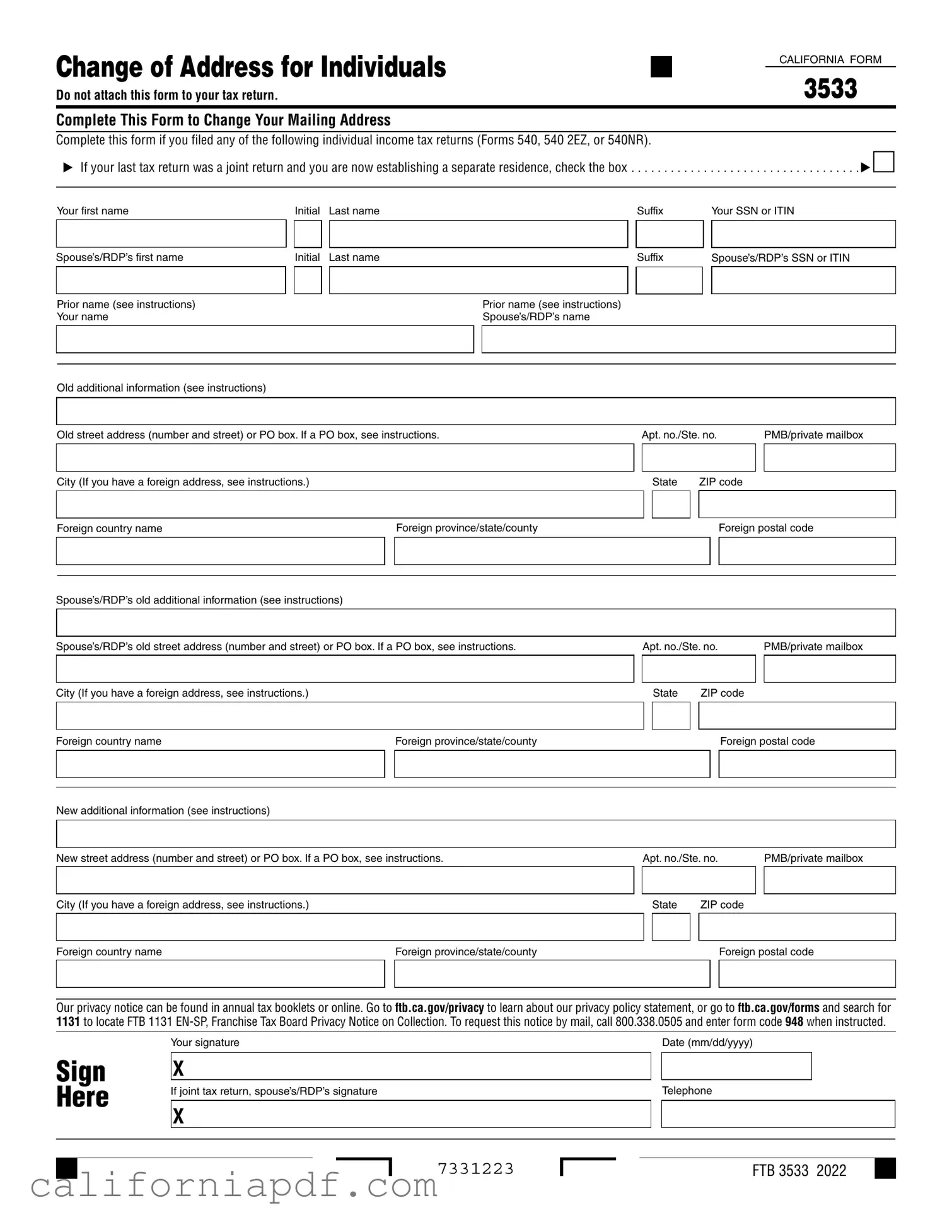

Fill a Valid California 3533 Form

When individuals or families find themselves changing residences within or outside of California, a critical administrative step involves notifying the California Franchise Tax Board (FTB) to ensure that tax documents and communications are accurately directed to the new address. This is where the California 3533 form, specifically designed for the purpose of changing one's mailing address, comes into play. It is essential for those who have filed California individual income tax returns, including Forms 540, 540 2EZ, or 540NR. Notably, the form facilitates a seamless update process not just for single filers but also for those who previously filed a joint return and are now moving to a separate residence. It requires the provision of key details such as the filer’s and spouse’s or Registered Domestic Partner's (RDP) names, Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs), as well as both the old and new addresses. Moreover, the form goes further to accommodate changes that may involve old and new additional information, which can be critical for ensuring mail delivery accuracy, especially in complex cases involving P.O. boxes or foreign addresses. Importantly, while the 3533 form is a crucial document for address update purposes, it is explicitly stated that it should not be attached to one’s tax return, underscoring its standalone role in the taxpayer's administrative affairs.

