Fill a Valid California 3523 Form

Among the myriad tax documents that businesses and individuals in California navigate annually, the California Form 3523, or the Research Credit form, stands out for its specific focus on incentivizing research and development within the state. Applicable for the 2020 tax year, this document is designed to support both corporations and non-corporate entities, including individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs), in claiming tax credits for qualified research expenses. These expenses encompass a wide array of costs, such as wages for qualified services, supplies, and rental or lease costs of computers. The form itself is divided into several sections, including Credit Computation, Alternative Incremental Credit, and Available Research Credit, culminating in detailed instructions on calculating and claiming credits based on incremental increases in research activities. Additionally, for entities that are part of a combined report, the form features a segment dedicated to Credit Allocation and Carryover per Entity. Importantly, those electing the reduced credit option under the Internal Revenue Code (IRC) Section 280C(c) have separate calculations, underscoring the form's adaptability to varied tax strategies. The inclusion of a passive and non-passive activity distinction further refines eligibility, ensuring that credits are accurately applied and carried over to subsequent years where applicable.

Document Example

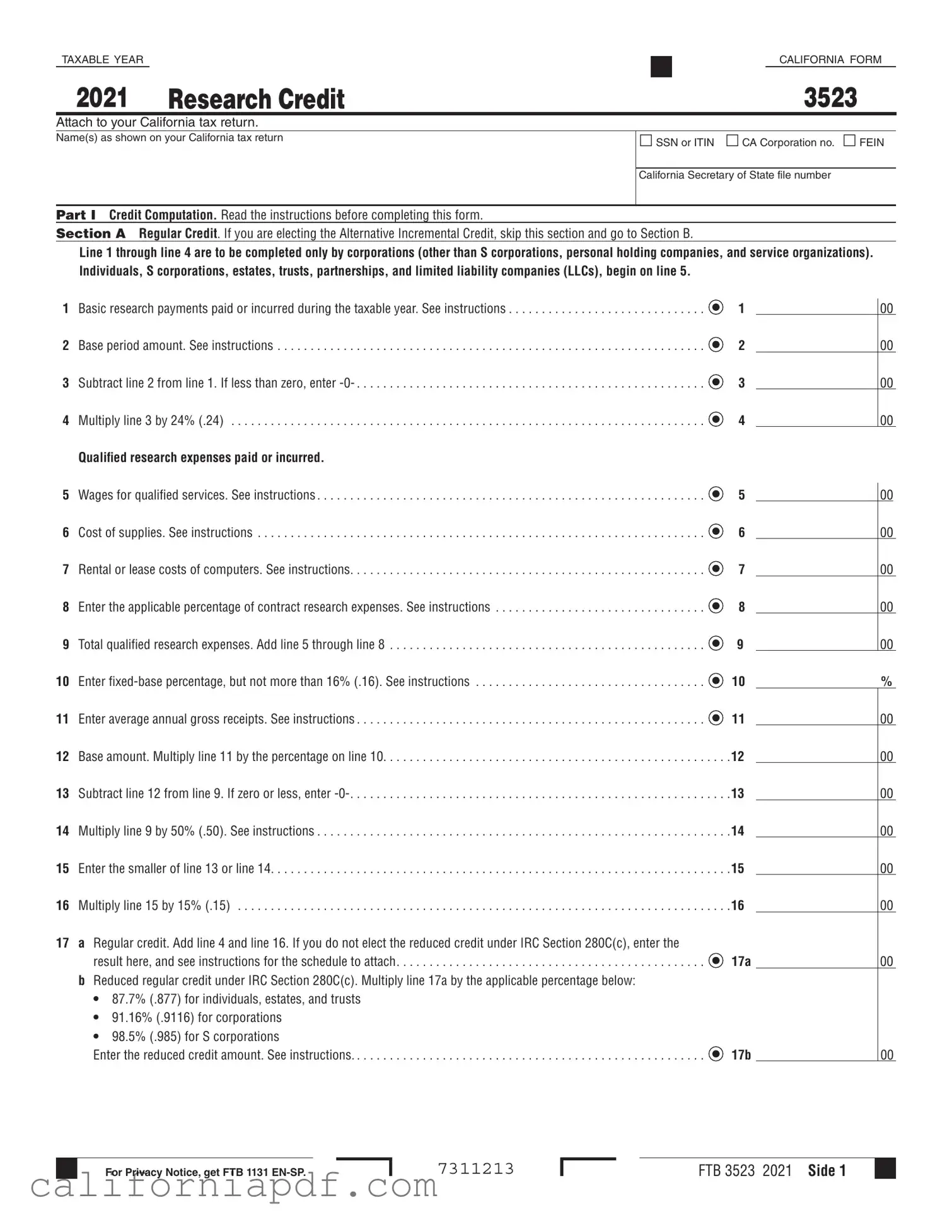

TAXABLE YEAR |

|

|

CALIFORNIA FORM |

|

|

|

|

2021 RESEARCH CREDIT |

3523 |

||

|

|

|

|

Attach to your California tax return.

Name(s) as shown on your California tax return

◻ SSN or ITIN ◻ CA Corporation no. ◻ FEIN

California Secretary of State file number

PART I Credit Computation. Read the instructions before completing this form.

