Fill a Valid California 540 Schedule P Form

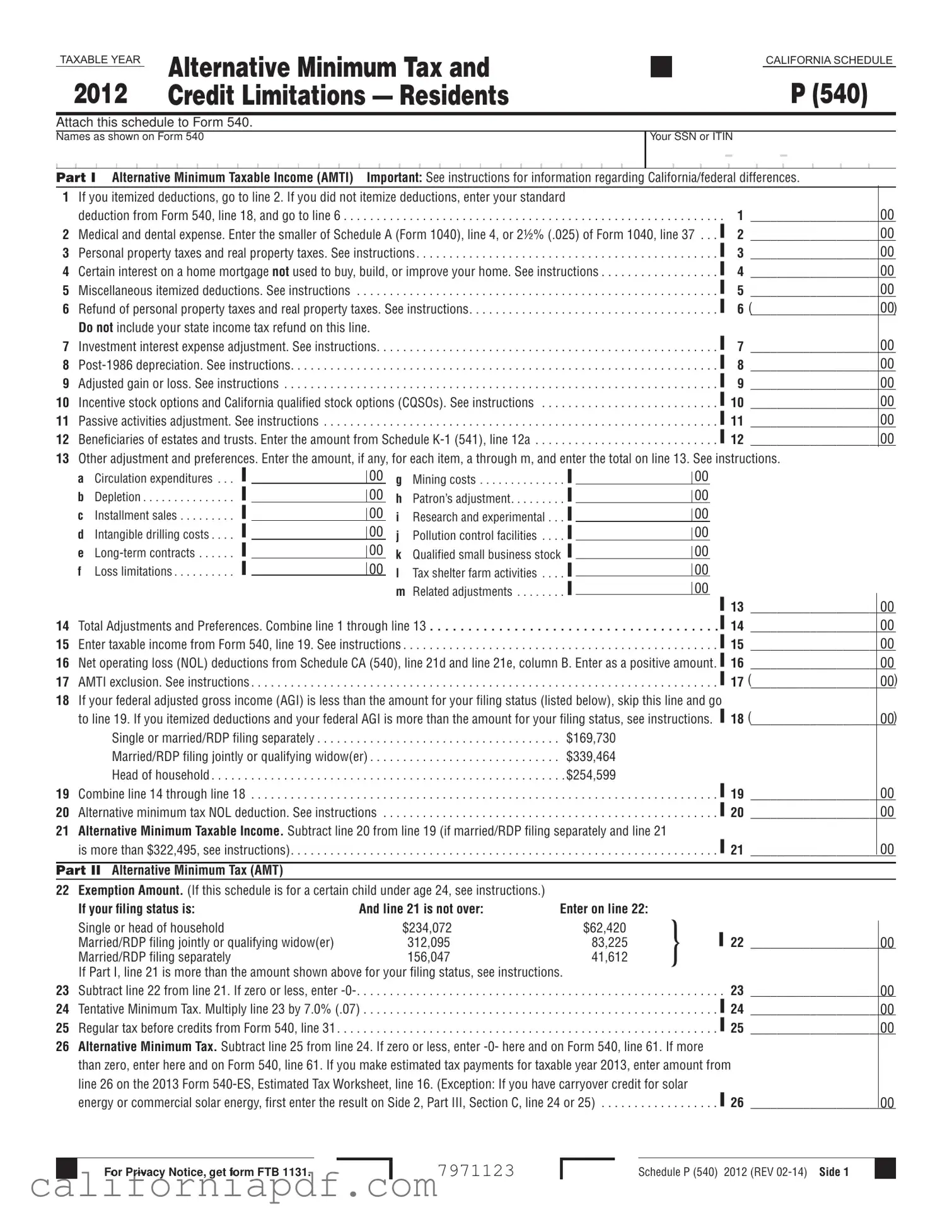

In the realm of tax preparation, California residents may encounter a suite of documentation essential in computing and submitting the correct amount of taxes due to the state. Among these, the California 540 Schedule P form is particularly noteworthy for its specific application to situations involving the Alternative Minimum Tax (AMT) and the intricate world of tax credit limitations. Primarily, this form accompanies the main Form 540 and takes center stage when elucidating adjustments and preferences that might affect an individual's AMT – a parallel tax system designed to ensure that taxpayers with significant deductions and credits pay at least a minimum amount of tax. The 540 Schedule P intricately details various adjustments relating to items such as medical expenses, personal and real property taxes, interest, depreciation, stock options, and miscellaneous itemized deductions, among others. Furthermore, it lays out the calculation of the AMT, from determining the Alternative Minimum Taxable Income (AMTI) to applying exemption amounts and calculating the tentative minimum tax and, eventually, the AMT itself if applicable. Another layer of complexity is added with Part III of the form, guiding taxpayers on utilizing various tax credits to reduce their taxable amount, potentially including but not limited to credits for solar energy investments, dependent care, and prior year AMT credit. Astutely managing these calculations is crucial for taxpayers endeavoring to navigate their fiscal responsibilities while availing themselves of permissible reliefs and avoiding common pitfalls in tax computation and submission.

Document Example

TAXABLE YEAR |

ALTERNATIVE MINIMUM TAX AND |

|

CALIFORNIA SCHEDULE |

|

|

|

|

2012 |

CREDIT LIMITATIONS — RESIDENTS |

|

P (540) |

ATTACH THIS SCHEDULE TO FORM 540.

NAMES AS SHOWN ON FORM 540

YOUR SSN OR ITIN

- -

PART I Alternative Minimum Taxable Income (AMTI) Important: See instructions for information regarding California/federal differences.

1If you itemized deductions, go to line 2. If you did not itemize deductions, enter your standard

|

deduction from Form 540, line 18, and go to line 6 |

.▌ |

1 |

|

2 |

