Fill a Valid California 3805Z Form

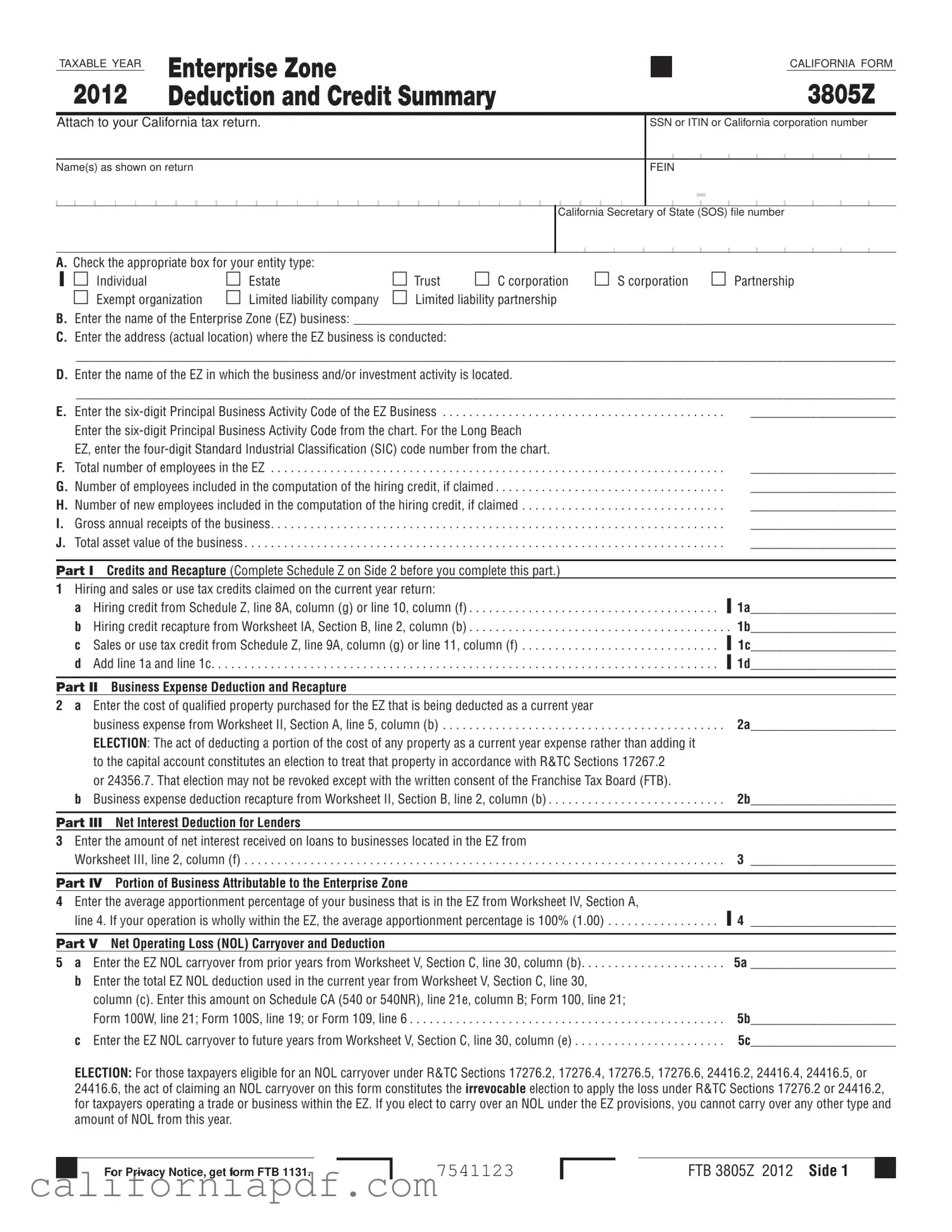

In the landscape of tax incentives designed to stimulate economic activity within specified regions, the California Form 3805Z stands out as a crucial document for entities operating within the state's designated Enterprise Zones (EZs). Applicable for the tax year 2012, this form plays a pivotal role in allowing businesses and various organizations to claim a range of deductions and credits, highlighting the state's commitment to fostering growth in areas that need it the most. Through meticulous sections that cover everything from the basic identification of the filer—such as Social Security Number (SSN), Individual Tax Identification Number (ITIN), or California corporation number—to more detailed inputs like the Principal Business Activity Code and the total asset value of the business, Form 3805Z encapsulates a comprehensive approach to tax relief. Moreover, it intricately details the process for claiming credits associated with hiring, sales or use tax, and business expense deductions, alongside provisions for net interest deduction for lenders and an apportionment for businesses operating entirely within an EZ. Additionally, it opens the floor for net operating loss (NOL) carryover and deductions, making clear the state's intention to back businesses through both prosperous and challenging times. The framework of the form, with its segments on credit limitations and specific inclusions for S corporations, aligns with the guiding principles of promoting employment and capital investment within Enterprise Zones, thereby aiming to yield long-term, sustainable economic benefits.

Document Example

TAXABLE YEAR |

Enterprise Zone |

|

|

CALIFORNIA FORM |

|

|

|

||

2012 |

Deduction and Credit Summary |

|

|

3805Z |

|

|

Attach to your California tax return.

SSN or ITIN or California corporation number

Name(s) as shown on return

FEIN

California Secretary of State (SOS) file number

A.Check the appropriate box for your entity type:

▐ Individual |

Estate |

Trust |

C corporation |

S corporation Partnership |

Exempt organization |

Limited liability company |

Limited liability partnership |

|

|

B.Enter the name of the Enterprise Zone (EZ) business: __________________________________________________________________________________

C.Enter the address (actual location) where the EZ business is conducted:

____________________________________________________________________________________________________________________________

D.Enter the name of the EZ in which the business and/or investment activity is located.

