Fill a Valid California 3588 Form

In the realm of tax compliance for Limited Liability Companies (LLCs) in California, navigating through the requisite forms and procedures emerges as a critical endeavor to ensure adherence to state tax obligations. The California Form 3588 plays a pivotal role in this landscape, specifically designed for LLCs that opt for electronic filing (e-filing) of their tax returns. This form, officially titled the Payment Voucher for LLC e-filed Returns, serves as a conduit for such entities to remit any dues accompanying their electronically submitted tax returns. It stipulates a structured format to facilitate accurate payment processing by the California Franchise Tax Board (FTB), thereby mitigating errors and ensuring timely fulfillment of tax liabilities. Applicable to LLCs that find themselves with a balance due post e-filing, the form mandates details ranging from basic identification information—such as the LLC’s name, business name if applicable (DBA), address, Secretary of State (SOS) file number, federal employer identification number (FEIN)—to the precise amount payable. Emphasis is laid on the importance of rounding off cents to the nearest dollar, specifying payment instruments, and the exacting nature of addressing guidelines, including the annotation for Private Mail Boxes (PMB). Furthermore, the sequence delineated for completing and submitting the form—alongside the critical deadlines, the repercussions of late payments, and the slightly lenient provisions for penalty waivers under certain conditions—highlights the procedural and regulatory precision expected from LLCs in the fray. As such, Form FTB 3588 embodies more than a mere payment voucher; it represents an integral facet of the tax filing process for electronically filing LLCs, underpinning the broader objective of streamlined tax administration and compliance within California.

