Fill a Valid California 3803 Form

California's tax law sets certain provisions for reporting income, and among these is the California Form 3803, or the Parents’ Election to Report Child’s Interest and Dividends form, a critical document for parents or guardians managing the income of their dependent children. This form allows parents to report their child's income from interest and dividends on their own tax return, negating the need for the child to file a separate return. To be eligible to use this form, specific criteria concerning the child's age, income type, and income level must be met. It's designed to streamline the tax process for families by including any interest or dividend income earned by children under a certain age threshold directly on the parents’ tax return. The form is part of a broader tax strategy aimed at simplifying the filing process and potentially lowering the overall tax burden on the family. Additionally, it highlights California's deviation in certain areas from federal tax laws, underscoring the importance for residents to pay close attention to state-specific tax filings. Form 3803 requires detailed information about the child’s income sources and offers guidance on calculating any applicable taxes due on this income, emphasizing California’s approach to taxation within the familial context.

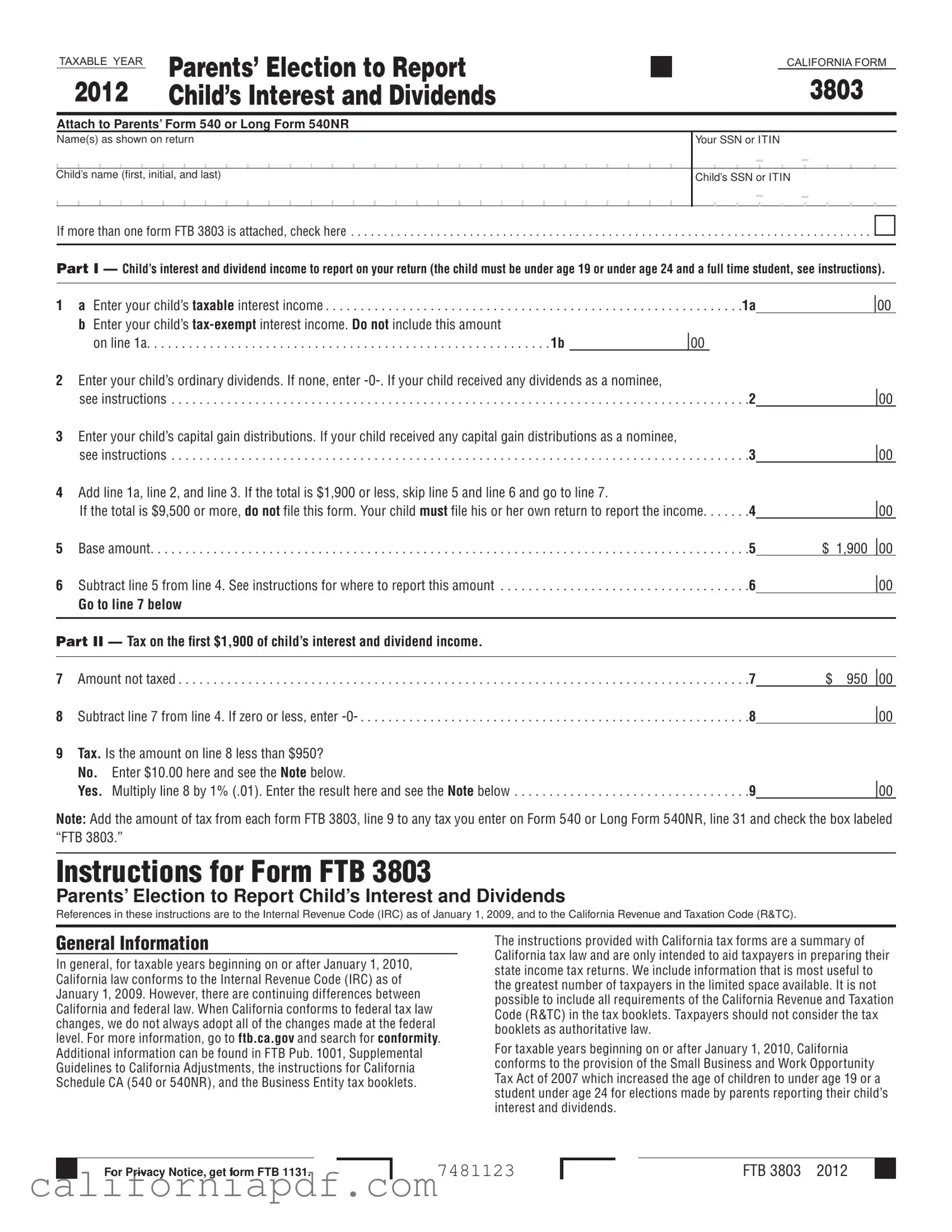

Document Example

TAXABLE YEAR |

Parents’ Election to Report |

|

|

CALIFORNIA FORM |

|

|

|

|

|

2012 |

Child’s Interest and Dividends |

3803 |

||

|

|

|

|

|

Attach to Parents’ Form 540 or Long Form 540NR

Name(s) as shown on return

Child’s name (first, initial, and last)

Your SSN or ITIN

Child’s SSN or ITIN

- -

If more than one form FTB 3803 is attached, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I — Child’s interest and dividend income to report on your return (the child must be under age 19 or under age 24 and a full time student, see instructions).

1 a Enter your child’s taxable interest income |

1a |

|00 |

bEnter your child’s

on line 1a |

1b |

|00 |

2Enter your child’s ordinary dividends. If none, enter

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

3Enter your child’s capital gain distributions. If your child received any capital gain distributions as a nominee,

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

4Add line 1a, line 2, and line 3. If the total is $1,900 or less, skip line 5 and line 6 and go to line 7.

If the total is $9,500 or more, do not file this form. Your child must file his or her own return to report the income. . . . . . .4

