Fill a Valid California 461 Form

In the landscape of political contributions and campaign finance, the California Form 461 holds a vital place, serving as the Major Donor and Independent Expenditure Committee Campaign Statement. This crucial document is tailored for both individuals and entities whose financial contributions or nonmonetary support to state or local officeholders, candidates, and committees reach or exceed $10,000, as well as those making independent expenditures of $1,000 or more to advocate for or against candidates or ballot measures in a given calendar year. Distinctly, Form 461 delineates the intricate details of direct monetary contributions, loans, nonmonetary contributions, and other forms of support that are not broadly available to the public, ensuring transparency and accountability in political financing. Moreover, it underscores the requisites for personal contributions by candidates and officeholders, alongside specifying the guidelines for electronic filing for major donors and independent expenditure committees, particularly those engaging with contributions or expenditures aggregating to $25,000 or more within a calendar year. This form not only facilitates adherence to the contribution limits set for candidates for elective state office but also embodies a comprehensive approach towards managing and reporting political contributions and expenditures, thereby promoting an informed and engaged electorate.

Document Example

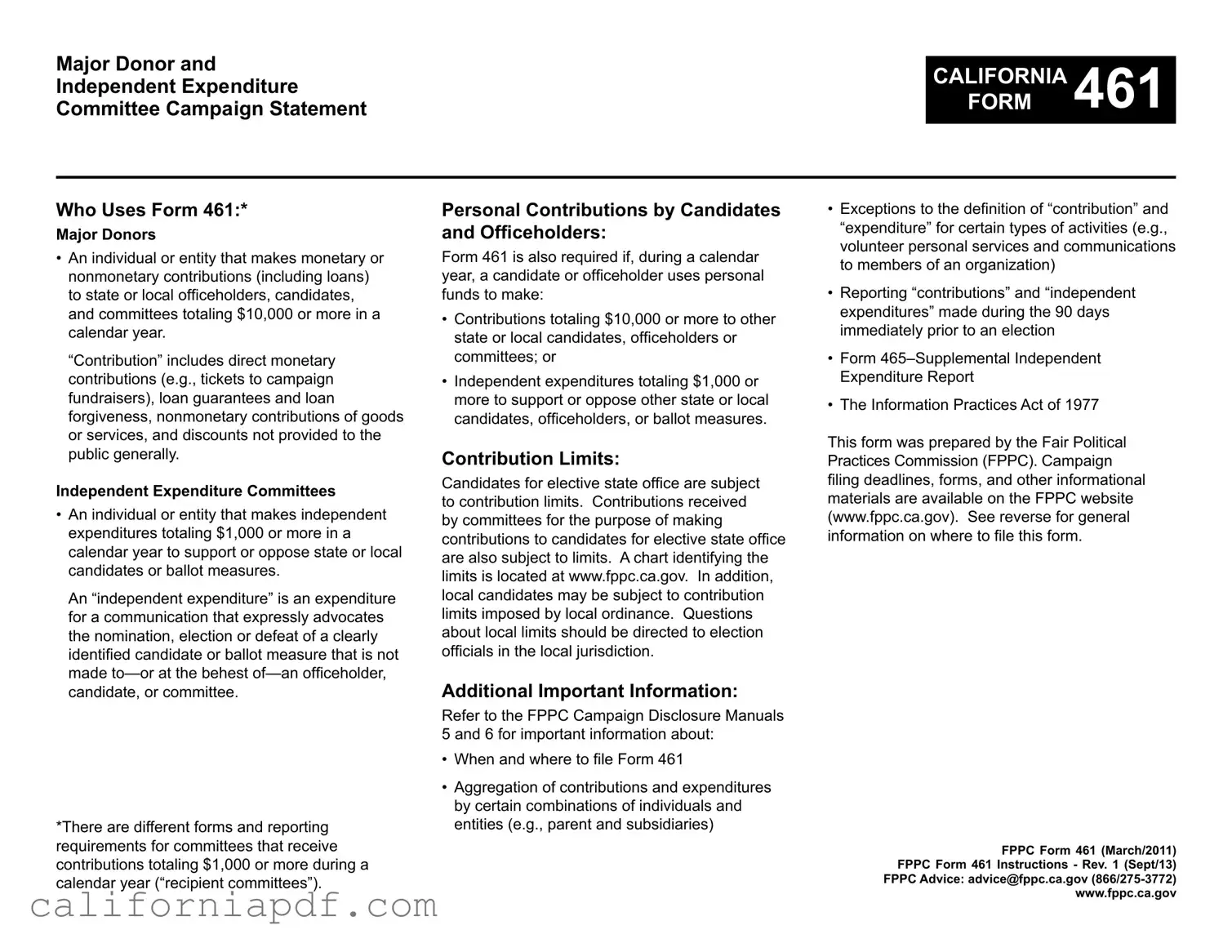

Major Donor and

Independent Expenditure

Committee Campaign Statement

CALIFORNIAFORM 461

Who Uses Form 461:*

Major Donors

•An individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local oficeholders, candidates, and committees totaling $10,000 or more in a calendar year.