SECTION A Regular Credit. If you are electing the Alternative Incremental Credit, skip this section and go to Section B.

Line 1 through line 4 are to be completed only by corporations (other than S corporations, personal holding companies, and service organizations). Individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs), begin on line 5.

1 |

Basic research payments paid or incurred during the taxable year. See instructions |

1 |

2 |

Base period amount. See instructions |

2 |

3 |

Subtract line 2 from line 1. If less than zero, enter |

3 |

4 |

Multiply line 3 by 24% (.24) |

4 |

|

Qualified research expenses paid or incurred. |

|

5 |

Wages for qualified services. See instructions |

5 |

6 |

Cost of supplies. See instructions |

6 |

7 |

Rental or lease costs of computers. See instructions |

7 |

8 |

Enter the applicable percentage of contract research expenses. See instructions |

8 |

9 |

Total qualified research expenses. Add line 5 through line 8 |

9 |

10 |

Enter |

10 |

11 |

Enter average annual gross receipts. See instructions |

11 |

12 |

Base amount. Multiply line 11 by the percentage on line 10 |

12 |

13 |

Subtract line 12 from line 9. If zero or less, enter |

13 |

14 |

Multiply line 9 by 50% (.50). See instructions |

14 |

15 |

Enter the smaller of line 13 or line 14 |

15 |

16 |

Multiply line 15 by 15% (.15) |

16 |

17a Regular credit. Add line 4 and line 16. If you do not elect the reduced credit under IRC Section 280C(c), enter the

result here, and see instructions for the schedule to attach. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  17a

17a

bReduced regular credit under IRC Section 280C(c). Multiply line 17a by the applicable percentage below: 87.7% (.877) for individuals, estates, and trusts

91.16% (.9116) for corporations

98.5% (.985) for S corporations

Enter the reduced credit amount. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  17b