5 Base amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

6 Subtract line 5 from line 4. See instructions for where to report this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

Go to line 7 below

|00

|00

|00

$1,900 |00 |00

Part II — Tax on the first $1,900 of child’s interest and dividend income.

7 |

Amount not taxed |

7 |

$ 950 |00 |

|

8 |

Subtract line 7 from line 4. If zero or less, enter |

8 |

|00 |

|

9 |

Tax. Is the amount on line 8 less than $950? |

|

|

|

|

No. |

Enter $10.00 here and see the Note below. |

|

|00 |

|

Yes. |

Multiply line 8 by 1% (.01). Enter the result here and see the Note below |

9 |

|

Note: Add the amount of tax from each form FTB 3803, line 9 to any tax you enter on Form 540 or Long Form 540NR, line 31 and check the box labeled “FTB 3803.”

Instructions for Form FTB 3803

Parents’ Election to Report Child’s Interest and Dividends

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

In general, for taxable years beginning on or after January 1, 2010, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2009. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider the tax booklets as authoritative law.

For taxable years beginning on or after January 1, 2010, California conforms to the provision of the Small Business and Work Opportunity Tax Act of 2007 which increased the age of children to under age 19 or a student under age 24 for elections made by parents reporting their child’s interest and dividends.

For Privacy Notice, get form FTB 1131.

7481123

FTB 3803 2012

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified.

When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

A Purpose

Parents may elect to report their child’s income on their California income tax return by completing form FTB 3803, Parents’ Election to Report Child’s Interest and Dividends. If you make this election, the child will not have to file a return. You may report your child’s income on your California income tax return even if you do not do so on your federal income tax return. You may make this election if your child meets all of the following conditions:

•Was under age 19 or a student under age 24 at the end of 2012. A child born on January 1, 1994, is considered to be age 19 at the end of 2012. A child born on January 1, 1989, is considered to be age 24 at the end of 2012.

•Is required to file a 2012 income tax return.

•Had income only from interest and dividends.

•Had gross income for 2012 that was less than $9,500.

•Made no estimated tax payments for 2012.

•Did not have any overpayment of tax shown on his or her 2011 return applied to the 2012 estimated taxes.

