Fill a Valid California 3555 Form

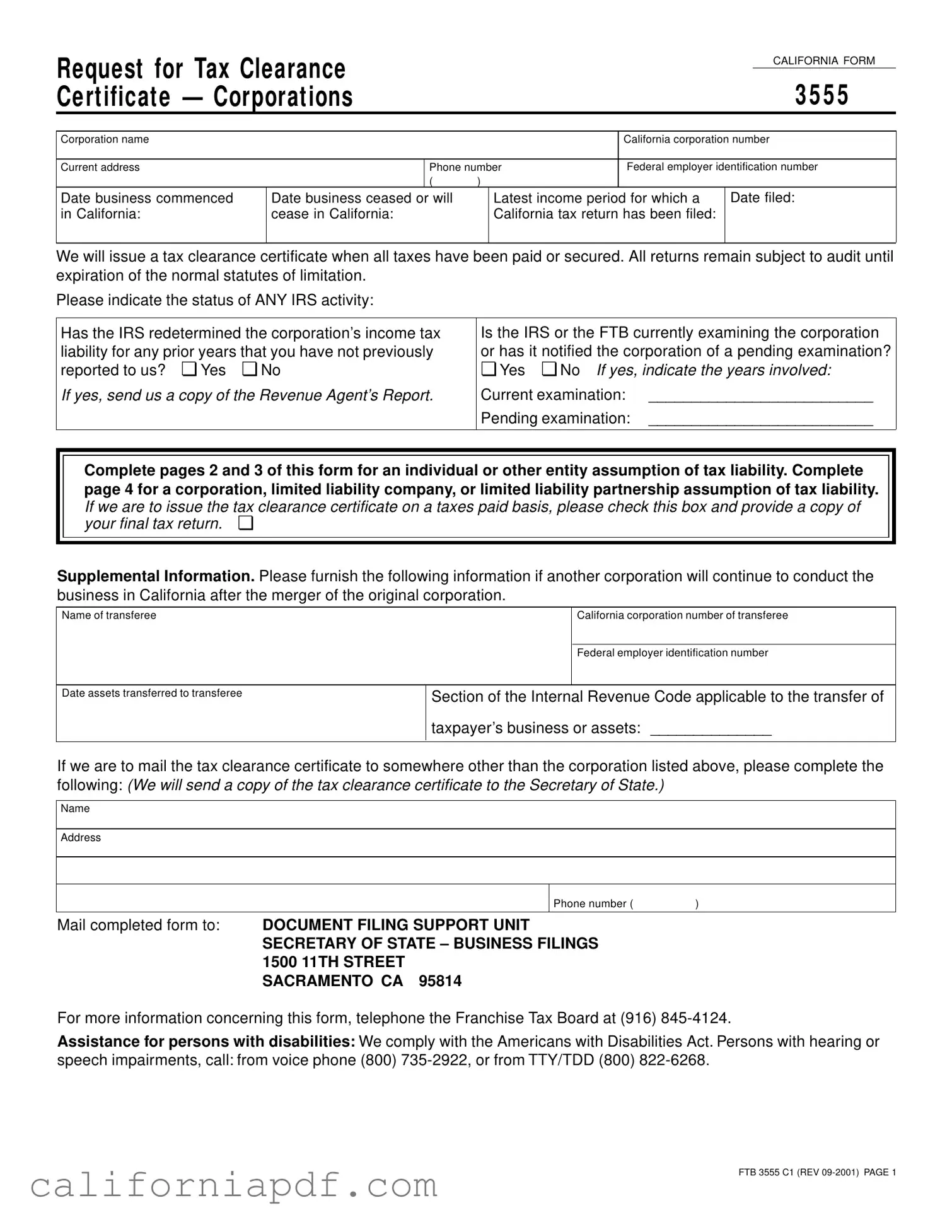

For businesses undergoing significant transitions in California, such as mergers, dissolutions, or ceasing operations within the state, navigating the legal requirements to ensure a smooth process is crucial. The California 3555 form, or Request for Tax Clearance Certificate for Corporations, plays a pivotal role in this framework, serving businesses in their final stages of operation within the state. This comprehensive form outlines the necessary steps and information required from corporations to receive a tax clearance certificate, affirming that all state tax obligations have been fulfilled. Key sections include providing detailed company information, the current status of tax filings, any ongoing or pending examinations by the IRS or the Franchise Tax Board (FTB), and arrangements for assuming tax liabilities. Furthermore, it addresses scenarios involving the transfer of business after a merger, ensuring the continuation of operations by a successor aligns with state regulations. Besides the procedural aspects, the form also facilitates entities assuming tax liability, be it individuals, trusts, other corporations, or partnerships, by requiring detailed financial statements and unconditional agreements to fulfill the obligations of the dissolving entity. The form's completion and submission to the Secretary of State – Business Filings signify a critical step for businesses concluding their activities in California, emphasizing the importance of compliance and financial transparency in the process.

Document Example

Request for Tax Clearance |

|

|

|

|

CALIFORNIA FORM |

||

|

|

3 5 5 5 |

|||||

Certificate — Corporations |

|

|

|||||

|

|

|

|

|

|

|

|

Corporation name |

|

|

|

|

California corporation number |

||

|

|

|

|

|

|||

Current address |

|

Phone number |

Federal employer identification number |

||||

|

|

( |

) |

|

|

|

|

Date business commenced |

Date business ceased or will |

|

Latest income period for which a |

Date filed: |

|||

in California: |

cease in California: |

|

California tax return has been filed: |

|

|||

|

|

|

|

|

|

|

|

