Fill a Valid California 3540 Form

The California 3540 form, known as the Credit Carryover Summary, plays a pivotal role for taxpayers in managing their financial responsibilities to the state. It is specifically designed to facilitate the calculation of prior year credit carryovers from a range of repealed tax credits that no longer have dedicated forms. This form becomes relevant when taxpayers have remaining credits after the repeal dates of certain credits but owe them to carryover provisions, allowing these credits to still be claimed. For instance, credits related to agricultural products, commercial solar electric systems, employee ridesharing, and even specific investments like the Manufacturing Investment Credit (MIC) against the alternative minimum tax (AMT) for corporations highlight the form's broad application. Beyond its primary function, the form also outlines the possibility of assigning credits within affiliated corporations, a strategy that became possible for tax years starting after July 1, 2008, offering strategic tax planning opportunities for combined reporting groups. Taxpayers are reminded of the importance of maintaining previous tax returns and relevant documentation to substantiate their claims. Additionally, the form lays out specific limitations that ensure credits cannot be applied retroactively or reduce certain minimum taxes, thus ensuring clarity and compliance in its utilization. This adherence to fine details and procedural requirements underscores the form’s value in navigating the complexities of tax liability and strategic financial planning for both individuals and corporations within California.

Document Example

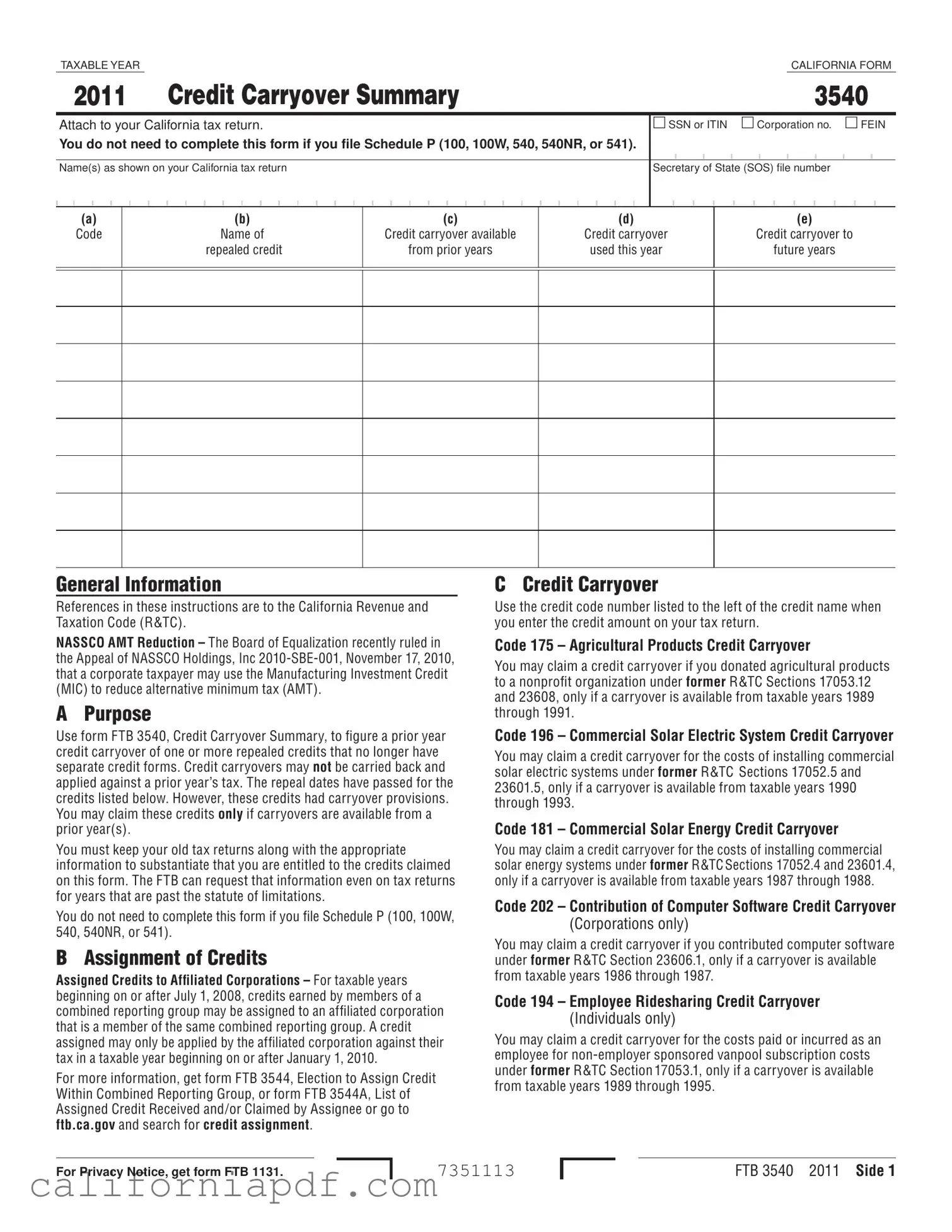

TAXABLE YEARCALIFORNIA FORM

2011 |

Credit Carryover Summary |

3540 |

Attach to your California tax return. |

SSN or ITIN Corporation no. FEIN |

|

You do not need to complete this form if you file Schedule P (100, 100W, 540, 540NR, or 541).

