Fill a Valid California 51 055A Form

Understanding the California 51 055A form is crucial for fruit and vegetable shippers operating within the state. This form plays a key role in the agriculture sector, specifically for those involved in the shipping of various citrus commodities like oranges, lemons, and mandarins. Designed by the California Department of Food and Agriculture, its main purpose is to ensure that monthly remittances are properly documented and sent to the right department. The form requires detailed information about the company, including its name, address, and registration number, along with the total number of containers shipped for each type of fruit. The rates per container vary depending on the fruit, emphasizing the importance of accurate record-keeping. Moreover, compliance with the submission deadline is essential to avoid penalties, making it critical for shippers to submit the form on the last day of the reporting month. Additionally, there's a procedure in place for instances when no shipments are made. By streamlining this reporting process, the form not only helps in the standardization of the industry but also ensures that the necessary fees are collected to support the state’s agriculture infrastructure.

Document Example

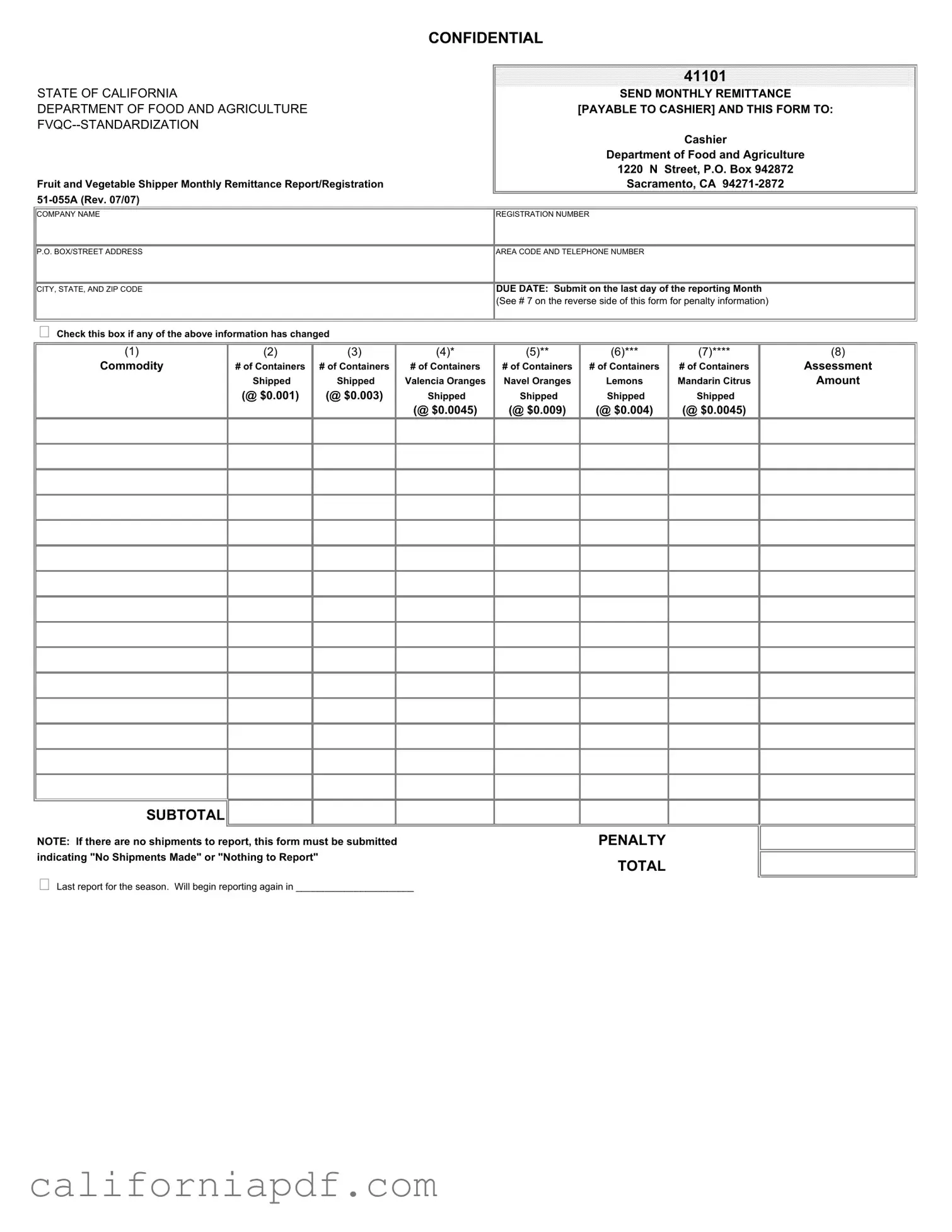

CONFIDENTIAL

STATE OF CALIFORNIA

DEPARTMENT OF FOOD AND AGRICULTURE

Fruit and Vegetable Shipper Monthly Remittance Report/Registration

41101

SEND MONTHLY REMITTANCE

[PAYABLE TO CASHIER] AND THIS FORM TO:

