Fill a Valid California 3528 A Form

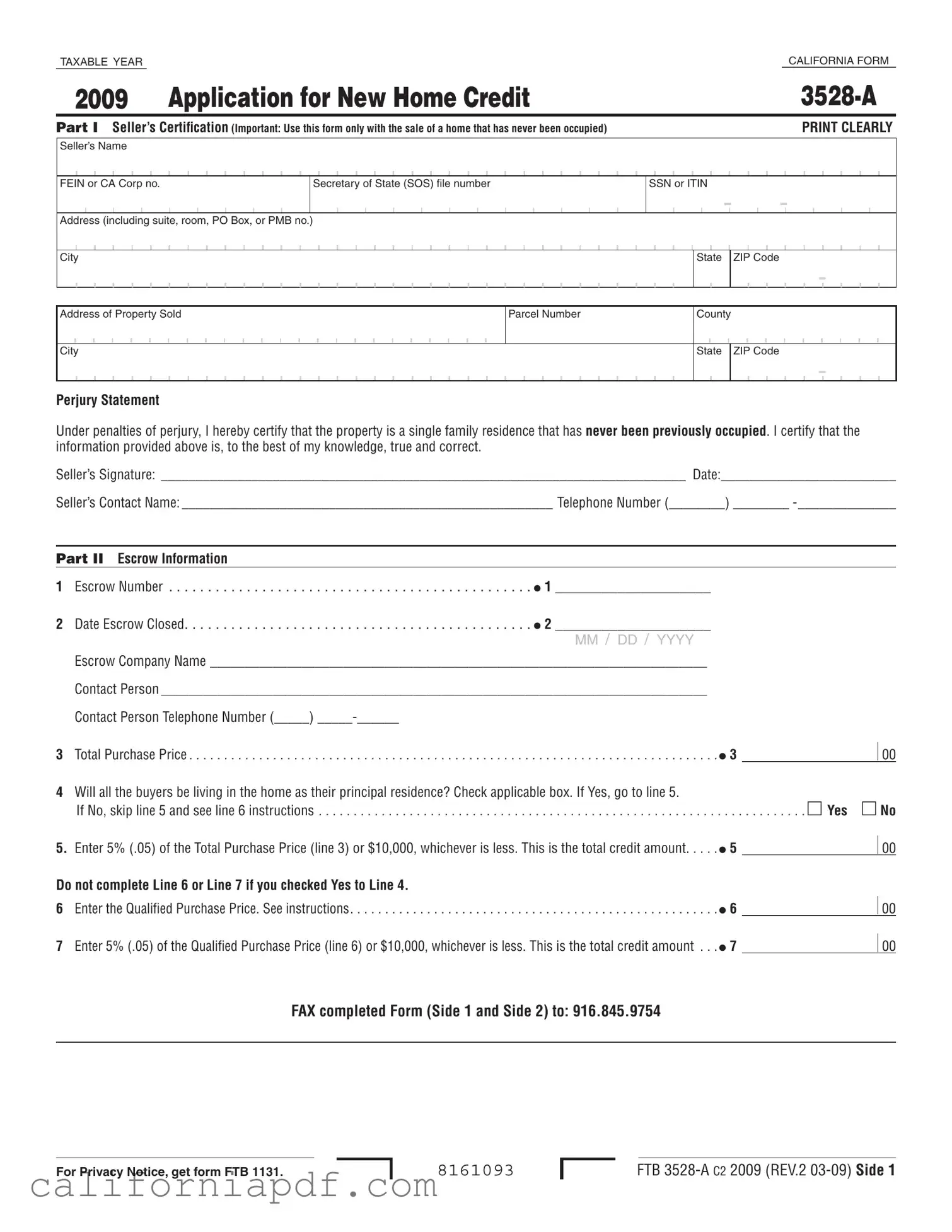

The California 3528 A form plays a significant role in the realm of real estate and taxation for individuals engaging in the purchase of new homes within the state. Designed to facilitate the Application for New Home Credit, this form underlines the commitment of the state to promote homeownership and offer financial incentives to buyers of newly constructed residences. At the heart of the form is a mechanism to provide a tax credit to eligible individuals, aimed at reducing the financial burden on homebuyers and stimulating the housing market. The form is meticulously structured into sections that deal with the seller's certification, escrow information, and qualified buyer's details, each intricately designed to ensure the integrity and smooth facilitation of the tax credit allocation process. The guidelines stipulated require the seller to certify that the property is a new single-family residence that has not been previously occupied, thereby setting the stage for the buyer's eligibility for the credit. The escrow information section serves as a conduit for corroborating the transaction details, including the closing date and total purchase price, which are crucial for determining the credit amount. Intriguingly, the form not only caters to the buyer's declaration regarding the intended use of the property as their primary residence but also meticulously calculates the credit based on ownership percentages among multiple buyers, thereby ensuring a fair distribution of the incentive. Furthermore, with a cap on the total credit amount, the form embodies the state's strategic approach to budget allocation while incentivizing homeownership. Through its intricate design and functional segments, the California 3528 A form stands as a testament to the synergy between real estate practices and taxation policies, aimed at fostering a conducive ecosystem for potential homeowners.

Document Example

TAXABLE YEARCALIFORNIA FORM

2009 |

|

|

|

Application for New Home Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

Part I Seller’s Certiication (Important: Use this form only with the sale of a home that has never been occupied) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINT CLEARLY |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seller’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN or CA Corp no. |

|

|

|

|

|

|

|

|

|

|

Secretary of State (SOS) ile number |

SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Address (including suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Property Sold

City

Perjury Statement

Parcel Number |

County |

||||||||

|

|

|

|

|

|

|

|

|

|

|

State ZIP Code |

||||||||

-

Under penalties of perjury, I hereby certify that the property is a single family residence that has never been previously occupied. I certify that the information provided above is, to the best of my knowledge, true and correct.