____________________________________________________________________________________________________________________________

E. Enter the |

______________________ |

|

|

Enter the |

|

|

EZ, enter the |

|

F. |

Total number of employees in the EZ |

______________________ |

G. |

Number of employees included in the computation of the hiring credit, if claimed |

______________________ |

H. |

Number of new employees included in the computation of the hiring credit, if claimed |

______________________ |

I. |

Gross annual receipts of the business |

______________________ |

J. |

Total asset value of the business |

______________________ |

Part I Credits and Recapture (Complete Schedule Z on Side 2 before you complete this part.)

1Hiring and sales or use tax credits claimed on the current year return:

a |

Hiring credit from Schedule Z, line 8A, column (g) or line 10, column (f) |

▐ 1a______________________ |

|

b |

Hiring credit recapture from Worksheet IA, Section B, line 2, column (b) |

.▐. |

1b______________________ |

c |

Sales or use tax credit from Schedule Z, line 9A, column (g) or line 11, column (f) |

1c______________________ |

|

d |

Add line 1a and line 1c |

▐ |

1d______________________ |

Part II Business Expense Deduction and Recapture

2 |

a Enter the cost of qualified property purchased for the EZ that is being deducted as a current year |

|

|

business expense from Worksheet II, Section A, line 5, column (b) |

2a______________________ |

|

ELECTION: The act of deducting a portion of the cost of any property as a current year expense rather than adding it |

|

|

to the capital account constitutes an election to treat that property in accordance with R&TC Sections 17267.2 |

|

|

or 24356.7. That election may not be revoked except with the written consent of the Franchise Tax Board (FTB). |

|

|

b Business expense deduction recapture from Worksheet II, Section B, line 2, column (b) |

2b______________________ |

|

|

|

Part III Net Interest Deduction for Lenders |

|

|

3 |

Enter the amount of net interest received on loans to businesses located in the EZ from |

|

|

Worksheet III, line 2, column (f) |

3 ______________________ |

Part IV Portion of Business Attributable to the Enterprise Zone

4Enter the average apportionment percentage of your business that is in the EZ from Worksheet IV, Section A,

line 4. If your operation is wholly within the EZ, the average apportionment percentage is 100% (1.00) |

▐ 4 ______________________ |

Part V Net Operating Loss (NOL) Carryover and Deduction |

|

5 a Enter the EZ NOL carryover from prior years from Worksheet V, Section C, line 30, column (b) |

