Fill a Valid California 540 V Form

As taxpayers navigate the complexities of filing their state tax returns, the California 540-V form emerges as a vital tool designed to streamline the payment process for individual taxpayers. Throughout the state of California, the introduction of the Form 540-V marks a significant stride towards modernizing the payment system of the Franchise Tax Board, ensuring accurate and efficient processing of payments. This payment voucher, specifically designed for the 1997 tax year, encourages taxpayers to accompany their payments—whether by check or money order—with this form, although it remains optional and incurs no penalties for non-use. Tailored for those whose returns indicate a tax due, the form clearly outlines the steps to prepare and mail payment, from making the payment payable to the Franchise Tax Board, through filling out the necessary details on the voucher, to attaching it with the return. Importantly, the form advises against using it if the filer's return shows a refund or no tax due, highlighting its dedicated purpose for payments. The clear instructions lay out the process of preparing the check or money order, completing the voucher with personal information and the amount due, and ensuring the documentation is mailed to the correct address. With this form, the Franchise Tax Board addresses the nuances of tax payment submissions, accommodating penalties or interest in the payment total, and provides a structured pathway for filing, aimed at mitigating errors and enhancing the efficiency of tax administration for Californians.

Document Example

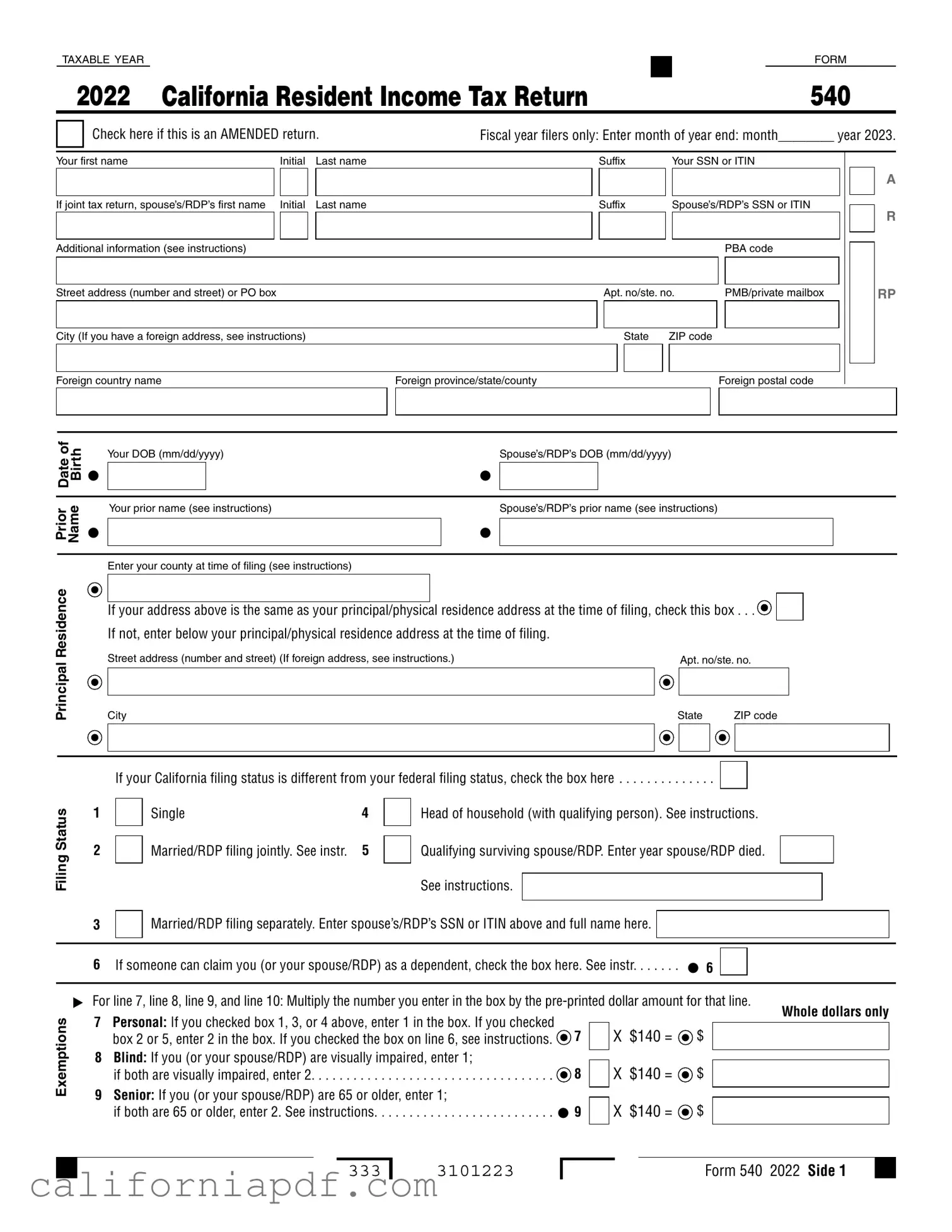

TAXABLE YEAR |

|

|

FORM |

|

|||

2022 California Resident Income Tax Return |

|

540 |

|

|

|||

Check here if this is an AMENDED return.