We will issue a tax clearance certificate when all taxes have been paid or secured. All returns remain subject to audit until expiration of the normal statutes of limitation.

Please indicate the status of ANY IRS activity:

Has the IRS redetermined the corporation’s income tax |

Is the IRS or the FTB currently examining the corporation |

|

liability for any prior years that you have not previously |

or has it notified the corporation of a pending examination? |

|

reported to us? ❏ Yes ❏ No |

❏ Yes ❏ No If yes, indicate the years involved: |

|

If yes, send us a copy of the Revenue Agent’s Report. |

Current examination: |

__________________________ |

|

Pending examination: |

__________________________ |

|

|

|

Complete pages 2 and 3 of this form for an individual or other entity assumption of tax liability. Complete page 4 for a corporation, limited liability company, or limited liability partnership assumption of tax liability.

If we are to issue the tax clearance certificate on a taxes paid basis, please check this box and provide a copy of your final tax return. ❏

Supplemental Information. Please furnish the following information if another corporation will continue to conduct the business in California after the merger of the original corporation.

Name of transferee

California corporation number of transferee

Federal employer identification number

Date assets transferred to transferee

Section of the Internal Revenue Code applicable to the transfer of

taxpayer’s business or assets: ______________

If we are to mail the tax clearance certificate to somewhere other than the corporation listed above, please complete the following: (We will send a copy of the tax clearance certificate to the Secretary of State.)

Name

Address

Phone number ( |

) |

Mail completed form to: DOCUMENT FILING SUPPORT UNIT

SECRETARY OF STATE – BUSINESS FILINGS 1500 11TH STREET

SACRAMENTO CA 95814

For more information concerning this form, telephone the Franchise Tax Board at (916)

Assistance for persons with disabilities: We comply with the Americans with Disabilities Act. Persons with hearing or

speech impairments, call: from voice phone (800)

FTB 3555 C1 (REV

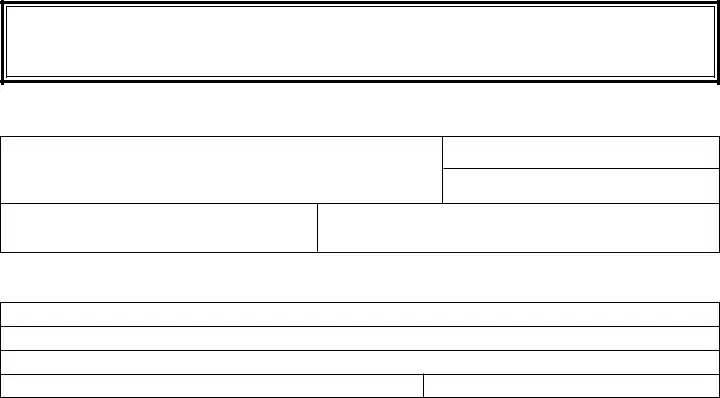

Please complete Section A or B below.

