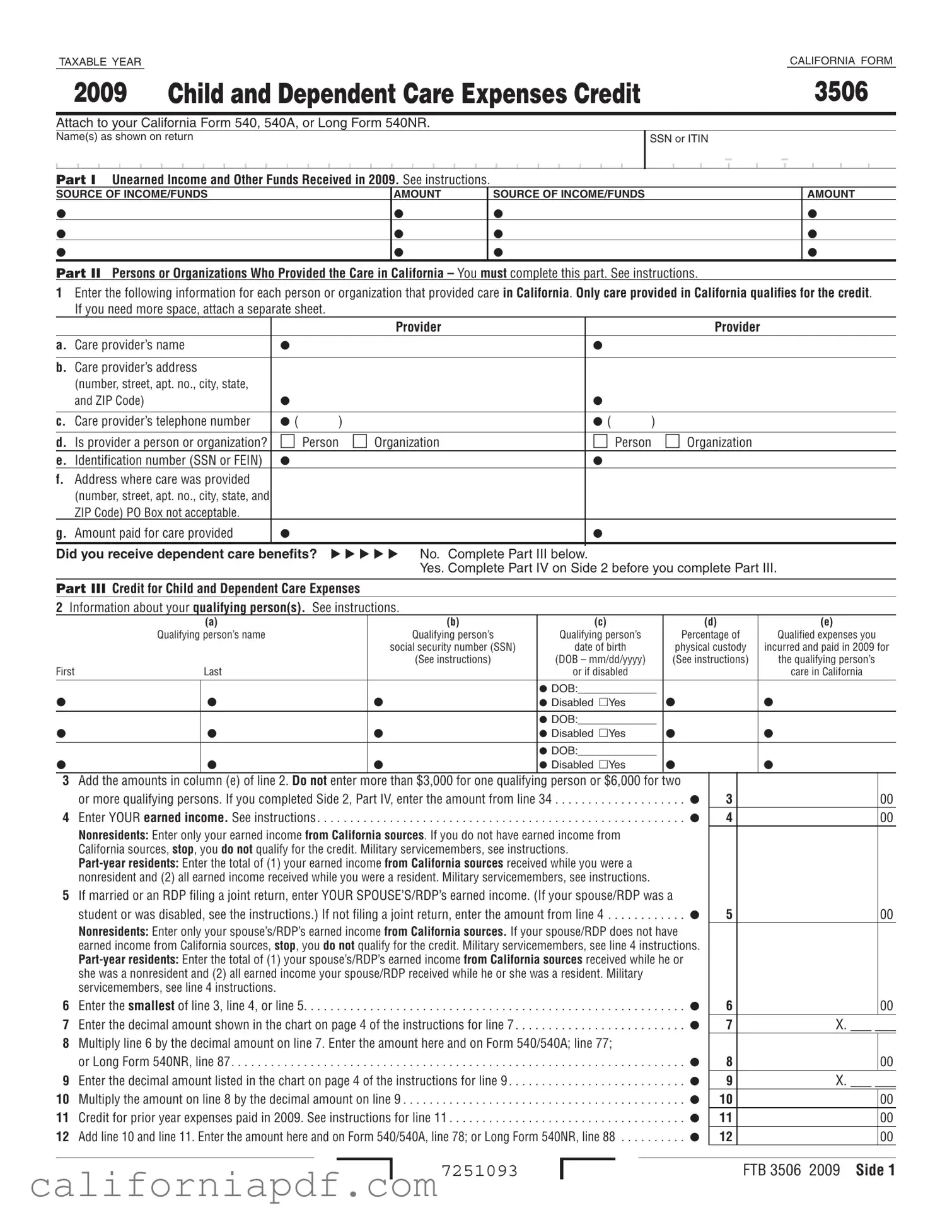

Fill a Valid California 3506 Form

Navigating through the complexities of tax forms can be a daunting task, especially when it involves understanding the specifics of credits for child and dependent care expenses. The California Form 3506, also known as the Child and Dependent Care Expenses Credit for the 2009 taxable year, is designed to offer financial relief to taxpayers who incurred expenses for the care of qualifying individuals. This form, which should be attached to the California Form 540, 540A, or Long Form 540NR, requires detailed information about the care provider, including their name, address, and identification number, as well as specifics about the care provided in California. Part I of the form deals with unearned income and other funds received, which plays a crucial role in determining eligibility for the credit. In parts II and III, taxpayers must detail the persons or organizations that provided care, and list the qualifying person(s) for whom care was provided, including their name, social security number, date of birth, and the qualified expenses incurred for their care. Moreover, the form takes into account the taxpayer's earned income and, if applicable, their spouse’s or registered domestic partner's (RDP) income, as these figures are instrumental in calculating the credit amount. Additionally, for those who received dependent care benefits, an intricate calculation involving these benefits is required on Side 2 of the form to ascertain the taxable and deductible portions of these benefits. Understanding and accurately completing this form can significantly impact the financial benefits received by caregivers, emphasizing the form's importance in the broader context of tax planning and fiscal responsibility for California residents.

Document Example

TAXABLE YEAR |

|

CALIFORNIA FORM |

2009 |

Child and Dependent Care Expenses Credit |

3506 |

Attach to your California Form 540, 540A, or Long Form 540NR.

Name(s) as shown on return

SSN or ITIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

Part I Unearned Income and Other Funds Received in 2009. See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

SOURCE OF INCOME/FUNDS |

AMOUNT |

|

SOURCE OF INCOME/FUNDS |

|

|

AMOUNT |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part II Persons or Organizations Who Provided the Care in California – You must complete this part. See instructions.

