Fill a Valid California 100 We Form

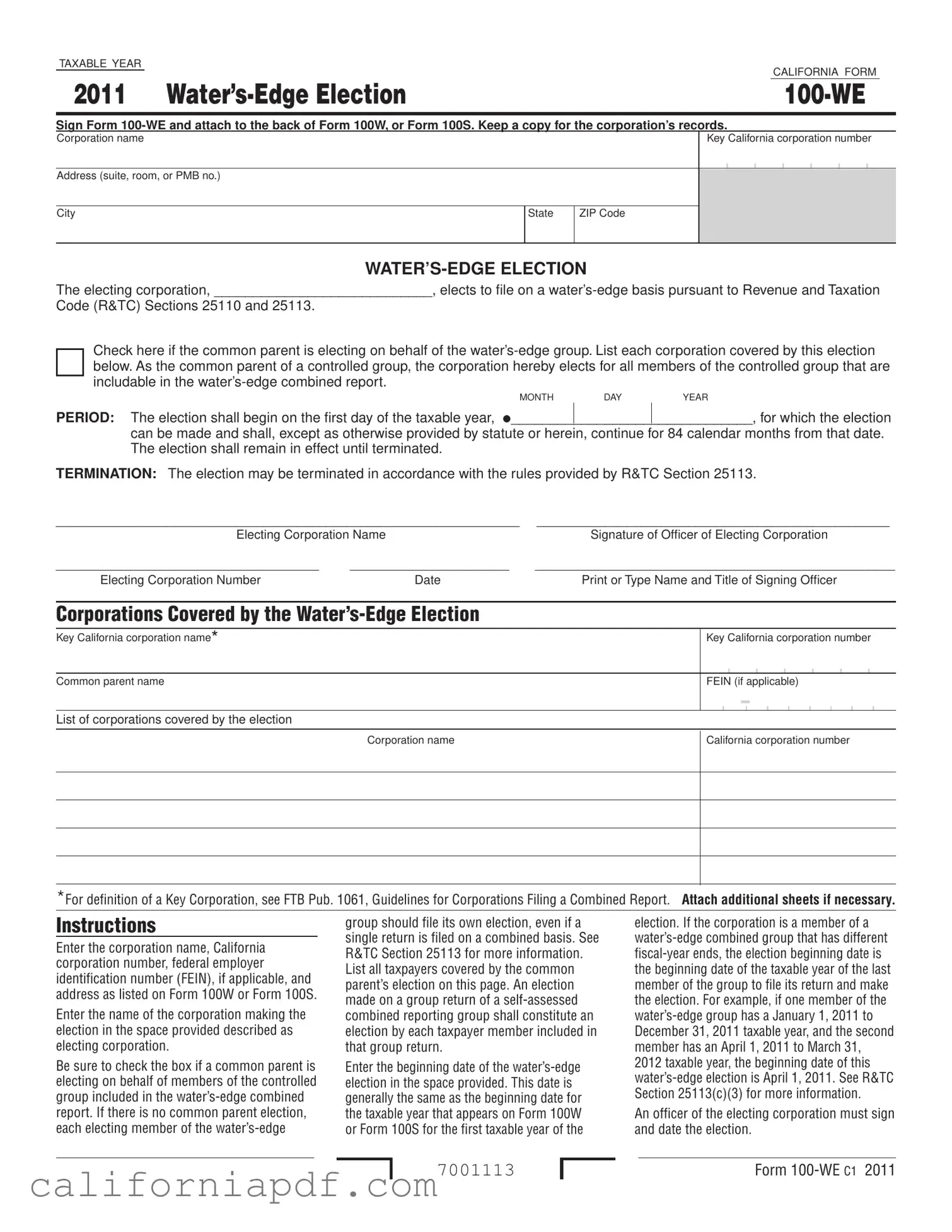

Navigating the complexities of corporate taxation in California can be challenging, especially when considering the strategic decision to file under the Water's-Edge Election via the California Form 100-WE for the 2011 tax year. This form is an integral document for corporations electing to report their income on a water's-edge basis, as outlined in Revenue and Taxation Code (R&TC) Sections 25110 and 25113. The form requires detailed information about the electing corporation, including its name, California corporation number, address, and the period for which the election is to begin. The water's-edge election allows corporations to limit their tax base to the income earned from their U.S. and certain foreign operations. This decision could have significant implications for a corporation's tax liabilities and operational strategy. Importantly, the form must be signed by an officer of the electing corporation and be attached to Form 100W or Form 100S, with all corporations covered by the water's-edge election clearly listed. The election stays in effect for 84 months, unless terminated under specific statutory provisions. Additionally, corporations are advised to keep a copy for their records and pay attention to instructions regarding the common parent's election on behalf of the controlled group. This overview captures the critical elements to consider and the procedural steps for making a water's-edge election, providing a foundation for understanding how to navigate this option within California's tax regulations.

Document Example

TAXABLE YEAR

|

|

CALIFORNIA FORM |

|

|

|

2011 |

||

|

|

|

Sign Form

Corporation name

Key California corporation number

Address (suite, room, or PMB no.)

City

State

ZIP Code

The electing corporation, ____________________________, elects to file on a

Code (R&TC) Sections 25110 and 25113.

Check here if the common parent is electing on behalf of the

MONTHDAYYEAR

PERIOD: The election shall begin on the first day of the taxable year, I_______________________________, for which the election

can be made and shall, except as otherwise provided by statute or herein, continue for 84 calendar months from that date. The election shall remain in effect until terminated.

TERMINATION: The election may be terminated in accordance with the rules provided by R&TC Section 25113.

___________________________________________________________________ |

___________________________________________________ |

|

Electing Corporation Name |

Signature of Officer of Electing Corporation |

|

______________________________________ |

_______________________ |

____________________________________________________ |

Electing Corporation Number |

Date |

Print or Type Name and Title of Signing Officer |