A. INDIVIDUAL ASSUMPTION OF TAX LIABILITY

Corporation name

Current address

|

California corporation number |

Phone number |

Federal employer identification number |

( )

I unconditionally agree to file or cause to be filed with the Franchise Tax Board, under the provisions of the Bank and Corporation Tax Law, all tax returns and data required and to pay in full all accrued or accruing tax liabilities, penalties, interest, and fees due from the above named corporation at the effective date of dissolution or surrender.

My net worth (assets minus liabilities) is not less than: $ _____________________ .

(We require a detailed financial statement [PAGE 3].)

Name of individual assumer (print) |

|

Social security number |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone number ( |

) |

|

|

|

|

|

|

|

|

Date |

Signature |

|

|

|

|

|

|

B. TRUST ASSUMPTION OF TAX LIABILITY

Corporation name

Current address

|

California corporation number |

Phone number |

Federal employer identification number |

( )

This trust unconditionally agrees to file or cause to be filed with the Franchise Tax Board, under the provisions of the Bank and Corporation Tax Law, all tax returns and data required and to pay in full all accrued or accruing tax liabilities, penalties, interest, and fees due from the above named corporation at the effective date of dissolution or surrender:

(We require a detailed financial statement [PAGE 3].)

Name of trust

Trust federal identification number

Address

Phone number ( |

) |

Date

Trustee’s name (print)

Trustee’s signature

FOR PRIVACY ACT NOTICE, SEE FORM FTB 1131.

FTB 3555 C1 (REV

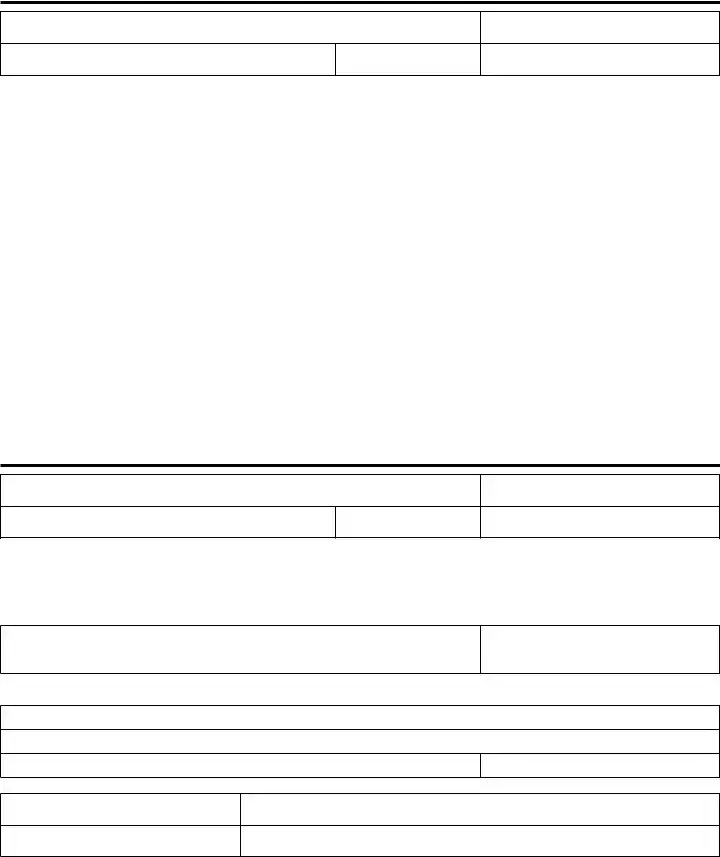

FINANCIAL STATEMENT FOR INDIVIDUAL OR OTHER ENTITY

Corporation name |

Corporation number |

|

|

|

|

Statement of Assets and Liabilities

Item |

|

Present |

Liabilities |

Equity in |

|

value (A) |

balance due (B) |

asset |

|

|

|

|||

Cash |

|

|

|

|

Bank accounts |

|

|

|

|

Stocks and bonds |

|

|

|

|

Cash or loan value of insurance |

|

|

|

|

Household furniture |

|

|

|

|

Real property |

|

|

|

|

Vehicles |

|

|

|

|

|

|

|

|

|

Other assets (describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal taxes outstanding |

|

|

|

|

Loans |

|

|

|

|

|

|

|

|

|

Other (include judgements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets |

|

|

|

|

(Total column A less total column B) |

|

|

|

$ |

General Information (Please attach additional schedules if necessary.) |

||||

|

|

|

|

|

Net annual income |

Source (name of business or employer) |

|

|

|

|

|

|

|

|

Banks and savings and loan accounts (names and addresses)

Description and license number of each vehicle

Stocks and bonds (name of company, number of shares, etc.)

