Fill a Valid California 3522 Form

The California 3522 form, known as the LLC Tax Voucher, plays a critical role in the compliance landscape for limited liability companies (LLCs) operating within the state. This form is utilized by LLCs to make an annual tax payment of $800, ensuring they meet state taxation requirements for the taxable year 2022. It applies to LLCs that are registered with the California Secretary of State, whether by articles of organization or certificate of registration, and those conducting business in California. The importance of this form lies not only in its use for tax payment but also in its significance for various kinds of LLCs including newly established ones, foreign LLCs starting to do business in California, and even those exempt under specific conditions like small businesses owned by deployed members of the United States Armed Forces. The due date for this annual tax aligns with the 15th day of the 4th month after the beginning of the LLC's taxable year, with certain exemptions provided to new LLCs. Payment methods have also been broadened to include electronic funds withdrawal, online payments through Web Pay, and credit card payments, offering convenience and flexibility. Moreover, the form provides detailed instructions regarding the information and documentation required, ensuring LLCs can adhere to the procedural aspects effectively. In the scenario of missed or late payments, the form also outlines the penalties and the process for making payments to avoid further implications.

Document Example

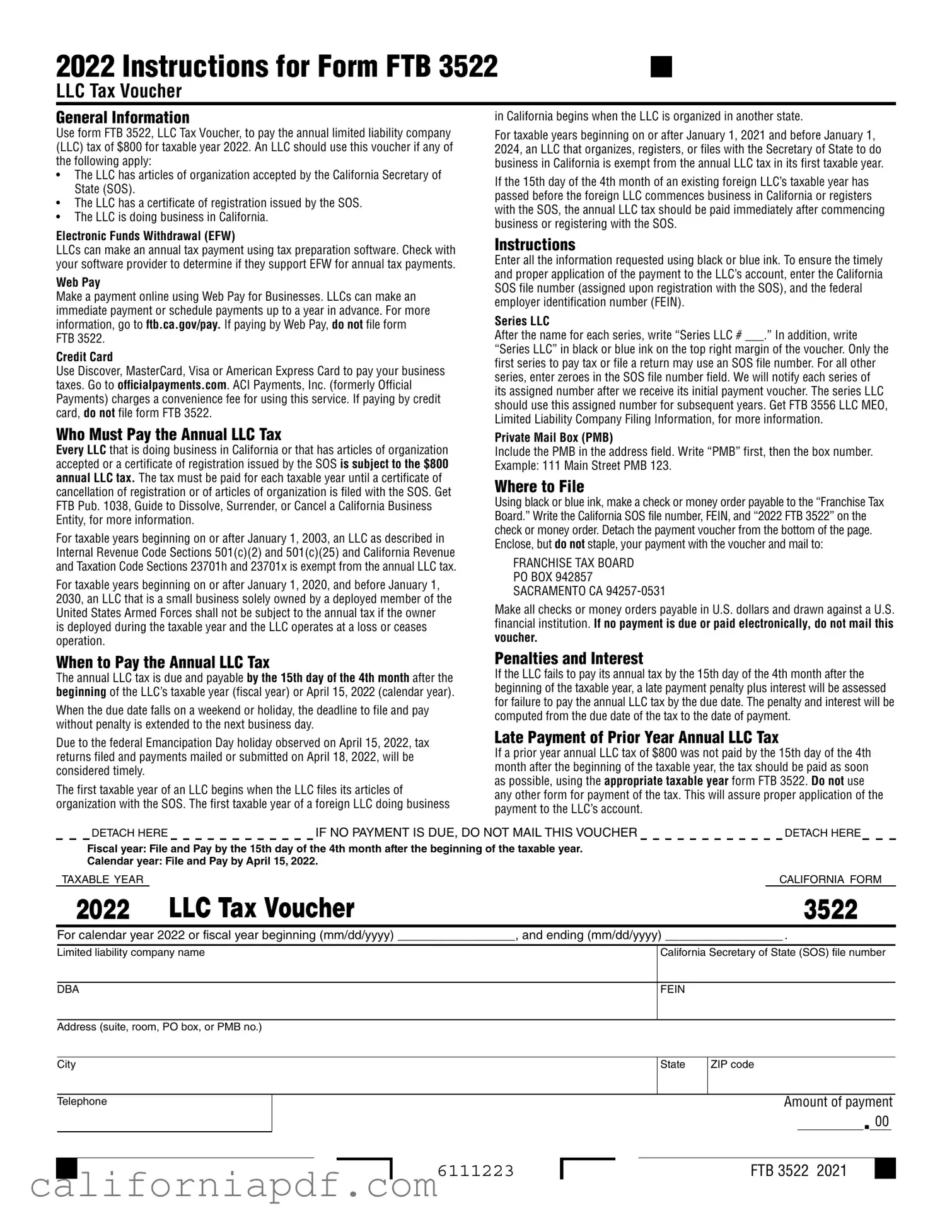

2022 Instructions for Form FTB 3522

LLC Tax Voucher

General Information

Use form FTB 3522, LLC Tax Voucher, to pay the annual limited liability company (LLC) tax of $800 for taxable year 2022. An LLC should use this voucher if any of the following apply:

•The LLC has articles of organization accepted by the California Secretary of State (SOS).

•The LLC has a certificate of registration issued by the SOS.

•The LLC is doing business in California.

Electronic Funds Withdrawal (EFW)

LLCs can make an annual tax payment using tax preparation software. Check with your software provider to determine if they support EFW for annual tax payments.

Web Pay

Make a payment online using Web Pay for Businesses. LLCs can make an immediate payment or schedule payments up to a year in advance. For more information, go to ftb.ca.gov/pay. If paying by Web Pay, do not file form FTB 3522.

Credit Card

Use Discover, MasterCard, Visa or American Express Card to pay your business taxes. Go to officialpayments.com. ACI Payments, Inc. (formerly Official Payments) charges a convenience fee for using this service. If paying by credit card, do not file form FTB 3522.

