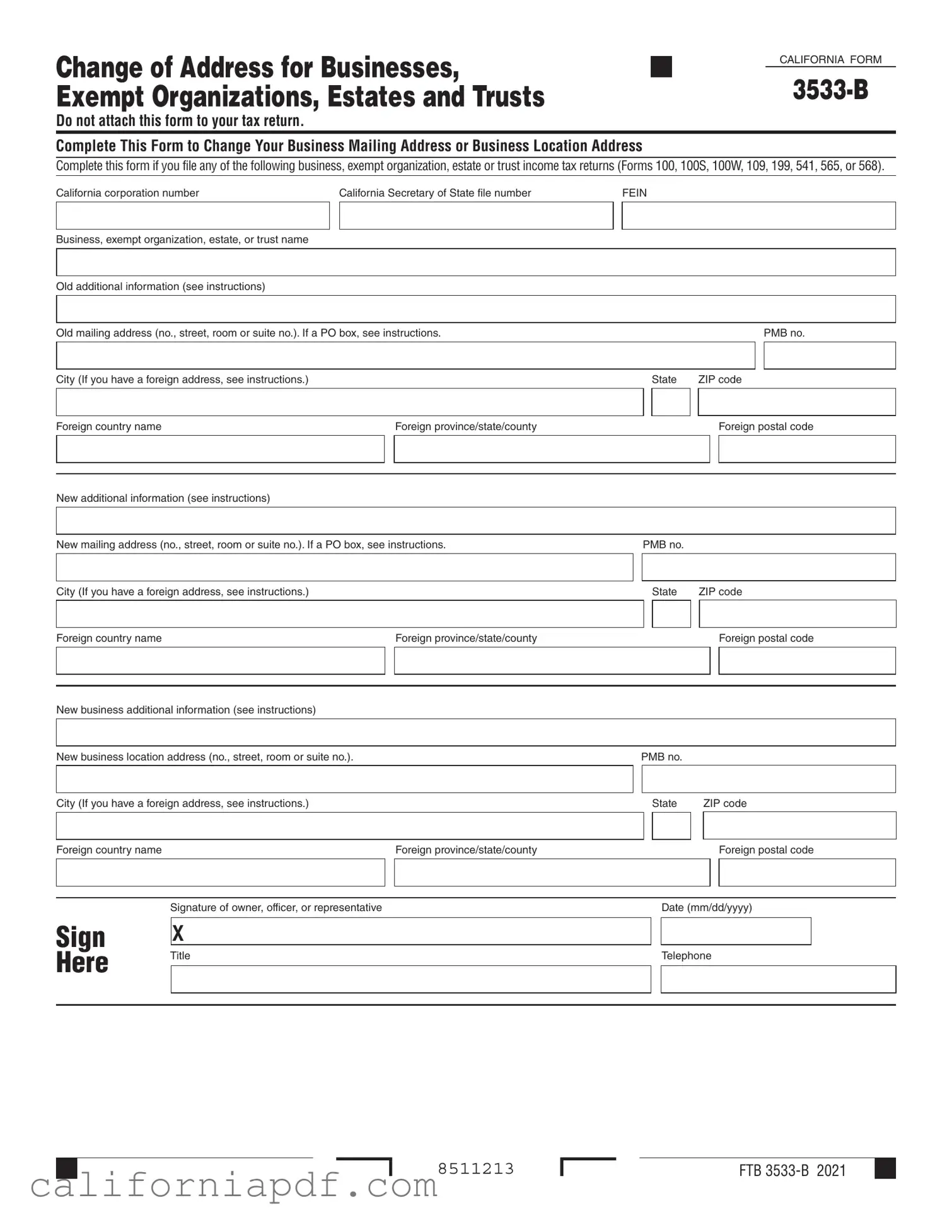

Fill a Valid California 3533 B Form

For businesses, exempt organizations, estates, and trusts in California that need to communicate a change in mailing or location address to the relevant tax authorities, the California 3533 B form serves as a crucial document. This form allows entities to update their address information without attaching this documentation to their tax return, ensuring that critical communication and tax-related correspondence are properly directed. Specifically designed for a variety of entities—including those filing Forms 100, 100S, 100W, 109, 199, 541, 565, or 568—the form requires details such as the California corporation number, the Secretary of State file number, and the Federal Employer Identification Number (FEIN). It meticulously asks for both the old and new addresses, detailing specifics down to the room or suite number, and it includes fields for foreign addresses, indicating its extensive applicability. Moreover, the form underscores the necessity of a signature from an authorized individual, affirming the legitimacy of the request and the information provided. The California 3533 B form thus stands as a vital tool in maintaining current and accurate record-keeping with tax agencies, facilitating smoother operations and compliance for various entities within the state.

Document Example

Change of Address for Businesses, |

|

|

CALIFORNIA FORM |

|

|

|

|

Exempt Organizations, Estates and Trusts |

|

|

|

|

|

Do not attach this form to your tax return.

Complete This Form to Change Your Business Mailing Address or Business Location Address

Complete this form if you file any of the following business, exempt organization, estate or trust income tax returns (Forms 100, 100S, 100W, 109, 199, 541, 565, or 568).

California corporation number |

California Secretary of State file number |

|

FEIN |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business, exempt organization, estate, or trust name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Old mailing address (no., street, room or suite no.). If a PO box, see instructions. |

|

|

|

|

|

|

|

|

|

PMB no. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

|

|

|

|

State |

ZIP code |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

|

Foreign province/state/county |

|

|

|

|

|

|

|

Foreign postal code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New additional information (see instructions)

New mailing address (no., street, room or suite no.). If a PO box, see instructions. |

|

PMB no. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

ZIP code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/state/county |

|

|

|

|

|

|

|

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New business additional information (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New business location address (no., street, room or suite no.). |

|

PMB no. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions.) |

|

|

|

State |

|

|