•Had no state income tax withheld from his or her income (backup withholding).

As a parent, you must also qualify as explained in Section B.

B Parents Who Qualify to Make the Election

You qualify to make this election if you file Form 540, California Resident Income Tax Return, or Long Form 540NR, California Nonresident or Part- Year Resident Income Tax Return, and if any of the following applies to you:

•You and the child’s other parent were married to each other or in a registered domestic partnership and you file a joint return for 2012.

•You and the child’s other parent were married to each other or in a registered domestic partnership but you file separate returns for 2012 AND you had the higher taxable income. If you do not know if you had the higher taxable income, get federal Publication 929, Tax Rules for Children and Dependents.

•You were unmarried, treated as unmarried for state income tax purposes, or separated from the child’s other parent by a divorce, separate maintenance decree, or termination of a domestic partnership and you had custody of your child for most of the year (you were the custodial parent). If you were the custodial parent and you remarried or entered into another registered domestic partnership, you may make the election on a joint return with your new spouse/RDP (your child’s stepparent). But if you and your new spouse/RDP do not file a joint return, you qualify to make the election only if you had higher taxable income than your new spouse/RDP.

If you and the child’s other parent were not married or in a registered domestic partnership but you lived together during the year with the child, you qualify to make the election only if you are the parent with the higher taxable income.

If you elect to report your child’s income on your return, you may not reduce that income by any deductions that your child would be entitled to claim on his or her own return, such as the penalty on early withdrawal of child’s savings or any itemized deductions. For more information, get the instructions for federal Form 8814, Parents’ Election to Report Child’s Interest and Dividends.

C How to Make the Election

To make the election, complete and attach form FTB 3803 to your Form 540 or Long Form 540NR and file your return by the due date (including extensions).

File a separate form FTB 3803 for each child whose income you choose to report.

Specific Line Instructions

Use Part I to figure the amount of the child’s income to report on your return. Use Part II to figure any additional tax that must be added to your tax.

Name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Enter your name as shown on your tax return. If filing a joint return, include your spouse’s/RDP’s name but enter the SSN or ITIN of the person whose name is shown first on the return.

For more information about interest, dividends, and capital gain distributions taxable by California, get the instructions for Schedule CA (540), California Adjustments — Residents, or Schedule CA (540NR), California Adjustments — Nonresidents or

Part I Child’s Interest and Dividend Income to Report on Your Return

Line 1a

Enter all interest income taxable by California and received by your child in 2012. If, as a nominee, your child received interest that actually belongs to another person, write the amount and the initials “ND” (for “nominee distribution”) on the dotted line to the left of line 1a. Do not include amounts received by your child as a nominee in the total entered on line 1a.

If your child received Form

Line 1b

If your child received any interest income exempt from California tax, such as interest on United States savings bonds or California municipal bonds, enter the total

Line 2

Enter ordinary dividends received by your child in 2012. Ordinary dividends should be shown on Form

If your child received, as a nominee, ordinary dividends that actually belong to another person, enter the amount and the initials “ND” on the dotted line to the left of line 2. Do not include amounts received as a nominee in the total for line 2.

Line 3

Enter the capital gain distributions taxable by California and received by your child in 2012. Capital gain distributions should be shown on Form

Line 6

If the total amount on line 6 of all form(s) FTB 3803 is less than the total amount on line 6 of all your federal Form(s) 8814, enter the difference on Schedule CA (540 or 540NR), line 21f, column B and write “FTB 3803” on line 21f.

If the total amount on line 6 of all form(s) FTB 3803 is more than the total amount on line 6 of all your federal Form(s) 8814, enter the difference on Schedule CA (540 or 540NR), line 21f, column C and write “FTB 3803” on line 21f.

If you did not file federal Form 8814, enter the amount from form

FTB 3803, line 6, on Schedule CA (540 or 540NR), line 21f, column C and write “FTB 3803” on line 21f.

