Fill a Valid California 3885 Form

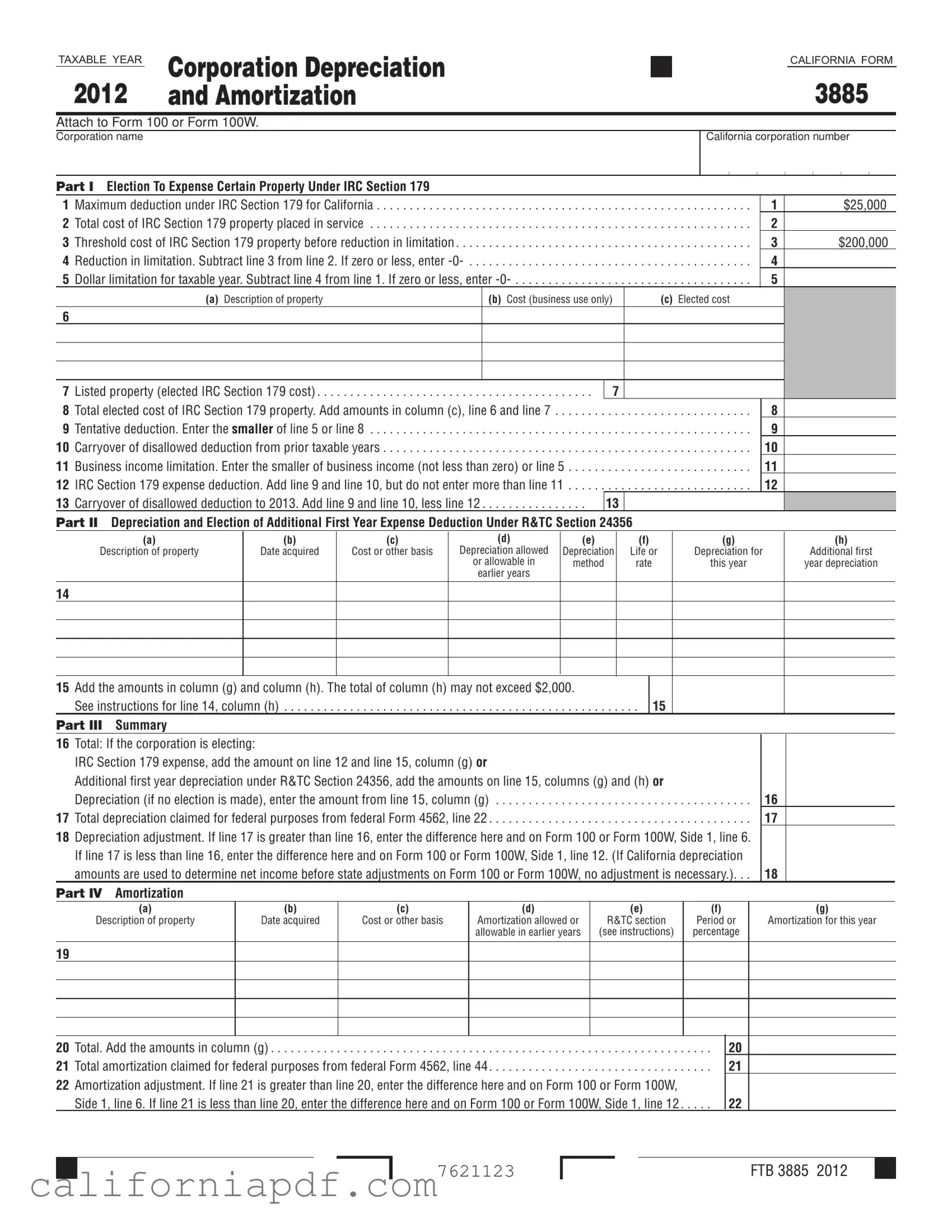

In today's comprehensive overview, we delve into the intricacies of the California Form 3885 for the 2012 taxable year, a critical document that corporations, partnerships, and limited liability companies classified as corporations must familiarize themselves with. This essential form, integral for calculating depreciation and amortization deductions within the golden state, serves as an attachment to Form 100 or Form 100W. Its design is to accommodate businesses in navigating through the election to expense certain property under IRC Section 179, thus showcasing a max deduction of $25,000, alongside providing a structured means for documenting the total cost of IRC Section 179 property placed in service, and any potential business income limitation affecting the deductible amount. Moreover, the text further illuminates federal and state differences concerning depreciation and amortization, highlighting specific areas where California law diverges from federal statutes such as the enhanced expensing election for certain assets and the non-conformity to the 50% bonus depreciation deduction for properties acquired within specified tax years. Additionally, this form intricately outlines depreciation calculation methods, including Straight-Line and Declining Balance, while emphasizing periods of depreciation adherent to the California Code of Regulations and federal useful lives alignment. Part IV meticulously details the amortization of various assets, underlining the conformity to IRC Section 197 amortization of intangibles, with certain exceptions elaborated within California's tax directives. Through this article, entities will gain a clarified understanding of how to adeptly navigate the complexities of the California Form 3885, ensuring accurate reporting and optimization of tax benefits.

