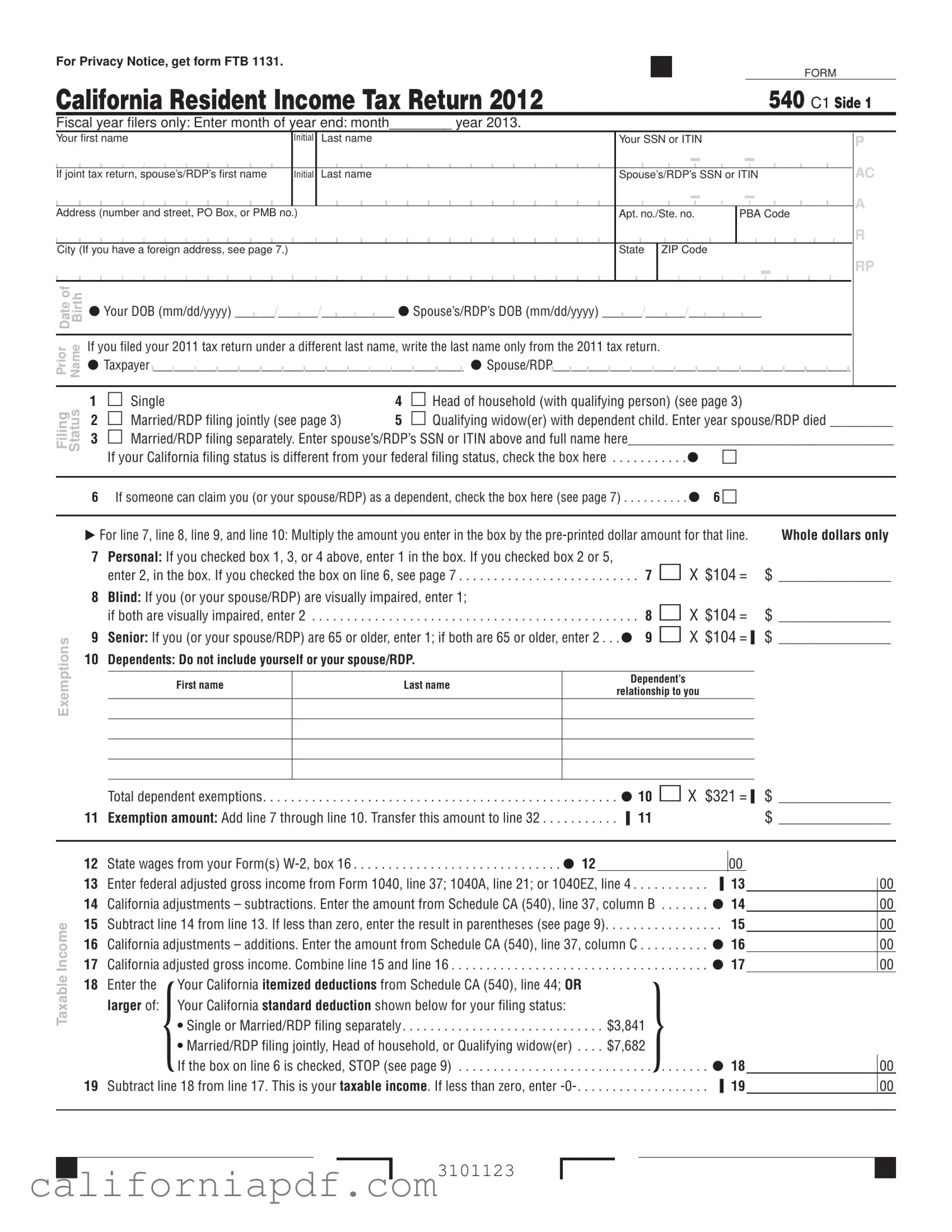

Fill a Valid California 540 C1 Form

The California 540 C1 form, integral for residents preparing their state tax returns, encapsulates a comprehensive picture of an individual’s fiscal year. Whether one is navigating through the specifics of personal and dependent exemptions that vary depending on filing status and visual impairments or aging, tackling the subtleties of taxable income adjustments, or deciphering the myriad credits — from nonrefundable child and dependent care expenses to newer job credits — this form offers a structured pathway for taxpayers. Noteworthy is the embrace of contributions towards societal cause, allowing taxpayers to earmark funds for numerous charitable efforts, alongside the critical calculations involving overpaid taxes, underpayments, and the option for applying refunds to future taxes or opting for a direct deposit. The underlying structure of the form demands attentive detail towards aggregates of state wages, adjustments influencing gross income, and the nuances of deductions, ensuring that the tax narrative each resident constructs is as accurate and advantageous as possible. Equally, provisions for addressing penalties, interest, and specific directives for payment encapsulate the form’s role as an indispensable tool in the yearly financial cycle, accentuating the necessity for a meticulous approach in its completion.

