Fill a Valid California 3800 Form

Navigating tax obligations can often feel like a complex puzzle, especially when it involves specific circumstances such as those outlined by the California Form 3800. This particular form plays a crucial role for children with investment income, ensuring that their tax computations are handled accurately for the taxable year of 2011. Essentially, the form serves as an attachment to the child’s main tax return, whether it's Form 540 or Long Form 540NR, providing detailed instructions for computing taxes if certain conditions are met. It's aimed at children who are either 18 years and under or students under age 24 with investment income exceeding $1,900. The form intricately outlines how to calculate such a child's investment income and subsequently, how their tax should be computed considering the parents' tax rate, potentially leading to higher tax liabilities. It takes into account multiple factors including the child’s and parents’ income levels, filing statuses and the number of exemptions claimed on the parent’s return. Furthermore, California's alignment with the provisions of the Small Business and Work Opportunity Act of 2007, the specific requirements for Registered Domestic Partners (RDPs), and the detailed process for form completion, underline the form's complexity and its importance for affected families. By ensuring accurate completion, families can navigate through the intricacies of tax calculations for young investors, aligning with California's specific tax regulations.

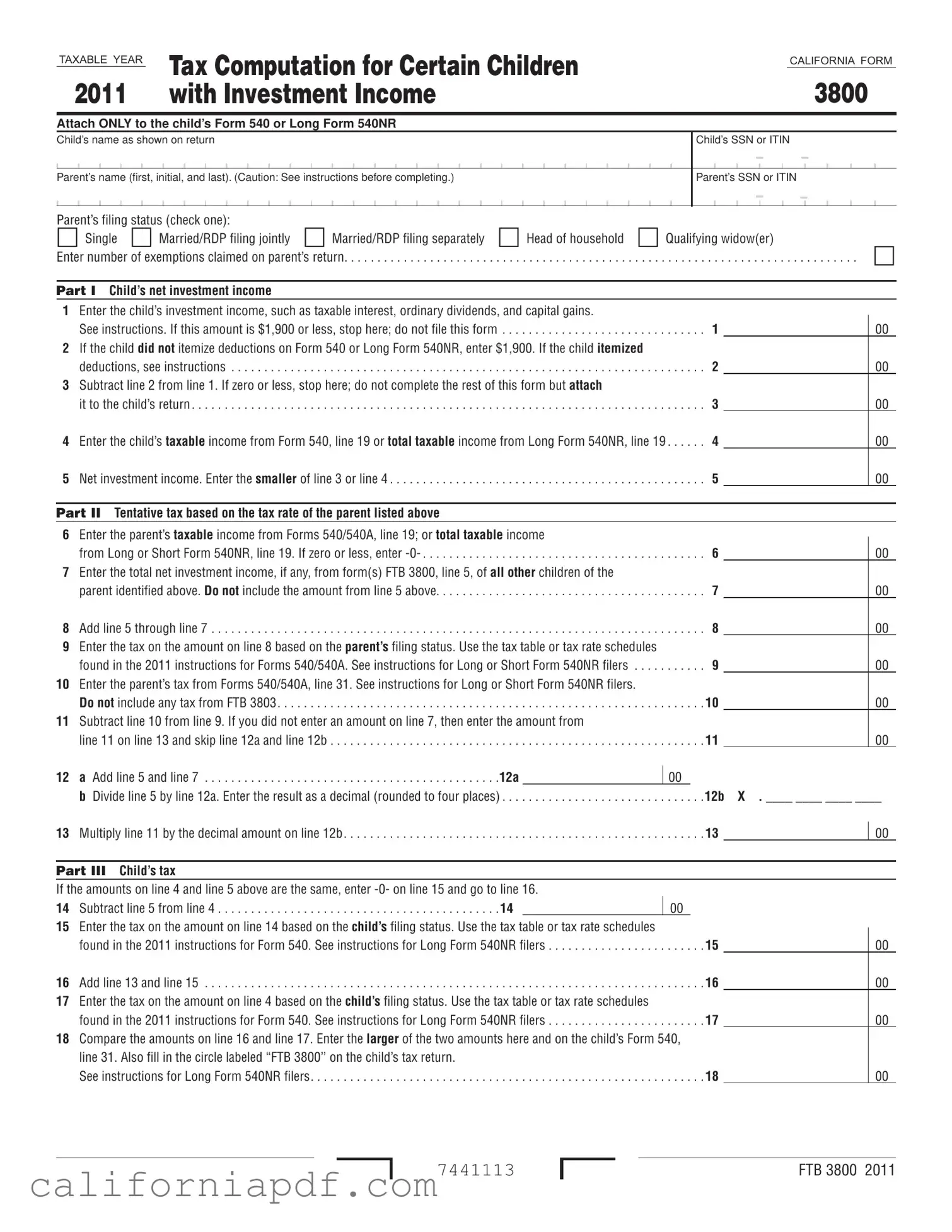

Document Example

|

TAXABLE YEAR |

|

Tax Computation for Certain Children |

|

|

|

|

|

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2011 |

|

|

|

with Investment Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

3800 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach ONLY to the child’s Form 540 or Long Form 540NR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Child’s name as shown on return |