“Contribution” includes direct monetary contributions (e.g., tickets to campaign fundraisers), loan guarantees and loan forgiveness, nonmonetary contributions of goods or services, and discounts not provided to the public generally.

Independent Expenditure Committees

•An individual or entity that makes independent expenditures totaling $1,000 or more in a calendar year to support or oppose state or local candidates or ballot measures.

An “independent expenditure” is an expenditure for a communication that expressly advocates the nomination, election or defeat of a clearly identiied candidate or ballot measure that is not made

*There are different forms and reporting requirements for committees that receive contributions totaling $1,000 or more during a calendar year (“recipient committees”).

Personal Contributions by Candidates and Oficeholders:

Form 461 is also required if, during a calendar year, a candidate or oficeholder uses personal funds to make:

•Contributions totaling $10,000 or more to other state or local candidates, oficeholders or committees; or

•Independent expenditures totaling $1,000 or more to support or oppose other state or local candidates, oficeholders, or ballot measures.

Contribution Limits:

Candidates for elective state ofice are subject to contribution limits. Contributions received by committees for the purpose of making contributions to candidates for elective state ofice are also subject to limits. A chart identifying the limits is located at www.fppc.ca.gov. In addition, local candidates may be subject to contribution limits imposed by local ordinance. Questions about local limits should be directed to election oficials in the local jurisdiction.

Additional Important Information:

Refer to the FPPC Campaign Disclosure Manuals

5 and 6 for important information about:

•When and where to ile Form 461

•Aggregation of contributions and expenditures by certain combinations of individuals and entities (e.g., parent and subsidiaries)

•Exceptions to the deinition of “contribution” and “expenditure” for certain types of activities (e.g., volunteer personal services and communications to members of an organization)

•Reporting “contributions” and “independent expenditures” made during the 90 days immediately prior to an election

•Form

•The Information Practices Act of 1977

This form was prepared by the Fair Political Practices Commission (FPPC). Campaign iling deadlines, forms, and other informational materials are available on the FPPC website (www.fppc.ca.gov). See reverse for general information on where to ile this form.

FPPC Form 461 (March/2011) FPPC Form 461 Instructions - Rev. 1 (Sept/13)

FPPC Advice: advice@fppc.ca.gov

Instructions for Major Donor and Independent Expenditure Committee Campaign Statement

CALIFORNIAFORM 461

Where to File:

State Elections and Committees Active in More Than One County: If more than 50% of your contributions or independent expenditures were made to support or oppose state candidates, measures and committees, or to support or oppose local candidates and measures being voted on in more than one county. File in the following place:

•Secretary of State (original and one copy) Political Reform Division

1500 11th Street, Room 495 Sacramento, CA 95814 Phone (916)

County Elections: If you are not a state committee and more than 50% of your contributions or independent expenditures were made to support or oppose candidates and measures being voted on in a single county, file with the election offi cial in that county (original and one copy).

This fi ling requirement also applies to contributions or independent expenditures made to support or oppose candidates and measures on the ballot in more than one jurisdiction located within a single county.

City Elections: If you are not a state committee and more than 50% of your contributions or independent expenditures were made to support or oppose candidates and measures being voted on in a single city, fi le with the city clerk in that city (original and one copy).

Electronic Filing:

Major donor and independent expenditure committees that are required to fi le reports with the Secretary of State must fi le Form 461 electronically if they make contributions or independent expenditures totaling $25,000 or more in a calendar year. Paper reports are also required. Some local jurisdictions also require reports to be electronically filed.

FPPC Form 461 (March/2011) FPPC

Major Donor and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAJOR DONOR AND INDEPENDENT EXPENDITURE |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITTEE STATEMENT |

|||||||||||||

Independent Expenditure Committee |

|

|

Type or print in ink. |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

Date Stamp |

|

CALIFORNIAFORM |

461 |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Campaign Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

(Government Code sections |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Statement covers period |

Date of election if applicable: |

|

|

|

|

|

Page |

|

|

|

|

of |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

(Month, Day, Year) |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

from |

|

|

|

|

|

|

|

|

|

|

|

|

|

For Offi cial Use Only |

|

|||||||||||

SEE INSTRUCTIONS ON REVERSE |

|

through |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. Name and Address of Filer |

|

|

|

|

|

|

|

3. Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

NAME OF FILER |

|

|

|

|

|

|

|

|

(Amounts may be rounded to whole dollars.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

