Fill a Valid California 109 Form

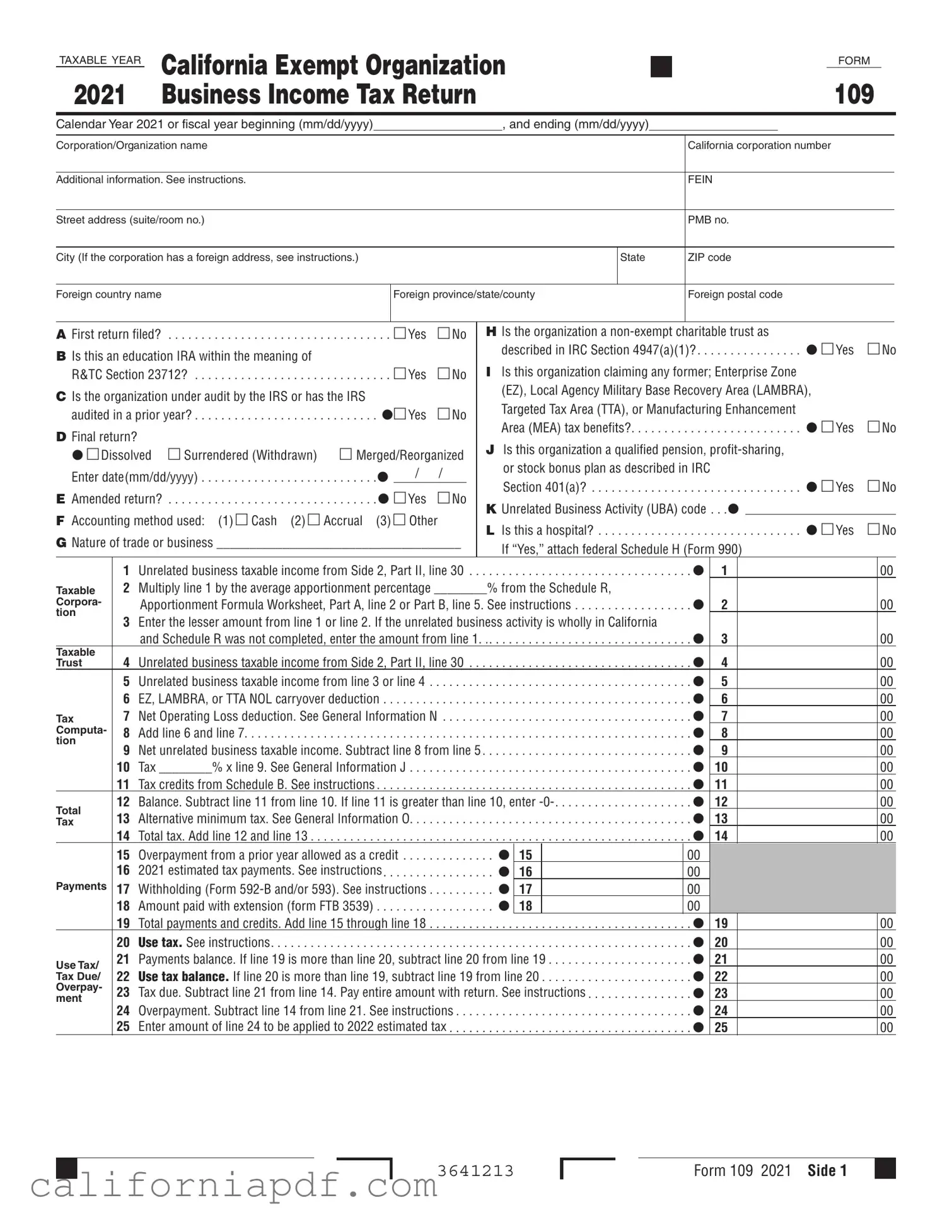

In the landscape of non-profit organizations and their regulatory compliance in California, the Form 109, titled "California Exempt Organization Business Income Tax Return," stands out as an essential document for the 2020 fiscal or calendar year. This form plays a vital role for organizations that hold exempt status under California law, enabling them to report income that is unrelated to their main exempt function, which may still be subject to taxation. Key sections within this document capture a wide range of information, from basic identification details of the filing organization, including its California corporation number and Federal Employer Identification Number (FEIN), to more specific inquiries about the nature of its activities, such as whether it has undergone IRS audits or is a non-exempt charitable trust. Furthermore, the form delves into detailed financial data, including but not limited to sources of income, deductions not taken elsewhere, and net operating loss carryover deductions, thereby painting a comprehensive financial picture for regulatory bodies. Additionally, it addresses tax credits, payments, and even the alternative minimum tax, ensuring a thorough accounting process. Form 109 not only serves as a financial reporting tool but also requires organizations to furnish information on apportionment percentages and explore categories like unrelated business taxable income, thereby ensuring adherence to the state's taxation rules while highlighting the unique position of exempt organizations in managing their tax liabilities.

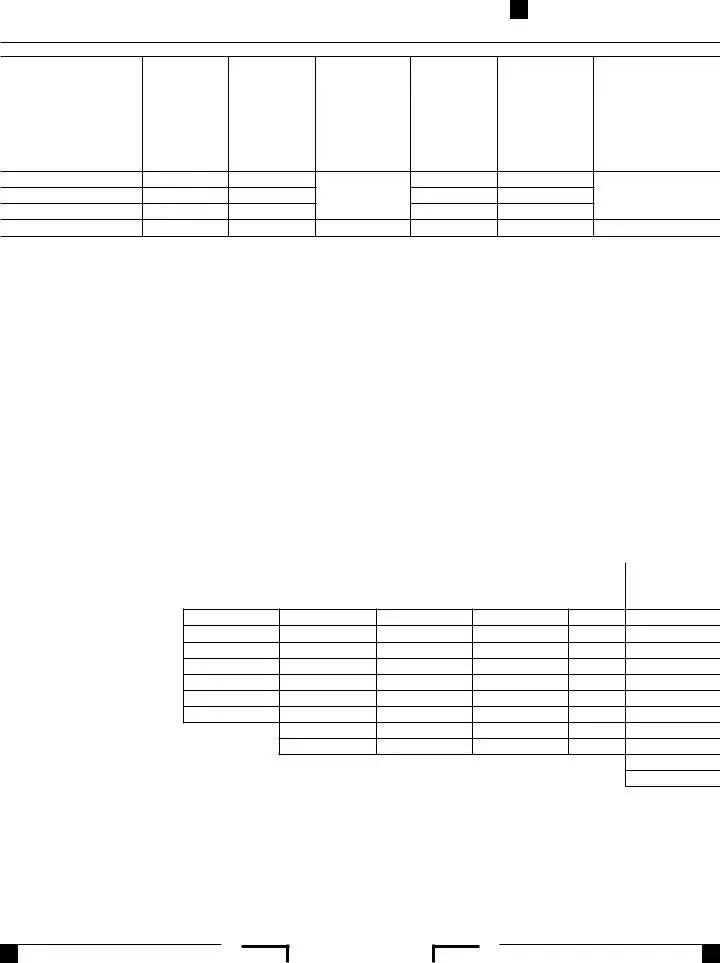

Document Example

TAXABLE YEAR |

California Exempt Organization |

|

|

|

|

|

|

|

|

|

FORM |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

109 |

|

|

|

||||||||||||||||||||

2021 |

|

Business Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Calendar Year 2021 or fiscal year beginning (mm/dd/yyyy) |

|

|

|

|

|

|

|

, and ending (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation/Organization name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California corporation number |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Additional information. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Street address (suite/room no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PMB no. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

