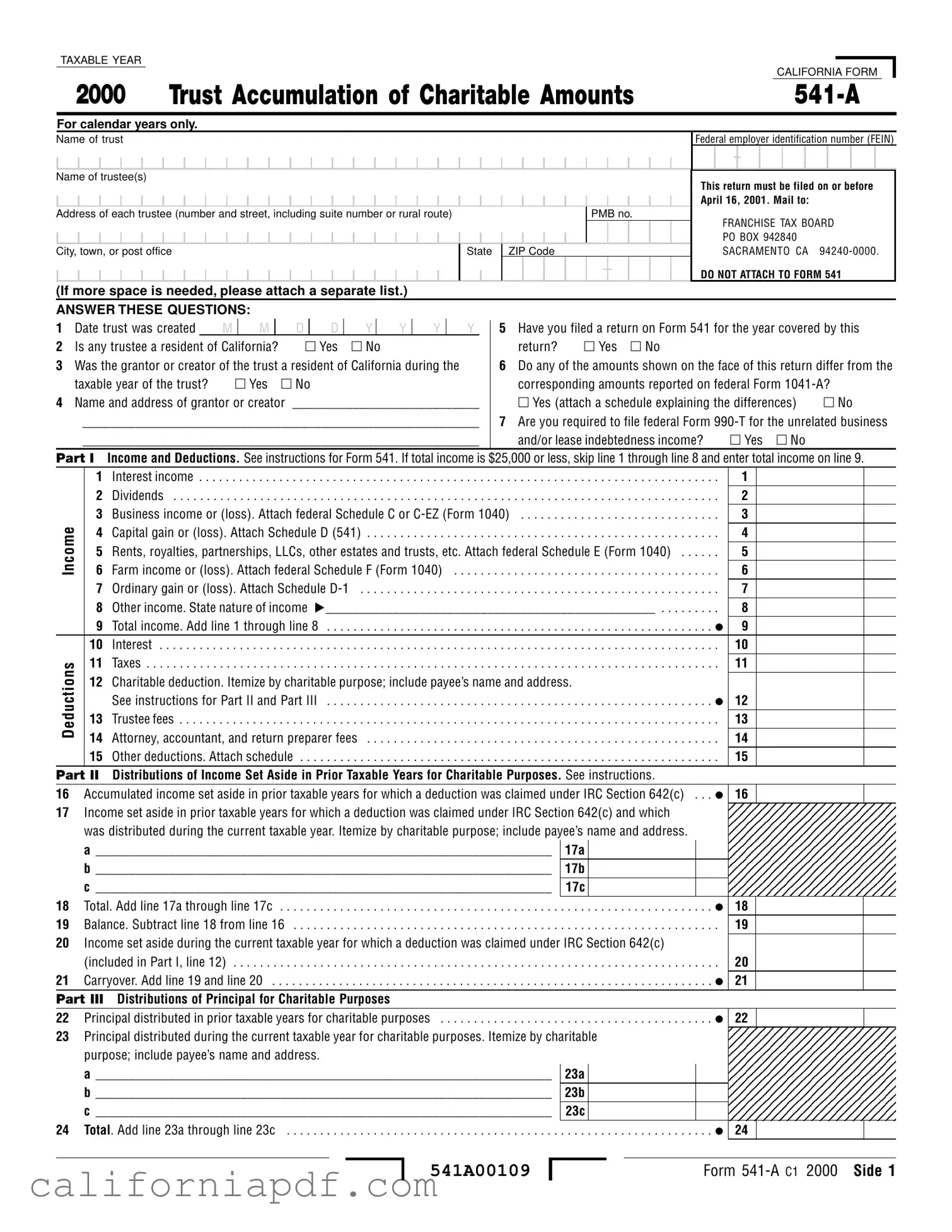

Fill a Valid California 541 A Form

As a critical component of tax filing for trusts in California, the Form 541-A plays a pivotal role by detailing the accumulation of charitable amounts. Primarily intended for trusts that earmark funds for charitable purposes or that operate under a split-interest agreement, the form navigates the intricacies of reporting within the framework dictated by both the state and the Internal Revenue Code (IRC) as of January 1, 1998. Despite California’s adherence to the IRC, it's noteworthy that deviations persist due to non-conformity to several federal amendments post-1998. Trustees are obligated to file this form for any taxable year where a trust claims a charitable deduction under IRC Section 642(c), highlighting the state's commitment to ensuring philanthropic endeavors are accurately recorded and rewarded. Nonetheless, certain trusts, including those mandated to distribute all income currently or those exempt under specific tax sections, may be exempt from this filing requirement. The designation of the trust, whether as a non-exempt charitable entity or a split-interest trust, significantly influences the filing criteria. Additionally, the details surrounding asset distribution, both from income and principal for charitable purposes, require meticulous documentation. This necessitates a comprehensive understanding of the form’s parts, from income and deductions through to details on specific charitable distributions and the required balance sheet information for trusts with income over a certain threshold. With a filing deadline that falls on April 16, a year following the taxable year, trustees must act promptly, though an automatic six-month extension offers some leeway. Delving into the Form 541-A unveils a methodical process designed to encourage and scrutinize charitable contributions, reinforcing the fiscal partnership between trusts and charitable causes within California.

Document Example

TAXABLE YEAR

|

|

CALIFORNIA FORM |

2000 |

TRUST ACCUMULATION OF CHARITABLE AMOUNTS |

For calendar years only.

Name of trust

Federal employer identification number (FEIN)

-

Name of trustee(s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of each trustee (number and street, including suite number or rural route) |

|

|

|

|

|

|

PMB no. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town, or post office |

State |

ZIP Code |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This return must be filed on or before April 16, 2001. Mail to:

FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA

DO NOT ATTACH TO FORM 541

(If more space is needed, please attach a separate list.)

ANSWER THESE QUESTIONS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

1 Date trust was created |

|

M |

M |

|

D |

|

D |

|

Y |

|

Y |

Y |

|

Y |

|

5 |

Have you filed a return on Form 541 for the year covered by this |

||||||||||

2 Is any trustee a resident of California? |

|

|

Yes |

No |

|

|

|

|

|

|

return? |

Yes |

No |

|

|

|

|

|

|||||||||

3 Was the grantor or creator of the trust a resident of California during the |

|

|

6 |

Do any of the amounts shown on the face of this return differ from the |

|||||||||||||||||||||||

|

taxable year of the trust? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

corresponding amounts reported on federal Form |

|

|

||||||||||

4 Name and address of grantor or creator |

____________________________ |

|

Yes (attach a schedule explaining the differences) |

No |

|||||||||||||||||||||||

|

____________________________________________________________ |

|

7 |

Are you required to file federal Form |

|||||||||||||||||||||||

|

____________________________________________________________ |

|

|

and/or lease indebtedness income? |

Yes |

No |

|

|

|||||||||||||||||||

PART I |

Income and Deductions. See instructions for Form 541. If total income is $25,000 or less, skip line 1 through line 8 and enter total income on line 9. |

||||||||||||||||||||||||||

|

|

1 |

Interest income |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

1 |

|

|

|

|

||

|

|

2 |

. . .Dividends . . . . |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

2 |

|

|

|

|

|

|

|

3 |

Business income or (loss). Attach federal Schedule C or |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

3 |

|

|

|

|

||||||||||||||||

Income |

|

4 |

Capital gain or (loss). Attach Schedule D (541) |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

4 |

|

|

|

|

||||||||

|

5 |

. . . . . .Rents, royalties, partnerships, LLCs, other estates and trusts, etc. Attach federal Schedule E (Form 1040) |

5 |

|

|

|

|

||||||||||||||||||||

|

6 |

. .Farm income or (loss). Attach federal Schedule F (Form 1040) |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

6 |

|

|

|

|

||||||||||||||

|

|

7 |

.Ordinary gain or (loss). Attach Schedule |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