1. |

Expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(including loans) of $100 or more |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

made this period. (Part 5.) |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

RESIDENTIAL OR MAILING ADDRESS |

(NO. AND STREET) |

|

|

................................................ |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

2. |

Unitemized expenditures and |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

contributions (including loans) under |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

CITY |

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

$100 made this period |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

3. Total expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

RESPONSIBLE OFFICER |

AREA CODE/DAYTIME PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

(If fi ler is other than an individual) |

|

|

|

|

|

|

|

|

|

made this period. (Add Lines 1 + 2.) |

SUBTOTAL |

$ |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

4. Total expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

made from prior statement. (Enter |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2. Nature and Interests of Filer (Complete each applicable section.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

amount from Line 5 of last statement |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

A FILER WHO IS AN INDIVIDUAL MUST LIST THE NAME, ADDRESS, AND BUSINESS INTERESTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

fi led. If this is the fi rst statement for |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

OF EMPLOYER OR, IF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

the calendar year, enter zero.) |

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

NAME OF EMPLOYER/BUSINESS |

|

|

|

BUSINESS INTERESTS |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

5. Total expenditures and contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(including loans) made since |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

ADDRESS OF EMPLOYER/BUSINESS |

|

|

|

|

|

|

|

|

|

January 1 of the current calendar year. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

(Add Lines 3 + 4.) |

|

|

TOTAL |

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

A FILER THAT IS A BUSINESS ENTITY MUST DESCRIBE THE BUSINESS ACTIVITY IN WHICH IT IS |

4. Verification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

ENGAGED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I have used all reasonable diligence in preparing this statement. I have |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

reviewed the statement and to the best of my knowledge the information |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

contained herein is true and complete. I certify under penalty of perjury under |

|||||||||||||||||||

|

|

A FILER THAT IS AN ASSOCIATION MUST PROVIDE A SPECIFIC DESCRIPTION OF ITS INTERESTS |

|

|||||||||||||||||||||||||||

|

|

|

the laws of the State of California that the foregoing is true and correct. |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Executed on |

|

|

By |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

A FILER THAT IS NOT AN INDIVIDUAL, BUSINESS ENTITY, OR ASSOCIATION MUST DESCRIBE THE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF INDIVIDUAL DONOR OR |

||||||||||||||||||||

|

|

COMMON ECONOMIC INTEREST OF THE GROUP OR ENTITY |

|

|

|

|

|

|

|

DATE |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

RESPONSIBLE OFFICER, IF OTHER THAN AN INDIVIDUAL |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amendment (Explain): |

|

FPPC Form 461 (March/2011) |

|

FPPC |

|

|

|

|

|

|

|

Instructions for Major Donor and Independent Expenditure Committee Campaign Statement

CALIFORNIAFORM 461

For defi nitions and detailed information about completing Form 461, refer to the FPPC Campaign Disclosure Manuals 5 and 6.

Period Covered by a Statement:

The “period covered” by a campaign statement begins the day after the closing date of the last campaign statement you fi led. For example, if the closing date of the last statement was June 30, the beginning date of the next statement will be July 1.

If this is the fi rst campaign statement for the calendar year, begin with January 1.

The closing date of the statement depends on the type of statement you are filing.

Date of Election:

Enter the date of the election if you are filing Form 461 as a city or a county major donor or independent expenditure committee and the city or county’s election will be held this year.

1. Name and Address of Filer:

Enter the legal name of the individual or entity

filing the statement. If the fi ler is commonly known to the public by another name, that name may be used. When a person directs and controls the making of contributions and independent expenditures by a related entity (e.g., a parent and subsidiaries or a majority shareholder of a

corporation) that must be aggregated and reported on Form 461, list as the “Name of Filer” the name of the individual or entity that directs and controls the making of the contributions and independent expenditures. In addition, you must:

•Indicate that the campaign statement includes the contributions and independent expenditures of other entities. For example, “ABC Corporation, including aggregated contributions/ independent expenditures.”

•Identify any entities added to this report that were not included in a prior report fi led for the current calendar year, as well as any entities included in a prior report for the current calendar year that are no longer required to aggregate under the name of filer.

•Identify both names if the “Name of Filer” listed on a previous report filed for the current calendar year is different than the name identified on this report. For example, “John Lewis, formerly identifi ed as Lewis Construction.”

Enter the name of the responsible offi cer of an entity or organization fi ling the statement.

2. Nature and Interests of Filer:

When more than one person or entity is listed under “Name of Filer,” identify the nature and interests of each. (Use appropriately labeled continuation sheets if necessary.)

3. Summary:

Summary totals are calculated from the information itemized in Part 5 of the Form 461 and unitemized payments of less than $100. If this is the first report being filed for a calendar year, enter a zero on line 4 of the summary.