Corporations Covered by the

Key California corporation name*

Key California corporation number

Common parent name

FEIN (if applicable)

List of corporations covered by the election

Corporation name

California corporation number

*For definition of a Key Corporation, see FTB Pub. 1061, Guidelines for Corporations Filing a Combined Report. Attach additional sheets if necessary.

Instructions

Enter the corporation name, California corporation number, federal employer identification number (FEIN), if applicable, and address as listed on Form 100W or Form 100S.

Enter the name of the corporation making the election in the space provided described as electing corporation.

Be sure to check the box if a common parent is electing on behalf of members of the controlled group included in the

group should file its own election, even if a single return is filed on a combined basis. See R&TC Section 25113 for more information. List all taxpayers covered by the common parent’s election on this page. An election made on a group return of a

Enter the beginning date of the

election. If the corporation is a member of a

2012 taxable year, the beginning date of this

An officer of the electing corporation must sign and date the election.

7001113

Form

Form Breakdown

| Fact | Description |

|---|---|

| Form Title and Year | California Form 100-WE, 2011 Taxable Year |

| Purpose | To elect to file on a water's-edge basis |

| Governing Law | Revenue and Taxation Code Sections 25110 and 25113 |

| Attachment Requirement | Sign and attach Form 100-WE to the back of Form 100W, or Form 100S |

| Record Keeping | Keep a copy for the corporation’s records |

| Election Criteria | The common parent can elect on behalf of the water's-edge group |

| Duration | Election continues for 84 months from the date it begins, unless terminated earlier as provided by statute or agreement |

| Termination | May be terminated in accordance with R&TC Section 25113 |

| Signatory Requirements | An officer of the electing corporation must sign the form |

| Key Corporation Definition | For the definition of a Key Corporation, see FTB Pub. 1061, Guidelines for Corporations Filing a Combined Report |

How to Write California 100 We

Successfully completing the Form 100-WE is a crucial step for corporations electing to file on a water’s-edge basis in California. As this form is attached to either Form 100W or Form 100S, it denotes a significant decision affecting the taxation and reporting methods of the electing corporation and its group. Careful attention to detail and accuracy in filling out this form ensures compliance with California's Revenue and Taxation Code (R&TC) Sections 25110 and 25113. Below, a step-by-step guide is laid out to help navigate through this important process smoothly.