Real property (brief descriptions and locations)

I certify that the information above is correct to the best of my knowledge.

Assumer’s name (print) _____________________________________________________________________________________________________

Assumer’s address |

____________________________________________________________ Phone number ( |

) |

_______________________ |

Assumer’s signature |

__________________________________________________________________________ |

Date |

_______________________ |

FTB 3555 C1 (REV

CORPORATION, LIMITED LIABILITY COMPANY, OR LIMITED LIABILITY PARTNERSHIP ASSUMPTION OF TAX LIABILITY

The Assumption of Tax Liability

of (1) __________________________________________________________ )

|

) |

|

A corporation |

) ________________________ |

|

|

) |

California Corporation number, Secretary of |

|

State file number, or federal employer |

|

by (2) _________________________________________________________ ) |

identification number |

|

|

||

|

) |

|

A corporation, limited liability company, or limited liability partnership |

) ________________________ |

|

|

|

California Corporation number, Secretary of |

|

|

State file number, or federal employer |

|

|

identification number |

(Name of assumer) __________________________________________________ unconditionally

agrees to file with the Franchise Tax Board all tax returns and data required and pay in full all tax liabilities, penalties, interest and fees of (1) _________________________________________

_________________________________________________________________________________; at the

effective date of dissolution or surrender of the corporation.

|

(2) _________________________________________ |

|

Exact corporation, limited liability company, or limited liability partnership name |

_______________________________________ |

_________________________________________ |

Printed name and title of officer/manager/partner/member |

Signature and title of officer/manager/partner/member |

State of _______________________________

County of _____________________________

On ________________________________________ before me, the undersigned, a notary public in and for

said state, personally appeared _______________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

personally known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature ________________________________________________________

Name __________________________________________________________

(typed or printed)

Note: LLC, LLP, and corporation assumers must provide a financial statement.

FTB 3555 C1 (REV

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Form 3555 | This form is a Request for Tax Clearance Certificate, primarily utilized by corporations to confirm all taxes have been paid or secured before concluding business operations in California. |

| Governing Law | The form operates under the provisions of the Bank and Corporation Tax Law within California, ensuring that entities fulfill their tax obligations upon dissolution, surrender, or transfer of liability. |

| Required Information | Entities must provide comprehensive details, including corporation name, California corporation number, current address, federal employer identification number, and dates concerning the beginning and cessation of business activities in California, along with the latest income period for which a California tax return has been filed. |

| Audit and IRS Activity Disclosure | Entities are required to disclose any IRS activity, including redetermination of tax liabilities or pending examinations, and all returns remain subject to audit until expiration of the normal statutes of limitation. This ensures transparency and compliance with both state and federal tax laws. |

How to Write California 3555

Once your business operations in California have concluded, or if you're involved in a merger or assumption of tax liability, it's critical to request a tax clearance certificate using Form 3555. This certificate proves that all applicable state taxes have been satisfied. Here's a straightforward guide to help you accurately complete the form.

- Begin by filling in the corporation's name and its California corporation number.

- Next, provide the current address and phone number of the corporation.

- Enter the Federal employer identification number (FEIN).

- Indicate the date the business commenced operations in California and the date it ceased or will cease operations within the state.

- Record the latest income period for which a California tax return has been filed.

- If the IRS has redetermined the corporation's income tax liability for any prior years not previously reported to the California Franchise Tax Board, or if there's currently an examination underway or pending by either the IRS or the FTB, check the appropriate "Yes" box and provide the years involved or send a copy of the Revenue Agent’s Report as indicated.

- For an individual or other entity assuming tax liability, complete details are required on page 2, including the corporation name, address, California corporation number, phone number, federal employer identification number, and the financial assurance from the assumer. The assumer must sign the form, indicating their unconditional agreement to fulfill the tax liabilities of the corporation.