Child’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Parent’s name (first, initial, and last). (Caution: See instructions before completing.) |

Parent’s SSN or ITIN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parent’s filing status (check one):

Single Married/RDP filing jointly Married/RDP filing separately Head of household Qualifying widow(er)

Enter number of exemptions claimed on parent’s return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I Child’s net investment income

1Enter the child’s investment income, such as taxable interest, ordinary dividends, and capital gains.

See instructions. If this amount is $1,900 or less, stop here; do not file this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2If the child did not itemize deductions on Form 540 or Long Form 540NR, enter $1,900. If the child itemized

deductions, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3Subtract line 2 from line 1. If zero or less, stop here; do not complete the rest of this form but attach

it to the child’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

00

00

4 Enter the child’s taxable income from Form 540, line 19 or total taxable income from Long Form 540NR, line 19 . . . . . . 4

00

5 Net investment income. Enter the smaller of line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

Part II Tentative tax based on the tax rate of the parent listed above

6Enter the parent’s taxable income from Forms 540/540A, line 19; or total taxable income

from Long or Short Form 540NR, line 19. If zero or less, enter

7Enter the total net investment income, if any, from form(s) FTB 3800, line 5, of all other children of the

parent identified above. Do not include the amount from line 5 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9Enter the tax on the amount on line 8 based on the parent’s filing status. Use the tax table or tax rate schedules

found in the 2011 instructions for Forms 540/540A. See instructions for Long or Short Form 540NR filers . . . . . . . . . . . 9

10Enter the parent’s tax from Forms 540/540A, line 31. See instructions for Long or Short Form 540NR filers.

Do not include any tax from FTB 3803 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11Subtract line 10 from line 9. If you did not enter an amount on line 7, then enter the amount from

line 11 on line 13 and skip line 12a and line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

00

00

00

00

00

12 a |

Add line 5 and line 7 |

12a |

00 |

b |

Divide line 5 by line 12a. Enter the result as a decimal (rounded to four places) |

. . . . . .12b X . ____ ____ ____ ____ |

|

13 Multiply line 11 by the decimal amount on line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Part III Child’s tax

If the amounts on line 4 and line 5 above are the same, enter

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14 Subtract line 5 from line 4 |

14 |

|

00 |

15Enter the tax on the amount on line 14 based on the child’s filing status. Use the tax table or tax rate schedules

found in the 2011 instructions for Form 540. See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Add line 13 and line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17Enter the tax on the amount on line 4 based on the child’s filing status. Use the tax table or tax rate schedules

found in the 2011 instructions for Form 540. See instructions for Long Form 540NR filers . . . . . . . . . . . . . . . . . . . . . . . . 17

18Compare the amounts on line 16 and line 17. Enter the larger of the two amounts here and on the child’s Form 540, line 31. Also fill in the circle labeled “FTB 3800’’ on the child’s tax return.

See instructions for Long Form 540NR filers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

00

00

00

00

7441113

FTB 3800 2011

Instructions for Form FTB 3800

Tax Computation for Certain Children with Investment Income

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

For taxable years beginning on or after January 1, 2010, California conforms to the provision of the Small Business and Work Opportunity Act of 2007 which increased the age of children to 18 and under or

a student under age 24 for elections made by parents reporting their child’s interest and dividends.

Registered Domestic Partners (RDP) – For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

Purpose

For certain children, investment income over $1,900 is taxed at the parent’s rate if the parent’s rate is higher. Use form FTB 3800, Tax Computation for Certain Children with Investment Income, to figure the child’s tax.

Complete form FTB 3800 if all of the following apply:

•The child is 18 and under or a student under age 24 at the end of 2011. A child born on January 1, 1994, is considered to be age 18 at the end of 2011. A child born on January 1, 1988, is considered to be age 24 at the end of 2011.

•The child had investment income taxable by California of more than $1,900.

•At least one of the child’s parents was alive at the end of 2011.

If the child uses form FTB 3800, file Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or

If the child does not file form FTB 3800, figure the tax in the normal manner on the child’s Forms 540/540A, or Long or Short Form 540NR.

