Fill a Valid California 3832 Form

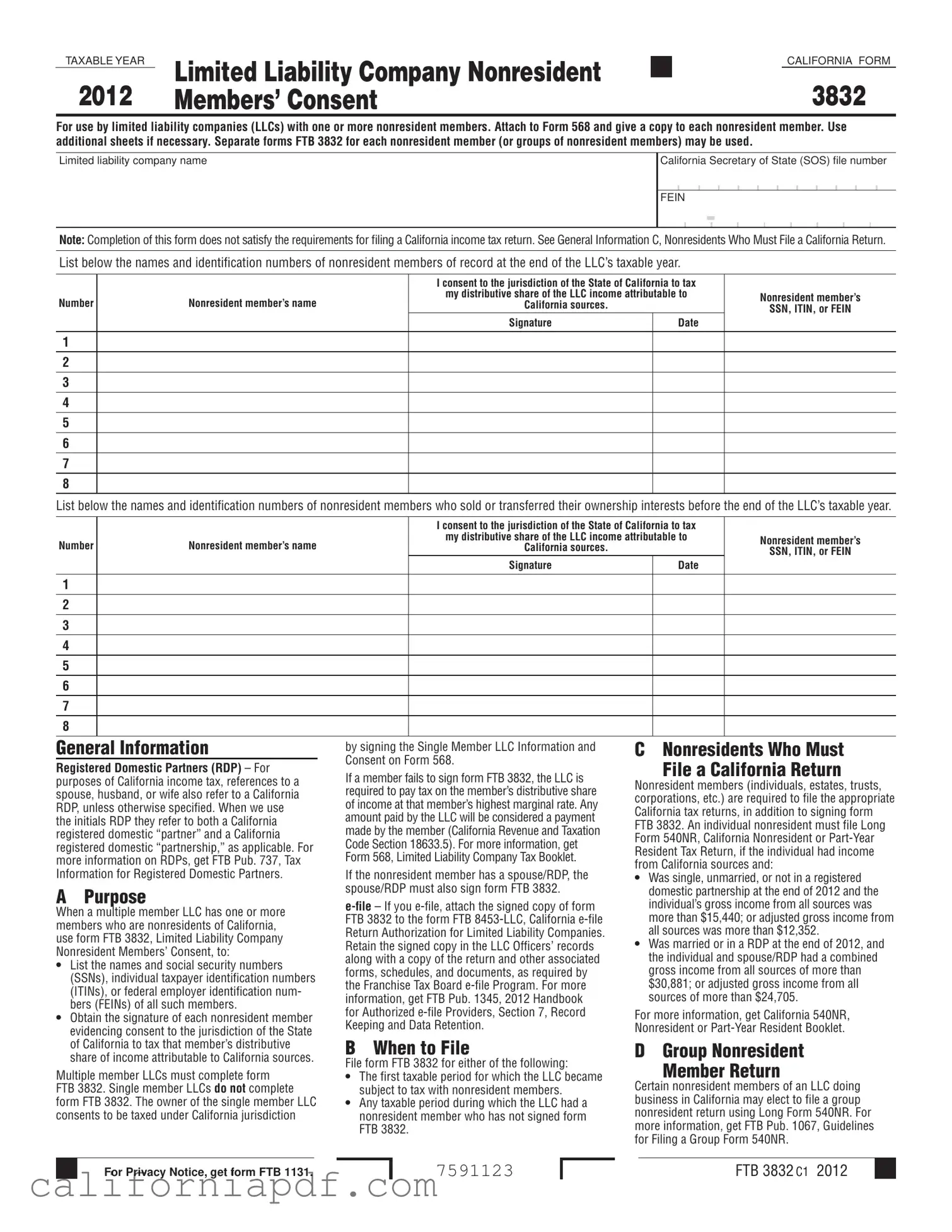

Understanding the intricacies of the California Form 3832 is crucial for Limited Liability Companies (LLCs) that operate with nonresident members. This form serves as a consent by nonresident members, allowing the State of California to tax their distributive share of income from sources within the state. It's an essential component of compliance for LLCs, to be attached to Form 568, highlighting the importance of ensuring that every nonresident member's consent is properly documented. Failure to obtain this consent obligates the LLC to pay the tax on the member’s behalf at the highest marginal rate, making it a critical step in the filing process. Furthermore, Form 3832 should be given to each nonresident member, illustrating the state's requirements for transparency and individual acknowledgment of tax obligations. Throughout the form, specifics such as the LLC's name, the California Secretary of State file number, and each nonresident member's identification number must be meticulously reported. Additionally, the form underscores the necessity for nonresident members to file their individual California tax returns if they have income from California sources, ensuring full compliance with state tax laws. This detailed approach helps LLCs with nonresident members navigate the complexities of California’s tax system, ensuring that both the company and its members meet their tax obligations efficiently.

Document Example

TAXABLE YEAR |

Limited Liability Company Nonresident |

|

|

CALIFORNIA FORM |

|

|

|

|

|

||

2012 |

3832 |

||||

Members’ Consent |

|||||

For use by limited liability companies (LLCs) with one or more nonresident members. Attach to Form 568 and give a copy to each nonresident member. Use additional sheets if necessary. Separate forms FTB 3832 for each nonresident member (or groups of nonresident members) may be used.

Limited liability company name

California Secretary of State (SOS) file number

FEIN

-

Note: Completion of this form does not satisfy the requirements for filing a California income tax return. See General Information C, Nonresidents Who Must File a California Return.

List below the names and identification numbers of nonresident members of record at the end of the LLC’s taxable year.

Number

1

2

3

4

5

6

7

8

Nonresident member’s name

I consent to the jurisdiction of the State of California to tax

my distributive share of the LLC income attributable to

California sources.

Signature |

Date |

|

|

Nonresident member’s

SSN, ITIN, or FEIN

List below the names and identification numbers of nonresident members who sold or transferred their ownership interests before the end of the LLC’s taxable year.