City (If the corporation has a foreign address, see instructions.) |

|

|

|

|

|

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Foreign country name |

|

|

|

Foreign province/state/county |

|

|

Foreign postal code |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

A First return filed? |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . |

□ Yes |

□ No |

|

H Is the organization a |

|

|

|

|

||||||||||||||||||||

B Is this an education IRA within the meaning of |

|

|

|

|

|

|

|

|

described in IRC Section 4947(a)(1)? . . . . |

. . |

. . . . . . . |

. . . • □ Yes |

□ No |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

R&TC Section 23712? |

. . . . . |

. . . |

□ Yes |

□ No |

|

I Is this organization claiming any former; Enterprise Zone |

|

|

|

|

|||||||||||||||||||||

C Is the organization under audit by the IRS or has the IRS |

|

|

|

|

|

|

(EZ), Local Agency Military Base Recovery Area (LAMBRA), |

|

|

|

|

||||||||||||||||||||

•□ Yes |

|

|

|

Targeted Tax Area (TTA), or Manufacturing Enhancement |

|

|

|

|

|||||||||||||||||||||||

audited in a prior year? |

. . . . . |

|

□ No |

|

|

|

|

|

|||||||||||||||||||||||

D Final return? |

|

|

|

|

|

|

|

|

|

|

Area (MEA) tax benefits? |

. |

. . . |

. . |

. . |

. . . . . . . |

. . . • □ Yes |

□ No |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

• □ Dissolved |

□ Surrendered (Withdrawn) |

□ Merged/Reorganized |

|

J Is this organization a qualified pension, |

|

|

|

|

|||||||||||||||||||||||

Enter date(mm/dd/yyyy) |

|

. |

• |

|

/ |

/ |

|

|

|

or stock bonus plan as described in IRC |

|

|

|

• □ Yes |

|

|

|

|

|||||||||||||

. . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ No |

|||||||||||||

E Amended return? |

|

. |

• □ Yes |

□ No |

|

|

. . . . . . . . . . . . . .Section 401(a)? |

. |

. . . |

. . |

. . |

. . . . . . . . . . |

|||||||||||||||||||

. . . . . |

|

|

K Unrelated Business Activity (UBA) code . . |

.• |

|

|

|

|

|||||||||||||||||||||||

F Accounting method used: (1) □ Cash (2) □ Accrual |

(3) □ Other |

|

L Is this a hospital? |

|

|

|

|

|

|

. |

. . . • □ Yes |

□ No |

|||||||||||||||||||

G Nature of trade or business _____________________________________ |

|

. |

. . . |

. . |

. . |

. . . . . . |

|||||||||||||||||||||||||

|

If “Yes,” attach federal Schedule H (Form 990) |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

1 |

Unrelated business taxable income from Side 2, Part II, line 30 |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

1 |

|

|

|

|

|

00 |

|

|||||||||||||

Taxable |

2 |

Multiply line 1 by the average apportionment percentage ________% from the Schedule R, |

|

|

. • |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Corpora- |

|

Apportionment Formula Worksheet, Part A, line 2 or Part B, line 5. See instructions |

|

2 |

|

|

|

|

|

00 |

|

||||||||||||||||||||

tion |

3 |

Enter the lesser amount from line 1 or line 2. If the unrelated business activity is wholly in California |

|

|

. • |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

and Schedule R was not completed, enter the amount from line 1 |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

3 |

|

|

|

|

|

00 |

|

||||||||||||||

Taxable |

4 |

Unrelated business taxable income from Side 2, Part II, line 30 |

|

|

|

|

|

|

|

|

|

. • |

|

4 |

|

|

|

|

|

00 |

|

||||||||||

Trust |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

5 |

Unrelated business taxable income from line 3 or line 4 |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

5 |

|

|

|

|

|

00 |

|

||||||||||

|

6 |

EZ, LAMBRA, or TTA NOL carryover deduction . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

6 |

|

|

|

|

|

00 |

|

||||||||

Tax |

7 |

Net Operating Loss deduction. See General Information N |

. . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

7 |

|

|

|

|

|

00 |

|

|||||||||

Computa- |

8 |

Add line 6 and line 7 |

. . . . . . |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

|

8 |

|

|

|

|

|

00 |

|

||||||

tion |

9 |

Net unrelated business taxable income. Subtract line 8 from line 5 |

|

|

|

|

|

|

|

|

|

. • |

|

9 |

|

|

|

|

|

00 |

|

||||||||||

|

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

10 |

Tax ________% x line 9. See General Information J |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

10 |

|

|

|

|

|

00 |

|

|||||||||||

|

11 |

Tax credits from Schedule B. See instructions |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

11 |

|

|

|

|

|

00 |

|

||||||||

Total |

12 |

Balance. Subtract line 11 from line 10. If line 11 is greater than line 10, enter |

. • |

12 |

|

|

|

|

|

00 |

|

||||||||||||||||||||

13 |

Alternative minimum tax. See General Information O |

|

|

|

|

|

|

|

|

|

|

|

|

. • |

13 |

|

|

|

|

|

00 |

|

|||||||||

Tax |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

||||||||||||||||

|

14 |

Total tax. Add line 12 and line 13 . . . . |

. . . . . . |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

14 |

|

|

|

|

|

00 |

|

|||||||

|

15 |

. . . . . . . . . .Overpayment from a prior year allowed as a credit |

. . |

. |

. • |

15 |

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

16 |

. .2021 estimated tax payments. See instructions |

|

. . . . . . . . . . . |

. . |

. |

. • |

16 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|||||||

Payments |

17 |

Withholding (Form |

. . |

. |

. • |

17 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

18 |

Amount paid with extension (form FTB 3539) |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. • |

18 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

||||||

|

19 |

Total payments and credits. Add line 15 through line 18 |

|

|

|

|

|

|

|

|

|

|

|

|

• |

19 |

|

|

|

|

|

00 |

|

||||||||

|

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|||||||||||||||||

|

20 |

USE TAX. See instructions |

. . . . . . |

. . . |

|

. . . . . . . . . . . |

. . |

. |

. . . . |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

20 |

|

|

|

|

|

00 |

|

|||||||

Use Tax/ |

21 |

Payments balance. If line 19 is more than line 20, subtract line 20 from line 19 |