7 |

|

|

|

|

||||||||

|

|

8 |

Other income. State nature of income |

. . . . . . . . ._________________________________________________ |

8 |

|

|

|

|

||||||||||||||||||

|

|

9 |

Total income. Add line 1 through line 8 |

. . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . |

9 |

|

|

|

|

||||||

|

|

10 |

Interest |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

10 |

|

|

|

|

|

Deductions |

|

11 |

. . .Taxes |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

11 |

|

|

|

|

|

|

12 |

Charitable deduction. Itemize by charitable purpose; include payee’s name and address. |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

See instructions for Part II and Part III |

. . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . |

12 |

|

|

|

|

|||||||

|

13 |

. . .Trustee fees . . . |

. . . |

. . . . . . |

. . |

. . . |

. |

. . . . |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

13 |

|

|

|

|

||

|

14 |

Attorney, accountant, and return preparer fees |

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|||||||||

|

|

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

|

|

|

|

|||||||||||

|

|

15 |

. . . . . . .Other deductions. Attach schedule |

. . . |

. . |

. . . |

. . |

. . . . . |

. . . |

. . |

. . |

. . . . |

. . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . |

15 |

|

|

|

|

|||||||

PART II Distributions of Income Set Aside in Prior Taxable Years for Charitable Purposes. See instructions. |

|

|

|

|

|

||||||||||||||||||||||

16 |

|

Accumulated income set aside in prior taxable years for which a deduction was claimed under IRC Section 642(c) . . . |

16 |

|

|

|

|

||||||||||||||||||||

17Income set aside in prior taxable years for which a deduction was claimed under IRC Section 642(c) and which

|

was distributed during the current taxable year. Itemize by charitable purpose; include payee’s name and address. |

|

|

a _____________________________________________________________________ |

17a |

|

b _____________________________________________________________________ |

17b |

|

c _____________________________________________________________________ |

17c |

18 |

Total. Add line 17a through line 17c |

. . . . . . . . . . . . . . . . . . . . . . 18 |

19 |

Balance. Subtract line 18 from line 16 |

. . . . . . . . . . . . . . . . . . . . . . . 19 |

20 |

Income set aside during the current taxable year for which a deduction was claimed under IRC Section 642(c) |

|

|

(included in Part I, line 12) |

. . . . . . . . . . . . . . . . . . . . . . . 20 |

21 |

Carryover. Add line 19 and line 20 |

. . . . . . . . . . . . . . . . . . . . . . 21 |

PART III Distributions of Principal for Charitable Purposes |

|

|

22 |

Principal distributed in prior taxable years for charitable purposes |

. . . . . . . . . . . . . . . . . . . . . . 22 |

23 |

Principal distributed during the current taxable year for charitable purposes. Itemize by charitable |

|

|

purpose; include payee’s name and address. |

|

|

a _____________________________________________________________________ |

23a |

|

b _____________________________________________________________________ |

23b |

|

c _____________________________________________________________________ |

23c |

24 |

Total. Add line 23a through line 23c |

. . . . . . . . . . . . . . . . . . . . . . 24 |

|

541A00109 |

|

PART IV |

Balance Sheet. If line 9 is $25,000 or less, complete only line 38, line 42, and line 45. If books of account do not agree, please reconcile all differences. |

|

|

|

|||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|

|

|

|

ASSETS |

|

|

|

|

|

(a) |

(b) |

|

||||||||||||

|

Cash — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

25 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

26 |

. . . . . . . . . . . . . . . . . . . .Savings and temporary cash investments |

. . . . |

. . . . . . . |

. . . . . . . . . . |

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

27 |

a |

. . . . . . . . . . .Accounts receivable |

. . . . . . . . . . . . . . . . . . . . . . |

27a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

. . . . . . . . . . . . . . . . . .b Less: allowance for doubtful accounts |

27b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

28 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .a Notes and loans receivable |

28a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

. . . . . . . . . . . . . . . . . .b Less: allowance for doubtful accounts |

28b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

29 |

Inventories for sale or use |

. . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . |

. . . . . . . . . . |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

30 |

. . . . . . . . . . . . . . . . . . . . .Prepaid expenses and deferred charges |

. . . . |

. . . . . . . |

. . . . . . . . . . |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

31 |

. . . . . . . . . . . . . . . . .Investments — U.S. and state government obligations. Attach schedule |