- Begin by entering the corporation name, California corporation number, and the corporation's address (including suite, room, or PMB number), city, state, and ZIP code as listed on Form 100W or Form 100S.

- In the section labeled "The electing corporation", input the name of the corporation making the election.

- If a common parent is electing on behalf of the controlled group included in the water’s-edge combined report, make sure to check the box indicating this choice.

- For corporations where there is no common parent election, remember that each electing member should file its own election, even if a combined return is filed on a combined basis.

- Under the section designated for the list of corporations covered by the election, enter the name and California corporation number of each taxpayer that is included in the common parent’s election. Include the common parent name and federal employer identification number (FEIN) if applicable. Attach additional sheets if necessary to list all covered corporations.

- Enter the beginning date of the water’s-edge election in the provided space. This date typically aligns with the beginning date for the taxable year shown on Form 100W or Form 100S for the initial year of election.

- An officer of the electing corporation must sign and date the form at the designated area, including their printed or typed name and title.

Once the Form 100-WE is fully completed with all necessary information accurately entered, it should be attached to the back of the appropriate form (Form 100W or Form 100S) as instructed. Keeping a copy of the completed Form 100-WE for the corporation’s records is also advisable. This careful compliance underpins the correct application of the election and upholds the integrity of the corporation's financial reporting to the State of California.

Listed Questions and Answers

What is Form 100-WE and who needs to file it?

Form 100-WE, known as the Water’s-Edge Election form, is for corporations that choose to file their California income taxes on a water’s-edge basis. This election allows only the income and apportionment factors from the U.S. and certain related entities to be considered in the California tax base. It's required for any corporation that opts for this tax filing method, whether filing individually or as part of a controlled group.

How do I attach Form 100-WE to my tax return?

You must sign Form 100-WE and attach it to the back of Form 100W, or Form 100S, depending on your filing. Ensure you keep a copy for the corporation’s records.

What information is required on Form 100-WE?

The information required includes the corporation name, California corporation number, address, and the list of all corporations covered by the election. If applicable, the federal employer identification number (FEIN) of the common parent and the election date must also be included.

Can a common parent elect on behalf of the water’s-edge group?

Yes, a common parent can make the election on behalf of all members of the controlled group that are included in the water’s-edge combined report. This should be indicated on the form by checking the designated box.

How long does the water’s-edge election last?

The water’s-edge election begins on the first day of the taxable year for which the election is made and continues for 84 calendar months (7 years) from that date, remaining in effect until it is terminated in accordance with statutory provisions.

How can the water’s-edge election be terminated?

Termination of the water’s-edge election must follow the rules provided by Revenue and Taxation Code Section 25113. Specific termination procedures ensure compliance and proper transition.

What if my corporation is part of a water’s-edge combined group with different fiscal year ends?

If the group's members have different fiscal year ends, the beginning date for the water’s-edge election is the start date of the last member's fiscal year. The election applies to all members included in the state group return, ensuring a unified tax approach.

Who is required to sign the Form 100-WE?

An officer of the electing corporation must sign and date the form. This signifies the corporation's commitment to the water’s-edge election and its terms.

Where can I find more information or assistance with Form 100-WE?

For more detailed information or assistance, you can refer to FTB Pub. 1061, Guidelines for Corporations Filing a Combined Report, or contact the California Franchise Tax Board directly. These resources provide comprehensive guidance on the water’s-edge election process.

Common mistakes

Filing the California Form 100-WE requires attention to detail. Some common mistakes can lead to unnecessary delays or complications. These mistakes include:

- Not including the correct corporation name and California corporation number as they appear on Form 100W or Form 100S.

- Failing to check the box if a common parent is making the election on behalf of the water’s-edge group, which is crucial for the election to be recognized for the entire group.