Medical and dental expense. Enter the smaller of Schedule A (Form 1040), line 4, or 2½% (.025) of Form 1040, line 37 . . . |

2 |

|

|

3 |

Personal property taxes and real property taxes. See instructions |

▌ |

3 |

|

4 |

Certain interest on a home mortgage not used to buy, build, or improve your home. See instructions |

▌ |

4 |

|

5 |

Miscellaneous itemized deductions. See instructions |

▌ |

5 |

|

6 |

Refund of personal property taxes and real property taxes. See instructions |

▌ |

6 |

( |

|

Do not include your state income tax refund on this line. |

▌ |

|

|

7 |

Investment interest expense adjustment. See instructions |

7 |

|

|

8 |

▌ |

8 |

|

|

9 |

Adjusted gain or loss. See instructions |

▌ |

9 |

|

10 |

Incentive stock options and California qualified stock options (CQSOs). See instructions |

▌ 10 |

|

|

11 |

Passive activities adjustment. See instructions |

▌ 11 |

|

|

12 |

Beneficiaries of estates and trusts. Enter the amount from Schedule |

▌ 12 |

|

|

13Other adjustment and preferences. Enter the amount, if any, for each item, a through m, and enter the total on line 13. See instructions.

a |

Circulation expenditures |

▐ |

|

|

00 |

g |

Mining costs |

▐ |

|

|

00 |

|

|

|

|

|

|||||||||

b |

Depletion |

▐ |

|

|

00 |

h |

Patron’s adjustment |

▐ |

|

|

00 |

|

|

|

|

|

|||||||||

c |

Installment sales |

▐ |

|

|

00 |

i |

Research and experimental |

▐ |

|

|

00 |

|

|

|

|

|

|||||||||

d |

Intangible drilling costs . |

▐ |

|

|

00 |

j |

Pollution control facilities . |

▐ |

|

|

00 |

|

|

|

|

|

|||||||||

e |

▐ |

|

|

00 |

k |

Qualified small business stock ▐ |

|

|

00 |

|

||

|

|

|

|

|||||||||

f |

Loss limitations |

▐ |

|

|

00 |

l |

Tax shelter farm activities . |

▐ |

|

|

|

|

|

|

|

|

00 |

|

|||||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

m Related adjustments |

▐ |

|

▐ 13 |

|||

|

|

|

|

|

|

|

|

00 |

||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Total Adjustments and Preferences. Combine line 1 through line 13 |

. . . . . . . . . . . . . . . . |

. . |

. ▌ 14 |

|||||||||

15 Enter taxable income from Form 540, line 19. See instructions . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . . |

. ▌ 15 |

||||||||

16Net operating loss (NOL) deductions from Schedule CA (540), line 21d and line 21e, column B. Enter as a positive amount. ▌ 16

17 AMTI exclusion. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▌ 17 (

18If your federal adjusted gross income (AGI) is less than the amount for your filing status (listed below), skip this line and go

to line 19. If you itemized deductions and your federal AGI is more than the amount for your filing status, see instructions. ▌ 18 (

|

Single or married/RDP filing separately |

$169,730 |

|

Married/RDP filing jointly or qualifying widow(er) |

$339,464 |

|

Head of household |

$254,599 |

19 |

Combine line 14 through line 18 |

. . . . . . . . . . . . . . . . . . . . . . . ▌ 19 |

20 |

Alternative minimum tax NOL deduction. See instructions |

. . . . . . . . . . . . . . . . . . . . . . . ▌ 20 |

21Alternative Minimum Taxable Income. Subtract line 20 from line 19 (if married/RDP filing separately and line 21

is more than $322,495, see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART II Alternative Minimum Tax (AMT)

22Exemption Amount. (If this schedule is for a certain child under age 24, see instructions.)

|

If your filing status is: |

And line 21 is not over: |

Enter on line 22: |

|

|

|

Single or head of household |

$234,072 |

$62,420 |

} |

▌ 22 |

|

Married/RDP filing jointly or qualifying widow(er) |

312,095 |

83,225 |

||

|

Married/RDP filing separately |

156,047 |

41,612 |

|

|

|

If Part I, line 21 is more than the amount shown above for your filing status, see instructions. |

|

|

||

23 |

Subtract line 22 from line 21. If zero or less, enter |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . |

. 23 |

24 |

Tentative Minimum Tax. Multiply line 23 by 7.0% (.07) |

. . . . . . . . . . . . . . . . . |

. . . . . . . |

▌ 24 |

|

25 |

Regular tax before credits from Form 540, line 31 . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . |

▌ 25 |

26Alternative Minimum Tax. Subtract line 25 from line 24. If zero or less, enter

than zero, enter here and on Form 540, line 61. If you make estimated tax payments for taxable year 2013, enter amount from line 26 on the 2013 Form

energy or commercial solar energy, first enter the result on Side 2, Part III, Section C, line 24 or 25) . . . . . . . . . . . . . . . . . . ▌ 26

00

00

00

00

00

00)

00

00

00

00

00

00

00

00

00

00

00)

00)

00

00

00

00

00

00

00

00

For Privacy Notice, get form FTB 1131.

7971123

Schedule P (540) 2012 (REV

PART III Credits that Reduce Tax Note: Be sure to attach your credit forms to Form 540.

1 |

Enter the amount from Form 540, line 35 |

|

|

|

1 |

|

|

00 |

. . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

2 |

Enter the tentative minimum tax from Side 1, Part II, line 24 |

. . . . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

2. |

|

|

00 |

|

|

|

|

|||||

|

|

|

(a) |

(b) |

(c) |

(d) |

||

|

|

|

Credit |

Credit used |

Tax balance that |

Credit |

||

SECTION A – Credits that reduce excess tax. |

|

amount |

this year |

may be offset |

carryover |

|||

|

|

|

by credits |

|

|

|

||

3 |

Subtract line 2 from line 1. If zero or less enter |

|

|

|

|

|

|

|

|

This is your excess tax which may be offset by credits |

3 |

|

|

|

|

|

|

A1 Credits that reduce excess tax and have no carryover provisions. |

|

|

|

|

|

|

|

|

4 |

Code: 162 Prison inmate labor credit (FTB 3507) |

4 |

|

|

|

|

|

|

5 |

Code: 169 Enterprise zone employee credit (FTB 3553) |

5 |

|

|

|

|

|

|

6 |

Code: ____ ____ ____ New Home Credit or First Time Buyer Credit |

6 |

|

|

|

|

|

|

7 |

Code: 232 Child and dependent care expenses credit (FTB 3506) |

7 |

|

|

|

|

|

|

A2 Credits that reduce excess tax and have carryover provisions. See instructions. |

|

|

|

|

▌ |

|||

8 |

Code: ▌____ ____ ____ Credit Name: |

8 |

|

|

|

|||

9 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code: ▌____ ____ ____ Credit Name: |