17b

00

00

00

00

00

00

00

00

00

%

00

00

00

00

00

00

00

00

|

For Privacy Notice, get FTB 1131 |

7311213 |

FTB 3523 2021 Side 1 |

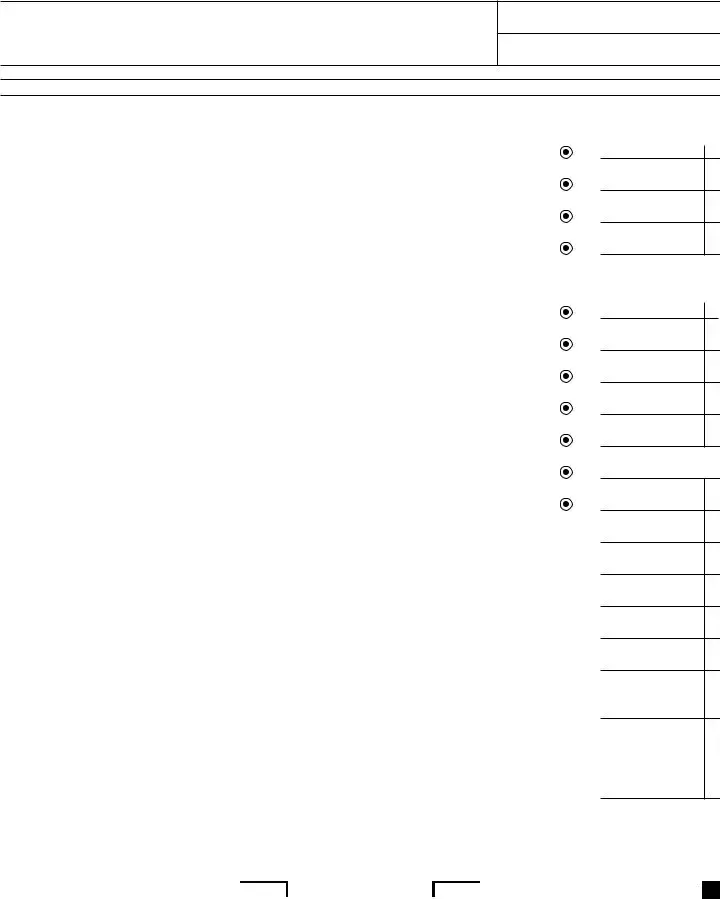

SECTION B Alternative Incremental Credit. Skip this section if you completed Section A, Regular Credit.

Line 18 through line 21 are to be completed only by corporations (other than S corporations, personal holding companies, and service organizations). Individuals, S corporations, estates, trusts, partnerships, and LLCs, begin on line 22.

18 |

Basic research payments paid or incurred during the taxable year. See instructions |

18 |

19 |

Base period amount. See instructions |

19 |

20 |

Subtract line 19 from line 18. If less than zero, enter |

20 |

21 |

Multiply line 20 by 24% (.24) |

21 |

|

Qualified research expenses paid or incurred. |

|

22 Wages for qualified services. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  22

22

23 Cost of supplies. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  23

23

24 Rental or lease costs of computers. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  24

24

25 Enter the applicable percentage of contract research expenses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  25

25

26 Total qualified research expenses. Add line 22 through line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  26

26

27 Enter average annual gross receipts. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  27 28 Multiply line 27 by 1% (.01). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28 29 Subtract line 28 from line 26. If zero or less, enter

27 28 Multiply line 27 by 1% (.01). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .28 29 Subtract line 28 from line 26. If zero or less, enter

39a Alternative incremental credit. Add line 21, line 36, line 37, and line 38. If you do not elect the reduced credit

under IRC Section 280C(c), enter the result here, and see instructions for the schedule that must be attached . . . . . . .  39a

39a

bReduced alternative incremental credit under IRC Section 280C(c). Multiply line 39a by the applicable percentage below: 87.7% (.877) for individuals, estates, and trusts

91.16% (.9116) for corporations

98.5% (.985) for S corporations

Enter the reduced credit amount. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  39b

39b

SECTION C Available Research Credit

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

40  40

40

41Current year research credit. If you did not elect the reduced credit under IRC Section 280C(c), add line 17a or

line 39a to line 40 and enter the result here. If you elected the reduced credit under IRC Section 280C(c),

add line 17b or line 39b to line 40 and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  41

41

42Enter the amount of credit on line 41 that is from passive activities. If none of the amount on line 41 is from

passive activities, enter

43 Subtract line 42 from line 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43 44 Enter the allowable credit from passive activities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .44

45

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  45

45

46 Total. Add line 43 through line 45. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  46

46

PART II Carryover Computation. Combined Report Filers see instructions for Part III before completing this part.

47Credit claimed. Enter the amount of the credit claimed on the current year tax return. See instructions.

