Fill a Valid California 3541 Form

Exploring the diverse facets of the California Form 3541 can be an illuminating journey for those involved in the motion picture and television production industry within California's vibrant boundaries. This form represents a crucial mechanism for producers and corporations to claim their deserved tax credits, given for eligible productions that meet the state guidelines. Crafted to stimulate the local entertainment industry, the form allows for claiming credits against net and franchise taxes, and uniquely, it encompasses provisions for sales and use taxes as well. At its core, Form 3541 covers the calculation and substantiation of the Motion Picture and Television Production Credit, offering detailed steps for figuring current year generated credits, credit carryovers, credits received from pass-through entities, and purchases or assignments of credits from other entities. The process also includes the option to sell or assign credits, under specific conditions, to unrelated parties or affiliated corporations. Moreover, it caters to both independent filmmakers and large productions, with different credit percentages and limitations applied based on the production's budget and nature. Through the allocation and certification by the California Film Commission, Form 3541 follows a structured approach to ensure that claimed credits are legitimate, traced, and meet the regulatory compliances, ultimately aiming to bolster film and television production within the state while providing financial incentives to those who choose California as their stage.

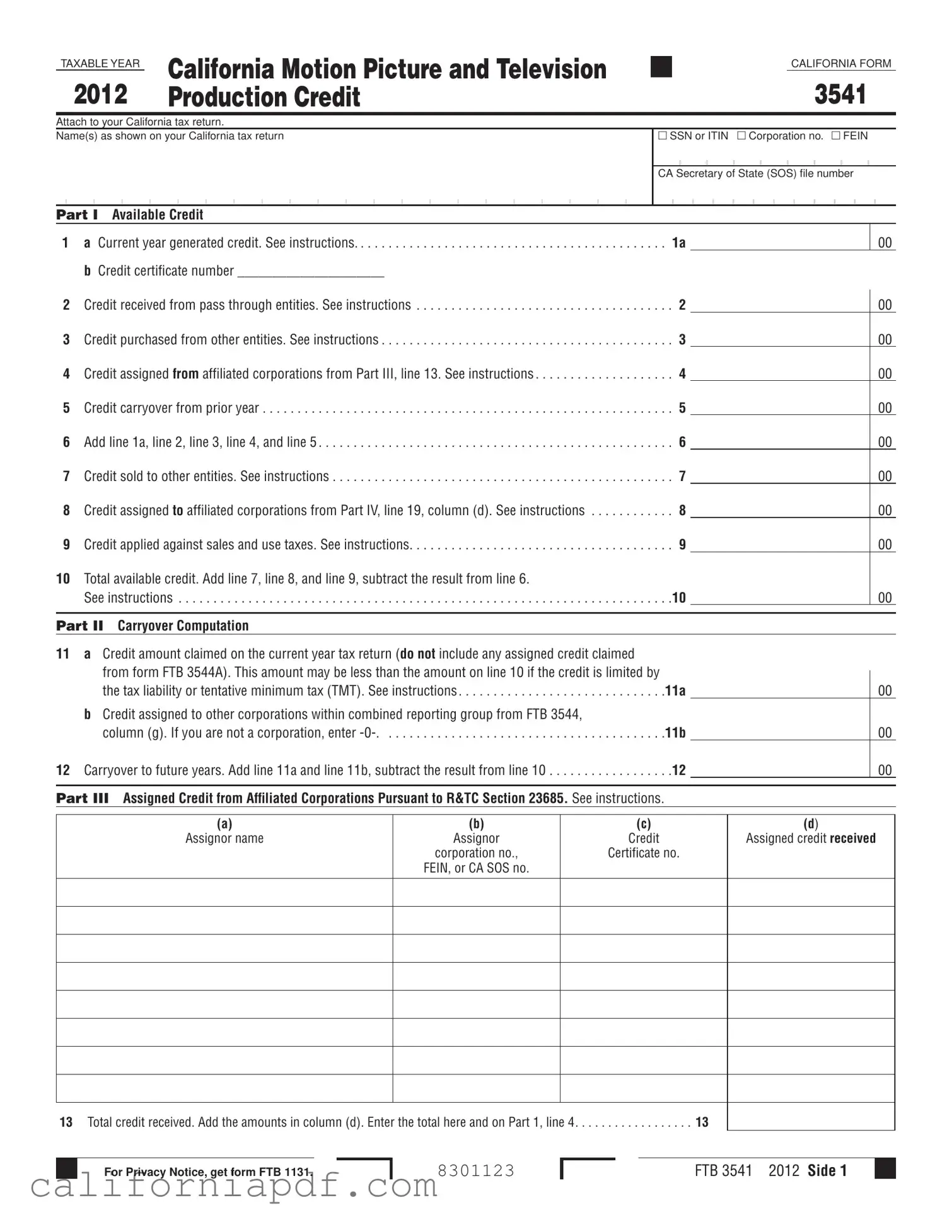

Document Example

TAXABLE YEAR |

|

CALIFORNIA MOTION |

PICTURE AND TELEVISION |

|

|

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

|||||||||||||||||||||||||||

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

3541 |

|

|

|||||||||||||||||||||||||||||||||||||||

|

PRODUCTION CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach to your California tax return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Name(s) as shown on your California tax return |

|

|

|

|

|

|

|

|

|

|

|

SSN or ITIN Corporation no. FEIN |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Secretary of State (SOS) file number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I Available Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