Document Example

Change of Address for Individuals |

|

|

CALIFORNIA FORM |

|

|

|

|

|

|

|

|

Do not attach this form to your tax return. |

3533 |

||

|

|

|

|

Complete This Form to Change Your Mailing Address

Complete this form if you filed any of the following individual income tax returns (Forms 540, 540 2EZ, or 540NR).

▶If your last tax return was a joint return and you are now establishing a separate residence, check the box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .▶ □

Your first name |

|

Initial |

Last name |

|

|

|

Suffix |

|

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s first name |

|

Initial |

Last name |

|

|

|

Suffix |

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Prior name (see instructions) |

|

|

|

|

|

Prior name (see instructions) |

|

|

||

Your name |

|

|

|

|

|

Spouse’s/RDP’s name |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old additional information (see instructions)

Old street address (number and street) or PO box. If a PO box, see instructions. |

Apt. no./Ste. no. |

|

|

PMB/private mailbox |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

|

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s old additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s old street address (number and street) or PO box. If a PO box, see instructions. |

Apt. no./Ste. no. |

|

PMB/private mailbox |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

|

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New street address (number and street) or PO box. If a PO box, see instructions. |

Apt. no./Ste. no. |

|

|

PMB/private mailbox |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

|

|

|

|

|

Foreign postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

|

|

Your signature |

|

|

Date (mm/dd/yyyy) |

|

||

SIGN |

|

|

|

|

|

|

||

X |

|

|

|

|

|

|||

|

|

|

|

|

|

|||

HERE |

If joint tax return, spouse’s/RDP’s signature |

|

|

Telephone |

|

|||

|

|

|

|

|

|

|

||

X |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7331223 |

|

|

FTB 3533 2022 |

|

||

Form Breakdown

| Fact | Description |

|---|---|

| Form Title | Change of Address for Individuals |

| Form Number | 3533 |

| Use Case | Used to update mailing address with the California Franchise Tax Board. |

| Applicable Tax Returns | Form 3533 is relevant for individuals who have filed Forms 540, 540 2EZ, or 540NR. |

| Attachment Instructions | Do not attach this form to your tax return. |

| Joint Return Indicator | Includes an option for indicating a new separate residence if the last return was filed jointly. |

| Governing Laws | Governed by California state law, as informed by the instructions for taxpayers and the privacy rights provided at ftb.ca.gov/forms. |

How to Write California 3533

Once you've determined the need to update your address with the California Franchise Tax Board (FTB), completing Form 3533 correctly is essential to ensure that your tax information is up-to-date. This is particularly important if you've filed California state tax returns such as Forms 540, 540 2EZ, or 540NR in the past. Changing your address using this form helps in keeping your records current with the FTB, which is critical for receiving any tax-related correspondence or refunds. The following steps provide guidance on how to complete the form thoroughly and accurately.

- Start by reading the entire form carefully to understand the information required. This ensures that you have all the necessary information at hand before you begin filling it out.

- Check the box at the top of the form if your last tax return was a joint return and you are now establishing a separate residence.

- Enter your first name, initial, last name, and suffix if applicable in the designated space. Repeat this process for your spouse or Registered Domestic Partner (RDP) if needed.

- Provide your Social Security Number (SSN) or Individual Tax Identification Number (ITIN) in the space provided. Do the same for your spouse/RDP's SSN or ITIN if applicable.

- If you or your spouse/RDP has had any prior name(s), list them in the appropriate section following the instructions provided.

- For the 'Old Address' section, enter your previous street address or PO Box, apartment/suite number, and any PMB/private mailbox number. Include your previous city, state, ZIP code, and, if applicable, your foreign country name, province/state/county, and postal code. Repeat this step for your spouse/RDP if their previous address is different.

- In the 'New Address' section, provide your new street address or PO Box, including the apartment/suite number and any PMB/private mailbox number. Then, list your new city, state, ZIP code, and, if applicable, your foreign country name, province/state/county, and postal code.

- Review the information regarding your privacy rights and how your information may be used by visiting the FTB website or calling the provided number.

- Sign and date the form in the designated area. If you filed a joint tax return, ensure that your spouse/RDP also signs the form.

- Finally, provide a telephone number where you can be reached to clarify any information, if necessary.

