Fill a Valid California 3521 Form

The California 3521 Form, officially known as the Low-Income Housing Credit form, plays an instrumental role for taxpayers in the realm of affordable housing investments within the state. Focused on the taxable year 2020, this form serves as an attachment to one's California tax return, addressing both individuals and corporations by including spaces for names, social security numbers (SSN) or individual taxpayer identification numbers (ITIN), California corporation numbers, and federal employer identification numbers (FEIN). Integral to the process are building identification numbers (BINs), highlighting the form's role in identifying specific eligible buildings for the credit. Through its sections, the form meticulously details how to calculate the available credit, incorporating potential decreases in eligible basis, affiliated corporation credits, and specifics on carryover computation. Moreover, it delves into the recomputation of the basis for projects or buildings whose eligible basis has decreased since initial approval, emphasizing the form’s comprehensive coverage of situations affecting the low-income housing credit. Clearly structured, the form guides taxpayers through the intricate process of claiming, computing, and potentially reallocating the low-income housing credit—a critical financial tool for incentivizing the provision of affordable housing in California.

Document Example

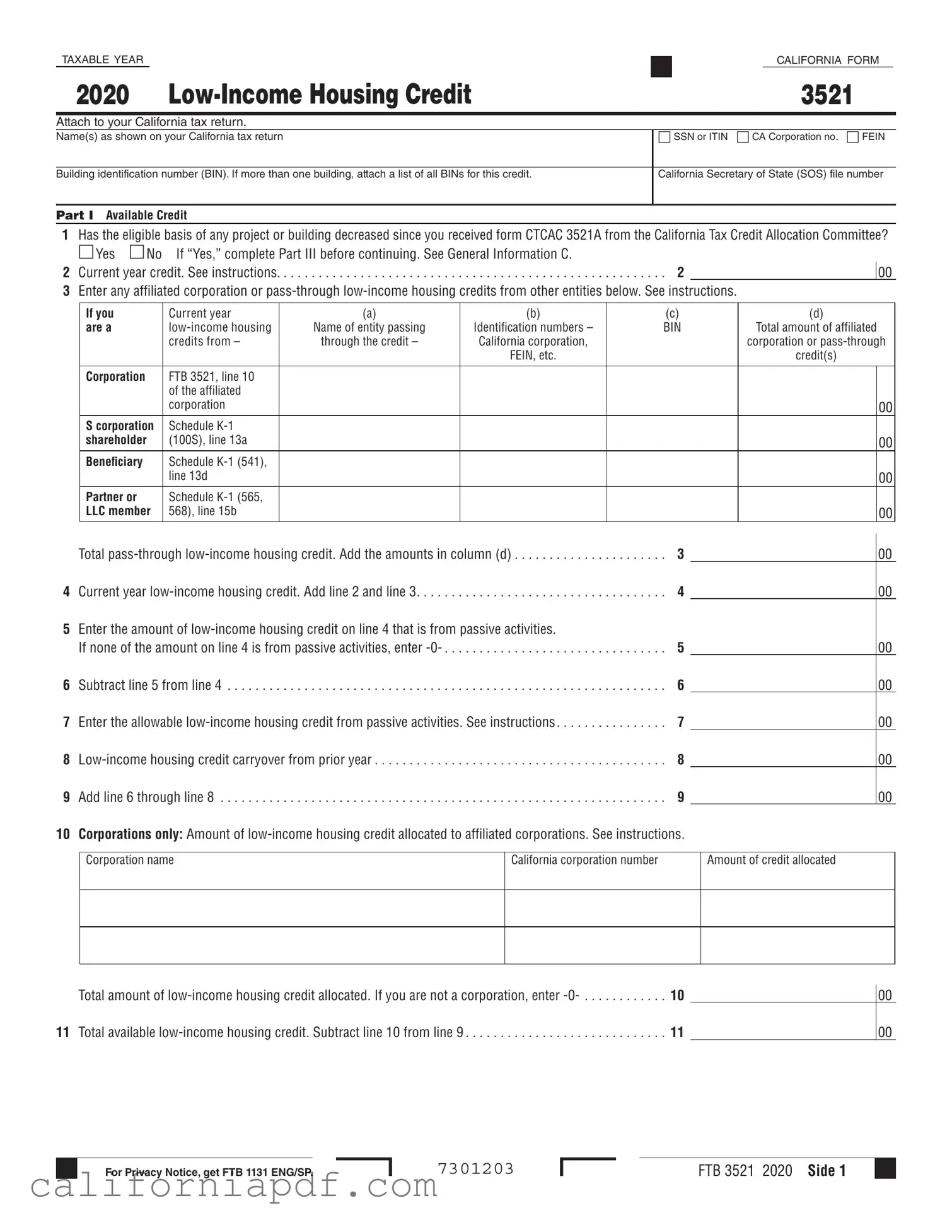

TAXABLE YEARCALIFORNIA FORM

2020 |

3521 |

Attach to your California tax return. |

|

Name(s) as shown on your California tax return |

□ SSN or ITIN □ CA Corporation no. □ FEIN |

Building identification number (BIN). If more than one building, attach a list of all BINs for this credit.

California Secretary of State (SOS) file number

Part I Available Credit

1Has the eligible basis of any project or building decreased since you received form CTCAC 3521A from the California Tax Credit Allocation Committee?

□Yes □No If “Yes,” complete Part III before continuing. See General Information C. |