Parents of children 18 and under or a student under age 24 at the end of 2011, may elect to include the child’s investment income on the parent’s tax return. To make this election, the child must have had income only from interest and dividends. The election is not available if estimated tax payments were made in the child’s name. Get form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends, for more information. If parents make this election, the child will not have to file a California tax return or form FTB 3800.

If you elect to report your child’s income on your federal income tax return, but not on your California income tax return, be sure to make an adjustment on your Schedule CA (540 or 540NR), line 21f.

Specific Line Instructions

Parent’s Name and Social Security Number (SSN) or Individual Taxpayer Identiication Number (ITIN)

If federal Form 8615, Tax for Certain Children Who Have Investment Income of More Than $1,900, was filed with the child’s federal tax return, enter the name and SSN or ITIN of the same parent who was identified at the top of federal Form 8615.

If the child’s parents were married to each other or in an RDP and filed a joint 2011 California tax return, enter the name and SSN or ITIN of the parent who is listed first on the joint return.

If the parents were married or in an RDP but filed separate California tax returns, enter the name and SSN or ITIN of the parent with the higher taxable income.

If the parents were unmarried, treated as unmarried for tax purposes, or separated either by a divorce or separate maintenance decree, enter the name and SSN or ITIN of the parent who had custody of the child for most of 2011.

Exception. If the custodial parent remarried or entered into an RDP and filed a joint return with the new spouse/RDP, enter the name and SSN or ITIN of the person listed first on the joint return, even if that person is not the child’s parent. If the custodial parent and the new spouse/RDP filed separate California tax returns, enter the name and SSN or ITIN of the person with the higher taxable income, even if that person is not the child’s parent.

If the child’s parents were unmarried but lived together during the year with the child, enter the name and SSN or ITIN of the parent who had the higher taxable income.

Part I Child’s Net Investment Income

Line 1 – Enter the child’s investment income. Include income such as taxable interest, dividends, capital gains, rents, annuities, and income received as a beneficiary. In most cases, this will be the same as the amount entered on federal Form 8615, include only income taxable by California. Also, include investment income that was not taxed on the child’s federal tax return but is taxable under California law. For more information, get the instructions for Schedule CA (540 or 540NR), line 8 and line 9.

If the child had earned income (defined below), use the following worksheet to figure the amount to enter on form FTB 3800, line 1.

1.Enter the amount of the child’s adjusted gross income from Form 540, line 17 or

Long Form 540NR, line 17, whichever applies . . . . . . 1 __________

2.Enter the child’s earned income . . . . . . . . . . . . . . . . . . 2 __________

(wages, tips, and other payments received for personal services performed)

3.Subtract line 2 from line 1. Enter the result

here and on form FTB 3800, line 1 . . . . . . . . . . . . . . . 3 __________

Line 2 – If the child itemized deductions, enter the greater of:

$950 plus the portion of the amount on Form 540 or Long Form 540NR, line 18, that is directly connected with the production of the investment income shown on form FTB 3800, line 1 or $1,900.

Part II Tentative Tax Based on Parent’s Tax Rate

If the parent used Form 540 2EZ, refigure your tax by referring to the tax table for Forms 540/540A in order to complete this part. Using Form 540 2EZ will not produce the correct result.

Line 6 – Enter the taxable income from Forms 540/540A, line 19; or total taxable income from Long or Short Form 540NR, line 19 of the parent whose name is shown at the top of form FTB 3800. If the parent’s taxable income is less than zero, enter

Line 7 – If the individual identified as the parent on this form FTB 3800 is also identified as the parent on any other form FTB 3800, add the amounts, if any, from line 5 on each of the other forms FTB 3800 and enter the total on line 7.

Line 9 – Use the California tax table or tax rate schedules in the 2011 instructions for Forms 540/540A to find the tax for the amount on line 8, based on the parent’s filing status.

FTB 3800 2011 Page 1

Long or Short Form 540NR Filers: To figure a revised California adjusted gross income and a tentative tax based on the parent’s tax rate, complete the following worksheet.