. • |

21 |

|

|

|

|

|

00 |

|

||||||||||||||||||||

22 |

USE TAX BALANCE. If line 20 is more than line 19, subtract line 19 from line 20 |

|

|

. • |

22 |

|

|

|

|

|

00 |

|

|||||||||||||||||||

Tax Due/ |

|

|

|

|

|

|

|||||||||||||||||||||||||

Overpay- |

23 |

Tax due. Subtract line 21 from line 14. Pay entire amount with return. See instructions |

|

|

. • |

23 |

|

|

|

|

|

00 |

|

||||||||||||||||||

ment |

|

|

|

|

|

|

|||||||||||||||||||||||||

24 |

Overpayment. Subtract line 14 from line 21. See instructions |

|

|

|

|

|

|

|

|

|

. • |

24 |

|

|

|

|

|

00 |

|

||||||||||||

|

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

|

|

|

|

|

|

|||||||||||||||||||

|

25 |

. . . . . . . . . .Enter amount of line 24 to be applied to 2022 estimated tax |

. . . . |

. . . . . . . . . . . . |

. . . . . |

. . . |

. . |

|

. • |

25 |

|

|

|

|

|

00 |

|

||||||||||||||

3641213

Form 109 2021 Side 1

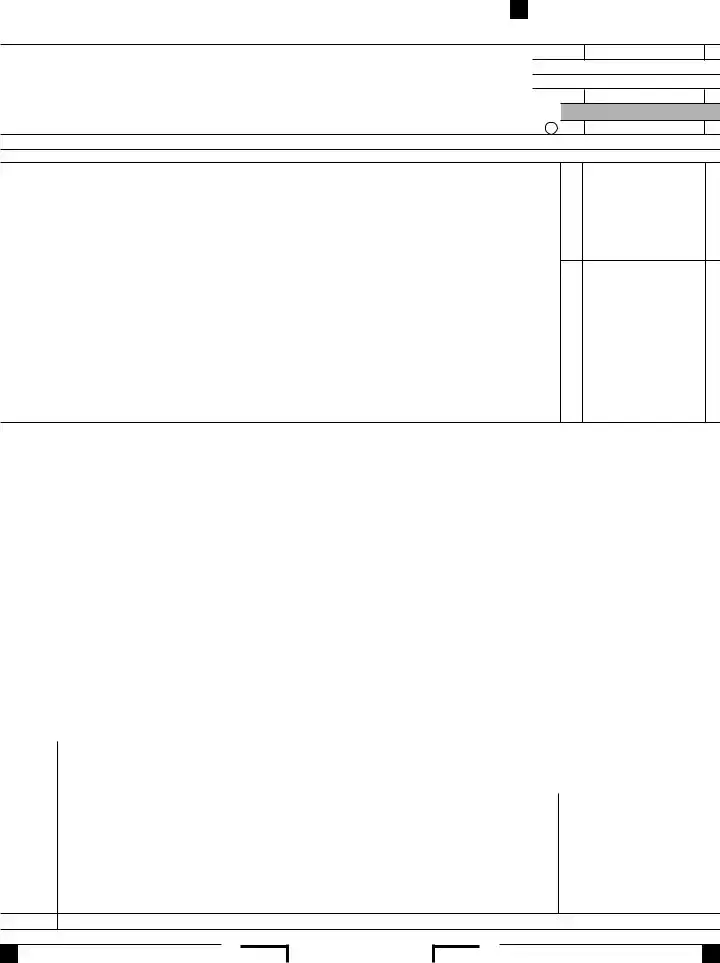

|

|

26 |

. . . . . . . . . . . . . . . . . . . . . . .Refund. If line 25 is less than line 24, then subtract line 25 from line 24 |

•. . . |

. . • |

26 |

||||

|

|

|

. . . . . . . . .a Fill in the account information to have the refund directly deposited. Routing number |

26a |

|

|||||

|

|

|

b Type: Checking |

•□ |

Savings |

c Account Number |

• |

|

26c |

|

Refund or |

|

|

|

|

•□ |

|

|

|

||

Amount |

|

27 |

Penalties and interest. See General Information M |

. |

. . • |

27 |

||||

Due |

|

. . |

|

|||||||

|

|

28 |

• □ Check if estimate penalty computed using Exception B or C and attach form FTB 5806 |

. . . |

. . . . |

|

||||

|

|

29 |

Total amount due. Add line 22, line 23, line 25, and line 27, then subtract line 24 |

. . . |

. . • |

29 |

||||

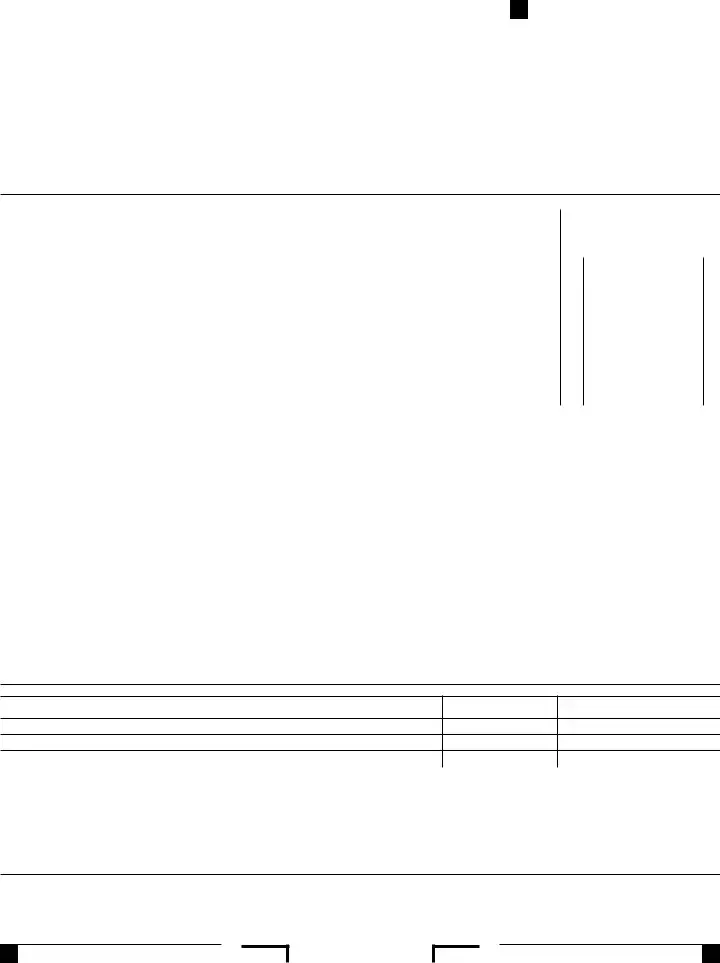

Unrelated Business Taxable Income |

|

|

|

|

|

|||||

Part I |

Unrelated Trade or Business Income |

|

|

|

|

|

||||

00

00

00

1 |

a |

Gross receipts or gross sales______________ b Less returns and allowances______________ c Balance |