Document Example

TAXABLE YEAR |

Corporation Depreciation |

|

|

|

|

|

|

|

|

|

|

CALIFORNIA FORM |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

and Amortization |

|

|

|

|

|

|

|

|

|

3885 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Attach to Form 100 or Form 100W. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Corporation name |

|

|

|

|

California corporation number |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PART I Election To Expense Certain Property Under IRC Section 179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Maximum deduction under IRC Section 179 for California |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

$25,000 |

|||||||||||||||

2 |

. . . . . . . . . . . . . . . . .Total cost of IRC Section 179 property placed in service |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2 |

|

|

|

|

|

|

|

|

||||||||

3 |

Threshold cost of IRC Section 179 property before reduction in limitation . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3 |

$200,000 |

|||||||||||||||

4 |

. .Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

4 |

|

|

|

|

|

|

|

|

||||||||

5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Dollar limitation for taxable year. Subtract line 4 from line 1. If zero or less, enter |

5 |

|

|

|

|

|

|

|

|

|||||||||

|

|

(a) Description of property |

(b) Cost (business use only) |

(c) Elected cost |

|

|

|

|

|

|

|

|

|||||||

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Listed property (elected IRC Section 179 cost) |

7 |

|

|

|

8 |

Total elected cost of IRC Section 179 property. Add amounts in column (c), line 6 and line 7 |

. . . |

. . . . . . . . . . . . . . . . . . . |

8 |

|

9 |

Tentative deduction. Enter the smaller of line 5 or line 8 |

. . . |

. . . . . . . . . . . . . . . . . . . |

9 |

|

10 |

Carryover of disallowed deduction from prior taxable years |

. . . |

. . . . . . . . . . . . . . . . . . . |

10 |

|

11 |

Business income limitation. Enter the smaller of business income (not less than zero) or line 5 |

. . . |

. . . . . . . . . . . . . . . . . . . |

11 |

|

12 |

IRC Section 179 expense deduction. Add line 9 and line 10, but do not enter more than line 11 |

. . . |

. . . . . . . . . . . . . . . . . . . |

12 |

|

13 |

Carryover of disallowed deduction to 2013. Add line 9 and line 10, less line 12 |

13 |

|

|

|

PART II Depreciation and Election of Additional First Year Expense Deduction Under R&TC Section 24356

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

Description of property |

Date acquired |

Cost or other basis |

Depreciation allowed |

Depreciation |

Life or |

Depreciation for |

Additional first |

|

|

|

or allowable in |

method |

rate |

this year |

year depreciation |

|

|

|

earlier years |

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15Add the amounts in column (g) and column (h). The total of column (h) may not exceed $2,000.

|

See instructions for line 14, column (h) |

15 |

PART III Summary |

|

|

16 |

Total: If the corporation is electing: |

|

|

IRC Section 179 expense, add the amount on line 12 and line 15, column (g) or |

|

|

Additional first year depreciation under R&TC Section 24356, add the amounts on line 15, columns (g) and (h) or |

|

|

Depreciation (if no election is made), enter the amount from line 15, column (g) |

. . . . . . . . . . . . . . . 16 |

17 |

Total depreciation claimed for federal purposes from federal Form 4562, line 22 |

. . . . . . . . . . . . . . . 17 |

18Depreciation adjustment. If line 17 is greater than line 16, enter the difference here and on Form 100 or Form 100W, Side 1, line 6. If line 17 is less than line 16, enter the difference here and on Form 100 or Form 100W, Side 1, line 12. (If California depreciation

amounts are used to determine net income before state adjustments on Form 100 or Form 100W, no adjustment is necessary.). . . 18

PART IV Amortization

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

Description of property |

Date acquired |

Cost or other basis |

Amortization allowed or |

R&TC section |

Period or |

Amortization for this year |

|

|

|

allowable in earlier years |

(see instructions) |

percentage |

|

19

20 |

Total. Add the amounts in column (g) |

20 |

21 |

Total amortization claimed for federal purposes from federal Form 4562, line 44 |

21 |

22 |

Amortization adjustment. If line 21 is greater than line 20, enter the difference here and on Form 100 or Form 100W, |

|

|

Side 1, line 6. If line 21 is less than line 20, enter the difference here and on Form 100 or Form 100W, Side 1, line 12 |

22 |

7621123

FTB 3885 2012

2012 Instructions for Form FTB 3885

Corporation Depreciation and Amortization

References in these instructions are to the Internal Revenue Code (IRC) as of JANUARY 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

In general, for taxable years beginning on or after January 1, 2010, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2009. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found

in FTB Pub. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider the tax booklets as authoritative law.

A Purpose

Use form FTB 3885, Corporation Depreciation and Amortization, to calculate California depreciation and amortization deduction for corporations, including partnerships and limited liability companies (LLCs) classified as corporations.

S corporations must use Schedule B (100S), S Corporation Depreciation and Amortization.

Depreciation is the annual deduction allowed to recover the cost or other basis of business or income producing property with a determinable useful life of more than one year. Generally, depreciation is used in connection with tangible property.

Amortization is an amount deducted to recover the cost of certain capital expenses over a fixed period. Generally amortization is used for intangible assets.

For amortizing the cost of certified pollution control facilities, use form FTB 3580, Application and Election to Amortize Certified Pollution Control Facility.