Seller’s Signature: ___________________________________________________________________________ Date:_________________________

Seller’s Contact Name: _____________________________________________________ Telephone Number (________) ________

Part II Escrow Information

1 |

Escrow Number |

I1 ____________________ |

2 |

Date Escrow Closed |

I2 ____________________ |

|

|

MM / DD / YYYY |

|

Escrow Company Name _______________________________________________________________________ |

|

|

Contact Person ______________________________________________________________________________ |

|

|

Contact Person Telephone Number (_____) |

|

3 |

Total Purchase Price |

. . . . . . . . . . . . . . . . . . . . . . . . . . . I3 |

00

4Will all the buyers be living in the home as their principal residence? Check applicable box. If Yes, go to line 5.

|

If No, skip line 5 and see line 6 instructions |

. . . . . . . . . . . . . |

mYes m No |

5. |

Enter 5% (.05) of the Total Purchase Price (line 3) or $10,000, whichever is less. This is the total credit amount |

I5 |

00 |

Do not complete Line 6 or Line 7 if you checked Yes to Line 4. |

|

|

|

6 |

Enter the Qualified Purchase Price. See instructions |

I6 |

00 |

7 |

Enter 5% (.05) of the Qualified Purchase Price (line 6) or $10,000, whichever is less. This is the total credit amount . . . |

I7 |

00 |

FAX completed Form (Side 1 and Side 2) to: 916.845.9754

For Privacy Notice, get form FTB 1131.

8161093

FTB

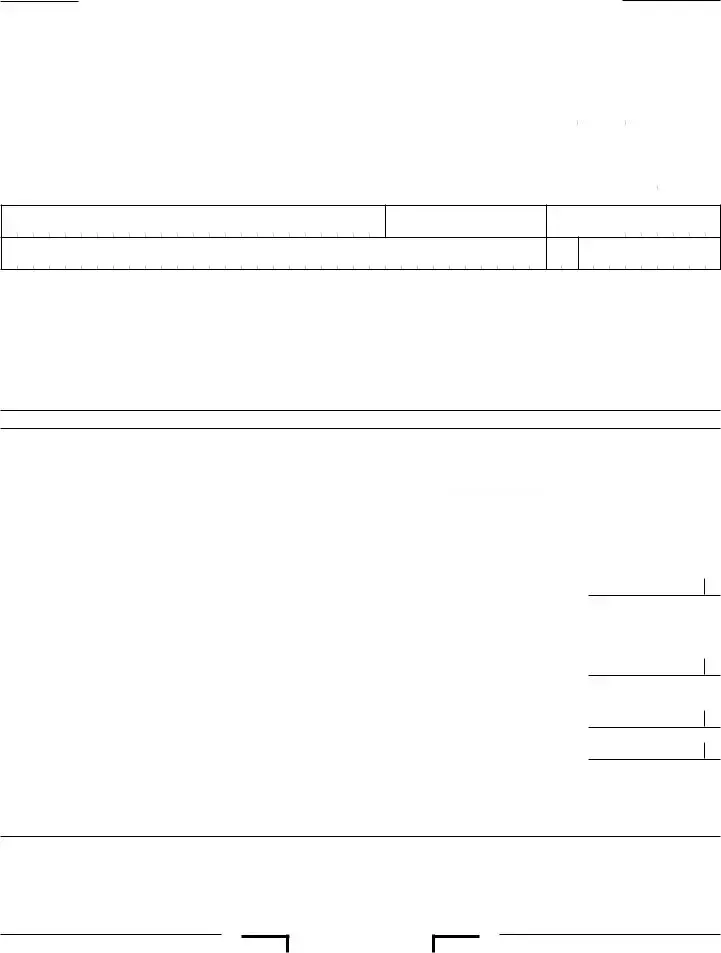

Part III Qualiied Buyer’s Information |

Escrow Number: __________________________ |

|

|

Perjury Statement |

|

By completing and signing, the Buyer is acknowledging that he/she is purchasing a single family residence in which he/she intends to live for a minimum of two years as his/her principal residence and which is eligible for the homeowner’s exemption under R&TC Section 218.

Buyer 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINT CLEARLY |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Buyer’s First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Buyer’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Buyer’s Ownership Percent |

|

Buyer’s Individual Credit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

______ _____ _____ • _____ _____% |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||||||||||||||||

Spouse’s/RDP’s First Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse’s/RDP’s SSN or ITIN |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( __________ ) __________ – _______________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Spouse/s/RDP’s Signature (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Buyer 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Buyer’s First Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Buyer’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Buyer’s Ownership Percent |

|

Buyer’s Individual Credit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

______ _____ _____ • _____ _____% |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||||||||||||||||||||||||||||||

Spouse’s/RDP’s First Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( __________ ) __________ – _______________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address

City

Buyer’s Signature

Spouse/s/RDP’s Signature (if applicable)