9 |

|

|

|

▌ |

||

10 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code: ▌____ ____ ____ Credit Name: |

10 |

|

|

|

▌ |

||

11 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code: ▌____ ____ ____ Credit Name: |

11 |

|

|

|

▌ |

||

12 |

Code: 188 Credit for prior year alternative minimum tax |

12 |

▌ |

▌ |

|

▌ |

||

SECTION B – Credits that may reduce tax below tentative minimum tax. |

|

|

|

|

|

|

|

|

13 |

If Part III, line 3 is zero, enter the amount from line 1. If line 3 is more than |

|

|

|

|

|

|

|

|

zero, enter the total of line 2 and the last entry in column (c) |

13 |

|

|

|

|

|

|

B1 Credits that reduce net tax and have no carryover provisions. |

|

|

|

|

|

|

|

|

14 |

Code: 170 Credit for joint custody head of household |

14 |

|

|

|

|

|

|

15 |

Code: 173 Credit for dependent parent |

15 |

|

|

|

|

|

|

16 |

Code: 163 Credit for senior head of household |

16 |

|

|

|

|

|

|

17 |

Nonrefundable renter’s credit |

17 |

|

|

|

|

|

|

B2 Credits that reduce net tax and have carryover provisions. See instructions. |

|

|

|

|

▌ |

|||

18 |

Code: ▌____ ____ ____ Credit Name: |

18 |

|

|

|

|||

19 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code: ▌____ ____ ____ Credit Name: |

19 |

|

|

|

▌ |

||

20 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code: ▌____ ____ ____ Credit Name: |

20 |

|

|

|

▌ |

||

21 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Code: ▌____ ____ ____ Credit Name: |

21 |

|

|

|

▌ |

||

B3 Other state tax credit. |

|

|

|

|

|

|

|

|

22 |

Code: 187 Other state tax credit |

22 |

|

|

|

|

|

|

SECTION C – Credits that may reduce alternative minimum tax. |

|

|

|

|

|

|

|

|

23 |

Enter your alternative minimum tax from Side 1, Part II, line 26 |

23 |

|

|

|

|

|

|

24 |

Code: 180 Solar energy credit carryover from Section B2, column (d) |

24 |

|

|

|

▌ |

||

25 |

Code: 181 Commercial solar energy credit carryover from Section B2, column (d) . . |

25 |

|

|

|

▌ |

||

26 |

Adjusted AMT. Enter the balance from line 25, column (c) here |

|

|

|

|

|

|

|

|

and on Form 540, line 61 |

26 |

|

|

|

|

|

|

Side 2 Schedule P (540) 2012

7972123

Form Breakdown

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The California 540 Schedule P form is designed for calculating Alternative Minimum Tax (AMT) and Credit Limitations for residents. |

| Attachment Requirement | This schedule must be attached to Form 540, which is the main tax return form for California residents. |

| Governing Law | The form is governed by California state tax laws and regulations. |

| Taxable Year | The form is relevant for the 2012 taxable year, highlighting its annual applicability for calculating specific tax liabilities. |

| California/Federal Differences | Instructions indicate that there are differences between California and federal guidelines, emphasizing the need for careful completion. |

| Parts and Sections | The form contains multiple parts, focusing on Alternative Minimum Taxable Income (AMTI), Alternative Minimum Tax (AMT), and Credits that Reduce Tax. |

| Adjustments and Preferences | It includes sections for various adjustments related to medical expenses, taxes, interest, and other items influencing AMTI. |

| Credits Section | There's a detailed section for applying tax credits that might affect the amount of tax due or refundable, including credits for solar energy. |

How to Write California 540 Schedule P

Filling out the California 540 Schedule P form is a critical step for residents who need to calculate their Alternative Minimum Tax (AMT) and understand their credit limitations. This part of your tax filing is essential to ensuring you're in compliance with state tax laws and potentially identifying opportunities for tax savings. Below are detailed steps to accurately complete the Schedule P form.

- Begin by attaching Schedule P to Form 540, ensuring that your names are consistent across both documents.

