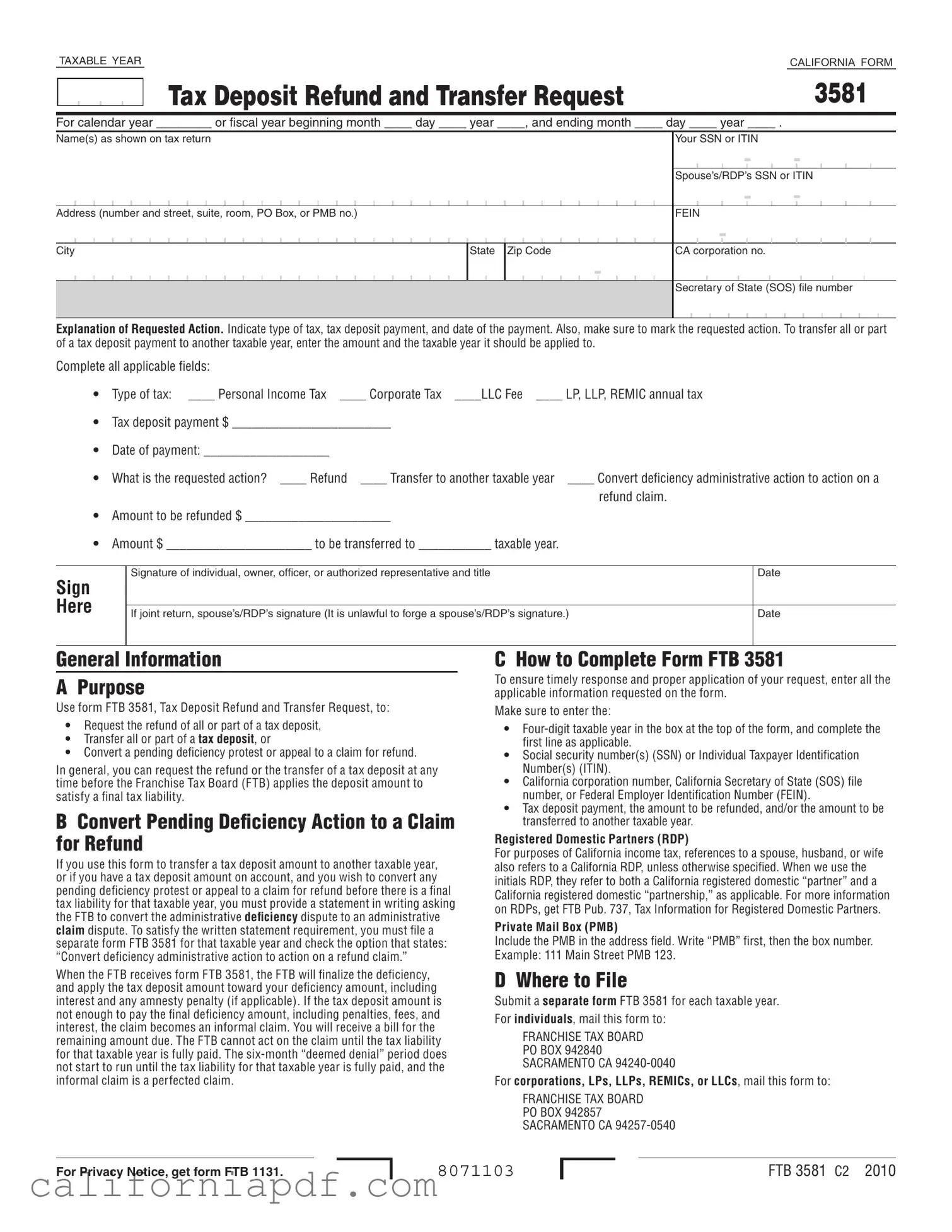

Fill a Valid California 3581 Form

The California Form 3581 plays a crucial role for taxpayers looking to manage their tax deposits effectively. Whether it's for a calendar year or a specific fiscal period, this form allows taxpayers to request a refund of all or part of a tax deposit, transfer their deposit to another taxable year, or convert a pending deficiency protest or appeal into a claim for a refund. The form is versatile, catering to various tax types such as Personal Income Tax, Corporate Tax, LLC Fee, and others related to LLPs, LPs, and REMICs. Accurately filling out the form requires detailed information, including social security numbers or taxpayer identification numbers, corporation numbers, and the amounts to be refunded or transferred. It's important to clearly indicate the action requested to ensure proper processing. For those in domestic partnerships, the form also accommodates the specific tax considerations related to registered domestic partners (RDPs), ensuring inclusivity. Filing the form is straightforward, with separate mailing addresses provided for individuals and entities such as corporations and LLCs. The Form FTB 3581 underscores California's commitment to providing taxpayers with flexible options for managing their taxes, while also including provisions for handling more complex tax situations that may involve appeals or protests.

Document Example

TAXABLE YEARCALIFORNIA FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Deposit Refund and Transfer Request |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3581 |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For calendar year ________ or fiscal year beginning month ____ day ____ year ____, and ending month ____ day ____ year ____ . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Name(s) as shown on tax return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Address (number and street, suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

City |

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

CA corporation no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary of State (SOS) file number |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Explanation of Requested Action. Indicate type of tax, tax deposit payment, and date of the payment. Also, make sure to mark the requested action. To transfer all or part of a tax deposit payment to another taxable year, enter the amount and the taxable year it should be applied to.

Complete all applicable fields:

• Type of tax: ____ Personal Income Tax ____ Corporate Tax ____LLC Fee ____ LP, LLP, REMIC annual tax

•Tax deposit payment $ ________________________

•Date of payment: ___________________

• What is the requested action? ____ Refund ____ Transfer to another taxable year ____ Convert deficiency administrative action to action on a

refund claim.

•Amount to be refunded $ ______________________

•Amount $ ______________________ to be transferred to ___________ taxable year.

Sign Here

Signature of individual, owner, officer, or authorized representative and title |

Date |

|

|

If joint return, spouse’s/RDP’s signature (It is unlawful to forge a spouse’s/RDP’s signature.) |

Date |

|

|

General Information

A Purpose

Use form FTB 3581, Tax Deposit Refund and Transfer Request, to:

•Request the refund of all or part of a tax deposit,

•Transfer all or part of a tax deposit, or

•Convert a pending deficiency protest or appeal to a claim for refund.

In general, you can request the refund or the transfer of a tax deposit at any time before the Franchise Tax Board (FTB) applies the deposit amount to satisfy a final tax liability.

BConvert Pending Deficiency Action to a Claim for Refund

If you use this form to transfer a tax deposit amount to another taxable year, or if you have a tax deposit amount on account, and you wish to convert any pending deficiency protest or appeal to a claim for refund before there is a final tax liability for that taxable year, you must provide a statement in writing asking the FTB to convert the administrative deiciency dispute to an administrative claim dispute. To satisfy the written statement requirement, you must file a separate form FTB 3581 for that taxable year and check the option that states: “Convert deficiency administrative action to action on a refund claim.”

When the FTB receives form FTB 3581, the FTB will finalize the deficiency, and apply the tax deposit amount toward your deficiency amount, including interest and any amnesty penalty (if applicable). If the tax deposit amount is not enough to pay the final deficiency amount, including penalties, fees, and interest, the claim becomes an informal claim. You will receive a bill for the remaining amount due. The FTB cannot act on the claim until the tax liability for that taxable year is fully paid. The

C How to Complete Form FTB 3581

To ensure timely response and proper application of your request, enter all the applicable information requested on the form.

Make sure to enter the:

•

•Social security number(s) (SSN) or Individual Taxpayer Identification Number(s) (ITIN).