4. Verification:

A responsible offi cer of an entity or an entity filing jointly with any number of affi liates must sign the Form 461. An attorney or a certified public accountant may sign on behalf of the entity or entities. A statement fi led by an individual must be signed by the individual.

Amendments:

To amend previously fi led Form 461, check the “Amendment” box, enter the period covered by the statement you are amending, and complete Part

1.Disclose the amended information, including Part 3, if applicable, and complete the Verification.

FPPC Form 461 (March/2011) FPPC

Major Donor and |

|

|

|

MAJOR DONOR AND INDEPENDENT EXPENDITURE |

||||||||

|

|

|

|

|

COMMITTEE STATEMENT |

|||||||

Independent Expenditure Committee |

Type or print in ink. |

Statement covers period |

CALIFORNIA |

461 |

||||||||

Amounts may be rounded |

|

|

|

|

||||||||

Campaign Statement |

|

|

|

|

FORM |

|||||||

to whole dollars. |

from |

|

|

|

||||||||

|

|

|

through |

|

|

|

|

|

|

|

|

|

|

SEE INSTRUCTIONS ON REVERSE |

|

|

|

Page |

|

|

of |

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF FILER |

|

|

|

|

|

|

|

|

|

|

|

5. Contributions (Including Loans, Forgiveness of Loans, and Loan Guarantees) and Expenditures Made

(If more space is needed, use additional copies of this page for continuation sheets.)

|

NAME, STREET ADDRESS, CITY, STATE AND ZIP CODE |

|

DESCRIPTION OF |

CANDIDATE AND OFFICE, |

AMOUNT THIS |

CUMULATIVE AMOUNT |

||

DATE |

TYPE OF PAYMENT |

PAYMENT |

MEASURE AND JURISDICTION, |

RELATED TO THIS |

||||

OF PAYEE |

PERIOD |

|||||||

|

|

(IF OTHER THAN MONETARY |

OR COMMITTEE |

CANDIDATE, MEASURE, |

||||

|

(IF COMMITTEE, ALSO ENTER I.D. NUMBER) |

|

|

|||||

|

|

CONTRIBUTION OR LOAN) |

|

|

|

OR COMMITTEE |

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

Support |

Oppose |

|

|

||

|

|

Expenditure |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Expenditure |

|

Support |

Oppose |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

Support |

Oppose |

|

|

||

|

|

Expenditure |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Monetary |

|

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

Loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Contribution |

|

|

|

|

|

|

|

|

Independent |

|

|

|

|

|

|

|

|

|

Support |

Oppose |

|

|

||

|

|

Expenditure |

|

|

|

|||

|

|

|

|

|

|

|

|

|

SUBTOTAL $

FPPC Form 461 (March/2011) FPPC

Instructions for Major Donor and

Independent Expenditure Committee Campaign Statement

CALIFORNIAFORM 461

5. Contributions and Expenditures:

When itemizing contributions and expenditures made by more than one entity (e.g., a parent and subsidiaries), note which entity made each payment.

Date of Contribution

A monetary contribution is made on the date it is mailed, delivered, or otherwise transmitted to the candidate or committee. A nonmonetary contribution is made on the earlier of the following: 1) the date you made an expenditure for goods or services at the behest of the candidate or committee; or 2) the date the candidate or committee or an agent of the candidate or committee obtained possession or control of the goods or services.

Name and Address of Payee

If a total of $100 or more is contributed or expended during a calendar year to support or oppose a single candidate, committee or measure, disclose the name and address of the payee. If the payee is a committee, also disclose the identification number assigned to that committee by the Secretary of State. If no ID number has been assigned to a committee, provide the name and address of that committee’s treasurer.

Contributions and expenditures of less than $100 to support or oppose a single candidate, committee or measure during a calendar year are totaled and reported as a lump sum on Line 2 of the Summary.

Candidate, Measure or Committee

Identify the candidate, measure or committee supported or opposed by the contribution or expenditure. Disclose the name of the candidate and the offi ce sought or held; the name of the ballot measure and its jurisdiction; or the name of

the committee if a nonmonetary contribution was made to a general purpose committee. Check the appropriate box to indicate whether the payment was made to support or oppose the candidate or measure listed.

Amount/Cumulative Amount

Disclose the amount of the contribution or expenditure made this period.

If a single payment supports or opposes more than one candidate or measure, provide the name and address of the vendor. Enter the amount paid to the vendor in the “Description of Payment” column. Identify each candidate or measure, and enter the amount of the contribution or expenditure attributable to each in the “Amount this Period” column.

For each contribution, also disclose the cumulative amount contributed to the candidate (including all of the candidate’s controlled election committees) or to the committee (in the case of a ballot measure or other type of committee) since January 1 of the current calendar year. For each independent expenditure, disclose the cumulative amount of independent expenditures made since January 1 of the current calendar year related to the candidate or ballot measure supported or opposed by the expenditure.

