Fill a Valid California 3725 Form

For businesses navigating the complexities of tax obligations following asset transfers, the California Form 3725 is a critical tool designed to simplify this process. Facilitating the tracking of assets transferred from a parent corporation to an insurance company subsidiary, this form plays an integral role in managing deferred capital gains and ensuring compliance with the California Revenue and Taxation Code (R&TC) Section 24465. This legislation outlines specific conditions under which the gains from such transfers can be deferred, notably when the assets remain within the active conduct of the insurer's trade or business or remain within a commonly controlled group. Provided these conditions are met, the deferred gain avoids immediate taxation, offering a valuable financial planning mechanism. Moreover, the form serves to detail both short-term and long-and-term capital gains or losses, depending on the duration the transferred assets were held before being disposed of. Through a structured approach to reporting, including specifics such as the fair market value at the date of transfer and the outcomes of any subsequent asset disposition, Form 3725 ensures that businesses can accurately account for and report these financial movements. Its use not only aids in abiding by California's taxation laws but also in strategic financial planning and the efficient management of a corporation's or group's tax liabilities.

Document Example

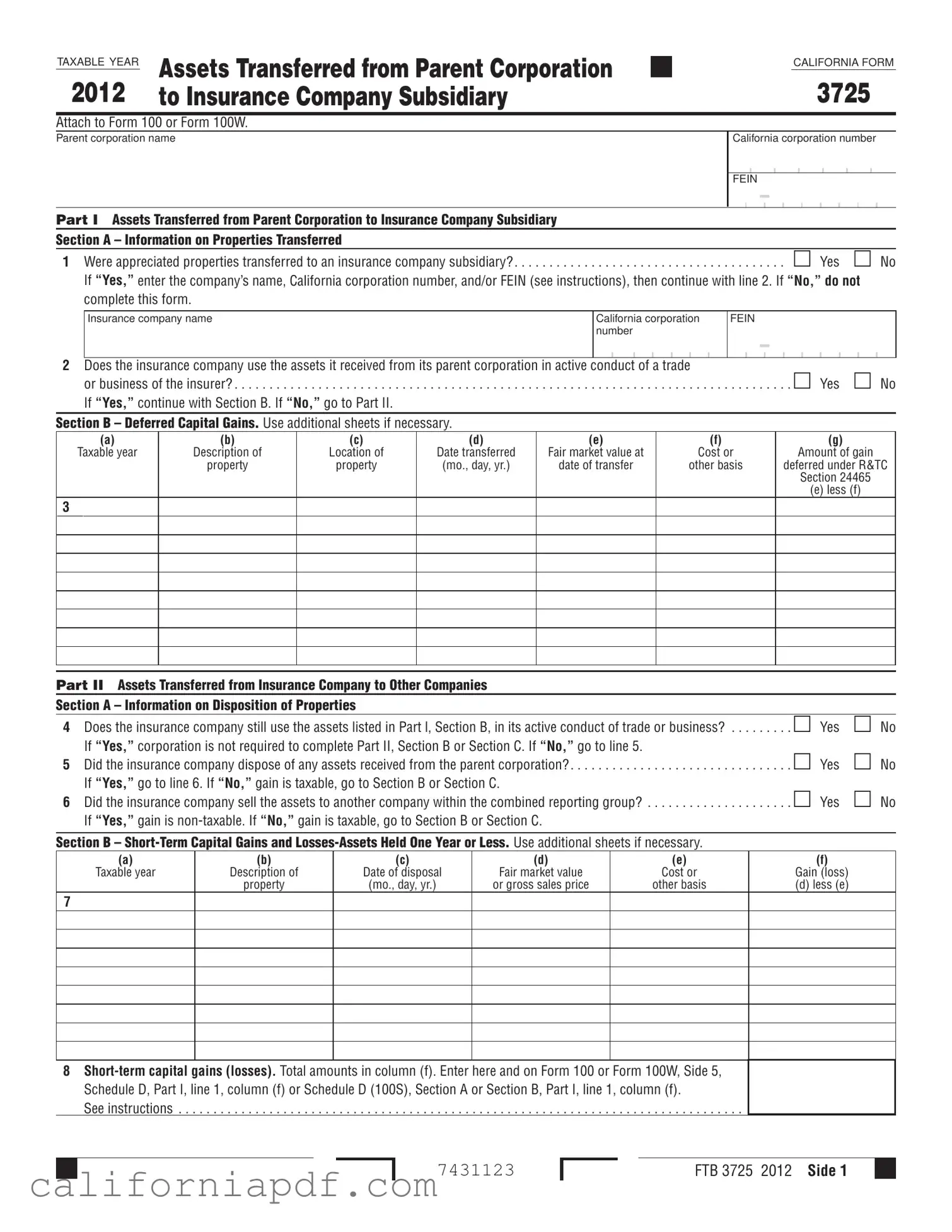

TAXABLE YEAR |

Assets Transferred from Parent Corporation |

|

CALIFORNIA FORM |

|

2012 |

3725 |

|||

to Insurance Company Subsidiary |

||||

Attach to Form 100 or Form 100W.

Parent corporation name

California corporation number

FEIN