- Omitting the list of all corporations covered by the common parent’s election, which is necessary for the election to apply to the entire water’s-edge group.

- Inaccurately entering the beginning date of the water’s-edge election period, leading to confusion about the election's effective duration.

It’s important to:

- Review the form and ensure that all necessary sections are completed accurately.

- Verify the corporation and California corporation numbers against official documents to prevent mismatches.

- Understand the significance of indicating if a common parent is electing on behalf of the group to ensure the election applies appropriately.

- Carefully determine the beginning date of the election period, considering the fiscal years of all group members, to avoid discrepancies.

Attention to these details enhances the accuracy of the filing and helps in achieving a smooth processing of the Form 100-WE.

Documents used along the form

When dealing with the California Form 100-WE, which is used for making a Water’s-Edge Election, there are several other forms and documents that businesses often need to use or consider. These additional documents help in ensuring that the corporation complies with all relevant tax and legal requirements for their specific situation. Here’s an overview of some of these essential documents.

- Form 100W: This is the California Corporation Franchise or Income Tax Return — Water’s-Edge Filers form. It is the primary tax return form for corporations electing to file on a water’s-edge basis. It details the income, deductions, and tax credits of the corporation.

- Form 100S: Known as the California S Corporation Franchise or Income Tax Return form. It is for S corporations operating in California and includes information on income, losses, and taxes owed.

- Form 1061: Guidelines for Corporations Filing a Combined Report provide detailed instructions for corporations that are part of a controlled group and wish to file a combined report, including those electing the water’s-edge option.

- Form 109: This is the California Exempt Organization Business Income Tax Return form. It is relevant for nonprofit organizations that are part of the water’s-edge election and have unrelated business taxable income.

- Form 199: Known as the California Exempt Organization Annual Information Return. Nonprofit organizations use it to report their annual financial information to the state.

- Schedule R: Apportionment and Allocation of Income form helps corporations that operate both within and outside of California calculate the portion of income subject to California taxes.

- Form 568: The Limited Liability Company Return of Income form is used by LLCs that are classified as partnerships for tax purposes. It details the income, deductions, and tax liability of the LLC.

- FTB Pub. 1061: This publication provides Guidelines for Corporations Filing a Combined Report, offering valuable insights and instructions for corporations making the water’s-edge election.

Understanding and utilizing these documents, when appropriate, is crucial for entities making a water’s-edge election in California. By carefully navigating these forms, corporations can better comply with tax regulations and minimize their tax liabilities while taking advantage of the water’s-edge election provisions. It’s important to consult with a tax professional to ensure that all reporting is accurate and complete.

Similar forms

The California Form 100-WE, utilized for the water’s-edge election, shares similarities with several other tax documents, each serving specific purposes but parallel in their ability to electioneer or report financial activity for tax purposes. One such document is the California Form 100W, which is used for filing corporate franchise or income tax returns on a combined reporting basis. Both forms are integral to the taxation process for corporations operating within a controlled group, allowing for the aggregation of income and deductions among affiliated entities to accurately reflect their California income tax obligations.

Similarly, the California Form 100S plays a crucial role for S corporations in California, akin to how Form 100-WE is used by corporations electing the water’s-edge method. While Form 100S is designed for S corporations to file their income tax returns, reflecting their pass-through status where income, losses, deductions, and credits flow through to shareholders, Form 100-WE applies to corporations opting for a specific international income reporting method. Both, however, require specific designations and elections to be made for the tax-filing entity.

The Federal Form 1120 stands as the U.S. Corporation Income Tax Return, paralleling the state-focused purpose of Form 100-WE by requiring corporations to report their income, gains, losses, deductions, and credits to the federal government. Even though one is federal and the other state-specific, both are essential in ensuring corporations comply with their respective tax obligations based on their operational and financial structures.

The California Form 565, the Partnership Return of Income, while primarily for partnerships, shares a structural similarity with Form 100-WE in terms of consolidating the financial activities of multiple entities for tax purposes. Form 100-WE achieves this by allowing corporations within a controlled group to be taxed on a combined basis, while Form 565 accomplishes a similar objective for partners within a partnership, aligning on the principle of collective financial reporting.