Name(s) as shown on your California tax return |

Secretary of State (SOS) file number |

(a)

Code

(b)

Name of repealed credit

(c)

Credit carryover available

from prior years

(d)

Credit carryover

used this year

(e)

Credit carryover to

future years

General Information

References in these instructions are to the California Revenue and Taxation Code (R&TC).

NASSCO AMT Reduction – The Board of Equalization recently ruled in the Appeal of NASSCO Holdings, Inc

A Purpose

Use form FTB 3540, Credit Carryover Summary, to figure a prior year credit carryover of one or more repealed credits that no longer have separate credit forms. Credit carryovers may not be carried back and applied against a prior year’s tax. The repeal dates have passed for the credits listed below. However, these credits had carryover provisions. You may claim these credits only if carryovers are available from a prior year(s).

You must keep your old tax returns along with the appropriate information to substantiate that you are entitled to the credits claimed on this form. The FTB can request that information even on tax returns for years that are past the statute of limitations.

You do not need to complete this form if you file Schedule P (100, 100W, 540, 540NR, or 541).

B Assignment of Credits

Assigned Credits to Afiliated Corporations – For taxable years beginning on or after July 1, 2008, credits earned by members of a combined reporting group may be assigned to an affiliated corporation that is a member of the same combined reporting group. A credit assigned may only be applied by the affiliated corporation against their tax in a taxable year beginning on or after January 1, 2010.

For more information, get form FTB 3544, Election to Assign Credit Within Combined Reporting Group, or form FTB 3544A, List of Assigned Credit Received and/or Claimed by Assignee or go to ftb.ca.gov and search for credit assignment.

C Credit Carryover

Use the credit code number listed to the left of the credit name when you enter the credit amount on your tax return.

Code 175 – Agricultural Products Credit Carryover

You may claim a credit carryover if you donated agricultural products to a nonprofit organization under former R&TC Sections 17053.12 and 23608, only if a carryover is available from taxable years 1989 through 1991.

Code 196 – Commercial Solar Electric System Credit Carryover

You may claim a credit carryover for the costs of installing commercial solar electric systems under former R&TC Sections 17052.5 and 23601.5, only if a carryover is available from taxable years 1990 through 1993.

Code 181 – Commercial Solar Energy Credit Carryover

You may claim a credit carryover for the costs of installing commercial solar energy systems under former R&TC Sections 17052.4 and 23601.4, only if a carryover is available from taxable years 1987 through 1988.

Code 202 – Contribution of Computer Software Credit Carryover

(Corporations only)

You may claim a credit carryover if you contributed computer software under former R&TC Section 23606.1, only if a carryover is available from taxable years 1986 through 1987.

Code 194 – Employee Ridesharing Credit Carryover

(Individuals only)

You may claim a credit carryover for the costs paid or incurred as an employee for

For Privacy Notice, get form FTB 1131.

7351113

FTB 3540 2011 Side 1

Code 191 – Employer Ridesharing Credit Carryover (Large)

You may claim a credit carryover for the cost of sponsoring a ridesharing program for your employees or for operating a private,

Use Code 191 if, in the year(s) in which the credit was generated, your available credit was computed using the Large Employer Program because you were an employer with 200 or more employees.

Code 192 – Employer Ridesharing Credit Carryover (Small)

You may claim a credit carryover for the cost of sponsoring a ridesharing program for your employees or for operating a private,

Use Code 192 if, in the year(s) in which the credit was generated, your available credit was computed using the Small Employer Program because you were an employer with fewer than 200 employees.

Code 193 – Employer Ridesharing Credit Carryover

(Transit Passes)

You may claim a credit carryover for the costs paid or incurred for providing subsidized public transit passes to your employees under former R&TC Sections 17053 and 23605, only if a carryover is available from taxable years 1989 through 1995.

Code 182 – Energy Conservation Credit Carryover

You may claim a credit carryover for the costs of installing energy conservation measures under former R&TC Sections 17052.4, 17052.8, and 23601.5, only if a carryover is available from taxable years 1981 through 1986.