State Zip Code

-

Date

Date

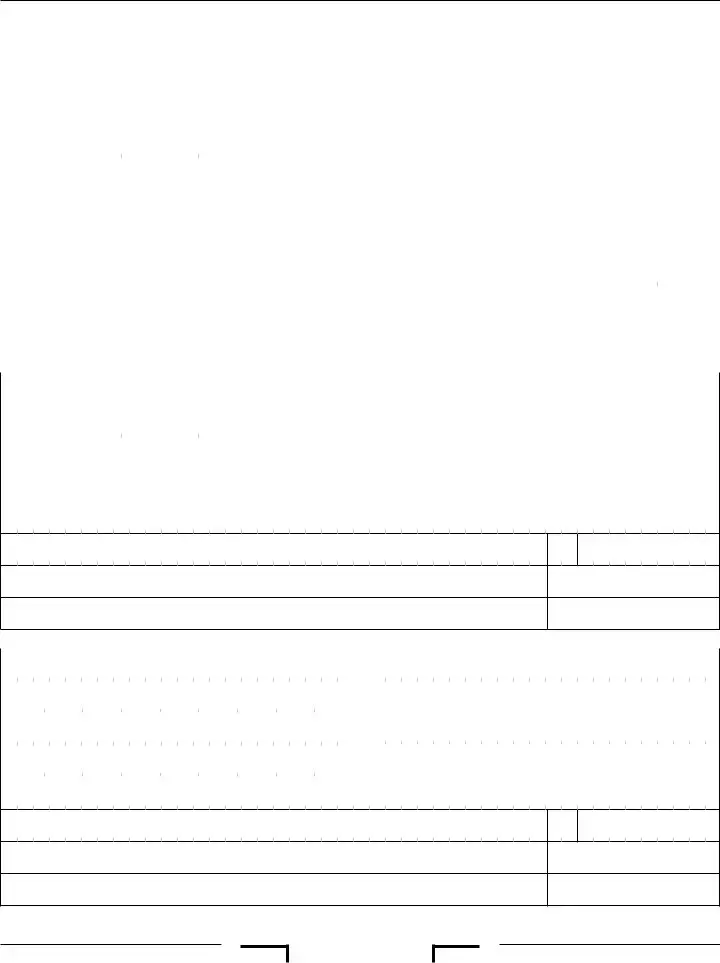

Buyer 3.

Buyer’s First Name |

|

Initial |

Buyer’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s SSN or ITIN |

|

* Buyer’s Ownership Percent |

Buyer’s Individual Credit |

|

|

|||||||||

- |

- |

______ _____ _____ • _____ _____% |

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

Spouse’s/RDP’s First Name (if applicable) |

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

- |

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

- |

( __________ ) __________ – _______________________ |

|||||||||||||

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address

City

Buyer’s Signature

Spouse/s/RDP’s Signature (if applicable)

State Zip Code

Date

Date

-

* Married/RDP couples are considered to be one buyer. If married/RDP, enter the combined percentage in the Buyer’s Ownership Percent field.