Who Must Pay the Annual LLC Tax

Every LLC that is doing business in California or that has articles of organization accepted or a certificate of registration issued by the SOS is subject to the $800 annual LLC tax. The tax must be paid for each taxable year until a certificate of cancellation of registration or of articles of organization is filed with the SOS. Get FTB Pub. 1038, Guide to Dissolve, Surrender, or Cancel a California Business Entity, for more information.

For taxable years beginning on or after January 1, 2003, an LLC as described in Internal Revenue Code Sections 501(c)(2) and 501(c)(25) and California Revenue and Taxation Code Sections 23701h and 23701x is exempt from the annual LLC tax.

For taxable years beginning on or after January 1, 2020, and before January 1, 2030, an LLC that is a small business solely owned by a deployed member of the United States Armed Forces shall not be subject to the annual tax if the owner is deployed during the taxable year and the LLC operates at a loss or ceases operation.

When to Pay the Annual LLC Tax

The annual LLC tax is due and payable by the 15th day of the 4th month after the beginning of the LLC’s taxable year (fiscal year) or April 15, 2022 (calendar year).

When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely.

The first taxable year of an LLC begins when the LLC files its articles of organization with the SOS. The first taxable year of a foreign LLC doing business

in California begins when the LLC is organized in another state.

For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year.

If the 15th day of the 4th month of an existing foreign LLC’s taxable year has passed before the foreign LLC commences business in California or registers with the SOS, the annual LLC tax should be paid immediately after commencing business or registering with the SOS.

Instructions

Enter all the information requested using black or blue ink. To ensure the timely and proper application of the payment to the LLC’s account, enter the California SOS file number (assigned upon registration with the SOS), and the federal employer identification number (FEIN).

Series LLC

After the name for each series, write “Series LLC # ___.” In addition, write “Series LLC” in black or blue ink on the top right margin of the voucher. Only the first series to pay tax or file a return may use an SOS file number. For all other series, enter zeroes in the SOS file number field. We will notify each series of its assigned number after we receive its initial payment voucher. The series LLC should use this assigned number for subsequent years. Get FTB 3556 LLC MEO, Limited Liability Company Filing Information, for more information.