|

|

I consent to the jurisdiction of the State of California to tax |

|

|

Number |

Nonresident member’s name |

my distributive share of the LLC income attributable to |

Nonresident member’s |

|

California sources. |

|

|||

|

SSN, ITIN, or FEIN |

|||

|

|

|

|

|

|

|

Signature |

Date |

|

|

|

|

|

|

1 |

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

General Information |

|

by signing the Single Member LLC Information and |

C |

Nonresidents Who Must |

|||||||

Registered Domestic Partners (RDP) – For |

Consent on Form 568. |

|

|

File a California Return |

|||||||

If a member fails to sign form FTB 3832, the LLC is |

|

|

|||||||||

purposes of California income tax, references to a |

Nonresident members (individuals, estates, trusts, |

||||||||||

required to pay tax on the member’s distributive share |

|||||||||||

spouse, husband, or wife also refer to a California |

|||||||||||

corporations, etc.) are required to file the appropriate |

|||||||||||

of income at that member’s highest marginal rate. Any |

|||||||||||

RDP, unless otherwise specified. When we use |

|||||||||||

California tax returns, in addition to signing form |

|||||||||||

amount paid by the LLC will be considered a payment |

|||||||||||

the initials RDP they refer to both a California |

|||||||||||

FTB 3832. An individual nonresident must file Long |

|||||||||||

made by the member (California Revenue and Taxation |

|||||||||||

registered domestic “partner” and a California |

|||||||||||

Form 540NR, California Nonresident or |

|||||||||||

Code Section 18633.5). For more information, get |

|||||||||||

registered domestic “partnership,” as applicable. For |

|||||||||||

Resident Tax Return, if the individual had income |

|||||||||||

Form 568, Limited Liability Company Tax Booklet. |

|||||||||||

more information on RDPs, get FTB Pub. 737, Tax |

|||||||||||

from California sources and: |

|||||||||||

|

|

|

|||||||||

Information for Registered Domestic Partners. |

If the nonresident member has a spouse/RDP, the |

||||||||||

• Was single, unmarried, or not in a registered |

|||||||||||

A Purpose |

spouse/RDP must also sign form FTB 3832. |

|

|

domestic partnership at the end of 2012 and the |

|||||||

|

|

individual’s gross income from all sources was |

|||||||||

When a multiple member LLC has one or more |

|

|

|||||||||

FTB 3832 to the form FTB |

|

|

more than $15,440; or adjusted gross income from |

||||||||

members who are nonresidents of California, |

|

|

|||||||||

Return Authorization for Limited Liability Companies. |

|

|

all sources was more than $12,352. |

||||||||

use form FTB 3832, Limited Liability Company |

|

|

|||||||||

Retain the signed copy in the LLC Officers’ records |

• Was married or in a RDP at the end of 2012, and |

||||||||||

Nonresident Members’ Consent, to: |

|||||||||||

along with a copy of the return and other associated |

|

|

the individual and spouse/RDP had a combined |

||||||||

• List the names and social security numbers |

|

|

|||||||||

forms, schedules, and documents, as required by |

|

|

gross income from all sources of more than |

||||||||

(SSNs), individual taxpayer identification numbers |

|

|

|||||||||

the Franchise Tax Board |

|

|

$30,881; or adjusted gross income from all |

||||||||

(ITINs), or federal employer identification num- |

|

|

|||||||||

information, get FTB Pub. 1345, 2012 Handbook |

|

|

sources of more than $24,705. |

||||||||

bers (FEINs) of all such members. |

|

|

|||||||||

for Authorized |