ZIP code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/state/county |

|

|

|

|

|

|

|

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of owner, officer, or representative |

|

|

|

|

Date (mm/dd/yyyy) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERE |

Title |

|

|

|

|

Telephone |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8511213 |

FTB |

Form Breakdown

| Fact Name | Detail |

|---|---|

| Form Purpose | California Form 3533-B is designed for businesses, exempt organizations, estates, and trusts to notify the state of a change in business mailing address or business location address. |

| Applicable Entities | This form is applicable for the entities that file California income tax returns with form numbers 100, 100S, 100W, 109, 199, 541, 565, or 568. |

| Required Information | Entities must provide their California corporation number, California Secretary of State file number, Federal Employer Identification Number (FEIN), and both old and new addresses. |

| Governing Law | The use of Form 3533-B for changing address information is governed under the California Revenue and Taxation Code, which outlines the requirements for reporting and updating business-related address changes for tax purposes. |

How to Write California 3533 B

When the time comes for a business, exempt organization, estate, or trust in California to update their mailing or location address, the California Form 3533-B provides a straightforward way to notify the authorities. This ensures that all correspondence and important documents from the California Franchise Tax Board reach the right address, maintaining compliance and avoiding any unnecessary complications. Following a set of steps can simplify the completion of this form. It's important not to attach this form to your tax return, but rather to send it separately to the designated address provided by the California Franchise Tax Board.

- Identify the form's need by making sure it applies to your situation, particularly if you file business, exempt organization, estate, or trust income tax returns such as Forms 100, 100S, 100W, 109, 199, 541, 565, or 568.

- Start with providing the California corporation number, if applicable. This is a unique number assigned to your entity by the state.

- Enter the California Secretary of State file number, another unique identifier but specifically maintained by the California Secretary of State.

- Include the Federal Employer Identification Number (FEIN) to identify your entity with the federal government.

- Write the official name of the business, exempt organization, estate, or trust as recognized by the California Franchise Tax Board.

- Detail the old additional information as requested on the form. This could include any special instructions or details about the previous address that need clarification.

- Provide the complete old mailing address, including number, street, room or suite number, and if applicable, PMB number. For foreign addresses, additional instructions are provided on the form.

