with the name and address of its agent for service of process. Though the form may seem straightforward, it is imbued with significant implications for the future operation, governance, and liability of the newly formed entity. The completion and submission of this form to the California Secretary of State not only induct the corporation into legal existence but also necessitate meticulous attention to detail to ensure compliance with state law. Moreover, understanding the nuances of this form can unlock strategic benefits, including but not limited to, tax advantages, asset protection, and credibility with customers and suppliers. Overall, the Articles of Incorporation form represents a crucial step for entrepreneurs and business owners toward actualizing their visions within the robust economic landscape of California.

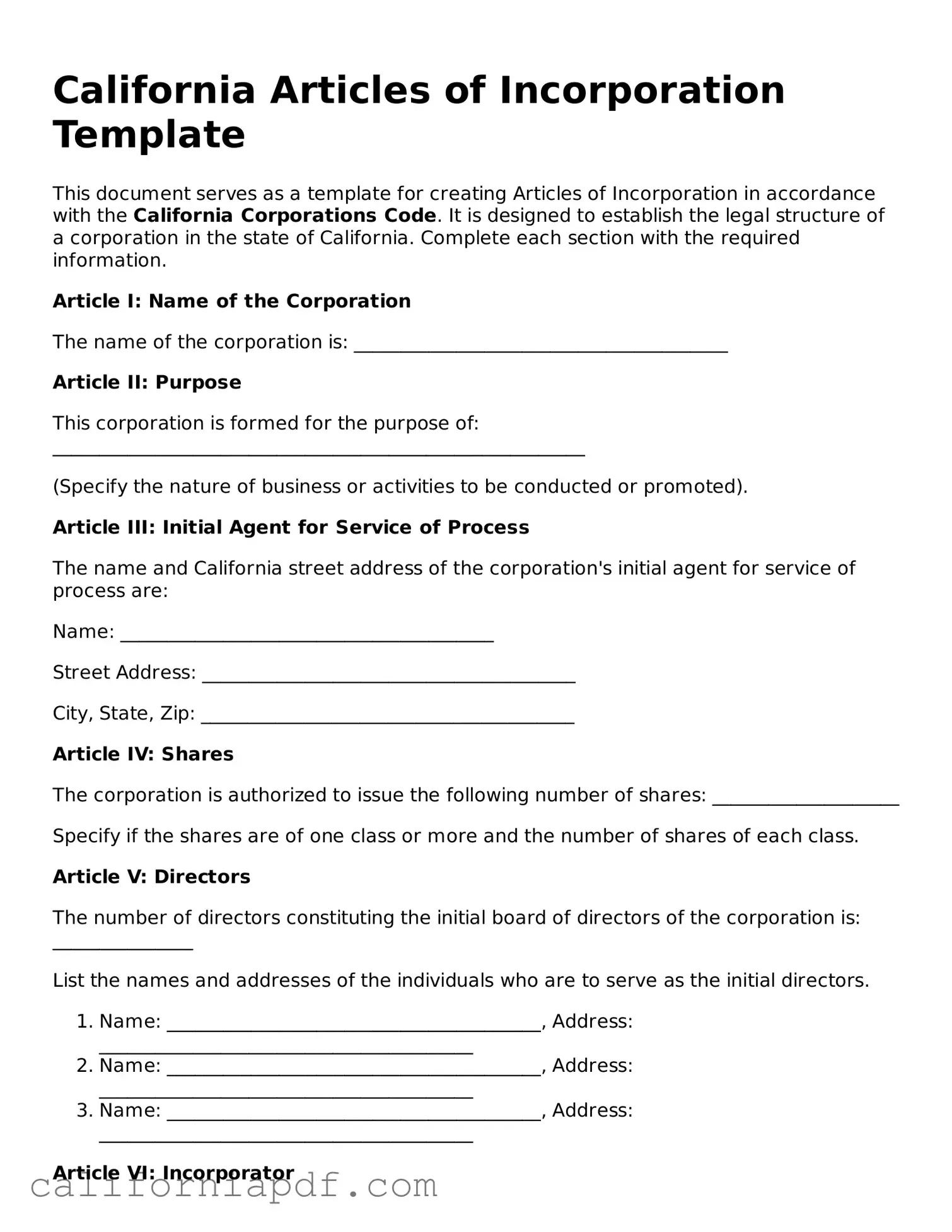

Document Example

California Articles of Incorporation Template

This document serves as a template for creating Articles of Incorporation in accordance with the California Corporations Code. It is designed to establish the legal structure of a corporation in the state of California. Complete each section with the required information.

