Fill a Valid California 541 T Form

An essential aspect of managing a trust or estate in California involves the allocation of estimated tax payments to beneficiaries, which is where the Form 541-T comes into play. Specifically designed for calendar year 2002, or fiscal years beginning in that same year, this form allows trusts or estates in their final year to elect certain tax payment treatments. By using Form 541-T, a fiduciary can choose to have any part of the estate or trust's estimated tax payments treated as though they were made by one or more beneficiaries. This choice, once made, is final and cannot be changed. It's important for fiduciaries to note that Form 541-T must be filed separately from the standard Form 541, California Fiduciary Income Tax Return, and there are specific deadlines that must be met to ensure the election is valid. Additionally, the proper reporting and calculation of these allocations—dividing estimated payments among beneficiaries by their proportional share—requires careful attention to detail. This form not only facilitates clear communication with the California Franchise Tax Board but also aids in the smooth operation and closure of estates and trusts by ensuring that tax responsibilities are properly attributed to the correct parties.

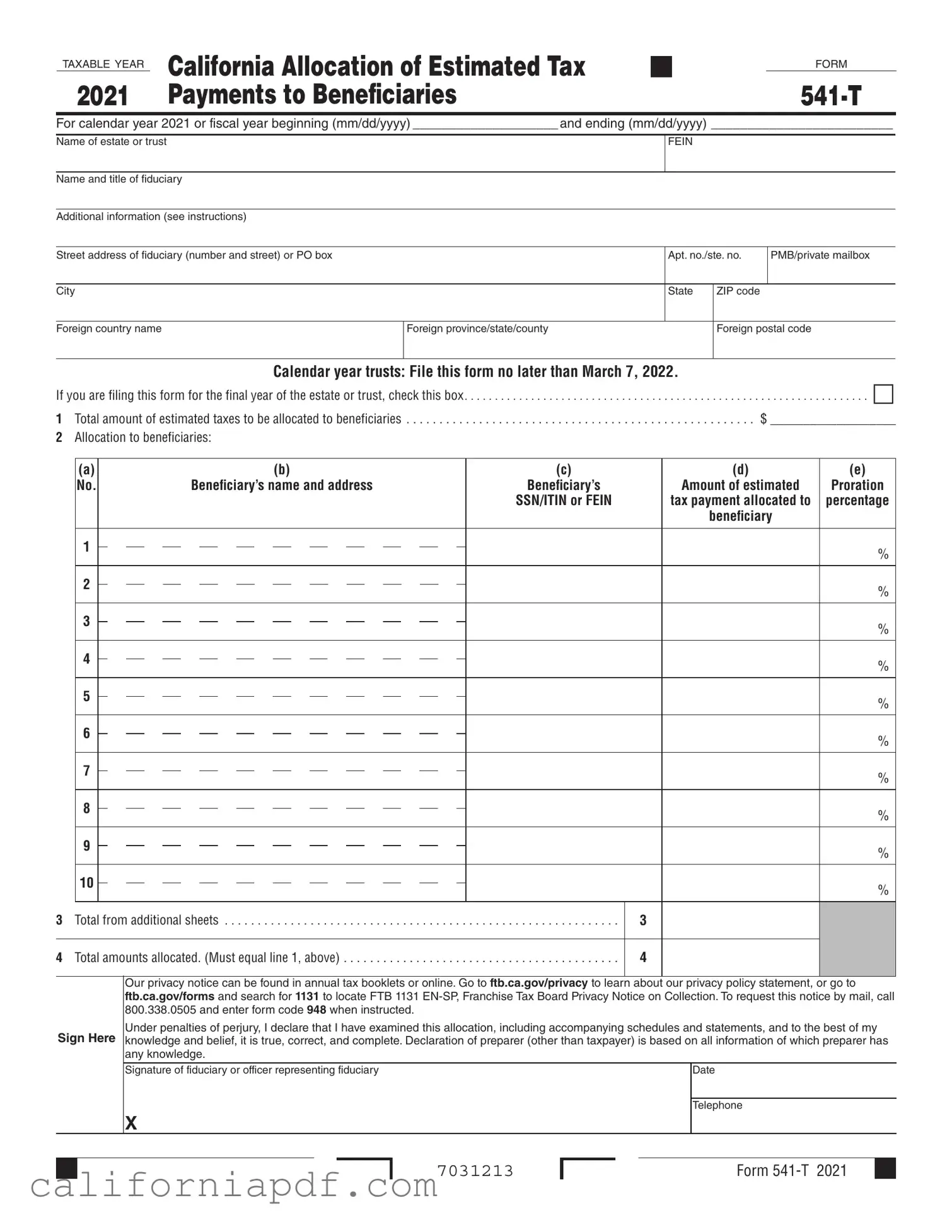

Document Example

TAXABLE YEAR |

CALIFORNIA ALLOCATION OF ESTIMATED TAX |

■ |

|

FORM |

|

|

|

||

2021 |

Payments to Beneficiaries |

|

|

For calendar year 2021 or fiscal year beginning (mm/dd/yyyy) ____________________ and ending (mm/dd/yyyy) _________________________

Name of estate or trust

FEIN

Name and title of fiduciary

Additional information (see instructions)

Street address of fiduciary (number and street) or PO box |

|

Apt. no./ste. no. |

PMB/private mailbox |

|

|

|

|

|

I |

City |

|

State |

ZIP code |

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

Foreign postal code |

||

|

I |

|

|

|

Calendar year trusts: File this form no later than March 7, 2022.

If you are filing this form for the final year of the estate or trust, check this box. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . • |

|||||

1 Total amount of estimated taxes to be allocated to beneficiaries |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . $ ___________________ |

||||||

2 |

Allocation to beneficiaries: |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

(c) |

(d) |

(e) |

|

|

|

No. |

|

Beneficiary’s name and address |

Beneficiary’s |

Amount of estimated |

Proration |

|

|

|

|

|

|

|

SSN/ITIN or FEIN |