|

2 Current year credit. See instructions. . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . 2 |

00 |

3Enter any affiliated corporation or

If you |

Current year |

(a) |

(b) |

(c) |

(d) |

|

are a |

Name of entity passing |

Identification numbers – |

BIN |

Total amount of affiliated |

||

|

credits from – |

through the credit – |

California corporation, |

|

corporation or |

|

|

|

|

FEIN, etc. |

|

credit(s) |

|

Corporation |

FTB 3521, line 10 |

|

|

|

|

|

|

of the affiliated |

|

|

|

|

|

|

corporation |

|

|

|

|

00 |

S corporation |

Schedule |

|

|

|

|

|

shareholder |

(100S), line 13a |

|

|

|

|

00 |

Beneficiary |

Schedule |

|

|

|

|

|

|

line 13d |

|

|

|

|

00 |

Partner or |

Schedule |

|

|

|

|

|

LLC member |

568), line 15b |

|

|

|

|

00 |

Total

4 Current year

5Enter the amount of

If none of the amount on line 4 is from passive activities, enter

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . . . . . 6

7Enter the allowable

8

9 Add line 6 through line 8 . . . . . . . . . . . . . . . . . 對 . . . . . . . . . . . . . . . 9

10Corporations only: Amount of

Corporation name |

California corporation number |

Amount of credit allocated |

00

00

00

00

00

00

00

Total amount of

11 Total available

00

00

|

|

|

7301203 |

|

|

|

For Privacy Notice, get FTB 1131 ENG/SP. |

FTB 3521 2020 Side 1 |

|

||

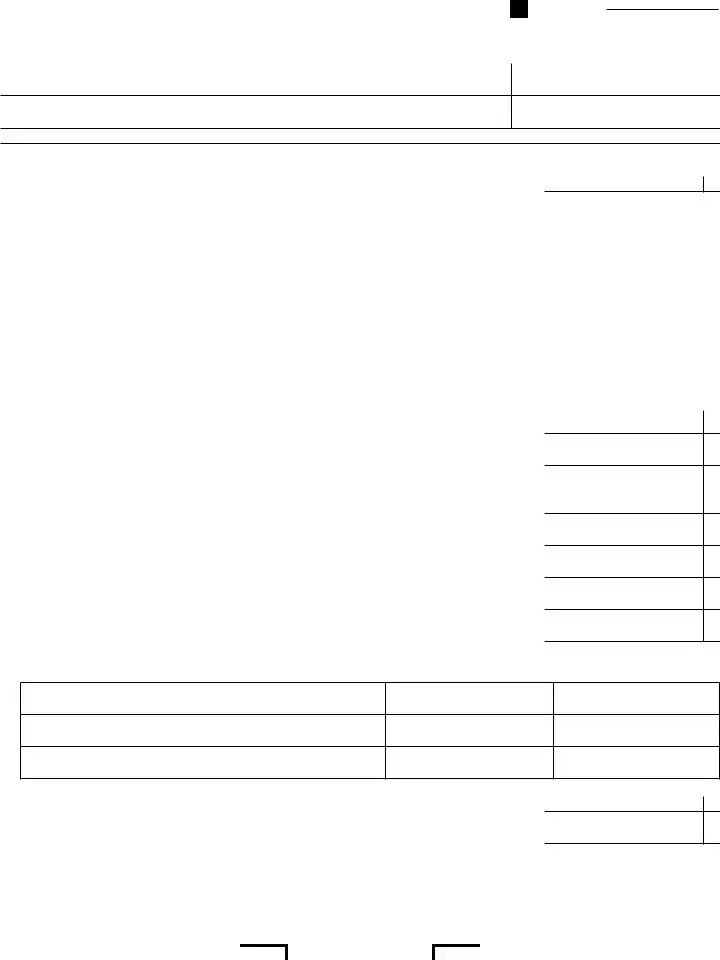

Part II Carryover Computation

12a Credit claimed. Enter the amount of the credit claimed on the current year tax return.

See instructions. . . . . . . . . . . . . . . . . . 對 . |

. . . . . . . . . . . . . . . .12a |

(Do not include any assigned credit claimed on form FTB 3544, |

Part B.) |

12b Total credit assigned. Enter the total amount from form FTB 3544, Part A, column (g).

If you are not a corporation, enter

13 Credit carryover available for future years. Add line 12a and line 12b, subtract the result from line 11 . . 13

00

00

00

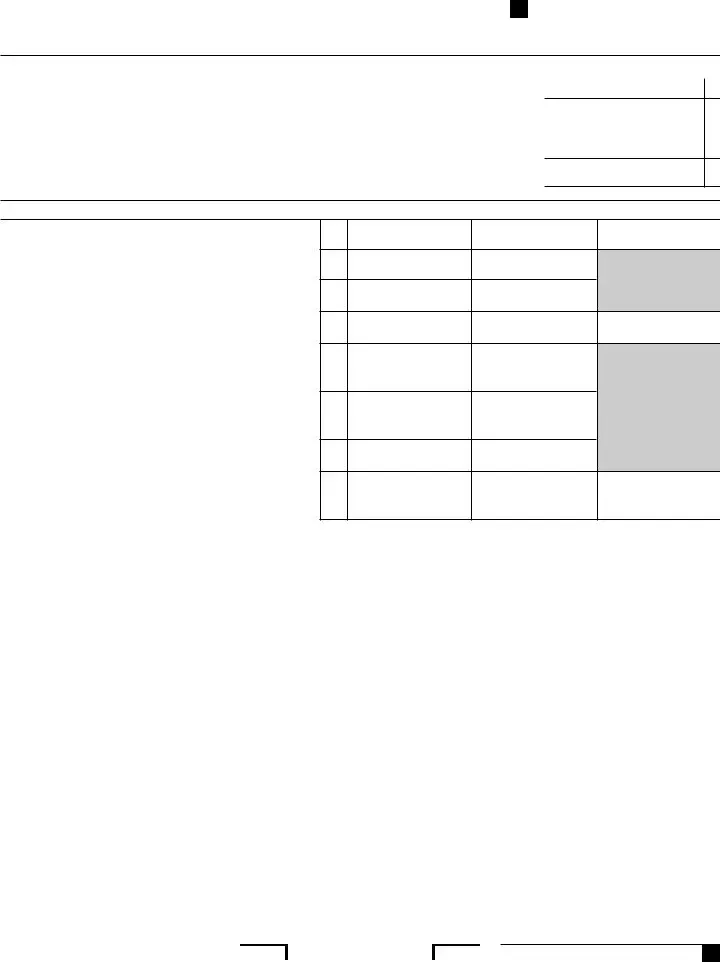

Part III Basis Recomputations. Complete this part only if the basis in a project or building has decreased. Use additional sheets if necessary.