AEnter the child’s portion of the net investment income that must be included in the child’s

|

CA adjusted gross income |

____________ |

B |

Enter parent’s CA adjusted gross income from |

|

|

Long or Short Form 540NR, Line 32 |

____________ |

C |

Add line A and line B |

____________ |

D |

Enter the child’s investment income |

|

|

(form FTB 3800, line 5) |

____________ |

E |

Enter parent’s adjusted gross income from all |

|

|

sources from Long or Short Form 540NR, line 17. . . |

____________ |

|

If the parents have other children for whom form |

|

|

FTB 3800 was completed, add the other children’s |

|

|

net investment income to the parent’s CA adjusted |

|

|

gross income on line B and to the parent’s adjusted |

|

|

gross income from all sources on line E. |

|

F |

Add line D and line E |

____________ |

G |

Divide line C by line F (not to exceed 1.0) |

____________ |

HEnter the parent’s total itemized deductions or standard deduction from Long or Short

|

Form 540NR, line 18 |

____________ |

I |

Multiply line H by line G |

____________ |

J |

Subtract line I from line C |

____________ |

K |

Subtract line H from line F |

____________ |

LFind the tax on the amount on line K for the parent’s filing status (Use the tax table or tax rate schedules in the 2011 instructions for

|

Long or Short Form 540NR) |

____________ |

M |

Divide line L by line K |

____________ |

N |

Multiply line J by line M. Enter the result on form |

|

|

FTB 3800, line 9 |

____________ |

Line 10 – Enter the tax shown on the tax return of the parent identified at the top of form FTB 3800 from Forms 540/540A, line 31.

If the parent filed a joint tax return, enter on line 10 the tax shown on that tax return even if the parent’s spouse/RDP is not the child’s parent.

Long Form 540NR Filers: If the parent’s tax amount on Long

Form 540NR, line 37 does not include an amount from form FTB 3803, then enter the parent’s tax amount from Long Form 540NR, line 37.

If the parent’s tax amount on Long Form 540NR, line 37 includes an amount from form FTB 3803, revise the parent’s tax by completing the following worksheet.

A |

Enter the tax from the parent’s |

|

|

Long Form 540NR, line 31 |

____________ |

B |

Enter the tax from form FTB 3803 |

____________ |

C |

Subtract line B from line A |

____________ |

D |

Enter the amount from the parent’s |

|

|

Long Form 540NR, line 19 |

____________ |

E |

Divide line C by line D |

____________ |

F |

Enter the amount from the parent’s |

|

|

Long Form 540NR, line 35 |

____________ |

G |

Multiply line F by line E. Enter the result |

|

|

on form FTB 3800, line 10 |

____________ |

Part III Child’s Tax

Line 15 – Use the California tax table or tax rate schedules in the 2011 instructions for Form 540 to find the tax for the amount on line 14 based on the child’s filing status.

Long Form 540NR Filers: To figure a revised California adjusted gross income for the child and the child’s tax, complete the following worksheet.

A Enter the child’s CA adjusted gross income |

|

from Long Form 540NR, line 32 |

____________ |

BEnter the portion of the child’s net investment income that must be included in the child’s

|

CA adjusted gross income |

____________ |

C |

Subtract line B from line A |

____________ |

D |

Enter the child’s adjusted gross income from all |

|

|

sources from Long Form 540NR, line 17 |

____________ |

E |

Enter the child’s investment income |

|

|

(form FTB 3800, line 5) |

____________ |

F |

Subtract line E from line D |

____________ |

G |

Divide line C by line F (not to exceed 1.0) |

____________ |

HEnter the child’s total itemized deductions or standard deduction from Long or Short

|

Form 540NR, line 18 |

____________ |

I |

Multiply line H by line G |

____________ |

J |

Subtract line I from line C |

____________ |

K |

Subtract line H from line F |

____________ |

LFind the tax on the amount on line K for the child’s filing status (Use the tax table or tax rate schedules in the 2011 instructions for

|

Long Form 540NR) |

____________ |

M |

Divide line L by line K |

____________ |

N |

Multiply line J by line M. Enter the result on |

|

|

form FTB 3800, line 15 |

____________ |

Line 17 – Use the California tax table or tax rate schedules found in the 2011 instructions for Form 540 to find the tax for the amount on line 4, based on the child’s filing status.

Long Form 540NR Filers: |

|

A Enter the amount from form FTB 3800, line 4 |

____________ |

BFind the tax for the amount on line A, by using the tax table or tax rate schedules in the 2011 instructions for Long Form 540NR based on

|

the child’s filing status |

____________ |

C |

Divide line B by line A |

____________ |

D |

Enter the amount from the child’s |

|

|

Long Form 540NR, line 35 |

____________ |

E |

Multiply line D by line C. Enter the result on |

|

|

form FTB 3800, line 17 |

____________ |

Line 18 – Compare the amounts on line 16 and line 17 and enter the larger of the two amounts on line 18. Be sure to fill in the circle labeled “FTB 3800” on Form 540, line 31 of the child’s tax return.