1 a Current year generated credit. See instructions |

1a |

bCredit certificate number _____________________

2 Credit received from pass through entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Credit purchased from other entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 Credit assigned from affiliated corporations from Part III, line 13. See instructions . . . . . . . . . . . . . . . . . . . . 4 5 Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 6 Add line 1a, line 2, line 3, line 4, and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 7 Credit sold to other entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 8 Credit assigned to affiliated corporations from Part IV, line 19, column (d). See instructions . . . . . . . . . . . . 8 9 Credit applied against sales and use taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10Total available credit. Add line 7, line 8, and line 9, subtract the result from line 6.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10

PART II Carryover Computation

11a Credit amount claimed on the current year tax return (do not include any assigned credit claimed

from form FTB 3544A). This amount may be less than the amount on line 10 if the credit is limited by

the tax liability or tentative minimum tax (TMT). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11a

bCredit assigned to other corporations within combined reporting group from FTB 3544,

column (g). If you are not a corporation, enter

12 Carryover to future years. Add line 11a and line 11b, subtract the result from line 10 . . . . . . . . . . . . . . . . . .12

PART III Assigned Credit from Affiliated Corporations Pursuant to R&TC Section 23685. See instructions.

00

00

00

00

00

00

00

00

00

00

00

00

00

(a)

Assignor name

(b)

Assignor

corporation no.,

FEIN, or CA SOS no.

(c)

Credit

Certificate no.

(d)

Assigned credit received

13 Total credit received. Add the amounts in column (d). Enter the total here and on Part 1, line 4. . . . . . . . . . . . . . . . . . 13

For Privacy Notice, get form FTB 1131.

8301123

FTB 3541 2012 Side 1

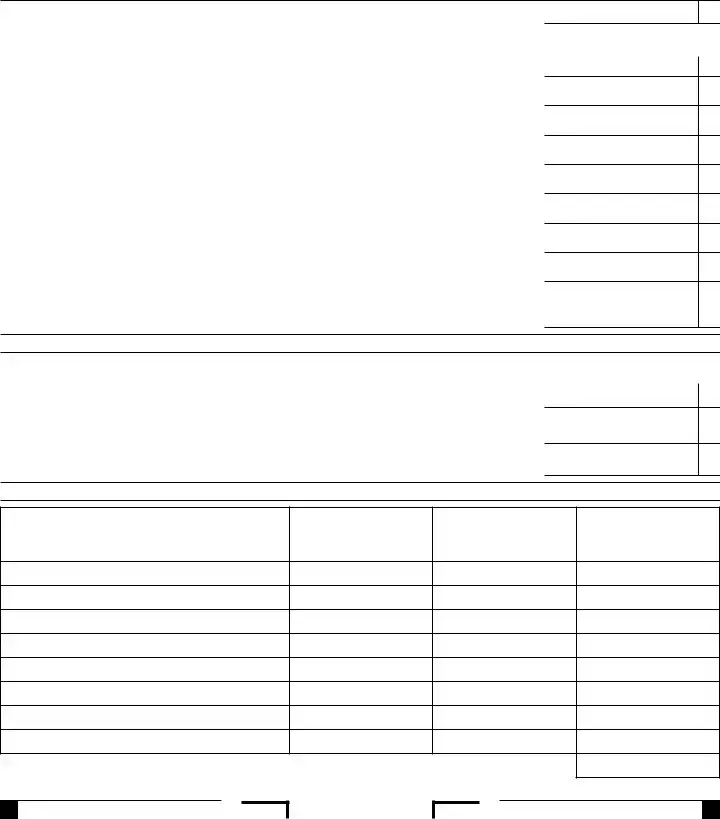

PART IV Credit Assigned to Affiliated Corporations Pursuant to R&TC Section 23685. See instructions.

14 Add line 1a and line 2 from Side 1, Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14

15 Tax liability. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15

16Excess credit available for assigning to affiliated corporations. Subtract line 15 from line 14, enter the

result here and on line 17, column (e). If the result is ‘0’ or less, enter ‘0’. See instructions. . . . . . . . . . . . . .16 This is the maximum amount of credit that may be assigned to affiliated corporations.

00

00

00

Credit Assigned to Affiliated Corporations.

|

(a) |

(b) |

(c) |

(d) |

(e) |

|

Assignee name |

Assignee corp. no., |

Credit |

Amount of |

Credit amount available |

|

|

FEIN, or CA SOS no. |

Certificate no. |

credit assigned |

for assignment |

|

|

|

|

|

|

17 |

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 Add the amounts in column (d). Enter the total here and on Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . 19

Side 2 FTB 3541 2012

8302123

Instructions for Form FTB 3541

California Motion Picture and Television Production Credit

Important Information

California Motion Picture and Television Production Credit. For taxable years beginning on or after January 1, 2011, Revenue & Taxation Code (R&TC) Section 17053.85 and Section 23685 allow a qualified taxpayer a California motion picture and television production credit against the net tax (individuals) or tax (corporations) and/or qualified sales and use tax. The credit, which is allocated and certified by the California Film Commission (CFC), is 20% of expenditures attributable to a qualified motion picture or 25% of production expenditures attributable to an independent film or a television series that relocates to California.

Write “CFC Credit”– Taxpayers attaching form FTB 3541, California Motion Picture and Television Production Credit, to the tax return should write “CFC Credit” in red ink at the top margin of their tax return.

Use of Credit – The credit can be used by the qualified taxpayer to:

•Offset franchise or income tax liability. Use credit code number 223 when claiming this credit.

•Sell to an unrelated party (independent films only).

•Assign to an affiliated corporation.

•Apply against qualified sales and use taxes.

This credit is not refundable.

Sales and Use Taxes – A qualified taxpayer who has been issued a certified Form M, Tax Credit Certificate, from the CFC may make an irrevocable election with the Board of Equalization (BOE) to apply the credit against qualified sales and use taxes. For more information, go to boe.ca.gov and search for ca film.