(Do not include any assigned credit claimed on form FTB 3544, Part B.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  47

47

48Total credit assigned. Enter the total amount from form FTB 3544, Part A, column (g). If you are not a corporation,

enter  48

48

49 Credit carryover available for use or assignment for future years. Subtract lines 47 and 48 from line 46 . . . . . . . . . . . . . .  49

49

00

00

00

00

00

00

00

00

00

00

|

Side 2 FTB 3523 2021 |

7312213 |

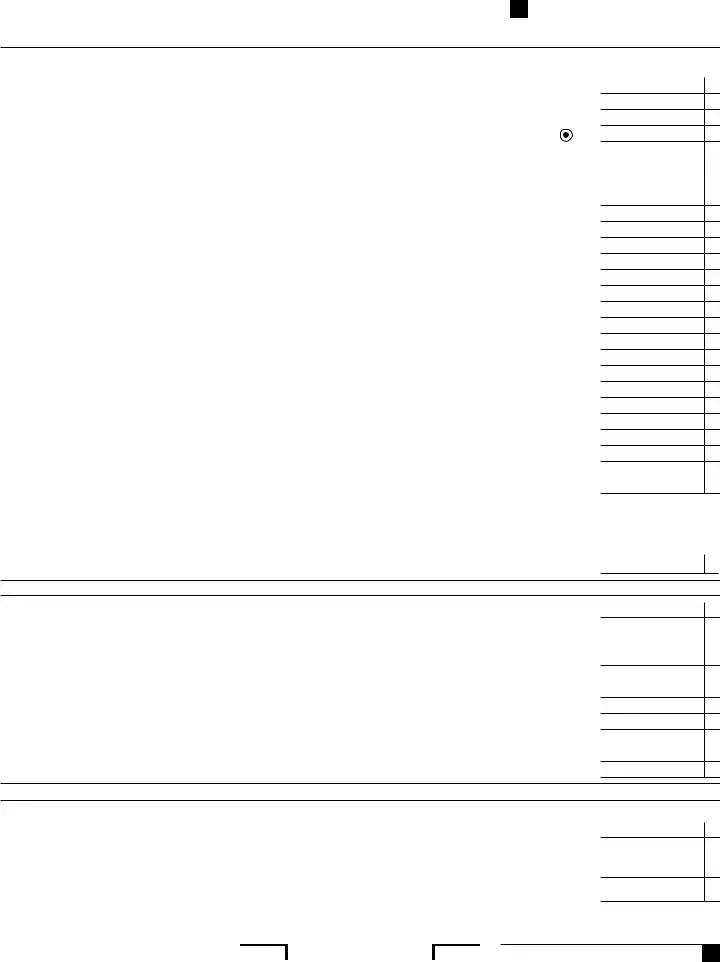

PART III Credit Allocation and Carryover Per Entity – Only Combined Report Filers

To make an election for assigning credits, you must also complete form FTB 3544, Part A. Otherwise, the assignment indicated here will be invalid.

Credit Generated and Assigned Per Entity

|

(a) |

(b) |

(c) |

(d) |

(e) |

|

Corporation |

Corporation no., FEIN, or |

Amount of credit generated |

Amount of generated credit |

Total of generated credit |

|

|

SOS no. |

in current year |

carryover from prior years |

and credit carryover from |

|

|

|

|

|

prior years |

|

|

|

|

|

col. (c) + col. (d) |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

(f)* |

(g) |

(h) |

|

Amount of credit from col. (e) claimed |

Amount of research credit |

Generated credit carryover |

|

in current year return. (Do not include |

assigned and to be reported |

for future years |

|

any assigned credit claimed on |

on form FTB 3544, Part A |

col. (e) – [col. (f) + col. (g)] |

|

form FTB 3544, Part B.) |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

*There is a $5,000,000 business credit limitation on the application of tax credits. See instructions.

|

|

7313213 |

FTB 3523 2021 Side 3 |

Form Breakdown

| Fact | Description |

|---|---|

| Form Type | California Form 3523 |

| Year | 2020 |

| Purpose | Research Credit |

| Attachment Requirement | Attach to your California tax return |

| Eligible Entities | Individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs) |

| Sections | Three sections including Credit Computation, Alternative Incremental Credit, and Available Research Credit |

| Governing Law | Internal Revenue Code Section 280C(c) |

| Inclusion Criteria | Different criteria for corporations and other entities in sections A and B |

| Privacy Notice | Reference to FTB 1131 ENG/SP for privacy information |

How to Write California 3523

Filling out the California 3523 form can seem like a complex task, but with clear instructions, it becomes manageable. This form is designed for taxpayers who need to calculate and claim their research credit. Below you'll find step-by-step guidance that simplifies the process, ensuring accuracy and compliance with state requirements.