B Federal/State Differences

Differences between federal and California laws affect the calculation of depreciation and amortization. The following lists are not intended to be

California law conforms to federal law for the following:

•The sport utility vehicles (SUVs) and minivans built on a truck chassis are included in the definition of trucks and vans when applying the 6,000 pound gross weight limit. See federal Rev. Proc.

•The additional

•The federal Class Life Asset Depreciation Range (ADR) System provisions, which specifies a useful life for various types of property. However, California law does not allow the corporation to choose a depreciation period that varies from the specified asset guideline system.

California law does not conform to federal law for the following:

•The enhanced IRC Section 179 expensing election for assets placed in service in 2010 through 2012 taxable year.

•The

•The IRC Section 613A(d)(4) relating to the exclusion of certain refiners. See R&TC Section 24831.3 for more information.

•The IRC Section 168(k) relating to the 50% bonus depreciation deduction for assets acquired in tax years 2008 through 2012 and placed in service before 2013 (or before 2014 for certain qualifying property). For property acquired and placed in service after September 8, 2010, and before 2012 (before 2013 in the case of certain qualifying property), the bonus depreciation deduction is 100%.

•The additional

•The accelerated recovery period for depreciation of smart meters and smart grid systems.

•The

•The federal special class life for gas station convenience stores and similar structures.

•The depreciation under Modified Accelerated Cost Recovery System (MACRS) for corporations, except to the extent such depreciation is passed through from a partnership or LLC classified as a partnership.

C Depreciation Calculation Methods

Depreciation methods are defined in R&TC Sections 24349 through 24354. Depreciation calculation methods, described in R&TC Section 24349, are as follows:

Declining Balance. Under this method, depreciation is greatest in the first year and smaller in each succeeding year. The property must have a useful life of at least three years. Salvage value is not taken into account in determining the basis of the property, but the property may not be depreciated below a reasonable salvage value.

The amount of depreciation for each year is subtracted from the basis of the property and a uniform rate of up to 200% of the

For example, the annual depreciation allowances for property with an original basis of $100,000 are:

|

|

Declining |

|

|

Remaining |

balance |

Depreciation |

Year |

basis |

rate |

allowance |

First. . . . . . $100,000 |

20% |

$20,000 |

|

Second . . . |

80,000 |

20% |

16,000 |

Third |

64,000 |

20% |

12,800 |

Fourth . . . . |

51,200 |

20% |

10,240 |

remaining in the useful life of the property. Therefore, the numerator changes each year as the life of the property decreases. The denominator of the fraction is the sum of the digits representing the years of useful life. The denominator remains constant every year.

Other Consistent Methods. Other depreciation methods may be used as long as the total accumulated depreciation at the end of any taxable year during the first 2/3 of the useful life of the property is not more than the amount that would have resulted from using the declining balance method.

D Period of Depreciation

Under Cal. Code Regs., tit. 18, section 24349(l), California conforms to the federal useful lives of property.

Use the following information as a guide to determine reasonable periods of useful life for purposes of calculating depreciation. Actual facts and circumstances will determine useful life. However, the figures listed below represent the normal periods of useful life for the types of property listed as shown in IRS Rev. Proc.

•Office furniture, fixtures, machines,

and equipment . . . . . . . . . . . . . . . . . . . . . . 10 yrs.

This category includes furniture and fixtures (that are not structural components of a building) and machines and equipment used in the preparation of paper or data.

Examples include: desks; files; safes; typewriters, accounting, calculating, and data processing machines; communications equipment; and duplicating and copying equipment.

•Computers and peripheral

equipment (printers, etc.) . . . . . . . . . . . . . . . 6 yrs.

•Transportation equipment and

automobiles (including taxis) . . . . . . . . . . . . 3 yrs.

•

Light (unloaded weight less than

13,000 lbs.) . . . . . . . . . . . . . . . . . . . . . . . . . 4 yrs. Heavy (unloaded weight 13,000 lbs.

or more) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 yrs.

•Buildings

This category includes the structural shell of a building and all of its integral parts that service normal heating, plumbing, air conditioning, fire prevention and power requirements, and equipment such as elevators and escalators.

Type of building:

Apartments . . . . . . . . . . . . . . . . . . . . . . . . . 40 yrs. Dwellings (including rental residences) . . . 45 yrs. Office buildings. . . . . . . . . . . . . . . . . . . . . . 45 yrs. Warehouses . . . . . . . . . . . . . . . . . . . . . . . . 60 yrs.

EDepreciation Methods to Use

Corporations may use the

|

Maximum |

Property description |

depreciation method |

Real estate acquired 12/31/70 or earlier

New (useful life 3 yrs. or more) . . . . . 200% Declining balance Used (useful life 3 yrs. or more) . . . . . 150% Declining balance

Real estate acquired 1/1/71 or later Residential rental:

New. . . . . . . . . . . . . . . . . . . . . . . . . . 200% Declining balance Used (useful life 20 yrs. or more) . . . 125% Declining balance Used (useful life less than 20 yrs.) . .

FTB 3885 Instructions 2012 Page 1

Commercial and industrial:

New (useful life 3 yrs. or more) . . . . 150% Declining balance Used . . . . . . . . . . . . . . . . . . . . . . . . .

Personal property

New (useful life 3 yrs. or more) . . . . . 200% Declining balance Used (useful life 3 yrs. or more) . . . . . 150% Declining balance

See “Other Consistent Methods” information on page 1.

