Fill a Valid California 3582 Form

Every year, countless individuals navigate the complexities of tax filing, and for those utilizing the convenience of electronic submissions in California, the Form FTB 3582 becomes an essential part of the process. Serving as the Payment Voucher for Individual e-filed Returns, this form bridges the final step for taxpayers who have a balance due after submitting their tax returns online. What stands out in the recent instructions is the emphasis on mandatory electronic payments for those who surpass certain payment thresholds, marking a significant push towards digital transactions in the realm of tax payments. This transition not only reflects the evolving nature of financial exchanges but also underscores the importance of adapting to technological advancements for both efficiency and security. Additionally, the detailed guidelines provide clarity on acceptable payment methods, ensuring taxpayers can fulfill their obligations without inadvertently triggering noncompliance penalties. With provisions also made for those living abroad or needing to update preprinted information, the California 3582 form embodies a comprehensive tool for closing out the tax year, whether one opts for traditional checks or navigates the digital avenues for settling their dues.

Document Example

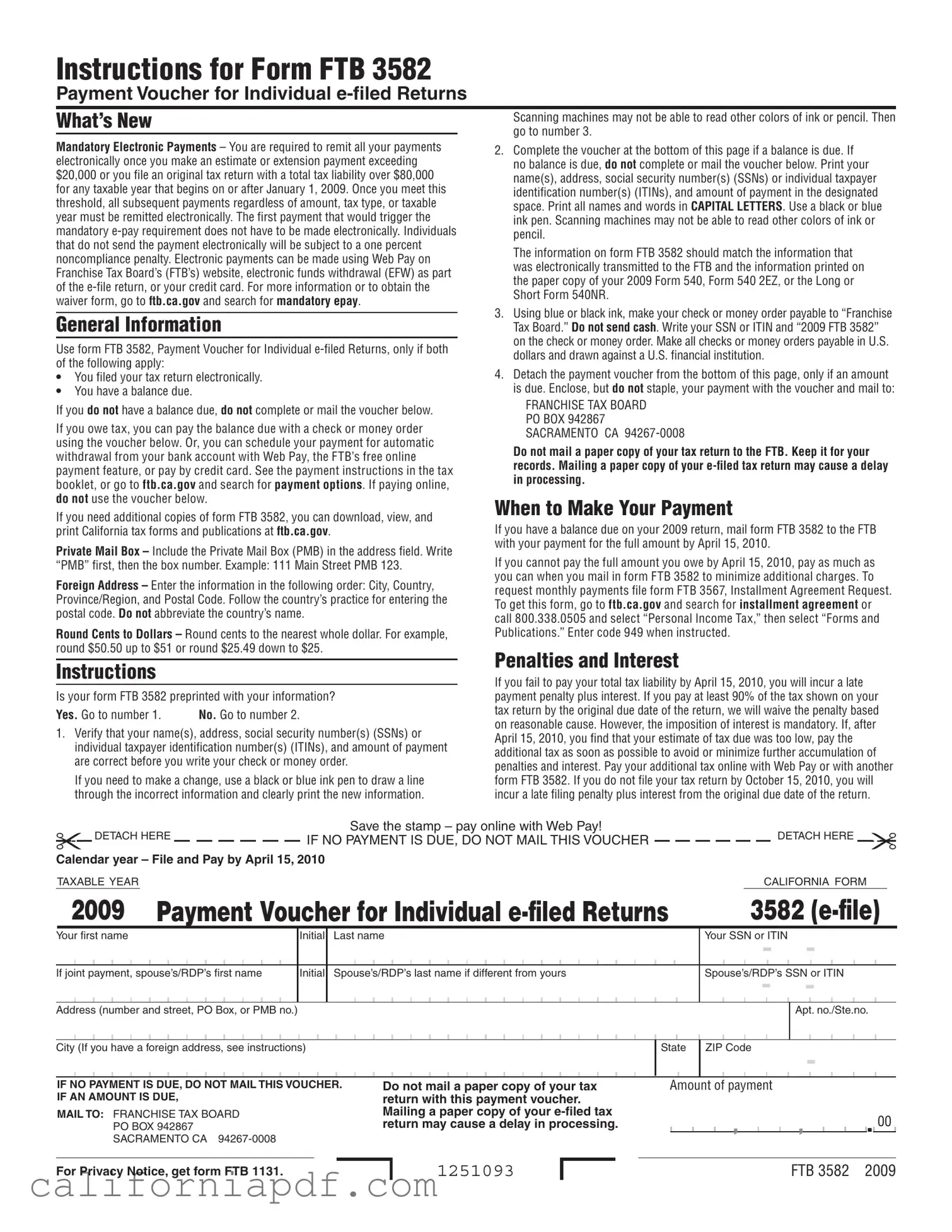

Instructions for Form FTB 3582

Payment Voucher for Individual

What’s New |

Scanning machines may not be able to read other colors of ink or pencil. Then |

|

go to number 3. |

||

|

Mandatory Electronic Payments – You are required to remit all your payments electronically once you make an estimate or extension payment exceeding $20,000 or you file an original tax return with a total tax liability over $80,000 for any taxable year that begins on or after January 1, 2009. Once you meet this threshold, all subsequent payments regardless of amount, tax type, or taxable year must be remitted electronically. The first payment that would trigger the mandatory

General Information

Use form FTB 3582, Payment Voucher for Individual

•You filed your tax return electronically.

•You have a balance due.

If you do not have a balance due, do not complete or mail the voucher below.

If you owe tax, you can pay the balance due with a check or money order using the voucher below. Or, you can schedule your payment for automatic withdrawal from your bank account with Web Pay, the FTB’s free online payment feature, or pay by credit card. See the payment instructions in the tax booklet, or go to ftb.ca.gov and search for payment options. If paying online, do not use the voucher below.

If you need additional copies of form FTB 3582, you can download, view, and print California tax forms and publications at ftb.ca.gov.

Private Mail Box – Include the Private Mail Box (PMB) in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

Round Cents to Dollars – Round cents to the nearest whole dollar. For example, round $50.50 up to $51 or round $25.49 down to $25.

Instructions

Is your form FTB 3582 preprinted with your information?

Yes. Go to number 1. |

No. Go to number 2. |

1.Verify that your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and amount of payment are correct before you write your check or money order.

If you need to make a change, use a black or blue ink pen to draw a line through the incorrect information and clearly print the new information.