For more information, get California 540NR, |

||||||||||

• Obtain the signature of each nonresident member |

|||||||||||

evidencing consent to the jurisdiction of the State |

Keeping and Data Retention. |

Nonresident or |

|||||||||

of California to tax that member’s distributive |

B When to File |

D |

Group Nonresident |

||||||||

share of income attributable to California sources. |

|||||||||||

File form FTB 3832 for either of the following: |

|

|

Member Return |

||||||||

|

|

|

|

|

|

||||||

Multiple member LLCs must complete form |

• The first taxable period for which the LLC became |

|

|

||||||||

FTB 3832. Single member LLCs do not complete |

subject to tax with nonresident members. |

Certain nonresident members of an LLC doing |

|||||||||

form FTB 3832. The owner of the single member LLC |

• Any taxable period during which the LLC had a |

business in California may elect to file a group |

|||||||||

consents to be taxed under California jurisdiction |

nonresident member who has not signed form |

nonresident return using Long Form 540NR. For |

|||||||||

|

|

|

|

FTB 3832. |

more information, get FTB Pub. 1067, Guidelines |

||||||

|

|

|

|

for Filing a Group Form 540NR. |

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Notice, get form FTB 1131. |

|

7591123 |

|

|

|

FTB 3832 C1 2012 |

|

|||

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The form is intended for use by limited liability companies (LLCs) with one or more nonresident members to indicate their consent for the State of California to tax their distributive share of income attributable to California sources. |

| Governing Law | Governed by California Revenue and Taxation Code Section 18633.5, which allows California to tax the distributive share of income from LLCs allocated to nonresident members. |

| Attachment Requirement | This form must be attached to Form 568 and a copy given to each nonresident member. |

| Use for Multiple Members | Separate Form FTB 3832 may be used for each nonresident member or groups of nonresident members as necessary. |

| Filing for Nonresidents | Completion of Form FTB 3832 does not fulfill the requirement for filing a California income tax return. Nonresident members are still required to file appropriate California tax returns. |

| Spouse/RDP Signature Requirement | If a nonresident member has a spouse or a California registered domestic partner (RDP), that spouse/RDP must also sign the form. |

| E-filing | If the LLC e-files its return, the signed copy of Form FTBA 3832 must be attached to the form FTB 8453-LLC, California e-file Return Authorization for Limited Liability Companies. |

How to Write California 3832

Filing the California Form 3832 is a critical step for Limited Liability Companies (LLCs) with nonresident members to manage their state tax obligations properly. This document ensures that each nonresident member has agreed to submit to California's tax jurisdiction, which is necessary for meeting compliance requirements with the California Franchise Tax Board. It's vital for each LLC member to understand the need for accurately completing this form to prevent any misunderstandable related to tax liabilities. Here's a simple guide to help you through the process.

- Begin by identifying the tax year for which the Form 3832 is being completed at the top of the form.

- On the designated lines, provide the full name of the Limited Liability Company along with the California Secretary of State (SOS) file number and the Federal Employer Identification Number (FEIN).

