Attorney-Approved California Bill of Sale Document

In the vibrant and bustling state of California, transactions of tangible goods between individuals necessitate a clear and concise document to ensure the legality and security of the exchange. Enter the California Bill of Sale form, an essential piece of documentation that plays a pivotal role in a wide array of transactions, from the sale of a car to the transfer of ownership for smaller items like furniture or electronics. This form not only serves as a receipt for the transaction but also as a binding document that details the terms of the sale, including the specifics about the item sold, the sale price, and the identities of the buyer and seller. Given its importance, understanding the nuances of this form, as well as how and when to use it, is crucial for both parties involved in the transaction. Ensuring the form is completed accurately can safeguard against potential disputes and serves as a tangible record of the agreement, providing peace of mind and legal protection in a simple yet effective manner.

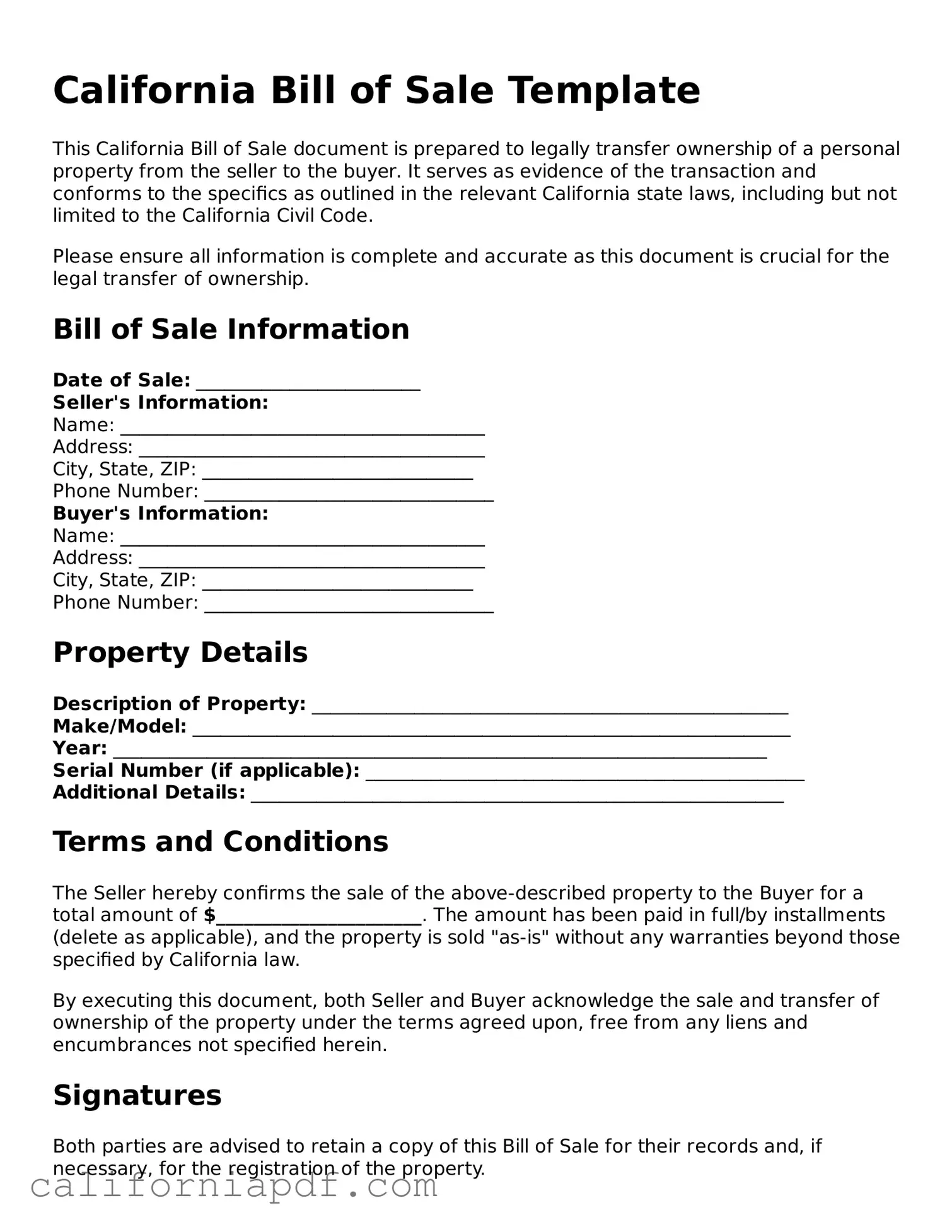

Document Example

California Bill of Sale Template

This California Bill of Sale document is prepared to legally transfer ownership of a personal property from the seller to the buyer. It serves as evidence of the transaction and conforms to the specifics as outlined in the relevant California state laws, including but not limited to the California Civil Code.

Please ensure all information is complete and accurate as this document is crucial for the legal transfer of ownership.

Bill of Sale Information

Date of Sale: ________________________

Seller's Information:

Name: _______________________________________

Address: _____________________________________

City, State, ZIP: _____________________________

Phone Number: _______________________________

Buyer's Information:

Name: _______________________________________

Address: _____________________________________

City, State, ZIP: _____________________________

Phone Number: _______________________________

Property Details

Description of Property: ___________________________________________________

Make/Model: ________________________________________________________________

Year: ______________________________________________________________________

Serial Number (if applicable): _______________________________________________

Additional Details: _________________________________________________________

Terms and Conditions

The Seller hereby confirms the sale of the above-described property to the Buyer for a total amount of $______________________. The amount has been paid in full/by installments (delete as applicable), and the property is sold "as-is" without any warranties beyond those specified by California law.

By executing this document, both Seller and Buyer acknowledge the sale and transfer of ownership of the property under the terms agreed upon, free from any liens and encumbrances not specified herein.

Signatures