Your first name |

|

Initial |

|

Last name |

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

|

Initial |

|

Last name |

|

|

|

|

|

Additional information (see instructions) |

|

|

|

|

Street address (number and street) or PO box

City (If you have a foreign address, see instructions)

Foreign country name

of |

|

Your DOB (mm/dd/yyyy) |

|||

Date Birth |

• |

||||

|

|

|

|||

|

|

|

|||

Prior Name |

|

|

Your prior name (see instructions) |

||

• |

|

|

|||

|

|||||

|

|

Enter your county at time of filing (see instructions) |

|||

Fiscal year filers only: Enter month of year end: month________ year 2023.

|

|

Suffix |

|

Your SSN or ITIN |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix |

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

R |

|||||||

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PBA code |

|

|

|

RP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no/ste. no. |

|

PMB/private mailbox |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign province/state/county |

|

|

|

Foreign postal code |

|

|

|

|

|||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s DOB (mm/dd/yyyy)

•

Spouse’s/RDP’s prior name (see instructions)

•

Principal Residence

Filing Status

If your address above is the same as your principal/physical residence address at the time of filing, check this box . . .

If not, enter below your principal/physical residence address at the time of filing.

If not, enter below your principal/physical residence address at the time of filing.

Street address (number and street) (If foreign address, see instructions.) |

|

Apt. no/ste. no. |

|

||

|

|

|

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . . . . . .

1 |

|

Single |

4 |

|

Head of household (with qualifying person). See instructions. |

|

|

|||

2 |

|

Married/RDP filing jointly. See instr. |

5 |

|

Qualifying surviving spouse/RDP. Enter year spouse/RDP died. |

|

|

|

||

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3 |

|

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here. |

|

|

|

|

||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

. . . . . .6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See instr. |

• 6 |

|

|

|

|

|

|

Exemptions

▶ For line 7, line 8, line 9, and line 10: Multiply the number you enter in the box by the |

Whole dollars only |

||||||

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked |

|

|

|

|

|

||

7 |

|

X $140 = |

• $ |

|

|

||

|

|

|

|||||

|

box 2 or 5, enter 2 in the box. If you checked the box on line 6, see instructions. |

|

|

|

|||

8 |

Blind: If you (or your spouse/RDP) are visually impaired, enter 1; |

8 |

|

X $140 = |

$ |

|

|

|

|

|

|||||

|

if both are visually impaired, enter 2 |

|

|

|

|||

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; |

• 9 |

|

X $140 = |

$ |

|

|

|

|

|

|||||

|

|

|

|||||

|

if both are 65 or older, enter 2. See instructions |

|

|

|

|||

333

3101223

Form 540 2022 Side 1

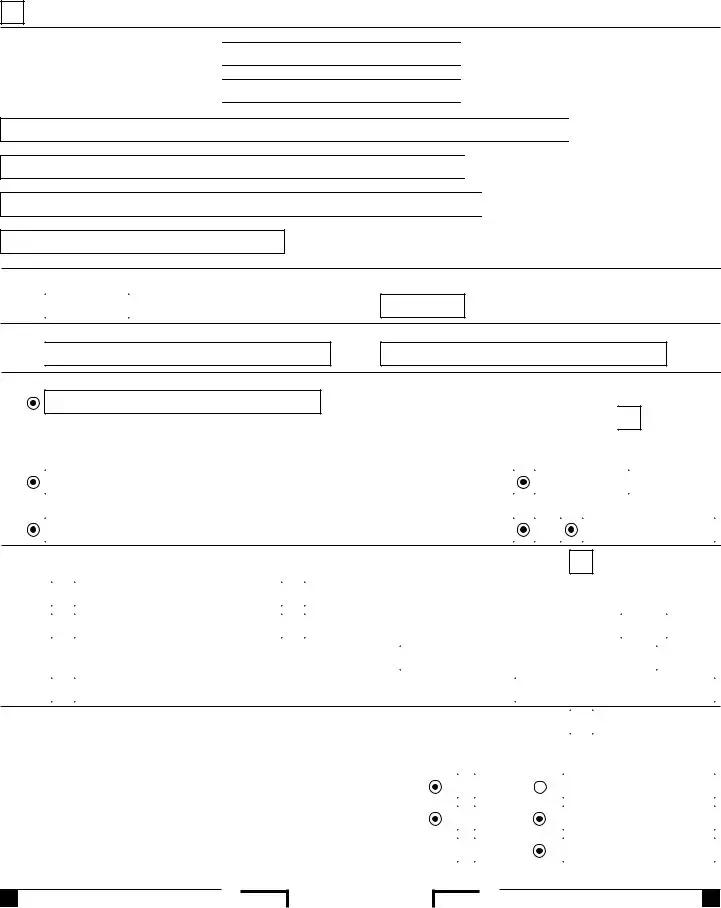

Your name: |

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

||

|

|

|

|

Exemptions

10 Dependents: Do not include yourself or your spouse/RDP.

|

Dependent 1 |

Dependent 2 |

First Name |

|

|

Last Name |

|

|

SSN. See |

• |

• |

instructions. |

||

Dependent’s |

|

|

relationship |

|

|

to you |

|

|

Dependent 3

•

. . . . . . . . . . . . . . . . . . . . . .Total dependent exemptions |

. . . . . . |

. . . . . . . . . . . • 10 |

|

X $433 = |

$ |

||||

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 |

. . . 11. . . . |

$ |

||||||

12 State wages from your federal |

• 12 |

|

|

|

. |

|

|

|

|

|

|

|

00 |

|

|

||||

|

Form(s) |

|

|

|

|

|

|||

13 |

Enter federal adjusted gross income from federal Form 1040 or |

. . . 13 |

|

||||||

|

|||||||||

14 |

California adjustments – subtractions. Enter the amount from Schedule CA (540), |