Cashier

Department of Food and Agriculture

1220 N Street, P.O. Box 942872

Sacramento, CA

COMPANY NAME

P.O. BOX/STREET ADDRESS

CITY, STATE, AND ZIP CODE

REGISTRATION NUMBER

AREA CODE AND TELEPHONE NUMBER

DUE DATE: Submit on the last day of the reporting Month

(See # 7 on the reverse side of this form for penalty information)

Check this box if any of the above information has changed

(1)

Commodity

(2) |

(3) |

(4)* |

# of Containers |

# of Containers |

# of Containers |

Shipped |

Shipped |

Valencia Oranges |

(@ $0.001) |

(@ $0.003) |

Shipped |

|

|

(@ $0.0045) |

(5)** |

(6)*** |

# of Containers |

# of Containers |

Navel Oranges |

Lemons |

Shipped |

Shipped |

(@ $0.009) |

(@ $0.004) |

(7)****

#of Containers Mandarin Citrus

Shipped

(@ $0.0045)

(8)

Assessment

Amount

SUBTOTAL

NOTE: If there are no shipments to report, this form must be submitted |

PENALTY |

indicating "No Shipments Made" or "Nothing to Report" |

TOTAL |

|

Last report for the season. Will begin reporting again in ______________________

Form Breakdown

| Fact Name | Detail |

|---|---|

| Form Title | California Fruit and Vegetable Shipper Monthly Remittance Report/Registration Form 51-055A |

| Revision Date | July 2007 (Rev. 07/07) |

| Recipient Address | Cashier Department of Food and Agriculture, 1220 N Street, P.O. Box 942872, Sacramento, CA 94271-2872 |

| Submission Deadline | Last day of the reporting month |

| Penalty Clause | Details regarding penalties for late submissions are provided on the reverse side (#7) |

| Form Purpose | To report and remit monthly assessments for shipped fruit and vegetable commodities |

| Governing Law | Covered under the regulations of the California Department of Food and Agriculture |

| Change Notification | Entities are required to notify any changes in the provided information by checking the designated box |

| Commodity Categories | Includes specific categories for reporting: Valencia Oranges, Navel Oranges, Lemons, and Mandarin Citrus, each with associated fees |

| No Shipments Reporting | Entities must submit the form even if there are no shipments, indicating "No Shipments Made" or "Nothing to Report" |

How to Write California 51 055A

Filling out the California 51 055A form is a straightforward process that requires accurate information regarding the monthly activities of fruit and vegetable shippers. This documentation is essential for the Department of Food and Agriculture, ensuring compliance with state regulations. Proper completion and timely submission of this form help maintain the integrity of agricultural practices in California.

- Start by entering the Company Name in the designated space.

- Provide the P.O. Box/Street Address of the company’s primary location.

- Fill in the City, State, and Zip Code relevant to the company’s address.

- Enter the Registration Number associated with the company.

- Indicate the Area Code and Telephone Number where the company can be reached.

- Check the box if any of the provided information has changed since the last report.

- Under the Commodity section, specify the quantity of each fruit type shipped in the respective columns:

- Enter the number of containers for Valencia Oranges, Navel Oranges, Lemons, and Mandarin Citrus, adhering to the rates mentioned next to each fruit type.

- Calculate the Assessment Amount for each commodity based on the rate and number of containers shipped. Enter these amounts in column (8).

- Add up all the assessment amounts to find the Subtotal.

- If applicable, include any Penalty amount in the space provided.

- Summarize the total amount due in the TOTAL section.

- If there are no shipments to report for the month, clearly indicate by writing "No Shipments Made" or "Nothing to Report" in a visible section of the form.

- For the last report of the season, specify when you will begin reporting again in the space provided.

- Ensure that the form is signed and dated before submitting.

- Send the completed form along with the monthly remittance to the Cashier Department of Food and Agriculture at the address provided at the top of the form. The submission must be made on the last day of the reporting month to avoid penalties.