Both parties are advised to retain a copy of this Bill of Sale for their records and, if necessary, for the registration of the property.

Seller's Signature: ______________________________ Date: _______________

Buyer's Signature: ________________________________ Date: _______________

Witness (if applicable)

Name: ______________________________________

Signature: ________________________________ Date: _______________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Used to document the transfer of ownership of goods from seller to buyer. |

| Applicability | Relevant for private sales of personal property in California. |

| Components | Typically includes information about the seller, buyer, the item sold, sale date, and price. |

| Legal Requirement | Not always mandated by law but highly recommended for legal protection and tax purposes. |

| Governing Law | Subject to California's Uniform Commercial Code for goods and vehicles under the Vehicle Code. |

| Additional Requirements | For vehicles, the California Department of Motor Vehicles may require additional documentation for registration. |

How to Write California Bill of Sale

Completing a Bill of Sale form in California is a straightforward process that establishes a legal record of the transaction between a seller and a buyer. This document is crucial as it not only provides proof of the transfer of ownership but also contains essential details about the item being sold and the terms of the sale. It's widely used for private sales of vehicles, boats, firearms, and other valuable items. Ensure all information is accurate and reflects the agreement between the parties to avoid any future disputes.

- Gather all necessary information including the full names and addresses of both the seller and the buyer, description of the item being sold (make, model, year, and serial number), the sale price, and the date of sale.

- Enter the seller's name and address at the top of the form where indicated.

- Fill in the buyer's name and address in the designated area on the form.

- Describe the item being sold, including its make, model, year, and any identifying numbers or features. For vehicles, this includes the Vehicle Identification Number (VIN).

- Input the sale price of the item in the space provided and specify the currency if necessary.

- Indicate the date the sale will be or was finalized.

- Both the buyer and seller should carefully review the document to ensure all the information is accurate and complete.

- Sign and date the form as the seller, and ensure the buyer also signs and dates the form. The signatures validate the document.

After filling out the California Bill of Sale form, it is recommended for both parties to keep a copy for their records. This document serves as legal proof of the exchange and can be vital for registration, tax purposes, or in the event of any disputes concerning the sale. There's no need to file it with the state, but maintaining a copy ensures that both parties have evidence of the transaction's terms and conditions.

Listed Questions and Answers

What Is a California Bill of Sale Form?