• 1c |

00 |

|

2 |

Cost of goods sold and/or operations (Schedule A, line 7) |

• |

2 |

00 |

|

3 |

Gross profit. Subtract line 2 from line 1c |

• |

3 |

00 |

|

4 |

a |

Capital gain net income. See Specific Line Instructions – Trusts attach Schedule D (541) |

• 4a |

00 |

|

|

|

|

|

|

|

|

b |

Net gain (loss) from Part II, Schedule |

• 4b |

00 |

|

|

|

|

|

|

|

|

c |

Capital loss deduction for trusts |

• 4c |

00 |

|

5Income (or loss) from partnerships, limited liability companies, or S corporations. See Specific Line Instructions.

|

Attach Schedule |

• |

5 |

00 |

6 |

Rental income (Schedule C) |

• |

6 |

00 |

7 |

Unrelated |

• |

7 |

00 |

8 |

Investment income of an R&TC Section 23701g, 23701i, or 23701n organization (Schedule E) |

• |

8 |

00 |

9 |

Interest, Annuities, Royalties and Rents from controlled organizations (Schedule F) |

• |

9 |

00 |

10 |

Exploited exempt activity income (Schedule G) |

• 10 |

00 |

|

|

|

|

|

|

11 |

Advertising income (Schedule H, Part III, Column A) |

• 11 |

00 |

|

|

|

|

|

|

12 |

Other income. Attach schedule |

• 12 |

00 |

|

|

|

|

|

|

13 |

Total unrelated trade or business income. Add line 3 through line 12 |

• 13 |

00 |

|

Part II Deductions Not Taken Elsewhere (Except for contributions, deductions must be directly connected with the unrelated business income.)

14 |

Compensation of officers, directors, and trustees from Schedule I |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

14 |

|

00 |

15 |

Salaries and wages |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

15 |

|

00 |

16 |

Repairs |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

16 |

|

00 |

17 |

Bad debts |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

17 |

|

00 |

18 |

Interest. Attach schedule |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

18 |

|

00 |

19 |

Taxes. Attach schedule |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

19 |

|

00 |

20 |

Contributions. See instructions and attach schedule |

. . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

• |

20 |

|

00 |

21 |

a Depreciation (Corporations and Associations – Schedule J) (Trusts – form FTB 3885F) |

• |

21a |

|

00 |

|

|

|

|

b Less: depreciation claimed on Schedule A. See instructions |

|

21b |

|

00 |

21 |

|

00 |

22 |

Depletion. Attach schedule |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

• |

22 |

|

00 |

23 |

a Contributions to deferred compensation plans |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . |

23a |

|

00 |

|

b Employee benefit programs. See instructions |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . .. |

•. . |

23b |

|

00 |

24 |

Other deductions. Attach schedule |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

24 |

|

00 |

|

25 |

Total deductions. Add line 14 through line 24 |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . .. |

•. . |

25 |

|

00 |

26 |

Unrelated business taxable income before allowable excess advertising costs. Subtract line 25 from line 13 |

26 |

|

00 |

||||

|

|

|

|

. |

• |

|

|

|

27 |

Excess advertising costs (Schedule H, Part III, Column B) |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

27 |

|

00 |

|

|

|

|

. |

• |

|

|

|

|

28 |

Unrelated business taxable income before specific deduction. Subtract line 27 from line 26 |

28 |

|

00 |

||||

|

|

|

|

. |

• |

|

|

|

29 |

Specific deduction. See instructions |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . |

29 |

|

00 |

|

30 |

Unrelated business taxable income. Subtract line 29 from line 28. If line 28 is a loss, enter line 28 |

. . |

30 |

|

00 |

|||

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Sign |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and |

||||||||||

Here |

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

||||||||||

|

|

|

|

Title |

|

Date |

|

|

• Telephone |

||

|

Signature |

▶ |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

of officer |

|

|

|

|

|

|

|

|

|

|

|

Preparer’s |

|

|

|

|

Date |

|

Check if self- |

• PTIN |

||

|

|

|

|

|

|

|

|

||||

|

▶ |

|

|

|

|

|

|

▶ □ |

|

||

Paid |

signature |

|

|

|

|

|

employed |

|

|||

|

|

|

|

|

|

|

|

|

|

• Firm’s FEIN |

|

Preparer’s |

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, |

|

|

|

|

|

|

|

|

|

||

Use Only |

if |

▶ |

|

|

|

|

|

||||

|

and address |

|

|

|

|

|

|

|

|

• Telephone |

|

|

|

|

|

|

|

|

|

|

|||

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . • □ Yes □ No

Side 2 Form 109 2021

3642213

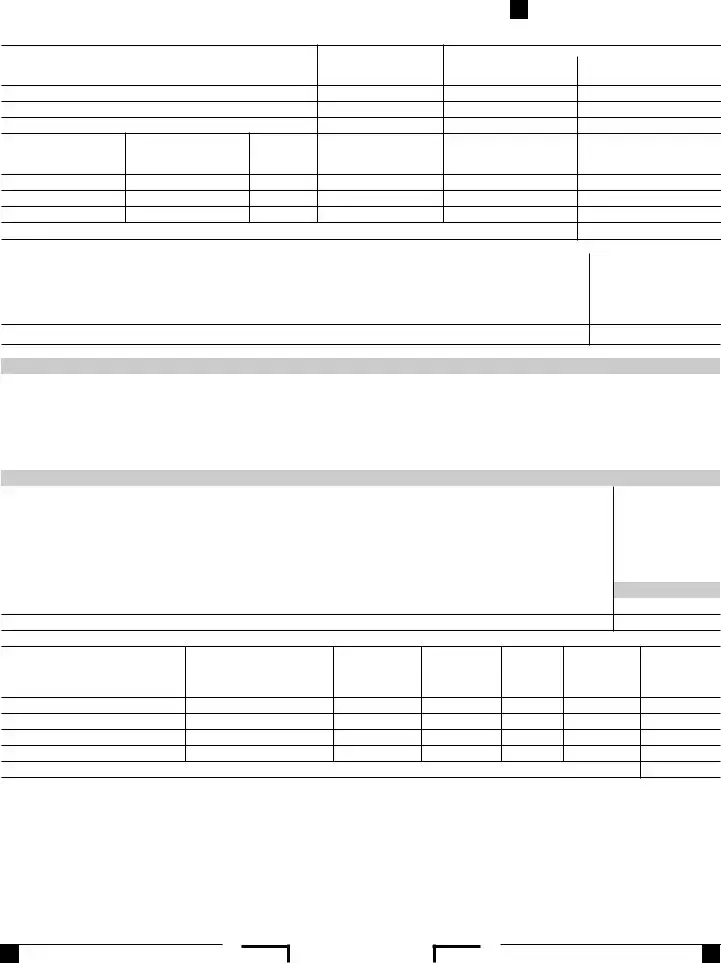

Schedule A Cost of Goods Sold and/or Operations.