•California corporation number, California Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN).

•Tax deposit payment, the amount to be refunded, and/or the amount to be transferred to another taxable year.

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband, or wife also refers to a California RDP, unless otherwise specified. When we use the initials RDP, they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

Private Mail Box (PMB)

Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

D Where to File

Submit a separate form FTB 3581 for each taxable year.

For individuals, mail this form to:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA

For corporations, LPs, LLPs, REMICs, or LLCs, mail this form to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA

For Privacy Notice, get form FTB 1131.

8071103

FTB 3581 C2 2010

Form Breakdown

| Fact | Detail |

|---|---|

| Purpose of Form 3581 | Used for requesting the refund of all or part of a tax deposit, transferring all or part of a tax deposit to another taxable year, or converting a pending deficiency protest or appeal into a claim for refund. |

| Applicability | Applies to personal income tax, corporate tax, LLC fee, LP, LLP, REMIC annual tax. |

| Governing Law | California state law governs the use of Form 3581, under the administration of the California Franchise Tax Board. |

| Requirement for Transfer/Refund Request | Requests for refunds or transfers of tax deposits can be made at any time before the Franchise Tax Board applies the deposit amount to satisfy a final tax liability. |

| Filing Deadlines and Procedures | A separate Form 3581 must be submitted for each taxable year. Addresses for submission vary based on the entity type: individuals, corporations, LPs, LLPs, REMICs, or LLCs. |

How to Write California 3581

Filling out the California Form 3581 is a structured way to handle tax deposit refunds and transfers. This form allows you to request a refund of all or part of a tax deposit, transfer the deposit to another taxable year, or convert a pending deficiency protest or appeal into a claim for a refund. It's an important process that involves specifying the exact nature of your request, your tax details, and what you intend to do with the deposits in question. Accurate completion of this form ensures that your request is processed efficiently by the Franchise Tax Board (FTB). Follow these steps to accurately fill out and submit your Form 3581.

- At the top of the form, enter the four-digit taxable year you are filing for in the "TAXABLE YEAR" field.

- If you are filing for a fiscal year rather than a calendar year, specify the beginning and ending months and days, along with the respective years.

- Under the section titled "Name(s) as shown on tax return," provide the required information exactly as it appears on your tax return.

- Next, enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) alongside your spouse’s or Registered Domestic Partner’s (RDP's) SSN or ITIN if applicable.

- Fill in your complete address, including number and street, suite, room, PO Box, or PMB number if you have one, ensuring accuracy for all details such as city, state, and zip code.

- Corporations should enter their California corporation number, Secretary of State (SOS) file number, and Federal Employer Identification Number (FEIN) as relevant.

- In the "Explanation of Requested Action" section, clearly indicate the type of tax and the amount of the tax deposit payment you made, including the date of the payment.

- Specify the requested action by marking the appropriate option: Refund, Transfer to another taxable year, or Convert deficiency administrative action to action on a refund claim.

- Enter the amount you wish to be refunded or transferred. If transferring, specify the taxable year the amount should be applied to.

- Sign and date the form in the "Sign Here" section. If filing jointly, ensure your spouse or RDP also signs and dates the form.

- Review all entries for accuracy and completeness to avoid delays in processing.

After completing the Form 3581, it’s crucial to send it to the correct address to ensure it reaches the right department for processing. For individuals, the completed form should be mailed to the address designated for individuals as provided in the form's instructions. Corporations, LPs, LLPs, REMICs, or LLCs should send their form to the separate address allocated for these entities. Submitting the form to the right address helps in smooth handling and timely action on your request.

Listed Questions and Answers

What is Form FTB 3581 used for in California?

Form FTB 3581, labeled as 'Tax Deposit Refund and Transfer Request', serves three main purposes. It allows individuals and entities in California to request a refund of all or part of a tax deposit, transfer all or part of a tax deposit to another taxable year, or convert a pending deficiency protest or appeal into a claim for refund. This form plays a crucial role in managing tax deposits before the Franchise Tax Board applies them to satisfy a final tax liability.