|

. • 14 |

|

|||||

|

|

||||||||

|

Part I, line 27, column B |

. . . . . . . |

. . . . . . . . . . . . . . . . . |

. . . . . |

. . . |

|

|||

|

|

|

|

|

|||||

15Subtract line 14 from line 13. If less than zero, enter the result in parentheses.

Income |

|

See instructions |

. 15 |

|

||

16 |

Part I, line 27, column C |

. • 16 |

|

|||

Taxable |

California adjustments – additions. Enter the amount from Schedule CA (540), |

|

|

|||

17 |

California adjusted gross income. Combine line 15 and line 16 |

. • 17 |

{ |

|||

|

18 |

Enter the |

{ |

Your California itemized deductions from Schedule CA (540), Part II, line 30; OR |

||

|

|

larger of |

Your California standard deduction shown below for your filing status: |

|

||

|

|

|

• Single or Married/RDP filing separately |

$5,202 |

||

|

|

|

• Married/RDP filing jointly, Head of household, or Qualifying surviving spouse/RDP. $10,404 |

|||

|

|

|

|

If Married/RDP filing separately or the box on line 6 is checked, STOP. See instructions |

• 18 |

|

19Subtract line 18 from line 17. This is your taxable income.

If less than zero, enter  19

19

31 Tax. Check the box if from: |

|

Tax Table |

|

|

Tax Rate Schedule |

|

|

|

|

|

|

|

|

• |

|

FTB 3800 |

• |

|

. . . . . . . . .FTB 3803 |

• 31 |

|

|

32Exemption credits. Enter the amount from line 11. If your federal AGI is more than

Tax |

|

$229,908, see instructions |

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . . |

32 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

33 |

Subtract line 32 from line 31. If less than zero, enter |

. . . . |

. . . . . . . . |

33 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

34 |

Tax. See instructions. Check the box if from: • |

|

|

Schedule |

|

|

. .FTB 5870A |

• 34 |

|||||||

|

|

35 |

Add line 33 and line 34 |

|

|

|

|

|

|

|

|

|

|

|

. |

35 |

|

|

|

. . . . . |

. . . |

. |

. . . |

. . . . . . . . |

. . . . |

. . |

. |

. |

. . . . |

. . . . . . . |

|||||

Credits |

40 |

Nonrefundable Child and Dependent Care Expenses Credit. See instructions |

|

|

. |

• 40 |

|||||||||||

|

|

. |

. . . . |

. . . . . . . |

|||||||||||||

Special |

43 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

. . .and amount |

• 43 |

|||

44 |

Enter credit name |

|

|

|

|

|

|

code • |

|

|

|

and amount |

• 44 |

||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Side 2 Form 540 2022 |

333 |

3102223 |

|

|

|

|

|

|||||||

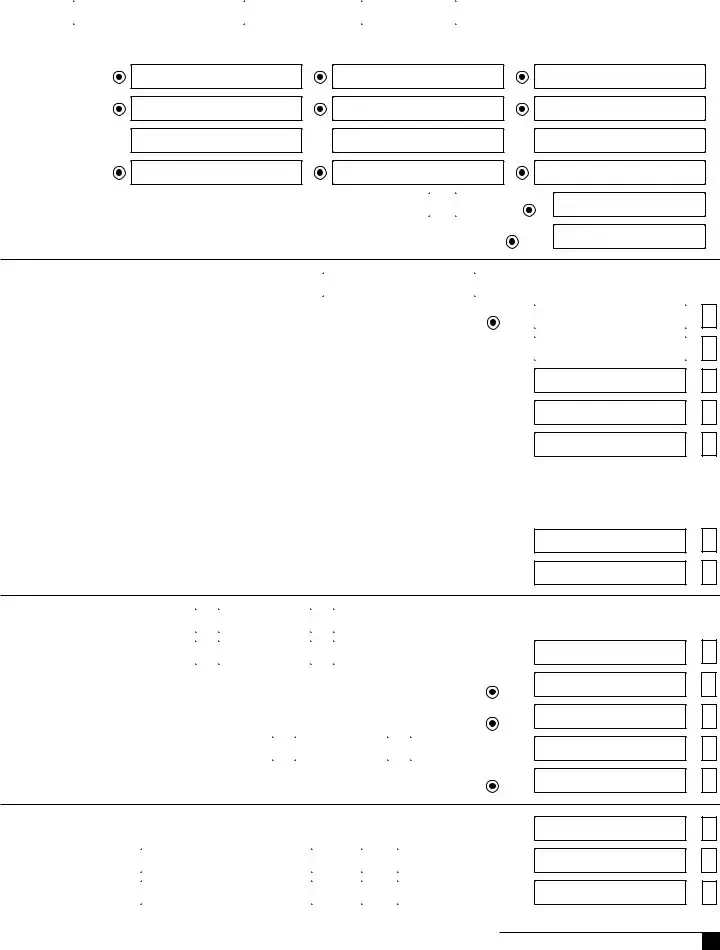

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

Your name: |

|

|

|

Your SSN or ITIN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Credits |

45 |

. . . . . . . . . . . . . .To claim more than two credits. See instructions. Attach Schedule P (540) |