Part I Assets Transferred from Parent Corporation to Insurance Company Subsidiary

Section A – Information on Properties Transferred

Were appreciated properties transferred to an insurance company subsidiary? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No If “Yes,” enter the company’s name, California corporation number, and/or FEIN (see instructions), then continue with line 2. If “No,” do not complete this form.

Insurance company name

California corporation number

FEIN

2 Does the insurance company use the assets it received from its parent corporation in active conduct of a trade |

Yes No |

or business of the insurer? |

|

If “Yes,” continue with Section B. If “No,” go to Part II. |

|

Section B – Deferred Capital Gains. Use additional sheets if necessary.

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

Taxable year |

Description of |

Location of |

Date transferred |

Fair market value at |

Cost or |

Amount of gain |

|

property |

property |

(mo., day, yr.) |

date of transfer |

other basis |

deferred under R&TC |

|

|

|

|

|

|

Section 24465 |

|

|

|

|

|

|

(e) less (f) |

3

Part II Assets Transferred from Insurance Company to Other Companies

Section A – Information on Disposition of Properties

|

|

|

|

4 |

Does the insurance company still use the assets listed in Part l, Section B, in its active conduct of trade or business? |

Yes |

No |

|

If “Yes,” corporation is not required to complete Part II, Section B or Section C. If “No,” go to line 5. |

Yes |

No |

5 |

Did the insurance company dispose of any assets received from the parent corporation? |

||

|

If “Yes,” go to line 6. If “No,” gain is taxable, go to Section B or Section C. |

Yes |

No |

6 |

Did the insurance company sell the assets to another company within the combined reporting group? |