14Date building was placed in service (month/year) . . . . .

15 BIN . . . . . . . . . . . . . . . . . 對 . . . . .

16Eligible basis of building. See General Information C . . . .

17

18Qualified basis of

by line 17 . . . . . . . . . . . . . . . . . 對 . . .

19Applicable percentage. See General Information B . . . . .

20Multiply line 18 by line 19. See Specific Line Instructions for Part I, line 2 . . . . . . . . . . . . . . . . . 對 . .

14

15

16

17

18

19

20

(a)

Building 1

(b)

Building 2

(c)

Total

|

Side 2 FTB 3521 2020 |

7302203 |

Form Breakdown

| Fact | Description |

|---|---|

| Form Purpose | The California Form 3521 is used to claim the Low-Income Housing Credit for qualified buildings allocated a credit by the California Tax Credit Allocation Committee (CTCAC). |

| Taxable Year | This form is for the 2020 tax year, indicating it is filed with the taxpayer's 2020 California tax return. |

| Attachment Requirement | It must be attached to the taxpayer's California tax return, integrating with the overall state tax documentation. |

| Eligibility Question | Part I asks if the eligible basis of any project or building has decreased since receiving form CTCAC 3521A, which could affect the credit amount. |

| Passive Activity Consideration | There is a specific line to note the amount of low-income housing credit from passive activities, ensuring correct tax treatment of such income. |

| Carryover Computation | Part II of the form is dedicated to the carryover computation, vital for determining the low-income housing credit available in future years. |

| Basis Recomputations | Part III provides the structure for recalculating the basis in a project or building if it has decreased, affecting the credit amount. |

| Governing Law | The form is governed by California state law, specifically regulations related to the allocation and calculation of low-income housing credits. |

How to Write California 3521

Filling out the California Form 3521, the Low-Income Housing Credit form, is a detailed process involving various steps. This form is crucial for entities or individuals who are claiming the low-income housing credit and must be attached to the California tax return. It's vital to provide accurate information to ensure compliance and secure the appropriate credits.

- Start by entering the tax year at the top of the form.

- Provide the names as shown on the California tax return.

- Check the appropriate box and fill in your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if filing as an individual, or the California Corporation number or Federal Employer Identification Number (FEIN) if filing for a corporation.

- Enter the Building Identification Number (BIN). If there are multiple buildings, attach a list of all BINs associated with this credit claim.

- Fill in the California Secretary of State (SOS) file number.

- Read Part I question 1 carefully. If the eligible basis of any project or building has decreased since receiving form CTCAC 3521A from the California Tax Credit Allocation Committee, check "Yes" and complete Part III before proceeding. Otherwise, check "No."

- Enter the current year credit in line 2 as instructed.

- If applicable, list any affiliated corporation or pass-through low-income housing credits from other entities in Part I section 3, including the name of the entity, identification numbers, and total amount of credits.

- Calculate the total current year low-income housing credit by adding lines 2 and 3, and enter this on line 4.

- Determine the amount of low-income housing credit from passive activities and enter this on line 5. If none, enter "-0-".

- Subtract line 5 from line 4 and enter this amount on line 6.

- Enter the allowable low-income housing credit from passive activities on line 7 as instructed.

- Input the low-income housing credit carryover from the prior year on line 8.

- Add lines 6 through 8 to get the total, and enter this on line 9.