Method of inventory valuation (specify)_______________________________________________

1 |

. . . . . . . . . . .Inventory at beginning of year |

. . |

1 |

|

00 |

2 |

Purchases |

•. . |

2 |

|

00 |

3 |

Cost of labor |

3 |

|

00 |

|

4 |

a Additional IRC Section 263A costs. Attach schedule |

•. . |

4a |

|

00 |

|

b Other costs. Attach schedule |

4b |

|

00 |

|

5 |

Total. Add line 1 through line 4b |

. . |

5 |

|

00 |

6 |

Inventory at end of year |

. . |

6 |

|

00 |

7 |

Cost of goods sold and/or operations. Subtract line 6 from line 5. Enter here and on Side 2, Part I, line 2 |

. . |

7 |

|

00 |

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to this organization? □ Yes □ No

Schedule B Tax Credits.

1 |

. . . . . . .Enter credit name__________________________code •__________ |

• |

1 |

|

00 |

|

2 |

. . . . . . .Enter credit name__________________________code •__________ |

• |

2 |

|

00 |

|

3 |

. . . . . . .Enter credit name__________________________code •__________ |

• |

3 |

|

00 |

|

4Total. Add line 1 through line 3. If claiming more than 3 credits, enter the total of all claimed credits,

|

on line 4. Enter here and on Side 1, line 11 |

. . . . . . . . . . . . . . . . . |

. . . . . |

4 |

00 |

|

Schedule K |

|

|

|

|

||

1 |

Interest computation under the |

. . . • |

1 |

00 |

||

2 |

Interest on tax attributable to installment: a Sales of certain timeshares or residential lots. |

. . . . . . . . . . . . . . . . . |

. . . • 2a |

00 |

||

|

|

|

|

|

|

|

|

|

b Method for |

. . . . . . . . . . . . . . . . . |

. . . • 2b |

00 |

|

|

|

. |

. . . • |

|

|

|

3 |

IRC Section 197(f)(9)(B)(ii) election to recognize gain on the disposition of intangibles |

. . . . . . . . . . . . . . . . |

3 |

00 |

||

|

|

. |

. . . • |

|

|

|

4 |

Credit recapture. Credit name___________________________________________ |

. . . . . . . . . . . . . . . . |

4 |

00 |

||

5 |

Total. Combine the amounts on line 1 through line 4. See instructions |

. . . . . . . . . . . . . . . . . |

. . . . . |

5 |

00 |

|

Schedule R Apportionment Formula Worksheet. Use only for unrelated trade or business amounts. |

|

|

|

|||

Part A. |

Standard Method – |

|

||||

|

|

|

(a) |

|

(b) |

(c) |

|

|

|

Total within and |

Total within |

Percent within |

|

|

|

|

outside California |

California |

California [(b) ÷ (a)] x 100 |

|

1 |

Total sales |

• |

• |

|

|

|

2 |

Apportionment percentage. Divide total sales column (b) by total sales column (a) and |

|

|

|

• |

|

|

|

|

||||

|

multiply the result by 100. Enter the result here and on Form 109, Side 1, line 2 |

|

|

|

||

Part B. |

Three Factor Formula. Complete this part only if the corporation uses the |

|

|

|

||

|

|

|

(a) |

|

(b) |

(c) |

|

|

|

Total within and |

Total within |

Percent within |

|

|

|

|

outside California |

California |

California [(b) ÷ (a)] x 100 |

|

1 |

Property factor: See instructions |

• |

• |

|

• |

|

2 |

Payroll factor: Wages and other compensation of employees |

• |

• |

|

• |

|

3 |

Sales factor: Gross sales and/or receipts less returns and allowances |

• |

• |

|

• |

|

|

||||||

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total percentage: Add the percentages in column (c) |

|

|

|

|

|

5 |

Average apportionment percentage: Divide the factor on line 4 by 3 and enter the |

|

|

|

|

|

|

result here and on Form 109, Side 1, line 2. See instructions for exceptions. |

|

|

|

|

|

Schedule C Rental Income from Real Property and Personal Property Leased with Real Property

For rental income from

1Description of property

2 Rent received |

3 Percentage of rent attributable |

or accrued |

to personal property |

%

%

%

4 Complete if any item in column 3 is more than 50%, or for any item |

5 Complete if any item in column 3 is more than 10%, but not more than 50% |

|

||

if the rent is determined on the basis of profit or income |

|

|

|

|

(a) Deductions directly connected |

(b) Income includible, column 2 |

(a) Gross income reportable, |

(b) Deductions directly connected with |

(c) Net income includible, column 5(a) |

(attach schedule) |

less column 4(a) |

column 2 x column 3 |

personal property (attach schedule) |

less column 5(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add columns 4(b) and column 5(c). Enter here and on Side 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3643213

Form 109 2021 Side 3

Schedule D Unrelated

1 Description of |

2 Gross income from or |

3 |

Deductions directly connected with or allocable to |

|

|

allocable to |

(a) |

(b) Other deductions |

|

|

property |

|||

|

|

(attach schedule) |

(attach schedule) |

|

|

|

|

||

4 Amount of average acquisition |

5 Average adjusted basis of or |

6 Debt basis |

7 Gross income reportable, |

8 Allocable deductions, |

9 Net income (or loss) includible, |

indebtedness on or allocable |

allocable to |

percentage, |

column 2 x column 6 |

total of columns 3(a) and |

column 7 less column 8 |

to |

property (attach schedule) |

column 4 ÷ |

|

3(b) x column 6 |

|

(attach schedule) |

|

column 5 |

|

|

|

%

%

%

Total. Enter here and on Side 2, Part I, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule E Investment Income of an R&TC Section 23701g, Section 23701i, or Section 23701n Organization

1 Description |

2 Amount |

3 Deductions directly connected |

4 Net investment income, |

5 |

6 Balance of investment income, |

|

|

(attach schedule) |

column 2 less column 3 |

(attach schedule) |

column 4 less column 5 |

|

|

|

|

|

|

|

|

|

|

|

|

Total. Enter here and on Side 2, Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter gross income from members (dues, fees, charges, or similar amounts). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule F Interest, Annuities, Royalties and Rents from Controlled Organizations

|

|

|

Exempt Controlled Organizations |

|

|

||

1 |

Name of controlled organizations |

2 Employer |

3 |

Net unrelated income |

4 Total of specified |

5 Part of column (4) that is |

6 Deductions directly |

|

|

identification |

|

(loss) |

payments made |

included in the controlling |

connected with income in |

|

|

number |

|

|

|

organization’s gross |

column (5) |

|

|

|

|

|

|

income |

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

Nonexempt Controlled Organizations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Taxable income |

|

8 |

Net unrelated income |

9 Total of specified payments |

10 Part of column (9) that is |

11 Deductions directly |

|

|

|

|

(loss) |

made |

included in the controlling |

connected with income in |

|

|

|

|

|

|

organization’s gross |

column (10) |

|

|

|

|

|

|

income |

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

Add columns 5 and 10 |

. . . . . . . . . . . . . . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . |

|

|

5 |

Add columns 6 and 11 |

. . . . . . . . . . . . . . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

|

6 Subtract line 5 from line 4. Enter here and on Side 2, Part I, line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule G Exploited Exempt Activity Income, other than Advertising Income