Document Example

For Privacy Notice, get form FTB 1131.

FORM

California Resident Income Tax Return 2012

540 C1 Side 1

Fiscal year filers only: Enter month of year end: month________ year 2013.

Your first name |

Initial |

Last name |

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

Initial |

Last name |

Spouse’s/RDP’s SSN or ITIN |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no./Ste. no. |

|

PBA Code |

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see page 7.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dateof Birth |

Your DOB (mm/dd/yyyy) ______/______/ |

|

___________ Spouse’s/RDP’s DOB (mm/dd/yyyy) ______/______/ |

|

___________ |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior Name |

If you filed your 2011 tax return under a different last name, write the last name only from the 2011 tax return. |

||||||||||||||||||||

Taxpayer |

|

|

|

_______________________________________________ |

|

|

|

Spouse/RDP |

|

|

|

_____________________________________________ |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

P

AC

A

R

RP

Filing Status

1 |

Single |

4 |

Head of household (with qualifying person) (see page 3) |

2 |

Married/RDP filing jointly (see page 3) |

5 |

Qualifying widow(er) with dependent child. Enter year spouse/RDP died _________ |

3 Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here______________________________________

If your California filing status is different from your federal filing status, check the box here |

|

|

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here (see page 7) |

6 |

|

|

Exemptions

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the |

Whole dollars only |

|

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked box 2 or 5, |

7 X $104 = |

|

enter 2, in the box. If you checked the box on line 6, see page 7 |

$ _________________ |

|

8Blind: If you (or your spouse/RDP) are visually impaired, enter 1;

|

if both are visually impaired, enter 2 |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . |

. . . 8 |

X $104 |

= |

|

$ _________________ |

|

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . |

9 |

X $104 |

=▐ |

$ _________________ |

||||

10 |

Dependents: Do not include yourself or your spouse/RDP. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

First name |

|

Last name |

|

Dependent’s |

|

|

|

|

|

|

|

relationship to you |

|

|

|

|||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income

|

Total dependent exemptions |

. . . . . |

. . . 10 X $321 =▐ |

$ _________________ |

|||||

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 . . . |

. . . . . |

. . . ▐ 11 |

|

|

|

$ _________________ |

||

12 |

State wages from your Form(s) |

12 |

|

|

|

|

|||

|

00 |

|

|

|

|||||

13 |

Enter federal adjusted gross income from Form 1040, line 37; 1040A, line 21; or 1040EZ, line 4 |

▐ 13 |

|

|

00 |

||||

|

|||||||||

14 |

California adjustments – subtractions. Enter the amount from Schedule CA (540), line 37, column B |

14 |

|

00 |

|||||

15 |

Subtract line 14 from line 13. If less than zero, enter the result in parentheses (see page 9) |

. . 15 |

|

|

00 |

||||

16 |

California adjustments – additions. Enter the amount from Schedule CA (540), line 37, column C |

16 |

|

|

00 |

||||

17 |

California adjusted gross income. Combine line 15 and line 16 |

. . . . . |

. . . . . . . . . . . . . . . . |

17 |

|

00 |

|||

18 |

Enter the |

Your California itemized deductions from Schedule CA (540), line 44; OR |

|

|

|

|

|

||

|

larger of: |

Your California standard deduction shown below for your filing status: |

|

|

|

|

|

||

•Single or Married/RDP filing separately |

$3,841 |

{ |

|

|

|

•Married/RDP filing jointly, Head of household, or Qualifying widow(er) . . . . |

$7,682 |

|

|

|

|

{If the box on line 6 is checked, STOP (see page 9) |

|

18 |

|

||

. . . . . . . |

|

00 |

|||

19 Subtract line 18 from line 17. This is your taxable income. If less than zero, enter |

. . . . . . . |

. . . . . . . . |

▐ 19 |

|

00 |

3101123

Your name: __________________________________ Your SSN or ITIN: ____________________________