Private Mail Box (PMB)

Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Where to File

Using black or blue ink, make a check or money order payable to the “Franchise Tax Board.” Write the California SOS file number, FEIN, and “2022 FTB 3522” on the check or money order. Detach the payment voucher from the bottom of the page. Enclose, but do not staple, your payment with the voucher and mail to:

FRANCHISE TAX BOARD PO BOX 942857 SACRAMENTO CA

Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution. If no payment is due or paid electronically, do not mail this voucher.

Penalties and Interest

If the LLC fails to pay its annual tax by the 15th day of the 4th month after the beginning of the taxable year, a late payment penalty plus interest will be assessed for failure to pay the annual LLC tax by the due date. The penalty and interest will be computed from the due date of the tax to the date of payment.

Late Payment of Prior Year Annual LLC Tax

If a prior year annual LLC tax of $800 was not paid by the 15th day of the 4th month after the beginning of the taxable year, the tax should be paid as soon as possible, using the appropriate taxable year form FTB 3522. Do not use any other form for payment of the tax. This will assure proper application of the payment to the LLC’s account.

DETACH HERE |

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER |

DETACH HERE |

Fiscal year: File and Pay by the 15th day of the 4th month after the beginning of the taxable year. |

|

|

Calendar year: File and Pay by April 15, 2022. |

|

|

TAXABLE YEAR |

|

CALIFORNIA FORM |

2022 |

LLC Tax Voucher |

3522 |

For calendar year 2022 or fiscal year beginning (mm/dd/yyyy) _________________, and ending (mm/dd/yyyy) _________________ .

Limited liability company name

DBA

California Secretary of State (SOS) file number

FEIN

Address (suite, room, PO box, or PMB no.)

City

Telephone

State |

ZIP code |

Amount of payment

. 00

6111223

FTB 3522 2021

Form Breakdown

| Name of Fact | Detail |

|---|---|

| Purpose of Form FTB 3522 | Used to pay the annual $800 tax for limited liability companies (LLCs) operating in California. |

| Applicability | Required for LLCs with articles of organization accepted, a certificate of registration issued by the California Secretary of State, or doing business in California. |

| Electronic Funds Withdrawal | LLCs can pay their annual tax using tax preparation software that supports EFW for annual tax payments. |

| Web Pay Option | Allows for immediate or future scheduled payments online via ftb.ca.gov/pay without filing form FTB 3522 if done through Web Pay. |

| Credit Card Payment | Allows payment with Discover, MasterCard, Visa, or American Express cards through officialpayments.com, with a service fee. |

| Annual LLC Tax Requirement | All LLCs doing business in California or registered with the California Secretary of State must pay the $800 tax annually until formally cancelled. |

| Exemption Conditions | LLCs under IRC Sections 501(c)(2) or 501(c)(25) and California RTC Sections 23701h or 23701x are exempt, as are small businesses owned by deployed military members under specific conditions. |

| Payment Deadline | Due by the 15th day of the 4th month after the beginning of the LLC’s taxable year; adjustments are made for weekends and certain holidays. |

| First Year Tax Exemption | Newly organized, registered, or filed LLCs are exempt from the annual tax in their first taxable year from 2021 to 2024. |

| Penalties and Interest | Failure to pay the annual LLC tax by the due date results in a late payment penalty plus interest from the due date to the date of payment. |

| Governing Laws | Governed by the California Revenue and Taxation Code and subject to regulations by the California Franchise Tax Board. |

How to Write California 3522

Filling out the California Form 3522 is an essential step for LLCs operating within the state to comply with tax obligations. This form is used to pay the annual limited liability company tax of $800 for the taxable year 2022. Correctly completing and submitting this form ensures that your LLC remains in good standing with the California tax authorities. Follow these steps to fill out the form accurately.

- Prepare to fill out the form: Use black or blue ink. Ensure you have the LLC’s California Secretary of State (SOS) file number and the federal employer identification number (FEIN) at hand. These are crucial for identifying your LLC with the tax authorities.

- Enter the taxable year: At the top of the form, specify whether the form is for a calendar year (2022) or a fiscal year, by entering the beginning and ending dates (mm/dd/yyyy).