tax payment allocated to |

percentage |

|

|

|

|

|

|

|

beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

% |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Total from additional sheets |

3 |

|

|||||

4 Total amounts allocated. (Must equal line 1, above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Sign Here

Our privacy notice can be found in annual tax booklets or online. Go to ftb.ca.gov/privacy to learn about our privacy policy statement, or go to ftb.ca.gov/forms and search for 1131 to locate FTB 1131

Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature of fiduciary or officer representing fiduciary |

Date |

Telephone

X

■

7031213

FORM |

■ |

Form Breakdown

| Fact | Detail |

|---|---|

| Form Title | California Allocation of Estimated Tax Payments to Beneficiaries |

| Tax Year | 2002 |

| Governing Law | Revenue and Taxation Code Section 17731 and Internal Revenue Code Section 643(g)(1)(B) |

| Filing Deadline | 65 days after the close of the tax year |

| Filing Requirement | Separate from Form 541, California Fiduciary Income Tax Return |

| Where to File | FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA 94240-0002 |

| Primary Purpose | Election for tax payments to be treated as made by beneficiaries |

How to Write California 541 T

After completing Form 541 for the California Fiduciary Income Tax Return, fiduciaries of trusts or decedents' estates may face the task of allocating estimated tax payments to beneficiaries. This is where Form 541-T comes into play, allowing for the allocation of these payments for the tax year. It's crucial to note that this election is irreversible once made. Therefore, ensuring accuracy and timeliness in filing this form is paramount. Below are the steps to properly fill out the California Form 541-T for the Taxable Year 2002.

- At the top of the form, indicate whether the form is for a calendar year by marking 2002, or for a fiscal year by filling in the specific beginning and ending dates within the year 2002.

- Provide the name of the estate or trust, along with the name and title of the fiduciary responsible for filing.

- Enter the Federal Employer Identification Number (FEIN) of the trust or estate.

- Include the fiduciary’s full address, including the suite, number, PMB no. (if applicable), city, state, and ZIP code.

- If this form is being filed for the final year of the estate or trust, ensure to check the designated box near the top of the form.

- Under line 1, enter the total amount of the estimated taxes paid by the trust or estate that you wish to allocate to beneficiaries.