Long Form 540NR Filers: Divide the child’s Long Form 540NR, line 35 by the child’s Long Form 540NR, line 19 to determine the child’s percentage. Divide the larger of line 16 or line 17, by the percentage. Enter the amount on line 18 and on the child’s Long Form 540NR, line 31. Be sure to the fill in the circle labeled “FTB 3800” on the child’s Long Form 540NR.

Note: The amount entered on 540NR, line 31 reflects your tax on total taxable income before applying the California tax rate to your California source income. Follow the instructions for Long Form 540NR to determine your final California tax.

Page 2 FTB 3800 2011

Form Breakdown

| Fact Number | Detail |

|---|---|

| 1 | The California Form 3800 is used for the tax computation for certain children with investment income. |

| 2 | This form is attached only to the child's Form 540 or Long Form 540NR. |

| 3 | It is applicable for children who are 18 and under or a student under age 24 at the end of the tax year 2011. |

| 4 | Investment income over $1,900 for these children may be taxed at the parent's rate if higher. |

| 5 | California conforms to the provisions of the Small Business and Work Opportunity Act of 2007 regarding the age of children for electing parents reporting their child’s interest and dividends. |

| 6 | The instructions for California Form 3800 refer to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC). |

| 7 | References to a spouse, husband, or wife within the context of California income tax laws for registered domestic partners (RDPs) are applicable unless specified otherwise. |

How to Write California 3800

Filing the California Form 3800 involves a detailed process aimed at computing the appropriate tax for certain children with investment income. This form is specifically designed for children who are under 18 or students under 24 years of age by the end of the tax year, and have investment income over $1,900. It's crucial to accurately complete each step to ensure the child's tax is calculated correctly, leveraging the parent's tax rate where applicable. Below are step-by-step instructions to assist in the completion of California Form 3800.

- Start by entering the child’s name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) as shown on their tax return.

- Fill in the parent’s name, including first, initial, and last name. Also, provide the parent's SSN or ITIN.

- Select the parent's filing status by checking the appropriate box.

- Enter the number of exemptions claimed on the parent's return.

- Under Part I, input the child's total investment income in line 1.

- If the child did not itemize deductions, enter $1,900 in line 2. If they itemized, follow the instructions to determine the correct amount to enter.

- Subtract line 2 from line 1, and input the result in line 3.

- Enter the child's taxable income from Form 540, line 19 or from Long Form 540NR, line 19 in line 4.

- In line 5, input the net investment income, which is the smaller of line 3 or line 4.

- Move to Part II. Input the parent’s taxable income from their tax returns in line 6.

- If applicable, add the total net investment income of all other children of the parent in line 7.

- Add lines 5 and 7, then input that total in line 8.

- Calculate the tax on the amount from line 8 based on the parent’s filing status and enter it in line 9.

- Enter the parent’s tax from their tax forms in line 10.

- Subtract line 10 from line 9, and record the result in line 11.

- In lines 12a and 12b, calculate the proportion of the tax attributable to the child's income.

- Multiply line 11 by the decimal amount in line 12b and input the result in line 13.

- For Part III, determine if line 4 and line 5 are the same. If so, input -0- on line 14 and skip to line 16.

- Calculate the tax on the amount from line 14 based on the child’s filing status and enter it in line 15.

- Add lines 13 and 15, entering the sum in line 16.

- Use the tax table or rate schedules to find the tax on the amount in line 4, enter this in line 17.

- Compare the amounts on lines 16 and 17. Enter the larger amount in line 18 and also on the child’s Form 540, line 31. Ensure to fill in the circle labeled “FTB 3800” on the child’s tax return.

Once the form is accurately completed, attach it to the child's Form 540 or Long Form 540NR. This step is essential for ensuring the child's tax reflects any necessary computations based on the parent's tax rate. Filing this form could result in a different tax amount due or a refund owed to the child.

Listed Questions and Answers

What is the California Form 3800?

California Form 3800, also known as the Tax Computation for Certain Children with Investment Income, is a tax document used in California to calculate the income tax on investment income earned by children. This form is necessary when a child's investment income exceeds $1,900 and is part of an effort to tax this income at the parent’s rate if that rate is higher.

Who needs to complete Form 3800?

This form should be completed if all the following conditions are met:

- The child is either 18 years old and under or a student under age 24 at the end of the tax year.

- The child has more than $1,900 of investment income taxable by California for the tax year.

- At least one of the child's parents was alive at the end of the tax year.

How does one determine a child's investment income for Form 3800 purposes?

Investment income for the purpose of Form 3800 includes taxable interest, ordinary dividends, and capital gains, among other income such as rents and annuities. The amount to be reported is the child’s investment income that is taxable by California, which might differ from federal taxable amounts due to specific state adjustments.