|

|

|

|

|

||||||||||||||||

46 |

Nonrefundable Renter’s Credit. See instructions |

|

|

|

|

• 46 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Special |

|

. |

. . . . |

|

|

|

|||||||||||||||||

47 |

Add line 40 through line 46. These are your total credits |

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

. |

. . . . |

|

|

|

|

|

|

|

|

||||||||||||

|

48 |

Subtract line 47 from line 35. If less than zero, enter |

|

|

|

|

|

48 |

|

|

|

|

|

|

|

||||||||

|

|

. |

. . . . |

|

|

|

|

|

|

|

|

||||||||||||

Taxes |

61 |

Alternative Minimum Tax. Attach Schedule P (540) |

|

|

|

|

• 61 |

|

|

|

|

|

|

||||||||||

|

. |

. . . . |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

62 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Mental Health Services Tax. See instructions |

|

. |

. . . . |

• 62 |

|

|

|

|

|

|

||||||||||||

Other |

|

|

|

|

|

|

|

|

|

||||||||||||||

63 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Other taxes and credit recapture. See instructions |

|

. |

. . . . |

• 63 |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

64 |

. . . . . . . . . . . . . . . . . . .Add line 48, line 61, line 62, and line 63. This is your total tax |

|

. |

. . . . |

• 64 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

71 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .California income tax withheld. See instructions |

|

. |

. . . . |

• 71 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

72 |

. . . . . . . . . . . . . .2022 California estimated tax and other payments. See instructions |

|

. |

. . . . |

• 72 |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Payments |

73 |

. . . . . . . . . . . . . . . . . . .Withholding (Form |

|

. |

. . . . |

• 73 |

|

|

|

|

|

|

|||||||||||

75 |

Earned Income Tax Credit (EITC). See instructions |

|

|

|

|

• |

75 |

|

|

|

|

|

|

|

|||||||||

|

. |

. . . . |

|

|

|

|

|

|

|

||||||||||||||

|

74 |

Excess SDI (or VPDI) withheld. See instructions |

|

. |

. . . . |

• |

74 |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .76 Young Child Tax Credit (YCTC). See instructions |

|

. |

. . . . |

• 76 |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

77 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Foster Youth Tax Credit (FYTC). See instructions |

|

. |

. . . . |

• 77 |

|

|

|

|

|

|

|||||||||||

|

78 |

Add line 71 through line 77. These are your total payments. |

|

|

|

|

|

78 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Tax |

|

See instructions |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . . . |

. |

.. .. . •. . .91 |

. |

. . . . |

|

|

|

|

|

|

|

|

||||

91 |

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Use Tax. Do not leave blank. See instructions |

|

|

|

|

|

|

00 |

|

|||||||||||||||

Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

If line 91 is zero, check if: |

|

No use tax is owed. |

|

|

|

You paid your use tax obligation directly to CDTFA. |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

92 If you and your household had |

• |

|

|

|

|

|

|

|

|

|

||||||||||||

Penalty |

|

See instructions. Medicare Part A or C coverage is qualifying health care coverage |

|

|

|

|

|

|

|

|

|||||||||||||

ISR |

|

If you did not check the box, see instructions.. |

. . • 92 |

|

|

|

|

|

|

|

|

|

. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Individual Shared Responsibility (ISR) Penalty. See instructions |

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

Due |

93 |

Payments balance. If line 78 is more than line 91, subtract line 91 from line 78 |

|

93 |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

94 |

Use Tax balance. If line 91 is more than line 78, subtract line 78 from line 91 |

|

94 |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

Tax/Tax |

|

|

|

|

|

|

|

||||||||||||||||

95 |

. .subtract line 92 from line 93 |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . . |

. . . . . . . . . . . . |

|

. |

. . . . |

|

95 |

|

|

|

|

|

|

|

||||

Overpaid |

Payments after Individual Shared Responsibility Penalty. If line 93 is more than line 92, |

|

|

|

|

|

|

|

|

|

|

||||||||||||

96 |

Individual Shared Responsibility Penalty Balance. If line 92 is more than line 93, |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