- For line 2:

- In column (a), sequentially number the beneficiaries.

- In column (b), provide the full name and address of each beneficiary.

- In column (c), list each beneficiary’s Social Security Number (SSN) or Federal Employer Identification Number (FEIN), depending on whether they are an individual or an entity.

- In column (d), specify the amount of estimated tax payment being allocated to each beneficiary.

- In column (e), calculate and enter the proration percentage for each beneficiary, based on their share of the estimated payments.

- If more than 10 beneficiaries exist, attach additional sheet(s) following the format of line 2, and enter the total of these additional amounts on line 3. Include the name of the fiduciary and the FEIN on each attached sheet.

- Ensure the total amount allocated to all beneficiaries on line 4 matches the total amount entered on line 1.

- Review the form for accuracy, then have the fiduciary sign and date the form at the bottom.

- Finally, mail the completed Form 541-T to the designated address: FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA 94240-0002. Remember, do not attach Form 541-T to Form 541.

It is imperative to file Form 541-T by the 65th day after the close of the tax year to make the election valid. If this deadline falls on a weekend or legal holiday, the next business day becomes the due date. Adherence to these instructions and timelines will ensure a smooth process in allocating estimated tax payments to beneficiaries.

Listed Questions and Answers

What is the California Form 541-T?

The California Form 541-T, known as the Allocation of Estimated Tax Payments to Beneficiaries, is used by trusts or decedent’s estates in their final year to allocate portions of estimated tax payments to their beneficiaries. This election is made under Revenue and Taxation Code Section 17731, mirroring Internal Revenue Code Section 643(g)(1)(B), and is irrevocable once filed.

Who needs to file Form 541-T?

This form must be filed by fiduciaries of a trust or an estate that has decided to allocate estimated tax payments to one or more beneficiaries. It applies to estates in their concluding year and any year for trusts electing to make this allocation.

How is Form 541-T filed?

Form 541-T should be filed separately from Form 541, the California Fiduciary Income Tax Return. It should not be attached to Form 541, but mailed directly to the Franchise Tax Board at the specified address.

When is Form 541-T due?

The form must be filed by the 65th day after the close of the trust or estate’s tax year. If this day falls on a weekend or legal holiday, the next business day becomes the due date. For example, for a calendar year trust or estate, the due date would be on or before March 6th of the following year.

What are the specific requirements for Line 1 on Form 541-T?

On Line 1, fiduciaries are required to enter the total amount of the estimated tax payments made by the trust or estate that they wish to allocate to beneficiaries. This amount will be treated as if it were paid or credited to the beneficiaries on the last day of the tax year of the trust or estate.

How do you complete the allocation for beneficiaries on Form 541-T?

The allocation to beneficiaries requires detailed information including beneficiary name, address, Social Security Number (SSN) or Federal Employer Identification Number (FEIN), the amount of estimated tax allocated, and the proration percentage. Beneficiaries must be listed in two categories: individuals with SSNs and other entities with FEINs. If allocating to more than 10 beneficiaries, additional sheets following the line 2 format must be attached.

What happens if you do not provide a valid SSN or FEIN for a beneficiary?

Failure to provide a valid SSN or FEIN for each beneficiary may result in processing delays and could potentially lead to penalties for the beneficiary. It is crucial to ensure that all beneficiary identifying numbers are accurate and properly recorded.

Can Form 541-T be filed electronically?

As of the latest information available, Form 541-T must be mailed to the Franchise Tax Board and is not eligible for electronic filing. It is important to verify the current filing options directly with the California Franchise Tax Board or through their website.

What should be done if the estate or trust has more than ten beneficiaries?

If there are more than ten beneficiaries, additional beneficiaries must be listed on a separate sheet following the format of Line 2. This sheet should include the fiduciary's name and FEIN for identification and ensure the total amount from this sheet is entered on Line 3 of the Form 541-T.

Where can more information about Form 541-T be obtained?