If “Yes,” gain is

Section B –

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Taxable year |

Description of |

Date of disposal |

Fair market value |

Cost or |

Gain (loss) |

|

property |

(mo., day, yr.) |

or gross sales price |

other basis |

(d) less (e) |

7

8

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7431123

FTB 3725 2012 Side

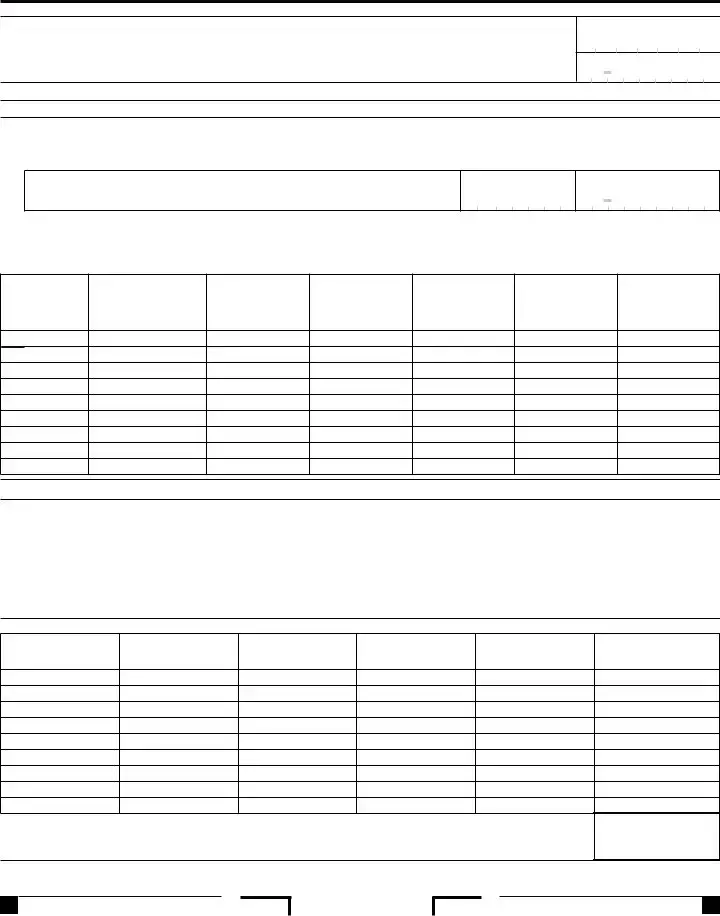

Section C –

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

Taxable year |

Description of |

Date of disposal |

Fair market value |

Cost or |

Gain (loss) |

|

property |

(mo., day, yr.) |

or gross sales price |

other basis |

(d) less (e) |

9

0

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

General Information

A Purpose

Use form FTB 3725, Assets Transferred from Parent Corporation to Insurance Company Subsidiary, to track the assets transferred from a parent corporation to an insurance company subsidiary. In addition, use this form to figure capital gains (losses) if the parent corporation transferred assets to an insurance company subsidiary beginning on or after June 23 2004.

California Revenue and Taxation Code (R&TC) Section 24465 provides that when a parent corporation transfers appreciated property to an insurance company subsidiary, the gain is deferred if the property transferred to the insurer is used in the active conduct of

a trade or business of the insurer. The gain must be recognized as income if any of the following apply:

•The transferred property is no longer owned by an insurer in the taxpayer’s commonly controlled group (or a member of the taxpayer’s combined reporting group).

•The property is no longer used in the active conduct of the insurer’s trade or business (or the trade or business of another member in the taxpayer’s combined reporting group).

•The holder of the property is no longer held by an insurer in the commonly controlled group of the transferor (or a member of the taxpayer’s combined reporting group).

R&TC Section 24465 applies to transactions entered into on or after June 23, 2004.

B Definitions

1.Appreciated property – Appreciated property means property whose fair market value (FMV), as of the date of the transfer, exceeds its adjusted basis as of that date.

2.Commonly controlled group – Commonly controlled group exists when stock possessing more than 50% of the voting power is owned, or constructively owned,

by a common parent corporation (or chains of corporations connected through the common parent) or by members of the same family, see R&TC Section 25105. Also, a commonly controlled group includes corporations that are stapled entities,

see R&TC Section 25105(b)(3). Special rules are provided in R&TC Section 25105 for partnerships, trusts, and transfers of voting power by proxy, voting trust, written shareholder agreement, etc.

Speciic Line Instructions

Part I – Assets Transferred from Parent Corporation to Insurance Company Subsidiary

Section A – Information on

Properties Transferred

Line – Enter the insurance company’s California corporation number or federal employer identification number (FEIN). If the insurance company does not have one of these numbers, enter “not applicable” and continue with line 2.

Section B – Deferred Capital Gains

Line 3, column (b) – Description of property. Describe the assets the parent corporation transferred to an insurance company subsidiary.

Line 3, column (e) – Fair market value at date of transfer. FMV is the price that the property would sell for in the open market.

Line 3, column (f) – Cost or other basis. In general, the cost or other basis is the cost of the property plus purchase commissions and improvements minus depreciation, amortization, and depletion. Enter the cost or adjusted basis of the asset for California purpose.

Part II – Assets Transferred from Insurance Company to Other Companies

Section B –

Section C –

Report

Line 7 and Line 9, column (b) – Description of property. Describe the assets that the insurance company sells to another company; or the transferred assets that the insurance company does not use in its active trade or business.

Line 7 and Line 9, column (d) – Fair market value or gross sales price. Enter the FMV of the assets as of the date that the insurance company no longer uses the assets in its active trade or business. Or, enter the gross sales price of the assets if the insurance company sells the assets to another company.