Reporting Loans:

Check the “loan” box under “Type of Payment” if you make, forgive, or guarantee a loan. You need not report loan repayments received. If you make and forgive a loan during the same calendar year, report the amount of the forgiveness under “Description of Payment.” The same is true if you guarantee a loan and you make payments to the lender during the same calendar year.

Loans to state candidates are subject to contribution limits. If the candidate repays all or a portion of a loan, the lender may make additional contributions subject to the applicable contribution limit.

Report the fair market value of

Reporting Subvendors:

If an agent (including an independent contractor) makes payments on your behalf (“subvendor payments”), disclose those payments in addition to the payments made to the agent. For example, you pay a public relations fi rm, which pays for an advertisement supporting a ballot measure. In addition to disclosing the payment(s) made to the public relations fi rm, itemize payments of $500 or more made by the firm related to the advertisement. Do not include payments that are not for the purpose of making contributions or independent expenditures (e.g., for overhead or operating expenses).

Report the name and address of the agent followed by the name and address of each subvendor. Disclose amounts paid to the agent and subvendor in the “Description of Payment” column.

FPPC Form 461 (March/2011) FPPC

Form Breakdown

| Fact Name | Detail |

|---|---|

| Usage | Used by major donors and independent expenditure committees in California. |

| Contributions Reporting Threshold | Applies to entities making contributions or independent expenditures of $10,000 or more in a calendar year for major donors, or $1,000 for independent expenditures. |

| Filing Locations | State active committees file with the Secretary of State; local committees file with the relevant county or city election official. |

| Electronic Filing Requirement | Required for committees that make contributions or independent expenditures totaling $25,000 or more in a calendar year. |

| Governing Law | Governed by the California Government Code sections 84200-84216.5 and administered by the Fair Political Practices Commission (FPPC). |

How to Write California 461

Once you've decided to take on the role of a major donor or independent expenditure committee, understanding how to properly file your campaign statements is crucial. California Form 461 is designed for individuals or entities contributing $10,000 or more in a calendar year to state or local officeholders, candidates, committees, or making independent expenditures of $1,000 or more to support or oppose state or local candidates or ballot measures. Before diving into the form, gather all relevant financial records to ensure accurate reporting. Here's a step-by-step guide to help you fill out Form 461 properly.

- Locate the section labeled "1. Name and Address of Filer" and enter the legal name of the individual or entity filing the statement. If known by another public name, include that too.

- In section "2. Nature and Interests of Filer," provide detailed information about the filer's employer, business interests, or economic interests, depending on the filer's nature.

- Proceed to the "3. Summary" section, where you'll calculate and enter totals from Part 5 for expenditures and contributions made during the reporting period. Include both itemized and unitemized amounts.

- In the "4. Verification" part, the responsible officer or individual donor must sign and date, certifying the accuracy and completeness of the information provided under penalty of perjury.

- For contributions, loans, loan forgiveness, and expenditures, turn to "5. Contributions (Including Loans, Forgiveness of Loans, and Loan Guarantees) and Expenditures Made." Itemize each transaction, including the payee's name, address, the candidate or measure it relates to, the amount, and the date.

- If additional space is needed for itemizing contributions and expenditures, use additional copies of the page or approved continuation sheets.

After completing Form 461, remember to check if you need to file electronically. Major donors and independent expenditure committees making contributions or expenditures totaling $25,000 or more in a calendar year must file reports both in paper and electronically with the Secretary of State. Review all entries for accuracy before submitting to ensure compliance with California's campaign finance laws. Filing this form correctly helps maintain transparency and accountability in the political process.

Listed Questions and Answers

Who needs to file California Form 461?

California Form 461 must be filed by major donors and independent expenditure committees. Major donors are individuals or entities that contribute (including loans) $10,000 or more in a calendar year to candidates, officeholders, or committees at the state or local level. Independent expenditure committees are those that spend $1,000 or more within a calendar year to support or oppose state or local candidates or ballot measures, without coordinating with the candidates or their committees. Additionally, officeholders or candidates who use personal funds to contribute $10,000 or more to other candidates or committees, or to make independent expenditures of $1,000 or more against other candidates or on ballot measures, must also file this form.

What contributions and expenditures are required to be reported on Form 461?

Participants required to file Form 461 must report:

- Monetary or nonmonetary contributions made to state or local candidates, officeholders, and committees totaling $10,000 or more in a calendar year.

- Independent expenditures totaling $1,000 or more in a calendar year to support or oppose state or local candidates or ballot measures. This includes payments for communications that expressly advocate for the election or defeat of a candidate or ballot measure.

Are there contribution limits that apply to the donations reported on Form 461?