- If filing as a corporation, list any low-income housing credit allocated to affiliated corporations in the provided table and enter the total on line 10. If not applicable, enter "-0-".

- Subtract line 10 from line 9 to receive the total available low-income housing credit and record this on line 11.

- In Part II, input the amount of the credit claimed this year on line 12a.

- If not a corporation, enter "-0-" on line 12b. Otherwise, total credit assigned goes here.

- Calculate the credit carryover available for future years by subtracting the sum of lines 12a and 12b from line 11 and enter on line 13.

- If applicable, complete Part III for any decreased basis in projects or buildings, providing the date the building was placed in service, the BIN, the eligible basis of the building, the low-income portion, the qualified basis of the low-income building, the applicable percentage, and the multiplication result of the qualified basis by the applicable percentage for each building involved. Use additional sheets if necessary.

Review each entry for accuracy before attaching the completed Form 3529 to your California tax return. It's recommended to consult with a tax professional if you encounter any uncertainties during this process.

Listed Questions and Answers

What is the California Form 3521?

The California Form 3521, also known as the Low-Income Housing Credit form, is a document used by individuals, estates, trusts, and corporations to calculate and claim the low-income housing credit on their California tax return. This credit is designed to encourage investment in low-income housing projects and is available for eligible properties placed in service throughout the tax year.

Who needs to file Form 3521?

Form 3521 must be filed by taxpayers who are claiming the low-income housing credit in California. This includes owners of qualifying low-income housing projects who have received a California Tax Credit Allocation Committee (CTCAC) Form 3521A, indicating the project’s eligibility for the credit. Applicable entities include: individual owners, corporations, estates, trusts, and pass-through entities such as partnerships and S corporations.

How is the credit on Form 3521 calculated?

The credit calculation involves several steps outlined in Parts I and III of the form:

- Part I focuses on calculating the current year credit based on the eligible basis and applicable percentage of the qualifying property, and any affiliated corporation or pass-through entity credits.

- If the eligible basis of a project or building has decreased since receiving the form CTCB 3521A, Part III must be completed to recalculate the basis before proceeding.

- The total available credit is determined after accounting for any passive activity limitations and carryover amounts from prior years.

What information do I need to complete Form 3521?

To properly complete Form 3521, the following information is necessary:

- Building Identification Number(s) (BIN) for each eligible building.

- The eligible and qualified basis of the property.

- Information on pass-through credits from other entities, if applicable.

- Details of any decrease in the eligible basis of the property since receiving CTCAC 3521A.

- Carryover amounts from prior years, if any.

Can Form 3521 credits be carried over to future years?

Yes, credits that are not utilized in the current tax year can be carried over to future years. Part II of Form 3521 is dedicated to computing the carryover amount. This involves subtracting the credit amount claimed in the current year and any assigned credits from the total available credit determined in Part I.

Are there any limitations on claiming the credit?

There are several limitations to be aware of when claiming the low-income housing credit:

- The credit amount that can be claimed may be limited by the taxpayer’s tax liability.

- Credits from passive activities may only be used to offset tax from passive income.

- Corporations are subject to additional restrictions on the allocation of credits to affiliated corporations.

Where can I find more information on completing Form 3521?

Comprehensive instructions for completing Form 3521 are provided by the California Franchise Tax Board (FTB). These instructions offer step-by-step guidance, including specific line instructions and general information about the low-income housing credit. For the most accurate and detailed information, visiting the FTB’s official website or consulting a tax professional is recommended.

Common mistakes

Not attaching the list of Building Identification Numbers (BINs) when more than one building is involved. This oversight can complicate the processing of the form, leading to delays or errors in credit calculation.

Failure to complete Part III before continuing the form if the eligible basis of any project or building has decreased since receiving form CTCAC 3521A. This step is crucial for accurate calculation of available credits.

Incorrectly entering the current year credit in line 2. Proper understanding and calculation according to the instructions are vital to avoid miscalculating the amount of low-income housing credit claimed.