1Enter the following information for each person or organization that provided care in California. Only care provided in California qualifies for the credit. If you need more space, attach a separate sheet.

|

|

|

Provider |

|

|

Provider |

a. Care provider’s name |

|

|

|

|

|

|

b. Care provider’s address |

|

|

|

|

|

|

|

(number, street, apt. no., city, state, |

|

|

|

|

|

|

and ZIP Code) |

|

|

|

||

c. |

Care provider’s telephone number |

( |

) |

( |

) |

|

d. |

Is provider a person or organization? |

Person Organization |

Person |

Organization |

||

e. |

Identification number (SSN or FEIN) |

|

|

|

|

|

f.Address where care was provided (number, street, apt. no., city, state, and ZIP Code) PO Box not acceptable.

g. Amount paid for care provided |

|

|

Did you receive dependent care benefits? |

No. Complete Part III below. |

|

|

|

Yes. Complete Part IV on Side 2 before you complete Part III. |

Part III Credit for Child and Dependent Care Expenses

2Information about your qualifying person(s). See instructions.

|

|

(a) |

(b) |

(c) |

(d) |

(e) |

|

Qualifying person’s name |

Qualifying person’s |

Qualifying person’s |

Percentage of |

Qualified expenses you |

|

|

|

|

social security number (SSN) |

date of birth |

physical custody |

incurred and paid in 2009 for |

|

|

|

(See instructions) |

(DOB – mm/dd/yyyy) |

(See instructions) |

the qualifying person’s |

First |

|

Last |

|

or if disabled |

|

care in California |

|

|

|

|

|

|

|

|

|

|

|

DOB:_____________ |

|

|

|

Disabled Yes |

|||||

|

|

|

|

DOB:_____________ |

|

|

|

Disabled Yes |

|||||

|

|

|

|

DOB:_____________ |

|

|

|

Disabled Yes |

|||||

3Add the amounts in column (e) of line 2. Do not enter more than $3,000 for one qualifying person or $6,000 for two

or more qualifying persons. If you completed Side 2, Part IV, enter the amount from line 34 . . . . . . . . . . . . . . . . . . . .

4 Enter YOUR earned income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Nonresidents: Enter only your earned income from California sources. If you do not have earned income from California sources, stop, you do not qualify for the credit. Military servicemembers, see instructions.

5If married or an RDP filing a joint return, enter YOUR SPOUSE’S/RDP’s earned income. (If your spouse/RDP was a

student or was disabled, see the instructions.) If not filing a joint return, enter the amount from line 4 . . . . . . . . . . . .