The Class Life ADR System of depreciation may be used for designated classes of assets placed in service after 1970.

The Guideline Class Life System of depreciation may be used for certain classes of assets placed in service before 1971.

FElection To Expense Certain Property Under IRC

Section 179

For taxable years beginning on or after January 1, 2005, corporations may elect IRC Section 179 to expense part or all of the cost of depreciable tangible property used in the trade or business and certain other property described in federal Publication 946, How to Depreciate Property. To elect IRC Section 179, the corporation must have purchased property, as defined in the IRC Section 179(d)(2), and placed it in service during the taxable year. If the corporation elects this deduction, the corporation must reduce the California depreciable basis by the IRC Section 179 expense. See the instructions for federal Form 4562, Depreciation and Amortization, for more information.

California does not allow IRC Section 179 expense election for

California conforms to the federal changes made to the deduction of business

2005. Exceptions: California does not conform to the federal increase in the deduction for

Limitations. Federal limitation amounts are different than California limitation amounts. For California purposes, the maximum IRC Section 179 expense deduction allowed is $25,000. This amount is reduced if the cost of all IRC Section 179 property placed in service during the taxable year is more than $200,000. The total IRC Section 179 expense deduction cannot exceed the corporation’s business income.

G Amortization

California conforms to the IRC Section 197 amortization of intangibles for taxable years beginning on or after January 1, 1994. Generally, assets that meet the definition under IRC Section 197 are amortized on a

Amortization of the following assets is governed by California law:

Bond premiums |

R&TC 24360 |

– |

24363.5 |

Research expenditures |

R&TC 24365 |

|

|

Reforestation expenses |

R&TC 24372.5 |

|

|

Organizational expenditures |

R&TC 24407 |

– |

24409 |

R&TC 24414 |

|

|

|

Other intangible assets may be amortized if it is approved with reasonable accuracy that the asset has an ascertainable value that diminishes over time and has a limited useful life.

Specific Line Instructions

For properties placed in service during the taxable year, the corporation may complete Part I if the corporation elects to expense qualified property under IRC Section 179, or Part II if the corporation elects additional first year expense deduction for qualified property under R&TC Section 24356. The corporation may only elect IRC Section 179 or the additional first year expense deduction for the same taxable year. The election must be made on a timely filed tax return (including extension). The election may not be revoked except with the Franchise Tax Board‘s consent.

Part II is also used to calculate depreciation for property (with or without the above elections).

Part I Election To Expense Certain Property Under IRC Section 179

Complete Part I if the corporation elects IRC Section 179 expense. Include all assets qualifying for the deduction since the limit applies to all qualifying assets as a group rather than to each asset individually. The total IRC Section 179 expense for property, which the election may be made, is figured on line 5. The amount of IRC Section 179 expense deductions for the taxable year cannot exceed the corporation’s business income on line 11. See

the instructions for federal Form 4562 for more information.

Line 2

Enter the cost of all IRC Section 179 qualified property placed in service during the taxable year including the cost of any listed property. See General Information F, Election To Expense Certain Property Under IRC Section 179, for information regarding qualified property. See line 7 instructions for information regarding listed property.

Line 5

If line 5 is zero, the corporation cannot elect to expense any IRC Section 179 property. Skip line 6 through line 11, enter zero on line 12.

Line 6

Do not include any listed property on line 6. Enter the elected IRC Section 179 cost of listed property on line 7.

Column (a) – Description of property. Enter a brief description of the property the corporation elects to expense.

Column (b) – Cost (business use only). Enter the cost of the property. If the corporation acquired the property through a

Column (c) – Elected cost. Enter the amount the corporation elects to expense. The corporation does not have to expense the entire cost of the property. The corporation can depreciate the amount it does not expense.

Line 7

Use a format similar to federal Form 4562, Part V, line 26 to determine the elected IRC Section 179 cost of listed property. Listed property generally includes the following:

•Passenger automobiles weighing 6,000 pounds or less.

•Any other property used for transportation if the nature of the property lends itself to personal use, such as motorcycles,

•Any property used for entertainment or recreational purposes (such as photographic, phonographic, communication, and video recording equipment).

•Cellular telephones (and other similar telecommunications equipment). Note: California does not conform to the federal exclusion of these

items from being treated as listed property for taxable years beginning on or after January 1, 2010.

•Computers or peripheral equipment.

Exception. Listed property generally does not include:

•Photographic, phonographic, communication, or video equipment used exclusively in the corporation’s trade or business.

•Any computer or peripheral equipment used exclusively at a regular business.

•An ambulance, hearse, or vehicle used for transporting persons or property for hire.

Listed property used 50% or less in business activity does not qualify for the IRC Section 179 expense deduction. For more information regarding listed property, see the instructions for federal Form 4562.

Line 11

The total cost the corporation can deduct is limited to the corporation’s business income. For the purpose of IRC Section 179 election, business income is the net income derived from the corporation’s active trade or business, Form 100 or Form 100W, line 18, before the IRC Section 179 expense deduction (excluding items not derived from a trade or business actively conducted by the corporation).