. .subtract line 93 from line 92 |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

|

. . . |

. . . . . . . . . . . . |

|

. |

. . . . |

|

96 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

97 Overpaid tax. If line 95 is more than line 64, subtract line 64 from line 95 |

|

97 |

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

333

3103223

Form 540 2022 Side 3

|

Your name: |

|

Your SSN or ITIN: |

. |

. . . . • |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

|

Due |

98 Amount of line 97 you want applied to your 2023 estimated tax |

98 |

|

|

|

|

|||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Overpaid |

|

|

|

|

. |

. . . . • |

|

|

|

|

|

|

||

|

Tax/Tax |

99 |

Overpaid tax available this year. Subtract line 98 from line 97 |

99 |

|

|

|

|

||||||

|

100 |

. . . . . . . . . . . . . . . . . . .Tax due. If line 95 is less than line 64, subtract line 95 from line 64 |

100 |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

Code Amount |

|||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

California Seniors Special Fund. See instructions. |

. . . . • 400 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Alzheimer’s Disease and Related Dementia Voluntary Tax Contribution Fund . |

. . . . • 401 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Rare and Endangered Species Preservation Voluntary Tax Contribution Program . |

. . . . • 403 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Breast Cancer Research Voluntary Tax Contribution Fund. |

. . . . • 405 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Firefighters’ Memorial Voluntary Tax Contribution Fund. |

. . . . • 406 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

Emergency Food for Families Voluntary Tax Contribution Fund. |

. . . . • 407 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Peace Officer Memorial Foundation Voluntary Tax Contribution Fund . |

. . . . • 408 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

California Sea Otter Voluntary Tax Contribution Fund. |

. . . . • 410 |

|

|

|||||||

|

|

|

|

|

|

|||||||||

|

Contributions |

|

|

California Cancer Research Voluntary Tax Contribution Fund. |

. . . . • 413 |

|

|

|||||||

|

|

|

|

|

||||||||||

|

|

|

School Supplies for Homeless Children Voluntary Tax Contribution Fund. . . . . • 422 |

|

||||||||||

|

|

|

|

|||||||||||

|

|

|

|

State Parks Protection Fund/Parks Pass Purchase. |

. . . . • 423 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Protect Our Coast and Oceans Voluntary Tax Contribution Fund. |

. . . . • 424 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Keep Arts in Schools Voluntary Tax Contribution Fund. |

. . . . • 425 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Prevention of Animal Homelessness and Cruelty Voluntary Tax Contribution Fund . |

. . . . • 431 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

California Senior Citizen Advocacy Voluntary Tax Contribution Fund. |

. . . . • 438 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Native California Wildlife Rehabilitation Voluntary Tax Contribution Fund. |

. . . . • 439 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Rape Kit Backlog Voluntary Tax Contribution Fund. |

. . . . • 440 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Suicide Prevention Voluntary Tax Contribution Fund. |

. . . . • 444 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

||||||||||

|

|

|

|

Mental Health Crisis Prevention Voluntary Tax Contribution Fund. |

. . . . • 445 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

||||||||||

|

|

|

|

California Community and Neighborhood Tree Voluntary Tax Contribution Fund . |

. . . . • 446 |

|

||||||||

|

|

|

|

|

||||||||||

|

|

|

110 Add amounts in code 400 through code 446. This is your total contribution . |

. . . . • 110 |

|

|

||||||||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

Amount You Owe

111AMOUNT YOU OWE. If you do not have an amount on line 99, add line 94, line 96, line 100, and line 110. See instructions. Do not send cash.

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

|

. |

00 |

Pay Online – Go to ftb.ca.gov/pay for more information. |

|

|

|

|

Side 4 Form 540 2022 |

|

333 |

3104223

Your name:

Your SSN or ITIN:

Interest and Penalties

Refund and Direct Deposit

Voter Info.

112 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Interest, late return penalties, and late payment penalties |

112 |

|

. |

00 |

||||

113 |

Underpayment of estimated tax. |

|

|

|

|

|

|

||

|

Check the box: • |

|

FTB 5805 attached • |

|

|

• 113 |

|

. |

|

|

|

|

FTB 5805F attached |

|

00 |

||||

|

|

|

|

|

|||||

114 |

Total amount due. See instructions. Enclose, but do not staple, any payment |

114 |

|

. |

00 |

||||

|

|

||||||||

115REFUND OR NO AMOUNT DUE. Subtract the sum of line 110, line 112, and line 113 from line 99. See instructions.

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

|

. |

00 |

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip. See instructions. Have you verified the routing and account numbers? Use whole dollars only.

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

|

• Routing number |

• Type |

• Account number |

|

• 116 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below: |

|

|

|

|||||||

|

• Routing number |

• Type |

• Account number |

|

• 117 |

Direct deposit amount |

||||

|

|

|

Checking |

|

||||||

|

|

|

|

Savings |

|

|

|

|

. |

00 |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For voter registration information, check the box and go to sos.ca.gov/elections. See instructions . . . . . . . . . . . . . . . .

IMPORTANT: See the instructions to find out if you should attach a copy of your complete federal tax return.

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Your signature |

Date |

Spouse’s/RDP’s signature (if a joint tax return, both must sign) |

||

|

|

|

|

|

Your email address. Enter only one email address. |

|

|

Preferred phone number |

|

Sign Here

It is unlawful to forge a spouse’s/ RDP’s signature.

Joint tax return? See instructions.