After completing Form 3533, do not attach it to your tax return. Instead, follow the instructions provided by the California FTB for submitting the form, which may include mailing or faxing it to the designated address or number. By meticulously following these steps, you can accurately update your address with the California FTB, ensuring that you remain in good standing and receive timely updates and correspondence regarding your tax matters.

Listed Questions and Answers

What is the purpose of the California Form 3533?

The California Form 3533 is a document specifically designed for individuals who need to notify the California Franchise Tax Board (FTB) about a change in their mailing address. This form is applicable when individuals have previously filed California individual income tax returns using Forms 540, 540 2EZ, or 540NR. It ensures that the FTB has the most current address to send any correspondence, refunds, or notices.

Do I need to attach the Form 3533 to my tax return?

No, Form 3533 should not be attached to your tax return. It is a standalone document that you file separately with the California Franchise Tax Board to update your mailing address.

When should I complete and submit Form 3533?

You should complete and submit Form 3533 as soon as your mailing address changes. Ensuring that the FTB has your most current address helps in preventing delays in receiving important tax correspondences, refunds, or any other communications related to your tax filings.

Who should use Form 3533 to change their address?

Form 3533 should be used by individuals who have filed California individual income tax returns in the past, specifically using Forms 540, 540 2EZ, or 540NR. This includes:

- Those who filed individually and need to update their address.

- Individuals who filed a joint return but are now establishing a separate residence and therefore need to notify the FTQ of a new address.

Can I use Form 3533 to update an address for a business or other entity?

No, Form 3533 is specifically designed for individuals. Businesses or other entities need to use a different form, provided by the California Franchise Tax Board, to notify a change in address.

What information do I need to provide on Form 3533?

Form 3533 requires several pieces of information to accurately process your change of address, including:

- Your first name, initial, last name, and suffix, if applicable.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, similar information for your spouse/RDP (Registered Domestic Partner).

- Your previous mailing address and your new mailing address.

- Your signature and date, and if filed jointly, your spouse’s/RDP’s signature.

How can I submit Form 3533 to the California Franchise Tax Board?

After completing Form 3533, you can submit it to the California Franchise Tax Board through mail or electronically, if available. It is advised to check the most current submission guidelines directly with the FTB, as these can change. Always ensure that your form is fully completed and signed to prevent delays or issues with processing your address change.

Common mistakes

Filing Form 3533, the Change of Address form for California taxpayers, requires careful attention to detail to ensure the process is completed accurately and efficiently. However, individuals often encounter common mistakes that can lead to complications or delays. Here are nine frequently made errors:

- Not completing all required fields: Every section of the form must be filled out to process your address change successfully.

- Forgetting to check the box if the last tax return was a joint return and you are now establishing a separate residence. This distinction is crucial for accurate record-keeping.

- Incorrectly entering Social Security Numbers (SSN) or Individual Taxpayer Identification Numbers (ITIN): Entering these numbers inaccurately can lead to significant delays and confusion.

- Failing to update your name if it has changed since your last filing. If you don't include previous names, there might be discrepancies in your tax records.

- Omitting apt, suite, or PMB numbers: Not providing full address details can result in mailed documents not reaching you.

- Not specifying if the address is foreign: Failing to indicate a foreign address can cause processing issues, given that different address formats may apply.

- Leaving out previous additional information: This detail is vital for individuals who had multiple addresses or additional address information in the past.

- Signature omissions: The form requires the signature of the individual and, if applicable, their spouse/RDP. Missing signatures can invalidate the submission.

- Incorrect date format: The form specifies the mm/dd/yyyy format for dates. Deviating from this can lead to misunderstandings regarding the effective date of the address change.

Ensuring each of these common pitfalls is avoided can smooth the transition to your new address in the eyes of the California Franchise Tax Board. Paying close attention to the details and double-checking entries before submission will help avoid delays and ensure your tax situation is up-to-date and accurate.

Documents used along the form

When individuals file the California Form 3533 for a change of address, this key document often necessitates accompanying forms and documents to ensure a comprehensive update and verification process. The significance of this procedure rests on maintaining accurate and current information with the California Franchise Tax Board, preventing any delays or misunderstandings in tax administration and correspondence.

- Form 540 Series: This includes Forms 540, 540 2EZ, and 540NR, which are California Individual Income Tax Returns. These forms are directly tied to the Form 3533 as they identify the tax year and validate the identity and previous addresses of the filer(s).

- Form FTB 3522: The California LLC Annual Tax Voucher is often used by individuals who own business entities that might be affected by a change of personal address, ensuring their business records are also up to date with the state.