Article I: Name of the Corporation

The name of the corporation is: ________________________________________

Article II: Purpose

This corporation is formed for the purpose of: _________________________________________________________

(Specify the nature of business or activities to be conducted or promoted).

Article III: Initial Agent for Service of Process

The name and California street address of the corporation's initial agent for service of process are:

Name: ________________________________________

Street Address: ________________________________________

City, State, Zip: ________________________________________

Article IV: Shares

The corporation is authorized to issue the following number of shares: ____________________

Specify if the shares are of one class or more and the number of shares of each class.

Article V: Directors

The number of directors constituting the initial board of directors of the corporation is: _______________

List the names and addresses of the individuals who are to serve as the initial directors.

- Name: ________________________________________, Address: ________________________________________

- Name: ________________________________________, Address: ________________________________________

- Name: ________________________________________, Address: ________________________________________

Article VI: Incorporator

The name and address of the incorporator are:

Name: ________________________________________

Address: ________________________________________

Article VII: Bylaws

The initial bylaws of the corporation shall be adopted by the incorporator or by the board of directors. The power to alter, amend, or repeal the bylaws or adopt new bylaws shall be vested in the board of directors unless otherwise provided in the bylaws.

Article VIII: Indemnification

The corporation elects to be governed by the indemnification provisions provided in the California Corporations Code, protecting its directors, officers, employees, and other agents against expenses and liabilities.

Execution by Incorporator

I, the undersigned, declare I am the person who executed the foregoing Articles of Incorporation, which execution is my act and deed.

Name of Incorporator: ________________________________________

Signature: ________________________________________

Date: ________________________________________

PDF Form Characteristics

| Fact | Description |

|---|---|

| 1. Purpose | The form is used to legally form a corporation in California. |

| 2. Governing Law | The California Corporations Code is the governing law for this form. |

| 3. Filing Agency | The form is filed with the California Secretary of State. |

| 4. Required Information | Information such as the corporation's name, purpose, registered agent, and shares structure must be provided. |

| 5. Corporate Name Restrictions | The name chosen must comply with specific naming conventions and not be misleading or similar to existing entities. |

| 6. Registered Agent Requirement | A corporation must appoint a registered agent for service of process located in California. |

| 7. Shares Authorization | The form requires details on the number and type of shares the corporation is authorized to issue. |

| 8. Public Record | Once filed, the document becomes a public record accessible by the general public. |

| 9. Filing Fee | There is a state-mandated filing fee, which varies depending on the type of corporation. |

| 10. Annual Statement | Corporations are required to file an annual statement with the Secretary of State to maintain good standing. |

How to Write California Articles of Incorporation

After deciding to incorporate a business in California, one of the initial steps is to file the Articles of Incorporation. This document officially registers the company with the California Secretary of State. The process entails supplying specific information about the business, including details about its structure, purpose, and the people involved in managing it. Approaching this task with a clear understanding and organized data can streamline the process. The following steps are designed to help you fill out the California Articles of Incorporation form accurately.

- Gather all necessary information about your corporation, including the corporate name, principal business address, and the name and address of the agent for service of process.

- Begin by entering the exact name of the corporation as you wish it to be registered.

- Specify the purpose of the corporation. California allows for a general purpose statement, which means you can state that the corporation is organized for general business activities.

- Fill in the name and street address of the corporation's initial agent for service of process. This can be an individual resident in California or another corporation authorized to perform this service.

- Indicate the number of shares the corporation is authorized to issue. If there are different classes of shares, provide the details and rights associated with each class.

- Include any additional provisions or information required. This might involve special rights or restrictions for shareholders, or specifying how certain corporate decisions are made.

- Review the form for accuracy and completeness. Ensure that all the required fields are filled in and that the information provided is correct.

- Sign and date the form. The signature must be that of an incorporator or an authorized corporate officer.

- File the form with the California Secretary of State’s office. You may need to include the filing fee, which varies depending on the type of filing and the specifics of your corporation.

- Wait for confirmation. After processing, the Secretary of State’s office will send proof of registration. Keep this document for your records.

Completing the California Articles of Incorporation form is a significant milestone in the journey of establishing a corporation. It involves attention to detail and an understanding of the requirements. Once filed and approved, this document legally establishes your corporation’s existence and allows you to move forward with your business plans. Remember, the requirements and fees can change, so it's important to refer to the latest guidelines provided by the California Secretary of State’s office.