Code 207 – Farmworker Housing Credit Carryover – Construction

You may claim a credit carryover for the eligible costs to construct or rehabilitate qualified farmworker housing under former R&TC Sections 17053.14 and 23608.2 only if a carryover is available from taxable years 1997 through 2008.

Code 215 – Joint Strike Fighter Credit Carryover — Wages

You may claim a credit carryover for the percentage of qualified wages paid or incurred for qualified employees under former R&TC Sections 17053.36 and 23636, only if the carryover is available from taxable years 2001 through 2005.

Limitation: The credit may be carried forward for up to eight years from the year in which the credit was incurred, or until exhausted, whichever occurs first.

Code 216 – Joint Strike Fighter Credit Carryover — Property Costs

You may claim a credit carryover for the qualified cost to manufacture qualified property placed in service in California under former R&TC Sections 17053.37 and 23637, only if the carryover is available from taxable years 2001 through 2005.

Limitation: The credit may be carried forward for up to eight years from the year in which the credit was incurred, or until exhausted, whichever occurs first.

Code 159 – Los Angeles Revitalization Zone (LARZ) Hiring Credit Carryover & Sales or Use Tax Credit Carryover

You may claim a credit carryover for the following:

•Qualified wages paid to qualified employees under former

R&TC Sections 17053.10, 17053.17, 23623.5, and 23625, only if a carryover is available from taxable years 1992 through 1997.

•Sales or use tax paid or incurred on qualified property under former R&TC Sections 17052.15 and 23612.6, only if a carryover is available from taxable years 1992 through 1997.

The amount of credit carryover you may claim for the LARZ hiring credit and LARZ sales or use tax credit is limited by the amount of tax on business income attributable to the former LARZ. Get form FTB 3806, Los Angeles Revitalization Zone Business Booklet, to determine the amount of credit carryover you may claim.

Code 160 –

You may claim a credit carryover for the amount that was authorized by the CA Energy Commission under former R&TC Sections 17052.11 and 23603, only if a carryover is available from taxable years 1991 through 1995.

Code 199 – Manufacturers’ Investment Credit (MIC)

You may claim a credit carryover for the qualified costs paid or incurred for acquiring, constructing, or reconstructing qualified properties under Cal. Code Regs., tit. 18, sections

Limitation: The credit may generally be carried over for a maximum of eight years. However, if the qualified taxpayer met the definition of a small business as of the last day of the taxable year in the year the credit was allowed, then the credit may be carried over for ten years.

Even though the cost to construct or acquire the property may have been paid or incurred during 2003 or prior years, if the property was not placed in service before January 1, 2004, none of those costs are qualified costs for the credit.

Code 185 – Orphan Drug Credit Carryover

You may claim a credit carryover for expenses related to qualified clinical testing under former R&TC Sections 17057 and 23609.5, only if a carryover is available from taxable years 1987 through 1992.

Code 184 – Political Contributions Credit Carryover

(Individuals only)

You may claim a credit carryover for political contributions you made prior to January 1, 1992, under former R&TC Section 17053.14, only if a carryover is available from taxable years 1987 through 1991.

The political contribution credit was the smaller of one of the following:

•25% (.25) of the amount contributed.

•$50 ($25 for married filing separately and single).

Code 174 – Recycling Equipment Credit Carryover

You may claim a credit carryover for the purchase of qualified recycling equipment, which was certified by the California Integrated Waste Management Board, under former R&TC Sections 17052.14 and 23612.5, only if a carryover is available from taxable years 1989 through 1993.

Code 186 – Residential Rental and Farm Sales Credit

Carryover (Individuals Only)

You may claim a credit carryover if you had a gain from the sale of residential rental or farm property under former R&TC Section 17061.5, only if a carryover is available from taxable years 1987 through 1991.

Code 206 – Rice Straw Credit Carryover

You may claim a credit carryover for the purchase of rice straw grown in California under former R&TC Sections 17052.10 and 23610, only if a carryover is available from taxable years 1997 through 2007.

Limitation: The credit may be carried forward for up to ten years from the year in which the credit was incurred, or until exhausted, whichever occurs first.

Side 2 FTB 3540 Instructions 2011

Code 171 – Ridesharing Credit Carryover

You may claim a credit carryover for the cost of sponsoring a ridesharing program for your employees, or for operating a private,

Use Code 171 only for employer ridesharing credit carryovers from

Code 200 – Salmon and Steelhead Trout Habitat Restoration

You may claim a credit carryover for the cost associated with salmon and steelhead trout habitat restoration and improvement projects under former R&TC Sections 17053.66 and 23666, only if a carryover is available from taxable years 1995 through 1999.