Nonresidents: Enter only your spouse’s/RDP’s earned income from California sources. If your spouse/RDP does not have earned income from California sources, stop, you do not qualify for the credit. Military servicemembers, see line 4 instructions.

6 Enter the smallest of line 3, line 4, or line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Enter the decimal amount shown in the chart on page 4 of the instructions for line 7 . . . . . . . . . . . . . . . . . . . . . . . . . .

8Multiply line 6 by the decimal amount on line 7. Enter the amount here and on Form 540/540A; line 77;

|

or Long Form 540NR, line 87 |

|

9 |

Enter the decimal amount listed in the chart on page 4 of the instructions for line 9 |

|

10 |

Multiply the amount on line 8 by the decimal amount on line 9 |

|

11 |

Credit for prior year expenses paid in 2009. See instructions for line 11 |

|

12 |

Add line 10 and line 11. Enter the amount here and on Form 540/540A, line 78; or Long Form 540NR, line 88 |

|

3 |

00 |

|

4 |

00 |

|

5 |

00 |

|

6 |

00 |

|

7 |

X. ___ ___ |

|

8 |

|

00 |

9 |

X. ___ ___ |

|

10 |

|

00 |

11 |

|

00 |

12 |

|

00 |

7251093

FTB 3506 2009 Side 1

Part IV Dependent Care Benefits

13Enter the total amount of dependent care benefits you received for 2009. This amount should be shown in box 10 of your Form(s)

|

sole proprietorship or partnership |

13 |

|

00 |

|

14 |

Enter the amount, if any, you carried over from 2008 and used in 2009 during the grace period |

|

14 |

|

00 |

15 |

Enter the amount, if any, you forfeited or carried forward to 2010 |

|

15 |

( |

) 00 |

16 |

Combine line 13 through line 15 |

16 |

|

00 |

|

17Enter the total amount of qualified expenses incurred in 2009 for the

|

care of the qualifying person(s). See instructions |

17 |

00 |

18 |

Enter the smaller of line 16 or line 17 |

18 |

00 |

19 |

Enter YOUR earned income |

19 |

00 |

20If married or an RDP filing a joint return, enter YOUR SPOUSE’S/RDP’s earned income (if your spouse/RDP was a student or was disabled, see the instructions for line 5); if married or an RDP filing a separate return, see the instructions for the

amount to enter; all others, enter the amount from line 19 |

20 |

00 |

21 Enter the smallest of line 18, line 19, or line 20 |

21 |

00 |

22Enter $5,000 ($2,500 if married or an RDP filing separately and you were required

to enter your spouse’s/RDP’s earned income on line 20) |

22 |

00 |

23Enter the amount from line 13 that you received from your sole proprietorship or partnership. If you did not receive

|

|

any amounts, enter |

. . . . . . . . . . . . . . . . . . . . . |

23. |

00 |

||||

24 |

|

Subtract line 23 from line 16 |

24 |

|

00 |

|

|

|

|

25 |

|

Enter the smaller of line 21 or line 22 |

25 |

|

00 |

|

|

|

|

26 |

Deductible benefits. Enter the smallest of line 21, line 22, or line 23 |

. . . . . . . . . . . . . . . . . . . . . |

. |

26 |

|

00 |

|||

27 |

Excluded benefits. Subtract line 26 from line 25. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . |

. |

27 |

|

00 |

|||

28 |

Taxable benefits. Subtract line 27 from line 24. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . |

. |

28 |

|

00 |

|||

29 |

Enter $3,000 ($6,000 if two or more qualifying persons) |

. . . . . . . . . . . . . . . . . . . . . |

. |

29 |

|

00 |

|||

30 |

Add line 26 and line 27 |

. . . . . . . . . . . . . . . . . . . . . |

30. |

|

00 |

||||

31 |

Subtract the amount on line 30 from the amount on line 29. If zero or less, stop. You do not qualify for the credit. |

|

|

|

|

|

|||

|

|

Exception – If you paid 2008 expenses in 2009, see instructions for line 11 |

. . . . . . . . . . . . . . . . . . . . . |

. |

31 |

|

00 |

||

32 |

Complete Side 1, Part III, line 2. Add the amounts in column (e) and enter the total here |