Listed Questions and Answers

What is the purpose of the California Articles of Incorporation form?

The California Articles of Incorporation form is a crucial document used to officially establish a corporation within the state. It marks the beginning of a corporation's legal existence by outlining key details such as the corporation's name, purpose, and structure to the California Secretary of State. This formal registration is required for a corporation to be legally recognized, allowing it to engage in business activities, enter into contracts, and fulfill other functions as a corporate entity.

What are the mandatory fields that must be filled in the California Articles of Incorporation form?

The California Articles of Incorporation form requires several mandatory fields to be completed for successful submission. These include:

- The proposed name of the corporation, which must be distinguishable from other entities registered in California and comply with state naming requirements.

- The corporation’s purpose, which can often be stated in a general manner, such as engaging in any lawful act or activity for which a corporation may be organized under the General Corporation Law of California.

- The name and address of the corporation's registered agent in California, who is authorized to receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, which affects potential investment in the company and its ownership structure.

- The names and addresses of the incorporator(s) or the board of directors who are initiating the incorporation process.

Who needs to sign the California Articles of Incorporation form?

The California Articles of Incorporation form must be signed by the incorporator(s) or by one or more officers or directors named in the document. If the incorporation is initiated by an entity, an authorized representative must sign on behalf of that entity. The signature(s) confirm that the individuals or entities assume responsibility for the truthfulness and accuracy of the information provided in the form. It is an affirmation that the parties involved are committing to establishing the corporation in accordance with California laws.

How can one file the California Articles of Incorporation form?

The California Articles of Incorporation form can be filed in one of three ways:

- Online: The California Secretary of State's office offers an online filing option, which is the fastest way to submit the form and receive confirmation of filing.

- By mail: The completed form can be mailed to the Secretary of State’s office. This method requires the correct form to be properly filled out, signed, and accompanied by the appropriate filing fee.

- In person: For those who prefer or require in-person filing, the form can be submitted directly at the office of the Secretary of State. This option might be beneficial for those seeking immediate filing confirmation or who have questions regarding the process.

Common mistakes

Filling out the California Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the Golden State. While the process is straightforward, there are common mistakes that can delay or complicate your filing. Avoiding these errors can save you time, effort, and potentially money. Here’s a list of mistakes to keep in mind:

-

Not checking the availability of the corporation name first. Before you submit your form, you need to make sure that your desired name is not already in use or too similar to another name in California. This can be done through a preliminary search on the California Secretary of State’s website.

-

Failing to include the suffix indicating the corporation type (e.g., Inc., Corporation). California law requires that the name of the corporation includes a designation like "Incorporated" or "Corporation" to clearly identify it as a corporation.

-

Omitting the complete business address. The form asks for the street address of the corporation's principal executive office. P.O. Box addresses are not accepted for this field.

-

Misunderstanding the role of the Agent for Service of Process. Some people mistakenly list an officer of the corporation without understanding that this agent must be available at the listed address during normal business hours to receive legal documents.

-

Forgetting to detail the shares the corporation is authorized to issue. This is a critical component that determines the ownership structure of your corporation. Be clear about the number of shares and types, if applicable.

-

Skipping the initial directors’ information. If your corporation will have directors at the time of filing, their names and addresses must be listed on the form to comply with California law.

-

Not specifying the purpose of the corporation accurately. Although a general purpose is acceptable in California, being too vague or inaccurate can cause misunderstanding or delay.

-

Forgetting to sign and date the form. An unsigned or undated form is incomplete and will be returned, causing delays in the incorporation process.

-

Ignoring filing fees or payment method instructions. Ensure you understand the current filing fees and acceptable payment methods to avoid delays or returned forms.

Awareness and careful attention to these details can lead to a smoother filing process, setting the foundation for your corporation's success in California. Take the time to review your form thoroughly before submission to ensure all information is accurate and complete.

Documents used along the form

When starting a corporation in California, the Articles of Incorporation form is a fundamental step to legally establish your business. However, this is just the beginning. There are several additional documents and forms often used alongside the Articles of Incorporation to ensure a seamless process in compliance with state laws and regulations. These documents play a critical role in defining the structure and governance of your corporation, handling tax matters, and setting clear expectations for the operations and responsibilities of those involved.