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Investments — corporate stock. Attach schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

32 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

33 |

. . . . . . . . . . . . .Investments — corporate bonds. Attach schedule |

. . . . |

. . . . . . . |

. . . . . . . . . . |

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

34 |

a |

Investments — land, buildings, and equipment: basis |

34a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

b |

. . . . . . . . . . . . . . . . . . . . . . .Less: accumulated depreciation |

34b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Investments — other. Attach schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

35 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

36 |

a |

Land, buildings, and equipment (trade or business): basis . . |

36a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

b |

. . . . . . . . . . . . . . . . . . . . . . .Less: accumulated depreciation |

36b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

Other assets. Describe. |

_____________________________________________________ |

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

38 |

. . . . . . . . . . . . . . . . . . .Total assets. Add line 25 through line 37 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

Accounts payable and accrued expenses |

. . . . . |

. . . . . . |

. . . . . . . . . . |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

40 |

. . . . . . . . . . .Mortgages and other notes payable. Attach schedule |

. . . . |

. . . . . . . |

. . . . . . . . . . |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

41 |

Other liabilities. Describe. |

___________________________________________________ |

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

42 |

. . . . . . . . . . . . . . . . .Total liabilities. Add line 39 through line 41 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 Trust principal or corpus |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . |

. . . . . . . . . . |

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. . . . . . . . . . . . . . . . . . . . . . . . . .44 Undistributed income and profits |

. . . . |

. . . . . . . |

. . . . . . . . . . |

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

. . . . . . . . . . . . . . . . . . . .45 Total net assets. Add line 43 and line 44 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. . . . . . . .46 Total liabilities and net assets. Add line 42 and line 45 |

. . . . |

. . . . . . . |

. . . . . . . . . . |

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is |

|

|||||||||||||||||||||

Please |

|

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

||||||||||||||||||||||

Sign |

|

|

|

|

|

|

|

|

|

|

Date |

Trustee’s SSN/FEIN |

|

||||||||||||

Here |

|

|

___________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Signature of trustee or officer representing trustee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Date |

|

|

|

Paid preparer’s SSN/PTIN |

|

||||||||||||

Paid |

|

|

Preparer’s |

|

|

|

|

|

|

|

Check if self- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Preparer’s |

signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Use Only |

Firm’s name (or yours, if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Side 2 Form

541A00209

For Privacy Act Notice, get form FTB 1131.

Instructions for FTB Form

Trust Accumulation of Charitable Amounts

General Information

In general, California tax law conforms to the Internal Revenue Code (IRC) as of

January 1, 1998. However, there are continuing differences between California and federal tax law. California has not conformed to most of the changes made to the IRC by the federal Internal Revenue Service Restructuring and Reform Act of 1998 (Public Law

Law

A Purpose

Use Form

BWho Must File

A trustee must file a calendar year Form

A charitable trust is a trust which:

•Is not exempt from taxation under R&TC Section 23701d; and

•Has all the unexpired interests devoted to charitable purposes described in IRC Section 170(c); and

•Had a charitable contribution deduction allowed for all the unexpired interests under the R&TC.

A

•Is not exempt from taxation under R&TC Section 23701d; and

•Has some of the unexpired interests devoted to one or more charitable purposes described in IRC Section 170(c); and

•Has amounts in trust for which a chari- table contributions deduction was allowed under the R&TC. Pooled income funds (IRC Section 642(c)(5)), charitable remainder annuity trusts (IRC

Section 664(d)(1)), and remainder unitrusts (IRC Section 664(d)(2)), are considered

Simple trusts which received a letter from the Franchise Tax Board (FTB) granting exemption from tax under R&TC Section 23701d are considered to be corporations for tax purposes. They may be required to file Form 199, California Exempt Organization Annual Information Return. See the instructions for that form.

Nonexempt charitable trusts, described in IRC Section 4947(a)(1), must file Form 199.