Omitting or inaccurately reporting affiliated corporation or pass-through low-income housing credits from other entities in line 3. Accurate documentation and addition of these amounts ensure the correct total credit is claimed.

Failure to properly calculate and enter the amount of low-income housing credit from passive activities in line 5. This mistake can lead to an incorrect claim amount, affecting the tax liability.

Incorrectly subtracting line 5 from line 4 in line 6, which can result in an erroneous amount of credit available. Attention to detail in these calculations prevents issues in the credit amount claimed.

For corporations, wrongly allocating the amount of low-income housing credit to affiliated corporations or not entering the total allocated amount correctly in line 10 can lead to discrepancies in the total available low-income housing credit, impacting the final claim amount on the tax return.

Addressing these common mistakes ensures the accurate and efficient processing of the California Form 3521. This not only helps in claiming the correct amount of low-income housing credit but also in maintaining compliance with California tax laws.

Documents used along the form

When dealing with the California Form 3521, which focuses on the Low-Income Housing Credit, there are often several other documents and forms that may be required to complete the process efficiently and comply with all the relevant regulations. Understanding these additional documents can help individuals and organizations navigate the complexities of tax credits for low-income housing projects.

- FTB 3544: This form, the "Partnership Allocation of Credit," helps allocate credit among partners in a partnership, ensuring that the credit distribution is clearly documented and aligns with tax laws.

- FTB 3544A: Accompanying Form FTB 3544, this "Part A — Credit Allocation among the Controlled Group" form specifies how credits are distributed within a group of corporations, partnerships, or LLCs that are controlled by the same entity.

- CTCAC 3521A: Mentioned in Form 3521, this document from the California Tax Credit Allocation Committee certifies the amount of tax credit allocated to a project, which is fundamental for completing the Form 3521.

- Schedule K-1 (1065): For partnerships, this form details the share of income, deductions, and credits, key for reporting individual partners' distributive shares of the tax credits.

- Schedule K-1 (1120S): Used by S corporations to report each shareholder's share of income, losses, deductions, and credits, this is critical for members to accurately claim the low-income housing credit on their individual returns.

- Form 3800: The "General Business Credit" form is often necessary for entities looking to claim multiple business tax credits, including the low-income housing credit, against their federal income tax.

- Form 8586: This form is used to claim the low-income housing credit on a federal tax return, providing the IRS with details of the credit calculated for affordable housing projects.

Each of these documents plays a crucial role in the overall process of claiming and reporting the low-income housing credit on both state and federal levels. By familiarizing themselves with these forms, filers can ensure they meet all necessary requirements, maximizing their potential benefits while adhering to compliance standards.

Similar forms

The IRS Form 8586, which deals with Low-Income Housing Credit, shares common ground with the California 3521 form. They both aim to provide a tax incentive for the investment in low-income housing, balancing the playing field for those needing affordable housing solutions. Individuals and entities can claim these credits on their tax returns, directly offsetting their tax liabilities based on their investments in qualifying properties. The main focus of these forms is to encourage the development and maintenance of affordable rental houses through financial incentives.

Form 8823, titled "Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition," is related in its focus on maintaining the standards and qualifications necessary for properties to continue receiving the low-income housing tax credit. While California Form 3521 is used to claim the credit, Form 8823 serves as a regulatory check, ensuring the properties stay compliant with the program's rules. This relationship underscores the balance between providing incentives for low-income housing and maintaining quality and regulatory compliance within the projects.

The Schedule K-1 (Form 1065), used by partnerships to report the income, deductions, and credits to the IRS, plays a significant role similar to parts of the California 3521 form. Investors in low-income housing projects often operate through partnerships or S corporations, with the Schedule K-1 outlining each partner's share of the credit. Similarly, the 3521 form integrates information about pass-through low-income housing credits, highlighting the collaborative investment structure behind these community-serving projects.