- In the section provided, list all nonresident members of the LLC by their number in the order. Include their full names and their respective Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Federal Employer Identification Number (FEIN), as applicable.

- Each nonresident member listed must sign the form to indicate their consent to California's jurisdiction over their distributive share of the LLC income attributable to California sources. Make sure each signatory also includes the date next to their signature.

- If any nonresident members sold or transferred their ownership interests before the end of the LLC’s taxable year, list these members in the provided section. Include their name, identification number (SSN, ITIN, or FEIN), and obtain their signature along with the date, similar to the previously listed members.

- Review the entire form for accuracy and completeness. Ensure that all applicable sections have been filled out correctly and all nonresident members have provided their consent through signatures.

- Attach the completed Form 3832 to Form 568 as instructed, and retain a copy for the LLC’s records. Additionally, distribute a copy of the completed form to each nonresident member.

It’s important to note that completing Form 3832 does not relieve members of the necessity to file individual California tax returns if they have income from California sources. LLCs and their nonresident members should also consider consulting with a tax professional to ensure compliance with all California tax laws and requirements.

Listed Questions and Answers

What is California Form 3832?

California Form 3832 is known as the Limited Liability Company Nonresident Members' Consent form. It is specifically designed for use by limited liability companies (LLCs) that have one or more nonresident members. The purpose of this form is to list the names and identification numbers of all nonresident members and to obtain their consent to the jurisdiction of the State of California to tax their distributive share of the LLC's income that is attributable to California sources.

Who needs to sign Form 3832?

Each nonresident member of an LLC operating in California must sign Form 3832, indicating their consent for California to tax their share of the LLC's income from California sources. If a nonresident member has a spouse or Registered Domestic Partner (RDP), the spouse or RDP must also sign the form.

Does Form 3832 replace the need for filing a California income tax return?

No, completing Form 3832 does not fulfill the requirement for filing a California income tax return. Nonresident members must still file the appropriate California tax return if they have income from California sources.

How is Form 3832 related to Form 568?

Form 3832 should be attached to Form 568, which is the Limited Liability Company Return of Income form. A copy of Form 3832 must also be given to each nonresident member. It is part of the process to ensure that all nonresident members acknowledge and consent to California's taxation rules.

What are the consequences if a nonresident member fails to sign Form 3832?

If a nonresident member of an LLC fails to sign Form 3832, the LLC is required to pay tax on that member’s distributive share of income at the member’s highest marginal rate. Any amount paid by the LLC on behalf of the member is considered a payment made by the member themselves.

Can separate forms be used for different nonresident members?

Yes, separate Form 3832s may be used for each nonresident member or groups of nonresident members, which allows for detailed and individualized accounting of consent to the taxation provisions.

Is there a deadline for filing Form 3832?

Form 3832 should be filed for any taxable period during which the LLC has nonresident members and is subject to tax in California. The specific requirement includes filing Form 3832 either for:

- The first taxable period for which the LLC became subject to tax with nonresident members.

- Any taxable period during which the LLC had a nonresident member who has not already signed Form 3832.

Can Form 3832 be e-filed?

Yes, if you choose to e-file Form 568, the associated Form 3832 should be attached to the electronic submission through the Form FTB 8453-LLC, which is the California e-file Return Authorization for Limited Liability Companies. The signed copy of Form 3832 should be retained with the LLC's records.

What happens if a nonresident member leaves the LLC?

Even if a nonresident member sells or transfers their ownership interest before the end of the LLC’s taxable year, they must sign Form 3832 consenting to California's jurisdiction to tax their distributive share of income for the period they were a member.

Common mistakes

Filling out the California Form 3832, which is crucial for limited liability companies (LLCs) with nonresident members, can be challenging. Several common mistakes can lead to errors in processing or compliance issues. Recognizing and avoiding these missteps is essential for ensuring the form is accepted and the LLC remains in good standing. Below are nine common mistakes made when completing Form 3832:

- Not providing separate forms for each nonresident member or group of members: Each nonresident member should have a separate Form 3832 unless grouped appropriately, which helps in maintaining accurate records.

- Failing to attach the form to Form 568: Form 3832 must be attached to Form 568 when submitted, and a copy must be provided to each nonresident member, ensuring compliance with filing requirements.