- Provide LLC information: Clearly write the name of the limited liability company and if there's a doing business as (DBA) name, include that as well.

- State the California SOS file number: Enter the number assigned to your LLC upon registration with the California Secretary of State.

- Include the FEIN: Write the federal employer identification number assigned to your LLC.

- Address details: Fill in the LLC’s address including suite, room, PO box, or PMB (Private Mail Box) number if applicable, followed by the city, state, and ZIP code. For PMBs, write “PMB” first, then the box number.

- Contact information: Provide a current telephone number for the LLC.

- Payment amount: Enter "$800.00" as the amount of payment for the annual LLC tax.

- Payment method: Using black or blue ink, write a check or money oorder payable to “Franchise Tax Board.” On the check or money order, write the California SOS file number, the FEIN, and “2022 FTB 3522.” Ensure that the check or money order is payable in U.S. dollars and drawn against a U.S. financial institution.

- Final steps: Detach the payment voucher from the bottom of the page. Enclose, but do not staple, your payment with the voucher. Mail to the address provided for the Franchise Tax Board. If you are paying electronically via Web Pay or by credit card, do not mail this form.

After completing and mailing Form 3522 or paying electronically, your LLC has fulfilled a critical annual obligation regarding state taxes. Remember, the timely completion of this step helps avoid penalties and interest for late payment. For future tax years or other tax obligations, ensure to stay informed about the deadlines and requirements to maintain compliance.

Listed Questions and Answers

What is Form FTB 3522 and who should use it?

Form FTB 3522, LLC Tax Voucher, is for paying the annual $800 tax required for limited liability companies operating in California. This form is applicable to LLCs that either have articles of organization accepted, a certificate of registration issued by the California Secretary of State, or are actively doing business in California.

Can LLCs pay their annual tax electronically?

Yes, LLCs have the option to pay their annual tax using electronic funds withdrawal (EFW) via tax preparation software, though it's recommended to check with the software provider to confirm support for EFW for annual tax payments. In addition, the Web Pay for Businesses service allows for online payments or scheduling payments up to a year in advance.

What payment methods are accepted for the annual LLC tax?

LLCs can pay their annual tax through:

- Electronic Funds Withdrawal

- Web Pay for Businesses online service

- Credit card payments via Discover, MasterCard, Visa, or American Express through ACI Payments, Inc., which charges a convenience fee.

If paying by Web Pay or credit card, there is no need to file Form FTB 3522.

Who is required to pay the annual LLC tax?

All LLCs that do business in California, have articles of organization accepted, or have a certificate of registration issued by the Secretary of State must pay the annual $800 tax. This requirement continues each taxable year until the LLC files a certificate of cancellation or registration is cancelled.

Are there any exemptions to the annual LLC tax?

Yes, exemptions apply to:

- LLCs as described in Internal Revenue Code Sections 501(c)(2) and 501(c)(25), along with California Revenue and Taxation Code Sections 23701h and 23701x, for taxable years beginning on or after January 1, 2003.

- Small businesses solely owned by a deployed member of the United States Armed Forces, operating at a loss or ceasing operation during the owner's deployment, for taxable years starting from January 1, 2020, to January 1, 2030.

When is the annual LLC tax due?

The tax is due by the 15th day of the 4th month after the beginning of the LLC's taxable year. For calendar year filers, this is April 15th. If the due date falls on a weekend or holiday, the deadline is extended to the next business start day.

What happens if the annual LLC tax is not paid on time?

If the LLC fails to pay the annual tax by the due date, it will incur a late payment penalty plus interest. These are calculated from the tax's due date to the actual payment date.

Where should Form FTB 3522 be filed?

Payments made with Form FTB 3522 should be through a check or money order, using black or blue ink, payable to the "Franchise Tax Board." It's important to include the LLC's California Secretary of State file number and federal employer identification number on the check or money order. Payments should be mailed to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA 94257-0531

Make sure to use U.S. dollars and a U.S. financial institution for the payment. If no payment is due or it's made electronically, there's no need to mail this voucher.