If your child received capital gain distributions (shown on Form

Part II Tax on the First $1,900 of Child’s Interest and Dividend Income

Line 9

Add the amount of tax from each form FTB 3803, line 9 to any tax you enter on Form 540 or Long Form 540NR, line 31 and check the box labeled “FTB 3803.”

Page 2 FTB 3803 2012

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | Form 3803 is for parents to report their child's interest and dividends on their own tax return, instead of the child filing separately. |

| Eligibility | Children under age 19 or under age 24 if a full-time student, with interest and dividend income only, and gross income less than $9,500 in 2012 qualify for this reporting. |

| Parental Eligibility | Parents qualify if filing together, the higher income parent if filing separately, or the custodial parent in case of divorce or separation. |

| Governing Law | This form is governed by the California Revenue and Taxation Code (R&TC) as it conforms to the Internal Revenue Code (IRC) with modifications. |

| Attachment Requirements | The completed Form 3803 must be attached to the parents' Form 540 or Long Form 540NR when filed. |

How to Write California 3803

Filling out the California Form 3803 allows parents to report their child's interest and dividends on their own tax return, potentially simplifying the tax filing process. This option can be advantageous if your child received a small amount of income from these sources during the tax year. Below are step-by-step instructions on how to correctly complete this form. Remember, this election is suitable only if certain conditions are met, including the child's age and income requirements as outlined in the instructions.

- At the top of the form, enter your name(s) as shown on your tax return. If filing jointly, include your spouse's name, but only the SSN or ITIN of the primary filer needs to be listed.

- Fill in your child's name in the designated space, including first name, initial, and last name.

- Provide your SSN or ITIN and your child's SSN or ITIN where requested.

- If attaching more than one Form 3803, check the box indicating this at the top of the form.

- In Part I:

- On line 1a, enter your child's taxable interest income.

- On line 1b, note any tax-exempt interest income your child received but do not include this amount in line 1a's total.

- Report your child's ordinary dividends on line 2.

- Enter your child's capital gain distributions on line 3.

- Add the amounts from lines 1a, 2, and 3, and enter the total on line 4.

- Follow the instructions for lines 5 and 6 to calculate and enter the relevant amounts. This involves subtracting the base amount on line 5 from the total on line 4 and reporting the figure on line 6.

- In Part II, determine the tax on the first $1,900 of your child's interest and dividend income:

- Enter the amount not taxed on line 7.

- Subtract line 7 from line 4, and enter this on line 8.

- On line 9, calculate the tax owed based on the instructions provided, depending on whether the amount on line 8 is less than $950.

- Add the amount from line 9 to any tax you enter on Form 540 or Long Form 540NR, line 31, and make sure to check the box labeled “FTB 3803.”

Once you have completed these steps, attach Form 3803 to your California Form 540 or Long Form 540NR. Make sure you've also completed any other necessary sections and included pertinent information required for your tax situation. Filing this form correctly can streamline your tax responsibilities by including your child's income on your return, provided they meet the specified criteria.

Listed Questions and Answers

What is California Form 3803 and who needs to file it?

California Form 3803, titled "Parents’ Election to Report Child’s Interest and Dividends," allows parents to report their child’s income from interest and dividends on their own tax return, rather than having the child file a separate return. This election can be made if the child was under age 19, or under age 24 if a full-time student, at the end of the tax year, and if the child’s income consists only of interest and dividends and is less than $9,500. Parents qualify to make this election if they file a Form 540 or Long Form 540NR and meet certain conditions regarding marital status and income.

How do I make the election on California Form 3803?

To make the election, complete and attach Form 3803 to your California Form 540 or Long Form 540NR. You will need to file a separate Form 3803 for each child whose income you elect to report on your return. Accuracy is key, so be sure to include all taxable interest and dividends, exempt-interest dividends, ordinary dividends, and capital gain distributions as instructed on the form.

What are the income limits for using California Form 3803?

The child's gross income for the year must be less than $9,500 to use Form 3803. This includes income solely from interest and dividends. If the child's income exceeds this amount, they must file their own tax return to report the income.