A California Bill of Sale form is a legal document used to record the transfer of ownership of personal property from a seller to a buyer. This document typically includes details such as the names and addresses of both the seller and the buyer, a description of the item being sold, the sale price, and the date of sale. While it's commonly used for the sale of vehicles, it can also apply to other types of personal property, such as boats, furniture, or electronics.

Do I Need to Notarize the California Bill of Sale Form?

In California, notarization of a Bill of Sale form is not a legal requirement for it to be considered valid. However, having the document notarized can add an extra layer of protection against potential disputes in the future. It verifies the signatures on the document, ensuring that the individuals involved in the transaction are indeed who they claim to be. While optional, it's something to consider, especially for high-value transactions.

How Can I Get a California Bill of Sale Form?

There are several ways to obtain a California Bill of Sale form:

- Online from legal document websites: Many platforms offer generic Bill of Sale forms that can be customized for California.

- From the California Department of Motor Vehicles (DMV): If the sale involves a vehicle, the DMV provides specific forms that meet state requirements.

- Creating your own: It's possible to create a Bill of Sale form provided it includes all necessary information required for a legal transaction. However, consulting with a legal professional can ensure accuracy.

What Information Is Required on a California Bill of Sale Form?

To complete a California Bill of Sale form, the following information is typically required:

- The full names and addresses of both the seller and the buyer.

- A detailed description of the item being sold. For vehicles, this includes the make, model, year, VIN, and mileage.

- The sale price of the item.

- The date of sale.

- Signatures of both the seller and the buyer.

Including additional information, such as warranty details or terms of the sale, can also be beneficial for both parties.

Is a California Bill of Sale Form Sufficient to Transfer Vehicle Ownership?

While a California Bill of Sale form is a crucial part of transferring ownership of a vehicle, it alone is not sufficient to complete the transfer. The seller must also complete a Notice of Transfer and Release of Liability (NRL), which is submitted to the California DMV. Additionally, the buyer needs to take the Bill of Sale, the vehicle's title, and payment for the transfer fee to the DMV to officially change the vehicle's registration into their name. It's important to complete these steps promptly to ensure a smooth transfer of ownership.

Common mistakes

When it comes to completing the California Bill of Sale form, it's crucial to fill it out correctly to ensure that the sale is legally binding and accurately recorded. However, many individuals make common mistakes during this process. Here's a list of the nine most frequent errors:

Not checking the form for the most current version. The state may update the form to reflect new legal requirements.

Forgetting to include full names and addresses of both the buyer and the seller. Accurate details are crucial for the validity of the document.

Leaving out the description of the item being sold. This includes the make, model, year, and, for vehicles, the Vehicle Identification Number (VIN).

Incorrectly noting the sale price or not specifying the currency used. This can lead to confusion or legal issues down the line.

Skipping the date of sale, which is critical for record-keeping and sometimes for legal reasons.

Failing to obtain signatures from both parties. Without both signatures, the document may not be legally binding.

Ignoring the need for witness signatures or a notary public, if required. This step adds an extra layer of legality and verification.

Not providing an accurate odometer reading for vehicle sales, a requirement which can lead to legal penalties if omitted or falsified.

Forgetting to make and distribute copies of the completed form to all parties involved, including the buyer, seller, and possibly a legal advisor or the DMV.

To avoid these mistakes, it's recommended to carefully review the form, double-check all entered information, and ensure that all necessary steps have been completed before finalizing the sale. These actions will help protect all parties involved in the transaction.

Documents used along the form

When transferring ownership of personal property in California, a Bill of Sale form is a crucial document that provides evidence of the transaction. However, to ensure the legality of the transaction and to fulfill all legal requirements, several other forms and documents are often used alongside the Bill of Sale. Here's a look at some of these documents.

- Certificate of Title: This document proves ownership of the property. For vehicles, the Department of Motor Vehicles (DMV) issues this certificate. It needs to be transferred to the new owner upon the sale.

- Odometer Disclosure Statement: Required for the sale of vehicles, this document records the mileage of the vehicle at the time of sale. It helps prevent odometer fraud.