. 5a ______________________ |

bEnter the total EZ NOL deduction used in the current year from Worksheet V, Section C, line 30, column (c). Enter this amount on Schedule CA (540 or 540NR), line 21e, column B; Form 100, line 21;

Form 100W, line 21; Form 100S, line 19; or Form 109, line 6 |

5b______________________ |

c Enter the EZ NOL carryover to future years from Worksheet V, Section C, line 30, column (e) |

5c______________________ |

ELECTION: For those taxpayers eligible for an NOL carryover under R&TC Sections 17276.2, 17276.4, 17276.5, 17276.6, 24416.2, 24416.4, 24416.5, or 24416.6, the act of claiming an NOL carryover on this form constitutes the irrevocable election to apply the loss under R&TC Sections 17276.2 or 24416.2, for taxpayers operating a trade or business within the EZ. If you elect to carry over an NOL under the EZ provisions, you cannot carry over any other type and amount of NOL from this year.

For Privacy Notice, get form FTB 1131.

7541123

FTB 3805Z 2012 Side 1

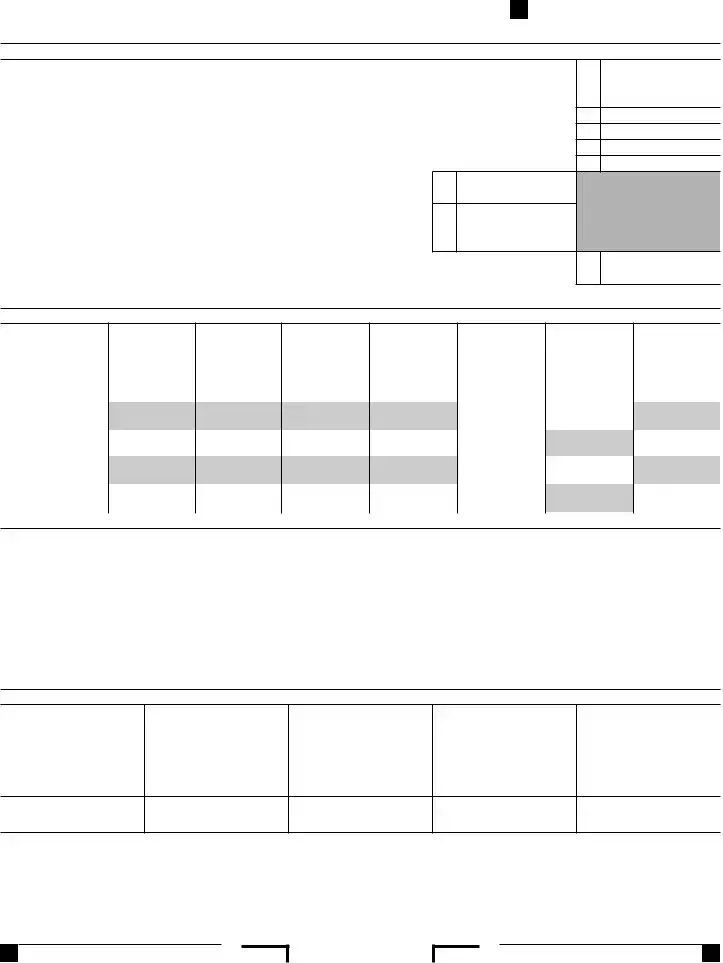

Schedule Z Computation of Credit Limitations – Enterprise Zones

Part I Computation of Credit Limitations. See instructions.

1Trade or business income. Individuals: Enter the amount from the Worksheet IV, Section C, line 14, column (c) on this line and on line 3 (skip line 2). See instructions. Corporations filing a combined report, enter the

|

taxpayer’s business income apportioned to California. See instructions for Part IV |

▐ |

1 |

2 |

Corporations: Enter the average apportionment percentage from Worksheet IV, Section A, line 4. See instructions |

. |

2 |

3 |

Multiply line 1 by line 2 |

. |

3 |

4 |

Enter the EZ NOL deduction from Worksheet V, Section C, line 30, column (c) |

. |

4 |

5 |

EZ taxable income. Subtract line 4 from line 3 |

▐ |

5 |

6a Compute the amount of tax due using the amount on line 5.