Common mistakes

Filling out the California 3522 form can seem straightforward, but small oversights can lead to errors that may affect your limited liability company (LLC) and its compliance with state tax obligations. Here are four common mistakes to avoid:

Not using black or blue ink: The form specifies that all information should be entered using black or blue ink. Using other colors or pencil might result in the form being rejected or improperly processed, causing unnecessary delays.

Omitting the California Secretary of State (SOS) file number or the federal employer identification number (FEIN): These numbers are critical for the Franchise Tax Board (FTB) to identify your LLC correctly. Failure to include these numbers can result in your payment not being applied to your account, potentially leading to penalties for unpaid taxes.

Incorrect payment information: It is important to ensure that checks or money orders are made payable in U.S. dollars, drawn against a U.S. financial institution, and correctly addressed to the "Franchise Tax Board". Additionally, writing the SOS file number, FEIN, and “2022 FTB 3522” on the payment ensures the correct application to your LLC's account.

Failure to file electronically when applicable: If you are making a payment electronically via Web Pay or credit card, there is no need to file the paper form FTB 3522. This mistake can lead to confusion and the possibility of double payments if not properly communicated.

By carefully avoiding these mistakes, you can help ensure that your LLC's annual tax is processed efficiently and accurately, maintaining good standing with the state of California.

Documents used along the form

When handling the affairs of a Limited Liability Company (LLC) in California, particularly regarding the payment of the annual LLC tax through Form FTB 3522, several other forms and documents might be required. These forms complement or are part of the process of managing and complying with state tax obligations, changes in the company structure, or dissolution processes. Understanding each one is crucial for ensuring timely and proper handling of an LLC's responsibilities to the state.

- FTB 3536 (Estimated Fee for LLCs): This form is used by LLCs to pay the estimated annual fee if the company expects its total annual income to be $250,000 or more.

- SOS/FTB 3556 (LLC MEO), Limited Liability Company Filing Information: Offers additional details on filing requirements, record-keeping, and the various forms needed for LLC operation in California.

- Form 568 (Limited Liability Company Return of Income): It is the tax return form for all California LLCs, detailing income, deductions, and credits of the LLC.

- FTB 3537 (Payment for Automatic Extension for LLCs): Used by LLCs requesting an automatic six-month extension to file Form 568.

- FTB 3523 (Research Credit): This form applies to LLCs claiming the research credit for increasing research activities and expenses.

- FTB Pub. 1038 (Guide to Dissolve, Surrender, or Cancel a California Business Entity): Provides detailed information on the steps, forms, and fees involved in dissolving an LLC in California.

- Secretary of State Statement of Information (Form LLC-12): Required annually, this form updates or confirms the records of the LLC, including address, management, and agent for service of process.

- FTB 3832 (Limited Liability Company Nonresident Members’ Consent): Needed if an LLC elects to pay the tax for its nonresident members; this consent form is attached to the Form 568 filing.

While each document serves a specific purpose within the broader framework of LLC operation and taxation in California, familiarity and compliance with these forms ensure that an LLC remains in good standing and avoids penalties. Timely and accurate filing supports the smooth operation and longevity of the company.

Similar forms

The California Form 568, Limited Liability Company Return of Income, shares similarities with the California 3522 form as both pertain specifically to the taxation and financial obligations of limited liability companies (LLCs) within the state. While Form 3522 is used for the payment of the annual LLC tax, Form 568 is comprehensive, focusing on reporting the income, deductions, and tax liability of an LLC for a given tax year, thereby ensuring the state has a complete financial profile of the entity.

Form 540-ES, California Estimated Tax for Individuals, parallels the California 3522 form in that both involve the advance payment of taxes. However, whereas Form 3522 serves business entities like LLCs, Form 540-ES is designed for individuals who expect to owe taxes on income not subject to regular withholding. This prepayment approach in both forms helps taxpayers manage their tax liabilities more efficiently by spreading payments over the tax year.

The California Form 100-ES, Corporation Estimated Tax, is akin to the Form 3522 as both are geared towards future tax payments. Form 100-ES is utilized by corporations to submit their estimated tax payments, similar to how LLCs use Form 3522 to pay their annual tax. These estimated payments are crucial for both corporations and LLCs in managing cash flow and avoiding underpayment penalties.