Private Mailbox (PMB) No.

If you lease a mailbox from a private business rather than a PO box from the United States Postal Service, enter your PMB number in the field labeled “PMB no.”

CWhen to File

File Form

DWhere to File

Mail Form

FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA

Specific Instructions

Part II and Part III

Describe in detail on an attached statement the purpose for which charitable disburse- ments were made from income set aside in prior taxable years and amounts which were paid out of principal for charitable purposes. Examples of appropriate descriptions are: payments for nursing service, laboratory construction, fellowships, or assistance to indigent families (not simply charitable, educational, religious, or scientific).

Part IV

If the balance sheet does not agree with the books of account, all differences must be reconciled in an attached statement.

Form

Form Breakdown

| Fact Number | Description |

|---|---|

| 1 | Form 541-A is used for the Trust Accumulation of Charitable Amounts in California. |

| 2 | This form is applicable only for calendar years. |

| 3 | It must be filed by April 16, 2001, for the year 2000. |

| 4 | The form is required for trustees of trusts that claim a charitable deduction under Internal Revenue Code (IRC) Section 642(c). |

| 5 | California tax law generally conforms to the IRC as of January 1, 1998, with several exceptions. |

| 6 | Form 541-A is not necessary if the trust is required to distribute all its income currently by the governing instrument and applicable law. |

| 7 | Nonexempt charitable trusts and split-interest trusts must file this form. |

| 8 | The form should be mailed to the FRANCHISE TAX BOARD PO BOX 942840, SACRAMENTO CA 94240-0000. |

How to Write California 541 A

Filing out the California 541-A Form might initially seem daunting, but with a methodical approach, it can be straightforward. This form, which deals with trust accumulation of charitable amounts, is a vital part of ensuring your trust's compliance with state tax obligations. Let's walk through the key steps needed to properly fill out this form, ensuring clarity and correctness.

- Start by entering the taxable year at the top of the form.

- Fill in the Name of trust and Federal employer identification number (FEIN) as requested.

- Proceed to input the Name of trustee(s) and Address of each trustee, ensuring to include the number and street, suite number or rural route, PMB no. (if applicable), city, town, or post office, state, and ZIP Code.

- Answer the general questions about the trust, including the date it was created, whether any trustee is a resident of California, if the grantor or creator was a California resident during the taxable year, and the name and address of the grantor or creator.

- Indicate whether a return on Form 541 for the year covered by this return has been filed, if the amounts on this return differ from federal Form 1041-A, and if filing federal Form 990-T for the unrelated business and/or lease indebtedness income is necessary.

- Under Part I - Income and Deductions, list all types of income and deductions, attaching schedules as required. If total income is $25,000 or less, skip lines 1 through 8 and enter the total income on line 9.

- For Part II and Part III, detail distributions of income and principal for charitable purposes on attached statements, including the purpose and the payee’s name and address.

- In Part IV - Balance Sheet, fill out asset and liability information. This part may be simplified if the total income is $25,000 or less or if books of account do not agree with the balance sheet.

- Under penalties of perjury, sign and date the form at the designated section. If a paid preparer was involved, ensure their information is also included.

- Mail the completed 541-A Form to the FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0000, making sure it is sent on or before April 16, 2001.

Once your form is properly filled out and submitted, you've taken an important step in managing your trust’s charitable distributions in accordance with California law. Ensuring the accuracy of the information you provide and keeping timely with your submission will help avoid potential complications down the line. This process solidifies your trust's charitable commitments and ensures compliance with state regulations, supporting the greater good while adhering to legal obligations.

Listed Questions and Answers

What is California Form 541-A, and who needs to file it?

California Form 541-A, also known as the Trust Accumulation of Charitable Amounts form, is specifically designed for trusts to report charitable information as required by the Revenue and Taxation Code Section 18635. Trustees must file this form for a trust that claims a charitable or other deduction under the Internal Revenue Code Section 642(c), including charitable or split-interest trusts. However, it is not required for any year in which all the income of the trust is distributed by the terms of the governing instrument and applicable law. This includes nonexempt charitable trusts and split-interest trusts, among others.