The credit amount is the lesser of 10% of qualified costs, or other amounts determined by the California Department of Fish and Game.

Code 180 – Solar Energy Credit Carryover

You may claim a credit carryover for the costs of installing solar energy systems under former R&TC Sections 17052.5 and 23601, only if a carryover is available from taxable years 1985 through 1988.

Code 179 – Solar Pump Credit Carryover

You may claim a credit carryover for the cost of installing a solar pump system under former R&TC Sections 17052.1, 17052.4, 17052.8,

and 23607, only if a carryover is available from taxable years 1981 through 1983.

Code 217 – Solar or Wind Energy System Credit Carryover

You may claim a credit carryover for the purchase and installation costs of a solar energy or wind energy system installed on California property under former R&TC Sections 17053.84 and 23684, from taxable years 2001 through 2005.

Limitation: The credit may be carried forward for up to eight years from the year in which the credit was incurred, or until exhausted, whichever occurs first.

Code 201 – Technological Property Contribution Credit

Carryover (Corporations only)

You may claim a credit carryover if you contributed technological property under former R&TC Section 23606, only if a carryover is available from taxable years 1983 through 1984.

Code 178 – Water Conservation Credit Carryover

(Individuals, Estates, and Trusts only)

You may claim a credit carryover for the costs of installing water conservation measures under former R&TC Section 17052.8, only if a carryover is available from taxable years 1980 through 1982.

Code 161 – Young Infant Credit Carryover (Individuals Only)

You may claim a credit carryover for a dependent under 13 months of age under former R&TC Section 17052.20, only if a carryover is available from taxable years 1991 through 1993.

D Limitations

In general, a credit carryover cannot reduce the minimum franchise tax (corporations and S corporations) and the annual tax (limited partnerships, limited liability companies (LLCs) classified as partnerships, limited liability partnerships), the alternative minimum tax (corporations, exempt organizations, individuals, and fiduciaries), the

Alternative Minimum Tax (AMT) may be reduced by the following credit carryovers: solar energy credit, commercial solar energy credit and the manufacturing investment credit (MIC). However, the MIC carryover may only reduce the alternative minimum tax (AMT) for corporations. Get Schedule P (100, 100W, 540, 540NR, or 541).

If the available credit carryover for the current taxable year exceeds the current year tax, any unused amount may be carried over to succeeding years unless the credit carryover period has expired. Apply the carryover to the earliest taxable year(s) possible.

In no event can a credit carryover be carried back and applied against a prior year’s tax.

Single Member LLCs (SMLLC)

If a taxpayer owns an interest in a disregarded business entity [a single member limited liability company (SMLLC) not recognized by California, and for tax purposes treated as a sole proprietorship owned by an individual or a branch owned by a corporation], the credit amount received from the disregarded entity that can be utilized is limited to the difference between the taxpayer’s regular tax figured with the income of the disregarded entity, and the taxpayer’s regular tax figured without the income of the disregarded entity.

An SMLLC may be disregarded as an entity separate from its owner, and is subject to statutory provisions that recognize otherwise disregarded entities for certain tax purposes. Get Form 568, Limited Liability Company Income Tax Booklet.

If the disregarded entity reports a loss, the taxpayer may not claim the credit this year, but can carry over the credit amount received from the disregarded entity.

Specific Column Instructions

Column (a) – Enter the code number from the instructions for the carryover credit(s) you are eligible to claim.

Column (b) – Enter the name of repealed credit from the instructions for the carryover credit(s) you are eligible to claim.

Column (c) – Enter the amount of credit carryover available from prior years. This amount is on the prior year credit form or statement that you attached to your previous year’s tax return. This amount may also be on the prior year Schedule P (100, 100W, 540, 540NR, or 541), under Credit Carryover, column (d).

Column (d) – Enter the amount of credit carryover claimed on your current year tax return. The credit carryover amount you can claim on your tax return may be limited by tentative minimum tax or your tax liability. Refer to the credit instructions in your tax booklet to determine the amount of credit carryover you can claim and for information on claiming the credit carryover on your tax return. Also see General Information D, Limitations.

Column (e) – Subtract the amount in column (d) from the amount in column (c). Enter the result in column (e). This is the amount of credit that can be carried over to future years. To see if the credit is limited, see General Information D, Limitations.