Side 2 FTB

8162093

Instructions for

Application for New Home Credit

General Information |

The FTB may request documentation to |

residence is made, on a timely filed original |

|||

A |

Purpose |

ensure the parties have complied with the |

return. If the available credit exceeds the |

||

requirements of the credit under Revenue and |

current year net tax, the unused credit may not |

||||

Use form FTB |

Taxation Code (R&TC) Section 17059. |

be carried over to the following year. |

|||

Home Credit, if you are a seller of a new home |

The credit must be apportioned equally for |

F Filing Form FTB |

|||

which has never been occupied and are selling |

|||||

two married taxpayers filing separate tax |

The escrow person will FAX a copy of the form |

||||

to any individual who purchases the residence |

returns, even if their ownership percentage |

||||

on or after March 1, 2009, and before March 1, |

is not equal. For two or more taxpayers who |

FTB |

|||

2010. The seller must first complete Part I of |

are not married, the credit shall be allocated |

the buyer within one week after the close of |

|||

form FTB |

among the taxpayers who will occupy the |

escrow. If a seller has several buyers, send |

|||

has never been occupied, and provide a copy |

home as their principal residence using their |

only one application per FAX. |

|||

to the buyer or escrow person. The buyer will |

percentage of ownership in the property. The |

Do not mail the form. |

|||

complete the rest of form FTB |

total amount of the credits allocated to all of |

FTB’s FAX Number is 916.845.9754 |

|||

escrow person will FAX the completed form |

these taxpayers shall not exceed ten thousand |

The FAX number will be disconnected once the |

|||

FTB |

dollars ($10,000). |

||||

$100,000,000 total allocation amount has been |

|||||

within one week of the close of escrow, at |

C |

Definitions |

|||

reached. Do not use any other FAX number. |

|||||

916.845.9754, and provide a copy to the buyer. |

|||||

The copy received from the seller or escrow |

A “qualified principal residence” means a |

Applications sent to any other FTB FAX number |

|||

will not be be processed. |

|||||

person does not constitute an allocation of |

|||||

We will post a notice on our website at |

|||||

the credit to the Buyer; instead the Buyer will |

attached, that has never been occupied and |

||||

receive confirmation from the FTB certifying |

is purchased to be the principal residence of |

ftb.ca.gov when the credit has been fully |

|||

the allocation of tax credit. The Buyer cannot |

the taxpayer for a minimum of two years and |

allocated. |

|||

claim this credit unless they receive an |

is eligible for the property tax homeowner’s |

For more information, contact Withholding |

|||

allocation of the credit from the FTB. |

exemption. |

Services and Compliance at: |

|||

Upon receipt of form FTB |

• Types of residence: Any of the following can |

888.792.4900 |

|||

allocate the credit on a |

|

qualify if it is your principal residence and |

916.845.4900 (not |

||

basis. The total amount of credit that may |

|

is subject to property tax, whether real or |

|

||

be allocated by the FTB must not exceed one |

|

personal property: a single family residence, |

Specific Instructions |

||

hundred million dollars ($100,000,000). |

|

a condominium, a unit in a cooperative |

|

||

|

Part I – Seller’s Certification |

||||

Registered Domestic Partner – For purposes |

|

project, a houseboat, a manufactured home, |

|||

|

or a mobile home. |

Enter the name, address, and identification |

|||

of California income tax, references to a |

|

||||

• |

|||||

spouse, a husband, or a wife also refer to a |

number of the seller. If the seller is an |

||||

California Registered Domestic Partner (RDP), |

|

by an |

individual, enter the SSN or ITIN. If the seller |

||

unless otherwise specified. |

|

New Home Credit because the home has not |

is a corporation or partnership, enter the FEIN |

||

Round Cents to Dollars – Round cents to the |

|

been “purchased.” |

or CA Corporation number. If the seller is a |

||

“One week” means a 7 calendar day period. We |

Limited Liability Company (LLC), enter the |

||||

nearest whole dollar. For example, round $50.50 |

|||||

Secretary of State (SOS) file number. Include |

|||||

up to $51 or round $25.49 down to $25. |

will count the day after escrow closes as the |

||||

the Private Mail Box (PMB) in the address |

|||||

|

|

first full day. |

|||

B |

Qualifications |

field. Write “PMB” first, then the box number. |

|||

Example: Escrow closes March 1, 2009. We |

|||||

California allows a credit against net tax equal |

Example: 111 Main Street PMB 123. |

||||

will accept an application filed March 1, 2009 |

|||||

Enter the address of the property sold, |

|||||

to the lesser of 5% (.05) of the purchase |

through March 8, 2009. |

||||

price of the qualified principal residence or ten |

A “qualified buyer” is an individual who |

including parcel number and county. |

|||

thousand dollars ($10,000). |

Complete the Seller’s Certification, sign and date. |

||||

purchases a |

|||||

The credit shall be: |

|

||||

detached or attached, and intends to live in the |

Part II – Escrow Information |

||||

|

|

||||

• |

Allocated for the purchase of only one |

qualified principal residence for a minimum of |

Line 1 – Escrow Number |

||

|

qualified principal residence with respect to |

two years. |

|||

|

Enter the escrow number for the property |

||||

|

any taxpayer. |

“Total purchase price” is the price before |

|||

|

purchased, if any. |

||||

• Claimed only on a timely filed return, |

reduction of ownership percentage. |

||||

Line 2 – Date Escrow Closed |

|||||

|

including returns filed on extension. |

“Qualified purchase price” is the price after |

|||

• |

Applied in equal amounts over the three |

Enter the date escrow closed. Complete the |

|||

reduction of the |

|||||

|

successive taxable years beginning with |

escrow information including the escrow |

|||

|

percentage. |

||||

|

the taxable year in which the purchase of |

company name, contact person, and telephone |

|||

|

“Purchase date” is the date escrow closes. |

||||

|

the qualified principal residence is made |

number. |

|||

|

(maximum of $3,333 per year.) |

D |

Limitations |

Line 3 – Total Purchase Price |

|

The credit will not be allocated: |

The credit cannot reduce regular tax below |

Enter the total purchase price of the property. |

|||

|

|

If there is more than one buyer, this amount is |

|||

• |

If the residence has been previously |

the tentative minimum tax (TMT). This credit |

|||

the total paid by all buyers. |

|||||

|

occupied. |

cannot be carried over. |

|||

|

Line 4 |

||||

• If the taxpayer does not intend to take |

This credit is nonrefundable. |

||||

|

occupancy of the principal residence for at |

Check whether all of the buyers will be living |

|||

|

|

|

|||

|

least two years immediately following the |

E |

Claiming the Credit |

in the home as their principal residence. |

|

|

purchase. |

The credit is applied against the net tax in equal |

Disregard any buyers on title for incidental |

||

• If the application is not received within one |

purposes who do not have an ownership |

||||

amounts (1/3 each year) over three successive |

|||||

|

week after the close of escrow. |

interest. Check the applicable box. If Yes, go to |

|||

|

taxable years, beginning with the taxable year |

||||

in which the purchase of the qualified principal |

line 5. If No, go to line 6 of the instructions. |

|

FTB

Line 5

Do not complete line 5 if you checked No on line 4.

Enter 5% (.05) of the Total Purchase Price, from line 3, or $10,000, whichever is less. This is the total credit amount. Do not complete line 6 or line 7. Go to the instructions for Part III, Qualified Buyer’s Information, on Page 2.

Example:

Total Purchase Price . . . . . . . . . . . $250,000 X 5%

$12,500

Since $12,500 is greater than the maximum credit amount of $10,000, the total credit amount is $10,000.

Line 6

To compute line 6, first complete Part III, Qualified Buyer’s Information, on Side 2 of the form, for each qualified buyer. However, do not complete the Buyer’s Individual Credit amount. This will be computed and entered after completing line 6 and line 7 of form FTB

After completing the Qualified Buyer’s Information (except for the Buyer’s Individual Credit), compute the Qualified Purchase Price.

Qualiied Purchase Price

Compute the Total Qualified Ownership Percentage by adding the Ownership Percentage for each Qualified Buyer from Part III of the form.

Multiply the Total Qualified Ownership Percentage by the Total Purchase Price amount from line 3 on Side 1 of the form. This is the Qualified Purchase Price. Enter this amount on Line 6. See the following example.

Example:

The Total Purchase Price on line 3 is $180,000. There is one

Example: Buyer 1

included. There are three Qualified Buyers with the following listed Ownership Percentages:

Qualiied Buyer |

Ownership |

|

Percentage |

Buyer 1 |

50.00% |

|

|

Buyer 2 |

20.00% |

|

|

Buyer 3 |

20.00% |

|

|

Total Qualiied |

|

Ownership |

90.00% |

Percentage |

|

|

|

Multiply the Total Purchase Price from line 3 by the Total Qualified Ownership Percentage, to compute the Qualified Purchase Price.