1Description of exploited activity (attach schedule if more than one unrelated activity is exploiting the same exempt activity)

2 Gross unrelated |

3 Expenses directly |

business income |

connected with |

from trade or |

production |

business |

of unrelated |

|

business income |

|

|

4Net income from unrelated trade or business, column 2 less column 3

5Gross income from activity that is not unrelated business income

6Expenses attributable to column 5

7Excess exempt expense, column 6 less column 5 but not more than column 4

8Net income includible, column 4 less column 7 but not less than zero

Total. Enter here and on Side 2, line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Side 4 Form 109 2021

3644213

Schedule H Advertising Income and Excess Advertising Costs

Part I Income from Periodicals Reported on a Consolidated Basis

1 Name of periodical |

2 Gross |

3 Direct |

4 Advertising income |

5 Circulation |

6 Readership |

7 If column 5 is greater than |

|

advertising |

advertising |

or excess advertising |

income |

costs |

column 6, enter the income |

|

income |

costs |

costs. If column 2 is |

|

|

shown in column 4, in |

|

|

|

greater than column 3, |

|

|

Part III, column A(b). If |

|

|

|

complete columns 5, |

|

|

column 6 is greater than |

|

|

|

6, and 7. If column 3 |

|

|

column 5, subtract the sum |

|

|

|

is greater than |

|

|

of column 6 and column 3 |

|

|

|

column 2, enter the |

|

|

from the sum of column 5 |

|

|

|

excess in Part III, |

|

|

and column 2. Enter amount |

|

|

|

column B(b). Do not |

|

|

in Part III, column A(b). If the |

|

|

|

complete columns 5, |

|

|

amount is less than zero, |

|

|

|

6, and 7. |

|

|

enter |

|

|

|

|

|

|

|

Totals . . . . . . . . . . . . . . . . . . .

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 If column 5 is greater than |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column 6, enter the income |

||

Part II |

Income from Periodicals Reported on a Separate Basis |

|

|

|

|

|

|

|

|

|

|

shown in column 4, in |

|||||||||||

|

|

|

|

|

|

|

|

|

|

amount is less than zero, |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part III, column A(b). If |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column 6 is greater than |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column 5, subtract the sum |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of column 6 and column 3 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from the sum of column 5 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and column 2. Enter amount |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in Part III, column A(b). If the |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter |

0 . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part III |

Column A – Net Advertising Income |

|

|

|

Part III Column B – Excess Advertising Costs |

|

|

|

|||||||||||||||

(a) Enter “consolidated periodical” and/or |

|

|

(b) Enter total amount from Part I, columns 4 or 7, |

(a) Enter “consolidated periodical” and/or |

(b) |

Enter total amount from Part I, column 4, |

|||||||||||||||||

names of |

|

|

and amount listed in Part II, columns 4 or 7 |

|

names of |

|

and amounts listed in Part II, column 4 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter total here and on Side 2, Part I, line 11 |

|

|

|

|

|

|

|

Enter total here and on Side 2, Part II, line 27 |

|

|

|

|

|

|

|||||||||

Schedule I |

Compensation of Officers, Directors, and |

Trustees |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

1 Name of officer |

|

|

2 SSN or ITIN |

|

3 Title |

|

4 Percent of time devoted |

|

|

5 Compensation attributable |

|

6 Expense account allowances |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

to business |

|

|

|

to unrelated business |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

Total. Enter here and on Side 2, Part II, line 14 |

|

|

|

|

|

|

|

|

|

||||||||||||||

Schedule J |

Depreciation (Corporations and Associations only. Trusts use form FTB 3885F.) |

|

|

|

|

|

|

|

|

|

|

||||||||||||

1 Group and guideline class or description |

|

2 Date acquired (dd/mm/yyyy) |

|

3 Cost or other basis |

|

4 Depreciation allowed |

5 |

Method of computing |

6 Life or rate |

7 Depreciation for |

|||||||||||||

of property |

|

|

|

|

|

|

|

|

|

|

|

or allowable in prior |

|

depreciation |

|

|

|

|

|

this year |

|||

|

|

|

|

|

|

|

|

|

|

|

|

years |

|

|

|

|

|

|

|

|

|

|

|

1 Total additional |

|

||||||||||||||||||||||

2Other depreciation:

Buildings . . . . . . . . . . . . . . . . . . . .

Furniture and fixtures . . . . . . . . . . .

Transportation equipment . . . . . . .

Machinery and other equipment. . .

Other (specify)________________

___________________________

3 Other depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Amount of depreciation claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Balance. Subtract line 5 from line 4. Enter here and on Side 2, Part II, line 21a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3645213

Form 109 2021 Side 5

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Type | California Exempt Organization Business Income Tax Return |

| Taxable Year | 2020 |

| Form Number | 109 |

| Applicable Taxpayers | Exempt organizations operating in California |

| Reporting Period | Calendar Year 2020 or a fiscal year beginning and ending in 2020 |

| Key Components | Unrelated business taxable income, net operating loss deduction, tax payments and credits |

| Governing Laws | Internal Revenue Code (IRC) and Revenue and Taxation Code (R&TC) for the State of California |

| Special Conditions | Includes sections for First Return, Final Return, Amendment, and audits by IRS |

| Additional Schedules | Requires attachment of schedules for specific deductions, income, and tax credits |

| Electronic Filing | Encouraged for faster processing and response |

How to Write California 109

Completing the California Form 109, an Exempt Organization Business Income Tax Return, is a crucial step for applicable entities within the state to comply with taxation requirements. This process does not merely conclude with filling out the form; it further involves calculation of taxable business income, potential tax credits, and ensuring accurate reporting of all financial activities relevant to the exempt organization. Below, the step-by-step instructions provided aim to navigate through the form efficiently while adhering to legal stipulations. Ensuring accuracy and completeness in this process is essential to avoid potential complications and to facilitate smooth operations within the framework of state tax obligations.

- Identify the taxable year and indicate whether it's for a calendar year or a fiscal year by entering the start and end dates in the designated spaces.

- Fill in the corporation/organization name, California corporation number, and Federal Employer Identification Number (FEIN).

- Provide the complete street address, including suite or room number if applicable, and PMB no. if relevant.

- If operating with a foreign address, follow the specific instructions for entering the city, state, ZIP code, foreign country name, foreign province/state/county, and foreign postal code.

- Circle "Yes" or "No" to indicate if this is the first return filed.

- Indicate the organization's status with respect to specific conditions listed (e.g., education IRA within the meaning of R&TC Section 23712, under audit by the IRS, final return, amended return, etc.) by circling "Yes" or "No."

- Choose the accounting method used by the organization from the options provided (cash, accrual, other).

- Input the nature of trade or business and the Unrelated Business Activity (UBA) code, if applicable.