Upon completion and submission of the California 51 055A form, the Department of Food and Agricultural processes the information to ensure compliance with state standardization regulations for fruit and vegetable shipments. Timeliness and accuracy in filling out this form contribute to the effective monitoring and support of agricultural activities in California.

Listed Questions and Answers

What is the California 51-055A form?

The California 51-055A form, officially known as the Fruit and Vegetable Shipper Monthly Remittance Report/Registration, is a mandatory document that fruit and vegetable shippers must submit to the California Department of Food and Agriculture. This form allows the state to monitor and standardize the shipping of certain commodities, ensuring compliance with agricultural laws. Shippers are required to report the number of containers shipped for specific commodities along with corresponding assessments.

Who needs to fill out this form?

This form must be filled out by shippers of certain fruit and vegetable commodities within California. If your business involves the shipment of commodities like oranges, lemons, or mandarins, you are likely required to submit this form on a monthly basis to comply with state regulations.

What information is required on the form?

- Company Name

- P.O. Box/Street Address

- City, State, and Zip Code

- Registration Number

- Area Code and Telephone Number

- Number of Containers Shipped for each specified commodity

- Assessment Amount

- Total Amount due

By when does the form need to be submitted?

The form is due on the last day of the reporting month. It is critical to adhere to this deadline to avoid penalties. For example, if you are reporting shipments for the month of March, your form and remittance should be sent to the Cashier at the Department of Food and Agriculture by March 31.

What happens if I fail to submit the form on time?

If the form is not submitted by the due date, penalties may be applied. The specifics of these penalties are outlined on the reverse side of the form, under section #7. It is essential to review this information to understand the consequences of late submission, which might include financial penalties or a halt on your ability to ship further goods until compliance is achieved.

Where should the completed form and remittance be sent?

Completed forms along with the monthly remittance (payable to the Cashier) should be sent to the following address: Cashier, Department of Food and Agriculture, 1220 N Street, P.O. Box 942872, Sacramento, CA 94271-2872. It’s important to ensure all details are accurate and the necessary payment accompanies the form to prevent processing delays.

Common mistakes

Failing to update contact information: If there have been any changes to your company's address, phone number, or other contact details, making sure these are current in the form is essential. Neglecting to check the provided box indicating such changes can lead to communication issues.

Incorrect commodity identification: Each commodity—like Valencia oranges, Navel oranges, lemons, and Mandarin citrus—has a designated spot on the form. Misidentifying or placing them in the wrong section can complicate records and potentially affect the assessment amounts.

Inaccurate container counts: The number of containers shipped must be accurately reported for each commodity. Over or underestimating these figures can affect the total assessment amount, leading to discrepancies in the payable amount.

Miscalculating assessment amounts: Every commodity has a specific assessment rate. Not correctly applying these rates to the corresponding number of shipping containers can result in either an underpayment or an overpayment.

Omitting the subtotal and total: The form requires a subtotal of assessed amounts before calculating the total. Missing either of these calculations can invalidate the submission, as the Department needs these figures to ensure proper account settlement.

Neglecting to note “No Shipments”: In the event there were no shipments for the reporting period, explicitly stating “No Shipments Made” or “Nothing to Report” is mandatory. Failing to do so may lead the Department to believe the form was overlooked or forgotten.

Ignoring due date and penalty information: Submissions are due on the last day of the reporting month. Overlooking this deadline can incur penalties, hence, it's paramount to familiarize oneself with the penalty clauses detailed on the form’s reverse side to avoid late submissions.

Thorough attention to each part of the California 51-055A form ensures compliance with the Department of Food and Agriculture’s requirements. By avoiding these common mistakes, shippers can maintain a good standing and streamline their monthly reporting process.

Documents used along the form

When completing and submitting the California 51 055A form, various other documents are often required to ensure compliance and thorough reporting. These documents play a vital role in the process, each serving a specific purpose.

- Proof of Payment: This document is essential as it confirms the payment of the remittance. It acts as a receipt, showing that the shipper has made the required payment to the Department of Food and Agriculture. Keeping this document on file proves compliance with the payment requirements.

- Shipping and Receiving Records: These records detail the quantities and types of commodities shipped and received. They support the numbers reported on the 51 055A form and can be requested for verification purposes. Accurate and detailed records help prevent discrepancies and potential penalties.

- Annual Business License Renewal: In some cases, the company’s business license or registration with the Department of Food and Agriculture must be renewed annually. This document ensures that the business is legally allowed to operate and ship commodities within California.