|

|

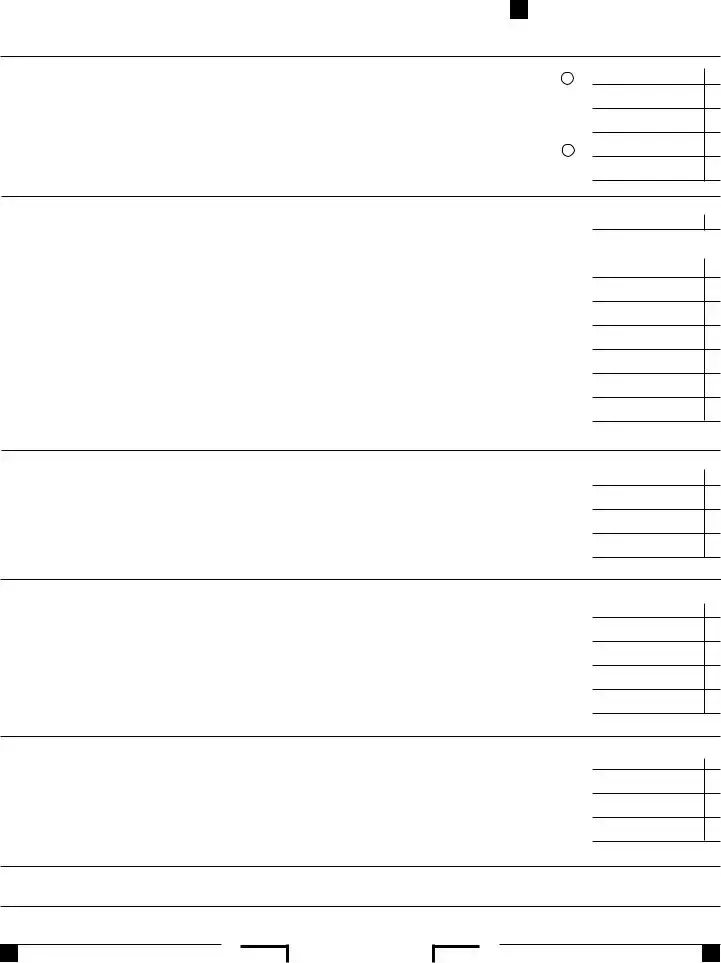

31 |

Tax. Check the box if from: Tax Table |

Tax Rate Schedule |

FTB 3800 FTB 3803 |

|

. . |

31 |

|||

|

|

32 |

Exemption credits. Enter the amount from line 11. If your federal AGI is more than $169,730 (see page 10) . . |

▐ |

32 |

||||||

Tax |

|

33 |

Subtract line 32 from line 31. If less than zero, enter |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

33 |

||

|

|

34 |

Tax (see page 11). Check the box if from: |

Schedule |

|

. . |

34 |

||||

|

|

35 |

Add line 33 and line 34 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

35 |

|

|

|

40 |

Nonrefundable Child and Dependent Care Expenses Credit (see page 11). Attach form FTB 3506 |

|

. . |

40 |

|||||

|

|

41 |

New jobs credit, amount generated (see page 11) |

41 |

|

|

|

|

|||

|

|

|

00 |

|

|

||||||

Credits |

|

42 |

. . . . . . . . . . . . . . . . .New jobs credit, amount claimed (see page 11) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

42 |

|||

|

43 |

Enter credit name▐_______________________________code number________ and amount |

|

|

43 |

||||||

|

|

|

. . |

||||||||

Special |

|

44 |

Enter credit name▐_______________________________code number________ and amount |

|

. . |

44 |

|||||

|

45 |

To claim more than two credits (see page 12). Attach Schedule P (540) |

|

|

45 |

||||||

|

|

|

. . |

||||||||

|

|

46 |

Nonrefundable renter’s credit (see page 12) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

46 |

||

|

|

47 |

Add line 40 and line 42 through line 46. These are your total credits . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

47 |

||

|

|

48 |

Subtract line 47 from line 35. If less than zero, enter |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

48 |

||

Taxes |

|

61 |

Alternative minimum tax. Attach Schedule P (540) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

61 |

|||

|

62 |

Mental Health Services Tax (see page 13) . |

|

|

|

|

|

|

62 |

||

Other |

|

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

|||||

|

63 |

Other taxes and credit recapture (see page 13) |

|

|

|

|

|

63 |

|||

|

|

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

||||||

|

|

64 |

Add line 48, line 61, line 62, and line 63. This is your total tax |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

64 |

|||

|

|

71 |

California income tax withheld (see page 13) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

71 |

|||

Payments |

|

72 |

2012 CA estimated tax and other payments (see page 13) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

72 |

|||

|

73 |

Real estate and other withholding (see page 13) |

|

|

|

|

|

73 |

|||

|

|

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

||||||

|

|

74 |

Excess SDI (or VPDI) withheld (see page 13) |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

74 |

|||

|

|

75 |

Add line 71, line 72, line 73, and line 74. These are your total payments (see page 14) |

|

. . |

▐ |

75 |

||||

OverpaidTax/ |

TaxDue |

91 |

Overpaid tax. If line 75 is more than line 64, subtract line 64 from line 75 |

|

. . |

▐ |

91 |

||||

94 |

Tax due. If line 75 is less than line 64, subtract line 75 from line 64. . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