Total Purchase Price . . . . . . . . . . $180,000 Total Qualified Ownership

Percentage . . . . . . . . . . . . . . . X 90%

Qualified Purchase Price . . . . . . . . $162,000

The Qualiied Purchase Price entered on line 6 would be $162,000.

Line 7

Enter 5% (.05) of the Qualified Purchase Price amount from line 6, or $10,000, whichever is less.

This is the total credit amount.

Example:

Qualified Purchase Price . . . . . . . $162,000

Total Qualified Ownership

Percentage . . . . . . . . . . . . . . . . X 5%

Total Credit Amount . . . . . . . . . . . . . $8,100

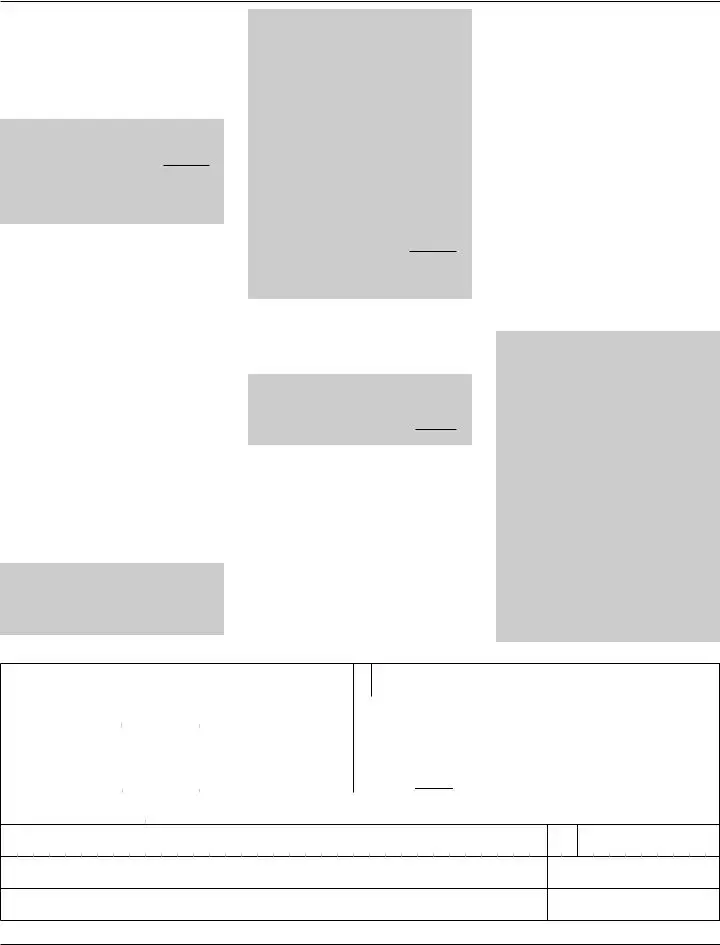

Part III – Qualified Buyer’s Information

Complete Part III, Qualified Buyer’s Information, on Side 2 of the Form, for each qualified buyer. If there are more than three qualified buyers, attach additional copies of Side 2 of form

FTB

bottom of the page shows how a married/RDP couple would complete the Qualified Buyer’s Information.

Computing the Individual Credit Amount

If Yes is checked on line 4:

For each qualified buyer, multiply the Buyer’s Ownership Percentage by the Total Credit Amount, on line 5. Enter the Individual Credit amount in Part III, in the repsective Buyer’s Individual Credit box for each qualified buyer.

If No is checked on line 4:

Compute the Individual Credit for each Qualified Buyer using the following formula:

Individual |

|

|

Ownership Percentage |

X Total credit amount |

|

Total Qualified |

||

|

||

Ownership Percentage |

|

Enter the Individual Credit amount in Part III, in the respective Buyer’s Individual Credit box for each Qualified Buyer. Round your credit to the nearest whole dollar.

Example:

There are three Qualified Buyers with the following Ownership Percentages:

Buyer 1 (a married couple): 50%

Buyer 2 (a single person): 20%

Buyer 3 (a single person): 20%

The Total Qualified Ownership Percentage is 90% (50%+20%+20%). The total credit from line 7 is $8,100. The individual credit amount for each buyer will be:

Buyer 1: (50% / 90%) x $8,100 = $4,500

Buyer 2: (20% / 90%) x $8,100 = $1,800

Buyer 3: (20% / 90%) x $8,100 = $1,800 Total credit amount = $8,100

The total credit can never be more than $10,000. If allocated, Buyer 1 will take a $1,500 credit for each of the next three years. Buyer 2 and Buyer 3 will take a $600 credit each for each of the next three years. The example below shows how Buyer 1 would complete the Qualified Buyer’s Information.

Buyer’s First Name |

Initial Buyer’s Last Name |

H |

|

|

U |

|

S |

|

|

B |

|

|

A |

|

|

|

N |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X B |

|

|

U |

|

|

Y |

|

E |

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Buyer’s SSN or ITIN |

- 4 |

|

|

|

- 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Buyer’s Ownership Percent |

Buyer’s Individual Credit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 |

|

|

|

|

2 |

|

|

3 |

|

5 |

|

|

|

7 |

|

|

8 |

|

|

|

9 |

______ 5_____ |

0_____ |

• 0 0 %_____ _____ |

$ |

|

|

4 |

|

5 |

0 |

|

0 |

|

.00 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Spouse’s/RDP’s First Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial |

Spouse’s/RDP’s Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

W |

|

I |

|

F |

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

B |

|

U |

|

Y |

|

E |

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

Spouse’s/RDP’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

1 |

|

|

|

2 |

|

|

|

3 |

- 4 |

|

5 |

- 6 |

|

|

7 |

|

|

8 |

|

|

9 |

( 5 5 5 ) 5 5 5 |

|

- 5 5 5 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

1 |

|

2 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

B |

U |

Y |

E |

R |

|

W |

A |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

City

B U Y E R V I L L E

Buyer’s Signature

State Zip Code

C A 1 2 3 4 5- 1 2 3 4

Date

Spouse/s/RDP’s Signature (if applicable)

Date

* Married/RDP couples are considered to be one buyer. If married/RDP, enter the combined percentage in the Buyer’s Ownership Percent field.