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge)

Firm’s name (or yours, if |

|

|

|

|

• PTIN |

|

||

|

|

|

|

|

|

|

|

|

Firm’s address |

|

|

|

|

• Firm’s FEIN |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? See instructions . . . . . . .• |

|

Yes |

|

|

|

No |

|

|

Print Third Party Designee’s Name |

|

Telephone Number |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

333

3105223

Form 540 2022 Side 5

Form Breakdown

| Fact Number | Details |

|---|---|

| 1 | The California Form 540-V is a payment voucher for individual tax returns. |

| 2 | It was introduced to modernize the payment system and improve accuracy and efficiency in processing tax payments. |

| 3 | Use of the Form 540-V is strongly encouraged by the Franchise Tax Board, though it's not mandatory. |

| 4 | Form 540-V should not be used if the individual’s tax return indicates a refund or no tax due. |

| 5 | To prepare a payment, individuals must make their check or money order payable to the Franchise Tax Board. |

| 6 | When preparing a check or money order, the social security number and the type of the return for the tax year 1997 should be written on it, specifying it's for Form 540, 540A, 540EZ, or 540NR. |

| 7 | The payment amount, including any penalties or interest, must be entered on the Form 540-V |

| 8 | Form 540-V along with the payment should be attached to the front of the return, ensuring visibility and accessibility. |

| 9 | The completed form and payment should be mailed to the Franchise Tax Board at the address provided on the form. |

| 10 | The governing law for this process falls under the jurisdiction of the California Revenue and Taxation Code, directing the operations of the Franchise Tax Board. |

How to Write California 540 V

After completing your California state tax return, if you owe money to the state, you'll need to fill out and submit Form 540-V. This is the payment voucher that you send along with your payment for the tax you owe. This voucher helps the California Franchise Tax Board process your payment more efficiently. It's a relatively simple form to fill out, but it's crucial to ensure all information is accurate to avoid any delays or issues with your tax payment. The following steps will guide you through filling out the Form 540-V for your California tax return.

- Prepare Your Check or Money Order: Write a check or obtain a money order made payable to the "Franchise Tax Board." Ensure that the full amount you owe is included. On the check or money order, write your social security number and indicate the type of return you're filing, choosing from ‘‘1997 Form 540EZ’’, ‘‘1997 Form 540A’’, ‘‘1997 Form 540’’, or ‘‘1997 Form 540NR’’.

- Complete the Return Payment Voucher (Form 540-V): Grab a blue or black pen and fill out the voucher. Write your name(s), address, and social security number(s) in the designated areas on the form. Then, enter the exact amount of payment you are sending. If you are including any payments for penalties or interest, add these to the total amount you owe and write this total on the voucher. After filling out the voucher, detach it along the dotted line.

- Attach the Return Payment Voucher and Check or Money Order to Your Return: Place your check or money order on top of the detached voucher. Then, attach both of them to the front of your tax return where indicated. Ensure that both the payment and voucher are visible and not obscured by other documents, such as Form(s) W-2.

- Mail Your Payment: Once everything is properly attached, mail your tax return, the attached voucher, and your payment to the following address: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001. Make sure to send it well before the deadline to avoid any late fees.

Filling out Form 540-V correctly and sending it with your payment is important for processing your state tax payment efficiently. By following the listed steps, you can ensure that your payment is processed without any issues.

Listed Questions and Answers

Do I need to use Form 540-V?

The California Franchise Tax Board recommends using Form 540-V to make payments on your taxes efficiently and accurately. However, if you have a refund or owe no taxes for the year 1997, you don't need to use this voucher. Remember, there's no penalty for not using Form 540-V.

How do I prepare my payment?

First, write a check or money order payable to the Franchise Tax Board for the total amount you owe. It's crucial to include your social security number and the type of return (e.g., "1997 Form 540") on your payment. This helps ensure your payment is processed correctly.

What should I include on the return payment voucher?

When completing Form 540-V, use blue or black ink to fill in your names, address, and social security numbers. Make sure to enter the total amount of your payment, including any penalties or interest, on the voucher.

How do I attach the payment voucher to my return?

Place your check or money order on top of the completed voucher. Both should be attached to the front of your tax return, ensuring they are visible and not covered by any other documents, such as your Form W-2.

Where do I mail my payment?

Send your tax return, Form 540-V, and your payment to the Franchise Tax Board at the following address:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0001

Can I make a payment without using Form 540-V?

Yes, you can still make a payment without using Form 540-V. However, using the voucher helps the Franchise Tax Board process your payment more efficiently and accurately, reducing the risk of errors.

What if I'm paying for penalties or interest?

If your payment includes penalties or interest, ensure the total amount (tax owed plus any penalties or interest) is clearly indicated on your payment and Form 540-V. This helps the Franchise Tax Board apply your payment correctly.

Common mistakes

When filling out the California Form 540-V, individuals commonly make a handful of mistakes that can delay processing and potentially affect the accuracy of their payment to the Franchise Tax Board. Understanding and avoiding these mistakes is crucial for a smoother, more efficient filing experience.