- If the tax liability is being assumed by another corporation, limited liability company, or limited partnership, provide the required declaration and financial statement on page 4. Include names, roles, and signatures of the authorized individuals, along with the corporation or entity information taking over the tax liabilities.

- If another corporation is continuing the business post-merger, supply the supplemental information requested about the transferee corporation, including its name, California corporation number, Federal employer identification number, date of asset transfer, and applicable Internal Revenue Code section.

- Should the tax clearance certificate be mailed to an address different from that of the corporation listed, fill in the requested mailing information.

- Lastly, review the form to ensure all information is accurate and complete. Include a copy of your final tax return if requesting a tax clearance certificate on a taxes paid basis. Mail the completed form to the Document Filing Support Unit at the Secretary of State - Business Filings in Sacramento, CA, as indicated on the form.

After submitting Form 3555, the Franchise Tax Board will review the submission to ensure all tax liabilities have been satisfied. Once approved, a tax clearance certificate will be issued. Remember, this process confirms the closing or transfer of your business activities in California is in good standing with state tax obligations. Keep accurate records and maintain copies of the submission for your records.

Listed Questions and Answers

What is the California Form 3555 used for?

The California Form 3555, also known as the Request for Tax Clearance Certificate, is crucial for corporations in California. It's used when a corporation is dissolving, surrendering, or transferring all of its assets to another entity. The form helps ensure that the corporation has settled any outstanding taxes with the state of California before it ceases its business operations or transitions its assets. Completing this form and receiving a tax clearance certificate means that all taxes have been paid or adequately secured, indicating to the state that the business can formally close or transfer ownership without leaving any tax liabilities behind.

Who needs to file Form 3555?

This form must be filed by corporations that are planning to dissolve, cease business operations in California, or transfer their assets to another entity. It's also applicable to corporations undergoing mergers where another company will continue the business in California. The requirement ensures that such transitions do not evade financial obligations to the state, particularly in terms of taxes.

What information is required on Form 3555?

To successfully complete Form 3555, several pieces of detailed information are required, including:

- Corporation name and California corporation number.

- Current address and phone number.

- Federal employer identification number.

- Dates business commenced and ceased in California.

- Latest income period for which a California tax return has been filed.

- Details on any IRS or FTB examinations, if applicable.

- Information on the individual or entity assuming the tax liability, if the business is being transferred rather than dissolved.

This information helps the California Franchise Tax Board (FTB) to ensure that all tax responsibilities are accounted for before the company dissolves or transfers assets.

How do you submit Form 3555?

Form 3555 should be completed and mailed to the Document Filing Support Unit of the Secretary of State – Business Filings at the address provided on the form itself. It's important to include all necessary attachments, such as the final tax return if the tax clearance certificate is being issued on a taxes paid basis, or a copy of the Revenue Agent’s Report if there's ongoing IRS or FTB examination.

What happens after Form 3555 is submitted?

Upon receiving Form 3555, the Franchise Tax Board reviews the submission to ensure all tax obligations have been met. If everything is in order, the FTB will issue a tax clearance certificate. This certificate is vital as it serves as proof that the corporation has no outstanding tax debts. The FTB also reserves the right to audit the returns subject to the normal statutes of limitation, which means that though the certificate may be issued, the company's financials can still be reviewed for a certain period afterward.

Is there any assistance available for completing Form 3555?

Yes, the Franchise Tax Board offers assistance for those who need help in completing Form 3555. Corporations can contact the FTB directly via the telephone number provided on the form for guidance. Additionally, for persons with disabilities, there are specific communication support options available, ensuring that everyone can access the necessary help to complete the form accurately.

Common mistakes

Filling out the California Form 3555, a Request for Tax Clearance Certificate for Corporations, can sometimes be challenging. It’s not just a matter of ticking boxes and signing at the bottom. To ensure smooth processing and avoid unnecessary delays or rejections, it's crucial to understand some common mistakes and how to avoid them.

Not providing the accurate corporation name and California corporation number as registered. This ensures that the request is matched to the right entity.

Failing to update the current address and phone number which might lead to miscommunication or lost correspondence from the Secretary of State or the Franchise Tax Board.

Omitting the Federal Employer Identification Number (FEIN). This number is essential for identifying the corporation for tax purposes.