2.Complete the voucher at the bottom of this page if a balance is due. If no balance is due, do not complete or mail the voucher below. Print your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and amount of payment in the designated space. Print all names and words in CAPITAL LETTERS. Use a black or blue ink pen. Scanning machines may not be able to read other colors of ink or pencil.

The information on form FTB 3582 should match the information that was electronically transmitted to the FTB and the information printed on the paper copy of your 2009 Form 540, Form 540 2EZ, or the Long or Short Form 540NR.

3.Using blue or black ink, make your check or money order payable to “Franchise Tax Board.” Do not send cash. Write your SSN or ITIN and “2009 FTB 3582” on the check or money order. Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution.

4.Detach the payment voucher from the bottom of this page, only if an amount is due. Enclose, but do not staple, your payment with the voucher and mail to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA

Do not mail a paper copy of your tax return to the FTB. Keep it for your records. Mailing a paper copy of your

When to Make Your Payment

If you have a balance due on your 2009 return, mail form FTB 3582 to the FTB with your payment for the full amount by April 15, 2010.

If you cannot pay the full amount you owe by April 15, 2010, pay as much as you can when you mail in form FTB 3582 to minimize additional charges. To request monthly payments file form FTB 3567, Installment Agreement Request. To get this form, go to ftb.ca.gov and search for installment agreement or call 800.338.0505 and select “Personal Income Tax,” then select “Forms and Publications.” Enter code 949 when instructed.

Penalties and Interest

If you fail to pay your total tax liability by April 15, 2010, you will incur a late payment penalty plus interest. If you pay at least 90% of the tax shown on your tax return by the original due date of the return, we will waive the penalty based on reasonable cause. However, the imposition of interest is mandatory. If, after April 15, 2010, you find that your estimate of tax due was too low, pay the additional tax as soon as possible to avoid or minimize further accumulation of penalties and interest. Pay your additional tax online with Web Pay or with another form FTB 3582. If you do not file your tax return by October 15, 2010, you will incur a late filing penalty plus interest from the original due date of the return.

|

DETACH HERE |

Save the stamp – pay online with Web Pay! |

|

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER |

|||

|

Calendar year – File and Pay by April 15, 2010

TAXABLE YEAR

DETACH HERE

CALIFORNIA FORM

2009 Payment Voucher for Individual |

|

|

3582 |

|||||||||||||||||||||||||||||||||||||||||||||

Your first name |

Initial |

Last name |

|

|

|

|

|

Your SSN |

- |

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint payment, spouse’s/RDP’s first name |

Initial |

Spouse’s/RDP’s last name if different from yours |

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no./Ste.no. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see instructions) |

|

State |

ZIP Code |

- |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER. IF AN AMOUNT IS DUE,

MAIL TO: FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA

Do not mail a paper copy of your tax return with this payment voucher. Mailing a paper copy of your

Amount of payment

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

For Privacy Notice, get form FTB 1131.