▐ |

94 |

||||

|

|

92 |

Amount of line 91 you want applied to your |

2013 estimated tax . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

|

92 |

|

|

|

93 |

Overpaid tax available this year. Subtract line 92 from line 91 |

. . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . |

93 |

|||

Use |

Tax |

95 |

Use Tax. This is not a total line (see page 14) |

. . . . . . 95 |

|

|

00 |

|

|

||

|

|

|

|||||||||

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Side 2 Form 540 C1 2012

3102123

Your name: __________________________________ Your SSN or ITIN: ____________________________

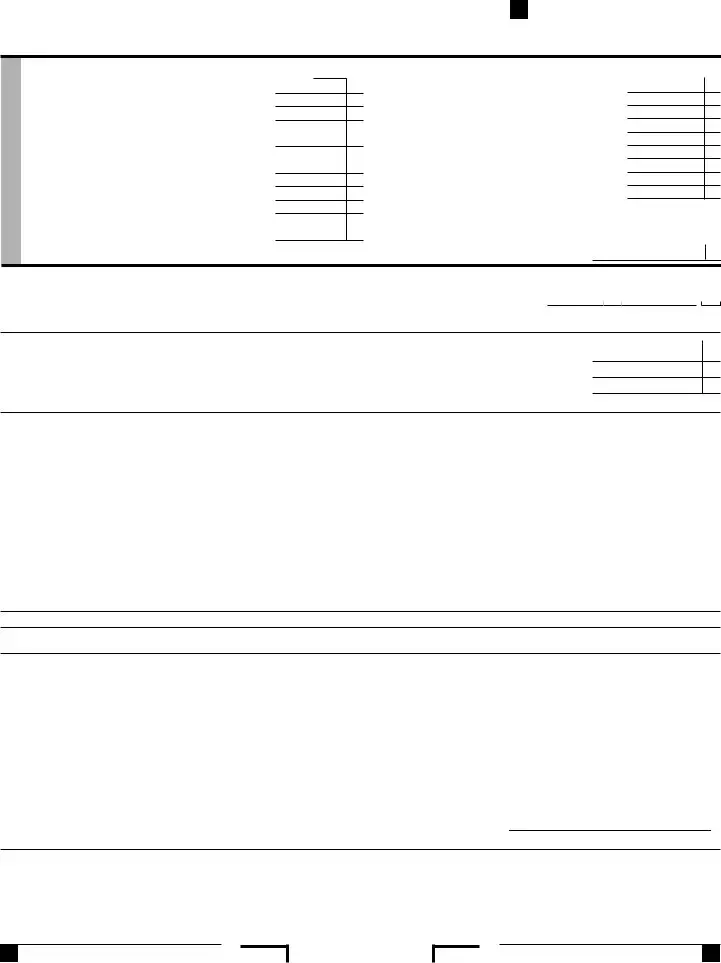

Contributions

|

Code |

Amount |

California Seniors Special Fund (see page 23) . . . |

. 400 |

00 |

Alzheimer’s Disease/Related Disorders Fund . . . . |

. 401 |

00 |

California Fund for Senior Citizens |

. 402 |

00 |

Rare and Endangered Species |

|

|

Preservation Program |

. 403 |

00 |

State Children’s Trust Fund for the Prevention |

|

|

of Child Abuse |

. 404 |

00 |

California Breast Cancer Research Fund |

. 405 |

00 |

California Firefighters’ Memorial Fund |

. 406 |

00 |

Emergency Food for Families Fund |

. 407 |

00 |

California Peace Officer Memorial |

|

|

Foundation Fund |

. 408 |

00 |

Code

California Sea Otter Fund . . . . . . . . . . . . . . . . . . . . 410 Municipal Shelter

Amount

00

00

00

00

00

00

00

00

00

110 Add code 400 through code 423. This is your total contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

00

Amount |

YouOwe |

|

Pay online – Go to ftb.ca.gov for more information. |

|

|

|

|

|

|

|

111 |

AMOUNT YOU OWE. Add line 94, line 95, and line 110 (see page 15). Do not send cash. |

111 |

|

|

|

|

andInterest |

Penalties |

. . . . . . . . . .Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

|

|

|

, |

||

Interest, late return penalties, and late payment penalties |

|

|

|

|

|

|||

|

|

112 |

112. . . . |

|||||

|

|

113 |

Underpayment of estimated tax. Check the box: FTB 5805 attached FTB 5805F attached |

. . . . . |

|

. . 113 |

||

|

|

114 |

Total amount due (see page 17). Enclose, but do not staple, any payment |

114. . . . |

||||

,

. 00

. 00

00

00

00

Refund and Direct Deposit

115REFUND OR NO AMOUNT DUE. Subtract line 95 and line 110 from line 93 (see page 17).