Incorrect Payment Amount: Individuals often enter an incorrect payment amount on Form 540-V. It's important to include the total sum of what is owed, including any penalties or interest, not just the base tax due.

Miswriting the Social Security Number: Filling in the wrong social security number(s) can lead to significant processing delays. The social security number should match what's on the tax return and be written clearly in blue or black ink.

Forgetting to Sign and Date: Neglecting to cut off the voucher and attach it with the check or money order on the front of the return where indicated can cause processing issues. Both need to be securely attached to avoid being misplaced.

Omitting the Type of Return: Failing to write the type of return and the tax year on the check or money order can lead to misapplication of the payment. It’s essential to clearly indicate for which return and tax year the payment is meant.

Incorrect Payee Name: The check or money order must be made payable to the "Franchise Tax Board" exactly. Any variations or errors can result in the payment being rejected.

Using Incorrect Address: Sending the return, payment voucher, and payment to an incorrect address can significantly delay the processing time. Always double-check the mailing address provided in the instructions.

Ensuring the avoidance of these errors can help taxpayers in ensuring their payment is processed accurately and on time. Delays and inaccuracies can be minimized, providing a smoother transaction with the Franchise Tax Board.

In addition to these specific errors, here are general tips that should be kept in mind:

Always use blue or black ink when filling out the form to ensure readability.

Double-check all information for accuracy before mailing.

Keep a copy of all documents for your records.

By paying close attention to these details, taxpayers can avoid common pitfalls that could complicate their filing process.

Documents used along the form

When individuals prepare their taxes in California, especially when making payments for state income taxes, the California Form 540-V, which is a payment voucher for individuals, often accompanies a variety of other forms and documents. It's part of streamlining the process, ensuring accuracy, and optimizing efficiency in tax payment processing. However, it's one of many pieces of the larger tax filing puzzle. Let’s take a closer look at several other forms and documents frequently used along with Form 540-V to give you a clearer picture of the tax filing process in California.

- Form 540: This is the primary state income tax return form for California residents. It is used to report their annual income, calculate state tax liability, and determine the amount of refund or additional tax owed.

- Form 540 2EZ: A simplified version of Form 540, designed for taxpayers with straightforward financial situations. It's a shorter form with fewer calculations, meant for individuals who meet specific requirements.

- Form 540NR: This form is for nonresidents or part-year residents of California. It's used to report income earned from California sources and calculate the tax rate applicable to that income.

- Schedule CA (540): Accompanying Form 540, Schedule CA is employed to make adjustments to the taxpayer’s income. It accounts for differences between federal and state tax laws, ensuring the accurate reporting of taxable income in California.

- Schedule D (540): Used by individuals to report capital gains or losses in California. This schedule is necessary for anyone who has sold property or realized gains from investments during the tax year.

- Form 3582 (Payment Voucher for Individual e-filed Returns): This payment voucher is specifically for taxpayers who e-file their returns. It serves a similar proposal to Form 540-V but tailored for the e-filing process.

Together, these forms and documents equip taxpayers with the necessary tools to accurately fulfill their tax obligations to the state of California. Each person's situation dictates which of these forms are relevant, making it essential to understand their purpose and requirements. Whether you owe taxes and are using Form 540-V to make a payment, or you’re simply filing your annual return, these documents play critical roles in navigating California’s tax landscape efficiently and correctly.

Similar forms

The IRS Form 1040-V is a payment voucher quite similar to the California Form 540-V, serving a parallel purpose at the federal level. Like the 540-V, it is used by taxpayers to submit payments for any taxes owed alongside their annual tax return. Taxpayers complete this form by including their personal information, the amount they are paying, and their social security number. The primary goal of both forms is to streamline the payment process and ensure accuracy in crediting the taxpayer's account, demonstrating their function as integral components of efficient tax collection mechanisms.

Another comparable document is the IRS Form 4868, which is an application for an automatic extension of time to file a U.S. individual income tax return. Though it primarily serves to extend the filing deadline, it shares a similarity with the California Form 540-V in that it provides taxpayers with an opportunity to estimate and pay any taxes owed by the original due date of the return. This preemptive payment process aligns with the objective of the 540-V to facilitate timely tax payments, even though the specific purposes of the forms differ.

The California Form 540-ES, which stands for Estimated Tax for Individuals, also bears resemblance to the 540-V. This form is intended for taxpayers to calculate and pay their estimated taxes on a quarterly basis. While the Form 540-V is used for submitting payment with the annual tax return, the Form 540-ES focuses on making periodic payments throughout the year. Both forms aid in the management of tax obligations by providing structured means for payment, thus ensuring that taxpayers remain compliant while managing their cash flows more effectively.

Form FTB 3522, the LLC Tax Voucher, is yet another California tax document that shares common objectives with the Form 540-V. It is specifically designed for limited liability companies (LLCs) to pay their annual LLC tax. Despite the different target audiences, both the Form 540-V and the FTB 3522 are payment vouchers that streamline the process of submitting payments to the California Franchise Tax Board (FTB). They simplify the taxpayer's responsibility by clearly outlining payment details, reinforcing the effectiveness of these documents in tax administration.