FTB 3540 Instructions 2011 Page 3

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Form 3540 | Form 3540, Credit Carryover Summary, is used to figure a prior year credit carryover for various repealed credits in California, allowing taxpayers to claim credits from previous years. | (

| Governing Law | The form and its instructions refer to the California Revenue and Taxation Code (R&TC), which provides the legal basis for credit carryovers. |

| Assignment of Credits | For taxable years beginning after July 1, 2008, credits earned by members of a combined reporting group can be assigned to an affiliated corporation within the same group, applicable for tax years starting on or after January 1, 2010. |

| Credit Types | The form covers various types of credits such as energy conservation, commercial solar energy, ridesharing, and more, each having specific codes and requirements for claiming carryover amounts. |

| Limitations and AMT | Credit carryovers cannot reduce certain taxes like the minimum franchise tax, annual tax, alternative minimum tax (except for specific credits like the manufacturing investment credit), built-in gains tax, or the excess net passive income tax. |

How to Write California 3540

When filling out the California Form 3540, also known as the Credit Carryover Summary, it's crucial to have your tax information from previous years accessible. This form plays an important role for individuals and corporations aiming to apply their past credit carryovers to their current year's tax obligations. Compiling and calculating the data accurately ensures that all eligible carryover credits are applied, potentially reducing the current year's tax liability. Follow these steps meticulously to complete Form 3540 correctly.

- Begin by identifying the Taxable Year at the top of the form. This should be the current year you are filing your taxes for.

- Next, choose the appropriate identifier for who is filling out the form by marking either the SSN (Social Security Number), ITIN (Individual Taxpayer Identification Number), Corporation no., or FEIN (Federal Employer Identification Number) box.

- Enter the Name(s) as shown on your California tax return. Ensure this matches exactly to avoid any processing delays.

- If applicable, fill in the Secretary of State (SOS) file number.

- For Column (a), input the code number for the carryover credit(s) you plan to claim. Refer to the instruction section to find the right code for your specific credit(s).

- In Column (b), write the name of the repealed credit(s) corresponding to the codes you entered in Column (a).

- Column (c) requires you to enter the amount of credit carryover available from prior years. This information would be on the prior year credit form or statement attached to your previous year's tax return or potentially on the prior year Schedule P under Credit Carryover, column (d).

- For Column (d), input the amount of the credit carryover you're claiming on your current year tax return. Note, the amount of credit you can claim may be subject to limitations based on tentative minimum tax or your tax liability. Refer to your tax booklet or the Limitations section in General Information D for guidance.

- Calculate the difference between the amounts in Columns (c) and (d) and enter this figure in Column (e). This figure represents the amount of credit that can be carried over to the next year. To determine if this carryover is limited, consult the Limitations in General Information D.

After the form is fully completed and double-checked for accuracy, attach it to your California tax return. It's a good practice to keep a copy of this form with your tax records. Should the Franchise Tax Board request information on your claimed credits, having this form readily available will streamline the process.

Listed Questions and Answers

What is California Form 3540?

California Form 3540, Credit Carryover Summary, allows taxpayers to report carryovers of certain repealed tax credits that no longer have separate forms. It is attached to the taxpayer's California tax return to claim credits from prior years under specific repealed provisions.

Who needs to complete Form 3540?

Form 3540 should be completed by individuals or entities that have carryover amounts from specified repealed tax credits and want to apply those amounts against their current year's tax liability. Taxpayers filing Schedule P (100, 100W, 540, 540NR, or 541) do not need to complete this form.

Can Form 3540 be used to carry back credits to a prior year?

No, credit carryovers reported on Form 3540 cannot be applied to taxes from previous years. They can only be carried forward to offset tax liabilities in future years.

What credits can be reported on Form 3540?

Form 3540 covers a variety of repealed credits provided they still have eligible carryover amounts. These include, but are not limited to, credits for agricultural products, commercial solar electric systems, employee ridesharing, energy conservation, and more.

How can credits be assigned to affiliated corporations?

For taxable years starting on or after July 1, 2008, members of a combined reporting group can assign credits earned to another affiliated corporation within the same group. The assigned credits can only be applied against the affiliated corporation's tax for years beginning on or after January 1, 2010. Forms FTB 3544 or FTB 3544A should be used for credit assignments.

What limitations apply to credit carryovers?

Credit carryovers on Form 3540 cannot reduce the minimum franchise tax for corporations, the annual tax for certain partnerships and LLCs, the alternative minimum tax (AMT) for specific credits, or other special taxes. AMT can only be reduced by certain credits like the manufacturing investment credit for corporations.

How long can credits be carried over?

The carryover period varies by credit type, generally ranging from around 5 to 10 years, with some credits having specific expiration or exhaustion requirements. Readers should consult the form or tax professionals for details on specific credits.

What documentation is needed to support credit carryovers on Form 3540?