Line 8 –

Line 0 –

Side 2 FTB 3725 2012

7432123

Form Breakdown

| Fact | Detail |

|---|---|

| Form Name | California Form 3725 |

| Taxable Year | 2012 |

| Purpose | For tracking assets transferred from a parent corporation to an insurance company subsidiary and figuring capital gains (losses). |

| Governing Law | California Revenue and Taxation Code (R&TC) Section 24465 |

| Eligibility Criteria | Transactions entered into on or after June 23, 2004, involving appreciated property transferred to an insurer used in active conduct of a trade or business. |

| Key Requirements for Deferred Gains | The property must remain with an insurer in the taxpayer’s commonly controlled group and continue to be used in active conduct of the insurer’s business. |

| Significance of Appreciated Property | Appreciated property is defined as property whose fair market value at the date of transfer exceeds its adjusted basis at that date. |

| Attachment Necessity | Form 3725 must be attached to Form 100 or Form 100W as applicable. |

How to Write California 3725

Filing the California Form 3725 involves reporting assets transferred from a parent corporation to an insurance company subsidiary. It's an essential task for those looking to document such transactions diligently, and properly completing this form ensures compliance with the California Revenue and Taxation Code. The process might seem complex at first, but breaking it down into a series of straightforward steps can simplify it. Whether you are a seasoned professional or new to this process, these instructions are designed to guide you through each section of the form methodically.

- Start by reading through the form carefully to understand the type of information you'll need to gather before filling it out.

- Enter the Parent corporation name, California corporation number, and FEIN at the top of the form.

- In Part I, Section A, check the appropriate box to indicate whether appreciated properties were transferred to an insurance company subsidiary. If you select "Yes," proceed to enter the Insurance company name, its California corporation number, and/or FEIN in the fields provided.

- If the transferred assets are used in the active conduct of a trade or business of the insurer, mark "Yes" for question 2. If you mark "No," skip to Part II.

- In Section B, for each asset transferred, detail the Taxable year in column (a), provide a Description of property in column (b), specify the Location of property in column (c), indicate the Date transferred in column (d), enter the Fair market value at date of transfer in column (e), the Cost or other basis in column (f), and calculate the Amount of gain deferred under R&TC Section 24465 in column (g).

- For Part II, start with Section A by indicating whether the insurance company still uses the listed assets in its active trade or business in question 4. If "Yes," Part II, Sections B and C are not required.

- If the insurance company disposed of any assets, mark "Yes" to question 5. Then, indicate whether the disposed assets were sold to another company within the combined reporting group in question 6.

- For assets held one year or less, fill out Section B with each asset's Taxable year, Description of property, Date of disposal, Fair market value or gross sales price, Cost or other basis, and compute the Gain (loss).

- Complete Section C similarly for assets held more than one year, listing the appropriate details and calculating long-term gains or losses.

- Summarize the Short-term capital gains (losses) in line 8 and the Long-term capital gains (losses) in line 0, entering these totals in their respective sections on Form 100 or Form 100W.

- Double-check your entries for accuracy. For any sections that require additional sheets due to space constraints, ensure these are clearly marked and attached to your Form 3725.

- Upon completion, attach Form 3725 to your Form 100 or Form 100W and include it in your tax filing. Remember to write "FTB 3725" under column (a) Description of property on Schedule D as instructed, attaching a copy of the form to your tax return.

Completing Form 3725 with careful attention to detail is crucial for accurately documenting the transfer of assets to an insurance company subsidiary. By following these step-by-step instructions, you can confidently navigate this form, ensuring all necessary information is reported correctly and keeping your financial records in compliance with state regulations.

Listed Questions and Answers

What is the purpose of California Form 3725?

Form 3725, also known as "Assets Transferred from Parent Corporation to Insurance Company Subsidiary," is used for documenting the transfer of assets from a parent corporation to its insurance company subsidiary. This form plays a crucial role in tracking these types of asset transfers, especially for calculating capital gains or losses if the parent corporation transferred appreciated assets to the insurance company subsidiary after June 23, 2004. Under the California Revenue and Taxation Code (R&TC) Section 24465, gains from the transfer of appreciated property to an insurer can be deferred as long as certain conditions regarding the use and ownership of the property are met.

Who needs to file Form 3725?

Form 3725 must be completed and attached by the parent corporation or the insurance company subsidiary engaging in the transaction of transferring appreciated properties. This requirement applies if the transferred assets are used in the active conduct of the insurer's trade or business. It is crucial for entities that have entered into transactions involving the transfer of assets to an insurance company subsidiary beginning on or after June 23, 2004, to comply by filing this form alongside their Form 100 or Form 100W tax returns.

How does one determine if assets are appreciated property for Form 3725?