Credit Assignment – A qualified taxpayer that is a corporation or is taxed as a corporation and whose credit exceeds the tax may elect to assign the credit to an affiliated corporation(s). The election to assign the credit is irrevocable. For more information, see General Information C, Credit Assignment.

Sale of Credit Attributable to an Independent Film – A qualified taxpayer may sell a credit, attributable to an independent film, to an unrelated party once the taxpayer receives Form M from the CFC. The credit can only be sold by the qualified taxpayer that generated the credit (that is a corporation, a Limited liability company (LLC) or partnership taxed as a corporation, or an individual) or by a shareholder, beneficiary, partner, or member who received the credit as their distributive or

Seller – A qualified taxpayer that sells an independent film credit is required to report the gain on the sale of the credit in the amount of the sale price.

Buyer – If the credit was purchased for less than the credit amount stated on Form M, the buyer is required to report income in the amount of the difference between the credit amount claimed on its return and the purchase price.

General Information

A Purpose

Use form FTB 3541 to report the credit for the production of a qualified motion picture in California that was:

•Allocated from the CFC on Form M, Tax Credit Certificate.

•Passed through from S corporations, estates and trusts, partnerships, or limited liability companies (LLCs) taxed as partnerships.

•Purchased from a qualified taxpayer.

•Assigned to or from an affiliated corporation under R&TC Section 23865(c)(1). For more information, see General Information C, Credit Assignment.

•Applied or will be applied against BOE qualified sales and use taxes. For more information, go to boe.ca.gov and search for ca film.

Note: Each entity that received or assigned a motion picture and television production credit from or to another entity within a combined reporting group must complete a separate form FTB 3541.

S corporations, estates and trusts, and partnerships, or LLCs taxed as partnerships should complete form FTB 3541 to figure the amount of credit to

Corporate taxpayers attach this form to Form 100, California Corporation Franchise or Income Tax Return, or Form 100W, California Corporation Franchise or Income Tax Return - Water’s Edge Filers.

Individual taxpayers attach this form to Form 540, California Resident Income Tax Return, or Form 540NR, California Nonresident or

B Definitions

Credit certificate. Credit certificate means the certificate issued by the CFC for the allocation of the credit to a qualified taxpayer.

Qualified taxpayer. Qualified taxpayer means a taxpayer who has paid or incurred qualified expenditures and has been issued a credit certificate by the CFC. In the case of any

Qualified motion picture. Qualified motion picture means a motion picture that is produced for distribution to the general public, regardless of medium. For more information, refer to the R&TC Section 17053.85, Section 23685, or go to film.ca.gov.

Independent film. Independent film means a motion picture with a minimum budget of one million dollars ($1,000,000) and a maximum budget of ten million dollars ($10,000,000) that is produced by a company that is not publicly traded and publicly traded companies do not own, directly or indirectly, more than 25 percent of the producing company.

Television series. Television series means a television series that relocated to California, without regard to episode length or initial media exhibition, that filmed all of its prior season or seasons outside of California and for which the taxpayer certifies that this credit is the primary reason for relocating to California.

Affiliated corporation. Affiliated corporation has the meaning provided in R&TC Section 25110(b), except that “100 percent” is substituted for “more than 50 percent” wherever it appears in the section and “voting common stock” is substituted for “voting stock” wherever it appears in the section. For more information, see General Information C, Credit Assignment.

FTB 3541 Instructions 2012 Page 1

C Credit Assignment

For taxable years beginning on or after January 1, 2011, R&TC Section 23685(c)(1) allows a qualified taxpayer to assign a California motion picture and television production credit to an eligible assignee. The credit must first exceed the tax of the qualified taxpayer (the assignor) for the taxable year in which the credit is to be assigned.

The election to assign any credit is irrevocable. The assignor shall make the election and report the credit assignment by completing Part IV, Credit Assigned to Affiliated Corporations Pursuant to R&TC Section 23685. Once a credit is assigned to an eligible assignee, it cannot be reassigned. The assignor will reduce the credit amount available for assignment by the amount of the credit assigned.

After assignment of an eligible credit, the eligible assignee may use the credit against income tax liability, or apply it against BOE qualified sales and use taxes. Also, the restrictions and limitations that applied to the assignor (entity that originally generated the credit) may apply to the eligible assignee.

There is no requirement of payment or other consideration for assignment of the credit by an eligible assignee to an assignor.

The assignor and the eligible assignee shall maintain the information necessary to substantiate any credit assigned and to verify the assignment and subsequent use of the credit assigned. Lack of substantiation may result in the disallowance of the assignment. The assignor and the eligible assignee shall each be liable for the full amount of any tax, addition to tax, or penalty that results from any disallowance of the credit assigned under R&TC Section 23685. The Franchise Tax Board may collect such amount in full from either the assignor or the eligible assignee.

Note: This credit may also be assigned under the credit assignment rules of R&TC Section 23663. Any portion of the credit assigned under either Section 23663 or 23685 may not be subsequently assigned under either statute. For more information on credit assignment under R&TC Section 23663, get form FTB 3544, Election to Assign Credit Within Combined Reporting Group, and form FTB 3544A, List of Assigned Credit Received and/or Claimed by Assignee.

Assignor. An assignor is the qualified taxpayer that receives Form M from the CFC. The following rules must be met before a credit can be assigned:

•The assignor must be taxed as a corporation.

•The credit must first exceed the “tax” of the assignor for the taxable year in which the credit is to be assigned.

•The eligible assignee must be an affiliated corporation as defined by R&TC Section 23685(c)(1).