Yes, candidates for elective state office in California are subject to specific contribution limits. Additionally, committees that receive contributions for the purpose of donating to candidates for such elective offices are also subject to contribution limits. Details of these limits can be found on the FPPC website. It's worth noting that local candidates may face additional contribution limits set by local ordinances. For specifics on local limits, inquiries should be directed to local election officials.

Where should Form 461 be filed?

The filing location for Form 461 depends on the activities of the filer:

- State Elections and Committees Active in More Than One County: File with the Secretary of State, providing the original and one copy.

- County Elections: If contributions or expenditures are primarily within a single county, file with the election official of that county, submitting the original and one copy.

- City Elections: If activities are focused within a single city, file with the city clerk, also providing the original and one copy.

What is the period covered by Form 461?

The period covered by a Form 461 campaign statement begins the day after the last statement's closing date. For example, if your last statement covered up to June 30, the next statement would begin on July 1. If no previous statement was filed for the calendar year, the reporting period begins on January 1. The closing date for the current statement depends on the specific type of statement you are filing.

How can amendments be made to a previously filed Form 461?

To amend a previously filed Form 461, filers must check the "Amendment" box located on the form, clearly state the period covered by the statement being amended, and then accurately disclose the amended information. This includes completing the verification part of the form. It is essential to provide clear explanations for the amendments made to ensure transparency and compliance with state regulations.

Common mistakes

Filling out the California Form 461, which is crucial for major donors and independent expenditure committees, requires attention and precision. However, several common mistakes are often made during this process. Recognizing and avoiding these errors can ensure the accuracy and compliance of campaign statements.

Not reporting all contributions and expenditures: A frequent oversight is the failure to include both monetary and nonmonetary contributions, such as loan guarantees, goods or services, and discounts not available to the general public, that total $10,000 or more in a calendar year. Additionally, independent expenditures of $1,000 or more in support or opposition to candidates or ballot measures must also be reported comprehensively.

Misunderstanding the filing requirements: Not correctly identifying whether to file with the Secretary of State, a county election official, or a city clerk based on where the majority of contributions or independent expenditures are targeted, leads to misfiling. It’s crucial to understand the nuances of filing requirements tied to the geographical focus of expenditures and contributions.

Incorrectly rounding amounts: While amounts may be rounded to whole dollars, errors arise when this rounding is done inconsistantly or inaccurately, leading to discrepancies in reported totals and summaries.

Failing to detail the nature and interests of the filer: Both individual and entity filers must accurately describe their business or association interests, including the specific description of their economic interests or the common economic interest of the group, which is a detail often overlooked.

Incomplete summary: Another common error is not fully completing the Summary section, which requires detailed calculations from Part 5 and the reporting of unitemized payments under $100. This section should reflect the totality of expenditures and contributions made during the reporting period.

Incorrect signature verification: The form must be signed by a responsible officer of an entity or by the individual donor themselves. Submissions are sometimes delayed or rejected due to the lack of the appropriate signature or failing to accurately certify the statement under penalty of perjury.

Ensuring accuracy in these areas is essential for compliance with the Fair Political Practices Commission's (FPPC) guidelines and for maintaining the integrity of political campaign reporting in California.

Documents used along the form

When engaging in the process of completing and filing the California Form 461, Major Donor and Independent Expenditure Committee Campaign Statement, certain documents often work in tandem with this form to ensure a comprehensive and compliant campaign disclosure. These documents facilitate a transparent financial reporting process for those involved in supporting state and local officeholders, candidates, or ballot measures financially.

- Form 460: Campaign Statements - This is the primary form used by recipient committees to record contributions and expenditures throughout the campaign cycle. It provides a detailed account of all financial aspects of a campaign, making it crucial for maintaining transparency and compliance with state regulations.

- Form 465: Supplemental Independent Expenditure Report - Specifically designed for individuals or entities making independent expenditures, this form supplements the information provided on Form 461 when additional details about independent expenditures are required. It ensures that financial activities intended to support or oppose candidates or ballot measures, but not directly coordinated with them, are fully disclosed.

- Form 497: 24-Hour Contribution Report - This form serves a critical role during the closing periods of a campaign. When contributions of $1,000 or more are made or received during the 90 days before an election, this form must be filed within 24 hours. It ensures timely disclosure of significant financial contributions as election day approaches.

- Schedule A: Monetary Contributions Received - As part of the Form 460 packet, Schedule A is used to itemize each monetary contribution received by a committee. Detailing the contributor's name, address, occupation, employer, and the amount contributed, this schedule offers transparency about the sources of a campaign's financial support.

Each of these forms contributes to a framework designed to promote accountability and integrity within political campaigns. By requiring detailed reporting and public disclosure, these documents help maintain trust in the electoral process, ensuring that voters have access to information about the financial influences that may affect election outcomes.

