Fill a Valid California 540X Form

When Californians need to correct or update their state income tax return, the California Form 540X is their go-to solution. This form, officially titled the Amended Individual Income Tax Return, serves a crucial function by allowing taxpayers to make necessary adjustments to their originally filed tax returns. These adjustments might be needed due to a variety of reasons such as reporting additional income, claiming missed deductions or credits, or correcting errors related to filing status, income, deductions, or credits. The process involves a detailed comparison where the original figures are reported alongside the amended ones, requiring the taxpayer to clearly explain the reason for each change. Additionally, supporting documents must be attached, ensuring the amendments are well substantiated. It's important for taxpayers to know that amending a return with the California Form 540M is a straightforward way to correct or update their tax records with the state, avoiding potential issues with the California Franchise Tax Board. Whether it's a simple oversight or a significant change to their financial situation, Form 540X provides a structured process for Californians to keep their state tax records accurate and up to date.

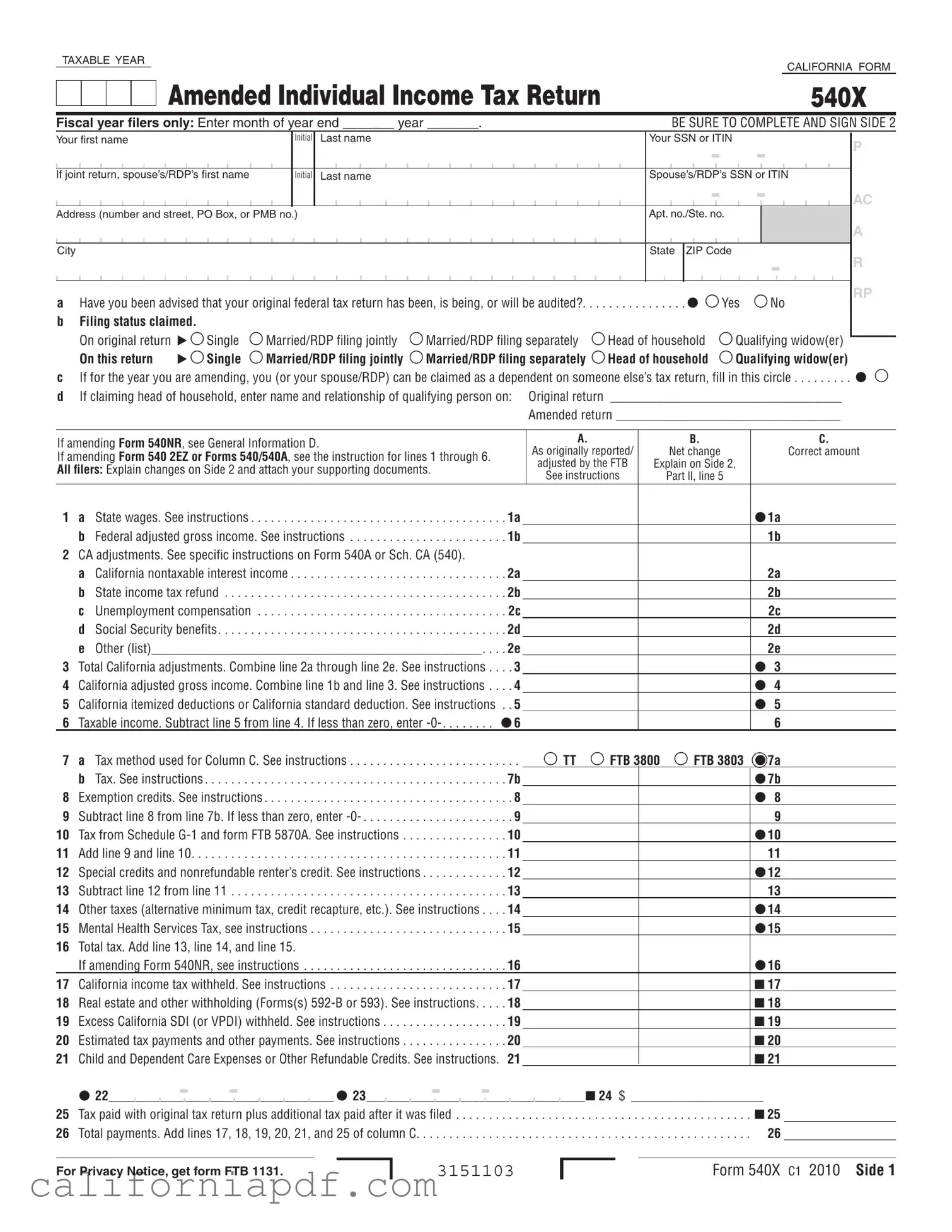

Document Example

TAXABLE YEAR

CALIFORNIA FORM

|

|

|

|

Amended Individual Income Tax Return |

540X |

|

|

|

|

||

Fiscal year ilers only: Enter month of year end _______ year _______. |

BE SURE TO COMPLETE AND SIGN SIDE 2 |

||||

Your first name |

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN or ITIN |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s/RDP’s first name |

|

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no./Ste. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

a Have you been advised that your original federal tax return has been, is being, or will be audited?. . . . . . . . . . . . . . . . Yes |

No |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

bFiling status claimed.

On original return |

Single |

Married/RDP filing jointly |

Married/RDP filing separately Head of household |

Qualifying widow(er) |

On this return |

Single |

Married/RDP filing jointly |

Married/RDP filing separately Head of household |

Qualifying widow(er) |

cIf for the year you are amending, you (or your spouse/RDP) can be claimed as a dependent on someone else’s tax return, fill in this circle . . . . . . . . .

d If claiming head of household, enter name and relationship of qualifying person on: Original return ___________________________________