What if a child's investment income is $1,900 or less?

If the child's investment income is $1,900 or less, you do not need to file Form 3800. In such cases, the child's investment income is not subject to the higher tax rate potentially applicable to the parents' tax bracket.

How do you report a parent’s information on Form 3800?

The parent’s information required includes their name, SSN or ITIN, and filing status. If parents are married/RDP (Registered Domestic Partners) filing jointly, enter the name and SSN or ITIN of the parent listed first on the joint return. If the parents file separately, use the information of the parent with the higher taxable income.

Can parents elect to include their child's investment income on their own return instead?

Yes, parents have the option to include their child's investment income on their tax return instead of filing a separate return for the child. This election is available only if the child's income consists solely of interest and dividends and if no estimated tax payments were made in the child’s name. Form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends, is used for this purpose.

What happens if you elect to report your child's income on your federal return but not on your California return?

If you choose to report your child's investment income on your federal return but decide not to do so on your California return, you must make an adjustment on your California Schedule CA (540 or 540NR), line 21f, to ensure the income is accurately reported and taxed.

What are the key parts of Form 3800?

Form 3800 is divided into several parts focusing on:

- Calculating the child's net investment income.

- Determining the tentative tax based on the parent’s tax rate.

- Calculating the child's tax considering their own filing status and either their or the parent’s rate, whichever results in a higher tax.

Where to attach Form 3800?

Form 3800 should be attached to the child's California Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return, following the calculation to determine whether the child’s investment income should be taxed at the child or the parent's tax rate.

Common mistakes

Failing to verify if the child qualifies based on the age requirement. The child must be 18 and under or a student under age 24 at the end of the taxable year.

Incorrectly reporting the child’s investment income by either overestimating or underestimating taxable interest, dividends, and capital gains, leading to miscalculations in the tax owed.

Overlooking the need to attach the form to the child's Form 540 or Long Form 540NR, as required for proper filing.

Entering the incorrect Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for either the child or the parent, which can cause processing delays.

Misinterpreting the parent's filing status or inaccurately reporting it, affecting the computation of the tax rate applied to the child's investment income.

Not correctly calculating the child’s net investment income by either not subtracting the standard deduction when the child did not itemize deductions or by miscalculating the deduction amount if the child itemized.

Omitting or inaccurately reporting the parent’s taxable income, impacting the tentative tax calculation that is based on the parent's tax rate.

Forgetting to include the total net investment income of all other children, if applicable, which should be factored into the tentative tax computation on the parent’s rate.

Incorrect use of tax tables or tax rate schedules meant for determining the tax on the child’s taxable income and the tax based on the parent's filing status, leading to potential underpayment or overpayment of tax.

To avoid these common errors, it's important to thoroughly review instructions for the California Form 3800, ensure all income is accurately reported and calculated, and verify that all required fields and calculations are correctly filled out and computed. Attention to detail can make a significant difference in the accurate and timely processing of tax forms.

Documents used along the form

When dealing with California Form 3800, specifically designed for certain children with investment income, it's also important to be familiar with other forms and documents that may be required or helpful in the process. From understanding a child's investment income to incorporating a child’s income on a parent’s tax return, each document plays a vital role.

- Form 540 - This is the California Resident Income Tax Return. It’s used by individuals who reside in California to report their annual income and calculate their tax liability.

- Form 540NR - Known as the California Nonresident or Part-Year Resident Income Tax Return, this form is for those who either lived outside of California for part of the year or did not reside in the state but earned income from California sources.

- Form 540/540A - These forms are previous versions of the California Resident Income Tax Return, applicable for specific tax years, used by residents for filing their taxes.

- Form 540 2EZ - A simplified version of the California tax return for certain filers with straightforward tax situations. It's designed for ease of use, but not everyone qualifies to use it.

- Form 8615 - A federal tax form titled "Tax for Certain Children Who Have Unearned Income." It’s used to calculate the tax on a child’s investment income at the parent's tax rate if it's higher, ensuring that higher tax rates apply to the child’s income.

- FTB 3803 - Named "Parents’ Election to Report Child’s Interest and Dividends," this form allows parents to include their child’s income on their return, potentially simplifying the filing process and eliminating the need for the child to file a separate return.

- Schedule CA (540 or 540NR) - These schedules are used with Forms 540 and 540NR to make adjustments to the federal adjusted gross income and itemized deductions to conform with California law.

- Form 540 2EZ Tax Tables - These tables are used in conjunction with Form 540 2EZ to determine the amount of California state tax owed based on income.