1251093

FTB 3582 2009

Form Breakdown

| Fact | Detail |

|---|---|

| Form Purpose | Form FTB 3582 is used for paying the balance due on individual e-filed California state income tax returns. |

| Eligibility | Individuals who filed their tax return electronically and have a balance due are required to use this form. |

| Mandatory Electronic Payments | If an individual makes an estimate or extension payment over $20,000 or files an original tax return with a total tax liability over $80,000, all future payments must be made electronically. |

| Penalty for Noncompliance | A one percent penalty is applied to individuals who are required but fail to make payments electronically. |

| Payment Methods | Payments can be made with a check, money order, or electronically via Web Pay on the FTB website or by credit card. |

| Foreign Address Instructions | For foreign addresses, the form requires city, country, province/region, and postal code in specific order without abbreviating the country’s name. |

| Governing Law | The form and instructions are governed by California state law specifically related to tax filings and payments. |

How to Write California 3582

To ensure a smooth process with your California state taxes, especially if you have a balance due after filing your tax return electronically, the FTB 358X form comes into play. This payment voucher facilitates the payment process, making it easier to settle your dues. Remember, this form is critical for individuals who filed their taxes online and ended up owing taxes to the state. Here are the steps to accurately fill out the form, avoiding common mistakes and ensuring your payment is processed without delay.

- Check your preprinted information: If your form FTB 3582 is preprinted, confirm that your name(s), address, social security number(s) (SSNs) or individual taxpayer identification number(s) (ITINs), and payment amount are all correct. Use a black or blue ink pen to cross out any incorrect information and write the correct details clearly.

- Fill in the voucher: If your form isn't preprinted and you have a balance due, complete the payment voucher located at the bottom of the instructions. Print your name(s), address, SSNs or ITINs, and the amount of the payment in the designated spaces. Remember, all entries should be in CAPITAL LETTERS using a black or blue ink pen, as scanning machines might not detect other colors.

- Write your check or money order: Make your payment using a check or money order payable to “Franchise Tax Board.” It's important not to send cash. Clearly write your SSN or ITIN and “2009 FTB 3582” on your payment, ensuring it's made in U.S. dollars and drawn from a U.S. financial institution.

- Detach and mail the voucher: If you owe a payment, detach the voucher carefully from the bottom of the page. Include, but don't staple, your payment with the voucher and mail it to the FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008. Avoid mailing a paper copy of your tax return with this voucher to prevent processing delays.

Make sure to send your payment by the due date to avoid late penalties and interest. If you're unable to pay the full amount, consider paying as much as you can and then look into setting up an installment agreement with the FTB for the remaining balance. Timely communication and action can help manage any additional financial implications.

Listed Questions and Answers

What is Form FTB 3582?

Form FTB 3582 is a Payment Voucher for Individual e-filed Returns used by California taxpayers to make a payment on their balance due when filing their tax returns electronically. It serves as a way to submit a payment separately from an e-filed tax return.

When should I use Form FTB 3582?

You should use Form FTB 3582 only if you e-filed your tax return and have a balance due. If you do not have a balance due, there's no need to complete or mail this voucher.

What are the payment methods I can use with Form FTB 3582?

Payment methods include:

- Writing a check or money order and mailing it with the payment voucher.

- Scheduling a payment through Web Pay, the Franchise Tax Board's free online payment feature.

- Paying by credit card via an accepted payment processor.

Note that if you choose to pay online, you should not use the voucher.

What if my form is preprinted with incorrect information?

If your Form FTB 3582 is preprinted with incorrect information, use a black or blue ink pen to draw a line through the incorrect data. Then, clearly print the correct information next to it.

How do I fill out Form FTB 3582?

To fill out Form FTB 3582:

- Ensure that your name, address, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and payment amount are correct.

- Use CAPITAL LETTERS to print your information in the designated spaces, using a black or blue ink pen.