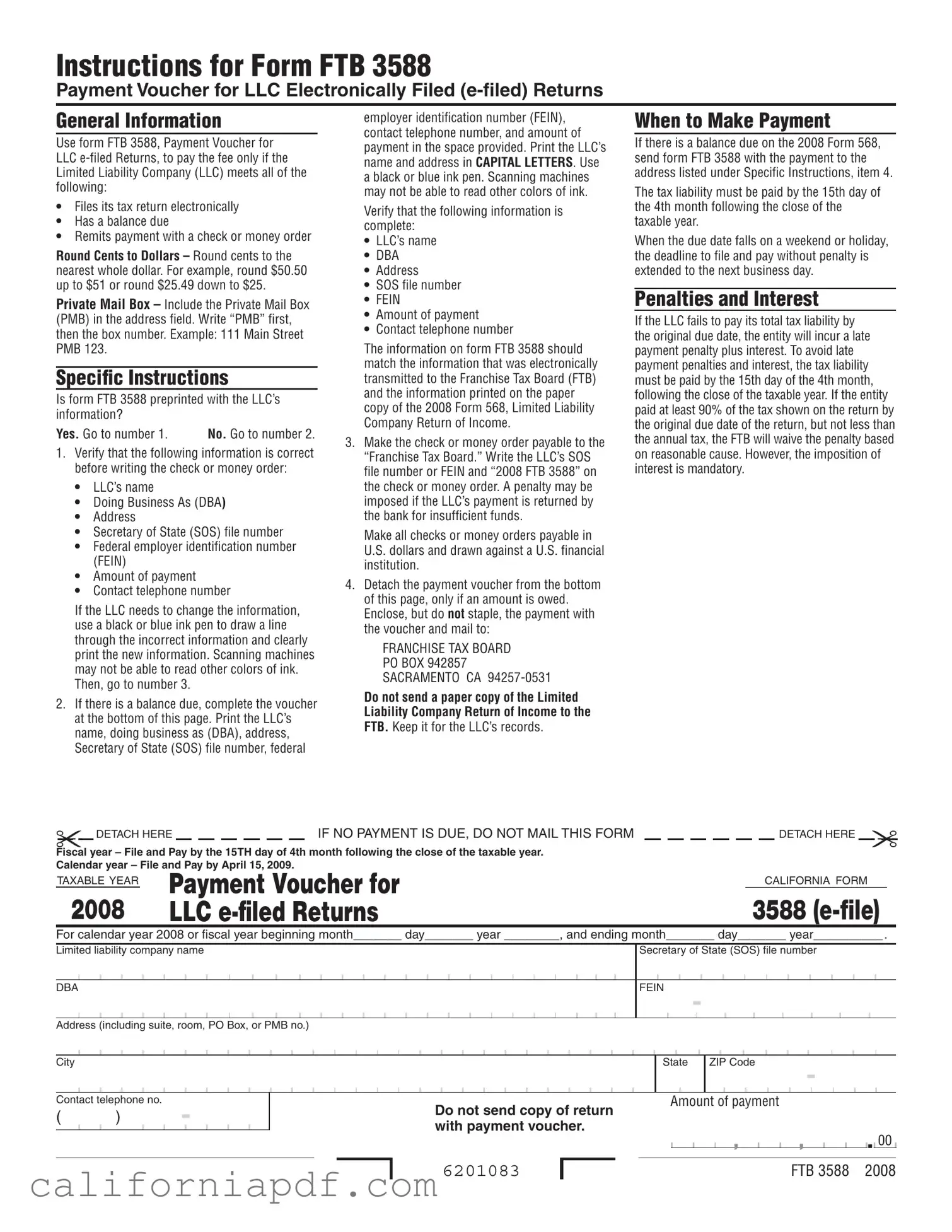

Document Example

Instructions for Form FTB 3588

Payment Voucher for LLC Electronically Filed

General Information

Use form FTB 3588, Payment Voucher for LLC

•Files its tax return electronically

•Has a balance due

•Remits payment with a check or money order

Round Cents to Dollars – Round cents to the nearest whole dollar. For example, round $50.50 up to $51 or round $25.49 down to $25.

Private Mail Box – Include the Private Mail Box (PMB) in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Specific Instructions

Is form FTB 3588 preprinted with the LLC’s information?

Yes. Go to number 1. |

No. Go to number 2. |

1.Verify that the following information is correct before writing the check or money order:

•LLC’s name

•Doing Business As (DBA)

•Address

•Secretary of State (SOS) file number

•Federal employer identification number (FEIN)

•Amount of payment

•Contact telephone number

If the LLC needs to change the information, use a black or blue ink pen to draw a line through the incorrect information and clearly print the new information. Scanning machines may not be able to read other colors of ink. Then, go to number 3.

2.If there is a balance due, complete the voucher at the bottom of this page. Print the LLC’s name, doing business as (DBA), address, Secretary of State (SOS) file number, federal

employer identification number (FEIN), contact telephone number, and amount of payment in the space provided. Print the LLC’s name and address in CAPITAL LETTERS. Use a black or blue ink pen. Scanning machines may not be able to read other colors of ink.

Verify that the following information is complete:

•LLC’s name

•DBA

•Address

•SOS file number

•FEIN

•Amount of payment

•Contact telephone number

The information on form FTB 3588 should match the information that was electronically transmitted to the Franchise Tax Board (FTB) and the information printed on the paper copy of the 2008 Form 568, Limited Liability Company Return of Income.

3.Make the check or money order payable to the “Franchise Tax Board.” Write the LLC’s SOS file number or FEIN and “2008 FTB 3588” on the check or money order. A penalty may be imposed if the LLC’s payment is returned by the bank for insufficient funds.

Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution.

4.Detach the payment voucher from the bottom of this page, only if an amount is owed. Enclose, but do not staple, the payment with the voucher and mail to:

FRANCHISE TAX BOARD

PO BOX 942857

SACRAMENTO CA

Do not send a paper copy of the Limited Liability Company Return of Income to the FTB. Keep it for the LLC’s records.

When to Make Payment

If there is a balance due on the 2008 Form 568, send form FTB 3588 with the payment to the address listed under Specific Instructions, item 4.

The tax liability must be paid by the 15th day of the 4th month following the close of the taxable year.

When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

Penalties and Interest

If the LLC fails to pay its total tax liability by the original due date, the entity will incur a late payment penalty plus interest. To avoid late payment penalties and interest, the tax liability must be paid by the 15th day of the 4th month, following the close of the taxable year. If the entity paid at least 90% of the tax shown on the return by the original due date of the return, but not less than the annual tax, the FTB will waive the penalty based on reasonable cause. However, the imposition of interest is mandatory.

|

DETACH HERE |

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM |

DETACH HERE |

|

|

|

Fiscal year – File and Pay by the 15TH day of 4th month following the close of the taxable year. Calendar year – File and Pay by April 15, 2009.

TAXABLE YEAR |

Payment Voucher for |

|

|

2008 |

LLC |

CALIFORNIA FORM

3588

For calendar year 2008 or fiscal year beginning month_______ day_______ year ________, and ending month_______ day_______ year__________ .

Limited liability company name

DBA

Secretary of State (SOS) file number

FEIN

-

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Contact telephone no.

()-

Do not send copy of return with payment voucher.