The California Form 565, Partnership Return of Income, while distinct in its target audience, mirrors the Form 3522 in the sense that it deals with the reporting and taxation obligations of partnerships. Both forms address the compliance requirements of business structures operating in California, ensuring that the financial activities of these entities are fully accounted for during the tax year.

Similar to the California 3522 form, the Schedule C (Form 1040), Profit or Loss from Business, is another document used in the tax filing process, specifically by sole proprietors and single-member LLCs treated as disregarded entities. While Schedule C pertains to federal income tax filings and the 3522 form deals with state-level obligations, both require detailed financial information to accurately assess tax liabilities based on business income.

California Form 109, Payment for Automatic Extension for Corporations and Exempt Organizations, shares a procedural similarity with Form 3522 in providing a mechanism for entities to meet their tax obligations beyond the standard deadline. While Form 3522 facilitates the payment of the annual LLC tax, Form 109 is utilized to extend the filing deadline for corporations and exempt organizations, showing how different forms cater to varied needs yet aim to maintain tax compliance.

The California Form 3500, Exemption Application, while primarily focused on securing tax-exempt status for eligible entities, intersects with the purpose of the Form 3522 in the broader context of entity registration and state compliance. Entities successfully granted exemption through Form 3500 may alter their tax obligations, thereby influencing the relevance or application of other tax forms, including the 3522.

Similar to Form 3522, the FTB 3536 (Estimated Fee for LLCs) is another essential document for LLCs operating in California. It is designed for the payment of estimated fees based on total annual income. Both forms are integral in fulfilling the financial responsibilities of LLCs to the state, with the 3522 covering the flat annual tax and the 3536 addressing income-based fees.

Form 3554, New Employment Credit, although designed for a different purpose, shares the intent of facilitating tax benefits for businesses, much like Form 3522 facilitates the compliance with tax obligations. Form 3554 offers a credit for qualified businesses hiring new employees in designated areas, illustrating the state's broader efforts to manage tax liabilities and incentivize economic activity across diverse business operations.

Finally, the California Statement of Information (Form LLC-12) is required by LLCs and serves a function complementary to the Form 3522 by maintaining updated records with the Secretary of State. Though LLC-12 focuses on operational and structural information of the company, rather than its tax liabilities, submitting this form along with meeting tax requirements through forms like 3522 forms a complete picture of an LLC's adherence to state regulations.

Dos and Don'ts

When filling out the California 3522 form, which is used by limited liability companies (LLCs) to pay their annual tax, it's important to follow these guidelines to ensure the process is smooth and error-free. Below are things you should and shouldn't do:

- Do ensure that all the information requested is filled out using black or blue ink, as this ensures clarity and reduces the chance of errors during processing.

- Do include the California Secretary of State (SOS) file number and the federal employer identification number (FEIN) to ensure the timely and proper application of the payment to the LLC’s account.

- Do write the payment amount clearly in U.S. dollars and ensure the check or money order is drawn against a U.S. financial institution.

- Don't staple your payment to the voucher; enclose the payment with the voucher when mailing it to ensure it can be processed correctly.

- Don't mail the form if no payment is due or if the payment was made electronically, to avoid confusion and processing delays.

- Don't use any form other than the appropriate year's Form FTB 3522 for paying the annual LLC tax, as using the wrong form can lead to incorrect application of your payment.

Making sure you follow these guidelines will help in successfully submitting your annual LLC tax payment. For further details and to avoid any late payment penalties, always refer to the latest guidelines provided by the Franchise Tax Board.

Misconceptions

There are several common misconceptions about the California Form 3522, also known as the LLC Tax Voucher. Understanding the facts can help ensure that LLC members meet their tax obligations without confusion. Below are explanations aimed at clearing up these misunderstandings:

- Only large LLCs need to file Form 3522. This is not accurate. All LLCs that are doing business in California, or have articles of organization accepted or a certificate of registration issued by the California Secretary of State, must file Form 3522 and pay the annual tax.

- Form 3522 is for tax reporting. Actually, Form 3522 is a tax voucher used for paying the annual LLC tax of $800, not for reporting income or losses. The form itself does not require detailed financial information.