What is the deadline for filing Form 541-A?

Form 541-A must be filed on or before April 16, 2001, for trusts operating on a calendar year basis. Trustees who require more time to prepare their filing are granted an automatic six-month extension without the need to submit a request form. This flexibility aims to accommodate various circumstances that may delay timely submission.

What information is required on Form 541-A?

The form collects detailed information about the trust, including the name and address of the trust and trustee(s), the Federal Employer Identification Number (FEIN), as well as specific financial data related to income and deductions associated with charitable activities. Trustees must itemize income set aside or distributed for charitable purposes, including the payee’s name and address, and detail any deductions claimed under IRC Section 642(c). A balanced sheet section is also included for trusts with total income above $25,000, requiring reconciliation if differences with book accounts exist.

Where should Form 541-A be filed?

Completed Form 541-A should be mailed to the Franchise Tax Board at PO BOX 942840, SACRAMENTO CA 94240-0000. This ensures that the form is directed to the appropriate department within the California tax authority for processing. For trusts utilizing private mailboxes, it's important to include the Private Mailbox (PMB) number in the designated field to ensure accurate and timely delivery of their filing.

Common mistakes

Not filing on time: Form 541-A must be submitted by April 16 of the following year. Failing to meet this deadline can result in penalties and interest charges.

Incorrect FEIN: Trustees often enter an incorrect Federal Employer Identification Number (FEIN). This number is crucial for the form's processing and must be accurately provided.

Not answering residency questions correctly: Questions regarding the residency of the trustee or the grantor are sometimes overlooked or incorrectly answered, creating potential for misinterpretation of tax obligations.

Omitting trustee address information: The address of each trustee is mandatory. Some fail to include suite numbers or rural route information, leading to incomplete records.

Leaving income and deduction lines incomplete: All lines of Part I concerning income and deductions need thorough completion. Skipping these sections or reporting incorrect totals will impact the trust's taxable income calculation.

Mismatching amounts with federal Form 1041-A: Amounts reported must align with those on the federal Form 1041-A unless differences are clearly explained in an attached schedule.

Not itemizing deductions properly: Charitable deductions in Part II and III require detailed itemization, including the payee's name and address. Generic descriptions or omissions can invalidate the deduction.

Ignoring the balance sheet section: Part IV's balance sheet is often left blank or incompletely filed, especially if total income is below $25,000. Even minimal entries are required for accuracy.

Failing to reconcile book and tax differences: Part IV requires reconciliation if the book values do not match. Many neglect this, leading to discrepancies in asset valuation.

Incorrect or missing signatures: The form requires the trustee’s signature. Sometimes, forms are submitted without this critical component, rendering the submission invalid.

In summary, to ensure compliance and accurate reporting, attention to detail across all sections of Form 541-A is crucial. Trustees should carefully review the entire form before submission, adhere to deadlines, and consult instructions or a professional advisor if uncertainties arise.

Documents used along the form

When managing the affairs of a trust in California that involves charitable contributions or amounts, the Form 541-A, Trust Accumulation of Charitable Amounts, is crucial. However, it is often not the only document necessary for comprehensive trust administration and compliance with both state and federal laws. A range of other forms and documents frequently accompany Form 541-A to ensure that all financial activities and charitable distributions are accurately reported and in full compliance.

- Form 541: California Fiduciary Income Tax Return. This form details the income, deductions, and tax liability of the trust for the tax year, providing an overall view of the trust's financial activities.

- Form 1041: U.S. Income Tax Return for Estates and Trusts. While Form 541 is for California state taxes, Form 1041 is its federal counterpart, necessary for reporting the trust’s federal income tax obligations.

- Form 990-T: Exempt Organization Business Income Tax Return. For trusts engaging in business activities unrelated to their charitable purpose, this form reports income and expenses related to those activities.

- Schedule D (541): Capital Gain or Loss. Attached to Form 541, this schedule details the capital gains and losses from the trust's investments, crucial for accurate reporting of investment income.