- If you itemized deductions, proceed to line 2; otherwise, enter the standard deduction amount from Form 540, line 18, on line 1, then skip to line 6.

- For medical and dental expenses, enter the smaller amount from Schedule A (Form 1040), line 4, or 2.5% of Form 1040, line 37, on line 2.

- Consult the instructions to accurately fill out lines regarding personal property taxes, home mortgage interest, and miscellaneous itemized deductions (lines 3 through 5).

- Do not include the state income tax refund but enter refunds of personal or real property taxes on line 6.

- For lines 7 through 13, refer to the instructions for adjustment amounts related to investment interest, post-1986 depreciation, incentive stock options, passive activities, beneficiaries of estates and trusts, and other adjustments and preferences. Document these on the appropriate lines.

- Combine the totals of lines 1 through 13 and enter this on line 14.

- Enter taxable income from Form 540, line 19, on line 15.

- Document any net operating loss deductions on line 16 as positive amounts.

- Calculate the AMTI exclusion as instructed and enter it on line 17.

- If applicable based on your adjusted gross income, review the instructions and fill line 18 accordingly. If not, simply go to line 19.

- Combine the amounts of lines 14 through 18, entering the total on line 19.

- Calculate and enter the alternative minimum tax NOL deduction on line 20.

- Subtract line 20 from line 19 to find the Alternative Minimum Taxable Income, entering this on line 21.

- Based on your filing status and the instructions provided, enter the exemption amount on line 22.

- Subtract line 22 from line 21, entering this total on line 23. If the amount is zero or less, enter -0-.

- Calculate the tentative minimum tax by multiplying line 23 by 7% and enter this on line 24.

- Enter the regular tax before credits from Form 540, line 31, on line 25.

- Subtract line 25 from line 24 to find the Alternative Minimum Tax, and enter this amount on line 26. If it's not more than zero, enter -0- both here and on Form 540, line 61.

- For Part III, follow the specific instructions to accurately report credits that reduce the tax amount, documenting these on the applicable lines and sections as directed.

After completing the Schedule P form carefully, review all entries for accuracy to ensure compliance with California tax regulations. Attach any required documentation or additional forms as referenced in the instructions, and proceed with the rest of your tax filing process.

Listed Questions and Answers

What is the California 540 Schedule P form used for?

The California 540 Schedule P form is designed for computing and reporting the Alternative Minimum Tax (AMT) and credit limitations for California residents. It helps determine if you owe AMT and calculates the allowable credit limits against this tax.

Who needs to file Schedule P with their California Tax Return?

Schedule P should be filed by taxpayers who are subject to the Alternative Minimum Tax (AMT), have adjustments and preferences that are different from the federal income tax calculations, or who have specific credits that are limited by the AMT.

How does the Alternative Minimum Tax (AMT) work?

The AMT is a separate tax calculation intended to ensure that individuals who benefit from certain exclusions, deductions, or credits pay at least a minimum amount of tax. The AMT calculation starts with your taxable income, adds or subtracts certain adjustments, and applies AMT-specific exemptions before calculating the tax due under AMT rules.

What are some common adjustments that may need to be made on Schedule P?

Adjustments on Schedule P may include, but are not limited to:

- Medical and dental expenses.

- Personal and real property taxes.

- Home mortgage interest on loans not used to buy, build, or improve your home.

- Miscellaneous itemized deductions.

- Investment interest expense adjustments.

Can you explain the difference between California and federal AMT rules?

Although California's AMT rules are similar to the federal AMT rules, there are distinctions in terms of exemption amounts, tax rates, and allowable deductions. Specifically, California has its own set of adjustments and preferences, and the rates and exemptions might differ from federal AMT calculations.

What credits are available to reduce the AMT according to Schedule P?

Schedule P outlines several credits that can reduce the AMT, divided into three sections:

- Credits that reduce tax but have no carryover provisions.

- Credits with carryover provisions that can reduce tax.

- Other state tax credits and specific credits that may reduce the AMT.

How is the exemption amount for AMT calculated on the Schedule P?

The exemption amount for AMT is determined based on your filing status and Alternative Minimum Taxable Income (AMTI). There are specific exemption amounts that phase out at higher income levels, which are detailed in the form's instructions.