Inaccurately reporting the dates business began or ceased operations in California. Such dates affect tax liability and clearance.

Overlooking to state the latest income period for which a California tax return has been filed. This information helps the tax authorities determine your current compliance status.

Ignoring to disclose IRS activities, such as redeterminations of income tax liability or pending examinations. Full disclosure is necessary for accurate tax clearance.

Leaving the supplemental information section, which concerns asset transfers or business continuance through another corporation, incomplete when applicable.

Sending the form without the necessary attachments, such as a copy of the final tax return if requesting a tax clearance certificate on a taxes-paid basis, or a financial statement when required.

Forgetting to complete the mailing address section if the tax clearance certificate needs to be sent to an address different from the listed corporation.

Providing incomplete or inaccurate information on the assumption of tax liability pages for individuals, trusts, corporations, limited liability companies, or partnerships assuming tax liability.

Avoiding these missteps is key to a hassle-free processing of the California Form 3555. Always ensure that every piece of information provided is accurate, complete, and corresponds to the required documentation. When in doubt, consulting a professional or the Franchise Tax Board directly can provide clarity and prevent future complications.

Documents used along the form

When dealing with business transactions in California, particularly those that necessitate a request for Tax Clearance via the California Form 3555, several other forms and documents are often used in conjunction to ensure compliance and accuracy. It's crucial to understand the role of each form or document in the context of business operations and transactions within the state.

- Form 100 (California Corporation Franchise or Income Tax Return): This is filed by corporations to report their income, deductions, and credits to calculate their state tax liability.

- Form 568 (Limited Liability Company Return of Income): For LLCs operating in California, this form details the income, deductions, and available credits, along with determining the fee based on income levels.

- Form 3522 (LLC Annual Tax Voucher): LLCs must pay an annual tax to the state, and this voucher is used for payment if not done electronically.

- Form 109 (Corporation Dissolution or Surrender): Used by corporations to officially dissolve or surrender their right to do business in California.

- Statement of Information (Form SI-550): Required annually or biennially, depending on the entity type, this form provides updated information on the business, such as current addresses and officers.

- Form SI-PT (Statement of Partnership Authority): Partnerships use this to identify the authority of individuals to enter into transactions on behalf of the partnership.

- Form 590 (Withholding Exemption Certificate): Used to certify that income is not subject to California withholding. It is relevant for entities or individuals who receive payments from California sources.

- Form 8832 (Entity Classification Election - IRS): Though a federal form, it's crucial for California tax purposes as it determines how an entity is taxed (corporation, partnership, or disreg arded entity).

- Articles of Incorporation: Required for establishing a corporation in California, these outline the primary information about the business, including its purpose and structure.

- Operating Agreement for LLCs: While not filed with the state, this internal document outlines the operating procedures, ownership, and managerial structures of an LLC.

Understanding and preparing these documents in conjunction with the California Form 3555 is essential for businesses aiming to maintain compliance with state regulations. Accurate and timely filing not only helps in avoiding penalties but also ensures that the business operations proceed smoothly and without legal hindrances. Especially for significant steps like dissolution or restructuring, a comprehensive approach to documentation is crucial for the seamless execution of these transactions.

Similar forms

The Form 3555 for Request for Tax Clearance from California resembles the IRS Form 4506, Request for Copy of Tax Return, in several foundational ways. Both forms are integral to verifying past tax compliance and ensuring that all necessary taxes have been paid or accounted for before proceeding with certain financial or legal actions. While the Form 3555 applies specifically to entities in California seeking clearance on state tax obligations, Form 4506 serves a broader purpose, allowing individuals or entities to request copies of their federal tax returns from the IRS. This similarity underscores their common goal of facilitating tax compliance verification.

Another document similar to California Form 3555 is the IRS Form 8822-B, Change of Address or Responsible Party — Business. Form 3555 includes sections for updating current address information for the corporation in question, much like Form 8822-B is used by businesses to notify the IRS of changes in address or responsible party. This overlap shows their mutual emphasis on maintaining current and accurate records to ensure proper communication and tax compliance.