- Organic Certification (if applicable): For shippers dealing with organic produce, an up-to-date organic certification is required. This document verifies that the commodities meet organic standards, and it may need to be presented alongside the 51 055A form.

Together, these documents complement the California 51 055A form, ensuring that all legal and regulatory requirements are met. By maintaining and submitting these documents as needed, shippers can avoid penalties and confirm their adherence to state guidelines.

Similar forms

The California Sales and Use Tax Return form is notably similar to the California 51 055A form because it also requires businesses to report and remit taxes collected, albeit on a broader scale. While the 51 055A form focuses on shippers within the fruit and vegetable industry, the Sales and Use Tax Return covers a wider array Sectors, reporting taxes collected on most goods and services sold or used within California. Both forms play a critical role in ensuring that businesses comply with state tax laws, contributing to the funding of statewide programs and services.

The California Quarterly Federal Excise Tax Return shares similarities with the 51 055A form as both are used for reporting purposes on a periodic basis. The key distinction is that the Federal Excise Tax Return addresses taxes on specific goods, services, and industries at the federal level. Similar to how shippers report and remit assessments on certain commodities using the 51 055A form, businesses involved in the sale of goods and services subject to federal excise tax must file and pay those taxes quarterly, underscoring their responsibility to both state and federal tax regulations.

Another document that bears resemblance to the 51 055A form is the California Employer’s Quarterly Contribution Return and Report of Wages. This form is designed for employers to report their employee's wages and calculate contributions to state unemployment insurance and employment training taxes. Like the 51 055A form, which collects specific commodity-related fees, this document facilitates the funding of unemployment and job training programs, emphasizing the employer's role in supporting state employment initiatives.

The California Commercial Fish Business License Fee and Fish Landing Tax Return are also aligned with the 51 055A form in function. Both require industry-specific reporting and fee remittance: the 51 055A for fruit and vegetable shippers, and the Fish Landing Tax Return for businesses involved in the commercial fishing industry. These documents ensure that businesses within their respective sectors contribute to state regulatory and support programs, directly linking industry activity to state income.

The California Alcohol Beverage Tax Return is similar to the 51 055A form by requiring businesses to report and remit taxes on a specific category of products. For the Alcohol Beverage Tax Return, the focus is on the distribution and sale of alcohol within the state, necessitating detailed reporting on the quantities sold to maintain compliance with state regulations. The parallel process of reporting and remittance between these forms highlights the state's commitment to monitoring and regulating industry-specific activities.

Last but not least, the California Tire Fee Return resembles the 51 055A form in its purpose and structure. It mandates retailers and businesses in the auto industry to report and pay fees associated with the sale of new tires. The intention behind both forms is to fund environmental and recycling programs. This commonality—sector-specific reporting leading to direct environmental or programmatic funding—showcases how different industries are engaged in supporting statewide efforts through structured fee or tax remittance processes.

Lastly, the Uniform Hazardous Waste Manifest is another document comparable to the 51 055A form because it involves detailed reporting requirements for businesses that handle hazardous waste. While the 51 055A form focuses on agricultural commodities, the Hazardous Waste Manifest ensures the safe and regulated transport and disposal of hazardous materials. Both forms are critical to state efforts in monitoring and managing industry-specific operations to safeguard public health and the environment, emphasizing regulatory compliance and accountability.

Dos and Don'ts

When completing the California 51 055A form, it's essential to follow guidelines that will ensure accurate and compliant reporting. Below are lists of things you should and shouldn't do while filling out this form.

What you should do:

- Ensure all company information is current. If any changes have occurred, check the box indicating that there has been a change.

- Accurately report the number of containers for each commodity shipped during the reporting month, including Valencia oranges, Navel oranges, lemons, and Mandarin citrus, following the specified rates.

- Calculate the assessment amounts correctly for each commodity and enter the subtotal and total accurately to avoid discrepancies.

- Submit the form and remittance payable to the Cashier at the Department of Food and Agriculture by the due date, which is the last day of the reporting month.

- If no shipments were made during the reporting period, clearly indicate "No Shipments Made" or "Nothing to Report" on the form to fulfill reporting obligations.

What you shouldn't do:

- Do not leave any fields blank. If a particular section does not apply, make sure to clearly indicate so by writing "N/A" or the appropriate indication that there were no shipments.

- Do not underestimate or overestimate the number of containers shipped. Report accurately to avoid penalties.