Page 2 FTB

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | Application for New Home Credit |

| Form Number | 3528-A |

| Taxable Year | 2009 |

| Eligibility | Sale of a home that has never been occupied |

| Part I Relevance | Seller's Certification |

| Application Deadline | Purchase must occur between March 1, 2009, and March 1, 2010 |

| Credit Calculation | Lesser of 5% of purchase price or $10,000 |

| Filing Method | FAX to 916.845.9754 |

| Governing Law | Revenue and Taxation Code (R&TC) Section 17059 |

| Allocation Basis | First-come, first-served |

| Maximum Credit Allocation | $100,000,000 |

| Usage Limitation | Cannot reduce tax below tentative minimum tax (TMT), nonrefundable, not carried over |

How to Write California 3528 A

Filling out the California 3528 A form is an important step for both sellers and buyers in the sale of a new home that has never been occupied, allowing them to apply for a New Home Credit. This step-by-step guide aims to simplify the process. Accuracy and attention to detail are crucial when completing this form, as it involves certification from the seller regarding the condition of the property and financial information from the buyer that will be used to calculate a potential tax credit.

- Begin with Part I – Seller’s Certification. The seller must provide their name, contact information, and identification numbers (FEIN or CA Corp no., SOS file number, SSN, or ITIN).

- Include the full address of the seller and the property being sold.

- Complete the Perjury Statement, confirming the house has never been occupied.

- Move to Part II – Escrow Information, to be completed by the escrow person.

- Enter the Escrow Number and the Date Escrow Closed.

- Provide the Escrow Company's Name, Contact Person, and Telephone Number.

- Record the Total Purchase Price of the property.

- Answer whether all buyers will live in the home as their principal residence. If "Yes," proceed to the next line; if "No," skip to the instructions for line 6.

- (If applicable) Enter the total credit amount calculated as 5% (.05) of the Total Purchase Price or $10,000, whichever is less, in Line 5.

- Complete Part III – Qualified Buyer’s Information, to be done by the buyer.

- For each buyer, clearly print the First Name, Initial, Last Name, SSN or ITIN*, Ownership Percent, and the Buyer’s Individual Credit.

- Include the spouse’s/RDP's information if applicable.

- Provide a contact number and mailing address for buyer notifications.

- Sign and date the form to certify the information provided.

- For buyers not living in the home as their principal residence: Skip Line 5 and see Line 6 instructions on the form, entering the Qualified Purchase Price and calculating the credit based on ownership percentages.

- FAX the completed Form (Side 1 and Side 2) to 916.845.9754 as directed. The Escrow agent should send one copy to the buyer within a week after escrow closes and fax another to the Franchise Tax Board (FTB).

Once the process is complete and the form is submitted, the FTB will allocate the credit on a first-come, first-served basis. The allocation does not exceed one hundred million dollars ($100,000,000) in total. Buyers will receive confirmation from the FTB about the allocation of their tax credit, which is essential for claiming the credit on their tax return. The form, therefore, serves a dual purpose: it helps the seller certify the condition and sale of the property and allows the buyer to apply for a tax credit based on the purchase of a new home.

Listed Questions and Answers

What is the California Form 3528-A?

The California Form 3528-A, also known as the Application for New Home Credit, is a document used in the state of California for individuals who have purchased a new home that has never been occupied before. This form allows eligible buyers to apply for a tax credit on their purchase.

Who needs to fill out the Form 3528-A?

Form 3528-A must be completed by the seller certifying that the home has never been occupied and by the buyer or buyers purchasing the residence. Additionally, the information regarding the escrow must be provided to complete the transaction details.

How is the New Home Credit calculated according to Form 3528-A?

The new home credit is calculated based on 5% of the total purchase price of the qualified principal residence or $10,000, whichever is less. This calculation is reflected in sections of the form that assess the eligibility of the credit based on the purchase details and buyer's intent to occupy the residence as their principal home.

What documentation is required for Form 3528-A?

To complete Form 3528-A, sellers need to provide their name, FEIN or CA Corp number, Secretary of State (SOS) file number, and the address of the sold property. Buyers must include their personal information, including social security or ITIN numbers, ownership percentage, and the credit amount they're eligible for, based on their share of the ownership.

What are the qualifications for the New Home Credit?

To qualify for the New Home Credit, the purchased property must be a single-family residence that has never been occupied. Buyers must intend to occupy the home as their principal residence for at least two years following the purchase.

How is the tax credit applied?

The credit must be claimed on a timely filed return and is applied in equal amounts over three successive taxable years starting with the taxable year in which the purchase of the qualified principal residence is made. The total amount of credits allocated cannot exceed one hundred million dollars.

Can the credit amount exceed $10,000?

No, the total credit amount cannot exceed $10,000 regardless of the purchase price of the property. This cap is enforced to ensure the fair distribution of the credit among eligible buyers.

What happens if not all buyers will be living in the home?

If not all buyers will be living in the home, the Form 3528-A requires that line 6 and line 7 be filled out to determine the Qualified Purchase Price based on the ownership percentage of qualified buyers. This adjustment ensures that the credit is allocated only for those portions of the property that will be utilized as a principal residence by the qualified buyers.

Is there a deadline to submit Form 3528-A?

The form must be faxed to the specified number within one week after the close of escrow. This strict deadline is set to ensure timely processing and allocation of the new home credit.