For the purposes of Form 3725, appreciated property is defined as property whose fair market value (FMV) exceeds its adjusted basis at the date of transfer. The FMV is essentially the price that the property would command in an open market transaction on the date it was transferred to the insurance company subsidiary. To assess whether property is appreciated, the transferring entity must evaluate the FMV against the property's adjusted basis, which includes the cost of acquisition plus any improvements, and subtracts factors like depreciation, amortization, or depletion.

What are the tax implications of filing Form 3725?

Filing Form 3725 has significant tax implications regarding the deferral and recognition of capital gains from transferred assets. Under R&TC Section 24465, the gain from transferring appreciated property to an insurer is deferred, meaning it's not immediately subject to tax. However, this gain must be recognized and thus becomes taxable if the transferred property is no longer owned by an insurer in the taxpayer’s commonly controlled group, is no longer used in the active conduct of the insurer's business, or if the holding entity of the property changes away from an insurer in the controlled group. Calculating short-term and long-term capital gains or losses correctly is essential for accurate tax reporting and compliance, with specific instructions provided for detailing these amounts on Form 100 or 100W.

Common mistakes

When completing the California Form 3725, it is crucial to avoid common mistakes that can lead to inaccuracies or delays. Below is a detailed list of missteps often made during the process:

- Not verifying the insurance company’s details: Providing incorrect California corporation number, FEIN, or improperly stating “not applicable” when the insurance company does indeed have one of these numbers.

- Overlooking appreciated properties: Failing to accurately report whether appreciated properties were transferred to an insurance company subsidiary.

- Misunderstanding asset usage: Incorrectly stating the insurance company's use of the transferred assets in the active conduct of its trade or business.

- Incorrectly reporting the fair market value (FMV): Not properly calculating or reporting the FMV of the transferred property at the date of transfer.

- Errors in the cost or other basis: Providing inaccurate figures for the cost or other basis of the transferred assets, neglecting necessary adjustments for depreciations or improvements.

- Failure to add additional sheets: Not using additional sheets where necessary, especially when detailing deferred capital gains or losses.

- Incorrect disposition of assets: Misreporting whether the insurance company still uses the assets or has disposed of any, leading to confusion over taxable gains.

- Mix-up in gain taxation: Confusion over the taxable status of gains from sold assets, especially regarding sales within the combined reporting group.

- Improper listing of short-term and long-term capital gains or losses: The failure to accurately report the correct gains or losses, including the omission of required details such as the description of property or the fair market value/gross sales price.

- Attachment errors: Forgetting to attach a copy of the completed Form 3725 to the tax return or incorrectly referencing “FTB 3725” on Schedule D.

It is essential for filers to carefully review the specific line instructions and double-check their information to ensure accuracy and compliance. By avoiding these common mistakes, filers can streamline the submission process and minimize potential complications with their tax returns.

Documents used along the form

When working with the California Form 3725, which monitors assets transferred from a parent corporation to an insurance company subsidiary, stakeholders often need additional documentation to ensure compliance and accurate reporting. These documents range from introductory applications to detailed schedules and reports that provide a comprehensive view of a company's financial movements and responsibilities.

- Form 100 or Form 100W: These are the California Corporation Franchise or Income Tax Return forms. Form 100 is for corporations in general, while Form 100W is for water's-edge filers. They serve as the primary tax return documents for corporations and are where the summary data from Form 3725 is reported.

- Schedule D (Form 100 or 100W): This schedule is used to report capital gains and losses. It complements Form 3725 by detailing specific transactions that led to short-term and long-term capital gains or losses, aligning with the information required in Parts I and II of Form 3725.

- Statement of Information (Form SI-550): Required by the California Secretary of State, this form provides essential information about the corporation, such as the principal business address, the CEO, and directors. It helps in identifying the correct entities involved in the transfer covered by Form 3725.

- Form 109: This form is the Exempt Organization Business Income Tax Return in California. If an insurance company subsidiary is part of a non-profit organization, this form must be filed to report unrelated business income.

- Form 3554: New Employment Credit (NEC) Form, relevant for corporations that hire new employees in designated areas. While not directly related to asset transfers, it can impact the overall tax situation of a parent corporation and its subsidiaries.

- Form 5806: Underpayment of Estimated Tax by Corporations. This document is vital for corporations, including insurance subsidiaries, that have not met their estimated tax payments throughout the year. It works beside forms like the 3725 to ensure comprehensive tax liability management.