- Detach the payment voucher at the bottom of the page if an amount is due and mail it with your payment to the address provided.

What address should I send Form FTB 3582 to?

Send Form FTB 3582 along with your payment to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0008.

What should I do if I cannot pay the full amount by the due date?

If you cannot pay the entire amount due by the deadline, pay as much as you can to minimize additional charges. To set up monthly payments, file Form FTB 3567, Installment Agreement Request. You can find this form on the ftb.ca.gov website or by calling 800.338.0505.

Are there penalties for not paying the full amount on time?

Yes, failing to pay your total tax liability by the due date results in a late payment penalty and interest. The penalty may be waived if you pay at least 90% of your tax due by the original due date, based on reasonable cause. However, interest charges are mandatory and accumulate until the full payment is made.

Common mistakes

Filling out the California 3582 form might seem straightforward, but there are common mistakes that can lead to issues or delays in processing. Here are five mistakes that are often made:

Not using black or blue ink when completing the form manually. The instructions specify that these colors must be used because scanning machines may not be able to read other colors of ink or pencil. This simple oversight can make your submission unreadable and delay processing.

Failing to ensure that the information matches across documents. The information on form FTG 3582 should align with the details electronically transmitted and the information printed on your tax return forms such as Form 540 or Form 540NR. Mismatches can cause confusion and potentially incorrect tax assessments or payments.

Incorrectly addressing the payment method. Payments should be made payable to the “Franchise Tax Board,” and it's important to write your SSN or ITIN and “2009 FTG 3582” on the check or money order. This mistake can lead to payments not being credited to your account properly.

Omitting the Private Mail Box (PMB) number or typing it incorrectly when filling out the mailing address. For those using a PMB, the correct format is crucial (“PMB” followed by the box number) to ensure the payment voucher reaches the intended destination without unnecessary delays.

Not rounding cents to dollars correctly. The form instructs taxpayers to round cents to the nearest whole dollar, which some may overlook or calculate incorrectly. This can affect the total payment amount slightly but is important for adherence to the instructions provided.

While these mistakes might seem minor, they can lead to bigger headaches if your payment is delayed or misapplied. Paying attention to the details and following the instructions closely can save time and ensure that your tax payments are processed smoothly.

Documents used along the form

When preparing your taxes, especially if you're working with the California Form 3582 (Payment Voucher for Individual e-filed Returns), you'll often find that there are additional forms and documents you may need to include or be aware of during the process. These forms help ensure that all aspects of your tax situation are covered, from adjusting your payments if you can't pay in full to declaring all sources of income accurately. Let’s take a look at some of these essential documents.

- Form 540/540 2EZ: California Resident Income Tax Return. This is the main tax return form for California residents, used to report income, calculate state tax liability, and determine any refund or balance due.

- Form 540NR: California Nonresident or Part-Year Resident Income Tax Return. For individuals who are not residents of California for the entire tax year, this form helps calculate the tax on income sourced from California.

- Form FTB 3567: Installment Agreement Request. If you can't pay your tax liability in full, this form can be used to request a payment plan with the California Franchise Tax Board (FTB).

- Form 540-ES: Estimated Tax for Individuals. For those who need to make estimated tax payments throughout the year, this voucher helps you calculate and submit those payments.

- Form FTB 3500: Exemption Application. This form is used by organizations to apply for tax-exempt status in California.

- Form FTB 3519: Payment for Automatic Extension for Individuals. If you need more time to file your tax return, this payment voucher is used to pay the estimated tax due by the original deadline.

- Form FTB 3885: California Depreciation and Amortization Adjustments. For individuals who need to make adjustments to the depreciation and amortization reported on their federal tax return, this form aligns those amounts with California's regulations.

- Schedule CA (540): California Adjustments - Residents. This accompanies the Form 540 and is used to make adjustments to the federal adjusted gross income and deductions based on California law.

- Schedule D (540): California Capital Gain or Loss Adjustment. If you have capital gains or losses that differ from what is reported on your federal tax return, this schedule is used to report those for California taxes.

- Form FTB 3532: Head of Household Filing Status Schedule. For individuals claiming the head-of-household filing status, this form helps determine eligibility based on California's requirements.

Dealing with taxes can feel overwhelming, especially when multiple forms and documents are involved. However, each of these forms serves a specific purpose in ensuring that your tax filings are accurate and that you're taking advantage of the deductions and credits available to you. Always make sure to check the California Franchise Tax Board’s website or consult with a tax professional to ensure you’re using the correct forms for your specific situation.