- Electronic payments exempt an LLC from filing Form 3522. This is true in part. If an LLC pays its tax via electronic funds withdrawal (EFW), Web Pay, or credit card, it does not need to submit a physical Form 3522. However, the LLC still must ensure the tax is paid.

- The $800 tax is due at the end of the fiscal year. In fact, the tax is due by the 15th day of the 4th month of the LLC’s taxable year, typically April 15 for those on a calendar year.

- All LLCs pay the $800 tax, no exceptions. There are exceptions. For instance, LLCs classified under certain sections of the Internal Revenue Code and California Revenue and Taxation Code may be exempt. Additionally, small businesses owned by a deployed member of the United States Armed Forces may not have to pay the tax under certain conditions.

- The tax amount varies based on income. The annual LLC tax is a flat rate of $800, not dependent on the company's income. However, LLCs may be subject to additional fees based on their total annual income.

- First-year LLCs must pay the annual tax immediately. For taxable years beginning on or after January 1, 2021, and before January 1, 2024, newly organized or registered LLCs are exempt from the annual LLC tax in their first taxable year.

- Any form can be used to pay a late annual LLC tax. To properly apply the payment to the LLC’s account, a late annual LLC tax should be paid specifically using Form 3422 for the appropriate taxable year. Using the correct form ensures accurate processing.

- Series LLCs can use the same SOS file number for each series. This is incorrect. Each series within a Series LLC must use its assigned number, provided by the Franchise Tax Board after the initial payment voucher is received. Only the first series to pay tax or file a return can use an SOS file number.

Understanding these key points about Form 3522 can help California LLCs navigate their tax obligations more effectively, avoiding common pitfalls and ensuring compliance with state tax requirements.

Key takeaways

Understanding how to properly complete and utilize the California 3522 form is crucial for any limited liability company (LLC) operating within the state. This form is designed for the payment of the annual LLC tax, a requirement that ensures compliance and good standing in the eyes of California's regulatory framework. Here are nine key takeaways that provide clear guidance on navigating this obligation:

- The Form FTB 3522, or LLC Tax Voucher, is used by LLCs to pay the mandatory annual tax of $800 for the 2022 tax year.

- The annual tax payment is obligatory for all LLCs that are either registered with the California Secretary of State, conducting business in California, or both.

- Payments can be made electronically, utilizing either Electronic Funds Withdrawal (EFW) through tax preparation software, or Web Pay for Businesses, which allows for immediate or scheduled payments.

- If opting to pay via credit card, LLCs can use platforms like ACI Payments, Inc. but should note that a convenience fee will apply, and in such cases, the FTB 3522 form should not be mailed.

- The $800 annual LLC tax is due by the 15th day of the 4th month following the start of the LLC’s taxable year. For calendar year filers, this typically falls on April 15th.

- Exceptions apply to certain LLCs, including those exempt under specific Internal Revenue Code and California Revenue and Taxation Code sections, and LLCs owned by a deployed member of the U.S. Armed Forces under certain conditions.

- There is a provision for a first-year tax exemption for LLCs that organize, register, or file with the California Secretary of State to do business within California, effective for tax years beginning on or after January 1, 2021, and before January 1, 2024.

- When completing the form, it is essential to use black or blue ink and accurately provide the LLC’s California SOS file number and federal employer identification number (FEIN) to ensure proper account crediting.

- Failure to pay the annual tax by the designated due date results in a late payment penalty plus interest calculated from the original due date to the actual payment date.

Attentiveness to these details when filling out and submitting the California 3522 form will help LLCs maintain compliance, avoid penalties, and ensure their operations are unhindered by avoidable financial or legal setbacks.

Different PDF Templates

Ca 109 - Exempt organizations must complete Form 109 if they have unrelated business taxable income (UBTI) in California.

California 592 F - Filing for a federal extension impacts the filing process and deadline of the California Form 592-F.

Which of the Following Expenses Qualifies for the Child and Dependent Care Credit? - Calculations on the form consider both taxpayers’ and their spouses'/RDP's earned income to accurately assess eligibility.