See instructions |

▐ 6a |

b Enter the amount of tax from Form 540, line 35; Long Form 540NR, line 42; |

|

Form 541, line 21; Form 100, line 24; Form 100W, line 24; Form 100S, line 22; |

|

or Form 109, line10. Corporations and S corporations, see instructions |

6b |

7Enter the smaller of line 6a or line 6b. This is the limitation based on the EZ business income.

Go to Part II, Part III, or Part IV. See instructions |

▐ 7 |

Part II Limitation of Credits for Corporations, Individuals, Estates, and Trusts. See instructions.

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

Credit |

Credit |

Total |

Total credit |

Total credit |

Limitation |

Credit used on |

Total credit |

name |

amount |

prior year |

assigned from |

sum of col. (b) |

based on |

Sch. P |

carryover |

|

|

carryover |

form FTB 3544 |

plus col. (c), |

EZ business |

Can never be |

col. (e) minus |

|

|

|

col. (g) |

minus col. (d) |

income |

greater than col. (e) |

col. (f) |

|

|

|

|

|

|

or col. (f) |

|

8 |

Hiring credit |

A |

|

|

|

|

▌ |

▌ |

|

|

|

|

|

|

|||||

B |

▌ |

▌ |

▌ |

▌ |

▌ |

▌ |

|||

|

|

||||||||

9 |

Sales or use |

A |

|

|

|

|

▌ |

▌ |

|

|

|

|

|

|

|||||

|

tax credit |

B |

▌ |

▌ |

▌ |

▌ |

▌ |

▌ |

|

|

|

Part III Limitation of Credits for S corporations Only. See instructions.

|

(a) |

(b) |

(c) |

(d) |

|

(e) |

|

(f) |

(g) |

|

Credit |

Credit |

S corporation |

Total |

|

Total credit |

|

Credit used |

Carryover |

|

name |

amount |

credit col. (b) |

prior year |

|

col. (c) |

|

this year by |

col. (e) minus |

|

|

|

multiplied by 1/3 |

carryover |

|

plus col. (d) |

|

S corporation |

col. (f) |

|

|

|

|

|

|

|

|

|

|

10 |

Hiring |

▌ |

▌ |

▌ |

▌ |

|

▌ |

|

▌ |

|

credit |

|

|

||||||

11 |

Sales or use |

▌ |

▌ |

▌ |

▌ |

|

▌ |

|

▌ |

|

tax credit |

|

|

Part IV Limitation of Credits for Corporations and S Corporations Subject to Paying Only the Minimum Franchise Tax. See instructions.

(a) |

(b) |

(c) |

(d) |

(e) |

Credit |

Credit |

Total prior |

Total credit assigned |

Total credit carryover |

name |

amount |

year carryover |

from form FTB 3544 |

sum of col. (b) plus |

|

|

|

col. (g) |

col. (c), minus col. (d) |

|

|

|

|

|

12 Hiring credit |

▌ |

▌ |

▌ |

▌ |

|

13Sales or use

tax credit |

▌ |

▌ |

▌ |

▌ |

|

|

|

|

Refer to page 4 for information on how to claim deductions and credits.

Side 2 FTB 3805Z 2012

7542123

Form Breakdown

| Fact Number | Description |

|---|---|

| 1 | The form is for the tax year 2012 and is specific to California. |

| 2 | It is used for summarizing deductions and credits related to Enterprise Zones (EZ). |

| 3 | It must be attached to the taxpayer's California tax return. |

| 4 | Taxpayers need to provide identification numbers such as SSN, ITIN, or California Corporation number. |

| 5 | Various entity types can use form 3805Z, including individuals, trusts, corporations, and partnerships. |

| 6 | The form requires detailed information about the enterprise zone business, including its name and address. |

| 7 | Taxpayers need to enter principal business activity codes to complete the form. |

| 8 | It includes sections for credits and recapture, business expense deduction and recapture, net interest deduction for lenders, and calculations for net operating loss. |

| 9 | The form has provisions for calculating limitations on credits and deductions specific to enterprise zone activities. |

| 10 | Governing laws for the deductions and credits include several Revenue and Taxation Code (R&TC) sections specific to California. |

How to Write California 3805Z

Once the California 3805Z form, also known as the Deduction and Credit Summary form for Enterprise Zones, is filled out correctly, it should be attached to your state tax return. This document is crucial for claiming various tax reliefs associated with business operations within designated enterprise zones. To ensure accuracy and compliance, follow these step-by-step instructions carefully. Remember, this form is an integral piece of documentation that supports your tax filings and can impact your tax obligations significantly.