Eligible assignee. An eligible assignee is any affiliated corporation, which includes a corporation where one of the following applies:

•Owns, directly or indirectly, 100 percent of the assignor’s voting common stock.

•The assignor owns, directly or indirectly, 100 percent of the voting common stock.

•Is wholly owned by a corporation or individual owning 100 percent of the voting common stock of the assignor, or

•Is a stapled entity as defined in R&TC Section 25105.

D Limitations

The credit cannot reduce the S corporation 1.5%

The credit cannot reduce regular tax below the tentative minimum tax. For more information, get Schedule P (100, 100W, 540, 540NR, or 541), Alternative Minimum Tax and Credit Limitations.

S corporation. If a C corporation has unused credit carryovers when it elects S corporation status, the credit carryovers may not be passed through to the S corporation or the shareholders. For more information, get Schedule C (100S), S Corporation Tax Credits.

Disregarded business entity. If a taxpayer owns an interest in a disregarded business entity [for example, a single member limited liability company (SMLLC), which for tax purposes is treated as a sole proprietorship if owned by an individual or a division if owned by a corporation], the credit amount received from the disregarded entity is limited to the difference between the taxpayer’s regular tax figured with the income of the disregarded entity, and the taxpayer’s regular tax figured without the income of the disregarded entity. If the credit is sold under Section 17053.85(c) or assigned or sold under Section 23685(c) this restriction does not apply.

E Carryover

If the available credit exceeds the current year tax liability or is limited by tentative minimum tax, the unused credit may be carried over for six years or until the credit is exhausted, whichever occurs first. Apply the credit carryover to the earliest taxable year(s) possible. In no event can the credit be carried back and applied against a prior year’s tax.

Retain all records that document this credit and carryover used in prior years. The FTB may require access to these records.

Specific Line Instructions

Part I – Available Credit

Line 1a – Current year generated credit. If you received Form M from CFC, enter the full amount of credit allocated to you by the CFC as shown on Form M. If you received more than one Form M during the taxable year, add the credit amounts from all Form Ms and enter the total on this line. If you received the credit from a pass through entity, purchased the credit from a qualified taxpayer, or received the credit through an assignment from another corporation pursuant to R&TC Section 23685, do not enter the amounts on this line. Instead, enter these amounts on line 2, line 3, or line 4, respectively.

Line 1b – Enter the credit certificate number from Form M for the current year generated credit entered on line 1a. If you reported multiple credits on line 1a, list all credit certificate numbers on this line.

Line 2 – Credit received from pass through entities. Add the

Line 3 – Credit purchased from other entities. Enter the amount of credit purchased from a qualified taxpayer. Do not enter the consideration amount paid for the credit.

Line 4 – Credit assigned from affiliated corporations. If you received an assigned credit from an affiliated corporation pursuant to R&TC Section 23685, complete Part III, Assigned Credit from Affiliated Corporations Pursuant to R&TC Section 23685, and enter the amount from Part III, line 13 on this line.

Line 7 – Credit sold to other entities. Enter the amount of credit sold to an unrelated party from form FTB 3551, box 7 (Total amount of credit being sold).

Line 8 – Credit assigned to affiliated corporations. If you assigned a credit to an affiliated corporation pursuant to R&TC Section 23685, complete Part IV, Credit Assigned to Affiliated Corporations Pursuant to R&TC Section 23685. Enter the amount from Part IV, line 19, on this line.

Line 9 – Credit applied against sales and use taxes. If you applied any portion of the credit against qualified sales and use taxes, enter the amount on this line.

Page 2 FTB 3541 Instructions 2012

Part II – Carryover Computation

Line 11a – Credit amount claimed on the current year tax return. The credit amount you can claim on your tax return may be limited. Refer to the credit instructions in your tax booklet for more information. These instructions also explain how to claim this credit on your tax return. Use credit code number 223 when you claim this credit. Also see General Information D, Limitations.

Line 11b – Credit assigned to other corporations within combined reporting group. If you assigned a credit to an affiliated corporation pursuant to R&TC Section 23663, enter the total credit assigned from form FTB 3544, column (g) on this line.

Part III – Assigned Credit from Affiliated Corporations Pursuant to R&TC Section 23685.

Complete this table if you received credits assigned from an affiliated corporation pursuant to R&TC Section 23685.

Column (a) – Assignor name. Enter the name of the corporation that assigned the credit.

Column (b) – Assignor corporation number , FEIN, or CA SOS number. Enter the California corporation number, FEIN, or CA SOS number of the corporation that assigned the credit.

Column (c) – Credit Certificate number. Enter the credit certificate number from the qualified taxpayer’s (assignor’s) tax credit certificate issued by the CFC.

Column (d) – Assigned credit received. Enter the assigned credit received from the assignor.

Part IV – Credit Assigned to Affiliated Corporations Pursuant to R&TC Section 23685.

Line 15 – Tax liability. Enter on this line the amount from Form 100, California Corporation Franchise or Income Tax Return, or Form 100W, California Corporation Franchise or Income Tax Return —

Line 16 – Excess credit available for assigning to affiliated corporations. Subtract line 15 from line 14. If the result is:

•‘0’ or less, enter ‘0’. Do not complete the Credit Assigned to Affiliated Corporations table. You do not have available credit to assign.

•More than zero, this is the maximum amount of credit that may be assigned to affiliated corporations. Enter the amount on Line 17, column (e).

Complete the Credit Assigned to Affiliated Corporations table under Part IV if you have a balance on line 16 and will assign credits to affiliated corporations pursuant to R&TC Section 23685.