IRS Form 8609, "Low-Income Housing Credit Allocation and Certification," closely resembles the authorization aspect of the California 3521 form. Operating as a certificate of allocation for federal low-income housing tax credits, Form 8609 kickstarts the credit claiming process once a property is placed in service. Its role is crucial for investors to be officially recognized and being eligible to claim credits, much like the initial certification required in the California system.

The Statement of Specified Foreign Financial Assets (Form 8938) has a tangential similarity in the sense that both forms deal with specific disclosures to the government. Whereas Form 8938 focuses on the reporting of foreign financial assets for tax purposes, the California 3521 form addresses domestic investments in low-income housing. Both play pivotal roles in their respective areas, emphasizing transparency and compliance with federal or state tax laws.

California's Form 3544, "Partnership Allocation Schedule," complements the 3521 form by detailing how certain credits, including low-income housing credits, are allocated among partners or members of a pass-through entity. This collaboration ensures that each participant's share of the investment and ensuing tax credits is accurately reflected and reported, much like the distribution mechanism outlined in California Form 3521 for low-income housing credits.

The New Markets Credit on IRS Form 8874, although targeting investment in commercial ventures in low-income areas, parallels the California 3521 form by fostering economic growth and improvement through tax incentives. Both forms incentivize private investments but in different sectors—housing versus commercial development in economically disadvantaged communities. The goal of revitalizing communities and encouraging investment where it's most needed unites these two credits.

Lastly, the Historic Preservation Tax Credit programs, often documented through IRS Form 3468, share the core concept of using tax incentives to motivate specific investments, similar to the low-income housing credit. While Form 3468 is dedicated to preserving and rehabilitating historic structures, the California 3521 form focuses on affordable housing. Both contribute to societal welfare and community development, albeit with different focal points, by leveraging the tax code to encourage beneficial investments in the community.

Dos and Don'ts

Filling out the California Form 3521, also known as the Low-Income Housing Credit form, can be a straightforward process when the right steps are taken. To ensure accuracy and avoid common mistakes, here are some essential dos and don'ts to consider:

Do:

- 1. Double-check the building identification number (BIN). Make sure that it matches the number(s) provided by the California Tax Credit Allocation Committee. If managing more than one building, attach a comprehensive list of all BINs related to this credit.

- 2. Accurately report the eligible basis of your project or building. If the eligible basis has decreased since receiving form CTCAC 3521A, remember to complete Part III before proceeding further.

- 3. Include all affiliated corporations or pass-through low-income housing credits. Ensure that the identification numbers and the names of entities passing through the credit are correctly listed, along with the total amount of affiliated credits.

- 4. Calculate your low-income housing credit meticulously. Add the current year credit and the total pass-through low-income housing credit to determine the current year low-income housing credit accurately.

- 5. Carry over computation. Pay close attention to any credits that need to be carried over from the previous year and ensure they are calculated correctly in Part II of the form.

Don't:

- 1. Overlook the passive activity amount. If any of the amount on line 4 comes from passive activities, it must be entered correctly. If not, ensure to note this with a "-0-" on the form.

- 2. Forget to subtract the allocated credit for corporations only. If applicable, complete the calculation to determine the total available low-income housing credit by subtracting the total amount allocated to affiliated corporations.

- 3. Miss the completion of Part III if the basis has decreased. This section is crucial for projects or buildings with a decreased eligible basis. It ensures the form reflects accurate calculations specific to your situation.

- 4. Neglect the privacy notice. The Privacy Notice, FTB 1131 ENG/SP, provides important information on how your personal information is handled. Make sure to review this document to understand your rights.

- 5. Disregard specific line instructions. Each section of the form comes with specific instructions. Review them carefully to avoid mistakes in your calculations and ensure all necessary documentation is accurately completed and attached.

By following these guidelines, you can fill out the California Form 3521 with confidence, ensuring that all information provided is accurate and complete. This will help in the timely processing of your low-income housing credit and avoid potential delays or issues.