- Start by identifying your taxable year at the top of the form.

- Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if you are filing as an individual. Corporations should enter their California corporation number, and all types of entities must include their Federal Employer Identification Number (FEIN) and California Secretary of State (SOS) file number.

- In section A, check the box that corresponds to your entity type (e.g., Individual, C corporation, S corporation, Partnership, etc.).

- For section B, write the name of the Enterprise Zone (EZ) business.

- In section C, provide the address where the EZ business is conducted.

- Enter the name of the EZ in which your business and/or investment activity is located in section D.

- Section E requires the six-digit Principal Business Activity Code of the EZ business, or if applicable, the four-digit Standard Industrial Classification (SIC) code number for the Long Beach EZ. Refer to the provided chart for this number.

- Fill in the total number of employees in the EZ in section F.

- For sections G and H, input the number of employees included in the computation of the hiring credit, including new employees if claimed.

- Report the gross annual receipts of the business in section I.

- Enter the total asset value of the business in section J.

- Proceed to Part I for Credits and Recapture, ensuring to complete Schedule Z on Side 2 before filling in this part. Here, you'll include hiring and sales or use tax credits claimed, as well as any necessary recapture amounts.

- In Part II, outline any Business Expense Deduction and Recapture, including the cost of qualified property and any recapture amounts as per the instructions provided in the worksheet sections.

- For those applicable, Part III details Net Interest Deduction for Lenders, where you enter the net interest received on loans to EZ businesses.

- In Part IV, indicate the portion of Business Attributable to the Enterprise Zone, specifying the average apportionment percentage.

- Part V addresses the Net Operating Loss (NOL) Carryover and Deduction, including previous year's carryover, current year deduction, and future carryover.

- Ensure that the ELECTION sections, referring to specific R&TC Sections for business expense deductions and NOL carryover election, are reviewed and understood before signing the document.

- Finally, sign the form, indicating compliance and understanding of the form's declarations and elections.

Upon completion, verify that all information is accurate and complete. Attach the completed 3805Z form to your California tax return before submission. Timely and accurate completion of this form can facilitate your tax filing process and ensure you receive any eligible benefits associated with operating in an Enterprise Zone.

Listed Questions and Answers

What is the California Form 3805Z?

California Form 3805Z, titled "Enterprise Zone Deduction and Credit Summary," is a document that taxpayers attach to their California state tax return. It's used by individuals and entities who conduct business within an Enterprise Zone (EZ) and are eligible for specific tax deductions and credits related to business operations and investments in these areas.

Who needs to file the California Form 3805Z?

Any taxpayer, whether an individual, estate, trust, corporation, partnership, exempt organization, limited liability company, or limited liability partnership, that operates a business within an Enterprise Zone must file Form 3805Z if they want to claim the associated deductions and credits. This form allows the taxpayer to summarize deductions and credits from business activities and investments in the EZ.

How do you determine if you're eligible for credits or deductions on Form 3805Z?

Eligibility for credits or deductions on Form 3805Z depends on several factors:

- Operation of a business within an Enterprise Zone.

- Employment of qualifying individuals, potentially leading to hiring credits.

- Purchase of qualified property for use within the EZ, which may qualify for business expense deductions.

- Lending to businesses in the EZ, potentially qualifying for net interest deductions.

All of these credits and deductions are aimed at encouraging investment and economic growth within designated Enterprise Zones.

What information is needed to complete Form 3805Z?

To complete Form 3805Z, you'll need the following information:

- Name and type of the entity filing the form.

- Name and address of the EZ business.

- Principal Business Activity Code of the EZ business.

- Total number of employees and, specifically, the number of those eligible for the hiring credit.

- Gross annual receipts and total asset value of the business.