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

115 |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

. |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip (see page 17). Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Checking

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|

|

|

|

Routing number |

|

|

|

|

|

|

|

Type |

|

Account number |

|

|

116 Direct deposit amount |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below:

Checking

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|

|

|

Routing number |

|

|

|

|

|

|

|

Type |

|

Account number |

|

|

117 Direct deposit amount |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Sign Here

Your signature |

Spouse’s/RDP’s signature |

Daytime phone number (optional) |

||||||||||||||||||||||||||||||||||||||

|

(if a joint tax return, both must sign) |

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your email address (optional). Enter only one email address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

It is unlawful to forge a spouse’s/RDP’s signature.

Joint tax return? (see page 17)

|

|

|

|||||||||||||||||||

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge) |

PTIN |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

Firm’s address |

FEIN |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? (see page 17) . . . . . . . . . Yes No

__________________________________________________________________ |

( |

) |

Print Third Party Designee’s Name |

Telephone Number |

|

3103123

Form 540 C1 2012 Side 3

Form Breakdown

| Fact | Description |

|---|---|

| Form Designation | California Resident Income Tax Return 540 C1 |

| Tax Year | 2012, with provisions for fiscal year filers into 2013 |

| Applicability | For individuals who are California residents |

| Filing Status Options | Includes single, married/RDP filing jointly, married/RDP filing separately, head of household, and qualifying widow(er) |

| Exemptions | Personal, Blind, Senior, and Dependents with specific multipliers for each category |

| Income Reporting | Requires state wages, federal adjusted gross income, and California adjustments |

| Deductions and Credits | Includes standard/itemized deductions, exemption credits, and various other tax credits |

| Special Taxes and Credits | Covers alternative minimum tax, mental health services tax, and others |

| Governing Law | Administered under the California Revenue and Taxation Code |

How to Write California 540 C1

When it comes time to complete the California 540 C1 form, it's important to approach the process with patience and attention to detail. The 540 C1 is an essential document for California residents filing their state income tax return, ensuring accurate tax calculations and compliance with state laws. Below, you will find a step-by-step guide designed to assist you through filling out this form correctly. The goal is to provide clarity and simplify what might seem like a daunting task, making it more manageable for taxpayers to fulfill their obligations.

- Begin with your personal information, including your full name, social security number (SSN) or individual taxpayer identification number (ITIN), and address. Don't forget to include your apartment or suite number if applicable.

- If filing a joint tax return, provide your spouse’s/RDP's (Registered Domestic Partner's) first name, initial, and last name along with their SSN or ITIN.

- Enter your date of birth (DOB) and, if filing jointly, your spouse's/RDP's DOB in the format mm/dd/yyyy.

- For those who have changed their last name since their last tax filing, remember to list the last name used on your 2011 tax return.

- Choose your filing status by checking the appropriate box that applies to you.

- Determine the number of exemptions you are claiming: personal, blind, senior, and dependent exemptions, and multiply each by the pre-printed dollar amount, entering the resulting figures in the designated boxes.

- Report your income starting with state wages listed on your Form(s) W-2, box 16. Proceed to enter your federal adjusted gross income and make any necessary adjustments for California-specific income and deductions.

- Calculate your California adjusted gross income by subtracting any subtractions and adding any additions listed in the respective sections of the form.

- Choose between itemized deductions and the California standard deduction for your filing status, entering the larger amount. Subtract this figure from your California adjusted gross income to find your taxable income.

- Follow the instructions to calculate your tax, exemption credits, and total credits. Remember to check the applicable boxes for your sources of tax calculation.

- If applicable, fill out sections related to nonrefundable child and dependent care expenses credit, new jobs credit, and various other credits, adding these to your total credits.

- Calculate any other taxes owed, such as Alternative Minimum Tax or Mental Health Services Tax, and include any payments made via withholding or estimated tax payments.

- Decide how you want to apply any overpaid tax and calculate the amount due or refund owed. If you expect a refund, you can authorize direct deposit by providing your bank account details.

- On side 2 of the form, if you wish to make contributions to California funds, list each contribution with its corresponding code and amount.

- Total the amounts you owe, factoring in any underpayment of estimated tax, late return penalties, and interest if applicable.

- Review the final total amount due or your refund, and if authorizing a direct deposit, ensure the correct routing and account numbers are provided for one or two accounts.