Taxpayers should maintain their old tax returns and any relevant documents to substantiate the credit amounts claimed on Form 3540. The Franchise Tax Board may request these documents, even for years beyond the statute of limitations.

How does the assignment of credits work for combined reporting groups?

Credits earned by a member of a combined reporting group can be assigned to another member within the same group. This allows for more flexible use of credits to offset tax liabilities across affiliated corporations. Detailed instructions and forms for credit assignment can be found on the Franchise Tax Board's website.

Where can additional information and assistance be found?

For more details on filling out Form 3540, taxpayers can visit the California Franchise Tax Board’s website at ftb.ca.gov. Additional resources, including forms and instructional materials, are available to guide taxpayers through the process.

Common mistakes

Filling out tax forms can sometimes feel like navigating through a maze. The California Form 3540, or the Credit Carryover Summary, is no exception. Here, we'll explore common mistakes people make when completing this form. By being mindful of these errors, taxpayers can ensure they're maximizing their potential benefits while staying compliant with state tax laws.

- Not Attaching Required Documentation: It’s crucial to attach all prior year tax returns and any other documents that substantiate the credits being claimed. Failure to do so could lead to disqualification of those credits.

- Entering Incorrect Credit Codes: Each credit has a specific code number listed in the instructions. Using the wrong code can lead to processing delays or denial of the credit.

- Miscalculating Carryover Amounts: Column (c) should only include carryover amounts that are truly available from prior years. Overestimating these amounts could result in inaccuracies on your return.

- Incorrect Calculation of Current Year's Credit Usage: The amount of credit carryover used in the current year (column d) must be accurately calculated within the constraints of your tax liability and any applicable limitations.

- Failure to Properly Calculate Future Carryover: The amount left over for future carryover (column e) is a simple subtraction, but getting the numbers wrong in preceding columns can throw this off.

- Overlooking Assignment of Credits: For taxable years beginning after July 1, 2008, credits earned by members of a combined reporting group may be assigned. Ignoring this option could mean missing out on strategic tax advantages.

- Forgetting About the Limitations: There are several limitations on how credits can be applied, including the minimum franchise tax and the alternative minimum tax, among others. Not accounting for these can lead to miscalculated carryovers.

- Not Checking for AMT Exceptions: Some credits, like the Manufacturing Investment Credit (MIC), can reduce Alternative Minimum Tax (AMT) for corporations. Neglecting to apply these exceptions can lead to paying more tax than necessary.

By avoiding these eight common mistakes, taxpayers can more effectively navigate the complexities of Form 3540, ensuring they fully leverage their credit carryovers. Remember, when in doubt, referencing the official instructions or consulting with a tax professional can provide clarity and prevent costly errors.

Documents used along the form

When dealing with taxes in California, especially regarding carryover credits, there are several important documents and forms that are often used alongside the California Form 3540, Credit Carryover Summary. Form 3540 is specifically designed for reporting prior year credit carryovers of repealed credits. Its purpose is detailed, aiming to ensure taxpayers can claim credits no longer directly supported by ongoing forms due to their repeal, but for which carryover provisions allow for their current application. Understanding the suite of documents that typically accompany or relate to Form 3540 can simplify the tax filing process and ensure compliance.

- Form 568, Limited Liability Company Income Tax Booklet: This booklet includes necessary forms and instructions for single-member LLCs and multi-member LLCs filing in California. It's critical for understanding how LLC income is taxed and how credits can be applied.

- Schedule P (100, 100W, 540, 540NR, or 541): These schedules are used for calculating alternative minimum tax (AMT) and credit limitations, including determining how carryovers reduce AMT.

- Form 3544, Election to Assign Credit Within Combined Reporting Group: This form is used by members of a combined reporting group to assign credits to an affiliated corporation within the same group. It directly relates to the credit carryover process.

- Form 3544A, List of Assigned Credit Received and/or Claimed by Assignee: Accompanying Form 3544, this document lists the credits assigned and claimed, which is essential for proper tax credit allocation and carryover documentation.

- Form 3806, Los Angeles Revitalization Zone Business Booklet: Essential for businesses operating in the Los Angeles Revitalization Zone, this booklet helps in calculating credit carryovers specific to this zone.

- Form FTB 1131, Privacy Notice on Collection: This notice provides information on the collection and use of personal information by the Franchise Tax Board, vital for understanding privacy rights.

- California Revenue and Taxation Code (R&TC): While not a form, the R&TC is critical for understanding the legal provisions underpinning tax credits and carryovers in California.

- Previous year tax returns and credit forms/statements: These documents are necessary to substantiate the credit carryover amounts claimed on Form 3540. They provide a historical record of credits generated, used, and carried over.