Part II Depreciation and Election of

Additional First Year Expense

Deduction Under R&TC

Section 24356

Line 14

Corporations may enter each asset separately or group assets into depreciation accounts. Figure the depreciation separately for each asset or group of assets. The basis for depreciation is the cost or other basis reduced by a reasonable salvage value (except when using the declining balance method), additional

If the Guideline Class Life System or Class Life ADR System is used, enter the total amount from the corporation’s schedule showing the computation on form FTB 3885, column (g), and identify as such.

Line 14, Column (h), Additional

Corporations may elect to deduct up to 20% of the cost of “qualifying property” in the year acquired in addition to the regular depreciation deduction. The maximum additional

“Qualifying property” is tangible personal property used in business and having a useful life of at least six years. Land, buildings, and structural components do not qualify. Property converted from personal use, acquired by gift, inheritance, or from related parties also does not qualify.

See R&TC Section 24356 and the applicable regulations for more information.

An election may be made to expense up to 40% of the cost of property described in R&TC Sections 24356.6, 24356.7, and 24356.8.

For more information, get form FTB 3809, Targeted Tax Area Deduction and Credit Summary; form FTB 3805Z, Enterprise Zone Deduction and Credit Summary; or form FTB 3807, Local Agency Military Base Recovery Area Deduction and Credit Summary.

Part IV Amortization

Line 19, Column (e) – R&TC section. Enter the correct R&TC section for the type of amortization. See General Information G, Amortization, for a list of the R&TC sections.

Page 2 FTB 3885 Instructions 2012

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of Form 3885 | Used by corporations to calculate depreciation and amortization deductions in California. |

| Governing Law | California Revenue and Taxation Code (R&TC) and Internal Revenue Code (IRC) as of January 1, 2009. |

| Applicable Tax Years | Typically for taxable years beginning on or after January 1, 2010. |

| Form Attachment | Attached to Form 100 or Form 100W when filed. |

| IRC Section 179 Deduction | Corporations can elect to expense part or all of the cost of certain property under IRC Section 179, with a maximum deduction of $25,000. |

| Depreciation Methods Included | Includes straight-line, declining balance, and sum-of-the-years-digits methods among others. |

| California vs. Federal Law | There are key differences in depreciation calculations and limits between California law and federal law. |

| Specific Depreciation Rules | California law provides specific rules for the depreciation of certain types of property, like computers and transportation equipment. |

| Amortization of Intangibles | California conforms to IRC Section 197 for the amortization of intangibles, typically over 15 years. |

| Additional First Year Expense Deduction | Allows for additional first-year depreciation under R&TC Section 24356, separate from federal provisions. |

How to Write California 3885

When a corporation in California needs to report depreciation and amortization for tax purposes, it uses Form 3885. This form is essential for detailing the depreciation of business property, which refers to spreading out the cost of tangible assets over their useful life, and for reporting amortization, which is similar but applies to certain intangible assets. Both of these are methods to reduce taxable income by considering the wear and tear on property and assets over time. For entities like corporations, partnerships, and limited liability companies classified as corporations, completing Form 3885 accurately is crucial for compliance with tax regulations and to maximize potential tax benefits. Here are the step-by-step instructions to guide through the process of filling out the form.

- Part I: Election To Expense Certain Property Under IRC Section 179

- Enter the maximum deduction under IRC Section 179 for California ($25,000) on line 1.

- On line 2, report the total cost of IRC Section 179 property placed in service during the year.

- Fill in the threshold cost of IRC Section 179 property before reduction ($200,000) on line 3.

- Calculate the reduction in limitation by subtracting line 3 from line 2, and enter this on line 4. If this calculation results in zero or less, enter "-0-".

- Determine the dollar limitation for the taxable year by subtracting line 4 from line 1, and report this on line 5. Again, if zero or less, enter "-0-".

- For lines 6 and 7, describe the property, its cost (business use only), and elected cost for both listed property and other IRC Section 179 property. Then add these amounts and enter on line 8.

- Enter the tentative deduction, smaller of line 5 or line 8, on line 9.

- Report any carryover of disallowed deduction from prior years on line 10.

- On line 11, indicate the business income limitation, entering the smaller of business income or line 5.

- Add lines 9 and 10 but do not enter more than the business income limitation from line 11 on line 12.

- Finally, calculate the carryover of disallowed deduction to the next year by adding lines 9 and 10, subtracting line 12, and report this on line 13.

- Part II: Depreciation and Election of Additional First Year Expense Deduction Under R&TC Section 24356

- For each asset or group of assets, provide a description of the property, date acquired, cost or other basis, depreciation allowed or allowable, and the depreciation method, life or rate for additional first-year depreciation.

- Calculate the amounts in columns (g) and (h), and enter the total of both in line 15. Remember, the total of column (h) may not exceed $2,000.

- Part III: Summary

- Combine relevant amounts for IRC Section 179 expense and additional first-year depreciation as instructed and enter on line 16.

- Report the total depreciation claimed for federal purposes from federal Form 4562, line 22, on line 17.

- Calculate the depreciation adjustment. If line 17 is greater than line 16, enter the difference on line 18 and on Form 100 or Form 100W. If line 17 is less, also enter the difference on line 18 and the corresponding form, as directed.

- Part IV: Amortization

- For amortization, specify each asset's description, date acquired, cost or other basis, the R&TC section applicable, period or percentage of amortization for this and earlier years, and enter the totals on line 20.

- Enter total amortization claimed for federal purposes from federal Form 4562, line 44, on line 21.