The following instructions are for completing line 18:

Column (a) – Assignee name. Enter the name of the corporation that is receiving a credit assignment from the assignor.

Column (b) – Assignee California corporation number, FEIN, or CA SOS number. Enter the California corporation number, FEIN, or CA SOS number of the corporation that is receiving the credit assignment. If the corporation has applied for but not yet received the California corporation number or FEIN, enter “Applied For” in column (b). If

the corporation is a

Column (c) – Credit Certificate number. Enter the credit certificate number from Form M issued to you by the CFC.

Column (d) – Amount of credit assigned. Enter the amount of credit that is being assigned to an assignee.

Column (e) – Credit Amount available for assignment. Subtract the amount in column (d) from the amount in previous line column (e).

FTB 3541 Instructions 2012 Page 3

Form Breakdown

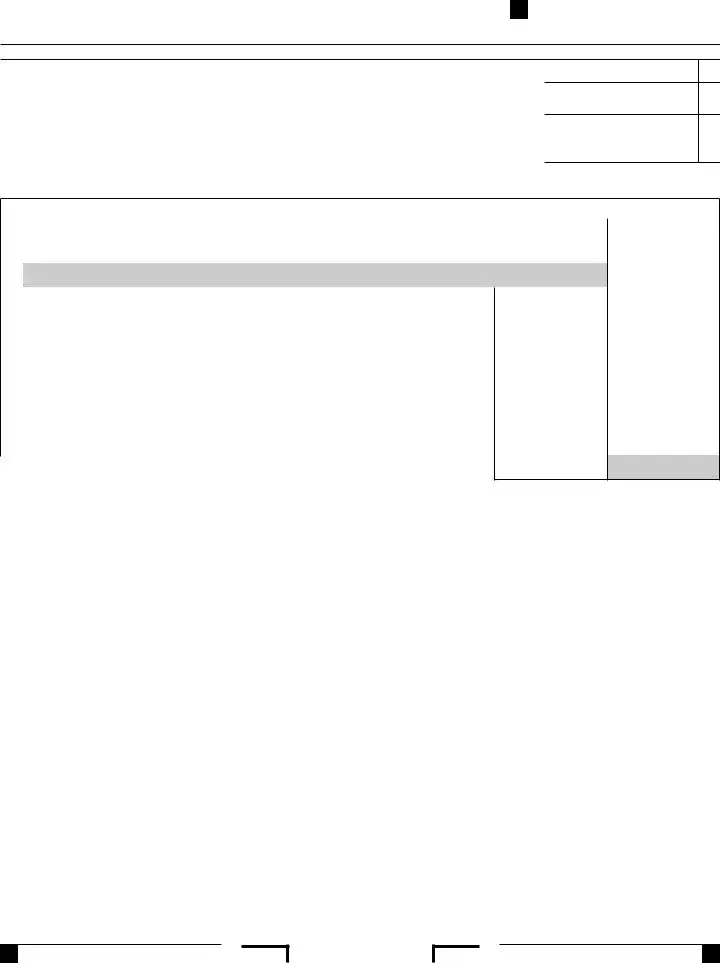

| Fact Name | Detail |

|---|---|

| Document Title | California Motion Picture and Television Production Credit |

| Form Number | 3541 |

| Issuing Entity | California Franchise Tax Board (FTB) |

| Taxable Year | 2012 |

| Governing Law(s) | Revenue & Taxation Code (R&TC) Sections 17053.85, 23685 |

| Purpose | To report the credit for the production of a qualified motion picture in California. |

| Key Features | Credit can offset franchise or income tax liability, be sold, assigned, or applied against qualified sales and use taxes. |

| Assignment and Sale | Credit can be assigned to affiliated corporations or sold once the taxpayer receives Form M from the CFC. |

How to Write California 3541

The California 3541 form is critical for reporting the Motion Picture and Television Production Credit. This credit is available for qualified expenditures related to the production of motion pictures and television series in California. Correctly filling out this form ensures that your credits are accurately documented and applied towards your tax liabilities. Individuals, corporations, and other entities that qualify for this credit must attach the completed form 3541 to their California tax return. The process requires meticulous attention to detail to ensure all the necessary information is captured accurately and completely.

- Start by indicating the tax year at the top of the form.

- Enter your name(s) as shown on your California tax return.

- Mark the applicable box and provide either your SSN or ITIN if filing as an individual, or your Corporation no. and FEIN if filing as a corporation. Include the CA Secretary of State (SOS) file number where applicable.

- Under PART I Available Credit, input the current year generated credit in line 1a and provide the credit certificate number in line 1b.

- Report any credit received from pass-through entities on line 2.

- Enter any credit purchased from other entities on line 3.

- For credit assigned from affiliated corporations, fill line 4 according to instructions provided in Part III, then input the total in line 4.

- Include any credit carryover from the prior year on line 5.

- Sum the amounts listed from line 1a through 5 and enter it on line 6.

- If you sold credit to other entities, report the amount on line 7.

- For credit assigned to affiliated corporations per Part IV directions, enter the total on line 8.

- Input any credit applied against sales and use taxes on line 9.

- Calculate the total available credit by adding lines 7, 8, and 9, then subtract this total from line 6. Record this figure on line 10.

- Move on to PART II Carryover Computation, start with inputting the credit amount claimed this year on line 11a and any credit assigned to other corporations within the combined reporting group on line 11b.

- Add lines 11a and 11b, then subtract this total from line 10 to get the carryover for future years. Enter this on line 12.

- In PART III, if you received assigned credits, fill out details for each in columns (a) to (d) as instructed. Add the amounts in column (d) to find the total credit received and enter this on line 13.