- Examine and fill in the parts relevant to Unrelated Trade or Business Income, including gross receipts, cost of goods sold, and other incomes and deductions.

- Calculate the Unrelated Business Taxable Income before and after specific deductions and enter the amounts.

- Detail any applicable EZ, LAMBRA, or TTA NOL carryover deduction and Net Operating Loss deduction.

- Fill in the tax computations, including tax credits from Schedule B, alternative minimum tax, total tax, payments, and overpayment if applicable.

- Specify the use tax information if necessary.

- Conclude with calculating the net tax due or overpayment, indicating the amount to be applied to the following year's estimated tax or refund.

- Complete the payment and refund section, providing routing number, account type, and account number for direct deposit if a refund is expected.

- Note penalties and interests, and complete the schedules (A to R) as per the organization's activities being reported.

- Sign and date the form, ensuring the declaration under perjury is read and understood. If prepared by someone other than the taxpayer, the preparer’s information should be filled in accordingly.

Upon completing this step-by-step guide, the responsible individual(s) must review the entire form to ensure all information is accurate and complete. Documents that support the filing, such as financial statements, schedules, and other pertinent documentation, should be organized and kept readily available if requested by the California Franchise Tax Board. This careful preparation aids in ensuring that the organization's tax obligations are met with precision, thereby upholding its financial integrity and compliance with state tax laws.

Listed Questions and Answers

What is the California Form 109?

California Form 109 is the Business Income Tax Return specifically designed for exempt organizations operating in California. It is used to report unrelated business income and calculate taxes owed on income that is not related to the exempt purposes of the organization. This form ensures that entities still contribute to state taxes on portions of their income generated from activities unrelated to their exempt purposes.

Who needs to file Form 109?

Form 109 must be filed by exempt organizations that have generated income from business activities unrelated to their exempt purposes, provided such income is subject to taxation. This includes a variety of organizations such as charities, educational institutions, and other nonprofit entities recognized under California law. If an organization's unrelated business income exceeds certain thresholds or it expects to owe any taxes, filing this form is necessary.

What information is required to complete Form 109?

To properly complete Form 109, organizations need to provide detailed information on their unrelated business income, deductions, and any applicable credits. The required information typically includes:

- Corporation or organization name and address.

- Federal Employer Identification Number (FEIN) and California corporation number.

- Detailed accounting of unrelated business income and expenses.

- Apportionment information, if the business activity occurs both inside and outside of California.

- Information on any net operating loss carryover deductions or tax credits.

What are the deadlines for filing Form 109?

The deadline for filing Form 109 aligns with the fiscal year of the organization. For organizations operating on a calendar year basis, the form is due by May 15th of the following year. For those operating on a different fiscal year schedule, the form is due by the 15th day of the fifth month following the close of the fiscal year. Organizations may request an extension to file, but this does not extend the deadline to pay any taxes due.

Where and how can Form 109 be filed?

Form 109 can be filed electronically through the California Franchise Tax Board's (FTB) e-file system, which is the preferred method for speed and accuracy, or it can be mailed to the FTB if necessary. Organizations choosing to file electronically will need to use approved software or the services of a tax professional who uses such software. Those opting to file a paper return can download the form from the FTB's website and mail it to the address specified in the form's instructions.

Common mistakes

When filling out the California Form 109, organizations often make mistakes that can be easily avoided. Here's a list of common errors:

- Incorrect Fiscal Year Dates: Failing to correctly fill in the fiscal year beginning and ending dates can cause confusion and delays.

- Misclassification: Incorrectly classifying the organization under the wrong type, such as misunderstanding exemption status or incorrectly identifying as a non-exempt charitable trust.

- Incorrect Address Information: Not providing a complete foreign or domestic address, including state, ZIP code, or foreign postal code, leads to processing issues.

- Tax Benefit Misunderstanding: Claims for tax benefits like EZ, LAMBRA, or MEA are often filled out incorrectly due to misunderstanding the qualifications.

- Unrelated Business Income: Incorrect reporting of unrelated business taxable income or not properly apportioning income which is partially from California and partially from other locations.

- Improper Deduction Claims: Deducting expenses not directly connected with the production of unrelated business income, such as incorrectly calculated depreciation or not properly applying limitations.

- Failure to Report Payments: Overlooking the requirement to report 2020 estimated tax payments and withholding from Form 592-B and/or 593 and amounts paid with extension (Form FTB 3539).

- Not Signing the Form: The form is often submitted without the necessary signature of the officer. This omission can invalidate the return.

These errors can lead to delays in processing the form, audits, and potential penalties. It's crucial to review the form carefully before submission.

Documents used along the form

When completing the California 109 Form for exempt organizations, it's important to be aware of other documents and forms that may be needed to ensure a comprehensive and compliant tax return. Here's a list of forms often used alongside Form 109:

- Form 199: This is the California Exempt Organization Annual Information Return. It provides details on the organization's activities, governance, and financial data. Many organizations that file Form 109 also need to file Form 199 unless specifically exempt.

- Form 990 or Form 990-EZ: These are Federal forms that provide the IRS with information about the organization's activities and financial situation. While they are federal forms, the information can complement and sometimes is necessary for completing state forms.

- Schedule A (Form 990 or 990-EZ): This schedule supports the Form 990 or 990-EZ by providing more details about public charity status and public support. It's essential for organizations claiming exempt status under certain classifications.

- Form 1096: This form is actually more generic and serves as a summary or cover sheet for submitting multiple forms of a specific type, like the 1099 forms, to the IRS. However, it's commonly used by organizations to report payments and transactions to vendors or consultants.

- Form 592-B and/or 593: Mentioned within Form 109, these pertain to income tax withheld on California residents or real estate transactions. They're crucial for organizations that have withheld taxes for employees or other entities.

- FTB 3539: This is the Payment for Automatic Extension for Corporations and Exempt Organizations form. It's used to request additional time to file the organization's income tax return, including Form 109.

Each of these documents plays a crucial role in the organization's compliance with state and federal tax requirements. Exempt organizations should review their obligations carefully and ensure they provide complete and accurate information across all required forms to uphold their exempt status and avoid penalties. Consultation with a tax professional specialized in nonprofit law can provide tailored advice and assistance with these and other necessary documentation.

Similar forms

The California 109 Form is akin to the U.S. Internal Revenue Service's Form 990-T, Exempt Organization Business Income Tax Return. Both forms are used by tax-exempt organizations to report and pay income tax on unrelated business income. They require detail on income, deductions, and net taxable income, ensuring organizations comply with tax regulations on income not related to their exempt purposes.

Similarly, the California Form 199, the Exempt Organization Annual Information Return, parallels the federal IRS Form 990. While Form 109 focuses on taxable business activities, Form 199 and Form 990 gather comprehensive information about an organization's overall operations, financial status, and compliance with exemption requirements, highlighting differences in focus between income reporting and organizational transparency.

The California Form 568, Limited Liability Company Return of Income, shares common features with Form 109 in terms of reporting income, deductions, and taxes due. Both forms cater to entities that must declare income generated within California, but Form 568 is specifically designed for LLCs, including those managed by tax-exempt organizations for their unrelated business income.