- Bylaws: Bylaws are essential for detailing the internal rules governing the corporation. They include procedures for holding meetings, electing officers and directors, and other operational guidelines necessary for the smooth functioning of the corporation.

- Statement of Information: Filed shortly after the Articles of Incorporation, the Statement of Information provides necessary details about the corporation, such as the name and address of the officers, the registered agent, and the address of the principal executive office. It's required by the California Secretary of State and needs to be updated periodically.

- Stock Certificates: For corporations that will issue stock, stock certificates serve as physical proof of ownership in the corporation. These documents specify the number of shares owned by a shareholder.

- Corporate Minutes: Recording the minutes of board meetings and shareholder meetings is a legal requirement in California. Corporate minutes document the discussions and decisions made during these meetings, providing a record of corporate governance.

- Employer Identification Number (EIN) Application: An EIN, obtained from the IRS, is essentially a social security number for your corporation. It's necessary for tax purposes and to open a business bank account.

- S Corporation Election Form (Form 2553): If the corporation chooses to be taxed as an S corporation, a special tax status that allows corporations to pass income directly to shareholders and avoid double taxation, it must file Form 2553 with the IRS.

- Shareholder Agreement: This document outlines the rights and obligations of the shareholders. It includes provisions for the transfer of shares, resolution of disputes, and other important issues concerning shareholders.

In conclusion, while the Articles of Incorporation form is a necessary starting point for incorporating a business in California, it's important to be aware of and prepare the additional documents and forms that are needed. Each plays a unique role in ensuring legal compliance, managing the internal affairs of the corporation, and addressing tax requirements. Understanding these documents can significantly contribute to the efficient and lawful operation of your corporation.

Similar forms

The California Articles of Incorporation share similarities with the Certificate of Formation commonly used in several states for the creation of limited liability companies (LLCs). Both documents serve as foundational legal filings that officially establish a business entity within their respective state governments. They require information such as the entity's name, purpose, registered agent, and principal office location. However, the Articles of Incorporation specifically apply to the formation of a corporation, whereas the Certificate of Formation is for LLCs, highlighting their difference in the type of business structure they create.

Similarly, the Certificate of Incorporation found in states like Delaware has parallels with California's Articles of Incorporation. Both documents are essential for the establishment of a corporation within their respective states and necessitate details such as the corporation's name, the number and type of authorized shares, the name and address of the registered agent, and the incorporator's information. The primary difference between the two lies in their state-specific requirements and the legal and tax implications associated with the state where the corporation is formed.

Another related document is the Bylaws of a corporation, which while not filed with the state, are essential internal documents that detail the governance of the corporation. Bylaws typically cover topics such as the corporation's organizational structure, the roles and responsibilities of directors and officers, and the process for handling corporate meetings and decision-making. Though Bylaws and the Articles of Incorporation serve different purposes, they are interconnected, with the Articles establishing the corporation’s existence and the Bylaws guiding its internal operations.

The Operating Agreement for LLCs, although more closely related to the Certificate of Formation, shares its relevance with the Articles of Incorporation in a broader sense. This document outlines the operational procedures, financial decisions, and ownership percentages among members of an LLC. Like the Bylaws in a corporation, an Operating Agreement details the internal governance structure but for an LLC instead. The commonality between these documents lies in their focus on structuring and regulating the affairs of the business entity.

The Statement of Information, required periodically by states like California, also shares similarities with the Articles of Incorporation. While the Articles are a one-time filing that officially creates the corporation, the Statement of Information provides updated information about the corporation's directors, officers, registered agent, and business address. Both documents are essential for maintaining the corporation's compliance with state regulations, albeit at different stages of the corporation's lifecycle.

The DBA (Doing Business As) registration form, though fundamentally different in its purpose, aligns with the Articles of Incorporation in the aspect of legal recognition of a business entity. A DBA allows a business to operate under a name different from its legal name, whereas the Articles of Incorporation establish the legal name and existence of a corporation. Both filings contribute to the business's capacity to engage in legal, financial, and operational activities under recognized names.

Finally, the Nonprofit Articles of Incorporation, specific to nonprofit organizations, mirror the for-profit Articles of Incorporation in structure and function but cater to a different sector. These documents delineate the formation of a nonprofit corporation, including its name, purpose, initial directors, and registered agent, similar to their for-profit counterparts. The distinction primarily lies in the nonprofit's mission-focused versus profit-seeking purpose and the specific tax exemptions available to nonprofit entities.