- Form 588: Nonresident Withholding Waiver Request is significant for individuals moving out of California who still earn income from California sources. It may need to be updated to reflect changes in residence and contact information.

- Form 590: Withholding Exemption Certificate, relevant for residents who have income sources within California that are subject to withholding. A change of address might require an update of personal details on this document.

- Power of Attorney Declaration (Form 3520): Allows for representation before the CA Franchise Tax Board. With any address change, it’s crucial that all representative information is accurate and mirrors that on Form 3533.

- Request for Copy of Tax Return (Form 3516): In the process of updating address information, individuals might also need to request copies of past tax returns to verify information or for personal records.

- Form 3500: Exemption Application is used by non-profit organizations. Individuals associated with such entities, in roles like directors, might need to ensure their personal address changes are reflected in the organization’s records.

Ensuring that all relevant documents and forms accompany the California Form 3533 change of address request fosters accuracy in record-keeping and aids in the seamless transition of information. This meticulous approach not only minimizes the risk of mailing discrepancies but also aligns with legal compliance, enhancing the overall integrity of tax administration processes. Thus, familiarity with and the proper preparation of these documents is essential for individuals navigating the complexities of maintaining current and legally compliant records with tax authorities.

Similar forms

The IRS Form 8822, "Change of Address," is quite similar to the California 3533 form in its core purpose—to update mailing addresses with tax authorities. Both forms serve as official notifications for when an individual or a family relocates, ensuring that crucial tax-related documents and communications are sent to the correct address. The primary difference lies in their jurisdiction, with the IRS Form 8822 designed for federal tax matters, while the California 3533 form is specific to the state of California.

Another comparable document is the USPS Change of Address Form, officially known as Form 3575. This form informs the United States Postal Service of a change in address, ensuring mail is forwarded to the new location. Like the California 3533, it plays a critical role in the process of moving by updating a key piece of personal information. However, it differs in that it encompasses all mail, rather than specifically tax-related correspondence.

Form AR-11, "Alien’s Change of Address Card," issued by the United States Citizenship and Immigration Services (USCIS), also shares similarities with the California 3533 form. Both are essential for updating governmental bodies about new addresses to maintain compliance and receive important documents. The AR-11 is specifically for non-citizens to report their change of address within the U.S., highlighting the specialization in the scope between these forms.

The DMV Change of Address Form, found in each state, including California (DMV 14 in California), resembles the California 3533 form in purpose. It updates the driver's license, vehicle registration, and identification card information with new address details. While addressing different state agencies, both forms ensure updated records to avoid legal or administrative issues.

State Voter Registration Update forms paralleled the need for California 3533, aiming at ensuring voters’ registration addresses are current for election purposes. While the California 3533 form focuses on tax-related correspondences, voter registration updates are critical for civic participation, both emphasizing the importance of current address information in their respective domains.

The Social Security Administration’s (SSA) Change of Address form serves a similar administrative function as California 3633, updating address information for Social Security and Medicare services. Though one is for tax purposes and the other for federal benefits, both are vital for ensuring individuals receive pertinent updates and information.

Bank Change of Address forms, used by most financial institutions, are necessary for updating personal information, including mailing addresses, to ensure account statements and notifications are correctly routed. Like the California 3533, this action prevents miscommunication and missed payments, illustrating the broader application of address updates across various services.

Tenant’s Notice to Change Contact Information forms, used within rental agreements, share the underlying principle of the California 3533 form—keeping essential contact information current. While the focus of these forms is on landlord-tenant communications, both play crucial roles in maintaining smooth operational relationships and ensuring notifications are accurately received.

College and University Change of Address Notifications, required by educational institutions for enrolled students, align with the California 3533 form’s function of updating personal information. Both ensure organizations have accurate records for sending important communications, albeit in different sectors (education versus taxation).

The Jury Duty Change of Address forms, required by county courts to update jury service records, correlate with the California 3533 form's intention. Each form notifies a relevant government body of a new address to maintain compliance and proper functioning of civic duties, highlighting the importance of such updates in various legal contexts.

Finally, Health Insurance Change of Address forms, whether for private insurance or government programs like Medicaid, require current address information to send essential healthcare communications and billing. Similar to the California 3533 form, keeping addresses up to date with these organizations is crucial for receiving necessary services and information without interruption.

Dos and Don'ts

Filling out the California 3533 form, which is used for changing your address, is an essential task for ensuring the tax authorities have your current details. This process can be smooth if you follow some straightforward dos and don'ts.