- Under PART IV for credits you are assigning, fill in your tax liability on line 15 and calculate excess credit available for assigning to affiliated corporations on line 16. Use columns (a) to (e) to detail each credit assignment to affiliated corporations, and enter the total assigned credit on line 19.

Once you have completed all required parts of Form 3541, attach it to your California tax return. Verify all information for accuracy before submission to ensure your Motion Picture and Television Production Credit is correctly applied, facilitating an accurate and timely processing of your tax return.

Listed Questions and Answers

What is California Form 3541?

California Form 3541, also known as the Motion Picture and Television Production Credit form, is used to claim a tax credit for qualified expenditures incurred in the production of a qualified motion picture in California. This includes specific allocations from the California Film Commission, credits passed through from other entities, credits purchased, or assigned from affiliated corporations.

Who can use California Form 3541?

Qualified taxpayers, including individuals and corporations that have incurred eligible production expenditures and have been issued a Certificate by the California Film Commission, can use Form 3541. Additionally, S Corporations, Estates, Trusts, Partnerships, or LLCs classified as partnerships that pass through credits to shareholders, beneficiaries, partners, or members can also use this form.

How does one obtain a Credit Certificate number, and where is it reported on Form 3541?

A Credit Certificate number is issued by the California Film Commission once a project is deemed qualified and the credit allocation is approved. This number is crucial for claiming the tax credit and is reported on Form 3541, Part I, line 1b for the current year generated credits.

Can the Motion Picture and Television Production Credit be transferred or sold?

Yes, under certain circumstances, this credit can be transferred or sold:

- Independent film credits can be sold to unrelated parties.

- Credits can be assigned to affiliated corporations.

What happens if the credit amount exceeds the taxpayer's current year tax liability?

If the available credit exceeds the taxpayer’s current tax liability or is limited by the tentative minimum tax, the unused credit can be carried over for six years or until exhausted, whichever comes first. However, credits cannot be carried back to previous tax years.

How are credits applied for partnerships, S Corporations, and LLCs?

For pass-through entities like Partnerships, S Corporations, and LLCs treated as partnerships, the credit cannot be used at the entity level. Instead, it must be passed through to the shareholders, beneficiaries, partners, or members. Each recipient should then report their share of the credit on their tax returns, adhering to the applicable limits and requirements.

What are the limitations on using the Motion Picture and Television Production Credit?

This tax credit has several limitations:

- It cannot reduce the minimum franchise tax, the alternative minimum tax, or other specific taxes like the S corporation 1.5% entity-level tax.

- The credit cannot reduce regular tax below the tentative minimum tax amount.

- Certain carryover and credit application rules must be adhered to, preventing the use of credits in ways not specified by the California Revenue and Taxation Code and the form’s instructions.

Where can more information about the Motion Picture and Television Production Credit be found?

More detailed information about the Motion Picture and Television Production Credit, including instructions for completing Form 3541, selling or assigning credits, and specific definitions and limitations, can be found in the form instructions or by visiting the California Film Commission and the Franchise Tax Board's websites. Additionally, taxpayers can consult a tax professional for personalized advice.

Common mistakes

Not indicating the current year generated credit correctly: When completing the California Form 3541, one common mistake involves inaccurately indicating the current year generated credit on Part I, line 1a. It's essential to reflect the full amount of credit allocated by the California Film Commission (CFC) accurately, as shown on Form M, or to aggregate the amounts if multiple Form Ms were issued within the taxable year.

Misreporting the credit certificate number: Part I, line 1b requires the input of the credit certificate number from Form M for the current year generated credit. A recurrent oversight is either omitting these numbers or listing them inaccurately when multiple credits are reported on line 1a.

Omitting pass-through entity details: Line 2 under Part I entails entering credits received from pass-through entities like S corporations or partnerships. Filers often miss attaching a schedule that details the entities from which these credits stem, including taxpayer names, identification numbers, original certificate numbers issued by the CFC, and ownership percentages.

Inappropriate reporting of purchased credits: A typical blunder on Part I, line 3, involves inaccuracies in reporting credits that were purchased from qualified taxpayers. It's crucial to state the amount of credit purchased accurately, not the consideration amount paid for the credit.

Incorrectly detailing assigned credits from affiliated corporations: For those who have credit assignments from affiliated corporations as specified in R&TC Section 23685, filling out Part III correctly is often mishandled. Line 4 in Part I should precisely reflect the total credit received from these assignments.

Failure to account for credit sold: Many falter on Part I, line 7, by not accurately entering the amount of credit sold to unrelated entities, as documented on Form FTB 3551. This oversight can lead to significant discrepancies in available credit calculation.

Errors in assigning credit to affiliated corporations: In Part IV, line 8, inaccuracies commonly arise from neglecting to correctly document the credit amounts assigned to affiliated corporations pursuant to R&TC Section 23685. Each step, from documenting the excess credit available for assignment to detailing the credit amounts assigned to specific entities, must be diligently followed.

Misinterpretation of carryover computation: Taxpayers frequently misunderstand the directives for Part II, leading to miscalculations in line 12’s carryover to future years. It's vital to adhere to the instructions for computing the credit amount claimed on the current year tax return versus the total available credit.

Inaccuracies in applying credit against sales and use taxes: When it comes to Part I, line 9, individuals often make the mistake of either failing to report or inaccurately reporting the portion of the credit applied against qualified sales and use taxes. This necessitates precise documentation and understanding of the allocation for such applications.

These common mistakes underscore the importance of meticulous attention to detail and a deep understanding of the form’s instructions to ensure accuracy and compliance with California's tax regulations regarding motion picture and television production credits.