- Sign and date the form. If you're filing jointly, your spouse/RDP must also sign. Provide a daytime phone number and email address for any follow-up correspondence.

- If a tax professional prepared your return, they should also sign and include their Preparer Tax Identification Number (PTIN).

- Lastly, decide if you want to allow a third party to discuss this return with the tax authorities by filling in the designated section with their name and telephone number.

Completing the California 540 C1 form with care ensures your tax responsibilities are met accurately and on time. Double-check the information provided to avoid common errors, and consult the instructions or a tax professional if you encounter difficulties. Remember, this process is about ensuring that you comply with state tax laws and contribute to the public goods and services that benefit all Californians.

Listed Questions and Answers

What is the purpose of the California 540 C1 form?

The California 540 C1 form is the primary income tax return form for California residents. Its purpose is to report all taxable income earned during the tax year and calculate the amount of state tax owed or the refund due from the state. Through this form, filers can claim exemptions, deductions, and credits to potentially lower their tax liability or increase their refund.

Who is required to file the California 540 C1 form?

Generally, any California resident who has earned income during the tax year and meets certain income thresholds is required to file a Form 540 C1. This includes individuals who earned income from wages, salaries, self-employment, investments, property, and other taxable sources. Additionally, if you have any other filing requirements as specified by the California Franchise Tax Board or if you owe any special taxes or have to claim certain credits, you might also need to file this form.

What information do I need to fill out the California 540 C1 form?

To accurately complete the California 540 C1 form, you will need:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Information about your income, such as wages (from W-2 forms), self-employment income, dividends, and interest

- Details of any deductions you plan to claim, such as for education expenses, health savings account (HSA) contributions, or student loan interest

- Information about any tax credits you’re eligible for, such as the Child and Dependent Care Expenses Credit or the Renters' Credit

- Your bank account information for direct deposit if you expect a refund

How can I submit the California 540 C1 form?

The California 540 C1 form can be submitted either electronically through the California Franchise Tax Board's website or via mail. If opting for electronic submission, you can use the Franchise Tax Board’s CalFile system or approved third-party software. For paper filing, you should mail your completed form to the address specified by the Franchise Tax Board. Whether filing electronically or by mail, it is important to ensure that your return is submitted by the deadline to avoid potential penalties and interest.

Common mistakes

When filling out the California 540 C1 form, individuals often encounter a variety of mistakes. Recognizing and avoiding these common errors can streamline the filing process, ensuring accuracy and potentially avoiding delays or issues with tax returns. Here's a compiled list of such missteps:

Not updating personal information, including changes in address or last name, which can lead to misdirected or lost correspondence from the tax authority.

Incorrectly filling in the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for oneself or a spouse/RDP (Registered Domestic Partner), leading to processing delays.

Choosing the wrong filing status or not understanding the implications of each option, which can affect tax liability and potential deductions.

Failing to report all sources of income, such as not including state wages from Form(s) W-2, which can result in underreporting income.

Mistakes in arithmetic or transferring amounts from schedules, especially when calculating adjusted gross income or deductions, can directly impact the tax calculation.

Overlooking potential credits and deductions, such as the Nonrefundable Child and Dependent Care Expenses Credit. Not claiming eligible credits can result in higher tax due.

Missing signatures, which are required to validate the tax return. An unsigned tax return is considered invalid and will not be processed.

Incorrect direct deposit information for refunds, which can delay or misdirect the refund process.

Failure to attach required documents, such as a copy of the federal tax return when necessary, can lead to processing delays.

Being mindful of these common mistakes can contribute to a smoother filing experience. Additionally, it's recommended to review the form thoroughly before submission and consult the instructions or a tax professional if there are uncertainties.

Documents used along the form

When filing the California 540 C1 form, a California Resident Income Tax Return, there are several additional forms and documents that you may need to include or consider. These documents serve to provide further information, claim specific credits, or adjust income and deductions on your tax return. Understanding each form's purpose will ensure a thorough and accurate filing process.

- Form FTB 3506: Used to claim the Child and Dependent Care Expenses Credit. This is beneficial for taxpayers who have incurred expenses for the care of qualifying individuals while they work or search for work.

- Schedule CA (540): Adjustments for California income, deductions, and credits. It's where you reconcile differences between your federal and California tax situations.

- Schedule P (540): Alternative Minimum Tax and Credit Limitations. This schedule is used if you are subject to the alternative minimum tax (AMT) in California.

- Form FTB 3800: Tax Computation for Certain Children with Unearned Income. This applies if you're reporting income on behalf of a child.