Dos and Don'ts

When filing the Articles of Incorporation in California, it's crucial to follow specific guidelines to ensure the process goes smoothly and to avoid common mistakes that could delay or invalidate your filing. Here are seven dos and don'ts to keep in mind:

- Do read the instructions carefully before filling out the form. Understanding the requirements will help you provide accurate and complete information.

- Don't use a fictitious name without checking that it's available and does not infringe on any trademarks. Conduct a name search on the California Secretary of State website to verify its uniqueness.

- Do specify the type of corporation you are registering (e.g., general stock, non-profit, professional). The classification will determine the applicable regulations and requirements.

- Don't ignore the agent for service of process section. You must designate an agent who resides in California, or a corporation authorized to act as an agent, who will receive legal and official documents on behalf of the corporation.

- Do include all required attachments and supplemental forms as specified in the instructions. This may include a Statement of Information, which is often required shortly after the Articles of Incorporation are filed.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will be rejected. Ensure that an authorized officer of the corporation signs the document.

- Do keep a copy for your records. After submitting the form, it's important to keep a copy for your corporation's records. This documentation can be crucial for legal and administrative purposes.

Following these suggestions can streamline the filing process and help establish your corporation on a solid legal foundation.

Misconceptions

Understanding the Articles of Incorporation in California is crucial for anyone looking to form a corporation in the state. However, there are several misconceptions about the form and its requirements. Clearing up these misunderstandings can streamline the process of incorporating and ensure compliance with state regulations.

Myth 1: The process is the same for all types of businesses. In reality, California has different Articles of Incorporation forms for various types of corporations, such as general stock, close corporations, nonprofit public benefit, nonprofit mutual benefit, and professional corporations. Each type has unique requirements and benefits, tailored to the corporation's specific needs and goals.

Myth 2: Once filed, the document's details cannot be changed. Many believe that once the Articles of Incorporation are filed with the California Secretary of State, the information is set in stone. However, amendments can be made to the Articles if the corporation needs to change its name, adjust the number of authorized shares, alter its business purpose, or update other details. This process involves filing Articles of Amendment with the Secretary of State, along with the appropriate fee.

Myth 3: The filing alone provides protection against personal liability for business debts and obligations. While incorporating offers limited liability protection, simply filing the Articles of Incorporation is not enough. Corporations must follow certain formalities, such as holding regular meetings, maintaining separate bank accounts, and properly documenting decisions to ensure that the corporate veil is not pierced, which could expose officers and directors to personal liability.

Myth 4: The Articles of Incorporation are the only document needed to start operations. Many assume that once the Articles are filed, the corporation is ready to do business. However, to be fully operational and compliant, additional steps are necessary. These include obtaining an Employer Identification Number (EIN) from the IRS, filing a Statement of Information with the California Secretary of State, possibly drafting bylaws, and applying for any required business licenses and permits. This comprehensive approach helps establish the corporation on solid legal and operational grounds.

Key takeaways

When setting up a corporation in California, the Articles of Incorporation form plays a pivotal role. This document establishes the corporation's existence under state law. Grasping the essentials of properly filling out and utilizing this form is critical to ensuring the process goes smoothly.

- Accurate Information is Crucial: It's imperative to fill out the form with accurate and complete information. This includes the corporation's name, which must be unique and meet California's naming requirements, the purpose of the corporation, and details about the agent for service of process, stock information, and the incorporator's information. Errors or omissions can delay the process or affect the corporation's legal standing.

- Select the Right Form: California offers different forms depending on the type of corporation being established (e.g., general stock, no stock, professional). Choosing the correct form is essential, as it contains specific provisions and requirements tailored to the type of corporation you're establishing.

- Follow Up on Submission: After submitting the Articles of Incorporation, it's important to monitor the status of the filing with the California Secretary of State's office. Delays can occur, and in some cases, additional information may be requested. Staying proactive can help expedite the process.

- Understanding the Legal Implications: Filling out the Articles of Incorporation is just the first step in a series of legal and regulatory requirements for new corporations in California. Familiarizing yourself with the ongoing requirements, such as annual reports and tax obligations, is essential for maintaining good standing and operating legally within the state.

Create Some Other Templates for California

Judicial Council of California Forms - This form is used to provide proof to the court that legal papers have been properly served to an individual or entity.

Divorce Settlement Agreement Template - The agreement is customizable to fit the unique needs of each couple, accommodating various family and financial situations.