For taxpayers in California, efficiently managing and claiming credit carryovers can significantly impact tax liabilities. Familiarity with these documents and forms ensures that taxpayers can navigate the complexities of California's tax system, maximize their eligible credits, and maintain compliance. By understanding the intricacies of these documents, taxpayers can make informed decisions and streamline their tax filing process.

Similar forms

The California Form 3540, Credit Carryover Summary, shares utilities and features with several other forms designed for tax and financial purposes across various states and federal systems. Each analogue serves a unique function but operates within the same umbrella of tracking, reporting, or utilizing fiscal credits, losses, and benefits, illustrating the interconnected nature of tax documentation.

Form 3800, General Business Credit, utilized by the IRS, parallels the California Form 3540 in its purpose of managing and claiming various business-related tax credits that companies can carry over to future years. Both forms aggregate eligible credits, ensuring taxpayers do not lose out on financial benefits over time, despite Form 3800 having a broader scope on a federal level.

Schedule D (Form 1040), Capital Gains and Losses, although primarily focused on reporting gains and losses from assets, shares conceptual similarities with Form 3540. By allowing the carryover of certain losses to subsequent years, akin to the carryover of credits in Form 3540, it enables individuals to mitigate their taxable income, highlighting the flexibility offered in tax reporting and planning.

Form 3468, Investment Credit, is part of the federal tax system and offers businesses an opportunity to claim credits for certain investments, much like California's 3540. Its function of carrying forward unused portions of the credit aligns with 3540’s mechanism for managing credit carryovers, marking a crucial tool for businesses managing investments over multiple years.

California's Form 3806, Los Angeles Revitalization Zone Business Booklet, like Form 3540, is designed to manage specific tax credits related to business activities within a designated area. Both documents emphasize the state's approach to utilizing tax incentives for fostering economic development and individual investments.

Form 8582, Passive Activity Loss Limitations, is another federal form that, while not directly related to tax credits, deals with the carryover concept by limiting the losses that can be deducted in a given year and allowing unused losses to be carried over. This concept mirrors the way credits are managed on Form 3540, pointing to a broader tax principle of optimizing tax liability across years.

Form 8863, Education Credits, used for claiming education-related credits on a federal tax return, and California's Form 3540 both exemplify the government's use of tax credits to incentivize specific economic behaviors. While they address different types of credits, both forms function to reduce taxable income based on past expenditures, reflecting the nuanced approach to educational and business investments in tax policy.

Form 8826, Disabled Access Credit, allows small businesses to claim a credit for expenses incurred in providing access to persons with disabilities. Its focus on carryover credits for accessibility improvements shares the core concept with Form 3540's handling of repealed credit carryovers, illustrating targeted incentives within tax law.

Finally, California's own Form 568, Limited Liability Company Return of Income, contains provisions for credit carryovers similar to those in Form 3540, albeit for a specific business structure. It underlines the continuity in California's tax system regarding the treatment of credits across different entities and tax situations, showcasing the state's comprehensive approach to fiscal management.

Dos and Don'ts

When dealing with the California Form 3540, also known as the Credit Carryover Summary, it’s important to proceed with accuracy and caution. This form is essential for taxpayers in California who are looking to carry over credits from repealed or expired tax credits into their current year tax filing. Below are some do’s and don’ts to help guide you through this process.

- Do thoroughly review your past tax returns. Before filling out Form 3540, make sure to go over your previous tax returns and relevant documentation to confirm the amounts of carryover credits you're entitled to claim.

- Don't guess amounts. Ensure that the credit carryover amounts you enter are accurate and backed by your tax records. Estimating or guessing can lead to errors and possible scrutiny from the Franchise Tax Board (FTB).

- Do double-check the credit codes. Each credit has a specific code number associated with it. Make sure to use the correct code from the instructions for the credits you are claiming.

- Don't overlook the limitation rules. Some credits have specific limitations on how they can be applied, such as those that cannot reduce the minimum franchise tax or annual tax. Be aware of these rules to correctly apply your carryover amounts.

- Do follow the assignment of credits rules if applicable. If you’re part of a combined reporting group, certain credits earned by one member may be assigned to another. Understand the rules and procedures if you’re planning to assign credits.

- Don't forget to attach Form 3540 to your tax return. Once you’ve accurately filled out the form, it must be attached to your California tax return for the credits to be considered.

- Do keep your documentation organized. After filing, organize and safely store all relevant documentation and copies of your tax return. The FTB may request these documents to verify the credits claimed, even for years past the statute of limitations.

Remember, the key to successfully claiming credit carryovers lies in maintaining accurate records and paying close attention to the details of the form. By following these guidelines, you can navigate the complexities of Form 3540 with confidence.