Amended return __________________________________

P

AC

A

R

RP

If amending Form 540NR, see General Information D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

B. |

|

C. |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As originally reported/ |

Net change |

|

Correct amount |

|||||||||||||||||||||

If amending Form 540 2EZ or Forms 540/540A, see the instruction for lines 1 through 6. |

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

adjusted by the FTB |

Explain on Side 2, |

|

|

||||||||||||||||||||||||||||||

All filers: Explain changes on Side 2 and attach your supporting documents. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

See instructions |

Part ll, line 5 |

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1 |

a State wages. See instructions |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 1a |

|

|

|

|

1a |

|||||||||||||||||||||||||

|

. . .b Federal adjusted gross income. See instructions |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 1b |

|

|

|

1b |

|||||||||||||||||||||||||

2 |

CA adjustments. See specific instructions on Form 540A or Sch. CA (540). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

a California nontaxable interest income |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2a |

|

|

|

|

2a |

|||||||||||||||||||||||

|

b |

.State income tax refund |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2b |

|

|

|

|

2b |

||||||||||||||||

|

c |

. . . . . . . . . . . . . . . . . . . .Unemployment compensation |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2c |

|

|

|

|

2c |

||||||||||||||||||||||||

|

d |

. .Social Security benefits |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 2d |

|

|

|

|

2d |

||||||||||||||||

|

e |

. . .Other (list)__________________________________________________ |

. 2e |

|

|

|

|

2e |

||||||||||||||||||||||||||||||

3 |

Total California adjustments. Combine line 2a through line 2e. See instructions . . |

. . 3 |

|

|

|

|

|

|

|

|

|

3 |

||||||||||||||||||||||||||

4 |

California adjusted gross income. Combine line 1b and line 3. See instructions . . |

. . 4 |

|

|

|

|

|

|

|

|

|

4 |

||||||||||||||||||||||||||

5 |

California itemized deductions or California standard deduction. See instructions |

. . 5 |

|

|

|

|

|

|

|

|

5 |

|||||||||||||||||||||||||||

6 |

. . . . . .Taxable income. Subtract line 5 from line 4. If less than zero, enter |

. |

. |

6 |

|

|

|

|

|

|

|

|

6 |

|

||||||||||||||||||||||||

7 |

a Tax method used for Column C. See instructions . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . . . |

. |

|

|

|

TT |

FTB 3800 FTB 3803 |

7a |

|||||||||||||||||||||||

|

b |

Tax. See instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

. 7b |

|

|

|

|

7b |

||||||||||||

|

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. |

|

|

|

|||||||||||||||||||||

8 |

Exemption credits. See instructions |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. . 8 |

|

|

|

|

|

|

|

|

|

8 |

|||||||||||||||||||

9 |

.Subtract line 8 from line 7b. If less than zero, enter |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. . 9 |

|

|

|

|

|

|

|

|

9 |

|

|||||||||||||||||||

10 |

Tax from Schedule |

. . |

. 10 |

|

|

|

|

|

|

|

|

|

10 |

|||||||||||||||||||||||||

11 |

. . . . . .Add line 9 and line 10 |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 11 |

|

|

|

|

|

|

|

|

|

11 |

|

|||||||||||

12 |

Special credits and nonrefundable renter’s credit. See instructions |

. |

. . |

. 12 |

|

|

|

|

|

|

|

|

|

12 |

||||||||||||||||||||||||

13 |

Subtract line 12 from line 11 |

. |

. . . . |

. . . |

. . . . |

|

. . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 13 |

|

|

|

|

|

|

|

|

|

13 |

|

|||||||||||

14 |

Other taxes (alternative minimum tax, credit recapture, etc.). See instructions |

. |

. . |

. 14 |

|

|

|

|

|

|

|

|

|

14 |

||||||||||||||||||||||||

15 |

Mental Health Services Tax, see instructions . . . . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 15 |

|

|

|

|

|

|

|

|

|

15 |

||||||||||||||||||

16 |

Total tax. Add line 13, line 14, and line 15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

||||||||||||||

|

If amending Form 540NR, see instructions |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 16 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

17 |

California income tax withheld. See instructions . |

. . . . . |

. . . |

. . . |

. . . . |

. . . . |

. . . |

. |

. . |

. 17 |

|

|

|

|

|

|

|

|

|

17 |

||||||||||||||||||

18 |

Real estate and other withholding (Forms(s) |

. |

. . |

. 18 |

|

|

|

|

|

|

|

|

|

18 |

||||||||||||||||||||||||

19 |

Excess California SDI (or VPDI) withheld. See instructions |

. 19 |

|

|

|

|

|

|

|

|

|

19 |

||||||||||||||||||||||||||

20 |

Estimated tax payments and other payments. See instructions |

. . |

. 20 |

|

|

|

|

|

|

|

|

|

20 |

|||||||||||||||||||||||||

21 |

Child and Dependent Care Expenses or Other Refundable Credits. See instructions. 21 |

|

|

|

21 |

|||||||||||||||||||||||||||||||||

|

|

- |

|

- |

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

22 |

|

|

|

__________________________________ |

|

|

|

|

|

23 |

|

|

|

|

_________________________________ |

|

|

|

|

|

24 $ ____________________ |

|

||||||||||||||

25 |

Tax paid with original tax return plus additional tax paid after it was filed . . . . |

. |

. . . . |

. . |

. |

. . . . |

|

. . . . |

. . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

25 |

||||||||||||||||||||||||||

26 |

. . . . . . . . . .Total payments. Add lines 17, 18, 19, 20, 21, and 25 of column C |

. |

. . . . |

. . |

. |

. . . . |

|

. . . . |

. . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

26 |

|

|||||||||||||||||||||||||

For Privacy Notice, get form FTB 1131.

3151103

Form 540X C1 2010 Side 1

Your name: |

Your SSN or ITIN: |

26a Enter the amount from Side 1, line 26 |

. 26a |

|

27 |

Overpaid tax, if any, as shown on original tax return or as previously adjusted by the FTB. See instructions |

27 |

28 |

Subtract line 27 from line 26a. If line 27 is more than line 26a, see instructions |

. . 28 |

29 |

Use tax payments as shown on original tax return. See instructions |

29 |

30 |

Voluntary contributions as shown on original tax return. See instructions |

30 |

31 |

Subtract line 29 and line 30 from line 28 |

. . 31 |

32AMOUNT YOU OWE. If line 16, column C is more than line 31, enter the difference

|

and see instructions |

32 |

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|

|

||||||

33 |

Penalties/Interest. See instructions: Penalties 33a______________________ Interest 33b______________________________ 33c |

|

|||||||||||

34 |

REFUND. If line 16, column C is less than line 31, enter the difference. See instructions |