What happens if I have a carryover credit?

If you have a carryover credit, such as for solar energy systems, you can apply these credits against your tax liability as specified in Schedule P. Any unused portion of these credits may be carried over to future years, subject to limitations detailed in the instructions.

Is there an income threshold for filing Schedule P?

There isn't a specific income threshold that requires a taxpayer to file Schedule P. Instead, the need to file depends on whether the taxpayer has adjustments or preferences that necessitate an AMT calculation, or if they are claiming credits that are limited by the AMT.

Where can I find more information or get help with filling out Schedule P?

For more information or assistance with Schedule P, taxpayers can refer to the instructions provided with the form, visit the California Franchise Tax Board's website, or consult a tax professional familiar with California tax laws and AMT calculations.

Common mistakes

When it comes to completing the California 540 Schedule P form, a few common mistakes often trip people up. Understanding these mistakes can help ensure the form is filled out correctly, potentially avoiding delays or issues with the tax return.

Not attaching the Schedule to Form 540: This form is an attachment to the main Form 540 and must be submitted together. Failing to attach Schedule P to Form 540 is a mistake that can lead to processing delays.

Inaccurate calculation of medical and dental expenses: Line 2 requires entering the smaller of Schedule A (Form 1040), line 4, or 2½% (.025) of Form 1040, line 37. Misunderstanding this instruction can lead to an incorrect figure.

Overlooking adjustments and preferences: Line 13 requires careful consideration of multiple items a through m. Each item represents a potential adjustment or preference that may affect the Alternative Minimum Taxable Income (AMTI). Often, omissions or errors in this section occur due to the complexity of tax laws and the specifics of each taxpayer's situation.

Incorrect entries for exemption amounts: On Part II, Line 22, taxpayers must enter the correct exemption amount based on their filing status and the total from Line 21. Using outdated figures or misunderstanding the instructions can result in an incorrect exemption amount.

Misunderstanding the credits that reduce tax: The sections in Part III (A, B, and C) require a clear understanding of what credits are available, how they reduce the Alternative Minimum Tax (AMT), and the limitations on these credits. Not fully comprehending these sections can lead to missed opportunities for reducing tax liability or, conversely, claiming credits incorrectly.

By being cautious and double-checking entries against the instructions, these common mistakes can be avoided. It's always a good idea to seek advice or clarification when in doubt, ensuring the information submitted is accurate and complete.

Documents used along the form

When dealing with the California 540 Schedule P form, it's crucial to have a complete understanding of the process to calculate the Alternative Minimum Tax (AMT) for residents. However, this form doesn't stand alone in the tax filing ecosystem. Additional forms and documents often accompany it, each serving a unique purpose in painting a comprehensive picture of an individual's financial situation for the tax year. Below, find a brief description of up to nine forms and documents frequently used alongside the California 540 Schedule P form.

- Form 540 – California Resident Income Tax Return: This is the main tax return form for California residents. It's where you summarize your income, deductions, and credits for the state.

- Schedule A (Form 1040) – Itemized Deductions: Used by taxpayers to list their itemized deductions for federal taxes, some of which may need to be adjusted for AMT purposes on Schedule P.

- Schedule CA (540) – California Adjustments - Residents: This schedule allows individuals to adjust their federal adjusted gross income and deductions to align with California's tax laws.

- Schedule K-1 (541) – Beneficiary’s Share of Income, Deductions, Credits, etc.: This document reports a beneficiary's share of an estate or trust's income, deductions, and credits.

- Form 540-ES – Estimated Tax for Individuals: For individuals who need to make estimated tax payments throughout the year, this form helps calculate those payments.

- Form 3506 – Child and Dependent Care Expenses Credit: If claiming the child and dependent care expenses credit, this form calculates the allowable credit for California taxes.

- Form 3553 – Enterprise Zone Credits: Used by individuals who are claiming credits related to employment in certain designated areas or zones within California.

- Form 3507 – Prison Inmate Labor Credit: For businesses that employ prison inmates, this form calculates the available tax credit.

- FTB 1131 – Privacy Notice on Collection: Although not a form to be filled out, this document provides important information about privacy rights and how personal information is handled during the tax process.