- Specify the old mailing address city, state, ZIP code, and if outside the United States, the foreign country name, province/state/county, and postal code.

- For the new address, repeat the instructions for the old address, starting with the new additional information that needs to be clarified or specified.

- Enter the new mailing address details, including number, street, room or suite number, and PMB number if relevant. Again, follow special instructions for foreign addresses as noted on the form.

- Point out the new business location address if it's different from the mailing address, including all pertinent details such as street number, name, and room or suite number.

- Sign and date the form to certify the changes. The signature must be that of the owner, officer, or authorized representative of the entity making the address change.

- Finally, include the title of the person signing and their telephone number for any potential follow-up or clarification.

Once completed, the form should be reviewed for accuracy and completeness before being mailed to the provided address by the California Franchise Tax Board. It's essential to ensure that all included information is up to date and accurately reflects the current details of the business, exempt organization, estate, or trust. Keeping records of this submission and noting the date sent can help with any future inquiries or necessary follow-ups.

Listed Questions and Answers

What is the purpose of the California Form 3533-B?

The California Form 3533-B is designed to notify the California Franchise Tax Board about a change in the mailing address or business location address for businesses, exempt organizations, estates, and trusts. This form ensures that important tax documents and correspondence from the state can be accurately delivered to the right location.

When should Form 3533-B be used?

Form 3533-B should be completed and submitted whenever there is a change in the mailing address or the physical location of a business, an exempt organization, an estate, or a trust that files any of the specified tax returns (Forms 100, 100S, 100W, 109, 199, 541, 565, or 568).

What information is required to complete Form 3533-B?

To complete Form 3533-B, the following information is needed:

- California corporation number or California Secretary of State file number.

- Federal Employer Identification Number (FEIN).

- Business, exempt organization, estate, or trust name.

- Old mailing and/or business location address, including city, state, and ZIP code.

- New mailing and/or business location address, including city, state, and ZIP code.

- Signature of the owner, officer, or authorized representative, along with their title and telephone number.

Do not attach Form 3533-B to your tax return. Why?

Form 3533-B should not be attached to your tax return because it is processed separately from tax returns. Attaching it to a tax return could delay the update of address information and potentially important correspondence related to your tax filings.

How can one submit Form 3533-B?

Form 3533-B can typically be submitted by mail to the address provided by the California Franchise Tax Board. Always check the latest instructions on the Franchise Tax Board's website to confirm the current submission procedure and address.

Is it necessary to notify the California Franchise Tax Board if only the phone number or email address of a business changes?

While the primary purpose of Form 3533-B is for changes in mailing or location addresses, updating contact information such as phone numbers or email addresses is also important to ensure effective communication. It's best to check with the California Franchise Tax Board for the appropriate way to report such changes.

Can a PO Box be used as a new mailing address on Form 3533-B?

Yes, a PO Box can be used as a new mailing address on Form 3533-B. However, specific instructions regarding PO Boxes must be followed, as outlined on the form. For businesses with a foreign address, additional guidance is provided in the instructions.

What if the business, exempt organization, estate, or trust has a foreign address?

If the entity has a foreign address, special instructions provided on Form 3533-B need to be followed. These include specifying the foreign country name, province/state/county, and postal code to ensure the correct handling and mailing of documents.

Who is authorized to sign Form 3533-B?

The form must be signed by an owner, officer, or authorized representative of the business, exempt organization, estate, or trust. The signer must include their title and telephone number for verification purposes and potential follow-up communication.

Common mistakes

Filling out the California Form 3533-B, which is used for changing the address of businesses, exempt organizations, estates, and trusts, requires attention to detail. Common mistakes can delay the processing of address changes or result in incorrect records. Here are nine typical errors people make when completing this form:

- Not specifying the type of address change: It's crucial to clarify whether the change is for the business mailing address or the business location address. Omitting this information can lead to confusion about where official correspondence should be sent.

- Incorrectly listing the California corporation number or California Secretary of State file number: These identifiers are essential for matching the form to the correct entity. Mistakes can cause delays or misfiled documentation.