- Omitting or incorrectly providing the California Secretary of State (SOS) file number and the Federal Employer Identification Number (FEIN): These identifiers are critical for the LLC’s identification and must be accurately included.

- Incorrectly listing the names and identification numbers of nonresident members: Ensuring that the names and either the Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or FEIN of nonresident members are correctly listed is imperative for proper tax attribution.

- Nonresident members not consenting to the jurisdiction of California: It’s mandatory for all nonresident members to consent to California's jurisdiction for taxing their distributive share of the LLC income attributable to California sources. All sections should be duly signed.

- Forgetting to list nonresident members who sold or transferred their ownership interests before the end of the LLC’s taxable year, which can lead to incomplete disclosure of members.

- Not retaining a signed copy of Form 3832 in the LLC’s records: For electronic filers, it's necessary to attach the form to the FTB 8453-LLC and retain a copy for record-keeping as outlined by the Franchise Tax Board (FTB) e-file program.

- Failure by nonresident members to file individual California tax returns when required. Signing Form FTB 3832 does not exempt them from their personal tax filing obligations if they meet the filing thresholds.

- Not updating the form each taxable period for new or departed nonresident members: Each year or taxable period that sees a change in the composition of nonresident members necessitates a revision and resubmission of Form 3832.

Addressing these common errors when completing the California Form 3832 can help ensure that an LLC's filing is both compliant and accurate. Diligence in gathering and verifying the required information, along with ensuring the active participation of members, forms the backbone of a properly managed and tax-compliant LLC.

Documents used along the form

The California Form 3832 plays a critical role for limited liability companies (LLCs) in involving nonresident members. Given its importance, several other documents typically accompany or relate to this form, facilitating compliance with state tax obligations and ensuring proper management and accountability within the LLC.

- California Form 568, Limited Liability Company Tax Booklet: This booklet provides comprehensive guidance on the taxation requirements for LLCs in California, including how to calculate and pay the annual LLC tax, fee schedules based on income, and additional filing instructions. Form 3832 should be attached to Form 568 when filed.

- Long Form 540NR, California Nonresident or Part-Year Resident Tax Return: Nonresident members, whose consent has been documented on Form 3832, use this form to file their California state income tax returns. It calculates tax owed to the state based on income sourced from California. Form FTB 8453-LLEC: California LLCs that e-file their tax returns will use the California e-file Return Authorization for Limited Liability Companies. This form serves as a declaration that the company has complied with the e-filing rules, and a copy of Form 3832, when applicable, must be attached to it.

- FTB Pub. 1067, Guidelines for Filing a Group Form 540NR: This publication outlines the process for nonresident members to file a consolidated nonresident income tax return. It offers an alternative filing method for members who have consented on Form 3832, potentially simplifying tax obligations for both the members and the LLC.

Understanding and preparing these documents in conjunction with California Form 3832 assure an LLC's adherence to the state's tax laws. By doing so, LLCs and their nonresident members ensure that they fulfill their obligations accurately and efficiently, avoiding penalties and facilitating smoother operations within California's legal and regulatory framework.

Similar forms

The California 540NR, mentioned within the text, shares similarities with the Form 3832 in its foundational purpose for nonresidents. Like Form 3832, the 540NR is focused on individuals who must meet tax obligations specific to their income within California. While Form 3832 pertains specifically to nonresident members of LLCs, the 540NR broadens the scope to include all nonresidents, or part-year residents, who have earned income from California sources. Both forms ensure compliance with state tax laws, mandating proper reporting and tax payments from those who do business or earn income in the state without residing there full-time.

FTB 8453-LLC, California e-file Return Authorization for Limited Liability Companies, bears resemblance to Form 3832 through its use in the e-filing process for LLCs. The 8453-LLC acts as a conduit for the electronic transmission of LLC tax returns, including documents like Form 3832 when they need to be submitted to the Franchise Tax Board (FTB). It underscores the necessity of keeping digital records within the e-filing system, validating the identity of filers and the authenticity of the documents submitted, including the consents gathered through Form 3852.