- FTB Notice 2011-04: This is a publication by the Franchise Tax Board outlining guidelines for transactions between corporations and their subsidiaries, providing context and additional rules affecting how Form 3725 should be filled out.

- Form 568: Limited Liability Company Return of Income. For insurance company subsidiaries structured as LLCs, this form is necessary to report income and determine tax obligations. It's especially relevant if LLCs are treated as disregarded entities for federal but not state tax purposes.

Collectively, these documents ensure that the financial activities stemming from asset transfers between a parent corporation and its insurance subsidiary are thoroughly documented, compliant with California law, and accurately represented in tax filings. Handling these forms requires a diligent approach to ensure that all related financial and corporate reporting responsibilities are met comprehensively.

Similar forms

The California 3725 Form shares similarities with the IRS Form 8886, Reportable Transaction Disclosure Statement. Both forms are used to report specific transactions to revenue agencies and require detailed information about the transactions, including descriptions, values, and dates. The 3725 Form tracks assets transferred within a corporate family, specifically from a parent corporation to an insurance subsidiary, for the purpose of deferring capital gains. Similarly, Form 8886 must be filed by taxpayers who participate in reportable transactions that have the potential to affect their tax liabilities. Each form aims to ensure transparency in transactions that could influence a taxpayer's or a corporation's tax responsibilities.

Another comparable document is the IRS Form 1120, U.S. Corporation Income Tax Return. Form 1120 is utilized by corporations to report their income, gains, losses, deductions, and to calculate their federal income tax liability. While Form 3725 is an attachment to California's Form 100 or Form 100W, dedicated to tracking asset movements and deferring gains specifically within corporate families transferring assets to insurance subsidiaries, Form 1120 serves a broader purpose. However, both forms are essential for reporting an entity's financial activities and relevant tax implications at the federal or state level, emphasizing their compliance with respective tax laws.

The California Schedule D (100S), Capital Gains and Losses, is similarly structured to the California 3725 Form in that it details the capital gains and losses from the sale or exchange of assets. Schedule D (100S) is used by S corporations in California to report the company's short-term and long-term capital gains and losses. The 3725 Form also requires detailed reporting of capital gains and losses but is specific to transactions involving assets transferred from a parent corporation to an insurance subsidiary. Both documents help to determine the capital gains tax obligations of a corporation by detailing the fair market values, costs, and gains or losses of assets.

Finally, the IRS Form 8594, Asset Acquisition Statement, bears resemblance to the 3725 Form regarding its focus on asset transfers. Form 8594 is used when a business is acquired or disposed of, and the buyer and seller must both file this form with their tax returns to report the sale and purchase of business assets. While Form 8594 is utilized for a broad range of asset acquisitions beyond insurance subsidiaries, and involves both buyers and sellers in a transaction, Form 3725 specifically tracks transfers of assets from a parent corporation to an insurance subsidiary, focusing solely on the deferral of gains. Both forms, however, play crucial roles in reporting and tracking the movement of assets for tax purposes.

Dos and Don'ts

Filling out the California Form 3725, which concerns the transfer of assets from a parent corporation to an insurance company subsidiary, requires careful attention to detail. To ensure accuracy and compliance with tax laws, here are several dos and don'ts to keep in mind:

- Do read the instructions carefully before you start filling out the form. Understanding the purpose and requirements can help avoid common mistakes.

- Do ensure that you have the accurate names and numbers for both the parent corporation and the insurance company subsidiary, including the California corporation number and the Federal Employer Identification Number (FEIN).

- Do accurately describe the assets transferred in detail, including their location, to make sure they're correctly categorized and reported.

- Do calculate the fair market value and the cost or other basis of the transferred assets as of the date of transfer meticulously to determine the correct amount of gain or loss.

- Do use additional sheets if necessary, especially when detailing deferred capital gains and losses in Section B and Short-Term and Long-Term Capital Gains and Losses in Sections B and C of Part II.

- Don't leave any mandatory fields blank. If a question does not apply, use "N/A" or "0" to indicate this, following the form's instructions.

- Don't overlook the requirement to attach the completed Form 3725 to either Form 100 or Form 100W. This step is crucial for proper filing.