Documents used along the form

When navigating the complexities of the California Motion Picture and Television Production Credit (California Form 3541), various supporting documents and forms are vital for ensuring compliance and maximizing benefits. These documents play a critical role in the process, from application to claiming credit and handling assignments or sales of credit. Understanding these documents is essential for individuals and entities involved in producing motion pictures or television content in California.

- Form FTB 3551: This form, titled "Sale of Credit Attributable to an Independent Film," is used when a qualified taxpayer decides to sell the tax credit associated with an independent film. The form is crucial for documenting the sale transaction, including the sale price and determining any gain on the sale for the seller or income for the buyer.

- Form FTB 3544: Known as the "Election to Assign Credit Within Combined Reporting Group," this form is instrumental for corporations looking to assign their credit to another entity within the same reporting group. It facilitates the transfer process and ensures proper documentation and compliance with tax regulations.

- Form FTB 3544A: This "List of Assigned Credit Received and/or Claimed by Assignee" form complements Form FTB 3544. It provides detailed information about the credits being assigned, including the assignor and assignee details and the respective amounts of assigned credits. It's essential for tracking the movement of credits within a combined reporting group.

- Form M, Tax Credit Certificate: The California Film Commission issues this certificate to qualified taxpayers, allocating the motion picture and television production credit. The certificate is a critical document, as it officially represents the credit amount a taxpayer is entitled to and serves as a basis for various credit-related filings, including claims against sales and use taxes or assignments to affiliates.

Each of these forms serves a specific purpose in the broader context of the California Motion Picture and Television Production Credit, enabling taxpayers to navigate the credit's application and utilization effectively. They ensure that all transactions and transfers related to the credit are properly documented and in compliance with California tax law, ultimately supporting the state's film and television production industry. Whether you're claiming the credit for the first time, assigning it to an affiliated corporation, or engaging in a sale, understanding and accurately completing these documents is essential for optimizing tax benefits while adhering to regulatory requirements.

Similar forms

The California 3541 form shares similarities with the Federal Form 3800, General Business Credit because both compile various business-related credits to offset income or franchise taxes. Like the California 3541 form, Federal Form 3800 aggregates credits from different sources, providing a mechanism to apply these against tax liabilities, albeit at the federal level. Both forms are crucial for businesses to effectively utilize available credits to minimize their tax obligations, showcasing the interconnectedness of federal and state tax incentive frameworks.

Similar to the Schedule K-1 (Form 1065) used for partnerships, the California 3541 form also involves pass-through mechanisms for credits. Schedule K-1 reports shares of income, deductions, and credits to partners, akin to how the California 3541 details credit pass-through from entities to individuals or corporations. Both documents serve as vehicles for transferring tax advantages from one entity to individuals or other entities, playing pivotal roles in the tax reporting and planning processes for partners and credit beneficiaries alike.

The California 3541 form's aspects relating to credit sales to unrelated entities echo the intentions behind IRS Form 8949, Sales and Other Dispositions of Capital Assets. While Form 8949 is designed for reporting capital gains and losses, the mechanism in the California 3541 form for reporting the sale of credits operates on a parallel concept, emphasizing the transfer of value (in this case, tax credits) and its tax implications. Both forms cater to the reporting requirements instigated by transactions, albeit with different focuses: one on capital assets and the other on tax credit sales.

Similarly, the 3541 form's instructions for assigning credits to affiliated corporations find a counterpart in the IRS Form 8827, Credit for Prior Year Minimum Tax—Corporations. Though focusing on minimum tax credits, Form 8827 facilitates the carryforward of unused credits to offset future tax liabilities, akin to the carryforward and assignment provisions under the California scheme. This parallel underscores how both state and federal levels provide mechanisms for businesses to manage and leverage their credits over multiple years.

The California Form 3582, Payment Voucher for Individual e-filed Returns, while primarily a payment tool, shares the commonality of being part of the tax filing process and focusing on streamlining taxpayer obligations with the 3541 form. Both forms serve to ensure compliance and optimization in the tax reporting and payment processes, albeit from different angles - direct payment versus credit application.

Another related document is the California Form 3522, LLC Tax Voucher, which, like the 3541, is tailored to specific entities – in this case, LLCs. Both forms are integral to California’s tax administration, providing structured ways for entities to meet state tax obligations, whether through direct tax payments or utilizing credits to reduce tax liabilities.

Form 3536, Estimated Fee for LLCs, also from California, parallels the 3541 form in its target audience of specific business structures. While Form 3536 pertains to the advance payment of fees based on income levels, it complements the 3541's role in tax planning and compliance, highlighting the state's multipronged approach to tax collection and incentive provision.

Finally, the resemblance with California Form 540, the state's individual income tax return, reflects in the provision to apply tax credits, similar to those detailed in Form 3541, against personal tax liabilities. Both documents underline the broader tax framework's adaptability, allowing for offsets and benefits that reduce the tax burden, either through earned credits or direct payments.

Dos and Don'ts

Filling out California Form 3541 can be a detail-oriented process, and it's important to get it right to take advantage of the Motion Picture and Television Production Credit. Here are seven dos and don'ts to keep in mind to ensure you fill out the form correctly and efficiently.

Do:Read the instructions carefully before starting. The instructions provided by the California Franchise Tax Board (FTB) give detailed information on how to correctly fill out the form.

Double-check your figures. Ensure that the calculations for your available credit, including current year generated credit and carryover computation, are accurate.

Include the credit certificate number (line 1b) for the current year generated credit. This number is essential for your form to be processed correctly.

Attach the form to your California tax return. This step is crucial for the credit to be applied toward your tax liability.