- Start by attaching the form to your California tax return. This form is a supplementary document and must be submitted along with your main return.

- Enter the name(s) as shown on your California tax return at the top of the form.

- Tick the appropriate box to indicate whether you are providing a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), a CA Corporation number, or a Federal Employer Identification Number (FEIN).

- If applicable, provide the California Secretary of State file number in the space provided.

- Proceed to Part I—Credit Computation. Start with Section A for Regular Credit unless you are electing the Alternative Incremental Credit, in which case, skip to Section B.

- In Section A, lines 1 through 4 should only be completed by corporations. If you are an individual, S corporation, estate, trust, partnership, or limited liability company (LLC), begin with line 5.

- Fill in the details for basic research payments, base period amount, and qualified research expenses as required in the designated lines from 5 to 17b. Ensure to read the instructions specified for each line to calculate and enter the correct amounts.

- For those electing the Alternative Incremental Credit, skip to Section B and fill in lines 18 through 39b as it applies to your situation. Again, read the line-specific instructions carefully. If Section A was completed, this section should be left blank.

- In Section C (Available Research Credit), calculate the carryover and current year research credit as directed, from line 40 to 46. This section helps you determine the amount of research credit available for the current year and any carryover to future years.

- Part II deals with the Carryover Computation. Enter the amount of credit claimed on the current year tax return and total credit assigned, if any, to figure out the credit carryover available for future years.

- If you are a Combined Report Filer, complete Part III to allocate and carry over the credit per entity. Those needing to assign credits must fill out form FTB 3544, Part A, alongside this section.

- Once all relevant sections have been completed, double-check your entries for accuracy. Ensure all applicable fields are filled in and any required attachments are included with your return.

After filling out the form, review it thoroughly to ensure all information is correct and complete. All necessary calculations should be double-checked to avoid any errors. This step is crucial for the proper processing of your form. Once satisfied with the completeness and accuracy, attach the form to your California tax return before submission according to the provided filing instructions.

Listed Questions and Answers

What is California Form 3523?

California Form 3523, also known as the Research Credit form, is a document used to calculate and claim a tax credit for qualified research expenses incurred in California. This credit aims to encourage companies and individuals to pursue research and development activities within the state.

Who is eligible to file Form 3523?

Eligibility to file Form 3523 extends to individuals, S corporations, estates, trusts, partnerships, limited liability companies (LLCs), and corporations, provided they have incurred qualified research expenses in California.

What are the two sections on Form 3523?

Form 3523 consists of two main sections:

- Regular Credit (Section A) for most filers who have incurred qualified research expenses.

- Alternative Incremental Credit (Section B) designed for filers meeting specific criteria, offering an alternate method of calculating the research credit.

How do I know if my expenses qualify for this credit?

Qualified expenses for the California research credit include:

- Wages for qualified services.

- Cost of supplies used in qualified research.

- Rental or lease costs of computers used in qualified research.

- A percentage of contract research expenses.

What is the base period amount?

The base period amount refers to a calculated figure that serves as a benchmark for determining the increase in research activities over time. It affects the credit calculation under both the Regular Credit and the Alternative Incremental Credit methods.

Can this credit be reduced?

Yes, the credit claimed on Form 3523 can be reduced if the taxpayer elects the reduced credit under IRC Section 280C(c). This election leads to a reduced tax credit amount but allows the taxpayer to deduct a portion of the qualified research expenses.

What happens if I can't use the entire credit this year?

If the full amount of the research credit cannot be used in the current tax year, it may be carried over to future years. Form 3523 includes calculations for determining the amount of credit carryover available.

Is there a limitation on the amount of credit I can claim?

Yes, there is a business credit limitation, with a maximum cap of $5,000,000 on the application of tax credits, including the research credit. Specific conditions and calculations related to this limitation are outlined in the instructions for Form 3523.