- Detailed information on credits and deductions being claimed, including amounts from qualifying purchases, hires, and loans made to businesses in the EZ.

How are the credits and deductions on Form 3805Z calculated?

Credits and deductions on Form 3805Z involve detailed calculations, which include:

- Calculating the hiring and sales or use tax credits based on eligible employees and purchases.

- Determining the business expense deduction for qualified property purchased for EZ use.

- Computing the net interest deduction for lenders to EZ businesses.

- Applying the net operating loss (NOL) carryover and deduction specific to EZ operations.

These calculations often require referencing additional worksheets provided in the instructions for Form 3805Z.

Where can you find Form 3805Z and its instructions?

Form 3805Z and its detailed instructions can be found on the California Franchise Tax Board's (FTB) official website. Searching the FTB site for "Form 3805Z" will direct you to both the form itself and a comprehensive guide to completing it, including definitions, eligibility criteria, and calculation instructions for each section.

Common mistakes

Filling out tax forms accurately is crucial to avoid errors that could lead to audits, delays, or missed deductions and credits. The California Form 3805Z for Enterprise Zone Deduction and Credit Summary is particularly complex and prone to mistakes. Here are common mistakes people make when completing this form:

- Not checking the correct entity type box in section A. It's essential to accurately indicate whether you're filing as an individual, a corporation, a partnership, or another entity type to ensure your tax liabilities and benefits are correctly calculated.

- Incorrectly entering the name or omitting the Enterprise Zone (EZ) business name in section B. This can lead to confusion or delays in processing the form, as the tax benefits available may vary based on specific enterprise zones.

- Failing to provide the exact physical address of the business operation in section C. This verification is crucial since eligibility for certain credits and deductions depends on the business's physical location within an enterprise zone.

- Forgetting to enter the Principal Business Activity Code in section E. This six-digit code is essential to categorize your business correctly and determine eligibility for specific enterprise zone incentives.

- Miscalculating the number of qualified employees in sections F, G, and H. This mistake can lead to incorrect computation of hiring credits, potentially reducing the total credits for which the business is eligible.

- Incorrectly reporting the gross annual receipts and total asset value of the business in sections I and J. Accurate figures are critical to calculate deductions and credits properly.

- Omitting or incorrectly filling out the Net Interest Deduction for Lenders in part III. This section, which affects businesses providing loans to other businesses within the EZ, is often overlooked or filled out incorrectly.

These are just a few examples of common mistakes made on the California Form 3805Z. To make the most of available tax benefits and avoid potential issues with the IRS, it's important to fill out this form with great care and attention to detail.

Documents used along the form

When handling taxes and business operations within California's Enterprise Zones (EZ), businesses often use the California Form 3805Z to summarize deductions and credits. This form is an integral part of a suite of documents necessary for proper tax filing and compliance. Below is a list of other forms and documents frequently used in conjunction with Form 3805Z, which collectively ensure businesses maximize their benefits and adhere to California tax laws.

- Form 540 or 540NR - California Resident or Nonresident Income Tax Return: These are the primary forms used by individuals to file their state income taxes. Form 3805Z credits may affect the calculations on these returns.

- Form 100 - California Corporation Franchise or Income Tax Return: Corporations operating within the EZ areas attach Form 3805Z to report and calculate specific credits and deductions on this return.

- Form 100S - California S Corporation Franchise or Income Tax Return: S Corporations include Form 3805Z when filing their state taxes to claim EZ credits and deductions.

- Form 100W - California Corporation Franchise or Income Tax Return — Water’s Edge Filers: This is for corporations filing within a water's edge election, and 3805Z credits may be relevant.

- Form 109 - California Exempt Organization Business Income Tax Return: Non-profit or exempt organizations operating within EZs use this form alongside 3805Z for pertinent deductions and credits.

- Schedule CA (540) - Adjustments for Residents or (540NR) for Nonresidents or Part-Year Residents: This schedule adjusts federal income and deductions to align with California's rules, including adjustments from EZ benefits.

- Worksheet V, Section C from Form 3805Z Documentation: Specifically related to Net Operating Loss (NOL) Carryovers and Deductions, this worksheet is a detailed record necessary for accurate 3805Z completion.