- Form FTB 3803: Parents’ Election to Report Child’s Interest and Dividends. Parents use this form to report their child's income on their own return.

- FTB 1131: Privacy Notice – For individuals to understand the privacy practices and policies before submitting personal information.

- Form FTB 5805: Underpayment of Estimated Tax by Individuals and Fiduciaries. This form helps calculate penalties if you did not pay enough taxes throughout the year through withholding or estimated tax payments.

- FTB 3519: Payment for Automatic Extension for Individuals. If you're filing for an extension on your tax return, this form accompanies your payment of estimated taxes due.

- Form FTB 5870A: Tax on Lump-Sum Distributions. For those who received a lump-sum distribution and choose to compute the tax using the special averaging method allowed under California law.

- Form FTB 3526: Investment Interest Expense Deduction. This is used if you're claiming a deduction for investment interest expenses.

Each of these forms addresses specific circumstances that may affect your tax liability or refund. Making sure you use the correct forms in conjunction with your California 540 C1 tax return will help streamline the processing of your taxes and potentially lead to better outcomes in your tax responsibilities and benefits. Always consult with a tax professional or visit the FTB website for more detailed information and instructions tailored to your situation.

Similar forms

The U.S. Federal 1040 Form, serving as the standard federal individual income tax return, shares notable similarities with California's 540 C1 Form. Both require detailed personal information, including Social Security Numbers (SSNs) for the taxpayer and spouse, if applicable, along with income and deduction information to calculate taxes owed or refunds due. Additionally, adjustments are taken into account to determine the adjusted gross income, which directly influences the taxable income calculation on both forms.

The 540 Schedule CA is a state-specific document complementary to the 540 C1 Form, designed to adjust the federal adjusted gross income and itemized deductions to meet California's tax codes. This adjustment process mirrors the relationship between the Federal 1040 Form and its schedules, where income and deductions may be modified based on state-specific tax laws, ensuring taxpayers' income is accurately reported after state-specific additions or subtractions.

Form W-2, the Wage and Tax Statement, provides the foundation for data entered on both the 540 C1 and Federal 1040 Forms. It outlines the tax withheld and wages earned by an employee. This critical information from the W-2 is directly used to fill in line items concerning state wages and income tax withheld, bridging employee earnings documentation with individual tax return filings.

The 540 Schedule CA (540), which serves as a detailed record of adjustments to federal income and deductions for Californian taxpayers, finds a counterpart in Schedule A of the Federal 1040 Form, where taxpayers itemize deductions. Both schedules are essential for taxpayers who opt to itemize, allowing them to deduct specific expenses like medical, charitable contributions, and mortgage interest, adjusting gross income subject to taxation.

Form FTB 3506, Child and Dependent Care Expenses Credit for California residents, is directly related to the federal Form 2441. Both are designed to provide tax credits to taxpayers who incur expenses for the care of a qualifying individual, to allow them to work or actively look for work. These forms calculate the allowable credit to be applied against the income tax owed, providing a mechanism for reducing tax liability based on childcare costs.

The Form 1099 series, which reports various types of income outside of wages, such as dividends, interest, and independent contractor income, is crucial for completing both the 540 C1 and Federal 1040 Forms. This information impacts the income reporting on both state and federal levels, underscoring the interconnected nature of tax documentation where multiple forms of income are subject to taxation.

Lastly, the FTB 3800 Form, used by Californians to calculate the minimum franchise tax for corporations, shares a foundational relationship with the corporate aspects of federal tax return preparations, specifically Form 1120 for corporations. While serving different entities – one for individual taxpayers and the other for corporations – both forms reflect the principle that tax calculations must be adjusted for specific financial situations, be it for an individual or a corporate entity, ensuring the right amount of tax is computed and subsequently paid.

Dos and Don'ts

When filling out the California 540 C1 form, there are several things you should and shouldn't do to ensure accuracy and compliance with the tax laws. This guidance helps to navigate common pitfalls and streamline the process of completing your tax return.

Things You Should Do- Double-check your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as your spouse’s/RDP’s (Registered Domestic Partner's) details if it's a joint return. Incorrect numbers can lead to processing delays.

- Accurately report income, deductions, credits, and payments. This includes wages from Form W-2 and federal adjusted gross income from Form 1040 or equivalent form.

- Take advantage of the California adjustments to income, if applicable, which can include adjustments for subtractions and additions based on state-specific tax laws.

- Claim all the exemptions you are entitled to, such as personal, blind, senior, and dependent exemptions, as these can significantly reduce your taxable income.

- Ensure to choose the correct filing status. Your filing status affects your tax rates, standard deductions, and eligibility for certain credits.

- Review the instructions for each line carefully. This includes looking up the correct figures to input for exemptions and deductions.