For detailed instructions and more information, fiduciaries can refer to the

- California Franchise Tax Board's website at www.ftb.ca.gov

- Specific instructions provided with Form 541-T

- Consulting a tax professional specializing in estate and trust tax matters

Common mistakes

Not correctly categorizing beneficiaries based on whether they have a social security number (SSN) or a federal employer identification number (FEIN). This error can delay processing and lead to potential penalties.

Omitting the fiduciary’s suite, room, or PMB number in the address section. Incorrect or incomplete address information can cause significant delays in communication and processing.

Failing to enter a valid SSN or FEIN for each beneficiary. This mistake not only causes delays but also risks incorrect allocation of payments, which might result in penalties on the beneficiary.

Incorrectly calculating the proration percentage for each beneficiary. Each beneficiary’s proration percentage must correctly reflect the portion of the estimated payment they are allocated, based on the payment amounts listed.

Forgetting to check the box indicating the final year of the estate or trust, if applicable. This oversight can lead to incorrect processing of the form and potential issues with estate or trust closure.

Ensuring accuracy in these areas can significantly streamline the processing of Form 541-T and help avoid unnecessary penalties and delays.

Documents used along the form

Navigating the financial responsibilities of managing an estate or trust in California necessitates meticulous record-keeping and timely filing of various tax documents, one of which is the Form 541-T. This form, specifically utilized for the allocation of estimated tax payments to beneficiaries, is just a part of the suite of documents and forms that fiduciaries might need to complete. Understanding each form and its purpose can ease the process considerably for both fiduciaries and beneficiaries.

- Form 541, California Fiduciary Income Tax Return: This is the primary return for an estate or trust, reporting its income, deductions, and tax liability for the year. It is where the estate or trust calculates the income distribution deduction, which can include amounts allocated using Form 541-T.

- Schedule K-1 (541), Beneficiary’s Share of Income, Deductions, Credits, Etc.: Accompanies Form 541, detailing each beneficiary's share of the estate or trust's income, deductions, and credits. It is essential for beneficiaries to correctly report their income from the estate or trust on their personal tax returns.

- Form 1041, U.S. Income Tax Return for Estates and Trusts: Although a federal form, Form 1041 is relevant for California fiduciaries because it mirrors many aspects of Form 541. Understanding both can help in preparing each accurately.

- Form 1041-ES, Estimated Income Tax for Estates and Trusts: Used by fiduciaries to calculate and pay estimated federal income tax for the estate or trust. This is the federal counterpart to any estimated tax payments the fiduciary might be allocating to beneficiaries on Form 541-T.

- Form FTB 3582, Payment Voucher for Fiduciary Income Tax: If the estate or trust owes income tax to the state of California, this payment voucher is used to submit payment along with the return.

- Form 593, Real Estate Withholding Tax Statement: Relevant for estates or trusts that sell real property in California. This form documents the withholding from the sale proceeds for state income tax purposes.

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return: For larger estates that might owe federal estate tax, Form 706 is required. Although not a California-specific form, it's crucial for estates that are potentially subject to federal estate taxes.

- Form FTB 3522, LLC Tax Voucher: If the estate or trust includes an interest in a California LLC, this voucher is used to pay the annual LLC tax due to the state.

- Form DE-1, Registration Form for Commercial Employers: In instances where an estate or trust hires employees, this form registers the estate or trust as an employer with the California Employment Development Department.

The interplay of these forms illustrates the complexities of tax planning and compliance for estates and trusts in California. Fiduciaries are encouraged to approach these responsibilities with a thorough understanding of each required document to fulfill their duties effectively and ensure the smooth administration of the estate or trust. Careful attention to the specific instructions and timely filing of these documents can significantly impact the financial health and tax obligations of the fiduciary entity.

Similar forms

The California Form 1099-G is similar to the Form 541-T in that it involves the reporting of amounts that may be taxable to recipients. Form 1099-G reports certain government payments, such as state tax refunds and unemployment compensation. Similar to how Form 541-T allocates estimated taxes to beneficiaries, Form 1099-G reports payments to individuals that may affect their tax liabilities. Both forms play a crucial role in ensuring transparency and accuracy in tax reporting, thereby aiding recipients in complying with their tax reporting obligations.