- Form FTB 3544 - Election to Assign Credit Within Combined Reporting Group or to Pass Through Credit to Affiliated Corporations, fits within a strategy for utilizing EZ credits among a group of related corporations or entities.

These additional documents, when used properly alongside Form 3805Z, offer a comprehensive strategy for businesses to leverage the specific tax advantages available within California's Enterprise Zones. This ensures not only compliance with state tax laws but also maximizes financial benefits designed to encourage business growth and development within these designated areas.

Similar forms

The California 3805Z form, focusing on deductions and credits for enterprises within designated zones, shares similarities with the Federal Form 4562, which deals with depreciation and amortization. Like the California 3805Z, Form 4562 allows businesses to report expenses that reduce their taxable income, though on a federal level. Both forms include sections for declaring the cost of qualified property and adjustments related to business expenses, ensuring businesses take full advantage of available tax benefits.

Form 3800, General Business Credit, parallels the California 3805Z form through its aggregation of various business tax credits into one comprehensive filing. It consolidates credits similar to those on the 3805Z, such as investment credits and employment credits, providing a unified approach to reduce tax liability. Both forms serve as summaries that support broader tax return documents and require detailed calculations from other schedules or worksheets to substantiate the credits claimed.

Another similar document is the California Form 3523, Research Credit, which, like the 3805Z, offers tax incentives aimed at stimulating certain activities within the state—specifically, research and development. Similarities include the requirement to detail expenses that qualify for the credit, and both forms directly impact the calculation of taxable income by offering deductions and credits against gross income.

The Schedule K-1 (Form 1065), used by partnerships to report each partner’s share of earnings, deductions, and credits, relates closely to the California 3805Z form in its focus on allocating income and deductions within a business structure. While the Schedule K-1 pertains to partnership income and the distributive share of deductions and credits, the 3805Z form encompasses a broader range of tax incentives for businesses in enterprise zones, including credits for hiring and equipment investment. Both forms are integral to ensuring proper reporting of tax benefits that affect individual taxes.

Last, the California Form 100S, S Corporation Franchise or Income Tax Return, shares similarities with the 3805Z form in its application to specific business entities and its facilitation of tax benefits, such as deductions and credits. S corporations filing Form 100S must calculate and report income, deductions, and credits similar to those detailed on the 3805Z for businesses operating in enterprise zones. Both documents require accurate reporting on income and how it is affected by strategic business practices encouraged by tax policy.

Dos and Don'ts

When filling out the California Form 3805Z for Deduction and Credit Summary, accuracy and thoroughness are crucial to ensure that you receive the correct deductions and credits associated with Enterprise Zone (EZ) businesses. Here are six essential do's and don'ts to follow:

Do's:

- Verify your entity type: Make sure to check the appropriate box in section A to accurately represent your entity type, such as Individual, C corporation, S corporation, Partnership, or Limited Liability Company.

- Name and location of the EZ business: Clearly enter the name of the Enterprise Zone business and the actual location where the business is conducted, as requested in sections B and C.

- Provide accurate business information: In section E, F, G, H, I, and J, diligently enter your EZ business’s Principal Business Activity Code, total number of employees, number of new hires eligible for the hiring credit, gross annual receipts, and total asset value.

- Complete the credits and recapture section accurately: Fill out Part I with precise information regarding hiring and sales or use tax credits claimed, including any required recaptures.

- Understand the Limitation of Credits: For both individuals and corporations, understand how the Limitation of Credits affects you, by carefully reviewing Schedule Z to ensure you're complying with the credit limitations as per your business's income.

- Sign and date the form: Ensure the form is properly signed and dated before attachment to your tax return, confirming the accuracy of the information provided.

Don'ts:

- Avoid incomplete information: Do not leave any required sections blank, especially those asking for specific details about your EZ business and the credits you are claiming.

- Don’t guess on numbers: Ensure all numerical entries, such as the number of employees and gross receipts, are accurate and verifiable. Guessing can lead to errors and possible audits.

- Avoid incorrect entity selection: Don’t check off the wrong entity type in section A, as this mistake can impact which tax benefits you are eligible for.

- Don’t overlook the recapture sections: Make sure to complete the recapture sections if applicable, to avoid issues with the Franchise Tax Board (FTB).