- Release of Liability: This form is submitted to the DMV, notifying them of the transfer of property. It releases the previous owner from liability for what the new owner may do with the property.

- Smog Certification: In California, a smog certificate is often required for the sale of a vehicle, indicating that it meets the state's emission standards.

- Notice of Transfer and Release of Liability: This document is used to inform the DMV about the change of ownership, similar to the Release of Liability, but it also includes the vehicle's new owner's information.

- Vehicle/Vessel Transfer and Reassignment Form: This form is necessary for the seller to transfer ownership to the buyer and is used when the title is missing or for adding or deleting names from the title.

- Power of Attorney: In some cases, a party might not be able to attend the sale or signing of documents. A power of attorney gives someone else the legal authority to sign on their behalf.

- As-Is Sale Agreement: Particularly relevant for the sale of used items, this document specifies that the item is being sold in its current condition, and the buyer accepts it, defects and all.

Together, these documents support the Bill of Sale by ensuring that all aspects of the transaction are properly recorded and legally binding. They protect both the buyer and seller, ensuring a smooth transfer of ownership and helping to avoid potential legal disputes in the future.

Similar forms

A Warranty Deed is one document similar to the California Bill of Sale as it also serves to transfer ownership, but of real estate rather than personal property. While the Bill of Sale is used for transactions involving items like vehicles or equipment, a Warranty Deed comes into play when the ownership of a house or land is changed. Both documents act to legally certify the transfer from one party to another, with the Warranty Deed providing an added assurance that the property is free from any undisclosed encumbrances.

The Quitclaim Deed, another document akin to the California Bill of Sale, is used in the transfer of property rights. Unlike the Warranty Deed, it does not guarantee that the title is clear of claims. It simply transfers whatever interest the grantor has in the property, which may be none. This aspect mirrors the Bill of Sale, as both convey ownership without making any claims about the condition of the asset being transferred.

A Promissory Note is somewhat parallel to the California Bill of Sale because it records a transaction, specifically a promise to pay a debt. The Bill of Sale confirms the transfer of ownership of an item, whereas the Promissory Note documents the conditions under which one party agrees to pay another a specified sum of money. Both are pivotal in providing evidence that an agreement has been made and the terms associated with it.

Another similar document is the Sales Agreement which, like the Bill of Sale, outlines the terms of a transaction between a buyer and a seller. However, it is often more detailed and used for more complex arrangements, specifying conditions such as payment plans, delivery dates, and warranties. The California Bill of Sale serves a similar function for more straightforward, immediate transactions, essentially proving a change of ownership took place.

The Loan Agreement shares similarities with the California Bill of Sale in that both signify an agreement between two parties. This document specifies the terms under which one party will lend money to another, including the repayment schedule, interest rate, and collateral, if applicable. While the Bill of Sale records the transfer of tangible property, the Loan Agreement deals with the transfer of money under agreed conditions.

Lastly, the Security Agreement is akin to the Bill of Sale, as it involves personal property. A Security Agreement, however, is used to provide a lender a security interest in the property of the borrower, serving as collateral for a loan. This document ensures that the lender has a legal right to seize the property if the borrower defaults on their loan. Both documents deal with personal property rights but with different purposes: the Bill of Sale for ownership transfer, and the Security Agreement for securing a loan.

Dos and Don'ts

When filling out the California Bill of Sale form, it's important to ensure all information is accurate and complete to legally transfer ownership of an item. Here are some essential dos and don'ts to keep in mind:

Things You Should Do

- Include detailed information about both the seller and the buyer, such as full names, addresses, and contact details.

- Provide a complete description of the item being sold, including make, model, year, and VIN or serial number, if applicable.

- Make sure the sale price is clearly stated and reflects the agreed-upon amount between the seller and the buyer.

- Both the seller and the buyer should sign and date the form in the presence of a notary public, if required.

Things You Shouldn’t Do

- Don't leave any sections of the form blank. If a section doesn't apply, mark it as "N/A" (not applicable).

- Don't forget to check if the state requires the Bill of Sale to be notarized. Failing to do so can invalidate the document.