- Do not miss the submission deadline. Penalties for late submissions can include fees that accumulate over time.

- Do not send the remittance to an incorrect address. Double-check the address to ensure it is sent to the Cashier at the Department of Food and Agriculture, 1220 N Street, P.O. Box 942872, Sacramento, CA 94271-2872.

- Do not forget to sign and date the form. An unsigned form may be considered incomplete and could delay processing.

Misconceptions

Understanding the California 51 055A form is crucial for fruit and vegetable shippers in California. However, misconceptions about its purpose and requirements can lead to errors in compliance. Below are six common myths about this form, debunked to provide clearer guidance.

It's only for large-scale shippers: Some believe that the California 51 055A form is intended solely for large-scale or commercial shippers. In reality, any entity engaging in the shipment of fruit and vegetables, regardless of scale, is required to submit this report monthly. This ensures all shipments are properly documented and assessed, maintaining fairness in the industry.

Submission is optional if there are no shipments: A common misconception is that submission of the form is optional in months without shipments. Contrary to this belief, the form must be submitted every month, even if it is to report "No Shipments Made" or "Nothing to Report." This requirement helps maintain an accurate and continuous record of shipping activities.

Penalties are applied only for late submissions: While it's true that penalties can be applied for submitting the form late, this is not the only instance when fines may be imposed. Not reporting accurately or failing to submit the form entirely can also result in penalties. It's critical to understand that compliance involves both timeliness and accuracy.

Only citrus fruits need to be reported: Although the form mentions specific citrus fruits, such as Valencia oranges, lemons, and mandarins, it is a misinterpretation to think these are the only commodities that need reporting. The form is a general template, and all fruit and vegetable shipments should be reported, ensuring a complete account of all produce shipped within the specified period.

Updating company information on the form is unnecessary: Some shippers might assume that once their company information is on file, updating it on the form is unnecessary. However, it is crucial to check the box and update information if any company details have changed. This ensures that all communications and correspondences are sent to the correct address, preventing delays or misunderstandings.

The form is only about shipments within California: Another misunderstanding is that the form pertains only to shipments within the state of California. In fact, the form is required for all shipments, regardless of destination. This comprehensive approach aids in the state's efforts to monitor and regulate the fruit and vegetable industry effectively.

Dispelling these misconceptions about the California 51 055A form will help ensure that shippers remain compliant, avoiding unnecessary penalties and contributing to the state's agricultural economy's smooth operation. Accurate and timely submissions support a fair and well-regulated marketplace, benefiting everyone involved in the fruit and vegetable industry.

Key takeaways

Filling out and using the California 51-055A form correctly is crucial for fruit and vegetable shippers within the state. Here are the key takeaways to ensure accuracy and compliance:

- Always verify that the form’s version you are using is the most current, as indicated by the revision date (Rev. 07/07) in this case.

- Ensure that your company’s name, address, and contact information are up-to-date. If any information has changed, mark the designated checkbox on the form.

- Understand the importance of the registration number. This number uniquely identifies your business with the Department of Food and Agriculture.

- Remittances must be submitted monthly. The due date is the last day of the reporting month, making timely submissions crucial to avoid penalties.

- For each commodity shipped (e.g., Valencia Oranges, Navel Oranges, Lemons, Mandarin Citrus), accurately report the number of containers shipped and calculate the assessment amount based on the rates provided.

- Fill in the “Assessment Amount Subtotal,” “PENALTY” (if applicable), and “TOTAL” sections carefully to ensure the accurate calculation of your remittance due.

- If no shipments were made during the reporting period, it's mandatory to submit the form indicating "No Shipments Made" or "Nothing to Report" to remain in compliance.

- Be aware of the penalty information referenced in item #7 on the reverse side of the form. Understanding the consequences of late or inaccurate reporting can help avoid unnecessary fines.

Accurately filling out and timely submission of the California 51-055A form plays a vital role in maintaining compliance with the Department of Food and Agriculture's standards for fruit and vegetable shippers. Take the time to review your form for accuracy before submission to ensure all requirements are met.

Different PDF Templates

How Old Do You Have to Be to Buy Scratch Offs - By providing voluntary demographic information on the form, you assist the Lottery in conducting internal analyses to better understand player demographics.

Gun Permit California - Special provisions are included for U.S. Armed Forces members or their spouses, including expedited processing with proof of military service or assignment.

Policy Signature Page - A necessary step in document authentication, this certificate helps deter identity fraud in legal documentation.