34 |

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|

|||||||

Part I Nonresidents or

. 00

. 00

Taxable years 2003 and after, enter amounts from your revised Short or Long Form 540NR. Your amended tax return cannot be processed without this |

||

information. For all taxable years attach your revised Short or Long Form 540NR and Schedule CA (540NR). |

|

|

1 |

Exemption amount from Short or Long Form 540NR, line 11 |

1 |

2 |

Federal adjusted gross income from Short or Long Form 540NR, line 13 |

2 |

3 |

Adjusted gross income from all sources from Short or Long Form 540NR, line 17 |

3 |

4 |

Itemized deductions or standard deduction from Short or Long Form 540NR, line 18 |

4 |

5 |

California adjusted gross income from Short or Long Form 540NR, line 32 |

5 |

6 |

Tax from Schedule |

6 |

7Special credits (from Long Form 540NR, lines 58, 59, or 60) and nonrefundable renter’s credit from Short and

Long Form 540NR, line 61 (Combine) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Alternative minimum tax from Long Form 540NR, line 71 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 9 Mental Health Services Tax (taxable years 2005 and after) from Long Form 540NR, line 72 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 10 Other taxes and credit recapture from Long Form 540NR, line 73 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Part II Explanation of Changes

1Enter name(s) and address as shown on original return below (if same as shown on this tax return, write “Same”). If changing from

separate tax returns to a joint tax return, enter names and addresses from original tax returns._________________________________________________

_______________________________________________________________________________________________________________________

2 |

Are you filing this Form 540X to report a final federal determination? |

Yes |

No |

|

If “Yes,” attach a copy of the final federal determination and all supporting schedules and data. |

Yes |

No |

3 |

Have you been advised that your original California tax return has been, is being, or will be audited? |

||

4 |

Did you file an amended tax return with the Internal Revenue Service on a similar basis? See General Information E |

Yes |

No |

5Explanation and Attachments. Explain your changes below. Attach a separate sheet if needed (see instructions).

Explain in detail each change made. Include: |

Attach: |

||

• |

Item being changed. |

• |

Revised California tax return including all forms and schedules. |

• |

Amount previously reported and corrected amount. |

• |

Include federal schedules if you made a change to your federal tax return. |

• |

Reason the change was needed. |

• |

Documents supporting each change, such as corrected |

• |

List of supporting documents you have attached. |

|

escrow statements, court documents, contracts, etc. |

Be sure to include your name and SSN or ITIN on each attachment. Refer to the tax booklet for the year you are amending.

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________________

Sign

Here

It is unlawful to forge a spouse’s/RDP’s signature.

Where to File Form 540X

Under penalties of perjury, I declare that I have filed an original tax return and that I have examined this amended tax return including accompanying schedules and statements and to the best of my knowledge and belief, this amended tax return is true, correct, and complete.

|

Your signature |

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s signature (if filing jointly, both must sign) |

Daytime phone number (optional) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

X |

|

|

|

|

|

|

|

|

|

X |

( |

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge) |

|

|

|

|

|

|

|

Paid preparer’s PTIN/SSN |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours if |

|

|

|

|

|

|

|

|

|

Firm’s address |

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not file a duplicate amended tax return unless one is requested. This may cause a delay in processing your amended tax return and any claim for refund.

If you are due a refund, have no amount due, or paid electronically, |

|

|

mail your tax return to |

FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

|

If you owe, mail your return and check or money order to: |

FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

Side 2 Form 540X C1 2010

3152103

Form Breakdown

| Fact Number | Description |

|---|---|

| 1 | Form 540X is for amending a previously filed California Individual Income Tax Return. |

| 2 | It includes sections for reporting changes in income, deductions, and credits. |

| 3 | Filers must complete both sides of the form and sign it before submission. |

| 4 | The form is applicable for both resident and non-resident filers amending a return. |

| 5 | Filers must explain the reason for each change on the second page of the form. |

| 6 | Supporting documents for the amendment must be attached as indicated. |

| 7 | If amending due to a federal tax return audit, a copy of the final federal determination must be attached. |

| 8 | The form is governed by the tax laws of the State of California. |

| 9 | There are specific mailing addresses for returns with payment due and those without. |

How to Write California 540X

Amending a California tax return is a meticulous process that requires the taxpayer to provide accurate and detailed information about the changes being made. The California Form 540X serves this purpose, allowing individuals to correct previously submitted information on their original tax return. Each step in filling out this form is crucial to ensure the amended return reflects the correct information, leading to an accurate assessment of taxes owed or refunds due. Below are the detailed steps for completing Form 540X.