Together, these forms create a suite of documents that, along with the California 540 Schedule P form, ensure a thorough and accurate accounting of an individual's tax obligations and benefits according to California law. Each document serves to provide detailed information in specific areas of tax filings, making it possible to navigate the complexities of state taxes effectively. Whether it's detailing income, calculating deductions and credits, or declaring estimated payments, these forms are essential tools in the tax preparation process.

Similar forms

The California Form 540 Schedule C, used for computing and reporting profit or loss from a business or profession, bears similarity to the Schedule P in its structure and nature of detailing financial information. Both forms require detailed breakdowns of income and deductions, albeit for different tax purposes. Schedule C focuses on business-related income and expenses to determine taxable profit, while Schedule P calculates adjustments and preferences affecting the alternative minimum tax calculation. This detailed approach ensures taxpayers accurately report their financial status, applying specific tax rules and regulations to compute their tax liability correctly.

Form 6251, Alternative Minimum Tax—Individuals, from the Internal Revenue Service (IRS), closely resembles California's Schedule P in its fundamental goal to calculate the Alternative Minimum Tax (AMT) for individuals. While the federal 6251 Form encompasses the broader scope of nationwide tax laws, Schedule P tailors to California state adjustments. Both documents necessitate adjustments to income and allowable deductions, revealing the nuanced differences between federal and state definitions of taxable income. They embody the parallel mechanisms at different government levels to ensure taxpayers contribute their fair share beyond the standard taxation rules.

Schedule K-1 (541), which reports the beneficiaries' share of income, deductions, and credits from estates and trusts in California, shares commonalities with Schedule P in its specificity for taxpayer circumstances and its role in detailing particular types of income adjustments. Both schedules are integral in accurately portraying a taxpayer's financial picture from specific sources—Schedule P for AMT adjustments and Schedule K-1 for trust and estate distributions. These forms contribute to a more granular understanding of an individual's tax responsibilities and serve to prevent the underpayment of taxes on income from diverse sources.

The California Schedule D (Form 540), used for reporting capital gains and losses, parallels Schedule P through its requirement for detailed financial information and its impact on the taxpayer's overall tax calculation. Both schedules adjust a taxpayer's income—Schedule D through the lens of capital transactions and Schedule P through adjustments specific to AMT calculation. They highlight the complexity of tax law and the importance of accurately reporting different types of income, ensuring that taxpayers receive appropriate credits and deductions.

Finally, Form 540-ES, Estimated Tax for Individuals, shares a conceptual connection with Schedule P, as both deal with future tax considerations. Schedule P might influence the amount entered in Form 540-ES by determining the AMT that needs to be accounted for in estimated tax payments. Though one is retrospective (Schedule P) and the other prospective (Form 540-ES), both forms are critical in the accurate forecasting and settling of tax liabilities, ensuring taxpayers remain compliant and minimize the potential for underpayment penalties.

Dos and Don'ts

When it comes to completing the California 540 Schedule P form, there are certain practices that can streamline the process and help avoid common pitfalls. Below, you'll find a curated list of things that you should and shouldn't do which can greatly assist in the accurate completion of this form.

- Do:

- Ensure that all names and social security numbers on Schedule P match those on Form 540 to prevent processing delays.

- Refer to detailed instructions for calculating Alternative Minimum Taxable Income (AMTI) to correctly adjust for California/federal differences.

- Use the correct figures from Form 540, such as the standard deduction or taxable income, to accurately fill in the respective lines on Schedule P.

- Attach any required documentation or supporting credit forms to Form 540 as Schedule P calculations may necessitate additional verification.

- Double-check calculations for accuracy, especially when applying adjustments and preferences to your AMTI to ensure the correct Alternative Minimum Tax (AMT) amount.

- Don't:

- Avoid guessing when it comes to adjustments and preferences; if unsure, consult the instructions or a tax professional.

- Do not overlook the importance of the AMT exemption amount; ensure that you apply the correct exemption based on filing status and income.

- Omit the calculation of credits that reduce the AMT, if applicable, since certain credits from Part III can directly affect the final AMT amount due.

- Fail to consider carryover provisions for certain credits which can impact the current year's tax calculations and potential savings.