- FTB Pub. 737 - A publication providing tax information for Registered Domestic Partners (RDPs) in California, giving guidance on how state tax laws apply to them.

Understanding and managing these documents can be quite the task, but they are crucial for accurately reporting investment income for children and determining their tax obligations in California. Each form has its unique purpose, whether it's for residents, non-residents, part-year residents, or those with simple tax situations. Completing these forms accurately ensures compliance with California tax laws and can help in optimizing the tax outcomes for young investors and their families.

Similar forms

The California Form 540 is notably similar to the California 3800 form, serving as the state tax return form for residents. This connection lies in the necessity of attaching the 3800 form to Form 540 when a child has investment income that needs to be calculated at the parent’s tax rate, highlighting a direct relationship in filing requirements. The key purpose of both forms is to report income and calculate taxes owed, but Form 540 encompasses all income types while Form 3800 specifically deals with children's investment income.

The Long Form 540NR shares a purpose with Form 3800 akin to that of Form 540, but it is designed for nonresidents or part-year residents of California. Like Form 540, it may require the attachment of the 3800 form when a nonresident or part-year resident child has investment income that necessitates tax calculation at the parent's rate. The similarity with the 3800 form underscores the common objective of ensuring that investment income for certain children is taxed appropriately, depending on the parent’s tax bracket.

Form FTB 3803, Parents' Election to Report Child's Interest and Dividends, functions as an elective alternative to Form 3800, allowing parents to report their child's investment income on their own tax return instead. This similarity rests in the management of children's investment income, yet they diverge in application, with Form 3800 being used if the child’s tax is calculated separately, and Form FTB 3803 serving when parents opt to include the child's income on their return.

The Federal Form 8615, Tax for Certain Children Who Have Investment Income of More Than $1,900, parallels California’s Form 3800 in its intent to tax a child's investment income at the parent's tax rate if it exceeds a specific amount. The 3800 form echoes this federal approach within California, requiring similar information and calculations to ensure consistency between federal and state tax obligations related to children's investment income.

Schedule CA (540 or 540NR) plays a complementary role to the 3800 form, as it is used for adjusting income and deductions that differ between federal and California tax law. While Schedule CA aids in determining the state-adjusted gross income, its relevance to Form 3800 comes into play when calculating the child's net investment income or the parent's adjusted gross income, if needed, ensuring accurate state tax calculations.

Form 540 2EZ serves as a simpler alternative to Form 540 for individuals with straightforward tax situations. Although it cannot be directly linked with Form 3800 since the latter deals with more complex investment income situations for children, both forms are integral to the California state tax filing process. The need to potentially switch from Form 540 2EZ to the detailed Form 540 to accommodate the attachment of Form 3800 exemplifies the layered approach to dealing with various income types in tax filings.

Form 540A, previously an alternative to Form 540 for residents with simpler tax scenarios, shares a procedural similarity with Form 3800 in the context of California taxation. When in use, Form 540A addressed straightforward income reporting and tax calculation, similar to Form 540 2EZ. Although no longer in use, its existence highlighted the tiered nature of tax forms designed to accommodate different levels of complexity in taxpayer situations, much like how Form 3800 is tailored for specific scenarios involving children’s investment income.

Finally, the instructions for Form 3800 provide guidance and clarification on completing the form, making them an essential companion document. These instructions detail the circumstances under which Form 3800 needs to be filed, how to accurately calculate the tax on a child’s investment income using the parent’s tax rate, and the specific requirements for both resident and nonresident filings. This guidance ensures that taxpayers comprehend the form’s purpose, its relation to other tax forms, and how to properly integrate their child’s investment income into their state tax calculations.

Dos and Don'ts

When completing California Form 3800, it's important to follow guidelines to ensure accuracy and compliance. Below are four do's and four don'ts to keep in mind:

Do:- Verify the child’s name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) matches the information on their return.

- Ensure that all investment income taxable by California over $1,900 for the child is accurately reported on Line 1.

- Use the tax rate of the parent listed at the top of the form when calculating the tentative tax on Part II.

- Compare the amounts on Line 16 and Line 17 to accurately enter the larger of the two amounts on Line 18 and the child’s Form 540, Line 31.

- File Form 3800 if the child’s investment income is $1,900 or less, as indicated in Part I instructions.

- Misreport the parent’s filing status or inaccurately input their SSN or ITIN, which could lead to discrepancies and possible delays.

- Overlook instructions for Long Form 540NR filers, which require additional steps to adjust the parent's and child's adjusted gross incomes.