- Determine the amortization adjustment. If line 21 is greater than line 20, report the difference on line 22 and on Form 100 or Form 100W as instructed, adjusting based on whether line 21 is greater or less.

After completing Form 3885, attach it to Form 100 or Form 100W as applicable. Filling out this form meticulously ensures that your corporation accurately reports its depreciation and amortization, adhering to California-specific regulations and potentially optimizing your tax liabilities.

Listed Questions and Answers

What is California Form 3885?

California Form 3885 is a document used by corporations, partnerships, and limited liability companies (LLCs) classified as corporations to calculate their depreciation and amortization deductions for state tax purposes. It covers various types of property, including tangible property depreciated over time and certain intangible costs that can be amortized. This form is attached to either Form 100 or Form 100W when filing.

How does the depreciation calculation differ from federal to state levels?

While California generally conforms to the Internal Revenue Code (IRC) as of January 1, 2009, there are notable differences in depreciation calculation between federal and California state law. For example:

- California does not conform to the enhanced IRC Section 179 expensing election for assets placed in service in specific years.

- The state does not allow the first-year depreciation deduction for new luxury autos or certain passenger automobiles for certain years.

- California has its own rules regarding the bonus depreciation deduction and does not follow the federal 50% bonus depreciation for assets acquired in specified tax years.

What is IRC Section 179 and how does it apply to California Form 3885?

IRC Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. For California purposes:

- The maximum expense deduction is $25,000.

- This deduction decreases dollar for dollar if the total cost of all IRC Section 179 property placed in service during the year exceeds $200,000.

- The total deduction cannot exceed the business's income for the year.

California does not allow the Section 179 deduction for off-the-shelf computer software, in contrast to federal law.

How are amortization calculations handled on Form 3885?

Amortization on Form 3885 applies to certain intangible costs that are deductible over a fixed period. California conforms to the IRC Section 197 amortization of intangibles, which generally allows these costs to be spread over 15 years. However, there are specific deviations for assets acquired before January 1, 1994, and for certain other exclusions and limitations that are based on California law rather than federal law.

What are the specific line instructions for completing Form 3885?

When completing Form 3885, be sure to:

- Detail the property for which you are calculating depreciation and amortization, including the date acquired and basis for depreciation.

- Calculate depreciation using the method that best applies to the property type, considering California-specific adjustments.

- Use Part I to elect to expense certain property under IRC Section 179, including calculating any carryover of disallowed deduction from previous years.

- For amortization, provide detailed information on the property being amortized, including the basis and the applicable Revenue and Taxation Code section.

Common mistakes

Neglecting to attach the form to the main tax return: The California Form 3885, for depreciation and amortization, must be attached to Form 100 or Form 100W. Failure to do so can lead to errors in processing the corporation's tax filings.

Misunderstanding the maximum deduction under IRC Section 179: Companies often mistake the amount they can deduct, not realizing the California limit is $25,000. This misunderstanding can lead to either underestimating or overestimating deductible amounts.

Overlooking the threshold cost limitation: Corporations sometimes miss that the total Section 179 property cost before reduction cannot exceed $200,000. Going beyond this amount reduces the deduction dollar-for-dollar, affecting the taxable income calculation.

Incorrect calculation of reduction in limitation: The step to subtract line 3 from line 2 is critical. If zero or less, entering -0- as instructed is crucial but often missed, leading to incorrect dollar limitations for the taxable year.

Failing to properly describe the property: Within the depreciation section, each piece of property must be accurately described. Mistakes or vague descriptions can complicate or delay deductions.

Forgetting to list the cost (business use only): The cost associated with business use should be meticulously recorded. Omitting or inaccurately reporting these costs can lead to miscalculations in elected cost deductions.

Misidentifying listed property: The specific identification of listed property, such as passenger automobiles and computers, is imperative for correct Section 179 cost election. Confusion over what constitutes listed property often leads to errors.

Incorrect business income limitation calculations: The amount of IRC Section 179 expense deduction is limited to the corporation's business income. Erroneously calculating the business income can result in over- or under-deducting expenses.

Amortization errors due to R&TC section misapplication: For amortization, it's necessary to reference the correct Revenue and Taxation Code (R&TC) sections relevant to the type of asset being amortized. Misapplication of these sections is a common mistake that affects the accuracy of total amortization deductions.

When preparing California Form 3885, attention to detail in every section ensures that the corporation maximizes its deductions while remaining compliant with state tax laws. Understanding and avoiding these common mistakes can significantly streamline the filing process.

Documents used along the form

Understanding the various documents and forms that supplement the California 3885 form is crucial for accurate and comprehensive corporate tax preparation. Alongside the Form 3885, several other documents often play a vital role in the depreciation and amortization processes for corporations.

- California Form 100 or 100W: These are the primary income tax returns for corporations. Form 100 is for C corporations, while Form 100W is for water's-edge filers. These forms provide the overall tax framework into which the depreciation and amortization reported on Form 3885 is integrated.

- Form FTB 3580: Application and Election to Amortize Certified Pollution Control Facility is used by corporations to amortize the cost of certified pollution control facilities over a period of 60 months or more, depending on the facility's life expectancy. This amortization can directly impact the figures entered into Form 3885.