Misconceptions

Understanding the California Form 3540 can be a bit of a labyrinth for those who aren't tax professionals. Here are eight common misconceptions about this form, each clarified to provide you with a clearer view.

All businesses can utilize Form 3540 for credit carryover. This is a misconception. Form 3540 is specifically designed for individuals and entities with certain types of credit carryovers from repealed credits. It's not a one-size-fits-all solution for businesses or individuals looking to carry over general tax credits.

If you file Schedule P, you must fill out Form 3540. Actually, the truth is the opposite. If you file Schedule P (100, 100W, 540, 540NR, or 541), you do not need to complete Form 3540. This stipulation helps avoid redundant reporting for taxpayers.

Form 3540 is only for claiming current year credits. In reality, Form 3540 is used to figure prior year credit carryovers to the current year from specific repealed credits that no longer have their own separate forms. Its primary function is to assist in the carryover process, not to claim new credits.

Credits claimed on Form 3540 can be carried back to prior years. This is not correct. Credits listed on Form 3540 may only be carried forward. They cannot be applied against a prior year’s tax liability. This limitation emphasizes the forward-looking nature of credit carryovers.

There's no need to keep past tax returns once you've claimed a credit on Form 3540. On the contrary, keeping old tax returns and relevant documentation is crucial. The Franchise Tax Board (FTP) may request this information to substantiate credits claimed, even for years that are past the statute of limitations.

Any credit can be assigned to affiliated corporations using Form 3540. This statement is misleading. Only credits earned by members of a combined reporting group, for taxable years beginning on or after July 1, 2008, may be assigned to an affiliated corporation within the same group, and there are restrictions on how these assigned credits can be applied.

The Form 3540 credit carryover can reduce any type of tax. In fact, certain taxes such as the minimum franchise tax, alternative minimum tax, and others cannot be reduced by credit carryovers claimed on Form 3540. There are specific limitations on how these credits can be used, which underscores the need to understand the nuanced rules surrounding them.

All credits on Form 3540 have the same carryover duration. Each credit has specific carryover rules. While some credits may be carried over indefinitely until they are exhausted, others have a finite carryover period, typically up to eight or ten years, depending on the specific credit. This variation requires careful attention to each credit's unique limitations.

By clarifying these misconceptions, taxpayers can navigate Form 3540 with a more accurate understanding of its purpose, requirements, and limitations. Whether you're an individual, a business owner, or a tax professional, staying informed about these details ensures proper compliance and maximizes potential benefits.

Key takeaways

Understanding how to correctly fill out and use the California Form 3540, a Credit Carryover Summary, is essential for taxpayers who are carrying over credits from prior years that no longer have separate forms. Here are five key takeaways for navigating this process effectively:

- Eligibility for Using Form 3540: This form is primarily used to figure a prior year credit carryover for repealed credits without separate forms. It is vital for those who have eligible credits from previous years and intend to apply these carryovers to their current tax liability.

- Mandatory Record Keeping: Taxpayers must keep their old tax returns and relevant documentation to substantiate the credit carryovers they claim. The Franchise Tax Board (FTB) may request this information, even for years that are beyond the statute of limitations, to verify eligibility for claimed credits.

- Restrictions on Credit Application: Credit carryovers cannot be used to reduce certain taxes, including the minimum franchise tax, alternative minimum tax (AMT), and others, although there are exceptions such as the Manufacturing Investment Credit (MIC) for corporations reducing AMT. It's crucial to be aware of these limitations when applying carryover credits.

- Assignment of Credits to Affiliated Corporations: For taxable years starting on or after July 1, 2008, credits earned by members of a combined reporting group can be assigned to an affiliated corporation within the same group. This can only be applied against the tax of the affiliate for taxable years beginning on or after January 1, 2010, expanding the utility of certain credits.

- Calculating and Reporting Credit Carryover: When filling out Form 3540, taxpayers must properly calculate the credit carryover available from previous years, how much is being used in the current year, and the amount to be carried over to future years. Accurate calculation and reporting are essential to maximizing potential tax benefits while ensuring compliance with tax laws.

By closely adhering to these guidelines, taxpayers can effectively leverage Form 3540 to utilize carryover credits, potentially reducing their current year tax liability. However, because the implications of misreporting can be significant, it's important to approach this process with careful attention to detail and an understanding of applicable limitations.

Different PDF Templates

Renew Cosmetology License Ca - California cosmetology license renewal fees are subject to increase if your application is postmarked after your license's expiration date.

Free California Rental Agreement Pdf - An essential tool for simplifying the rental process, this agreement outlines key components such as payment schedules, utility arrangements, and tenant responsibilities.