Amount of payment

,

,

,

. 00

. 00

6201083 |

|

|

FTB 3588 2008 |

Form Breakdown

| Fact Name | Fact Detail |

|---|---|

| Usage Criteria | Form FTB 3588 is used for payment solely if an LLC e-files its tax return, has a balance due, and is paying by check or money order. |

| Rounding Instructions | When completing the form, cents should be rounded to the nearest whole dollar. |

| Preprinted Information Verification | If the form is preprinted with the LLC's information, certain details such as the company name, address, and amount of payment must be verified or corrected with black or blue ink. |

| Payment and Mailing Instructions | Payments must be made payable to the "Franchise Tax Board," include certain identification numbers, and be mailed to the specified address without attaching the payment voucher to the check or money order. |

How to Write California 3588

Filling out a Form FTB 3588 in California is a crucial step for Limited Liability Companies (LLCs) that have chosen to file their tax returns electronically and owe a balance. This form accompanies a payment made by check or money order to the Franchise Tax Board (FTB), ensuring the LLC's tax obligations are met. The process is straightforward but requires attention to detail to ensure the payment is processed correctly and to avoid possible penalties. Here's how to accurately complete the form:

- First, check if the form is preprinted with the LLC's information. If everything is correct (LLC’s name, Doing Business As (DBA), address, Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), the amount of payment, and contact telephone number), proceed to step 3. If any information needs to be updated, use a black or blue ink pen to cross out the incorrect information and clearly print the new information directly on the form.

- If the FTB 3588 form is not preprinted or if details need to be added, fill out the voucher at the bottom of the page. You'll need to write the LLC's name, DBA, address (capital letters recommended), SOS file number, FEIN, contact telephone number, and the amount of payment. Make sure all the details match those previously electronically transmitted to the FTB and printed on the paper copy of the Form 568.

- Make the check or money order payable to the "Franchise Tax Board." On the payment, write the LLC's SOS file number or FEIN and add "2008 FTB 3588" to ensure the payment is credited correctly. Double-check this information to avoid delays in processing.

- Detach the payment voucher from the form if you owe a payment. Enclose the payment with the voucher in an envelope. Remember not to staple the payment to the voucher. Mail it to the FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0532. It's important not to send a paper copy of the Limited Liability Company Return of Income with this payment; keep that for your records instead.

Remember, the tax liability must be settled by the 15th day of the 4th month following the close of the taxable year. If this due date falls on a weekend or holiday, you’re given until the next business day to send your payment without incurring penalties. Should the LLC fail to meet its tax obligations by the due date, it may be subject to penalties and interest. However, if you've paid at least 90% of the tax due by the original deadline, the FTB might waive the penalty for reasonable cause, though interest charges are still applicable. Taking these steps helps ensure that your LLC remains compliant with California's tax requirements.

Listed Questions and Answers

What is Form FTB 3588 used for?

Form FTB 3588 is a Payment Voucher for LLC Electronically Filed (e-filed) Returns which should be used by a Limited Liability Company (LLC) to pay the fee if it has filed its tax return electronically, has a balance due, and remits payment with a check or money order.

Is the Form FTB 3588 preprinted with the LLC's information?

Yes, the form is preprinted with the LLC's information. However, if any information is incorrect, it should be drawn through with a line and the correct information should be clearly printed next to it using black or blue ink.

How should payments be made using Form FTB 3588?

Payments should be made with a check or money order payable to the "Franchise Tax Between". The LLC's Secretary of State (SOS) file number or Federal Employer Identification Number (FEIN), along with the notation "2008 FTB 3588", should be written on the check or money order. Payments must be in U.S. dollars and drawn against a U.S. financial institution.

Where should Form FTB 3588 be mailed?

The completed form, along with the payment, should be mailed to: FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531. It's important not to staple the payment to the voucher.

When is the payment due for Form FTB 3588?

The payment is due by the 15th day of the 4th month following the close of the taxable year. If this due date falls on a weekend or holiday, the deadline is extended to the next business day.

What are the penalties for late payment?

If the LLC fails to pay its total tax liability by the original due date, it will incur a late payment penalty plus interest. To avoid these, the liability must be paid by the due date. The Franchise Tax Board may waive the penalty for reasonable cause if at least 90% of the tax shown on the return was paid by the due date, but interest charges are mandatory.

How should the LLC's name and address be printed on the form?

The LLC's name and address should be printed in CAPITAL LETTERS using black or blue ink. This ensures the scanning machines can accurately read the information.