Are there any specific conditions that both the child and parents must meet to use Form 3803?

Yes, there are specific conditions:

- The child must have been under age 19, or under age 24 if a full-time student, at the end of the tax year.

- Only interest and dividends as sources of income are eligible.

- The child’s gross income must be less than $9,500 for the year.

- The child did not make any estimated tax payments or have any overpayment from the previous year applied to the current year’s estimated tax.

- No state income tax was withheld from the child's income.

Moreover, parents are eligible to make the election if they file a California resident or nonresident/part-year resident income tax return and meet certain criteria regarding their marital status and income relative to each other or a new spouse/RDP.

What are the tax implications of reporting my child’s income on my tax return using Form 3803?

By electing to report your child's interest and dividend income on your own tax return using Form 3803, you might potentially increase your tax liability, as it increases your taxable income. However, this method may be simpler and more cost-effective than having the child file a separate return, especially if the additional tax due is minimal. It's important to calculate the “Tax on the First $1,900 of Child’s Interest and Dividend Income” as outlined in Part II of the form and to add any calculated tax to your Form 540 or Long Form 540NR, line 31, checking the box labeled “FTB 3803.” Always consider consulting with a tax professional to understand the full implications based on your personal tax situation.

Common mistakes

Filling out the California 3803 form can be tricky, and making mistakes can lead to unnecessary delays or issues with your tax filing. Here are 10 common errors that people often make:

Failing to include all necessary names and Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) at the top of the form. It's crucial to list everyone accurately.

Not checking the box indicating if more than one form FTB 3803 is attached, when applicable. This helps the IRS keep track of the entire tax picture.

Misreporting the child's taxable interest income by either overestimating or underestimating, often due to overlooks of accrued interest not received.

Omitting the child's tax-exempt interest income. It should be listed separately, even if not taxable, to provide a full disclosure.

Incorrectly reporting ordinary dividends as capital gain distributions, or vice versa. These different types of incomes have distinct tax implications.

Forgetting to add all income types together correctly on line 4 or misunderstanding the thresholds for when a child must file his or her own return versus when it can be included on the parents' filing.

Not correctly identifying or reporting income received as a nominee for someone else. This mistake can significantly alter taxable income calculations.

Misunderstanding the eligibility requirements for not only the child but also the parents, in terms of who qualifies to make the election to include a child's income on their return.

Incorrect calculation of the baseline amount and taxable income on lines 5 and 6, leading to incorrect tax owed figures.

Omitting or inaccurately reporting the additional tax that must be added to the parents' tax due on line 9, for failing to multiply line 8 by 1% (.01) correctly or failing to recognize the threshold for when this tax applies.

It's also vital to remember:

Any corrections or additional information should be clearly indicated and attached if necessary.

Reviewing the instructions for both the California form 3803 and the federal counterpart is essential to grasp the specific requirements and avoid common pitfalls.

Understanding the differences between federal and California law, as these affect the reporting and taxation of a child's income.

Keeping good records throughout the year can prevent many of these errors, as it ensures all income is tracked and properly reported.

Documents used along the form

When dealing with California Form 3803—Parents’ Election to Report Child's Interest and Dividends, several other forms and documents may also be relevant or necessary, depending on the specific tax situation. This lineup of documents ensures compliance with both state and federal tax codes, and aids in the accurate reporting of income and calculation of taxes due. Understanding each form's purpose can significantly streamline the tax preparation process for individuals opting to report their child’s interest and dividends on their own tax returns.

- Form 540 - California Resident Income Tax Return: This is the primary state tax return form for California residents, to which the Form 3803 is attached if parents choose to report their child's income on their return.

- Form 540NR - California Nonresident or Part-Year Resident Income Tax Return: Nonresidents or part-year residents use this form for state tax filings, potentially including a child's income through Form 3803 attachment.

- Schedule CA (540 or 540NR) - California Adjustments: This schedule is used to adjust federal income to the California state level. It may include adjustments from child’s income reported on Form 3803.