- Avoid making handwritten changes or using correction fluid on the form. If errors are made, it's best to start with a new form.

- Don't neglect to keep a copy of the completed Bill of Sale for your records. Both the seller and the buyer should have a copy.

Misconceptions

When it comes to transferring ownership of personal property in California, a Bill of Sale form is often used to legally document the transaction. However, there are several misconceptions about the California Bill of Sale that can confuse both buyers and sellers. Let's clear up some of these misunderstandings.

- It's required for all sales. Many people believe that a Bill of Sale is a legal requirement for every transaction in California. The truth is, while it's highly recommended as it provides a record of the sale, it's not mandatory for all sales. For certain types of personal property, like vehicles, it's indeed important to have one, but it's not legally required for every single sale.

- One form fits all. Another common misconception is that there is a one-size-fits-all Bill of Sale form for every type of transaction. In reality, the form should be tailored to the specific item being sold. For example, selling a car will require information about the vehicle identification number (VIN), make, model, and year, which wouldn't be necessary for selling a piece of furniture.

- It must be notarized to be valid. While having a Bill of Sale notarized can add an extra layer of security and authenticity to the document, it is not a requirement for the form to be considered valid in California. As long as it includes the necessary elements and is signed by both parties, it is generally considered legally binding.

- It transfers the title of the property. Another misunderstanding is that signing a Bill of Sale automatically transfers the title of the property. In fact, a Bill of Sale is primarily a record of the transaction. The actual transfer of title or ownership depends on the item in question. For vehicles, a title transfer form must be filed with the Department of Motor Vehicles (DMV).

- Only the buyer needs to keep a copy. Lastly, there's a misconception that only the buyer needs to retain a copy of the Bill of Sale. However, it's beneficial for both the buyer and the seller to keep a copy. For the seller, it can serve as proof that the item was sold and the specifics of the transaction, which can be important for tax and liability purposes.

Understanding these misconceptions about the California Bill of Sale can help ensure that both buyers and sellers navigate the sale of personal property smoothly and legally.

Key takeaways

When engaging in transactions involving the sale of personal property, vehicles, or other items in California, the Bill of Sale form serves as a crucial document. Here are nine key takeaways to remember when filling out and using the California Bill of Sale form:

- Legal Proof of Transfer: The form acts as legal proof of the transfer of ownership from the seller to the buyer, ensuring all parties have a record of the transaction.

- Details of the Item Sold: It's vital to accurately describe the item being sold, including make, model, year, and serial number if applicable. This information helps in identifying and verifying the item.

- Information about Seller and Buyer: Full names and addresses of both the seller and the buyer must be clearly provided on the form to establish the identities of the parties involved in the transaction.

- Date of Sale: The document should clearly state the date on which the sale is completed. This date is important for record-keeping and sometimes for legal reasons.

- Price: Clearly state the sale price of the item. This amount should be agreed upon by both parties. If the item is a gift, it should be noted to avoid confusion about the transaction being a sale.

- Signature Requirement: For the document to be legally binding, both the seller and the buyer need to sign it. Some situations may also require witness signatures.

- No Statewide Requirement: While California does not mandate a Bill of Sale for personal transactions statewide, local jurisdictions may require it. It's always a good idea to complete one for record-keeping and proof of ownership reasons.

- Helpful for Tax and Legal Records: The Bill of Sale can be an essential document for tax purposes, especially when reporting income from the sale. It also may be required when registering a vehicle or defending against future legal disputes.

- Verification: Lastly, before finalizing, verify all the information on the form for accuracy. Mistakes can lead to problems in the future, especially if disputes arise over the specifics of the transaction.

Fill out the California Bill of Sale form with due diligence and keep a copy for your records to ensure that you have documented proof of your transactions clearly and thoroughly.

Create Some Other Templates for California

Does Llc Need Operating Agreement - Having an Operating Agreement can make it easier to secure financing, as lenders often require seeing your business plan and structure clearly delineated.

Are Non Compete Agreements Enforceable in California - Can include a clause specifying financial compensation for the employee, in return for agreeing to these restrictions.