- Forgetting the FEIN: The Federal Employer Identification Number (FEIN) is required to identify the business, exempt organization, estate, or trust for tax purposes. Omitting or inaccurately reporting it can lead to issues with tax records.

- Omitting old or new additional information: If there's relevant additional information that clarifies the old or new address, leaving this area blank can lead to miscommunication or paperwork being sent to the wrong address.

- Incorrect old or new mailing address details: Failing to provide the complete and correct mailing address, including the street number, room or suite number, and PMB number (if applicable), can result in documents failing to reach their intended destination.

- Ignoring instructions for a PO box: There are specific instructions for entering a PO box as the mailing address. Not following these instructions correctly can affect the delivery of mail.

- Leaving out the foreign address details when applicable: For entities with foreign addresses, it's important to include the foreign country name, province/state/county, and postal code. Neglecting these details can complicate international correspondence.

- Not filling out new business location address completely: When the business location address is changing, it's vital to provide the full details, including the street number, room or suite number, and PMB number (if applicable), to ensure that records are updated correctly.

- Failure to include the signature of the owner, officer, or authorized representative and date: The form is not valid without a signature and date, indicating approval for the change. This oversight is a common reason forms are returned or not processed.

Attention to these details will smooth the process of changing an address and help maintain accurate records with the State of California.

Documents used along the form

When submitting the California Form 3533-B, which is used for changing a business, exempt organization, estate, or trust's mailing or location address, various other documents might often accompany this form to ensure all facets of the entity's information are updated across governmental and regulatory bodies. These documents play pivotal roles in maintaining the legitimacy and operational continuity of a business or entity within the state of California. Below is a brief overview of some of these key documents.

- California Form 100: This form is the California Corporation Franchise or Income Tax Return, necessary for corporate entities to report their income, deductions, and credits to the California Franchise Tax Board. It's pertinent for corporations operating within California and often accompanies changes in address to assure all tax-related communications are accurately directed.

- California Form 568: This form is for Limited Liability Companies (LLCs) that are classified as disregarded entities or partnerships for tax purposes. It details the income, deductions, and tax liability of the LLC. When an LLC updates its address using Form 3533-B, filing Form 568 ensures that the state has the updated address for tax purposes.

- Statement of Information (SOI) - California Form LLC-12 for LLCs or Form SI-550 for Corporations: These forms are crucial for updating the California Secretary of State with current information about the business, including addresses, management, and agent for service of process. Timely filing of the Statement of Information is essential for compliance and ensuring that public records reflect the most current information following an address change.

- Business License Application/Renewal Form: Depending on the city or county where the business is located, a revised business license application or renewal form may be necessary to update the address details with local government agencies, ensuring compliance with local regulations and maintaining the validity of the business license.

- IRS Form 8822-B: This form is used to inform the IRS of a change in business mailing address or location. It is crucial for ensuring that federal tax obligations are sent to the correct address, preventing delays or complications with the IRS.

- Employer Registration Form (EDD): If the business has employees, updating the Employment Development Department with the new address is crucial for compliance with state employment laws and regulations. This ensures that all correspondence and reporting with the state's labor department are correctly addressed.

Together, these documents consider both the fiscal responsibilities and operational requisites of running a business or managing an entity. It's essential for businesses to timely update these documents in conjunction with Form 3533-B to mitigate any legal or administrative issues that may arise from outdated information. Keeping governmental and regulatory agencies informed of your current address helps in smooth operations and compliance, safeguarding the entity's standing within California.

Similar forms

The IRS Form 8822, "Change of Address", is quite similar to the California Form 3533-B as they both are official notifications used to inform tax authorities about a change in address. While Form 3533-B is specific to California for businesses, exempt organizations, estates, and trusts, Form 8822 is used on a federal level by individuals and businesses to report changes in mailing or location address to the Internal Revenue Service. Both forms ensure that important tax correspondence and documents are sent to the correct address.

Form SS-4, the "Application for Employer Identification Number (EIN)," shares some connection with California Form 3533-B, particularly in the way that both involve fundamental business information that could relate to address details. Although Form SS-4’s primary function is to apply for an EIN, it also collects the business address, similar to how Form 3533-B collects new address information for tax purposes. This is crucial for updating records for any business entity in terms of tax administration.