What if the LLC does not owe any payment?

If no payment is due, the form should not be mailed. It's designed solely for those instances where there is a balance owed.

Can the payment and form be separated?

The payment voucher located at the bottom of Form FTB 3588 should be detached only if there is an amount owed and it should be mailed along with the payment without being stapled.

Common mistakes

Filling out forms for governmental or financial purposes often involves attention to detail that can be overlooked in the rush to complete paperwork. Form 3588, the Payment Voucher for LLC Electronically Filed Returns in California, serves an important role in ensuring that limited liability companies (LLCs) meet their tax obligations. Below are four common mistakes made when filling out this form:

Incorrect Rounding of Cents to Dollars: The form requires that all monetary amounts are rounded to the nearest whole dollar. This means if you have an amount that is halfway between dollars, you should round up, and if it is less than halfway, round down. Overlooking this guidance can result in payment discrepancies.

Omission of Private Mail Box (PMB) Information: For LLCs using a private mailbox, the form instructs to include "PMB" followed by the box number in the address field. Failing to include this detail can lead to delays or misdirection of mail.

Using Incorrect Ink Color: The form specifies that all written changes must be made in black or blue ink because scanning machines may not accurately read other colors. Using an unauthorized ink color can lead to issues with processing the form.

Detachment and Mailing Instructions Not Followed: If an amount is owed, the payment voucher at the bottom of the form must be detached and mailed along with the payment. However, the instructions specifically advise not to staple the payment to the voucher. Ignoring these specifics can complicate the processing of your payment.

Addressing these common mistakes can improve the accuracy and efficiency of filing Form 3588, helping ensure that LLCs remain compliant with their tax obligations in California.

Documents used along the form

Navigating the complexities of legal documentation can be a daunting task, particularly when dealing with financial obligations and government forms. The California Form 3588, specifically designed for LLCs that are filing electronically, is a crucial document for ensuring that your tax liabilities are settled correctly. However, this form seldom stands alone. Several other forms and documents usually accompany or follow the filling out of Form 3588 to ensure full compliance and optimization of your tax responsibilities. Here's a closer look at some of these essential documents.

- Form 568, Limited Liability Company Return of Income: As referenced in the instructions for Form 3588, Form 568 is the primary tax return document for LLCs operating in California. This form captures the company's income, deductions, and tax liability for the year. It's essential that the information on Form 3588 matches the data submitted via Form 568 to avoid discrepancies.

- Form 3522, LLC Tax Voucher: This is an annual tax payment form for LLCs in California. While Form 3588 is used alongside e-filed returns with a balance due, Form 3522 is a pre-payment towards the LLC's annual tax requirement, generally due on the 15th day of the 4th month after the beginning of the tax year.

- Form 3536, Estimated Fee for LLCs: LLCs that expect to owe $1,000 or more in taxes must file Form 3536 to pay estimated fees based on their annual taxable income. This pre-emptive payment helps manage the financial burden by spreading it over the year.

- Secretary of State (SOS) File Number Documentation: Your SOS file number verifies your LLC’s registration and legal standing in California. This number is crucial for all your official documents, including Form 3588, ensuring that your payments are correctly applied to your entity.

- Federal Employer Identification Number (FEIN) Documentation: Similar to the SOS file number, your FEIN is necessary for all tax forms, including Form 3588. This unique number identifies your LLC for federal tax purposes and must be included on all forms submitted to the IRS and the California Franchise Tax Board.

Together with Form 3588, these documents form a comprehensive suite of forms that LLCs in California must manage diligently. Ensuring accuracy and timeliness in submitting these forms is not just a matter of legal compliance—it’s also a way to optimize your LLC’s financial health and avoid unnecessary penalties. Whether it’s your annual tax calculation, estimated payments, or keeping your registration details up to date, every document plays a critical role in the broader context of your business operations. Staying organized and informed about these requirements can significantly ease the management of your tax obligations.

Similar forms

The California Form 540-ES, or Estimated Tax for Individuals, bears a notable similarity to the Form FTB 3588. Both serve as vehicles for tax payments, albeit for different taxpayers; the 540-ES is for individual taxpayers making estimated tax payments, while the FTB 3588 is for LLCs settling their electronically filed return payments. Each form includes sections to specify the amount being paid and taxpayer identification information, ensuring that payments are correctly applied to the taxpayer's account. This structure aids in maintaining organized and accurate tax records for both the payer and the taxing authority.