The Property Tax Postponement (PTP) Application resembles the California Form 540-V in its functional aim to aid individuals in managing their financial obligations related to taxes. While the PTP Application allows eligible California residents to postpone paying property taxes on their primary residence, the Form 540-V facilitates the payment of individual income taxes. Both offer financial management tools to California residents, albeit for different types of taxes, highlighting the breadth of options available for meeting tax-related responsibilities.

Finally, the California Form 3552, the Installment Agreement Request, while not a voucher, shares a fundamental similarity with the Form 540-V by being another means to address outstanding tax liability. This form allows taxpayers who cannot pay their tax debt in full to propose a payment plan to the FTB, thereby providing a structured approach to settling tax debts over time. The Form 540-V and the Form 3552 exemplify the FTB's efforts to accommodate different taxpayer needs, ensuring that individuals have multiple avenues for complying with their tax obligations.

Dos and Don'ts

When managing your tax obligations in California, particularly with regards to completing and submitting the California Form 540-V, it's crucial to adhere to a set of dos and don'ts to ensure the process is carried out smoothly and accurately. The following guidelines highlight the important steps and precautions to take.

- Do make your check or money order payable to the Franchise Tax Board for the exact amount you owe.

- Do write your social security number and the tax year of the return on your check or money order. For example, "1997 Form 540".

- Do use blue or black ink when entering your name, address, and social security number(s) on Form 540-V.

- Do not overlook including any payment for penalties or interest you owe in addition to your tax; the total amount should be accurately reflected on Form 540-V.

- Do not attach the check or money order and voucher to your return in a manner that covers up important information or attachments like your Form(s) W-2.

- Do not forget to mail your return, the attached voucher, and your check or money order to the correct address, which is: FRANCHISE TAX BOARD PO BOX 942867 SACRAMENTO CA 94267-0001.

By meticulously following these instructions, individuals can contribute to a more efficient processing of their payments and help avoid potential delays or issues with the California Tax Board. The goal is to support accuracy and efficiency within the tax system, ensuring obligations are met with as little complication as possible.

Misconceptions

There are common misconceptions about the California Form 540-V, which is the Return Payment Voucher for Individuals. Understanding these misconceptions is essential for taxpayers in California to manage their taxes accurately and efficiently. Below are eight misconceptions that need clarification:

- Form 540-V is mandatory: While the California Franchise Tax Board encourages the use of Form 540-V to streamline processing, there is no penalty for not using it. Taxpayers can choose whether or not to use this form when they make a payment.

- Form 540-V applies to all tax situations: This form is specifically designed for individuals who owe taxes. If an individual's tax return shows a refund or no tax due, this form is not necessary.

- The form is complicated: Preparing Form 540-V is straightforward. It requires basic information such as name, address, social security number, and the amount being paid.

- Only checks are acceptable: Form 540-V instructions specify that both checks and money orders can be used to make a payment. Taxpayers have the flexibility to use the payment method that is most convenient for them.

- Electronic payments require Form 540-V: The purpose of Form 540-V is to accompany physical check or money order payments. Taxpayers making electronic payments do not need to complete or send this form.

- Personal information is at risk: The form requires taxpayers to include sensitive information such as their social security number. However, the California Franchise Tax Board maintains strict privacy and security measures to protect this information.

- Penalties and interest must be paid separately: If taxpayers owe penalties or interest in addition to their tax due, they can include these amounts in the total on Form 540-V. There is no need to make separate payments for each liability.

- Any address will work for mailing: The form specifies the exact address to which the return, payment, and Form 540-V should be mailed. Using a different address could result in delays or issues with processing the payment.

Clarifying these misconceptions ensures that taxpayers can handle their tax obligations with confidence, knowing they are following the correct procedures set forth by the California Franchise Tax Board.

Key takeaways

When it comes to managing tax payments in California, using the Form 540-V can simplify the process and ensure accuracy. Here are five key takeaways to remember:

- Form 540-V is highly recommended by the Franchise Tax Board to accompany your check or money order for tax payments, although not mandatory. Its main purpose is to assist in accurately and efficiently processing your payments.

- If you are expecting a refund or owe no tax, there's no need to use this payment voucher. The form is strictly for those who owe tax and are making a payment.

- Making your payment requires careful preparation. Write your check or money order payable to the "Franchise Tax Board," ensuring to include your social security number and the specific type of return you are filing for the tax year 1997. Clear identification helps in the proper allocation of your payment.

- To complete Form 540-V, use blue or black ink to fill in your name(s), address, and social security number(s). Also, specify the total payment amount you are sending, which should include any penalties or interest if applicable.

- When mailing, ensure the check or money order and Form 540-V are securely attached to the front of your return, without being covered by other documents, such as your W-2 forms. This placement helps the tax board immediately identify and process your payment.

Sending your payment to the correct address is equally important. For the 1997 tax year, send all items to the FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001. Making sure everything is correctly filled out and sent to the right location ensures that your tax obligations are met without delay.

Different PDF Templates

Change Business Address California - Empowers businesses to manage their tax-related mailing preferences effectively and efficiently.

Can You Get a Default Judgement Reversed - A document laying out a defendant's argument for why a default judgment should not be their last word in a legal dispute.