Form 568, Limited Liability Company Tax Booklet, is interconnected with Form 3832 in terms of providing a comprehensive overview of tax responsibilities for LLCs in California. While Form 3832 collects consent from nonresident members to be taxed, Form 568 outlines the broader tax obligations, filings, and potential deductions available to LLCs. It serves as an essential resource for understanding how Form 3832 fits within the overall tax framework for LLCs operating in California.

FTB Pub. 1345, Handbook for Authorized e-file Providers, while not a form, relates closely to the procedural aspects of submitting Form 3832 as part of an LLC’s e-file packet. This publication details the standards and practices for electronic filing, including how forms like 3832 should be integrated and retained within the e-filing system. Its guidelines ensure the secure and efficient submission of tax documents, reinforcing the importance of digital compliance for forms related to nonresident income allocation.

FTB Pub. 1067, Guidelines for Filing a Group Form 540NR, parallels the Form 3832 by addressing the group filing aspect for nonresident income earners. It outlines procedures for consolidating the tax filings of multiple nonresident individuals, mirroring how Form 3832 collects consent from nonresident LLC members. Both documents streamline the tax process for groups, albeit from different angles—FTB Pub. 1067 with a focus on personal income, and Form 3832 on business-related income from LLC operations.

FTB Pub. 737, Tax Information for Registered Domestic Partners (RDPs), provides tax guidance for RDPs living in California, touching on various forms and situations that could include scenarios like those addressed in Form 3832 when one or both partners are part of an LLC. It underscores the state's approach to taxing shared income and the responsibilities of RDPs in reporting and consenting to tax obligations, akin to the nonresident LLC members' need to consent via Form 3832.

Single Member LLC Information and Consent on Form 568 channels a specific subset of the LLC-related tax documentation process, much like Form 3832, but it zeroes in on the unique situation of single-member LLCs. This consent mechanism illustrates California’s requirement for all LLCs, regardless of size, to acknowledge and comply with tax responsibilities—a theme also central to Form 3832’s purpose with nonresident members.

Long Form 540NR, referred to within the context of filing individual nonresident taxes, alongside group filings discussed in FTB Pub. 1067, shares foundational objectives with California Form 3832. While primarily aimed at individuals, both documents cater to the taxation of income earned within California by nonresidents, ensuring compliance and proper income reporting. The core similarity lies in the acknowledgment and facilitation of California state tax obligations for those not residing within its borders but earning income through various channels, be it employment or LLC operations.

Lastly, the General Information section included in many California state tax forms, while not a form itself, provides relevant context and instructions that align with the intent behind Form 3832. It typically addresses the broader requirements of filing state taxes, touching on nuances that might affect nonresident LLC members, such as residency status, tax obligations, and consent to being taxed by California—key elements also central to the purpose and function of Form 3832.

Dos and Don'ts

When completing California Form 3832, it's crucial to approach the task with care to ensure compliance with state requirements. Here are ten dos and don'ts to help guide you through the process:

Do:Read the form's instructions carefully before beginning to fill it out to ensure you understand all requirements.

Verify the name of the limited liability company (LLC) and the California Secretary of State (SOS) file number are correctly entered as these are essential for identification.

Provide accurate identification numbers, such as Social Security Numbers (SSNs), Individual Taxpayer Identification Numbers (ITINs), or Federal Employer Identification Numbers (FEINs) for all nonresident members listed.

Ensure that each nonresident member signs the form to indicate their consent to the jurisdiction of the State of California to tax their distributive share of the LLC income attributable to California sources.

Attach Form 3832 to Form 568 as instructed and distribute copies to each nonresident member for their records.

Keep a copy of the signed Form 3832 with the LLC’s records, along with a copy of the return and other associated documents, as mandated.

Omit any nonresident members from the form. All nonresident members must be listed with their consent obtained.

Forget to check if any nonresident members sold or transferred their ownership interests before the end of the taxable year, and reflect this accordingly on the form.

Ignore the requirement for a spouse or Registered Domestic Partner (RDP) of a nonresident member to also sign the form if applicable.

Assume completion of Form 3832 satisfies the requirements for filing a California income tax return. Nonresident members may still need to file individual California tax returns.

Use one form for multiple nonresident members if their information or consent differs. Separate forms should be used in such instances.

Taking the time to accurately complete and thoroughly review Form 3832 is crucial for LLCs with nonresident members, ensuring compliance and preventing potential issues with the State of California.