. |

32 |

|

00 |

||||

33 |

Enter the amount from your federal Form 2441, Part III, line 34 |

. . . . . . . . . . . . . . . . . . . . . |

33. |

|

00 |

||||

34 |

Enter the smaller of line 31, line 32, or line 33. Also, enter this amount on Side 1, Part III, line 3 and |

|

|

|

|

|

|||

|

|

complete line 4 through line 12 |

. . . . . . . . . . . . . . . . . . . . . |

34. |

|

00 |

|||

Worksheet – Credit for 2008 Expenses Paid in 2009 |

|

|

|

|

|

|

|

||

1. |

Enter your 2008 qualified expenses paid in 2008. If you did not claim the credit for these expenses on your 2008 |

|

|

|

|

|

|||

|

|

return, get and complete a 2008 form FTB 3506 for these expenses. You may need to amend your 2008 return |

. . . |

|

. . . . |

. 1.____________________ |

|||

2. |

Enter your 2008 qualified expenses paid in 2009 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 2.____________________ |

|||

3. |

Add the amounts on line 1 and line 2 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 3.____________________ |

|||

4. |

Enter $3,000 if care was for one qualifying person ($6,000 for two or more) |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 4.____________________ |

|||

5. |

Enter any dependent care benefits received for 2008 and excluded from your income |

|

|

|

|

|

|

|

|

|

|

(from your 2008 form FTB 3506, Part IV, line 28) |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 5.____________________ |

||

6. |

Subtract amount on line 5 from amount on line 4 and enter the result |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 6.____________________ |

|||

7. |

Compare your and your spouse’s/RDP’s earned income for 2008 and enter the smaller amount |

. . . |

|

. . . . |

. 7.____________________ |

||||

8. |

Compare the amounts on line 3, line 6, and line 7 and enter the smallest amount |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 8.____________________ |

|||

9. |

Enter the amount from your 2008 form FTB 3506, Side 1, Part III, line 6 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 9.____________________ |

|||

10. |

Subtract amount on line 9 from amount on line 8 and enter the result. If zero or less, stop here. You cannot increase |

|

|

|

|

|

|||

|

|

your credit by any previous year’s expenses |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 10.____________________ |

||

11. |

Enter your 2008 federal adjusted gross income (AGI) (from your 2008 Form 540/540A, line13; |

|

|

|

|

|

|||

|

|

or Long Form 540NR, line 13) |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 11.____________________ |

||

12. |

2008 federal AGI decimal amount (from 2008 form FTB 3506, instructions for line 7) |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 12.______ . ______ ______ |

||

13. |

Multiply line 10 by line 12 |

. . . . . . . . . . . . . . . . . . . . . |

. . . |

|

. . . . |

. 13.____________________ |

|||

14. |

2008 California AGI decimal amount (from 2008 form FTB 3506, instructions for line 9) |

. . . |

|

. . . . |

. 14.______ . ______ ______ |

||||

15. |

Multiply line 13 by line 14. Enter the result here and on your 2009 form FTB 3506, Side 1, Part III, line 11 |

. . . |

|

. . . . |

. 15.____________________ |

||||

Side 2 FTB 3506 2009

7252093

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | The California Form 3506 is used for claiming the Child and Dependent Care Expenses Credit on California state tax returns. |

| Attachment Requirement | This form must be attached to California Form 540, 540A, or Long Form 540NR. |

| Eligible Expenses | The form accounts for qualified expenses incurred and paid in 2009 for the care of a qualifying person in California. |

| Governing Law | The Child and Dependent Care Expenses Credit is governed by California tax law as administered by the California Franchise Tax Board. |

How to Write California 3506

Getting ready to file your taxes involves many details, and one important aspect you might need to handle is claiming credits for child and dependent care expenses. If you paid for care in California so you could work or look for work, you may be eligible for a credit on your taxes. The California Form 3506 for the Taxable Year 2009 is designed for this purpose. Here are step-by-step instructions to guide you through completing Form 3506.