Similar forms

The California Form 460, "Recipient Committee Campaign Statement," closely resembles the Form 461 in purpose and design by documenting contributions and expenditures related to political campaigns. Both forms require detailed recording of financial activities to ensure transparency and compliance with state campaign finance laws. Form 460, however, is specifically for recipient committees that have received or spent $2,000 or more during a calendar year, highlighting its focus on ongoing campaign operations rather than major donors and independent expenditures exclusively.

The Schedule A of Form 460, detailing contributions received, mirrors part of Form 461’s content where major donors list their contributions. Both schedules serve to track the flow of money towards political campaigns, but Schedule A focuses on a wider range of contributions received by a committee, regardless of the donor's total annual contribution amount. This schedule is critical for maintaining the transparency and legality of campaign financing by recording each contribution's source, amount, and date.

The Form 497, "24-Hour Contribution Report," is akin to Form 461 as it also deals with political contributions, yet it is used under more urgent circumstances. Form 497 is required when contributions of $1,000 or more are made or received during specific periods close to an election. Similar to Form 461, it ensures transparency in campaign finance but acts on a more immediate basis, reflecting the dynamic nature of political campaigning.

The Form 450, "Recipient Committee Short Form," shares a similar goal with Form 461 by aiming to report campaign finance activities. However, Form 450 is for committees that anticipate they will not receive or spend $2,000 or more in a calendar year, offering a simplified reporting option. While both forms contribute to the oversight of political finance, Form 450 applies to smaller scale operations, emphasizing the broad spectrum of financial activities involved in political campaigning.

Form 465, "Supplemental Independent Expenditure Report," is directly related to Form 461 given that both handle independent expenditures. While Form 461 encompasses a broader range of reporting for major donors and independent expenditure committees, Form 465 specifically targets supplemental reporting of independent expenditures not already reported on the campaign statement. This specialization allows for more detailed scrutiny of expenditures aimed at influencing elections without coordinating with candidates or committees.

Form 501, "Candidate Intention Statement," although primarily a preliminary document for candidates declaring their intent to run for office, indirectly complements Form 461 by setting the stage for future financial reporting and compliance with campaign finance regulations. The early declaration required by Form 501 allows for a smooth transition into more detailed financial reporting, such as that required by Form 461, by establishing a candidate’s official entry into the electoral process.

Form 700, "Statement of Economic Interests," while not exclusively a campaign finance document, shares with Form 461 the goal of promoting transparency and preventing conflicts of interest within public offices. It requires detailed disclosures about a public official’s financial interests, similar to how Form 461 requires disclosures about financial contributions and expenditures in campaigns. Both forms function to ensure public trust in the electoral and governing processes by highlighting possible financial influences.

Form 410, "Statement of Organization Recipient Committee," serves as a foundational document that parallels Form 461 in the broader context of campaign finance reporting. By registering a political committee and detailing its purpose, Form 410 initiates the transparency and accountability process, which Form 461 continues through its detailed financial reporting requirements. Together, these forms create a comprehensive view of the financial dynamics within political campaigns.

Dos and Don'ts

When completing the California Form 461, which is essential for Major Donors and Independent Expenditure Committees, attention to detail and adherence to regulations are paramount. This guide highlights the dos and don'ts to ensure accuracy and compliance with the Fair Political Practices Commission (FPPC) requirements.

Do:- Review the definitions and instructions carefully. Understanding the specific requirements and terms used in Form 461 is crucial for accurate completion. The FPPC Campaign Disclosure Manuals 5 and 6 can be invaluable resources.

- Enter all required information accurately. This includes the name and address of the filer, nature and interests (for entities), and detailed summary of contributions and expenditures.

- Round amounts to whole dollars. When reporting expenditures and contributions, including loans, use whole dollar amounts to ensure consistency and ease of review.

- File amendments promptly if necessary. If you need to correct or update information after submission, do so immediately to remain in compliance.

- Sign and date the form as required. A responsible officer must sign Form 461, verifying the accuracy and completeness of the information provided.

- File electronically if required. If contributions or expenditures total $25,000 or more in a calendar year, electronic filing with the Secretary of State is obligatory, in addition to paper reports.

- Keep a copy for your records. Always retain a copy of the filed Form 461 and any corresponding documentation for at least five years, as per FPPC regulations.

- Ignore local filing requirements. Depending on the jurisdictions involved, additional filing with either county election officials or city clerks may be required.

- Omit details on contributions or independent expenditures. All contributions, including loans, loan forgiveness, guarantees, and non-monetary contributions, as well as independent expenditures, must be thoroughly reported.

- Forget to report unitemized contributions under $100. Even smaller contributions and expenditures need to be included in the summary totals, per campaign statement instructions.