Similar forms

The California 3582 form, necessitating detailed information about payments for e-filed tax returns, echoes the structure and purpose of the IRS Form 1040-V, the Payment Voucher for Individual Income Tax. Both serve as mechanisms for taxpayers to submit payments accompanying their e-filed returns, and they aim to streamline the payment process by providing clear instructions on how to execute the payment correctly. Specifically, each form requires the taxpayer's identifying information and the exact payment amount, ensuring that the payment is correctly applied to the taxpayer's account. This approach helps minimize errors in payment processing and promotes efficient government operations.

Another document bearing resemblance to California's 3582 form is the Electronic Federal Tax Payment System (EFTPS) voucher. While the EFTPS system primarily facilitates electronic payments, it generates vouchers for individuals who opt for or need to make payments via check or money order. Similarly, the 3582 form aims at taxpayers who, despite filing electronically, choose to or must make their payments through a physical medium. Both documents underscore the shift towards encouraging electronic transactions while still accommodating traditional payment methods, thereby bridging the gap between digital and non-digital tax-paying preferences.

The California FTB 3567, Installment Agreement Request, while distinct in its function of setting up payment plans for tax liabilities, shares foundational parallels with the 3582 form. Both require detailed taxpayer information to process payments or payment plans adequately. Moreover, they intersect at the point of facilitating taxpayer compliance, offering structured means for individuals to meet their tax obligations either in lump sums or over time. This similarity highlights the tax authority's role in providing multiple avenues for taxpayers to remain in good standing, reflecting an understanding of varied financial situations.

Lastly, the resemblance between the 3582 form and a local municipality's property tax payment voucher cannot be overlooked. Local property tax vouchers similarly collect detailed taxpayer and payment information, ensuring that payments are attributed correctly to the right property accounts. The parallel lies in the objective to make tax payment processes as error-free and efficient as possible, whether for state income tax or local property tax. Both types of documents play crucial roles in the broader fiscal ecosystem, facilitating the smooth operation of public services funded through these taxes.

Dos and Don'ts

When dealing with the California Form 3582, it's essential to be mindful of the do's and don'ts to ensure a smooth and error-free process. Here are some key points to consider:

Do:- Use black or blue ink when filling out the form manually to ensure that the scanning machines can accurately read your information.

- Verify preprinted information for accuracy if your Form FTB 3582 has your details preprinted. Make any necessary corrections by drawing a line through the incorrect information and clearly printing the new information beside it.

- Rounded cents to dollars on your payment amount, following the rounding instructions to avoid confusion and ensure your payment is processed correctly.

- Detach the payment voucher if you have a balance due. Enclose, but do not staple, your payment with the voucher when mailing.

- Include your payment when mailing the Form FTW 3582, making sure your check or money order is payable in U.S. dollars from a U.S. financial institution.

- Check your payment options carefully. If paying online, avoid using the voucher to streamline the process.

- Keep the paper copy of your e-filed tax return for your records, as mailing it can delay processing.

- Make your payment by the due date to avoid unnecessary penalties or interest charges.

- Use pencils or non-standard ink colors as they might not be readable by scanning machines, leading to processing errors.

- Staple your payment to the voucher; simply enclosing it is sufficient and ensures that the documents can be processed smoothly.

- Mail the voucher if no payment is due. This form is only necessary if you owe a balance.

- Forget to sign your check or money order, which can cause processing delays or make your payment void.

- Ignore the mandatory e-payment requirements if your estimates or tax liabilities exceed the specified threshold, as this will result in penalties.

- Abbreviate the country’s name if you have a foreign address. Accurate and complete information is crucial for processing.

- Mail a paper copy of your e-filed tax return with the voucher, as it's unnecessary and may delay the processing of your return and payment.

- Wait until the last minute to make your payment if you're unable to pay the full amount by the due date, consider paying as much as you can and explore installment agreement options to prevent or reduce additional charges.

Misconceptions

Understanding tax procedures is crucial for compliance and financial planning, particularly when dealing with the specifics of tax forms issued by the California Franchise Tax Board (FTB). Among these, Form FTB 3582, the Payment Voucher for Individual e-filed Returns, often generates confusion due to common misconceptions. Here's a clear breakdown of those misunderstandings to help guide taxpayers:

- Misconception 1: Form FTB 3582 needs to be submitted by all taxpayers.