Misconceptions

There are several misconceptions about the California Form 3521, also known as the Low-Income Housing Credit form. Understanding these misconceptions is crucial for taxpayers involved in providing low-income housing. Clarifying these misunderstandings ensures compliance with tax regulations and maximizes potential benefits.

Only for Corporations: A common misconception is that Form 3521 is solely for corporations. In reality, this form can be used by various entities, including individuals, who possess low-income housing credits. Eligibility extends beyond corporations, allowing a broader range of taxpayers to benefit from the low-income housing credit.

Passive Activity Restrictions: Some taxpayers believe that if the low-income housing credit arises from passive activities, they cannot claim it. This is incorrect. Form 3521 allows for the calculation of low-income housing credit coming from passive or non-passive activities. Taxpayers should carefully distinguish and report these amounts on lines 5 and 7 to correctly calculate their allowable credit.

Availability of Credit: There's a misconception that once the credit is calculated and reported on Form 3521, it's automatically available for use. However, calculating the credit and its availability are distinct steps. Taxpayers must navigate through carryforward rules and potential phasing out depending on their specific tax situation, as delineated in parts I and II of the form.

No Need for Detail on Multiple Buildings: Taxpayers sometimes misconceive that listing multiple buildings that qualify for the credit is unnecessary. However, the form explicitly requires the listing of Building Identification Numbers (BINs) for all buildings eligible for credits. If more than one building is involved, additional documentation is necessary.

Credit Does Not Affect Basis: Another misunderstanding is that claiming the low-income housing credit on Form 3521 does not affect the project's basis. Part III of the form requires recalculating the basis if it has decreased, demonstrating that claiming the credit can indeed impact the basis of the building or project.

Clearing up these misconceptions is essential for effective tax planning and compliance. Taxpayers involved in low-income housing should ensure they fully understand the requirements and implications of Form 3521 to take full advantage of the benefits it offers while adhering to tax laws.

Key takeaways

Understanding the California Form 3521, the Low-Income Housing Credit form, involves navigating through its various sections and stipulations. Here are key takeaways to help demystify the process for taxpayers:

- Eligibility: California Form 3521 is designed for entities that qualify for low-income housing credits. It must be attached to your California tax return. Both individuals and corporations can apply if they meet the requirements laid out by the California Tax Credit Allocation Committee.

- Building Identification Number (BIN): The form asks for the BIN, a critical piece of information. If you're claiming credits for more than one building, you need to attach a list that details all relevant BINs. This ensures each building's credits are accurately accounted for.

- Part I - Available Credit: This section requires careful attention. It includes questions about the eligible basis of a project and current year credits, among other details. If the eligible basis of any building or project has decreased, Part III must be completed before proceeding further.

- Pass-Through Credits: If you are part of an affiliated corporation or pass-through entity like an S corporation, LLC, or a beneficiary in a trust, identifying and summing pass-through credits from these entities is essential. This information impacts the total available low-income housing credit you can claim.

- Calculating Carryover: Part II focuses on the carryover computation of the credit, which is vital for understanding the amount of credit that can be claimed in the current year versus what can be carried over into future tax years. It helps in optimizing tax benefits over time.

- Documenting Changes in Basis: If there's a decrease in the eligible basis in any project or building since receiving form CTCAC 3521A, it's crucial to complete Part III. This part requires detailed information like the date the building was placed in service, eligible and qualified basis, and the applicable percentage, highlighting adjustments needed for accurate credit calculation.

It's important to carefully read the instructions and gather all necessary information before filling out the form to ensure accuracy and compliance. Proper completion of California Form 3521 can significantly impact your tax situation if you're involved in providing low-income housing.

Different PDF Templates

Ca Form 541 Instructions 2022 - The total amount on your check or money order should match the amount you enter on Form 540-V.

Form 3832 - Required for LLCs with nonresident members, the form ensures California can tax income from in-state sources.