The USPS Change of Address Form, officially known as PS Form 3575, though not a tax form, similarly facilitates a change of address, primarily for mail forwarding purposes. Similar to Form 3533-B, the USPS form ensures that mail is accurately routed to a new business or personal address. However, the USPS form is broader in scope, impacting all mailed documents, not just tax-related correspondence.

California Form 100, "California Corporation Franchise or Income Tax Return", is related to Form 3533-B through its requirement for up-to-date business address information for processing. Filing a Form 3533-B to update an address ensures that any correspondence or tax documents related to Form 100 are correctly directed, underscoring the importance of maintaining current address details with the tax authority.

The "Statement of Information" (Form SI-550) required by the California Secretary of State is akin to Form 3533-B in that both require accurate business location information. The Statement of Information, which must be filed by most entities doing business in California, collects various data point including the business address, just as Form 3533-B collects updated address information for tax purposes.

Form 1099-MISC, "Miscellaneous Income", has an indirect relation to Form 3533-B as accurate address information ensures proper delivery of this form to businesses or individuals who need to report miscellaneous income. By updating an address with Form 3533-B, entities in California ensure they receive their Form 1099-MISC and other tax-related documents at the right location.

Form 568, "Limited Liability Company Return of Income", also interacts closely with Form 3533-B, as any Limited Liability Company (LLC) that needs to update its address would use Form 3533-B to ensure that information on Form 568 is sent to the correct location. This connection highlights the issue of having updated logistical data for tax compliance.

The "Business License Application" forms that various cities within California use for licensing also relate to Form 3533-B. These forms collect business address information as part of the application process. Keeping this information updated with Form 3533-B ensures that tax records and business license records are consistent, which is crucial for regulatory compliance.

California's "Employer's Registration Form" (Form DE-1), used to register with the Employment Development Department, necessitates current business address information, similar to Form 3533-B. By maintaining updated address records, businesses ensure compliance not just with tax authorities but also with employment regulations.

Lastly, Form 540, "California Resident Income Tax Return," although primarily for individuals, can relate to Form 3533-B through scenarios where individuals act as representatives of estates or trusts. Updating an entity’s address with Form 3533-B ensures clear communication paths for tax matters associated with Form 540 filings relevant to estates or trusts.

Dos and Don'ts

When filling out the California Form 3533-B, which is used for changing an address for businesses, exempt organizations, estates, and trusts, it's important to follow certain guidelines to ensure the process is completed accurately and effectively. Below are nine key things one should and shouldn't do when completing this form:

- Do: Review the form thoroughly before you start filling it out. This helps in understanding what information is required.

- Do: Ensure you have the correct form version. The form is updated regularly, so using the most recent version is essential for processing your address change correctly.

- Do: Fill out all required fields with accurate information to prevent processing delays or other issues.

- Do: Include your California corporation number, the California Secretary of State file number, and the Federal Employer Identification Number (FEIN) for identity verification purposes.

- Do: Provide both the old and new addresses in full, including any suite or room numbers, to ensure that the change is applied correctly.

- Don't: Attach this form to your tax return. It is processed separately and should be sent to the appropriate department as indicated in the form's instructions.

- Don't: Use a PO Box for the new mailing address unless you have followed the specific instructions on the form related to PO Boxes.

- Don't: Skip signing the form. The signature of the owner, officer, or authorized representative is crucial for the form's validity.

- Don't: Leave the date and title fields blank beside the signature. These provide additional verification of who completed the form and when it was completed.

Completing the form carefully and following these guidelines can make the process smoother and ensure that your business or organization's address change is processed in an efficient and timely manner.

Misconceptions

When dealing with the California Form 3533-B, a plethora of misconceptions can cloud understanding and lead to unnecessary mistakes. This form is essential for businesses, exempt organizations, estates, and trusts in California that need to update their mailing or location addresses with the state's tax authorities. Here are ten common misconceptions about the Form 3533-B and the clarifications that aim to demystify them.