How can I correctly complete Form FTB 3581?

To complete Form FTB 3581 accurately and ensure a timely response, it is essential to fill in all the applicable fields with the correct information. These fields include:

- The four-digit taxable year at the top of the form.

- Applicable dates for the calendar or fiscal year in question.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and if applicable, that of your spouse or RDP.

- The California corporation number, California Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN).

- The type of tax, the amount of the tax deposit payment, the date of the payment, and details regarding the refund or transfer request.

Ensuring all these details are correctly filled out will facilitate the process and avoid delays.

What does it mean to convert a deficiency protest or appeal to a claim for refund?

Converting a deficiency protest or appeal to a claim for refund is a process that allows taxpayers who have tax deposit amounts on account and are in the middle of a deficiency protest or appeal to request these funds to be applied as a refund claim before there is a final tax liability for that taxable year. This involves filing a written statement with Form FTB 3581, checking the option that states “Convert deficiency administrative action to action on a refund claim.” This action finalizes the deficiency, applying the tax deposit toward the deficiency amount, and potentially converting the balance into an informal claim if the deposit does not cover the full amount.

Who should use Form FTB 3581?

Form FTB 3581 is designed for use by individuals, corporations, LPs, LLPs, REMICs, or LLCs in California looking to manage their tax deposits flexibly. This form is suitable for taxpayers who need to request a refund of their tax deposits, desire to shift a tax deposit to a different taxable year, or wish to convert a pending tax deficiency issue into a claim for a refund. It is also a necessary form for Registered Domestic Partners (RDPs) as pertained to their unique tax considerations in California.

Where should Form FTB 3581 be filed?

Form FTB 3581 should be submitted to specific addresses based on the filer's status:

- For individuals, the form should be mailed to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO, CA 94240-0040.

- For corporations, LPs, LLPs, REMICs, or LLCs, it should be sent to: FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO, CA 94257-0540.

It's important to submit a separate Form FTB 3581 for each taxable year involved.

What is the significance of including a Private Mail Box (PMB) in the address field?

For those using a Private Mail Box (PMB) as their mailing address, including the PMB number in the address field on Form FTB 3581 is crucial for ensuring the form is delivered accurately and promptly. The correct format includes writing "PMB" followed by the box number, as in "111 Main Street PMB 123." This precise information helps the Franchise Tax Board to process your request without unnecessary delays caused by mail delivery issues.

Common mistakes

Filling out the California 3581 form, which is used for Tax Deposit Refund and Transfer Requests, seems straightforward, but common mistakes can complicate or delay the process. Being aware of these pitfalls is the first step toward a smoother, error-free submission.

- Incorrect Taxable Year: A frequent mistake is entering the wrong taxable year at the top of the form. Ensure the four-digit taxable year is accurate to avoid processing delays.

- Missing or Incorrect Social Security Numbers (SSNs) or ITINs: Every field is crucial, especially the SSNs or ITINs. Double-check these numbers for yourself and your spouse/RDP to ensure they match exactly with your tax return documents.

- Incomplete Address Information: Leaving out any part of your address, including the PMB number if applicable or not following the specified format, can lead to significant delays. Make sure every piece of your address is present and correctly formatted.

- Unclear Requested Action: The form requires you to clearly indicate your requested action: a refund, transfer, or conversion of a deficiency administrative action. Failing to mark one or marking multiple can lead to confusion and processing errors.

- Leaving Amount Fields Blank: Whether requesting a refund or transfer, you must specify the exact amounts. Leaving these fields blank or entering incorrect values can lead to incorrect processing of your request.

Understanding and avoiding these common mistakes can lead to a smoother and more efficient handling of your Tax Deposit Refund and Transfer Request. Always review your form thoroughly before submission to ensure all information is correct and complete.