Common mistakes

Filling out California Form 3523 for research credits can seem daunting. Common mistakes can lead to processing delays or incorrect credit claims. Being aware of these errors can streamline your filing process and maximize your eligible credits.

- Not starting in the correct section: Corporate entities and individuals must start in different sections of the form. Corporations, other than S corporations, personal holding companies, and service organizations, begin in Section A, Line 1. All others, including S corporations, estates, trusts, partnerships, and LLCs, start at Line 5. Mistaking your starting point leads to inaccuracies in credit calculation.

- Incomplete fields: Skipping any required information, such as the California Secretary of State file number or incorrectly calculating the base amount, can lead to an incomplete submission. Every field pertinent to your tax situation needs to be accurately filled out.

- Inaccurate qualified research expenses (QREs): Lines 5 through 8 demand keen attention. Wages, supply costs, rental or lease of computers, and contract research expenses must be accurately recorded. Overlooking or misreporting these expenses can lead to either leaving money on the table or inflated credit claims that could trigger audits.

- Misunderstanding the fixed-base percentage: On Line 10, the fixed-base percentage is capped at 16%. This calculation confuses many filers. It represents the ratio of past QREs to gross receipts, influencing the credit amount. Incorrect figures here can significantly impact the total credit.

- Choosing the wrong credit calculation: Form 3523 offers two credit calculation options: the Regular Research Credit in Section A and the Alternative Incremental Credit in Section B. Selecting the option that doesn't best match your company's spending pattern can result in a lower credit than eligible.

- Failure to attach required documentation: For example, if you do not elect the reduced credit under IRC Section 280C(c), you must attach a schedule as indicated in the form instructions (Lines 17a and 39a). Failing to provide necessary schedules or documentation can result in the denial of the credit.

Ensuring accuracy and completeness in filling out Form 3523 is crucial to make the most of California's research credit. Paying attention to the specific requirements and avoiding these common mistakes can help optimize your tax benefits and reduce the likelihood of errors that could lead to audits or penalties.

Documents used along the form

When businesses or individuals in California file their tax returns, especially those seeking to claim the research credit with the 3523 form, several other forms and documents may be crucial for a complete and compliant submission. The complexity of tax regulations means that, depending on your circumstances, you may need additional documentation to support your claims or to provide further detail about your financial situation. Here's a list of the forms and documents often used alongside the California 3523 form:

- Form 540 or 540NR - California Resident or Nonresident Income Tax Return. This is the main state income tax form for individuals, where you summarize your income, deductions, and credits.

- Form 568 - Limited Liability Company Return of Income. For LLCs taxed as partnerships, this form details the company's income, deductions, and tax liability.

- Form 565 - Partnership Return of Income. Similar to Form 568, but specifically for partnerships, detailing the financial activities and tax responsibilities of the partnership.

- FTB 3544 - Credit Assignment and Allocation. This form is directly related to Form 3523 for those businesses or conglomerates that wish to allocate research credits among different entities within a combined group.

- FTB 3800 - Tax Computation for Certain Children with Unearned Income. If the taxpayer claiming the research credit has children with large amounts of unearned income, this form may be necessary to calculate the tax on this income properly.

- Schedule D (540) - California Capital Gain or Loss Adjustment. This schedule is used to report capital gains or losses and may impact the tax liability and available credits for individuals in California.

- Form 100 or 100S - California Corporation Franchise or Income Tax Return (or the S Corporation version). Corporations and S corporations file these forms to report income, deductions, and credits to the state.

- Schedule K-1 (568, 565, or 100S) - Share of Income, Deductions, Credits, etc. For entities such as partnerships, LLCs, and S corporations, this schedule itemizes how income and deductions are distributed to members or shareholders.

This suite of forms and documents ensures that those claiming the research credit via California Form 3523 accurately report their financial activities and take full advantage of the tax benefits available. Each document plays a vital role in painting a complete picture of financial and tax affairs, whether for individuals, corporations, partnerships, or LLCs. Understanding and accurately completing these forms can aid in maximizing potential credits while ensuring compliance with tax laws.