- Form 1099-INT - Interest Income: Shows interest income earned by the child, which needs to be reported on Form 3803 if elected by parents.

- Form 1099-DIV - Dividends and Distributions: Documents dividend income and capital gain distributions which are reported for the child on Form 3803 if applicable.

- Form 8814 - Parents’ Election to Report Child’s Interest and Dividends on Federal Return: The federal counterpart to California's Form 3803, used if parents decide to report their child's investment income on their own federal return.

- Schedule D - Capital Gains and Losses: If a child has capital gain distributions reported on Form 1099-DIV, parents may need to include this information on their Schedule D if filing Form 3803.

- FTB Pub. 1001 - Supplemental Guidelines to California Adjustments: Provides additional details about adjustments to California income, which might affect how you report child's income on Form 3803.

- FTB Pub. 929 - Tax Rules for Children and Dependents: Offers guidance on reporting child's income on federal returns, relevant for understanding similar state requirements.

- Form FTB 1131 - Privacy Notice: Not directly related to filing Form 3803 but provides important information on privacy laws as they relate to filing California tax returns.

Combining these forms and documents with California Form 3803 allows for a thorough and compliant approach to reporting a child's interest and dividends. Whether you are dealing with state-specific forms like the Form 540 or federal ones like Form 8814, each document plays a crucial part in ensuring that parents can accurately and legally report their child's income, taking advantage of any tax benefits or requirements set forth by law. This collection of documents reflects the interconnectedness of various facets of tax reporting and underscores the importance of detailed and accurate financial record-keeping.

Similar forms

The IRS Form 8814, "Parents' Election to Report Child’s Interest and Dividends," is directly analogous to California's Form 3803. Both forms allow parents to report their child’s income from interest and dividends on their own tax return, thus negating the need for the child to file a separate income tax return. This can be particularly advantageous if the child's income comprises solely of interest and dividends, and falls below a certain threshold. Each form is designed to simplify the reporting process for families by consolidating tax obligations when certain conditions are met, including age and income limits.

Another related document, although broader in scope, is Form 1040, the U.S. Individual Income Tax Return, or its California equivalent, Form 540. While Form 1040 and Form 540 are used for reporting an individual's total annual income, portions of these forms are utilized when parents elect to include their child’s income on their return. Specifically, parents using Forms 3803 or 881avelrt this income on their main tax return. These overarching forms serve as the foundational documents for submitting personal income details to the federal and state tax authorities, making them indirectly linked to the specific child income reporting process.

Form 1099-INT, "Interest Income," is also related, as it documents the interest income someone earns throughout the tax year. If a child receives interest income that is then reported by the parents using Form 3803, the information from Form 1099-INT would need to be included. Essentially, Form 1099-INT provides the detailed interest income information that would be summarized and potentially reported on Form 3803, making it a vital document in accurately reporting a child's income under a parent's tax return.

Similarly, Form 1099-DIV, "Dividends and Distributions," is integral to the process encapsulated by Form 3803. This form outlines the dividends a child might have received from investments during the tax year. Just like with interest income, the dividends reported on Form 1099-DIV would be included in the child’s income total on Form 3803 if parents choose to report this income on their tax return. Both Form 1099-INT and Form 1099-DIV provide the necessary specifics for interest and dividend income that can be relevant for inclusion on Form 3803, making them essential documents for accurate financial and tax reporting.

Dos and Don'ts

When you're filling out the California Form 3803 for reporting your child's interest and dividends, there are several dos and don'ts to steer by to ensure a smooth process. Keeping these guidelines in mind can help avoid mistakes that may delay your processing or even result in the need to amend your filed returns later on.

- Do make sure your child qualifies under the specific conditions laid out in the form instructions, such as their age and income limits. This can include being under age 19, or under age 24 if a full-time student, and having income only from interest and dividends that's less than $9,500.

- Do gather all necessary documentation on your child’s interest and dividend income before you start filling out the form. This includes 1099 forms or similar statements from banks or other financial institutions.