- Enter your full name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and if applicable, your spouse’s/RDP’s full name and SSN or ITIN at the top of the form.

- Fill in your address details, including the number and street, PO Box or PMB no., apartment or suite number, city, state, and ZIP code.

- Answer the question about whether you have been advised that your original federal tax return has been, is being, or will be audited by marking either "Yes" or "No".

- Indicate the filing status claimed on the original return and the status claimed on this amended return by checking the appropriate box.

- If you or your spouse/RDP can be claimed as a dependent on someone else’s tax return for the year you are amending, fill in the circle provided.

- If claiming head of household, provide the name and relationship of the qualifying person both on the original and amended return.

- Under Part I, fill in the columns A, B, and C with the as originally reported/adjusted by FT dboj; net change; and correct amount, respectively, for each line item from 1a to 21 according to the instructions specific to those lines.

- For lines 1 through 6, refer to instructions specific to whether you are amending Form 540NR, Form 540 2EZ, or Forms 540/540A.

- Explain the changes made on Side 2 of the form in the Explanation of Changes section. Be sure to include the item being changed, the amount previously reported and the corrected amount, and the reason for each change. Attach any supporting documents for the changes made.

- Sign and date the bottom of Side 2 of the form. If filed jointly, both you and your spouse/RDP must sign. Include a daytime phone number where you can be reached.

- Review the entire form to ensure all required information has been provided and that all changes are accurately reflected.

- Mail your completed Form 540X to the appropriate address listed under "Where to File," depending on whether you owe additional tax or are due a refund, or if you have already paid electronically.

Each step in this process is designed to clarify and rectify information pertaining to an individual's tax obligations. Careful attention to the instructions for each line will help avoid common errors, ensuring the amended return is processed smoothly and efficiently.

Listed Questions and Answers

What is the California Form 540X?

The California Form 540X is an Amended Individual Income Tax Return form. It's used to make corrections to your previously filed California state income tax return. This could include changes in your income, deductions, or credits that could affect the amount of tax you owe or increase your refund.

When should I file a Form 540X?

You should file Form 540X if you need to correct a California state income tax return you have already filed. Common reasons to file an amended return include needing to report additional income, correcting income amounts, or claiming deductions or credits not claimed on your original return. It's important to file an amended return if any information that affects your tax calculation has changed.

What documents do I need to attach with Form 540X?

When filing Form 540X, you must attach:

- A copy of the notice if you're filing as a result of an IRS change or audit.

- Any forms or schedules that have been changed or added.

- Supporting documents for each change, such as corrected W-2s, 1099s, or additional documentation related to deductions and credits.

Make sure to include your name and Social Security Number or ITIN on all attachments.

How do I complete Part II on the Form 540X?

Part II of the Form 540X is where you explain the changes you're making. You should:

- Clearly list each item you're changing.

- Provide the amount as originally reported and the corrected amount.

- Explain in detail why you're making the change.

- Attach a separate sheet if more space is needed, ensuring it includes your name and SSN or ITIN.

Can I file Form 540X electronically?

As of the last available information, the California Franchise Tax Board (FTKB) may allow electronic filing of the 540X form for certain tax years. Taxpayers should check the FTKB's official website or contact them directly to confirm current filing options and if electronic filing is available for the tax year they are amending.

What if I made a mistake on my federal tax return? Do I need to amend my California return?

If you amend your federal tax return or the IRS makes changes to it, you may also need to amend your California tax return. Any change to your federal return's income, deductions, or credits could affect your California tax obligations. File Form 540X to report these changes to the California Franchise Tax Board within six months of the final federal determination to avoid penalties and interest.

Common mistakes

Filling out the California 540X form, which is the amended individual income tax return, can sometimes be intricate. There are common mistakes that people make while completing this document. These mistakes can lead to delays in processing or even cause the amendment to be incorrect, potentially resulting in unnecessary tax liabilities or missing out on refunds. Here are seven common mistakes to be mindful of:

- Not providing a detailed explanation for the amendments. The form requires an explanation of the changes made. It is crucial to provide a clear and detailed reason for each amendment to avoid confusion or processing delays.