Form 568, the Limited Liability Company Return of Income in California, also resonates with the collective reporting aspect of Form 100-WE. While Form 568 is tailored for LLCs that are treated as partnerships for tax purposes, it similarly requires the aggregation of the financial details of the entity for state tax considerations, illustrating the broad application of these reporting principles across different business structures.

The Federal Form 1120S, used by S corporations to report their income, deductions, gains, losses, etc., at the federal level, reflects the intent of Form 100-WE in the aspect that both forms cater to specific entity types within the tax regime, requiring detailed financial disclosures and elections to be made to ensure accurate tax reporting and compliance based on the entity’s tax status and choices.

Form 3520, the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, though focused on foreign transactions, aligns with Form 100-WE’s international aspect. Form 100-WE applies to corporations electing a water’s-edge basis, thus limiting the scope of their taxable income to the U.S. and certain international incomes, similar to how Form 3520 tracks international financial transactions for tax purposes.

The California Form 109, California Exempt Organization Business Income Tax Return, parallels Form 100-WE by being a specialized state tax form catered towards a specific group – in this case, nonprofits. Both forms demonstrate the customization of tax reporting requirements to accommodate the unique characteristics and activities of different organizations, ensuring that each complies with tax laws that best fit their operational nature.

Finally, the Federal Form 8832, Entity Classification Election, while not a tax return form per se, shares the elective nature with Form 100-WE. It allows entities to choose how they are classified for federal tax purposes, similar to how corporations elect to file on a water’s-edge basis with Form 100-WE. Both forms are pivotal in determining how an entity is viewed and taxed within their respective tax jurisdictions, showcasing the importance of elections in tax reporting and compliance.

Each of these documents, while serving different purposes and for different entities, shares the fundamental goal of ensuring accurate tax reporting and compliance. Whether it’s through the lens of state or federal tax, for partnerships, S corporations, or those engaging in international transactions, the essence of making specific elections or consolidating financial activity across a group for tax purposes closely ties them to the California Form 100-WE.

Dos and Don'ts

When preparing the California Form 100-WE, attention to detail can make the process smoother and ensure compliance with filing requirements. Here are several do's and don'ts to consider:

Do's:- Double-check the corporation's information: Ensure the corporation name, California corporation number, and address are accurate as they appear on Form 100W or Form 100S.

- Identify the electing corporation correctly: Clearly enter the name of the corporation making the election in the designated space.

- Indicate if a common parent is electing: If applicable, check the box to show a common parent is making the election for all qualifying members of the controlled group.

- Include all required signatures and dates: An authorized officer must sign the form, indicating their name, title, and the current date.

- List all covered corporations: Provide the names and California corporation numbers of all entities covered by the water’s-edge election.

- Accurately enter the election beginning date: Calculate and enter the correct beginning date for the water’s-edge election, based on the guidelines provided.

- Keep a copy for your records: After attaching Form 100-WE to the back of Form 100W or 100S, retain a copy for the corporation’s records.

- Skip the common parent election indication: If the election involves a common parent, failing to check the appropriate box can lead to processing errors.

- Omit any covered corporations: Leaving out any entities that should be included under the water’s-edge election can invalidate the filing.

- Forget to sign and date: An unsigned or undated form is considered incomplete and will not be processed.

- Miscalculate the election starting date: Incorrect dates can affect the validity of the election, leading to potential compliance issues.

- Use incorrect information: Mismatched names or numbers that do not align with Form 100W or 100S details can delay or derail the submission.

- Fail to attach to the correct tax return: Form 100-WE must be attached to the back of the correct form (100W or 100S) for which the election applies.

- Discard the corporation's copy: Not keeping a copy for the corporation’s records can result in difficulties if verification of the election is needed in the future.

By following these guidelines, you can facilitate a smooth process for electing the water’s-edge election status, ensuring compliance and accuracy in your corporation’s tax filings.