- Schedule K-1 (541): Beneficiary's Share of Income, Deductions, Credits, etc. This document is provided to each beneficiary of the trust, reporting their share of the trust’s income and deductions.

- Form 199: California Exempt Organization Annual Information Return. For trusts with exempt status under California law, this form reports the organization's annual financial information.

- Form 1099: Miscellaneous Income. If the trust pays out income to beneficiaries or other parties that is not reported on Schedule K-1 (541), Form 1099 may be required to report these payments to the IRS.

Ensuring proper documentation and forms accompany the California Form 541-A is vital for legal and tax compliance. Each of these documents plays a unique role in painting a comprehensive picture of the trust's operations, taxable income, and distributions. Trust administrators should diligently prepare and file these forms as applicable to their situation to fulfill state and federal tax obligations, accurately report charitable disbursements, and maintain the trust's good standing.

Similar forms

The Form 990, Return of Organization Exempt from Income Tax, shares similarities with California's Form 541-A, particularly in their focus on charitable organizations and activities. Both forms are used by entities that manage funds designated for charitable purposes, but they serve different types of organizations. Form 990 is a federal requirement for tax-exempt organizations to provide the public with financial information about their operations, ensuring transparency. Like Form 541-A, it includes detailed reporting of income, deductions, and the distribution of charitable funds, ensuring that these organizations operate in accordance with their charitable mission.

California Form 199, Exempt Organization Annual Information Return, also parallels Form 541-A in its reporting requirements for organizations not subject to standard income taxes due to their nonprofit status. Form 199 is specifically designed for tax-exempt entities in California, requiring them to report their financial activities, much like Form 541-A demands detailed accounting from trusts allocating funds for charity. The objective behind both forms is to maintain oversight of organizations that benefit from tax exemptions, ensuring they fulfill their obligations to contribute to public goods.

The federal Form 1041, U.S. Income Tax Return for Estates and Trusts, is akin to the California Form 541-A as they both deal with the taxation specifics for fiduciary entities. Form 1041 is used to report income, deductions, and tax liability of estates and trusts. Its existence acknowledges the unique financial activities of these entities, similar to how Form 541-A addresses the trust's charitable activities and distributions. Both forms play crucial roles in the oversight and taxation of fiduciary arrangements, ensuring they comply with tax laws and properly distribute their resources.

Lastly, the similarity between Form 541-A and the IRS Form 1041-A, U.S. Information Return – Trust Accumulation of Charitable Amounts, is quite direct. Form 1041-A is used by trusts to report the accumulation of income set aside for charitable purposes, akin to how Form 541-A is utilized within California. Both forms target the specific scenario where trusts allocate portions of their income for charity, ensuring that these funds are properly accounted for and used in alignment with the trust's stated charitable objectives.

Dos and Don'ts

Filling out the California 541-A form, a crucial document for trusts engaged in charitable activities, requires meticulous attention to detail and adherence to specific instructions to ensure accurate and compliant submissions. Here are some key do's and don'ts to guide you through the process:

- Do thoroughly review the general instructions provided with the form to understand the specific requirements for the tax year and the kind of trusts that need to file it.

- Do ensure that all information regarding the trust, including the name, Federal employer identification number (FEIN), and trustee details, are accurately entered and correspond with official records.

- Do answer all questions on the form accurately, providing detailed information as required, especially regarding the date the trust was created, residency of the trustees, and specific questions about income and deductions.

- Do attach all necessary schedules and supporting documentation, such as federal Schedule C or C-EZ for business income or loss, Schedule D for capital gains or losses, and any other relevant schedules for income, deductions, and charitable contributions.

- Do itemize charitable deductions and distributions clearly, including payee’s name and address, ensuring to provide a detailed description of the charitable purposes for which disbursements were made.

- Don't overlook discrepancies between the amounts reported on this form and those on federal Form 1041-A. If differences exist, attach a schedule explaining them.

- Don't forget to sign and date the form. The declaration section at the end of the form is a legal attestation of the completeness and accuracy of the information provided. A trustee or an officer representing the trustee must sign here, and if a paid preparer was employed, ensure their information is completed as well.