- Incorrectly calculating the tax. Calculating taxes can be complex, especially when amending a return. It's important to carefully follow the instructions for the tax method used (Column C on the form) and to ensure that all calculations are accurate.

- Forgetting to include supporting documents. Supporting documents such as corrected W-2s, 1099s, K-1s, and others are essential to validate the changes made on the amended return. Not attaching these documents can result in processing delays or even denial of the amendment.

- Misreporting income or deductions. Whether it's state wages, federal adjusted gross income, or California adjustments, every figure must be accurately reported. Any discrepancy can raise red flags and potentially trigger an audit.

- Overlooking exemptions and credits. Exemptions and credits directly impact the amount of tax owed or the refund amount. Ensuring these are accurately claimed as per the latest guidelines is critical.

- Not signing the form. An oversight as simple as forgetting to sign the amended return can invalidate the submission. It's a simple yet critical final step.

- Using outdated forms or instructions. Tax laws and forms can change from year to year. Make sure to use the most current version of Form 540X and the accompanying instruction booklet to avoid making errors based on outdated information.

To mitigate these mistakes, here are a few best practices:

- Review the form and all instructions carefully before starting.

- Double-check all calculations and the information reported for accuracy.

- Ensure all necessary supporting documents are attached and clearly labeled with your name and Social Security Number or ITIN.

- Seek guidance from a tax professional if any part of the amendment process is unclear.

By avoiding these common mistakes and following the best practices, filers can ensure their amended return is processed efficiently, accurately reflecting their tax situation.

Documents used along the form

When filing an Amended Individual Income Tax Return in California using Form 540X, additional forms and documents might be required to support the changes being reported. These additional pieces play crucial roles in the amendment process, ensuring accurate reporting and compliance with state tax laws.

- Revised California Tax Return (Form 540, 540NR, etc.): This includes all forms and schedules initially filed. If amendments affect the overall tax calculation, a revised version of the original tax return form must be attached to demonstrate the corrected figures.

- Copy of Final Federal Determination (if applicable): If the amendment is due to changes in the federal tax return, a copy of the final determination by the Internal Revenue Service (IRS) should be attached. This document is necessary when the changes on the federal return influence the state tax obligation.

- W-2s, 1099s, or Other Corrected Tax Documents: These documents provide proof of income, tax withholding, or corrections to previously submitted information. They are essential for verifying the changes made to the income, deductions, or credits on the amended return.

- Documentation Supporting Deductions or Credits Claimed: If the amendment includes new or adjusted deductions or credits, relevant documentation such as receipts, bank statements, or legal papers must be attached. These documents support the eligibility and amount of the deductions or credits claimed.

Together, these documents ensure that the changes made on the Form 540X are well-documented and accurate. Filing an amended tax return with the necessary supporting forms and documents helps in the timely processing of the amendment and the accurate reflection of one’s tax liabilities or refunds. It is important for taxpayers to thoroughly review their amended returns and attached documents before submission to avoid any delays or issues with the state tax authority.

Similar forms

The California Form 540X is designed for taxpayers needing to amend previously filed state income tax returns. This process aligns closely with the purpose of the federal Form 1040X, which serves a similar function at the national level. Both forms allow individuals to correct errors, claim a more favorable filing status, or adjust their income, deductions, and credits after the original submission. The main difference lies in their jurisdiction, one targeting California state taxes and the other federal taxes, but their core function of facilitating post-filing adjustments remains the same.

Similar to the California Form 540X, the IRS Schedule C (Form 1040) also involves reporting financial details, but specifically focuses on profit or loss from business activities. Schedule C is for sole proprietors to detail business income and expenses. While Form 540X amends previously filed information, Schedule C may be among the documents amended if initial reporting was inaccurate. Both forms deal with the adjustment of previously reported financial figures, though they cater to different types of income and corrections.

The IRS Form 8862 is another document with a revision-related purpose, used to reclaim eligibility for certain credits after disallowance in previous years. If a taxpayer's claim for the Earned Income Tax Credit (EITC) is denied, they must file Form 8862 to requalify in future tax years. This mirrors the corrective nature of Form 540X, albeit with a focus on specific tax credits at the federal level. Each form plays a pivotal role in ensuring taxpayers can rectify or update their tax filings to accurately reflect their financial situations.