Misconceptions

Understanding the complexities and dispelling common misconceptions about the California Form 3832 can clarify its importance for limited liability companies (LLCs) and their nonresident members. Here are nine common misconceptions explained:

All LLCs must file Form 3832: Only LLCs with one or more nonresident members are required to complete and attach Form 3832 to their Form 568. Single-member LLCs do not use this form.

Form 3832 substitutes the need for a California income tax return: Completing Form 3832 does not fulfill the obligation to file a California income tax return. It is an additional requirement for LLCs with nonresident members to ensure they consent to California's jurisdiction over their income.

E-filing eliminates the need for Form 3832: Even if an LLC e-files its tax documents, the signed Form 3832 must be attached to Form FTB 8453-LLC, and a signed copy must be kept in the LLC’s records.

Form 3832 is a one-time requirement: This form must be filed for the first taxable year the LLC has nonresident members and any subsequent year when there is a change in the nonresident members or when a new nonresident member has not signed the form.

Signing Form 3832 is the responsibility of the LLC: While it's the LLC's responsibility to file the form, each nonresident member must individually sign the form to consent to California's taxation of their distributive share.

All nonresident members should be listed on a single Form 3832: Separate forms can be used for each nonresident member or groups of nonresident members, making it easier to manage consents.

Spouses or RDPs of nonresident members do not need to consent: If a nonresident member has a spouse or registered domestic partner (RDP), they must also sign Form 3832, consenting to California's jurisdiction.

Form 3832 does not apply to nonresident members who sell or transfer their interest within the year: Even nonresident members who divest their interest before the end of the taxable year must be listed and must consent through Form 3832.

Only individuals need to consent on Form 3832: Consent is required from all types of nonresident members, including individuals, trusts, estates, and corporations.

Clearing up these misconceptions can ensure compliance and avoid potential misunderstandings or missteps in the filing process for LLCs and their nonresident members in California.

Key takeaways

Filling out and using California Form 3832 plays a crucial role in managing the tax responsibilities of Limited Liability Companies (LLCs) with nonresident members conducting business in California. Here are the five key takeaways that can help LLCs comply with state tax regulations effectively:

- Form 3832, titled "Limited Liability Company Nonresident Members’ Consent," is a mandatory document for LLCs with one or more nonresident members. This form must be attached to Form 568, which is the main tax return form for LLCs in California, and a copy must be provided to each nonresident member.

- The purpose of Form 3832 is to list the nonresident members of the LLC and to obtain their consent to the jurisdiction of the State of California to tax their distributive share of the LLC's income that is attributable to California sources. This is crucial for ensuring that all income earned within California by nonresident members is properly reported and taxed.

- Separate Form 3832s can be used for each nonresident member or groups of nonresident members, which offers flexibility in consent documentation. However, if a nonresident member refuses to sign Form 3832, the LLC is responsible for paying tax on the member’s share of income at the highest marginal rate. This payment is considered as made by the member, affecting their individual tax liabilities.

- Nonresident members, including individuals, estates, trusts, and corporations, must file appropriate California tax returns in addition to signing Form 3832. This is especially important for nonresidents who have earned income from California sources, as failing to properly file could lead to taxation and penalties.

- Electronic filing (e-file) is supported for Form 3832 when submitted with Form 568 through the California e-file program. For those who e-file, the signed copy of Form 3832 should be attached to the California e-file Return Authorization for LLCs (Form FTB 8453-LLC). Keeping a signed copy in the LLC’s records, along with the return, schedules, and other documents, is required for compliance with the Franchise Tax Board's record-keeping regulations.

Understanding and adhering to the requirements of California Form 3832 ensures that LLCs and their nonresident members maintain compliance with California's tax laws, potentially avoiding costly penalties and fees associated with non-compliance. Proper attention to detail and timely submission of all required forms are essential aspects of tax planning and management for LLCs operating in the state.

Different PDF Templates

Exemption From Withholding California - This document is vital for both payers and recipients, affecting state tax obligations and returns.

Renew Cosmetology License Ca - Ensure you're familiar with the consequences of not providing all requested information for your cosmetology license renewal in California to avoid application rejection.