- Form FTB 3804: Business Credits Schedules. This form is used for claiming various business credits, some of which may be directly affected by depreciation and amortization calculations as reported on California Form 3885. The interaction between asset depreciation and eligible business credits is important for optimizing tax benefits.

- Form 4562: Federal Depreciation and Amortization (Including Information on Listed Properties). While this is a federal form, it's instrumental in providing a comparative foundation for California's depreciation and amortization calculations. The differences and similarities between federal and state calculations can directly impact decisions made on Form 3885.

These documents work together to provide a comprehensive view of a corporation's depreciation and amortization for tax purposes. Understanding and accurately completing these supplementary forms ensure that corporations meet their legal obligations and optimize their tax positions according to both federal and California state laws.

Similar forms

The California 3885 form, used by corporations to calculate depreciation and amortization deductions, shares similarities with other tax documents that also cover aspects of depreciation, amortization, or the reporting of business assets. One such document is the Federal Form 4562, "Depreciation and Amortization," which serves a nearly identical purpose at the federal level. Both forms require taxpayers to list assets acquired during the year, calculate depreciation or amortization, and make specific elections like Section 179 expensing. They are integral for businesses to accurately report the yearly financial erosion of their capital assets, reflecting how wear, tear, and obsolescence decrease these assets' value over time.

Another analogous document is Form 100 or Form 100W, which the California 3885 must be attached to. These forms are the California Corporation Franchise or Income Tax Return and its Water's-Edge Version, respectively. They summarize a corporation's income, deductions, and tax payable to the state of California. The inclusion of depreciation and amortization calculations from Form 3885 helps ensure that a corporation's taxable income reflects the reduction in value of its assets, aligning the corporation's tax liability more closely with its actual economic income.

Similarly, Schedule B (100S) of the S Corporation Depreciation and Amortization for California mirrors the 3885 but is tailored for S corporations. It requires these entities to report depreciation and amortization related to assets used in the business, ensuring the tax treatment of these items conforms to California's adjustments. This specificity underscores the state's approach to accommodating different business structures through tailored forms.

FTB Form 3580, "Application and Election to Amortize Certified Pollution Control Facility," though more specific in scope, is related in its aim to provide tax relief through amortization. Focused on environmental initiatives, it allows for the cost spread of pollution control facilities over a defined period, illustrating how amortization principles can apply to specialized assets under California tax law.

Federal Publication 946, "How to Depreciate Property," while not a form, is a guide that complements the California 3885 document in its expansive coverage of depreciation and amortization rules at the federal level. Taxpayers in California can find parallels between the instructions in Publication 946 and the requirements of Form 3885, especially regarding the general principles of asset depreciation and Section 179 expensing.

Form FTB 3809, "Targeted Tax Area Deduction and Credit Summary," alongside similar forms like FTB 3805Z and FTB 3807, which focus on enterprise zones and local agency military base recovery areas, shares a connection through its treatment of asset costs. These forms allow for special deduction and amortization rates in designated areas, demonstrating how asset costs can receive distinct treatment based on business location and type, similarly to how Form 3885 manages general asset depreciation and amortization.

The Internal Revenue Code (IRC), though a body of law rather than a form, is foundational to understanding the regulations governing both the California Form 3885 and its federal counterparts. The IRC outlines the rules for Section 179 expensing and the general framework for depreciation and amortization, with California making specific adjustments as noted in the instructions for Form 3885.

State conformity documents, such as FTB Publication 1001, "Supplemental Guidelines to California Adjustments," also share a conceptual link with Form 3885. They detail where California tax law diverges from federal rules, including treatments of depreciation and amortization, thereby providing the context and rationale behind specific line items in California's tax forms.

Lastly, instructions for California Schedule CA (540 or 540NR), which adjust federal itemized deductions and income to California standards, offer broader parallels. While focused on individual taxpayers, the adjustments made often consider depreciation and amortization from a business owner’s perspective, indirectly relating to the corporate focus of Form 3885.

These documents, while diverse in their specific applications and audiences, all circle back to the core functions of depreciation and amortization as they impact tax calculations. By providing frameworks for recognizing the decreasing value of assets, they ensure that businesses can align their tax liabilities with their true economic situations.

Dos and Don'ts

Filling out the California Form 3885, regarding Corporation Depreciation and Amortization, requires careful attention to detail. Here are some best practices and pitfalls to avoid to ensure accuracy and compliance:

Do:- Verify conformity between federal and state laws: Before you start, it's imperative to understand the specific areas where California law diverges from federal tax law, especially in terms of depreciation and amortization rules.

- Accurately calculate depreciation: Ensure you're using the correct depreciation methods and rates as specified by California law. This includes understanding distinctions for various types of property, such as tangible or intangible assets.

- Election to Expense: For Section 179 property, thoroughly review the limits and qualifications specific to California, noting the differences from federal limits, to properly elect the expense.

- Double-check listed property: Pay special attention to listed property requirements, ensuring you meet the specific usage criteria to qualify for deductions, particularly for vehicles and technology equipment that might be used for both personal and business purposes.

- Ignore California-specific modifications: California may not conform to all federal provisions regarding depreciation and amortization, such as bonus depreciation or certain amendments to Section 179; overlooking these nuances can lead to errors.

- Miscalculate carryover amounts: When handling carryover of disallowed deductions from previous years, be precise in your calculations and understand how these figures impact the current year's deductions.