- Avoid late submissions: Submitting your form after the deadline can result in missing out on potential tax benefits for the year.

- Don’t forget to attach the form to your tax return: Not attaching Form 3805Z to your return could result in the FTB not recognizing your EZ deductions and credits.

Misconceptions

Many taxpayers are confused about the specifics of California Form 3805Z, leading to common misconceptions. Understanding the form accurately is crucial for taking advantage of enterprise zone deductions and credits properly. Below are five misconceptions debunked to clarify the form's usage and benefits.

- Form 3805Z is only for corporations: This misconception leads individuals, estates, trusts, and other entity types to overlook potential tax incentives. In reality, Form 3805Z allows a variety of entities, including individuals and partnerships, to claim deductions and credits related to business activities in an Enterprise Zone.

- All business expenses are eligible for immediate deduction: While part II of Form 3805Z includes a section for business expense deduction, not all expenses qualify. The costs must be for qualified property purchased for use in the Enterprise Zone, and certain limitations and qualifications apply. Taxpayers can't assume all their business expenditures are immediately deductible.

- There's no cap on the amount of hiring credit you can claim: The form includes specific calculations and limitations for the hiring credit. Credits are subject to recapture and must be calculated according to the instructions on Schedule Z. Misunderstanding these limits could lead to incorrectly claimed credits.

- You can claim credits and deductions without specific documentation: Taxpayers sometimes believe that simply filling out Form 3805Z is enough to secure their deductions and credits. However, detailed documentation of the EZ business activities, number of employees, gross receipts, and asset values is required. Proper completion of the form and supporting documentation are crucial for compliance.

- Once you elect to use Form 3805Z, you can't change your election: There is a belief that elections made under Form 3805Z for certain deductions or credits cannot be changed. In fact, for certain sections like the Net Operating Loss (NOL) carryover and deduction, the election to apply losses under R&TC Sections related to enterprise zones is irrevocable for that year. However, taxpayers have flexibility in future years to choose different tax strategies that do not involve the enterprise zone incentives.

Understanding these realities ensures that taxpayers can fully and correctly utilize the incentives offered by the California Enterprise Zone program without risking non-compliance or missing out on potential tax benefits.

Key takeaways

Filling out and using California Form 3805Z, the Deduction and Credit Summary for Enterprise Zone businesses, requires thorough understanding to ensure accurate submission alongside one's tax return. Here are five key takeaways:

- The first part of the form requires detailed information about your business, including the identification number, type of entity, and specific details about the Enterprise Zone (EZ) where your business operates. This information is vital for the Franchise Tax Board (FTB) to determine eligibility for EZ tax benefits.

- Businesses must accurately report the number of employees working in the EZ and those qualifying for the hiring credit. This distinction is crucial for calculating certain credits correctly, reflecting the direct impact of business operations within the EZ.

- Form 3805Z allows for claiming various credits and deductions, such as sales or use tax credits, hiring credits, and business expense deductions for qualified property. Each credit or deduction section requires detailed computation and relevant information from attached worksheets or additional forms.

- The form facilitates the calculation of Net Operating Loss (NOL) Carryover specific to EZs, providing an opportunity to apply certain losses towards future tax liabilities. Proper reporting of NOL carryovers and deductions ensures that taxpayers take full advantage of EZ benefits to reduce taxable income.

- Accuracy and completeness when filling out Form 3805Z are paramount. The form not only determines the current year's tax benefits but also affects the calculation of credits and deductions in future tax years through carryovers and recaptures. Any errors or omissions can lead to revisions by FTB or potential audits, stressing the importance of careful review and adherence to instructions.

Understanding and properly applying the guidelines for Form 3805Z can significantly impact the tax advantages available to businesses in California's Enterprise Zones, making it essential for eligible entities to familiarize themselves with the form's requirements and benefits.

Different PDF Templates

Does Living Will Need to Be Notarized - Serves as an essential part of estate planning and personal healthcare management.

California Principal Business Activity Code - Form 100X addresses the recalibration of tax liabilities due to error, audits, or adjustments post-original filing, facilitating compliance and accurate tax reporting.