False. This form is specifically for individuals who have e-filed their California tax returns and owe a balance. If you do not owe any tax upon filing, there is no need to complete or send this voucher. - Misconception 2: You must pay electronically if you use Form FTB 3582.

Not necessarily. While the form does provide information for making electronic payments, taxpayers can choose to pay their balance due by check or money order using the voucher provided. Electronic payments, however, are encouraged and in some cases required based on the total tax liability or payment amounts. - Misconception 3: Electronic payments are optional regardless of the amount owed.

This is incorrect for those who have reached certain thresholds. If you make an estimate or extension payment over $20,000 or file a return with over $80,000 in total tax liability for any taxable year beginning after January 1, 2009, you must make all subsequent payments electronically. Failure to adhere to this requirement can result in noncompliance penalties. - Misconcession 4: The form can be used for payment with any ink color.

Actually, if you are filling out the form manually, it is important to use a black or blue ink pen. Scanners used by the FTB may not properly read other colors, potentially leading to errors in processing your payment. - Misconception 5: Information does not need to match exactly with the e-filed return.

On the contrary, the details you provide on Form FTB 3582, including your names, address, social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN), and the amount of payment, should exactly match the information transmitted electronically to the FTB and what is printed on your tax return. Discrepancies can cause processing delays. - Misconception 6: You must include a paper copy of your return when mailing the voucher.

This is not required and, in fact, doing so can delay processing. The FTB 3582 form is designed for those who have already e-filed their return. Including a paper copy of the return goes against the instructions and can lead to confusion or delays. - Misconception 7: It's acceptable to defer the payment if you cannot afford to pay by the deadline.

While it may seem like an immediate solution, not paying the full amount due by the payment deadline will result in additional charges due to late payment penalties and interest. If you are unable to pay in full by the due date, it is recommended to pay as much as you can and contact the FTB to discuss payment options or set up an installment agreement. - Misconception 8: Penalties are negotiable and can be waived under certain circumstances.

While the FTB may waive the late payment penalty for reasonable cause if at least 90% of the tax due is paid by the original due date, interest charges on unpaid balances are mandatory and cannot be waived. Therefore, it's important to pay any additional tax owed as soon as possible to minimize the accumulation of interest and penalties.

Correcting these misconceptions can help taxpayers avoid penalties, process their payments efficiently, and understand their obligations when using Form FTB 3582 for their California tax filings.

Key takeaways

When it comes to managing your tax obligations in California, ensuring accurate completion and use of the Form FTB 3582, Payment Voucher for Individual e-filed Returns, is crucial. Here are four key takeaways that every taxpayer should be mindful of:

- Electronic Payment Requirement: If you make a payment exceeding $20,000 or file a tax return with a total tax liability over $80,000 for any tax year starting on or after January 1, 2009, you are mandated to make all future payments electronically. This requirement kicks in after the first instance you hit these thresholds, and failing to comply will result in a one percent penalty on any non-electronically submitted payments.

- When to Use the Form FTB 3582: This form is specifically designed for taxpayers who have filed their tax returns electronically and have a balance due. If you do not owe any tax, there’s no need to complete or mail this voucher. Conversely, if a balance is due, options such as check, money order, or online payment methods are available to settle your tax bill.

- Correcting Preprinted Information: If your form comes preprinted but contains incorrect details such as your name, address, or Social Security Number/Taxpayer Identification Number, you are allowed to make changes. Cross out any incorrect information with a black or blue ink pen and clearly write the correct details. This ensures that your payment is accurately processed and attributed to you.

Mailing Instructions and Deadline: If you owe tax, detach the payment voucher at the bottom of the page and send it with your payment to the specified address. It’s critical not to staple your payment to the voucher and to mail it by the due date, typically April 15, to avoid late payment charges. For those unable to pay the full amount by the deadline, making a partial payment and contacting the Franchise Tax Board for a payment plan can help minimize additional charges.

Adherence to these guidelines not only facilitates a smoother transaction with the Franchise Tax Board but also helps in avoiding unnecessary penalties and interest charges. Remember, staying informed and proactive about your tax obligations is key to managing your financial health.

Different PDF Templates

Ca Form 100w - Instructions on Form 100-WE guide corporations through the election process, referencing relevant tax code sections for clarity.

Legal Guardianship California Form - The document must be filed with the appropriate county's Superior Court where the minor resides or is located.