What happens after submitting the form?

After submission, the Franchise Tax Board (FTB) will allocate the credit on a first-come, first-served basis until the $100 million allocation is reached. Buyers will receive confirmation from the FTB regarding the allocation of the tax credit, which is necessary to claim the credit on their tax returns.

Common mistakes

When filling out the California 3528-A form, commonly known as the Application for New Home Credit, people often make a handful of mistakes that can be avoided. Knowing these pitfalls ahead of time can help ensure the application process is smooth and error-free. Here are five common mistakes:

Forgetting to check the box in Part II, Line 4, indicating whether all the buyers will be living in the home as their principal residence. This oversight can complicate the processing of the form, as it determines if you need to complete Line 5 or skip to the instructions for Line 6.

Incorrectly calculating the Total Credit Amount in Line 5 or Line 7. Some applicants mistakenly enter the full purchase price instead of applying the 5% rule or the $10,000 cap, whichever is less. It's critical to follow the specific calculation instructions to determine the correct credit amount.

Not correctly identifying qualified buyers in Part III, Qualified Buyer’s Information. All too often, people include buyers who won't live in the home as their principal residence for at least two years or fail to properly divide the credit among multiple qualified buyers based on their ownership percent.

Misinterpretation of the perjury statement. Applicants sometimes miss that by signing the form, they are attesting under penalty of perjury that all provided information is accurate, and the property sold is indeed a single-family residence that has never been occupied. This signature carries legal weight and should be approached with due diligence.

Failing to fax the completed form within one week of the close of escrow as instructed. Timing is crucial, and missing this narrow window can disqualify the buyer from receiving the new home credit, as this tight timeframe is strictly enforced to ensure fair processing for all applicants.

All of these mistakes can delay the application process or result in a denial of the claimed credit. Carefully reviewing the form instructions and ensuring all information is fully and accurately reported will help avoid these common errors.

Documents used along the form

The California Form 3528-A, Application for New Home Credit, serves as a critical tool for facilitating the grant of tax credits to eligible individuals purchasing new homes. This form, central to the California tax system, often accompanies various other documents and forms integral to buying a home or processing tax credits. Understanding these accompanying forms helps streamline the application process and ensures compliance with state regulations.

- Form 540/540NR - California Resident or Nonresident Income Tax Return: Buyers of new homes may need to reference or adjust their income tax filings on Form 540 or 540NR to account for the tax credit received through Form 3528-A. This adjustment ensures the tax credit properly influences their overall tax liability.

- Form 593 - Real Estate Withholding Statement: Often handled during the closing of escrow, Form 593 details the withholding of tax on the sale of real estate. Sellers of new homes, which form 3528-A pertains to, may require this form as it provides essential information on real estate transactions and potential tax implications.

- Escrow Closing Statement: While not a tax form per se, the escrow closing statement is crucial when applying for the New Home Credit. This document details the transaction, including the final purchase price necessary for calculating the credit on Form 3528-A. The escrow number and closing date from this statement are directly entered into Form 3528-A.

- FTB 3500 - Exemption Application: For entities involved in the sale of new homes, such as nonprofit organizations, submitting an Exemption Application with the Franchise Tax Board might be necessary. Though not directly tied to the buyer's tax credit, it intersects with real estate transactions covered by Form 3528-A regarding seller qualifications.

In conclusion, the seamless coordination and submission of these forms alongside California Form 3528-A underscore the interconnected nature of real estate transactions and tax administration. These documents ensure both compliance with tax laws and facilitate the accurate processing of the New Home Credit, thereby supporting the state's housing market and providing financial incentives for new home purchases. Each plays a unique role in the broader context of purchasing a new home and handling associated tax implications.

Similar forms

The California Form 3528-A, or Application for New Home Credit, bears resemblance to several other types of forms in its structure and purpose, particularly those involved in property transactions and tax credits. One analogous document is the First-Time Homebuyer Credit (Form 5405) used by the IRS. Both forms are designed for individuals entering into homeownership; however, while Form 3528-A targets new homes in California, Form 5405 is geared towards first-time homeowners across the United States. Each form necessitates detailed information about the property and purchase, and both provide a tax advantage to the purchaser, underlining the encouragement from both state and federal levels for homeownership.

A document like HUD-1, the Settlement Statement used in real estate transactions, also shares similarities with Form 3528-A. The HUD-1 itemizes all charges to the buyer and seller in a transaction. Similar to part II of Form 3528-A, which gathers escrow information, the HUD-1 is filled out by a closing agent and outlines the financial details of the transaction. Both documents ensure transparency in the financial aspects of property transactions, though the HUD-1 has a broader use in various types of real estate deals beyond just the sale of new homes.

The Mortgage Interest Credit (Form 8396), used to claim a tax credit for mortgage interest paid on a qualifying home, also parallels Form 3528-A. Both forms serve to reduce the tax liability for homeowners, thereby promoting certain types of real estate ownership; the former supports those with lower income to afford home ownership through a mortgage credit, while the latter encourages the purchase of new, unused homes. Though addressing different aspects of the home buying process, each form highlights the policy goal of making home ownership more accessible.

Additionally, the Property Tax Exemption Statement, often required by local tax assessors for property tax exemptions, shares the aim of providing financial relief to homeowners, similar to Form 3528-A. While Form 3528-A provides a tax credit to new home buyers, the Property Tax Exemption Statement may reduce taxable property value, lowering property tax obligations for qualifying owners, such as veterans, the disabled, or seniors. Both forms showcase efforts at different government levels to use tax policy in supporting specific groups of property owners.