It's mandatory to attach this form to your tax return: Contrary to this belief, the form explicitly instructs not to attach it to your tax return. Its sole purpose is to notify the California Franchise Tax Board about a change in address.

Only businesses need to file this form: This is a misconception. Not only businesses but also exempt organizations, estates, and trusts that file specific tax returns, such as Forms 100, 100S, 100W, 109, 199, 541, 565, or 568, are required to use this form for address changes.

The form is complicated to fill out: Despite appearing complex, the form simply asks for crucial information regarding the old and new addresses, plus identification numbers that help the California Franchise Tax Board process the change efficiently.

Any changes in address can be reported informally: The formal process involves completing and submitting Form 3533-B to ensure the change is officially recorded. Informal reports of an address change might not be recognized, potentially leading to missed correspondence from the tax board.

This form is also for changing the business name: Form 3533-B is strictly for updating address information. Changes to your business or organization's name require a different process through the California Secretary of State.

Email or phone notifications are sufficient for address changes: Although modern communication methods are convenient, California law requires this specific form to document address changes officially to ensure they are accurately recorded in the state's tax system.

Only the business owner can sign the form: This is not the case. The form can be signed by an owner, officer, or authorized representative, ensuring flexibility and convenience in adhering to administrative requirements.

PO Boxes are not allowed: The form does accept PO Boxes as mailing addresses, but it includes specific instructions for their use to ensure clarity and compliance with mailing standards.

Filing this form changes your address for all state correspondence: Form 3533-B is specific to the California Franchise Tax Board. Other state departments may require separate notifications to update your address in their records.

There's no need to update foreign addresses: If your business or organization has a foreign address that has changed, California still requires you to update it using Form 3533-B, ensuring the state has the correct details for all tax-related correspondence.

Understanding these aspects of the Form 3533-B can help businesses, exempt organizations, estates, and trusts manage their correspondence with the California Franchise Tax Board more effectively, avoiding common pitfalls and ensuring compliance with state requirements.

Key takeaways

If you're handling tax matters for a business, exempt organization, estate, or trust in California, you may need to fill out the California Form 3533-B. This form is designed to facilitate the process of updating the mailing or location address with the California Franchise Tax Board. Here are seven key takeaways to guide you through this process:

- Applicability: Form 3533-B should be used if you are updating the address associated with business, exempt organization, estate, or trust income tax returns. This includes Forms 100, 100S, 100W, 109, 199, 541, 565, or 568.

- Do Not Attach: It’s important to remember not to attach this form to your tax return. Instead, complete and submit it as a standalone document to ensure the correct processing of your address change.

- When to Use: Whenever there is a change in your business mailing address or the location address, Form 3533-B is the required document to officially make this update with the tax authorities.

- Information Required: You will need to provide several pieces of information, including your California corporation number or Secretary of State file number, Federal Employer Identification Number (FEIN), and both your old and new addresses.

- PO Boxes and Foreign Addresses: If you’re using a PO Box or have a foreign address, there are specific instructions on the form that you need to follow. Ensure that these are reviewed carefully to avoid any delay or issues with the form’s processing.

- Signing the Form: The form must be signed by an owner, officer, or authorized representative of the entity making the address change. This is a crucial step to certify that the information provided is accurate and authorized by the business or organization.

- Updating Additional Information: If there are any changes to additional information about your business, such as contact details or business activities, make sure to include this on the form as per the instructions. This can help keep all records up to date and ensure smooth communications and filings in the future.

In summary, Form 3533-B serves as a critical tool for businesses and other organizations in California to manage their address information for tax purpose. By following these key points, you can ensure that your form is filled out correctly and submitted properly, maintaining compliance with the state's tax requirements.

Different PDF Templates

Get Drivers License Online - Navigate the renewal process for your California Identification Card with this easy guide.

California Principal Business Activity Code - Specific sections on the 100X form allow for detailed explanations of changes, requiring corporations to document the rationale and calculations behind each amendment fully.

Mechanics Lien California - This form acts as a powerful tool for unpaid contractors and suppliers, providing a legal pathway to secure and recover debts.