- Forget to reduce the basis for elected expenses: If opting for a Section 179 deduction or additional first-year expense, remember to adjust the basis of your asset accordingly, to avoid inaccurately large depreciation deductions in the future.

- Misreport property details: When detailing property for depreciation and amortization purposes, ensure each item is correctly classified (e.g., distinguishing between new and used property) and adhere strictly to reporting requirements for date acquired, cost basis, and recovery period.

Misconceptions

When tackling California Form 3885, which is related to Corporation Depreciation and Amortization, there are several misconceptions that can lead to confusion or errors in filing. Let's address and clarify some of the most common misconceptions:

- Misconception 1: Form 3885 is only for large corporations, not small businesses.

This is inaccurate. Both large and small businesses that are structured as corporations, including partnerships and limited liability companies classified as corporations, must use Form 3885 to calculate their California depreciation and amortization deductions.

- Misconception 2: The Section 179 deduction is the same for both federal and California returns.

There's a difference. While both federal and state allow for a Section 179 deduction, for California, the maximum expense deduction is significantly lower at $25,000 compared to the federal limit.

- Misconception 3: Off-the-shelf computer software qualifies for the Section 179 deduction in California.

Actually, California does not conform to federal rules in this regard and does not allow the Section 179 expense election for off-the-shelf computer software.

- Misconception 4: Calculating depreciation on Form 3885 is optional.

It's mandatory for businesses that have depreciable assets to calculate and report depreciation on Form 3885, as it significantly impacts the taxable income reported to the state.

- Misconception 5: All assets have the same rate and method of depreciation in California.

Different assets depreciate over different lifespans and can use different methods of depreciation based on state-specific regulations and federal IRS rules, which California may or may not fully conform to.

- Misconception 6: The additional first-year depreciation is available for all purchases.

In California, there are specific nonconformities to the federal bonus depreciation rules. Property acquired and placed into service in certain years do not qualify for the 50% or 100% additional first-year depreciation as they might on federal returns.

- Misconception 7: Amortization doesn't vary between federal and state filings.

California conforms to the federal amortization rules for most assets, but there are exceptions and specific differences, particularly for intangible assets acquired in taxable years beginning before 1994.

- Misconception 8: There's no cap on the additional first-year expense deduction for qualifying property under R&TC Section 24356.

Actually, there is a cap. The law stipulates that the deduction cannot exceed $2,000 per item of qualifying property. This is a specific limitation to ensure balanced tax benefits for businesses.

- Misconception 9: Form 3885 is only about depreciation.

While it's primarily used for depreciation, Form 3885 also covers amortization deductions for corporations. It's important to not overlook the amortization section of the form, as it could contain valuable deductions for certain capital expenses.

Understanding these nuances can save time and avoid potential issues with state tax filing. It's always recommended to consult with a tax professional to ensure compliance and optimize tax deductions and credits for your corporation.

Key takeaways

Understanding the California Form 3885 for "Depreciation and Amortization" can be pivotal for corporations in accurately calculating their tax responsibilities. Here are the key takeaways to guide you through this process:

- Intended Purpose: Form 3885 is specifically designed for corporations, including partnerships and limited liability companies (LLCs) classified as corporations, to calculate their depreciation and amortization deductions on the California state tax return.

- Conformity with Federal Law: California's laws generally conform to the Internal Revenue Code (IRC) as of January 1, 2009, with few exceptions. Hence, while calculating depreciation and amortization, be aware of differences between federal and state law to ensure accuracy.

- Depreciation Limits: The form outlines specific depreciation limits and methods that apply to different types of property, respecting California's adjustments to federal provisions. Pay careful attention to the depreciation method and periods applicable under California law.

- IRC Section 179 Deduction Differences: Even though California conforms to the federal IRC Section 179 allowing corporations to expense certain property purchases directly, there are stark differences in limitation amounts between California and federal guidelines. Familiarize yourself with these differences to optimize your deductions.

- Detailed Calculations Required: Form 3885 requires a detailed listing of properties, their acquisition dates, costs, and basis for depreciation or amortization. It emphasizes the need for meticulous record-keeping to accurately calculate and justify deductions.

- Additional First-Year Depreciation: California offers an additional first-year expense deduction under R&TC Section 24356 for qualifying property, with specific limitations. Understanding the eligibility criteria for this deduction can provide significant tax advantages.

- Amortization Rules: Form 3885 guides corporations through the amortization of various types of assets, conforming mostly to federal rules but with notable exceptions. Careful consideration of these rules can impact the amount of amortization deductions claimed.

- Specific Line Instructions: The form comes with detailed instructions for filling out each part, underscoring the importance of following these guidelines closely to avoid errors and maximize allowable deductions.

In conclusion, navigating the complexities of Form 3785 requires a good grasp of both federal and state depreciation and amortization rules. By paying attention to the distinctions between California and federal law, as well as meticulously detailing assets and adhering to the provided instructions, corporations can effectively manage their tax liabilities.

Different PDF Templates

California Pardon List 2023 - The state of California provides guidelines and FAQs to help applicants navigate the complexities of the clemency application process.

Non Resident Working in California Taxes - Designed with space for detailed explanations, it allows individuals to clearly convey their reasons for not e-filing.