- Begin by attaching Form 3506 to your California Form 540, 540A, or Long Form 520NR.

- Under Part I, list any unearned income and other funds received in 2009, including the source and amount.

- In Part II, provide the required information for each person or organization that provided care in California:

- a. Enter the care provider’s name.

- b. Fill in the care provider’s address, ensuring that it is complete and includes the ZIP Code. PO Boxes are not acceptable.

- c. Provide the care provider’s telephone number.

- d. Indicate whether the provider is a person or an organization.

- e. Input the provider’s identification number (SSN or FEIN).

- f. List the address where care was provided, following the same format as the provider's address.

- g. State the amount paid for the care provided.

- Answer whether you received dependent care benefits. If "No," proceed to Part III. If "Yes," complete Part IV on Side 2 before continuing with Part III.

- In Part III, provide information about your qualifying person(s):

- a. Enter each qualifying person's first and last name.

- b. List their social security number (SSN).

- c. Fill in the qualifying person's date of birth (DOB).

- d. Indicate the percentage of physical custody.

- e. State the qualified expenses you incurred and paid in 2009 for the qualifying person's care in California.

- Sum up the amounts in column (e) of line 2, ensuring you do not exceed the limits of $3,000 for one qualifying person or $6,000 for two or more qualifying persons. Enter this total in line 3.

- Report YOUR earned income in line 4, following specific instructions based on your residency status and considerations for military servicemembers.

- If applicable, enter YOUR SPOUSE'S/RDP's earned income in line 5. Adjustments might be necessary if your spouse/RDP was a student or was disabled.

- In line 6, enter the smallest amount from line 3, line 4, or line 5.

- Find the decimal amount in the chart on page 4 of the instructions for line 7, enter it in line 7, and then multiply line 6 by this decimal amount. Place the result in line 8 and also on Form 540/540A; line 77; or Long Form 540NR, line 87.

- Look up the decimal amount listed in the chart on page 4 of the instructions for line 9, multiply the amount from line 8 by this decimal, and enter the result in line 10.

- For credit for prior year expenses paid in 2009, see instructions for line 11, calculate and enter the amount.

- Sum line 10 and line 11, and enter this total in line 12 and also on Form 540/540A, line 78; or Long Form 540NR, line 88.

By accurately completing each section and providing the necessary information about your child and dependent care expenses, you can claim the appropriate credit on your taxes. Remember to review the instructions for any specific details or requirements related to your personal situation. This careful preparation now can save you time and ensure you receive the credits you are entitled to.

Listed Questions and Answers

What is California Form 3506?

California Form 3506, titled Child and Dependent Care Expenses Credit, is a tax form used by Californians to claim a credit for child and dependent care expenses. This credit aims to reduce the tax burden for families who incur costs for the care of qualifying individuals while working or actively looking for work. This form is attached to the California Form 540, 540A, or Long Form 540NR.

Who can claim the credit on Form 3506?

The credit can be claimed by taxpayers who have incurred expenses for the care of a qualifying person. A qualifying person includes dependents under the age of 13 or a spouse/dependent who is physically or mentally incapable of self-care and lives with the taxpayer for more than half the year. To claim this credit, the taxpayer must also have earned income and meet certain requirements regarding residency and the nature of the care expenses.

What types of care qualify for the credit on Form 3506?

The types of care that qualify for the credit include payments made to care providers for child and dependent care services. This includes expenses for services rendered in California that allow the taxpayer to work or search for employment. However, the care must be provided to a qualifying individual, and the care provider's information, including name, address, and identification number, must be included on the form.

How much credit can I claim on Form 3506?

The amount of credit you can claim on Form 3506 is dependent on your earned income, the total amount paid for care services, and the number of qualifying individuals. The credit is calculated as a percentage of your qualifying expenses, capped at $3,000 for one qualifying person or $6,000 for two or more qualifying persons. However, the exact credit amount also depends on your adjusted gross income.