Do:- Read all instructions carefully before you start filling out the form. This can help you avoid any mistakes that might delay the processing of your address change.

- Ensure you complete all the required fields with the correct information. Missing out on details can lead to unnecessary complications.

- For joint returns, if you are now establishing a separate residence, make sure to check the appropriate box indicating this change.

- Sign and date the form. A form without your signature or without a date might not be considered valid.

- If you had any name changes, include your prior name(s) as directed in the instructions. This helps in matching your new details with your previous records.

- For foreign addresses, follow the specific instructions given for filling out these sections accurately.

- Do not attach this form to your tax return. The form is meant to be sent separately.

- Avoid using abbreviations or nicknames when listing your first name, last name, or any other required names. Use the full legal names to prevent any confusion.

- Don’t skip the signature section. The absence of a signature can invalidate your form, delaying the update of your information.

- Do not rush through filling out the form. Taking your time ensures accuracy and completeness.

By following these dos and don'ts, you can ensure that the process of changing your address with the California tax authorities goes as smoothly as possible. Remember, keeping your address up-to-date is crucial for receiving important tax documents and information without delays.

Misconceptions

There are several common misconceptions about the California Form 3533, which relates to a change of address for individuals. Addressing these misunderstandings is crucial for ensuring that taxpayers can confidently manage their responsibilities while adhering to state requirements.

Form 3533 is attached to your tax return. This is incorrect. The instructions clearly state, "Do not attach this form to your tax return." It is a separate form specifically for updating your mailing address with the California Franchise Tax Board.

Only needed if you move within California. Another common misconception is that this form is only necessary if you move to a new address within California. However, you should complete this form regardless of whether your new address is in California, another state, or even a foreign country. The purpose is to ensure the Franchise Tax Board has the correct address on file for any communications.

You can't use it if your last return was filed jointly, and now you're separated. Actually, the form accommodates individuals who filed their last tax return jointly but are now establishing separate residences. There's a box to check if this situation applies to you, demonstrating that the state recognizes and has made provisions for such circumstances in their processes.

The form is complicated and requires professional assistance to complete. While some tax forms can be complex, Form 3533 is designed to be straightforward. It asks for basic information about your old and new addresses. Instructions are provided directly on the form to help clarify what is required in each section, making it manageable for most taxpayers to complete on their own without professional help.

Understanding the purpose and requirements of California Form 3533 can significantly ease the process of keeping your tax records up to date. It reassures the taxpayer that proactive steps are encouraged by the state to ensure timely and accurate communication, aiding in the smoother management of one’s tax affairs.

Key takeaways

Filling out and using California Form 3533 efficiently and accurately is crucial for anyone who needs to update their mailing address with the California Franchise Tax Board (FTB). Here are some key takeaways to guide you through the process:

- Complete Form 3533 to update your address: If you’ve filed California tax returns such as Forms 540, 540 2EZ, or 540NR and need to change your mailing address, this form is required.

- Do not attach to your tax return: It’s important to note that this form should not be attached to your tax return. It serves a distinct purpose and must be filed separately.

- Joint returns and separate residences: For those who filed a joint return but are now establishing separate residences, it's essential to check the designated box on the form to ensure that the FTB updates its records accurately.

- Provide comprehensive information: The form asks for detailed information including your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and similar details for a spouse or Registered Domestic Partner (RDP) if applicable.

- Address the details carefully: Both old and new addresses need to be filled out in full, including any apartment or suite numbers, city, state, and ZIP code, to make sure your mail from the FTB reaches you without delays.

- Include changes in names: If you or your spouse/RDP has changed names, ensure to provide prior names. This step is vital for the FTB to reconcile your past and present records accurately.

- Understand the importance of privacy rights: The form also brings attention to privacy rights, the use of provided information, and the consequences of not supplying the requested details.

- Signatures are mandatory: Your signature is required to validate the change of address. If the last tax return was filed jointly, then a signature from both parties is necessary.

- Contact information: Including a current telephone number is encouraged, providing a direct line for the FTB to clarify any questions or concerns quickly.

By adhering to these guidelines, individuals can ensure their address change requests are processed efficiently, maintaining the accuracy of their records with the California Franchise Tax Board and avoiding potential issues with future correspondence or tax filings.

Different PDF Templates

California 590 P - By completing the 590-P form, nonresidents can certify that the related income won’t be subject to California withholding taxes.

California Bar Exam - Ensuring only qualified attorneys serve as in-house counsel protects the interests of California-based entities.

California 3528 A - The California 3528-A Form is used by sellers to apply for the New Home Credit for properties sold in California that have never been occupied.