The Form 1040-ES, the Federal counterpart of California's 540-ES, is used by individuals to remit estimated tax payments to the IRS and shares a fundamental purpose with California's FTB 3588. While the FTB 3588 is specifically for LLCs making payment with their e-filed returns within California, the 1040-ES applies to individual taxpayers making federal estimated tax payments. Both documents necessitate the inclusion of identifying and payment information, facilitating the correct allocation of funds to the taxpayer's obligations at their respective tax authority levels.

California Form 100-ES, or Corporation Estimated Tax, parallels the FTB 3588 in its function for corporations to make estimated tax payments. Like the FTB 3588 ensures LLCs meet their state tax obligations through e-filing, the 100-ES enables corporations to comply with estimated tax payments throughout the year. Both forms contain sections for taxpayer details and payment information, streamlining the process for entities to remain in good tax standing with the state's Franchise Tax Board.

Form FTB 3536, or Estimated Fee for LLCs, is similar to the FTB 3588 as it pertains specifically to LLCs within California, albeit for estimated fee payments rather than balance due on e-filed returns. Both forms require detailed identification of the LLC, including name, address, and identifying numbers. These forms ensure LLCs have a structured method for fulfilling different types of tax-related obligations, emphasizing the state's approach to managing and collecting revenue from business entities.

California's Form 3522, LLC Annual Tax V booklet, shares similarities with the FTB 3588 in that it is another document aimed at LLCs within the state. While the 3522 is intended for the payment of an annual tax, the FTB 3588 is utilized for payments accompanying electronically filed returns. Both serve critical roles in the tax cycle of an LLC, offering a structured means for these entities to comply with distinct financial obligations to the state.

The Sales and Use Tax Return form by the California Department of Tax and Fee Administration closely mirrors the purpose of the FTB 3588 but in the context of sales tax. This form is used by businesses to report and remit sales tax collected from customers, similar to how the FTB 3588 is used by LLCs to remit their owed taxes to the state. Both forms play pivotal roles in the collection of taxes, albeit for different types of taxes, underscoring the varied manners in which businesses and entities fulfill their tax responsibilities.

Form FTB 3557, Application for Certificate of Revivor, though not a tax payment form, shares a connection with the FTB 3588 in the broader scope of maintaining tax compliance. While the FTB 3588 facilitates the payment of tax dues for LLCs, the FTB 3557 is used by businesses seeking to restore their good standing with the state after suspension or forfeiture for tax noncompliance. Both forms are essential to the regulatory framework that ensures businesses meet their California tax obligations.

Finally, the Property Tax Statement sent by local California county tax collectors to property owners shares a similar essence with the FTB 3588. Although focused on property taxes owed by individuals and businesses on real estate, both documents represent formal requests for payment to a government authority. They require the payer to submit relevant identification details and the payment amount due, reinforcing the structured approach to tax collection across different government levels and tax types.

Dos and Don'ts

When it comes to handling the California Form 3588, here's a concise guide on what you should and shouldn't do to ensure everything goes smoothly:

- Do make sure to round cents to the nearest dollar on your payment amount. This helps streamline the process.

- Do include your Private Mail Box (PMB) number in the address field if you’re using one, putting "PMB" before the box number.

- Do use black or blue ink when you need to correct or fill out any information. This ensures that scanning machines can read your entries clearly.

- Do verify that all listed information is correct and matches the details electronically transmitted, including the LLC's name, DBA, address, and Secretary of State file number.

- Do make your check or money order payable to the “Franchise Tax Board” and include your SOS file number or FEIN and “2008 FTB 3588” on it.

- Do detach the payment voucher and mail it with your payment if you owe an amount, without stapling them together, to the provided Franchise Tax Board address.

- Don't send a paper copy of the Limited Liability Company Return of Income to the Franchise Tax Board; just keep it for your records.

- Don’t forget to send your payment by the 15th day of the 4th month following the close of the taxable year to avoid penalties.

- Don't neglect to write the LLC’s SOS file number or FEIN and “2008 FTB 3588” on your check or money order. This information is critical for processing.

- Don’t use any ink colors other than black or blue as other colors might not be recognizable by scanning machines.

- Don't staple your payment to the voucher. This can cause issues with processing.

- Don’t hesitate to update any incorrect information on the form with a black or blue pen if the preprinted form contains errors.

Misconceptions

There are common misconceptions regarding the California Form FTB 3588, the Payment Voucher for LLC Electronically Filed Returns, which may lead to confusion among Limited Liability Companies (LLCs). Addressing these misunderstandings can help ensure compliance and accuracy when LLCs are managing their state tax obligations.