- Do include your and your child’s full names and Social Security Numbers (SSNs) or Individual Tax Identification Numbers (ITINs) accurately as they appear on Social Security cards or ITIN letters.

- Don’t attempt to file this form if your child’s total interest and dividend income exceeds $9,500. In this case, according to the form’s instructions, your child must file their own return.

- Don’t forget to check the box indicating if more than one Form 3803 is attached, when filing for multiple children.

- Don’t overlook the instructions for nominee distributions if your child received interest or dividends as a nominee. This income needs to be reported differently, as outlined in the form instructions.

Correctly reporting your child’s interest and dividend income by following these dos and don'ts not only complies with California tax laws but also may benefit your overall tax situation. Always refer to the latest forms and instructions or seek professional advice to ensure you're up-to-date with the current tax year's rules and regulations. Remember, the importance of details cannot be overstated in tax reporting to avoid errors that could impact your or your child’s tax responsibilities.

Misconceptions

One common misconception is that the California Form 3803 is only for reporting children's income on federal tax returns. In reality, Form 3803 is specifically for California state tax purposes, allowing parents to include their child's interest and dividend income on their own state return, rather than having the child file a separate return.

Another misunderstanding is about the age limit for children whose income can be reported on Form 3803. The form specifies that the child must be under age 19, or under age 24 if a full-time student, by the end of the year. However, some might incorrectly believe that any dependent child's income can be reported this way, regardless of age or student status.

There's also confusion around the types of income that can be reported using Form 3803. It's specifically designed for interest and dividends only. This means income from wages, salaries, or self-employment, for example, cannot be included and would require the child to file their own return if necessary.

Some believe that if you use Form 3803, you don't need to file it with your return. However, you must attach Form 3803 to your California Form 540 or Long Form 540NR when you file. It's not a standalone form or merely a worksheet—it is part of your tax return and is crucial for proper processing and calculation of your taxes.

Lastly, there's a misconception that using Form 3803 can always save money or lead to a lower tax obligation. While it can simplify filing and potentially lower the tax rate applied to the child's income, it doesn't automatically result in tax savings. Depending on the parents' income level and other factors, including the child's income on the parents' return might actually increase the family's overall tax liability.

Key takeaways

California Form 3803 allows parents to report their child’s interest and dividends on their own tax return, potentially simplifying the filing process under specific conditions.

To use Form 3803, the child must be under the age of 19 by the end of the year, or under 24 if a full-time student.

Children eligible for their income to be reported via Form 3803 must only have income from interest and dividends, and this income should be less than $9,500 for the year in question.

When reporting a child's income using this form, it is essential to skip certain lines if the total interest, dividends, and capital gain distributions are $1,900 or less, pointing towards specific tax treatment for small amounts of income.

Using Form 3803 necessitates parents to meet qualifying conditions, such as their marital status, relationship to the child, and whether they are filing jointly or separately.

- If a child's gross income exceeds $9,500 or if certain other conditions are not met, the child must file his or her own tax return.

- Parents cannot claim any deductions on their child's behalf that the child could claim on an individual return.

- The completion and attachment of Form 3803 to the parent's California tax return is a formal election by the parents to report their child’s interest and dividends.

- Specific income thresholds detailed in the form determine the necessity for additional tax payments or qualifications for certain tax breaks.

For parents who elect to report their child's income on their return, the specific line instructions provided with Form 3803 must be carefully followed to ensure accurate reporting and tax calculation.

Overall, while Form 3803 can simplify the process of reporting a child's income, it comes with multiple specific requirements and thresholds that must be met and considered, emphasizing the need for careful review and compliance with applicable guidelines.

Different PDF Templates

California Tax Form - Allows policyholders to designate a paid preparer with the authority to discuss the return with the FTB.

California Sales Tax Certificate - Ensuring the accurate and truthful completion of this certificate is crucial for maintaining tax compliance and eligibility for exemptions.

Suspended Ftb - Benefit from the directed assistance feature for individuals with disabilities to navigate corporation tax clearance requirements on Form 3555.