Can I claim the credit for payments to all types of care providers?

No, payments to certain types of care providers do not qualify for the credit. These include payments made to a spouse or a parent of the qualifying child, a care provider who is your child under the age of 19, or another dependent. Only payments made to eligible caregivers or care facilities qualify for this credit.

Are there any residency requirements for claiming the credit on Form 3506?

Yes, to claim the Child and Dependent Care Expenses Credit on Form 3506, you must be a resident, part-year resident, or non-resident with earned income from California sources. Non-residents must only include their earned income from California sources when calculating the credit, and specific rules apply to military service members.

What documentation do I need to claim the credit?

To claim the credit on Form 3506, you need documentation of all childcare expenses, including receipts or invoices from care providers. The care provider's identification number (SSN or FEIN), address, and the amount paid for care must be reported on the form. Additionally, you should keep records of your earned income and any dependent care benefits received, as these figures are also required to calculate the credit properly.

Where do I attach Form 3506 in my tax return?

Form 3506 should be attached to your California Form 540, 540A, or Long Form 540NR. The calculated credit amount from Form 3506 is then entered onto a specific line of your main tax return form, which varies depending on the form you are filing. This ensures that the credit is properly accounted for in your overall tax calculations.

Common mistakes

When completing the California Form 3506, several mistakes can occur that may affect the accuracy of the Child and Dependent Care Expenses Credit. Below is a detailed list of common errors:

- Incorrectly reporting unearned income and other funds received. This information must reflect all relevant unearned income for the tax year.

- Failing to provide complete information for each care provider, including the provider's name, address, and identification number. Every detail is crucial for verification and eligibility.

- Using a PO Box for the care provider’s address or the address where care was provided, which is not acceptable. A physical address must be used instead.

- Not accurately stating the amount paid for care provided. This figure should reflect all payments made to the care provider during the tax year for qualifying care.

- Omitting or incorrectly entering the dependent care benefits received, if applicable. This includes not properly completing Part IV when these benefits are received.

- Incorrect details regarding the qualifying person’s information, such as their name, social security number, or date of birth, which are critical for identifying eligible dependents.

- Exceeding the maximum amount allowed ($3,000 for one qualifying person or $6,000 for two or more qualifying persons) when adding up qualified expenses.

- Not following the instructions for taxpayers who are nonresidents, part-year residents, or military servicemembers concerning earned income from California sources, which can lead to inaccuracies in calculating the credit.

It’s imperative that each section of Form 3506 is filled out with the most accurate and up-to-date information to ensure proper calculation and eligibility for the Child and Dependent Care Expenses Credit. Additionally, always refer to the instructions provided with the form for detailed guidance on each part of the form.

Documents used along the form

When dealing with child and dependent care expenses in California, particularly for obtaining credits through the California Form 3506, it's crucial to understand the broader context and the additional documentation that might be required or beneficial. This hinges on providing comprehensive information about child care expenses, as well as aligning with federal requirements and ensuring eligibility for state-specific tax benefits. Here’s a list of other forms and documents often used in conjunction with the California Form 3506:

- California Form 540/540A – This is the primary state income tax return form for California residents. Form 3506 is attached to this return to claim the Child and Dependent Care Expenses Credit.

- Long Form 540NR – Nonresidents or part-year residents of California use this form for their state tax returns. Those qualifying can attach Form 3506 to claim the credit for care expenses incurred within the state.

- Federal Form 1040 – The U.S. individual income tax return is often necessary when filing state forms to reference income and other federal tax information.

- Federal Form 2441, Child and Dependent Care Expenses – Essential for taxpayers who are also claiming federally provided child and dependent care credits, capturing similar information to that required by Form 3506.

- W-2 Forms – These are crucial for indicating the amount of dependent care benefits received from an employer, part of which may be required information for both Form 3506 and Federal Form 2441.

- Receipts for Dependent Care Services – Keeping receipts or records of payments made to child and dependent care providers is necessary for verification purposes should the California Franchise Tax Board (FTB) request additional information.

- Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) for both the provider and the recipient of care services are necessary for accurate tax form completion.