Misconception 1: Form FTB 3588 is only for LLCs that owe taxes.

This belief overlooks the form's broader requirement. While Form FTB 3588 is indeed used to remit payment with a check or money order for taxes due, it is necessary for all LLCs that file their tax return electronically and have a balance due, regardless of whether their balance is derived from taxes, penalties, or interest accrued. The purpose of the form is to facilitate payment accompanying e-filed returns, ensuring the LLC's compliance with California’s tax payment process.

Misconception 2: Any color ink is suitable for completing Form FTB 3588.

The instructions specifically stipulate the use of black or blue ink for completing the form. This is because scanning machines used by the Franchise Tax Board (FTB) may not accurately read information completed in other colors. This guideline ensures the information is accurately captured and processed, helping avoid processing delays or errors in crediting the LLC’s payment.

Misconception 3: LLCs must always send a paper copy of their return with the payment voucher.

Contrary to this misunderstanding, the instructions explicitly state not to send a paper copy of the Limited Liability Company Return of Income with the payment voucher. The purpose of the FTB 3588 is to accompany payment only when returns are filed electronically; the e-filed return serves as the official document of record, and the voucher is simply a payment mechanism. Keeping the return for the LLC’s records is advised, but it should not be mailed with the voucher.

Misconception 4: The due date for payment is flexible.

Form FTB 3588 outlines a specific deadline for when payment is due, which is the 15th day of the 4th month following the close of the taxable year. There may be a belief that this date is flexible or that extensions are easily granted. However, to avoid late payment penalties and interest, adherence to this deadline is crucial. While there is a provision that extends the filing and payment deadline to the next business immediately following a weekend or holiday, the due date for payment is a firm deadline designed to ensure timely financial obligations are met by the LLC.

Understanding the specific requirements and clarifying common misconceptions of Form FTB 3588 can significantly aid LLCs in navigating their tax responsibilities efficiently and accurately. Ensuring compliance with the detailed instructions provided by the California Franchise Tax Board is essential for all LLCs operating within the state.

Key takeaways

When a Limited Liability Company (LLC) in California files its tax return electronically and owes a balance, it's required to use the Form FTB 3588, Payment Voucher for LLC Filed Returns. This process involves several key steps and considerations to ensure that payments are made correctly and on time. Here are some important takeaways:

- The form is specifically designed for LLCs that file their taxes electronically and have a balance due that they wish to pay via check or money order.

- Before writing a check or money order, it's crucial to verify that the LLC’s information preprinted on the form is accurate. This includes checking the LLC’s name, Doing Business As (DBA) name, address, Secretary of State (SOS) file number, Federal Employer Identification Number (FEIN), and the payment amount.

- If any information is incorrect, it should be corrected directly on the form using a black or blue ink pen, as other colors may not be readable by scanning machines.

- For those forms that aren’t preprinted with the LLC's information, it's necessary to complete the voucher at the bottom of the page carefully, ensuring all required information is clearly written in CAPITAL LETTERS using a black or blue ink pen.

- When preparing the payment, make the check or money order payable to the “Franchise Tax Board” and include the LLC’s SOS file number or FEIN and “2008 FTB 3588” on it to ensure proper processing.

- All payments must be made in U.S. dollars and drawn against a U.S. financial institution. A penalty might be charged if the payment is returned due to insufficient funds.

- Detach the payment voucher only if a payment is due and mail it, along with the payment (without stapling), to the specified address for the Franchise Tax Board.

- It is important to note that the tax liability must be settled by the 15th day of the 4th month following the close of the taxable year. If this date falls on a weekend or holiday, the deadline extends to the next businessist.

- To avoid late payment penalties and interest, ensure the total tax liability is paid by the due date. The Franchise Tax Board might waive the late payment penalty for reasonable cause if at least 90% of the tax shown on the return is paid by the original due date, provided it is not less than the annual tax.

Using the Form FTB 3588 correctly is key to fulfilling an LLC's tax responsibilities and avoiding unnecessary penalties or interest for late payments. Detailed attention to the instructions and ensuring all information is accurate can help streamline the payment process.

Different PDF Templates

Ca 109 - Organizations must sign the form under penalty of perjury, certifying the accuracy of the information provided.

Motion for Default Judgment - Think of it as sealing the deal on document delivery, making sure the other party can’t deny receiving them.