By carefully following these guidelines, taxpayers can accurately report the transfer of assets between their parent corporation and insurance company subsidiary, adhering to the regulations outlined by the California Revenue and Taxation Code Section 24465. Remember, when in doubt, consulting with a tax professional can provide clarity and prevent errors.

Misconceptions

When it comes to the California Form 3725, there are several misconceptions that could lead to confusion or errors in reporting. By addressing these misunderstandings, one can ensure accurate completion and submission of the form. Here are six common misconceptions about the California Form 3725:

- Form 3725 is only for large corporations: While it's true that Form 3725 is designed for parent corporations and their subsidiaries, including insurance company subsidiaries, it's a misconception that only large corporations need to file it. Any parent corporation that transfers assets to an insurance company subsidiary, as specified under the California Revenue and Taxation Code Section 24465, regardless of its size, is required to use this form.

- All asset transfers are taxable: Not all asset transfers from a parent corporation to an insurance company subsidiary result in immediate taxation. Form 3725 is used to track assets transferred and figure out capital gains or losses. A key aspect of this form is its role in deferring the gain on appreciated property transferred, provided it meets certain conditions such as being used in the active conduct of the insurer's trade or business.

- The form is complicated and requires extensive financial information: While Form 3725 does require detailed information about the assets transferred, including their fair market value and the gain deferred, the form and its instructions provide a step-by-step guide for inputting this information. It's structured to help corporations provide the necessary details without needing overly complex financial data.

- Any disposal of assets results in taxable gains: The form differentiates between assets disposed of within the insurance company's active trade or business and those sold to entities outside the insurance company's trade or business. Only the latter might result in taxable gains, contrary to the misconception that all disposals are taxable.

- It's only about reporting gains: Another misconception is that Form 3725 is solely concerned with reporting gains from asset transfers. In reality, the form also addresses losses, including both short-term and long-term capital losses, thus providing a comprehensive view of the financial impact of asset transfers.

- Form 3725 is independent of other tax documents: Completing Form 3725 is not an isolated task; this form is designed to be attached to Form 100 or Form 100W. Misunderstanding the form's relation to other tax filings could lead to errors in tax reporting. It's crucial to recognize that Form 3725 complements other tax documents, ensuring that capital gains or losses from asset transfers are accurately reported within the broader context of the corporation's tax obligations.

By dispelling these misconferences, corporations can better navigate the specifics of Form 3725, ensuring compliance with California's tax regulations and accurately reporting asset transfers and their tax implications.

Key takeaways

When completing the California Form 3725, it's essential for parent corporations transferring assets to an insurance company subsidiary to be mindful of the following key takeaways:

- The purpose of Form 3725 is for tracking assets transferred from a parent corporation to an insurance company subsidiary and for calculating capital gains or losses.

- Any appreciated property transferred should be listed, where "appreciated property" refers to property whose fair market value exceeds its adjusted basis at the time of transfer.

- This form is necessary for transactions starting on or after June 23, 2004, under the California Revenue and Taxation Code (R&TC) Section 24465.

- R&TC Section 24465 allows the deferral of gains if the transferred property is used in the active conduct of the insurer's trade or business.

- Gain must be recognized as income under certain conditions, such as if the property is not used in the insurer's business or is transferred out of the controlled group.

- A "commonly controlled group" is defined by ownership of more than 50% of voting power by a common parent or family, with special rules for partnerships and other entities.

- The insurance company's name, California corporation number, and/or FEIN need to be entered if it received appreciated properties.

- For assets held one year or less, report short-term capital gains or losses; for those held more than one year, report long-term capital gains or losses.

- When disposing of assets, the form requires details such as a description of the property, the location, the date of transfer, the fair market value at the date of transfer, and the cost or other basis.

- Ensure to enter total amounts of short-term and long-term capital gains (losses) on Form 100 or Form 100W, as appropriate, indicating “FTB 3725” in the description column and attaching this form to the tax return.

It is pivotal to accurately and meticulously fill out California Form 3725 as it plays a crucial role in the correct reporting and taxation of assets transferred between parent corporations and their insurance company subsidiaries.

Different PDF Templates

California Principal Business Activity Code - Corporations leveraging Form 100X have the opportunity to amend tax credits previously claimed, potentially impacting the overall tax burden for the amended year.

593/2 - Escrow officers play a role in completing withholding obligations and must use Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, for reporting.