Documents used along the form

When dealing with financial and tax-related matters, especially in California, the California Form 3581 plays a crucial role among various documents required for transactions with the Franchise Tax Board (FTB). However, it is rarely the only piece of paperwork needed. Understanding the supporting documents often used alongside Form 3581 can ease the process and ensure compliance with state tax laws.

- Form 540: This is the California Resident Income Tax Return form. It is used by residents to report their annual income and calculate state tax liability. It’s often necessary to reference this form when requesting a tax deposit refund or transfer to ensure the amounts align with reported income.

- Form 593: Real Estate Withholding Tax Statement. When real estate is sold in California, this form is used to withhold and report state income tax. If you're seeking a refund or transfer of tax deposits related to real estate transactions, this document provides crucial details.

- FTB Pub. 737: Tax Information for Registered Domestic Partners. Provides guidelines and clarifications for tax treatments and considerations for Registered Domestic Partners (RDPs) in California, relevant for ensuring accurate requests on Form 3581 if involving RDP scenarios.

- Form 3554: New Employment Credit (NEC) Reservation. Businesses may need to include this if their request on Form 3581 involves funds related to the NEC, ensuring eligibility and proper allocation of the tax deposit or refund.

- Form 100: California Corporation Franchise or Income Tax Return. Essential for corporations involved in requesting a refund or transfer of a tax deposit, as it outlines the income and calculated taxes for the company.

- Form 7004: Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. If a business has requested an extension for filing its tax returns, this form helps align the extended filing deadlines with any requests made on Form 3581.

- Form 3522: LLC Tax Voucher. For Limited Liability Companies (LLCs) that need to make tax payments or request tax deposit refunds or transfers. This voucher is a prerequisite for ensuring the proper application of LLC-related transactions on Form 3581.

For individuals and businesses navigating the complexities of California's taxation, these documents, alongside Form 3581, provide a framework to manage tax responsibilities effectively. From income reporting to real estate transactions and beyond, having a clear understanding of each form's role can streamline any tax-related process with the FTB. It's always advisable to consult with a tax professional or reach out directly to the FTB for guidance specific to your circumstances.

Similar forms

The federal Form 1040X, "Amended U.S. Individual Income Tax Return," shares foundational similarities with California's Form 3581 in its purpose to adjust or amend a previously filed tax return. Where the 1040X is applied to amend income and deductions on a federal tax return, Form 3581 provides a mechanism for taxpayers in California to request refund or transfer of their tax deposits for state tax obligations. Both forms necessitate detailed information about the original return, including the tax year in question, and outline the taxpayer's intention to either correct an error or adjust the tax amount based on new information, therefore acting as critical tools in ensuring tax compliance and accuracy of taxpayers’ liabilities.

California Form 3500, "Exemption Application," although serving a different primary purpose, aligns with Form 3581 in its administrative role within the state’s tax framework. While Form 3500 is used by organizations seeking tax-exempt status in California, both it and Form 3581 necessitate comprehensive disclosure of financial information and statuses to the Franchise Tax Board (FTB). These forms also underscore the importance of taxpayers' or organizations’ adherence to regulatory requirements, facilitating a structured approach to fiscal responsibilities and benefits within the state.

The Form 3520, "Power of Attorney," although not directly related to tax refunds or transfers, complements the functionalities of Form 3581 in the broader landscape of tax administration and representation. Form 3520 enables taxpayers to designate representatives to handle their tax matters, which can include filing a Form 3581. The interplay between these documents highlights how representation and direct action by taxpayers coexist within the legal procedures for managing tax engagements, ensuring that individuals and entities can efficiently address their obligations and rights involving tax matters.

"Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," commonly known through its federal designation as Form 4868, parallels California Form 3581 in providing taxpayers with procedural flexibility. While Form 4868 grants an extension for filing a federal tax return, the temporal adjustments allowed by Form 3581 for the application of tax deposits to different taxable years offer taxpayers additional time to organize their finances. Both forms recognize the complexities of financial situations, offering mechanisms to accommodate unforeseen circumstances or strategic financial planning.

Form 540, "California Resident Income Tax Return," serves as the primary vehicle for individuals to report their income, calculate taxes owed, and claim refunds at the state level, directly engaging with components addressed in Form 3581. Where Form 3581 deals with the specific adjustments to tax deposit allocations or refunds, Form 540 encompasses the broader responsibility of reporting annual income and calculating tax liability. The relationship between these forms highlights the comprehensive process of tax compliance, from initial reporting to subsequent adjustments.

Form 588, "Nonresident Withholding Waiver Request," while serving a niche area within California’s tax landscape, shares operational similarities with Form 3581 by facilitating specific taxpayer requests regarding tax handling. Form 588 allows nonresident taxpayers to request a waiver for withholding requirements on income sourced from California, paralleling the request mechanism in Form 3581 that allows taxpayers to direct the application of their tax deposits. Both forms cater to specific taxpayer needs, enabling individualized approaches to tax liability and compliance management.

The Federal Form 8822, "Change of Address," while primarily administrative, indirectly supports the processes associated with California Form 3581 by ensuring that the IRS and, by extension, state tax authorities, are apprised of a taxpayer's current mailing address, which is critical for the proper processing of refunds and transfers. The importance of accurate, current taxpayer information underlies both forms, emphasizing the role of clear communication in the administration of tax matters. This connectivity ensures that administrative and financial actions, such as those facilitated by Form 3581, are executed efficiently and reach the correct parties.

Dos and Don'ts

When completing the California Form 3581 for Tax Deposit Refund and Transfer Request, there are specific actions you should take to ensure the process goes smoothly, as well as actions you should avoid. Following these guidelines will help streamline your request and avoid unnecessary delays or errors.

Things You Should Do

- Fill out the form completely, making sure all applicable fields are entered accurately, including your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and, if applicable, your spouse's/RDP’s details.

- Clearly indicate the type of tax related to your request by checking the appropriate box for Personal Income Tax, Corporate Tax, LLC Fee, LP, LLP, REMIC annual tax.

- Specify the tax deposit payment amount and the exact date of the payment to ensure your request is processed accurately.

- Choose and mark clearly the requested action you want: Refund, Transfer to another taxable year, or Convert deficiency administrative action to action on a refund claim.

- Include written statements or additional documentation required for specific actions, such as converting a pending deficiency protest or appeal to a claim for refund.

- Sign and date the form. If you're filing a joint return, make sure both you and your spouse/RDP sign and date it.

Things You Shouldn't Do

- Don't leave any required fields blank. Incomplete forms may delay processing or result in your request being denied.

- Avoid making corrections or alterations on the form after you have filled it out to prevent any misunderstandings. If an error is made, it's better to start with a fresh form.

- Don't forget to include your Private Mail Box (if applicable) in the address field, properly labeled with "PMB" and the box number.

- Do not submit the form without ensuring all information is accurate, including checking the correct taxable year at the top of the form.

- Avoid sending the form to the wrong department or address; verify you are mailing it to the correct address for your specific taxpayer category.

- Don't forge your spouse's/RDP's signature. This is unlawful and can result in serious consequences.

By following these guidelines, you can help ensure that your Form 3581 is processed efficiently and accurately, leading to a quicker resolution of your tax deposit refund or transfer request.

Misconceptions

Many people have misconceptions about the California Form 3581, which is essentially a Tax Deposit Refund and Transfer Request form. Understanding these misconceptions can help taxpayers navigate their tax affairs more effectively. Here are five common misunderstandings and clarifications regarding this form:

- It's only for individuals: A common misconception is that Form 3581 is exclusive to individual taxpayers. However, this form is not just for individuals but also for corporations, limited partnerships (LPs), limited liability partnerships (LLPs), Real Estate Mortgage Investment Conduits (REMICs), and limited liability companies (LLCs). It serves to request the refund of a tax deposit or transfer part or all of it.