Write "CFC Credit" in red ink at the top margin of your tax return if you are attaching Form 3541. This helps the FTB identify the specific credit you're claiming.

Report any assigned credit correctly. If you received credits assigned from an affiliated corporation, complete Part III accurately.

Keep records of the form and any related documents. Having detailed records can help if there are any questions about your credit claim.

Forget to list all applicable credit certificate numbers if you report multiple credits on line 1a. Omitting numbers can delay processing.

Overlook credits received from pass-through entities, purchased, or assigned credits. Ensure these are entered in the appropriate sections (lines 2, 3, and 4).

Misreport the credit amount claimed on the current year tax return (line 11a). This figure may be limited by tax liability or tentative minimum tax.

Ignore the limitations section in the instructions. The credit cannot reduce certain taxes and minimum amounts owed under California law.

Leave any sections incomplete. An incomplete form can lead to processing delays or disqualification of the credit.

Enter incorrect taxpayer identification numbers, FEINs, or CA Secretary of State file numbers. Accuracy in these details is critical for the FTB to process your credit appropriately.

Sell or transfer the credit without properly reporting the transaction. If you sell an independent film credit, report the gain on the sale and follow the instructions carefully.

By following these guidelines, you can navigate the process of claiming the California Motion Picture and Television Production Credit more smoothly and ensure you take full advantage of the available benefits.

Misconceptions

Despite the specific instructions and details provided in the Form 3541 documentation, many misconceptions remain about this California tax form related to the Motion Picture and Television Production Credit. Understanding the intricacies of this form is beneficial for businesses and individuals in the entertainment industry seeking to leverage available tax credits for qualifying productions. Here are six common misconceptions and clarifications to provide a clearer understanding:

- Misconception 1: Only Film Productions Qualify

While it's called the Motion Picture and Television Production Credit, the scope of this tax credit extends beyond traditional film productions. Eligible projects also include television series that relocate to California, independent films meeting certain budget criteria, and new television series that meet the specific requirements laid out by the California Film Commission.

- Misconception 2: Credits Can Be Refunded

Some may believe that if the credit amount exceeds their tax liability, they can receive a refund for the difference. However, the California Motion Picture and Television Production Credit is non-refundable. It can only be used to offset income or franchise tax liabilities; any excess can be carried over to future tax years but not refunded.

- Misconception 3: The Credit is Automatically Applied

A common misunderstanding is that this credit will automatically be applied once eligibility is determined. In reality, qualified taxpayers must actively claim this credit by attaching Form 3541 to their California tax return and properly filling out all relevant sections and calculations as outlined in the form’s instructions.

- Misconception 4: There's No Limit to Credit Sale or Assignment

It's mistakenly thought that credits can be freely sold or assigned without limitations. The truth is, the sale of credits is restricted to those attributable to independent films, and assignments are tightly regulated, requiring careful adherence to the specific rules around eligible assignees and the amount of credit that can be assigned or sold.

- Misconception 5: Any Entity Can Claim the Credit

Another misconception is that any entity involved in a production can claim the credit. However, only the entity that has incurred qualifying expenses and has been issued a tax credit certificate by the California Film Commission is eligible to claim the credit. Pass-through entities can distribute the credit to their shareholders, beneficiaries, partners, or members, but it's not eligible at the entity level.

- Misconception 6: Credits Can Reduce Any Type of Tax

There's a false assumption that these credits can be applied against any tax owed. In fact, they're specifically aimed at reducing income or franchise tax liabilities and cannot be applied to reduce other taxes such as sales and use taxes without a proper election made with the California Department of Tax and Fee Administration, nor can they offset the minimum franchise tax, among other limitations.

Understanding these misconceptions and the realities of the California Form 3541 is crucial for those in the motion picture and television industry to maximize their tax benefits while remaining compliant with state tax regulations.

Key takeaways

Filling out and using the California Form 3541, Motion Picture and Television Production Credit, requires thoroughness and attention to detail. Here are five key takeaways to consider:

- To claim the credit, the California Form 3541 must be attached to the taxpayer’s California tax return. This step is crucial for ensuring the credit is properly recorded and processed.

- Know the types of credits: There are several types of credits outlined in Form 3541, including current year generated credits, credits received from pass-through entities, credits purchased from other entities, and credits assigned from affiliated corporations. Understanding each type is essential for accurately reporting and maximizing potential benefits.

- Documentation is key: For each credit claimed, specific information such as the credit certificate number and the amounts need to be documented meticulously. For credits that are purchased, received from pass-through entities, or assigned from affiliated corporations, additional substantiation may be required.

- The form allows for the carryover computation of unused credits. Taxpayers should carefully calculate the carryover to future years, ensuring they leverage the credit’s full value across multiple tax periods.

- Credits cannot reduce certain taxes, such as the minimum franchise tax or the alternative minimum tax (AMT), among others. Taxpayers should be aware of these limitations to accurately forecast the credit’s impact on their tax liability.

Form 3541 also makes provisions for the selling of credits attributed to independent films and assigning credits to affiliated corporations, underscoring the flexibility and potential economic advantages of film and television production credits. However, these transactions must comply with specified requirements, including proper reporting and, in the case of sales, recognition of gain or income. Thus, understanding and complying with the form's instructions can significantly affect a taxpayer’s ability to successfully claim and benefit from the California Motion Picture and Television Production Credit.

Different PDF Templates

Free California Rental Agreement Pdf - Room maintenance obligations are defined, emphasizing the tenant’s responsibility to keep the space clean, with provisions for property provider access in emergencies or with notice.

Exemption From Withholding California - Supports the correct documentation and remittance of withheld taxes to the California state tax authority.