- Use nicknames or abbreviations for filers' names. Always use the legal name or commonly known public name of the entity or individual filing the statement.

- Assume one form fits all scenarios. The nature of your contributions or independent expenditures may necessitate additional forms or schedules. Review the instructions and the FPPC's advice if uncertain.

- Miss filing deadlines. Timely submission is critical to avoid penalties and ensure compliance with campaign finance laws.

- Rush through the verification process. Accuracy is paramount. Double-check all entries for completeness and correctness before signing and dating the form.

Following these guidelines will aid in the successful filing of Form 461, contributing to the transparency and integrity of political campaign financing in California.

Misconceptions

Many individuals navigating the complexities of political campaign support in California encounter common misunderstanding regarding Form 461, a critical tool for reporting campaign contributions and independent expenditures. Below are ten misconceptions clarified to aid in accurately completing and submitting Form 461.

- Form 461 is only for large corporations: This form is required not exclusively for large corporations but for any individual or entity, including independent expenditure committees and major donors, who meet the specified contribution thresholds.

- Only monetary contributions matter: In addition to direct monetary contributions, Form 461 must account for non-monetary contributions, loan guarantees, and loan forgiveness, reflecting a broader scope of support or opposition than merely financial.

- Candidates and officeholders are exempt: Counter to this belief, candidates and officeholders must file Form 461 if they use personal funds to make contributions or independent expenditures that exceed the stipulated amounts.

- All contributions are unlimited: While Form 461 facilitates reporting of contributions, it's crucial to note that state candidates and certain committees are subject to specific contribution limits, underscoring the importance of adherence to legal thresholds.

- There’s no need to aggregate contributions: The form requires the aggregation of contributions and expenditures by affiliated entities, such as parent companies and their subsidiaries, ensuring transparency in the magnitude of support or opposition.

- Volunteer services need to be reported: Some activities, like volunteer personal services and certain types of communication, are exceptions to the definition of "contribution" and "expenditure," highlighting nuanced reporting requirements.

- Paper filing is the only option: Major donors and independent expenditure committees are mandated to file electronically if their contributions or independent expenditures reach $25,000 or more within a calendar year, alongside a paper report, showcasing the dual filing mechanisms.

- Only the state jurisdiction needs the filing: The reporting jurisdiction is determined by where the majority of contributions or independent expenditures are directed, which can require filing with county or city election officials, not just at the state level.

- One-time filing suffices for the campaign period: Filers must submit reports on a schedule that could involve multiple filings throughout the campaign, especially to report contributions and expenditures made in the final 90 days before an election.

- An attorney or CPA cannot sign the Form 461: While typically the individual donor or responsible officer of an entity signs the form, an attorney or certified public accountant may sign on behalf of the entity, offering flexibility in the filing process.

Understanding these clarifications can markedly ease the completion and submission of Form 461, ensuring compliance with California's regulations for campaign finance reporting.

Key takeaways

Understanding the California Form 461 is critical for major donors and independent expenditure committees to ensure compliance with state campaign finance laws. Here are six key takeaways regarding the filling out and utilization of the form:

- Entities or individuals qualify as major donors if they contribute $10,000 or more within a calendar year to state or local officeholders, candidates, and committees. Independent expenditure committees reach this designation by making expenditures of $1,000 or more to support or oppose candidates or measures.

- The form serves multiple functions including reporting monetary contributions, non-monetary contributions, independent expenditures, and loans provided or received, whether forgiven or guaranteed.

- It's imperative for filers to detail their contributions and expenditures, including the names and addresses of payees, the amount for this period, and cumulative amounts, alongside descriptions of candidates, measures, or committees and the jurisdiction related to each transaction.

- Filers must electronically submit their Form 461 to the Secretary of State when contributions or independent expenditures reach or exceed $25,000 within a calendar year. Additionally, paper reports are mandated for records.

- The form requires thorough identification of the filer’s nature and interested parties. For individuals, business interests and employer information are necessary, while business entities and associations must describe their activity or interests respectively.

- Amendment of previously submitted Form 461 is provided for within the document. Filers intending to amend must check the specific box, specify the period the amendment covers, disclose the adjusted information, and complete the verification section anew.

For those involved in political contributions or independent expenditures in California, adherence to these guidelines is essential for lawful participation in the political process. It is also helpful to consult the FPPC (Fair Political Practices Commission) Campaign Disclosure Manuals 5 and 6 for comprehensive instructions and additional important information.

Different PDF Templates

What Is a Dismissal Order - Follows specified guidelines set forth by the Penal Code Sections 4852.01 and 4852.06.

Form 3832 - Integral for tax planning, Form 3832 outlines nonresident members’ consent to taxation, a prerequisite for LLCs operating in California.