- Provider Identification Number – Whether it’s an SSN or a Federal Employer Identification Number (FEIN), this information is required to complete Part II of Form 3506 accurately.

- Copies of Previous Year’s Tax Returns – Both federal and state returns can be helpful when completing current year forms, especially if carrying over any unclaimed credit from a prior year.

In sum, properly claiming the Child and Dependent Care Expenses Credit on California Form 3506 requires attention to detail and a comprehensive approach to gathering necessary documentation. From verifying income with federal and state tax returns to providing detailed information about care providers, each document plays a role in ensuring eligible taxpayers receive the credits they deserve while complying with applicable tax laws.

Similar forms

The California 3506 form, concerning Child and Dependent Care Expenses Credit, has elements in common with the IRS Form 2441 which also deals with Child and Dependent Care Expenses on a federal level. Both documents are designed to provide tax relief to individuals who have incurred expenses for the care of a qualifying child or dependent, enabling them to work or look for work. Each form requires the taxpayer to report the amount spent on care and the information about care providers, then calculates the allowable credit based on earned income and expenses.

Similar to Schedule C (Form 1040), which is used by sole proprietors to report the income and expenses of their business, the California 3506 form requires detailed financial information. However, while Schedule C focuses on business operations, Form 3506 zeroes in on personal expenses related to child and dependent care necessary for employment. Both forms help in determining the tax implications of reported financial activities, impacting the filer's taxable income.

The W-2 form, commonly issued by employers outlining the employee's income and tax withholdings for the year, parallels the California 3506 form in its relation to employment. However, the 3506 specifically requires the inclusion of any dependent care benefits received, often reported in box 10 of the W-2, underscoring the intersection between employment benefits and personal tax credits.

The IRS Form 1040, U.S. Individual Income Tax Return, is a comprehensive record of an individual's annual financial information, including income, deductions, and credits similar to what is required in the California Form 3506. While Form 1040 encompasses the broad spectrum of an individual’s tax situation, Form 3506 specifically addresses the aspect of child and dependent care expenses, contributing to the calculation of credits on the state level.

Form 2106, Employee Business Expenses, shares similarities with the California 3506 form by allowing taxpayers to itemize and deduct specific expenses related to their employment. While Form 2106 is focused on work-related expenditures a taxpayer incurs, Form 3506 concentrates on expenses for child and dependent care necessary for a taxpayer to be employed or actively seeking employment.

The Earned Income Credit (EIC) worksheet, similar to the workings within the California 3506 form, calculates a tax credit based on earned income and family size. Both documents aim to provide financial relief to low-to-moderate-income working individuals and families, albeit through slightly different mechanisms and eligibility criteria focused on either work-related expenses or child care expenses.

California Form 540, the state’s standard Resident Income Tax Return, is directly related to Form 3506 as the latter must be attached to it if the taxpayer is claiming the child and dependent care expenses credit. While Form 540 covers the range of taxable income and various credits and deductions available to California residents, Form 3506 is specifically focused on the calculation and claim of credits for child and dependent care expenses.

Lastly, California Form 540NR, Nonresident or Part-Year Resident Income Tax Return, is akin to Form 3506, as both address the tax responsibilities of individuals with special circumstances in California - nonresidents or part-year residents in the case of Form 540NR, and individuals paying for child and dependent care to enable employment in the case of Form 3506. Form 3506 needs to be attached to Form 540NR when claiming the dependent care credit, demonstrating the integration of specific credits into broader tax filings.

Dos and Don'ts

When filling out the California Form 3506 for Child and Dependent Care Expenses Credit, it's essential to do it correctly to maximize your potential credit and avoid common mistakes. Here's a guide to help ensure you're on the right track.

Do:

- Ensure all personal information matches the details on your California Form 540, 540A, or Long Form 540NR. Consistency is key to proper processing.

- Accurately report your unearned income and other funds received in 2009 in Part I, as this information is crucial for calculating your credit correctly.

- Complete Part II thoroughly, detailing each care provider's information who provided care in California. Accurate provider details, including their identification number and the address where care was provided, are necessary for the credit.