By following these guidelines closely, trustees can navigate the filing process for the California Form 541-A more efficiently, maintaining compliance and upholding the trust's commitment to its charitable objectives.

Misconceptions

When it comes to the California Form 541-A, Trust Accumulation of Charitable Amounts, a number of misconceptions can lead to confusion. Understanding the form thoroughly helps in accurate and compliant tax filing. Here’s a look at some common misunderstandings:

- Only for charitable trusts: It's misunderstood that Form 541-A is solely for trusts with charitable purposes. While primarily for reporting charitable distributions, it's also for trusts claiming deductions under IRC Section 642(c), including split-interest trusts.

- Filing is yearly: Some believe that the form must be filed annually by all trusts. In reality, it's required only for years in which the trust claims specific deductions or makes charitable distributions.

- California residency requirement: There’s a misconception that all trustees must be California residents. The form asks if any trustee is a California resident, not requiring all to reside in the state.

- Exclusive to calendar year filers: While the provided form specifies "For calendar years only," it implies a requirement for trusts to report on a calendar-year basis. However, this relates to the tax year being reported, not limiting filings strictly to calendar-year accounting periods.

- Deadline misunderstandings: The April 16, 2001, deadline might be seen as strict; however, California grants an automatic six-month extension, removing the need for an extension request form.

- Attachment of Form 541: The instruction "DO NOT ATTACH TO FORM 541" is sometimes overlooked, leading to both forms being filed together, contrary to requirements.

- Simple trusts exempt from filing: There's a false assumption that simple trusts are always exempt. Only those granted exemption under R&TC Section 23701d and fulfilling specific conditions can avoid filing.

- Different forms for different trusts: A common mistake is thinking separate forms are needed for different types of trusts. Form 541-A encompasses charitable, split-interest, and other trusts requiring the reported information.

- Lack of detailed descriptions for distributions: Failing to provide detailed descriptions for charitable distributions and purposes is a frequent oversight. Detailed accounts of the use of funds are necessary for compliance.

Clarifying these misconceptions ensures proper filing and adherence to the California Revenue and Taxation Code, aiding trustees and preparers in managing their responsibilities efficiently.

Key takeaways

Understanding how to correctly fill out and use the California 541-A form is crucial for trusts that aim to claim charitable deductions or are characterized as charitable or split-interest trusts. Here are seven key takeaways to guide you through this process:

- The 541-A form is specifically designed for trusts that need to report charitable information as required by the Revenue and Taxation Code Section 18635.

- It is essential for a trustee to file a Form 541-A for a trust that claims a charitable or other deduction under Internal Revenue Code (IRC) Section 642(c), or for a charitable or split-interest trust. However, it is not required if all income of the trust is distributed currently as per the governing instrument and applicable local law.

- The form is applicable only for calendar year filings, emphasizing its annual submission by trusts that meet the specified criteria.

- Filing deadlines are strict, with the form due on or before April 16 of the following year. Trusts can avail themselves of an automatic six-month extension without the need to file a request form, providing additional time to gather required information and complete the form accurately.

- For trusts with total income of $25,000 or less, the process is simplified as they need only complete specific sections of the form, highlighting the tax authorities' effort to reduce the filing burden on smaller trusts.

- Detailed information regarding distributions from income set aside in previous years for charitable purposes, or from principal for such purposes, needs to be meticulously reported. This includes itemizing disbursements by charitable purpose and including the payee's name and address.

- Should there be any discrepancies between the book values and the amounts reported, a reconciliation statement must be attached, ensuring transparency and accuracy in reporting the trust's assets and liabilities.

Correctly filing Form 541-A not only ensures compliance with California tax law but also plays a pivotal role in the management and reporting of a trust's charitable contributions, thus aiding in maintaining its financial integrity and supporting its philanthropic missions.

Different PDF Templates

Motion for Default Judgment - Filling out this form with precision is crucial for the integrity of legal service in the California court system.

California Jurat 2023 - A notarization form that legally enforces the seriousness of making truthful declarations in California.