Together, these documents underscore various facets of the broad policy initiative to support homeownership and real estate investment through tax incentives and credits. While each form addresses different components of property transactions and ownership, their combined use facilitates a comprehensive approach to real estate-related tax benefits, reflective of a layered government strategy to stimulate housing markets, encourage property turnover, and support community stability through homeownership.

Dos and Don'ts

When completing the California 3528 A form, it is crucial to adhere to specific guidelines to ensure accuracy and compliance. Below are lists of things you should and shouldn't do during the process.

Do:

- Ensure the seller completes Part I of the form, verifying the home has never been occupied.

- Fill out all required sections clearly and accurately, including the buyer's and seller’s information.

- Calculate the credit amount correctly, adhering to the guidelines provided in the instructions regarding the total purchase price and qualified purchase price.

- Have the escrow agent fax the completed form to the Franchise Tax Board (FTB) at 916.845.9754 within one week of the close of escrow.

- Verify that the buyer intends to occupy the residence as their principal residence for a minimum of two years, making them eligible for the credit.

Don't:

- Use the form if the home has been previously occupied, as the credit is only available for homes that have never been lived in.

- Forget to include the escrow number and the date the escrow closed, as this information is critical for the FTB’s processing of the form.

- Omit the qualification details of the buyers if more than one is purchasing, including their intent to use the property as their principal residence and ownership percentage.

- Attempt to claim more than the allocated credit amount, which is the lesser of 5% of the purchase price or $10,000.

- Send the form to the FTB via mail or any other fax number aside from the one specified (916.845.9754), as it will not be processed.

Misconceptions

When it comes to the California Form 3528-A, also known as the Application for New Home Credit, there are quite a few misconceptions that can lead to confusion. Here’s a list of 10 common misunderstandings and the truths behind them:

- Misconception 1: The form is only for the seller to complete.

Truth: While Part I of the form is indeed for the seller to certify that the home has never been occupied, there are other sections that require completion by the buyer or the escrow agent. The form is a collaborative document that involves multiple parties in the transaction.

- Misconception 2: Any home purchase is eligible for the credit.

Truth: The credit is specifically for buyers of new homes that have never been occupied before. This is a critical requirement and reduces the pool of eligible transactions significantly.

- Misconception 3: The full $10,000 tax credit is available to all buyers.

Truth: The actual amount of the credit is the lesser of 5% of the purchase price or $10,000, and it may be reduced further depending on the buyers’ share in the property.

- Misconception 4: The credit is deducted from the purchase price of the home.

Truth: The credit is applied against the buyer's net state income tax, not the purchase price of the home. It does not reduce the amount owed to the seller but may reduce the buyer’s income tax owed to the state.

- Misconception 5: The credit is available immediately upon purchase.

Truth: The credit is applied over three successive tax years, starting with the year the home is purchased. It is not provided as a lump sum.

- Misconception 6: If the credit isn’t fully used one year, it can be carried over.

Truth: Any unused portion of the annual credit amount cannot be carried forward to the following years. Each year's portion of the credit is use-it-or-lose-it for that particular tax year.

- Misconception 7: All buyers on the title are eligible for the credit.

Truth: Only buyers who will use the home as their principal residence and comply with other stipulations qualify for the credit. Not all buyers on the title may qualify.

- Misconception 8: The form must be filed with your annual tax return.

Truth: The form is actually faxed by the escrow company to the FTB (Franchise Tax Board) within one week after the close of escrow, and not filed with the buyer's or seller's tax return.

- Misconception 9: The form is complex and requires a tax professional to complete.

Truth: While tax advice can be beneficial, especially for understanding the credit’s implications on your taxes, the form itself is straightforward and includes clear instructions for both the buyer and seller.

- Misconception 10: The program has unlimited funds.

Truth: There is a cap on the total amount of credits that can be allocated statewide ($100 million). Once this limit is reached, no more credits will be available unless the program is extended or replenished.

These clarifications can help both buyers and sellers navigate the process of claiming the New Home Credit on California Form 3528-A. It’s always a good idea to consult with a professional if you have specific questions about your situation.

Key takeaways

The California 3528 A Form is crucial for applicants seeking the New Home Credit in California, specifically designed for the sale of homes that have never been occupied. Here are eight key takeaways to understand the process and requirements of applying for this credit:

- The form is primarily used by sellers to certify that a property is a new, never occupied single-family residence being sold to an individual who will use it as their principal residence.

- It is imperative for the seller to complete Part I of the form, which involves providing detailed information about the property and certifying its eligibility.

- The application for the New Home Credit must be filed between March 1, 2009, and March 1, 2010, showcasing the specific timeframe for eligibility.

- Buyers have to inhabit the purchased property as their main residence for at least two years to qualify for this credit, underlining the commitment required by potential applicants.

- The New Home Credit equates to either 5% of the purchase price of the qualified residence or $10,000, whichever amount is less, presenting a significant financial incentive for eligible buyers.

- Allocation of the credit is conducted on a first-come, first-served basis, with a total allocation cap of $100 million dictated by the Franchise Tax Board (FTB), highlighting the competitive nature of the credit’s allocation.

- Documentation may be requested by the FTB to ensure compliance with the program’s requirements, emphasizing the importance of maintaining records and documentation relating to the property purchase and credit application.

- The completed Form 3528-A must be faxed to the FTB by the escrow agent within one week of the close of escrow, and not mailed, to ensure timely processing and consideration for the credit.

Understanding these considerations is essential for both sellers and buyers to navigate the application process for the California New Home Credit effectively, potentially providing significant financial benefits for eligible parties.

Different PDF Templates

Who Is Exempt From Workers Compensation Insurance California - This form is used by employers in California to report workplace injuries or illnesses.

De305 - Claimants must verify the gross value of the decedent’s interest in all California real property does not exceed the threshold.