Form 2555, used by taxpayers to claim the Foreign Earned Income Exclusion, shares similarities with Form 540X in that it could lead to an amendment. If an individual initially fails to claim the exclusion and realizes this omission could reduce their taxable income, they may file Form 540X to rectify the oversight. While Form 2555 directly claims a specific tax benefit for international income, Form 540X serves as the mechanism for correcting the state tax return to include such federal adjustments.

California's Form 3500, the Exemption Application, is geared towards organizations seeking state tax-exempt status. Like Form 540X, it involves a detailed application process but serves a different audience. Whereas Form 540X amends personal income tax returns, Form 3500 is exclusively for entities proving eligibility for tax exemption. Both forms require substantial documentation and careful reporting of financial details to meet state tax regulations.

The IRS Form 8822, Change of Address, although not amending tax figures directly, is vital for maintaining accurate taxpayer records, similar to the role of Form 540X in ensuring correct tax information. When taxpayers relocate, submitting Form 8822 promptly ensures they receive any refunds or correspondence, avoiding complications that could necessitate amendments with Form 540X. Both forms help keep taxpayer information current, though they serve different administrative functions.

Another related document, the IRS Form 9465, Installment Agreement Request, like Form 540X, addresses taxpayers' needs to manage their tax obligations more effectively. If unable to pay the full amount due with Form 540X amendments, taxpayers might need to establish a payment plan, paralleling Form 9465’s purpose at the federal level. Each form provides a structured way to address or rectify tax liabilities, acknowledging financial realities taxpayers face.

The California Form 593, Real Estate Withholding Tax Statement, is indirectly related to the 540X as it involves state tax implications of selling real property. Incorrect or omitted information on Form 593 could result in the need to file Form 540X to amend a tax return. Both forms play crucial roles in the context of real estate transactions and their impact on individual state tax obligations.

Form 540ES, the Estimated Tax for Individuals, and Form 540X are connected through the adjustment of taxpayers' estimated tax payments. Should initial estimates prove inaccurate, leading to overpayment or underpayment of taxes, Form 540X could be utilized to correct the discrepancy on a filed return. While Form 540ES focuses on prospective tax payments based on estimated income, Form 540X allows for retrospective corrections.

Lastly, Form 540NR, Nonresident or Part-Year Resident Tax Return, is directly amendable by Form 540X if errors are found or financial circumstances change after filing. Both forms cater to individuals with specific residency statuses concerning California state taxes but serve different functions—one for the initial reporting and the other for necessary amendments afterward.

Dos and Don'ts

When it comes to amending your income tax return using the California Form 540X, it's crucial to understand what you should and shouldn't do. Here are some guidelines to help you navigate the process accurately and efficiently.

Do's:

Review your original tax return: Before starting, thoroughly review your previously filed Form 540 to understand what needs amending. This comparison will guide your corrections on Form 540X.

Explain the changes: Use Part II on the form to provide a clear and detailed explanation for each change you are making. This explanation ensures that the reviewing authority understands the reasons behind your amendments.

Attach supporting documents: Include any relevant documentation that supports the changes you're making, such as corrected W-2s, 1099s, or schedules. These documents provide evidence for your amendments.

Double-check your figures: Ensure that all the numbers you enter, especially on lines where you report the original amounts, adjustments, and new figures, are accurate. Arithmetic errors can delay processing.

Sign and date the form: Your signature attests that you believe the amended return is true, complete, and correct. If filing jointly, both you and your spouse/RDP must sign.

Keep a copy: Save a copy of the amended return and all accompanying documentation for your records. It's important should there be questions later or for your personal records.

Don'ts:

Forget to report federal changes: If you amended your federal tax return or the IRS made changes, don't forget to amend your state return accordingly on Form 540X.

Overlook checking the boxes: The form includes several checkboxes that require your attention, such as your filing status and whether you’ve been audited. Make sure these accurately reflect your current situation.

Use incorrect tax year’s form: Verify that you are using the Form 540X for the correct tax year you are amending. Using the wrong form can invalidate your amendment.

Miss deadlines: Be aware of California's deadlines for filing an amended return, generally within four years of the due date of the original return or one year after the tax was paid, whichever is later.