Similar forms

The California Form 3523, or the Research Credit form, is akin to the Federal Form 6765 - Credit for Increasing Research Activities. Both forms are designed for taxpayers to calculate and claim credits related to research and development expenses incurred during the tax year. The fundamental aim of these forms is to encourage businesses to invest in research and development within their operational framework. They both require details on wages, supplies, and contract research expenses that are directly related to research activities. However, they are jurisdiction-specific, with Form 6765 used for federal tax returns and Form 3523 for California state returns.

Similarly, the California Form 3800, General Business Credit, parallels the California Form 3523 in that it also serves as a conduit for businesses to claim various credits, including the research credit highlighted in Form 3523. Form 3800 is a comprehensive form that consolidates various business credits available to a taxpayer in California, highlighting the interconnectedness of state tax credits and incentives. While Form 3523 is specifically focused on research and development credits, Form 3800 encompasses a broader range of tax incentives, demonstrating the layered approach to tax benefits within the state.

Another related document is the New Employee Credit (NEC) form, a part of California’s suite of tax incentives aimed at encouraging employment growth and economic expansion. Although distinct in purpose, the NEC shares a similarity with Form 3523, as both forms are geared towards fostering investment in the state’s economy—Form 3523 through R&D investment and the NEC through employment. Each form outlines specific qualifications and computations necessary to support businesses in their growth while contributing to the economic vitality of California.

The California Competes Tax Credit (CCTC) application also shares a conceptual connection with Form 3523. The CCTC is designed to attract and retain businesses in California by offering income tax credits for businesses that invest and create jobs in the state. While the CCTC is more focused on job creation and investment, and Form 3523 is centered around research and development expenses, both instruments are vital components of California’s tax incentive programs aimed at stimulating economic development and innovation within the state.

Dos and Don'ts

When dealing with the California Form 3523 for the research credit, it's important to approach it carefully to maximize your benefits while staying compliant with the state's tax requirements. Here are some dos and don'ts that can guide you:

Do:- Read the instructions carefully before you begin filling out the form. Thorough understanding helps in avoiding mistakes.

- Ensure all information matches the details on your California tax return, including name(s) and identification numbers.

- Start in the correct section based on your entity type. Individuals and most non-corporate entities should start from line 5 in Section A or line 22 in Section B.

- Accurately calculate the credit using the guidelines provided, including the base period amount and qualified expenses.

- Keep detailed records of all research expenses, in case the Franchise Tax Board (FTB) requests documentation.

- Consider whether electing the reduced credit under IRC Section 280C(c) benefits you, as it may offer tax advantages.

- Seek professional advice if unsure about any part of this form. Tax professionals can provide clarity and ensure accuracy.

- Skip any required fields. If a section or line doesn’t apply to your situation, enter "-0-" to indicate it’s been considered.

- Overlook the election for the Alternative Incremental Credit if it could result in a higher credit amount.

- Forget to attach the completed Form 3523 to your California tax return.

- Mistake this form for federal research credits. The California Form 3525 is specifically for state tax purposes.

- Ignore the Credit Allocation and Carryover sections if you're part of a combined report. These sections may provide additional benefits.

- Underestimate the importance of accurate gross receipts reporting. They play a crucial role in calculating the base amount for your credit.

- Delay your submission beyond the filing deadline. Timely filing ensures you benefit from eligible credits for the tax year.

Misconceptions

When dealing with the California Form 3523, there are several common misconceptions that may confuse individuals and businesses alike. Understanding these inaccuracies is crucial for those looking to accurately claim the research credit. Here, the misconceptions are dispelled to provide clarity on this tax matter.

Only large corporations can apply: This is not true. While certain sections of Form 3523 are indeed specific to corporations, individuals, S corporations, estates, trusts, partnerships, and limited liability companies (LLCs) can also qualify for and claim the research credit.

It's only for technological research: While the research credit strongly supports technological advancements, it is broadly available for various types of research activities that are intended to result in new or improved functionalities, performance, reliability, or quality.