Misconceptions

Understanding the California Form 100-WE, the Water’s Edge Election, can be complex, and various misconceptions often arise regarding its purpose, requirements, and effects. Here's a clarification of the most common misconceptions:

- Misconception 1: Any corporation can file Form 100-WE whenever they choose.

In reality, only corporations that meet specific criteria and wish to compute their California income on a water's-edge basis, rather than a worldwide basis, should file this form. The election to file on a water’s edge basis is also subject to timing restrictions.

- Misconception 2: The Water’s-Edge Election is automatically renewed each tax year.

However, once made, the election remains in effect for 84 months and does not automatically renew. Corporations must make a new election if they wish to continue after this period.

- Misconception 3: Form 100-WE is a standalone document.

Contrary to this belief, Form 100-WE must be attached to the back of Form 100W or Form 100S, and it is part of a broader filing requirement.

- Misconception 4: Only the parent company needs to file Form 100-WE for the entire group.

This is a partial truth. While a common parent can elect on behalf of all eligible members within a controlled group, each member covered by the election must be listed, and specific rules apply if there is no common parent election.

- Misconception 5: The election period can start at any point in the tax year.

The election period actually begins on the first day of the taxable year for which the election is first made and cannot be arbitrarily chosen.

- Misconception 6: All corporations, regardless of location, are covered by the election once it is made.

Only corporations that meet certain criteria and are part of the water’s-edge combined report are covered by the election. Not all members of a multinational group may qualify.

- Misconception 7: The election can be terminated at any time.

Terminating the election is subject to specific rules provided by the Revenue and Taxation Code, and cannot be done casually or at any time the corporation chooses.

- Misconception 8: Signature requirements are flexible for the Form 100-WE.

The form must be signed by an officer of the electing corporation, signifying a formal declaration and compliance with specific legal standards – it is not a mere administrative step.

Understanding these key points helps ensure that corporations accurately complete their California Form 100-WE and comply with the state’s regulatory requirements. It's important to consult with a tax professional or legal advisor familiar with California tax law and the specifics of the water’s-edge election to avoid any potential issues or misinterpretations.

Key takeaways

When corporations decide to operate on a waters-edge basis in California, navigating the Form 100-WE is crucial. Here are some key takeaways to ensure that the process is clear and straightforward:

- Understanding the Purpose: The Form 100-WE is used by a corporation to elect to compute California income tax on a water’s-edge basis, covering only income attributable to sources within and closely connected to the United States.

- Attachment Requirements: This form must be attached to the back of Form 100W (for water’s-edge filers) or Form 100S, depending on the corporation's tax filing requirements. Ensure to keep a copy for the corporation’s records.

- Common Parent Election: If a common parent is making the election for the controlled group, it is vital to check the appropriate box on the form. This signifies that the election applies to all includable members of the water’s-edge combined report.

- Listing Corporations Covered: For a common parent election, all corporations that are covered by the election need to be listed directly on the form. In cases where space is insufficient, attaching additional sheets is necessary.

- Election Starting Date: The election start date is the beginning of the taxable year for which the election is first applicable and continues for 84 months unless otherwise terminated.

- Signature Requirement: An officer of the electing corporation must sign and date the Form 100-WE to validate the election. The name and title of the officer should also be printed clearly.

- Termination of Election: It's possible to terminate the election as per the guidelines outlined in the Revenue and Taxation Code (R&TC) Section 25113. Adequate understanding of these rules is important for proper compliance.

By following these points carefully, corporations can accurately complete and submit Form 100-WE, ensuring compliance with California’s taxation laws. Remember, seeking guidance from a tax professional can also be beneficial in navigating complex tax regulations.

Different PDF Templates

Estate & Trust - Information about the creation date of the trust and the residency of trustees and grantors during the taxable year is necessary for completion.

California Gypsy Moth Checklist - Retain the filled checklist for records, as it may serve as necessary evidence of compliance in the future, safeguarding against possible disputes.

Death of Joint Tenant California - An important tool in validating the need for a change in trustee.