Form 1120, U.S. Corporation Income Tax Return, also shares similarities with the California 109 Form, as both are used by entities to report income, losses, and taxes owed. Though Form 1120 is for for-profit corporations, it mirrors the structure and purpose of Form 109 in its focus on taxable activities, albeit within different organizational contexts.

The California Form 541, California Fiduciary Income Tax Return, is analogous to Form 109 when trusts engage in unrelated business activities. While Form 541 caters to the broader income reporting requirements of trusts and estates, sections of it are dedicated to unrelated business taxable income, similar to the reporting obligations under Form 109 for exempt organizations.

California Form 100, Corporation Franchise or Income Tax Return, serves a similar function to Form 109 but is tailored for corporate entities. Both forms require detailed financial reporting and computation of tax liabilities, ensuring entities fulfill their tax obligations based on their income levels in the state of California.

Form 990-EZ, Short Form Return of Organization Exempt from Income Tax, under federal tax law, is a simpler version of Form 990 and akin to Form 109 in that it offers a shorter, less detailed format for smaller tax-exempt organizations to report on their operations and financial status, albeit without the specific focus on unrelated business income.

The Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., indirectly relates to Form 109, as it is used by partnerships (including those involved in tax-exempt organizations' unrelated business activities) to report each partner's share of income or loss. Though serving different functions, both forms play key roles in reporting income for tax compliance purposes.

Dos and Don'ts

Completing the California Form 109, while straightforward, does require attention to detail and a thorough understanding of your organization's financial and operational specifics. The guidelines provided below, organized into "do's" and "don'ts", serve to help you navigate the process while aiming for accuracy and compliance.

- Do ensure that you have all the necessary documents and information before you start filling out the form. This includes financial statements, detailed records of income and expenses, and any relevant supporting documentation.

- Do double-check the organization’s tax ID number and the California corporation number for accuracy to avoid processing delays or issues.

- Do accurately report all income and expenses, using the correct lines on the form. It's essential to follow the instructions for each line item to ensure that your organization's financial activities are correctly represented.

- Do take advantage of the tax credits available to your organization, but ensure eligibility first. Documenting and retaining proof of eligibility for each claimed credit is crucial.

- Don't overlook the need to attach supplementary schedules or documents, such as federal Schedule H for hospitals or Schedule K-1 for income from partnerships, LLCs, or S corporations, when required.

- Don't forget to review the form for common errors like incorrect math, missing entries, or misplaced figures, which can lead to unnecessary adjustments or inquiries from the tax authority.

- Don't hesitate to consult with a professional if there are unique circumstances or complex tax issues related to your organization. Complex areas might include unrelated business taxable income or specific deductions and credits.

- Don't delay in submitting the form before the deadline to avoid penalties and interest. Making use of the option for direct deposit can also expedite any refund due to your organization.

By adhering to these do's and don'ts, organizations can fill out the California Form 109 more effectively, ensuring accuracy and compliance with state tax regulations. It's always recommended to stay informed on any changes to tax laws that might affect your filing.

Misconceptions

There are several common misconceptions about the California Form 109, which is an income tax return for exempt organizations. Understanding these can help organizations accurately complete their tax obligations. Here are eight of the most prevalent misunderstandings:

- Misconception 1: All exempt organizations are not required to file Form 109.

This is incorrect. While many exempt organizations in California do indeed need to file Form 109 to report their unrelated business income, the necessity to file depends on specific income thresholds and the type of exempt organization.

- Misconception 2: Form 109 is only for organizations that pay federal taxes.

In reality, Form 109 is required for certain exempt organizations operating in California to report their state income tax, even if they do not owe federal taxes due to their exempt status.

- Misconception 3: Form 109 is complicated and always requires professional preparation.

Many organizations can complete Form 109 without professional help, especially if they carefully review the instructions provided by the California Franchise Tax Board. However, seeking professional advice is beneficial in complex situations.

- Misconception 4: The information required on Form 109 is the same each year.

While much of the required information may remain consistent, changes in the organization's activities, income, or the law may necessitate different information from year to year.

- Misconception 5: If an organization didn't earn any unrelated business income, it doesn't need to file Form 109.

Even if an organization did not earn unrelated business income, it might still be required to file Form 109 to affirm its exemption status and report any other relevant financial activities.

- Misconception 6: Form 109 filings are private and confidential.

Actually, like most tax returns for exempt organizations, filed Form 109s are public records. The information provided on the form is accessible to the public upon request, contributing to transparency and accountability.

- Misconception 7: Form 109 only reports income related to the organization's exempt purpose.

Contrary to this belief, Form 109 is specifically designed to report income from unrelated business activities—that is, income from activities not substantially related to fulfilling the organization’s exempt purpose.

- Misconception 8: Penalties for late filing of Form 109 are negligible.

Failure to file Form 109 on time can result in significant penalties and interest charges. It's important for organizations to understand the deadlines and ensure timely filing to avoid these penalties.

By clarifying these misconceptions, exempt organizations can better navigate their tax filing responsibilities and ensure compliance with California's tax laws.

Key takeaways

Filling out the California 109 form, a business income tax return tailored for exempt organizations, may seem daunting at first glance. Yet, with guidance and attention to detail, entities can navigate this process efficiently. Below are eight key takeaways to ensure your organization's compliance and optimization of tax benefits:

- The form starts by asking for basic information about your organization, including the California corporation number and the federal employer identification number (FEIN). This foundational data is critical for identification and should be filled out accurately.

- Indicating whether this is your organization's first return filed is important for record-keeping purposes and future references to your tax history.

- One section inquires about any ongoing IRS audits or previous audits. This transparency is vital for legal compliance and addressing potential discrepancies early on.

- Organizations must specify their accounting method: cash, accrual, or other. This choice affects how income and expenses are reported and should align with internal financial practices.

- The form includes sections on unrelated business taxable income and deductions related explicitly to such income, emphasizing the necessity for organizations to distinguish between related and unrelated business activities.

- If applicable, record any net operating loss carryover deductions or special tax credits, such as those received for operations in certain areas or for specific developments, which can significantly reduce the tax burden.

- The form allows organizations to report unrelated debt-financed income, investment income, and income from controlled entities, with specific sections dedicated to these scenarios. Understanding the nuances of these income types is crucial for proper reporting and taxation.

- Filing deadlines and penalties for late submissions are critical aspects of the tax process. Ensuring that your organization meets these deadlines can prevent unnecessary financial liabilities.

Adhering to the rules and guidelines laid out in the California 109 form is essential for exempt organizations operating within the state. With careful preparation and attention to detail, organizations can streamline their tax filing process, leverage available tax benefits, and maintain compliance with state laws.

Different PDF Templates

California 3522 - This voucher is mandatory for LLCs with articles of organization accepted by the California Secretary of State.

California 513 026 - Advises on the government code sections that regulate the processing time periods for permit applications.