- It can only be used for personal income tax: While personal income tax is one of the types of taxes mentioned in the form, it's incorrect to assume that Form 3581 is limited to that. Taxpayers can also use it for corporate tax, LLC fees, and the annual taxes of LPs, LLPs, and REMICs. This versatility makes it a critical tool for a broad spectrum of taxpayers.

- Refunds are automatic: Some might believe that once you file Form 3581, a refund or transfer is guaranteed. However, the process is subject to review by the Franchise Tax Board (FTB). The FTB will assess whether the amount deposited can be refunded or transferred, depending on the existence of any final tax liability or other debt to the state.

- You cannot convert a pending deficiency protest or appeal with it: In fact, Form 3581 allows taxpayers to convert a pending deficiency protest or appeal into a claim for a refund. This is a significant aspect of the form, as it provides a pathway for taxpayers to challenge a deficiency before there's a final tax liability, potentially altering the outcome of their case.

- Submission details are flexible: There's a specific requirement for the submission of Form 3581, which many might overlook. For individuals, the form should be mailed to a designated address, and similarly, there's a separate mailing address for corporations, LPs, LLPs, REMICs, and LLCs. Ensuring that the form is sent to the correct address is crucial for timely and proper processing.

In conclusion, understanding these common misconceptions about California Form 3581 can lead to more informed decisions when managing one's taxes. Always ensure that you complete the form accurately and mail it to the appropriate address to facilitate the desired action on your tax deposits.

Key takeaways

- The California Form 3581 is employed for multiple purposes, including requesting refunds of tax deposits, transferring tax deposits to other taxable years, and converting pending deficiency protests or appeals into claims for refund.

- Before the Franchise Tax Board (FTB) applies the deposit amount to satisfy a final tax liability, refund or transfer requests for tax deposits can be made at any time.

- To convert a pending deficiency action to a claim for refund, a written statement asking the FTB to make this conversion is necessary. This is achieved by checking the appropriate box on Form FTB 3581.

- When filling out Form 3581, it's essential to provide detailed information including the taxable year, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), California corporation number, Secretary of State (SOS) file number, or Federal Employer Identification Number (FEIN).

- For Registered Domestic Partners (RDPs), California income tax laws equate references to a spouse, husband, or wife to include a California RDP, unless specified otherwise. This ensures equal treatment under the tax law for RDPs.

- Including the Private Mail Box (PMB) number in the address details is crucial when providing an address that includes a PMB. The abbreviation "PMB" followed by the box number must be clearly indicated.

- A separate Form FTB 3581 is required for each taxable year for which a request is made. This ensures the correct processing and application of requests to the specific year in question.

- Accurate completion of all relevant fields in the form is imperative for a timely response from the FTB and to ensure the proper application of the taxpayer's request, whether it's a refund, transfer, or conversion action.

- Individuals, corporations, LPs, LLPs, REMICs, and LLCs have different mailing addresses for the submission of Form FTB 3581, highlighting the need to send the form to the correct address based on the entity type to avoid delays in processing.

- The form also facilitates the conversion of deficiency administrative actions to actions on a refund claim before a final tax liability for that taxable year is determined, which can be a strategic financial move for taxpayers facing potential deficiencies.

Different PDF Templates

California Llc - The purpose statement in the LLC-1 form must remain unaltered and states the company can engage in any lawful act or activity.

What Happens to a Jointly Owned Property If One Owner Dies in California - Streamlines property transactions in California by providing a legal pathway to resolve ownership following a joint tenant’s death.

Form 100s - The inclusion of Qualified Subchapter S Subsidiary (QSub) information via Schedule QS addresses specific tax scenarios for S corporations.