- Forget to attach Form 3800 to the child’s Form 540 or Long Form 540NR as required, ensuring all parts of the form are completed as applicable.

Misconceptions

Understanding the California Form 3800, designed for computing a child's tax with investment income, can be complex. Several misconceptions exist about its usage, requirements, and effects. Here's a clarification of the most common misunderstandings to help guide through the process accurately.

- Misconception 1: Only children with income from California need to file Form 3800. This is not accurate. Children with investment income taxable by California, regardless of where it originated, should use the form if the other conditions apply—for instance, if their investment income exceeds $1,900 for the tax year.

- Misconception 2: The form is required for all children. Actually, Form 3800 is used only for children under 19, or under 24 if a student, with more than $1,900 in investment income. Parents can choose to include the child’s investment income on their tax return instead for instances where it's advantageous and permitted.

- Misconception 3: Parents with lower incomes always benefit from filing Form 3800 for their child. The form calculates taxes based on the parent’s rate if higher, potentially increasing the tax owed on the child’s investment income, not necessarily providing a lower tax burden.

- Misconception 4: Form 3800 needs to be filed even if the investment income is $1,900 or less. The instructions clearly state to refrain from filing if the child's investment income does not exceed $1,900.

- Misconception 5: All information from the child’s and parent’s tax forms is needed to complete Form 3800. While the child's investment income, as well as the parent's taxable income, influence the computation on the form, not all data from the tax returns are directly used.

- Misconception 6: Form 3800 applies for any minor child’s income. It’s specifically tailored for certain children with more than $1,900 of investment income, not for all income types. Earned income, such as wages from a job, is excluded from its computation.

- Misconception 8: Form 3800 requires detailed breakdowns of the child’s investment expenses. While investment income must be calculated accurately, the form uses a more simplified approach focusing on total investment income rather than itemizing specific expenses related to generating that income.

- Misconception 9: If you mistakenly file Form 3800, it will heavily complicate your taxes. While it’s important to file correctly, errors can be corrected by amending your tax return. Mistakenly filing a Form 3800 when it’s not required may create a need for amendment but is not an irreparable mistake.

Dispelling these misconceptions ensures that Form 3800 is filled out correctly and only when truly applicable. This ensures the accurate calculation of taxes owed, potentially saving time and avoiding unnecessary complications with California state taxes.

Key takeaways

Understanding the form FTB 3800, "Tax Computation for Certain Children with Investment Income," is crucial for correctly processing the tax returns of certain minors in California. This form serves to calculate the tax on investment income for children who meet specific criteria, ensuring that it aligns with the potential higher tax rate of their parents. Here, we outline several key points to help demystify this form for both taxpayers and tax professionals.

- The FTB 3800 form is designed for children under the age of 18, or students under 24, who have more than $1,900 in investment income for the tax year. This income threshold prompts the need for special tax calculations to potentially apply the parent's tax rate to the child's investment income.

- Investment income that requires reporting on this form includes, but is not limited to, taxable interest, dividends, capital gains, and income from rents or annuities. This comprehensive approach helps ensure that all applicable income is considered in the child's tax computation.

- For the purpose of completing the FTB 3800 form, the term "investment income" is defined broadly. It encapsulates various types of income such as interest, dividends, capital gains, and more, ensuring a comprehensive assessment of the child's taxable income derived from investments.

- To accurately fill out this form, parents must identify the correct filing status, the child's net investment income, and any necessary deductions. These elements are crucial for calculating whether the child's investment income exceeds the threshold and determining the appropriate tax treatment.

- If a child's investment income is below the $1,900 threshold, the FTB 3800 form is not required. This simplification prevents unnecessary paperwork for income amounts that do not meet the criteria set for special tax rate application under California law.

- The child’s tax on investment income may be calculated using the parent's tax rate if it results in a higher tax liability. This approach aims to prevent tax avoidance through the shifting of income to children who would otherwise be taxed at a lower rate.

Correctly completing the FTB 3800 form is essential for complying with California tax regulations regarding children’s investment income. Parents or guardians must accurately report investment income and potentially apply their higher tax rate to their child's income to ensure proper tax treatment. This process underscores the importance of detailed attention when filling out tax forms to meet state requirements and avoid potential errors.

Different PDF Templates

California Notice of Completion - It ensures a legally backed framework for landlords to communicate rent increases or other significant lease modifications to tenants with a 20-day notice.

Ca Tax Extension 2023 - For corporations and exempt organizations uncertain about their EFT obligation, Form 3539 provides a clear directive on how to proceed.

Death of Joint Tenant California - Helps heirs and beneficiaries to navigate the aftermath of a trustee's death.