Taking the time to carefully read instructions and double-checking entries can save considerable time and effort in corrections later. While the process may seem daunting, paying attention to these dos and don'ts can make completing Schedule P a smoother and more accurate endeavor.

Misconceptions

Many California residents are required to fill out the California 540 Schedule P form, especially those dealing with taxes beyond the standard calculations. Complicated as it may seem, several misconceptions often arise regarding this form, affecting how people approach it. Below are four common misconceptions and clarifications to help understand the California 540 Schedule P form better.

Misconception #1: The form is only required for high-income earners.

This is a common misunderstanding. While it's true that high-income earners are more likely to need to fill out the Schedule P due to Alternative Minimum Tax (AMT) considerations, various adjustments and preferences can require individuals or households with lower incomes to also complete this form. This includes adjustments for things like stock options or certain types of deductions.

Misconception #2: Filling out Schedule P is straightforward and doesn’t require special attention.

Contrary to this belief, Schedule P can be complex and often requires a detailed understanding of one’s financial situation. The form requires adjustments for differences between California and federal tax law, and overlooking these adjustments can significantly affect the tax calculation. These adjustments include items such as medical expenses, investment interest expense adjustments, and passive activity adjustments.

Misconception #3: If you don’t owe AMT this year, you won’t owe it in the future.

The situation can change from year to year. Just because a taxpayer didn't owe AMT in one year doesn't mean they won't owe it in future years. Changes in income, deductions, and tax laws can affect whether AMT is owed. Furthermore, previous AMT payments can influence future tax liabilities through the credit for prior year minimum tax, which can be claimed on Schedule P.

Misconception #4: There are no credits available for those who fill out Schedule P.

This is incorrect. Part III of Schedule P allows taxpayers to calculate credits that reduce tax, including credits that may reduce the tax below the tentative minimum tax or even affect the AMT. These include credits for solar energy systems, child and dependent care expenses, and others. Correctly applying these credits can significantly reduce tax liabilities.

Understanding these misconceptions can help taxpayers more accurately complete the California 540 Schedule P form and potentially minimize their tax burden. It's always advisable to consult tax preparation resources or a tax professional when dealing with complex tax issues to ensure compliance and optimize tax outcomes.

Key takeaways

Filling out and using the California 540 Schedule P form, which addresses Alternative Minimum Tax and Credit Limitations for residents, requires attention to detail and an understanding of relevant tax terms. Here are key takeaways to assist taxpayers in navigating this process:

- Determine Your AMTI: Begin by calculating your Alternative Minimum Taxable Income (AMTI), which adjusts your taxable income by adding back or subtracting certain preferences and adjustments per California tax law and federal adjustments that California does not conform to.

- Understand Adjustments and Preferences: Carefully review the adjustments and preferences section, including medical and dental expenses, personal and real property taxes, mortgage interest, and others. These adjustments might differ from those on your federal tax return, highlighting the importance of understanding California-specific tax laws.

- Itemize Your Deductions If Applicable: If you itemized deductions on your federal return, you must do the same on the California Schedule P, ensuring to adjust for differences between California and federal tax laws regarding allowable deductions.

- Calculate Tentative Minimum Tax: Use Part II of the form to determine your Tentative Minimum Tax (TMT), taking into account the exemption amounts based on your filing status and AMTI. The calculation involves subtracting your allowable exemption from your AMTI and applying the appropriate tax rate.

- Apply Credits Accordingly: Part III of the form deals with various credits that can reduce your tax liability. It's crucial to adhere to the specific instructions for applying credits against your regular tax liability versus your AMTI, including the proper sequencing of credits to maximize tax savings.

It is also advisable to attach all necessary credit forms and documentation to your Form 540, as failure to do so might delay processing. Paying close attention to the instructions for each line of the Schedule P will ensure accuracy and prevent common mistakes. Remember that California's tax laws can differ significantly from federal tax laws, especially regarding deductions and credits, so a thorough understanding of these differences is essential for correctly filling out the Schedule P form.

Different PDF Templates

Gun Permit California - Refugees, asylees, or special immigrant visa holders can receive expedited licensing processes under specific conditions outlined in the application.

Suing Paper - The California Civil form is accessible to both legal professionals and the general public, aiming to demystify the legal process and make justice more attainable.