- Sign and date the form. An unsigned tax return is like an unsigned check – it’s not valid.

- Leave any fields blank that apply to you. If a specific section does not apply, ensure to put “0” or “N/A”, as leaving spaces blank can be misleading.

- Misreport your income or tax withholding amounts. Deliberate underreporting can lead to penalties and interest charges.

- Forget to attach the required documentation, such as W-2s and any schedules that supplement your tax return.

- Overlook the direct deposit section if you’re expecting a refund. By providing your banking information, you can receive your refund faster.

- Ignore the Use Tax obligation. Review the instructions related to reporting and paying use tax on out-of-state purchases.

- Attempt to claim credits or deductions you are not eligible for. This can delay processing and trigger an audit.

- Send your tax return to the wrong address. The California 540 C1 form has specific filing addresses depending on whether you are making a payment or not.

By following these do's and don'ts, you can fill out the California 540 C1 form accurately and efficiently, helping to ensure that your tax return is processed smoothly and you receive any refund due without unnecessary delay.

Misconceptions

When it comes to filling out tax forms, it's easy to get tangled in a web of confusion. The California 540 C1 form, or the California Resident Income Tax Return, is no exception. Let's clear up four common misconceptions to help make this process a bit smoother.

- Only for traditional employees: One common misconception is that the Form 540 is solely for individuals who receive a traditional W-2. In reality, it serves a broader audience, including freelancers, independent contractors, and others who have income to report in California. If you have income from various sources, including out-of-state, you may need to report it on this form, taking care to include any adjustments.

- Filing status must match federal return: Another misunderstanding is that your filing status on the California 540 C1 form must match what you chose on your federal return. While many taxpayers do maintain consistency between state and federal filings for simplicity, California offers flexibility. For example, due to differing recognition of relationships or dependents, your California filing status might differ to optimize your tax benefits.

- Deductions and credits are the same as federal: Taxpayers often expect state deductions and credits to mirror the federal ones closely. While there is overlap, California has unique deductions and credits not available federally and vice versa. Carefully review state-specific opportunities, such as the California standard deduction or the renter's credit, which may not have federal counterparts.

- Direct deposit only for refunds: Many believe that direct deposit is an option solely for those expecting a refund. However, the form provides space to authorize direct deposit for refund amounts into one or two accounts, indicating flexibility in processing payments and refunds. Hence, if you're arranging your transactions, you can specify how you wish to receive or allocate your funds.

Understanding these nuances of the California 540 C1 can make a significant difference in the tax filing experience, potentially leading to better outcomes and less stress. Whether dealing with deductions, filing status, or income types, always double-check the specifics to leverage the best possible tax situation for your circumstances.

Key takeaways

Filling out the California 540 C1 form, the state tax return form for residents, requires careful attention to detail and accuracy. Here are seven key takeaways to consider:

- Ensure you have the correct tax year form, as the California 540 C1 form is year-specific. This will prevent any processing delays or issues arising from submitting outdated forms.

- Accurately report your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), along with your spouse's/RDP's (Registered Domestic Partner) if filing jointly. Mistakes here can lead to significant delays in processing your return.

- Choose your filing status correctly, as it affects the tax rates applicable to you. The form offers options such as Single, Married/RDP filing jointly, Head of household, etc., and each has its eligibility criteria.

- Claim exemptions carefully, including personal, blind, senior, and dependent exemptions. These exemptions reduce your taxable income, potentially lowering the overall tax liability.

- Enter your income accurately, including state wages and federal adjusted gross income, as these figures play pivotal roles in calculating your tax due or refund.

- Understand the deductions and credits available to you, such as the standard deduction, itemized deductions, and various credits like nonrefundable child and dependent care expenses, which can further reduce your tax liability.

- Review the tax calculation section thoroughly, including tax, exemption credits, and total credits to ensure your tax due or refund is correctly calculated. Also, don’t overlook the use tax obligation - this often-missed section relates to purchases from out-of-state vendors.

Additionally, the form features sections for direct deposit, which speeds up refunds, and various contributions to charitable programs that you can opt into during filing. A section at the end of the form allows for the designation of a third party to discuss the return with tax officials, providing an extra level of convenience and reassurance. Lastly, verify all information before signing the declaration under penalties of perjury to affirm its accuracy and completeness. This final step is crucial as any inaccuracy could be subject to legal action.

Different PDF Templates

Get Drivers License Online - Ensure your California ID Card renewal goes smoothly by understanding the by-mail process.

Ca Form 100w - The inclusion of the controlled group's FEIN, when available, assists in the accurate association of the election with the correct entity or entities.