Comparable to Form 3555 is the Statement of Information (Form SI-550) required by the California Secretary of State for most types of corporations. Both documents necessitate detailed information about the corporation, such as addresses, identification numbers, and status updates. The Statement of Information also helps maintain the public record of active corporations, aligning with Form 3555's role in ensuring a corporation's tax obligations are fulfilled as part of the broader regulatory compliance landscape.

The UCC-1 Financing Statement similarly echoes aspects of the Form 3555's functionality, despite serving in a different regulatory spectrum. The UCC-1 is instrumental for creditors to secure interests in a debtor's assets and must include detailed information about both parties. Likewise, Form 3555 ensures that tax liabilities are secured and acknowledged before corporations dissolve or transfer ownership, protecting the state's financial interest.

Form 3555 shares purposes with the Application for Certificate of Revivor (FTB 3557 BC), where businesses in California seek reinstatement after being suspended or forfeited due to tax issues. Both forms are pivotal in resolving outstanding tax matters, although the FTB 3557 BC focuses on restoring good standing status, demonstrating the comprehensive approach to managing tax compliance in California.

Similarly, the Seller’s Permit Application (CDTFA-410-D) aligns with Form 3555 in its requirement for businesses to disclose information upfront for tax compliance. While the Seller’s Permit Application pertains to sales tax collection responsibilities, Form 3555 ensures broader tax liabilities are addressed, highlighting the multifaceted nature of tax regulation and compliance for California businesses.

The Business License Application, required by various local jurisdictions within California, also parallels the Form 3555 in ensuring businesses meet local tax and regulatory obligations. Though more focused on local compliance, this application, like Form 3655, mandates accurate representation of the business's status and intentions, reaffirming the importance of thorough regulatory adherence at both the state and local levels.

Lastly, Form 3555 bears resemblance to the IRS Form 8594, Asset Acquisition Statement under Section 1060. Both require detailed reporting related to business transactions, with Form 3555 focusing on tax clearance during corporational transitions, while Form 8594 is used to categorize and report assets after an acquisition. This similarity underscores the emphasis on transparency and accountability in business changes and tax obligations.

Dos and Don'ts

Filling out the California 3555 form, which is the Request for Tax Clearance Certificate for Corporations, requires careful attention to detail. This document is key for corporations seeking to confirm that all their tax obligations have been satisfied. Here are essential actions to take and avoid during the process.

What to Do:

- Double-check information for accuracy: Ensuring that the corporation's name, California corporation number, and all other details are correctly entered is crucial. Errors can cause delays or miscommunication with the Department of Tax and Fee Administration.

- Include all necessary documentation: Attach copies of pertinent documents, such as the latest tax return filed and any relevant financial statements. This supports your request and speeds up the review process.

- Provide updated contact details: Supply a current address and phone number to ensure that any communication related to the certificate or additional requests from the tax authority can be promptly addressed.

- Disclose IRS or FTB examinations: If the corporation has been reexamined by the IRS for prior years or is currently under examination, disclosing this upfront, along with the required documentation, can prevent future complications.

- Sign and date the form: An authorized individual must sign and date the form to validate the request. Without a signature, the form is incomplete and will not be processed.

What Not to Do:

- Avoid leaving sections incomplete: Failing to fill out every relevant section can lead to an automatic rejection of the form. Ensure that each part is completed, even if it requires entering "N/A" for non-applicable areas.

- Do not guess on dates or figures: Estimate dates or financial information only if you are unsure. Incorrect data can lead to discrepancies that may necessitate further investigation and delay the clearance process.

- Resist submitting without reviewing statutory requirements: Each corporation's situation varies, and certain conditions or exemptions might apply. Review the legal requirements related to the tax clearance process to ensure compliance.

- Refrain from using outdated forms: Always use the most current version of the Form 3555 to avoid submissions being rejected due to outdated information or format.

- Do not forget to notify of address changes: If the corporation’s address changes after submitting the form, notify the relevant department immediately to avoid misplacement of the tax clearance certificate or other crucial correspondence.

Misconceptions

When it comes to navigating the complexities of California's tax laws, the Form 3555, or the Request for Tax Clearance Certificate, is often misunderstood. Let's address some common misconceptions surrounding this document to clarify its purpose and requirements.

- Misconception 1: The form is only for corporations actively conducting business in California.