Qualified research expenses are limited to wages and supplies: Actually, qualified research expenses also include costs related to contract research expenses and rental or lease costs of computers as specified in the instructions of Form 3523.

The base amount is a fixed figure: The computation of the base amount involves several dynamic parameters including average annual gross receipts and the fixed-base percentage, which demonstrate that the base amount can vary.

The Alternative Incremental Credit is always less beneficial: The choice between the Regular Credit and the Alternative Incremental Credit should be based on specific circumstances and calculations, as there are situations where the Alternative Incremental Credit may offer a greater tax benefit.

There is only one type of research credit: Form 3523 allows for the calculation of both a Regular Credit and an Alternative Incremental Credit, providing options for taxpayers based on their qualifying expenses and activities.

Every expense related to research is qualified: Expenses must meet specific criteria outlined in the instructions to qualify. Importantly, the expenses must be tied to qualifying research activities.

All research activities qualify: The research must meet certain criteria defined by the IRS, including being technologically based and aimed at the creation of new or improved products or processes.

There's no carryover provision for unused credits: Form 3523 includes a section for carryover computation, allowing businesses to carry forward unused credits to future tax years.

The form is too complicated to complete without professional help: While seeking advice from a professional is beneficial, the instructions provided with Form 3523 are designed to guide filers through the process of calculating their research credit.

Clearing up these misconceptions helps ensure that eligible businesses and individuals can confidently take advantage of the research credit, potentially lowering their tax liabilities and fostering innovation and growth.

Key takeaways

The Form 3523 is a pivotal document for entities and individuals in California engaging in research activities as it allows them to compute and claim research credits against their state tax liabilities. Grasping the significant aspects of this form can ease the process of claiming the research credit, ensure compliance with state tax laws, and potentially lead to substantial tax savings. Here are key takeaways:

- The form is applicable for a range of entities including corporations, S corporations, limited liability companies (LLCs), individuals, estates, trusts, and partnerships, making it a versatile tool for claiming research credits across different types of taxpayers.

- Part I of the form is dedicated to the computation of the credit, segregating the calculation into Regular Credit (Section A) and Alternative Incremental Credit (Section B), providing flexibility in choosing the calculation method that is most beneficial.

- Corporations (other than S corporations, personal holding companies, and service organizations) start the calculation of their credits from Line 1, while other entities such as individuals and LLCs begin from Line 5, highlighting the need to closely follow instructions to ensure accurate computation.

- In the calculation of the Regular Credit, emphasis is placed on qualified research expenses, including wages, supply costs, and rental or lease costs of computers, signifying the broad range of expenses that can qualify for the credit.

- For both the Regular and Alternative Incremental Credit computations, the instructions stress the importance of accurate calculation of the base amount and qualified research expenses, underscoring the detailed nature of information required.

- The form offers the option to reduce the calculated credit under IRC Section 280C(c), which may be beneficial in certain tax planning scenarios, providing taxpayers with strategic flexibility.

- Pass-through entities such as S corporations, trusts, and partnerships can pass the research credit to their shareholders or beneficiaries, which is calculated in Section C of the form, illustrating the transferability of the credit.

- Part II focuses on the carryover computation of the credit, crucial for taxpayers who are unable to utilize the entire credit amount in the current tax year and wish to carry forward the excess to future tax years.

- For entities filing combined reports, Part III facilitates the allocation and carryover of credit per entity, an essential step for businesses operating multiple divisions or units.

- The form highlights a business credit limitation, reminding taxpayers of the maximum credit use against their tax liabilities and ensuring compliance with state-imposed limitations.

Understanding and properly utilizing Form 3523 can significantly benefit taxpayers involved in research activities within California by reducing their taxable income and, consequently, their tax liabilities. Taxpayers are encouraged to meticulously follow the instructions and consult with a tax professional if needed to maximize their benefits under this credit.

Different PDF Templates

California 1296 32 - Streamlines the post-hearing legal process for child support cases by clearly outlining court decisions in California.

California 3500 - Organizations must disclose if they're currently tax-exempt under the IRS and whether they’re seeking a group exemption.