- Calculate the qualified expenses you incurred and paid in 2009 for each qualifying person in Part III accurately. Only actual expenses paid should be included to determine your credit.

Don't:

- Leave any required fields blank. Incomplete forms can result in processing delays or a denial of the credit.

- Misreport the care provider’s identification number or any amounts paid. This can lead to discrepancies and potential audits.

- Enter more than $3,000 for one qualifying person or $6,000 for two or more qualifying persons in Part III, line 3. Staying within the limits is crucial for correct credit calculation.

- Forget to include your and your spouse's/RDP's earned income, if applicable. Proper income reporting is essential for determining eligibility for the credit.

Misconceptions

One common misconception is that the California Form 3506 is only for parents of young children. However, this form can also be used by taxpayers who have dependent care expenses for a disabled spouse or dependent of any age, as long as the other requirements are met.

Many believe that if they are married, both spouses must have earned income to qualify for the credit. While generally both spouses must have earned income, there are exceptions. For instance, if one spouse was a full-time student or was physically or mentally incapable of self-care, this requirement can be waived.

Some people think that any type of child care expense is eligible for the credit. The truth is, only payments made to a care provider for the purpose of allowing the taxpayer to work or look for work qualify. Expenses for overnight camps or schooling for a child in kindergarten or above do not qualify.

There's a misconception that the credit amount is the same for every taxpayer. Actually, the credit amount is based on the taxpayer's earned income, the amount spent on qualifying expenses, and the number of qualifying individuals. The credit is calculated as a percentage of the allowable expenses, which can vary.

Another incorrect belief is that if you did not claim the credit in the year the expenses were paid, you lose the opportunity to claim it. Taxpayers who fail to claim the credit in the year the expenses were incurred may still be able to claim it by amending a prior year’s tax return, within the IRS's time limits for amendments.

Finally, some think the form is overly complicated and not worth the effort. While tax forms can be daunting, Form 3503 is accompanied by detailed instructions to help taxpayers. Moreover, claiming the credit can significantly lower the amount of tax owed or increase a taxpayer's refund, making it a worthwhile effort for those who qualify.

Key takeaways

When completing the California Form 3506 for Child and Dependent Care Expenses Credit, it's important to follow guidelines meticulously to ensure you maximize your benefits while adhering to California tax laws. Below are key takeaways for effectively filling out and using this form:

- The form must be attached to your California Form 540, 540A, or Long Form 540NR. This integration ensures that your credit calculation is properly included with your state income tax filing.

- Part I focuses on Unearned Income and Other Funds Received in 2009. Accurately reporting these amounts is crucial as they may affect the total credit amount you're eligible for.

- In Part II, detailed information about each care provider in California who qualifies for the credit is required. This includes the provider’s name, address, telephone number, identification number (SSN or FEIN), and the address where care was provided. Remember, only care provided within California qualifies for this credit.

- Part III is where you detail your qualifying person(s), which includes their name, social security number, date of birth, percentage of physical custody, and the qualified expenses you incurred and paid for in 2009 for their care in California. You cannot claim more than $3,000 for one qualifying person or $6,000 for two or more qualifying persons.

- If you received dependent care benefits, Part IV on Side 2 must be completed before Part III. This section reconciles the total amount of dependent care benefits received in 2009 with the qualified expenses incurred.

- For individuals with prior year expenses paid in 2009, a worksheet is available to calculate the credit for 2008 expenses paid in the subsequent tax year. This includes entering your 2008 qualified expenses, subtracting any dependent care benefits excluded from your income, and determining your credit based on your 2008 adjusted gross income.

Understanding these takeaways ensures accurate reporting and maximizes potential credits for child and dependent care expenses on your California tax return. Always refer to the detailed instructions provided with the form for specific guidance tailored to your individual circumstances.

Different PDF Templates

Form 3832 - It delineates the process for nonresident LLC members to consent to California's jurisdiction over their taxable income.

Renew Cosmetology License Ca - If you've experienced a name change, California requires additional documentation for cosmetology license renewal. Check the form for details.