In fact, Form 3555 is relevant for any corporation that has ceased operations or is planning to cease operations in California as well. It's a crucial step in ensuring all tax liabilities are settled or accounted for before dissolution or withdrawal of the business from the state.

- Misconception 2: Completing Form 3555 immediately grants a tax clearance certificate.

Completing the form is just the first step. The California Franchise Tax Board (FTB) will issue a tax clearance certificate only after verifying that all tax obligations have been fulfilled. This process includes ensuring all returns are filed, and any due taxes, penalties, interest, and fees are paid.

- Misconception 3: The form is only for the dissolution of a business.

While dissolution is a common reason for filing, Form 3555 is also required for mergers, conversions, or when another entity is assuming the tax liabilities of the business. It's about ensuring a clear tax status with the FTB, regardless of the reason for ceasing operations or transferring liabilities.

- Misconception 4: Only the registered business or corporation needs to complete the form.

Actually, if another individual or entity is taking over the tax liabilities of the business, they must complete parts of the form as well. Sections A and B on page 2 are specifically designed for these situations, requiring detailed information from the assuming party.

- Misconception 5: IRS examinations or audits exempt you from needing to file Form 3555.

Even if the IRS is currently auditing your business or has notified you of a pending examination, you are still required to file Form 3555 if ceasing operations or transferring liability in California. You must disclose any IRS activity and provide relevant documentation as requested by the FTB.

- Misconception 6: The form is a one-and-done deal exempt from further review.

While submitting the form is a critical step towards clearing your tax obligations, the information and documents submitted remain subject to audit by the FTB. The statue of limitations laws still apply, meaning your business's financial activities can be audited until those limitations expire.

Understanding the purpose and requirements of Form 3555 can significantly ease the process of dissolving or transferring a business in California. Ensure that you are fully compliant by familiarizing yourself with these common misconceptions and proceeding accordingly.

Key takeaways

When dealing with the California Form 3555, it's important to consider a number of key factors to ensure compliance and accuracy. Here are ten essential takeaways:

- The form is titled Request for Tax Clearance Certificate — Corporations and is utilized primarily when a corporation needs to clear any outstanding tax liabilities with the California Franchise Tax Board (FTB).

- It is vital for corporations seeking dissolution, surrender, or confirmation of good standing in terms of tax liabilities to complete and submit this form.

- The form requires detailed information about the corporation, including the corporation name, California corporation number, current address, phone number, and federal employer identification number.

- Corporations must indicate their date of commencement and, if applicable, the date business ceased or will cease in California. This ensures the FTB has a clear timeline for tax assessment purposes.

- The latest income period for which a California tax return has been filed must be disclosed. This helps the FTB determine the corporation's compliance with filing requirements.

- Any IRS or FTB examinations or redeterminations of income tax liability for previous years not reported must be disclosed. This includes providing the years involved and, if applicable, a copy of the Revenue Agent’s Report.

- If the business will be continued by another entity after a merger, supplemental information about the transferee corporation is necessary. This includes the name, California corporation number, federal employer identification number, date of asset transfer, and applicable section of the Internal Revenue Code.

- The form also provides options for an individual or another entity to assume tax liability. This section requires a detailed financial statement to ensure the assumer has sufficient net worth to cover the liabilities, penalties, interest, and fees.

- In cases where a corporation, limited liability company, or limited liability partnership assumes tax liability, precise information about both the assuming and the dissolving entities is necessary. This segment culminates in a declaration that the assumer unconditionally agrees to comply with tax responsibilities as of the effective date of dissolution or surrender.

- Completed forms should be sent to the Document Filing Support Unit, Secretary of State – Business Filings in Sacramento, CA. This ensures the proper processing and issuance of the tax clearance certificate.

Understanding and accurately completing the California Form 3555 is crucial for corporations aiming to fulfill their tax obligations and effectively manage transitions such as dissolution or a change in ownership. Guidance from a tax professional may be beneficial in navigating these requirements.

Different PDF Templates

California Fnp 004 - For physician practices under a dba, the FNP-004 form is their pathway to ensuring that all particulars related to their fictitious name permit are current and in good standing with California regulations.

What Is a Dros - Helps maintain public trust in the legal process of firearm transactions, contributing to community safety.

Estate & Trust - Comparing the information on Form 541 A with federal reporting requirements highlights any discrepancies that may need to be addressed.