Ignore the direct deposit option: For faster processing and receiving any refund due, consider opting for direct deposit instead of a mailed check.

Rush and make errors: Take your time filling out the form to ensure all information is correct and no section is overlooked. Mistakes can lead to delays in processing or further audits.

Misconceptions

When it comes to filing an amended California tax return using Form 540X, there are several misconceptions that can create confusion. Understanding these can help ensure the process is smoother and more efficient.

- Misconception 1: You must wait for a notice of audit from the IRS before amending your California tax return.

Many believe they must wait for an audit notification from the IRS before they can file an amended California tax return with Form 540X. However, taxpayers are encouraged to file an amended return whenever they discover errors or omissions on their original return, regardless of an IRS audit.

- Misconception 2: Filing an amended return is only necessary for underreported income.

While correcting underreported income is a common reason for amending a tax return, Form 540X also allows taxpayers to adjust overreported income, change filing status, or claim deductions or credits not previously claimed. It’s a versatile form meant for various corrections.

- Misconception 3: Filing Form 540X will always lead to a tax audit.

Some taxpayers avoid filing an amended return due to fear of an audit. Filing a 540X form does not automatically trigger an audit. It is meant for rectifying inaccuracies, ensuring you pay the correct amount of tax, neither too much nor too little.

- Misconception 4: You can file Form 540X to amend a tax return from any tax year.

There’s a timeframe within which you can file an amended return using Form 540X. Typically, you have to file it within three years from the original filing deadline of your tax return, or within two years from the date you paid the tax, whichever is later.

- Misconception 5: The process for amending nonresident tax returns is the same as for resident returns.

While Form 540X is used for both residents and nonresidents to amend their tax returns, nonresidents who need to amend their California tax returns must also attach a revised Form 540NR, the Nonresident or Part-Year Resident Tax Return. This requirement underscores the different conditions applied to residents and non-residents for tax purposes.

Correcting these misconceptions ensures that taxpayers approach the amendment of their California tax returns informed and prepared, leading to a higher degree of accuracy and compliance with state tax laws.

Key takeaways

When dealing with the California Form 540X, or the Amended Individual Income Tax Return, taxpayers must navigate a few critical aspects to ensure an accurate submission. Here are seven key takeaways to guide you through the process:

- Before diving into filling out Form 540X, understand that this form is specifically designed for taxpayers who need to amend a previously filed state tax return. This could be due to a variety of reasons, such as reporting additional income, claiming overlooked deductions, or correcting errors.

- It's important to have your original tax return on hand when preparing your amendment. Comparison between original figures and amendments is essential for accurately completing Form 541X. You will need to provide figures as originally reported, the net changes, and the correct amounts for each line being amended.

- If you've been informed of an audit on your federal tax return, Form 540X explicitly asks whether your federal return has been, is being, or will be audited. This question must be answered honestly to avoid discrepancies between state and federal tax records.

- Your filing status can affect your amendment. If there has been a change in your filing status since you submitted your original tax return, you can report this change on Form 540X. Both your original and amended filing statuses need to be indicated.

- Form 540X requires detailed explanations for all changes made to the original tax return. It's crucial not only to list the changes but also to provide a clear rationale for each modification. Supporting documents should be attached to substantiate these changes.

- In cases where the amendment leads to an additional refund or tax owed, Form 540X guides taxpayers on calculating the correct amounts. If you owe additional tax, it's advisable to pay as soon as possible to avoid or minimize interest and penalties.

- Once your 540X form is prepared, signing it is a declaration under penalty of perjury that, to the best of your knowledge, the information provided is true, correct, and complete. For joint returns, both spouses or RDPs (Registered Domestic Partners) must sign the form. The final step is mailing your amended return to the address provided in the Form 540X instructions, ensuring you send it to the correct address based on whether you're enclosing a payment.

By paying careful attention to these key aspects of Form 540X, taxpayers can confidently amend their California tax returns, ensuring that their obligations are met and that any errors or omissions on their original return are correctly addressed.

Different PDF Templates

Dmv Change of Address - The form reflects the licensee's responsibility to maintain accurate and up-to-date information with the board, a cornerstone of professional practice.

Form 100s - Clarification on capital assets and their treatment provides S corporations with critical information for asset management and tax planning.