Form 1041, U.S. Income Tax Return for Estates and Trusts, shares similarities with California's Form 541-T as they both pertain to fiduciary entities. While Form 541-T focuses specifically on the allocation of estimated tax payments to beneficiaries of a trust or decedent's estate, Form 1041 serves a broader purpose by reporting the income, deductions, and gains of estates and trusts. Both are essential for trustees and fiduciaries to manage and report financial activities associated with their fiduciary responsibilities accurately.

The Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc., is another document with functions akin to those of Form 541-T. It is used to report a beneficiary's share of an estate's or trust's income, deductions, and credits. The direct allocation of estimated tax payments in Form 541-T similarly allows beneficiaries to be aware of the amounts allocated to them, which can impact their individual tax filings. Both documents ensure that beneficiaries receive the information necessary to accurately report their share of estate or trust-related income and payments on their tax returns.

California's Form 541, California Fiduciary Income Tax Return, is closely related to Form 541-T in purpose and practice. While Form 541 is the primary document for reporting a trust or estate's annual income, deductions, and tax liabilities, Form 541-T is used to allocate estimated tax payments to beneficiaries explicitly. Both forms are integral to the financial management and tax compliance of estates and trusts, facilitating accurate reporting to the Franchise Tax Board.

The Form 8582, Passive Activity Loss Limitations, although not directly related to trusts or estates, shares a conceptual similarity with Form 541-T in terms of limiting tax liabilities. Form 8582 is designed to calculate and limit the losses that taxpayers can claim from passive activities to offset other income. In contrast, Form 541-T helps manage the allocation of estimated taxes, potentially affecting the tax liabilities of beneficiaries. Both forms contribute to the broader objective of ensuring that tax liabilities are correctly calculated and reported, in accordance with federal and state tax laws.

Dos and Don'ts

When completing the California 541-T form, an Allocation of Estimated Tax Payments to Beneficiaries, there are several key things to keep in mind to ensure the form is filled out correctly and efficiently. Here's a list of the things you should and shouldn't do:

- Do ensure you have all the necessary information about the estate or trust, including the Federal Employer Identification Number (FEIN), before you start filling out the form.

- Do separate the beneficiaries into two categories as specified: individuals with a Social Security Number (SSN) and other entities with a Federal Employer Identification Number (FEIN).

- Do accurately calculate the proration percentage for each beneficiary to ensure the correct allocation of estimated tax payments.

- Do include suite, room, or unit numbers in the fiduciary's address if applicable, to ensure the address is complete.

- Do attach additional sheets if you are allocating payments to more than 10 beneficiaries, ensuring the format matches what's required on the form.

- Don't file Form 541-T with Form 541; they should be filed separately.

- Don't forget to check the box if you are filing this form for the final year of the estate or trust.

- Don't miss the filing deadline, which is the 65th day after the close of the tax year.

- Don't forget to sign the form. An unsigned form may cause delays or be considered invalid.

- Don't neglect to review the entire form and attached documents for accuracy before submitting. Errors can lead to processing delays or incorrect allocations.

This advice aims to simplify the process of filling out the California 541-T form, facilitating a more straightforward and error-free experience.

Misconceptions

There are several misconceptions about the California 541-T form, which is used for the Allocation of Estimated Tax Payments to Beneficiaries by trusts and estates. Understanding these misunderstandings can help ensure that fiduciaries fulfill their responsibilities accurately and comply with California tax laws.

- Misconception 1: Form 541-T must be attached to Form 541.

This is incorrect. Form 541-T should be filed separately from Form 541, the California Fiduciary Income Tax Return. Attaching it to Form 541 can lead to processing errors and delays.

- Misconception 2: Beneficiaries cannot be allocated estimated tax payments for the final year of the estate or trust.

Even in its final year, a trust or decedent’s estate can elect to have any part of its estimated tax payments treated as made by a beneficiary or beneficiaries. This option provides flexibility in handling the concluding financial affairs of the entity.

- Misconception 3: Estimated tax payments allocated to beneficiaries can be distributed on Form 541-T.

Form 541-T is solely for the election to have estimated tax payments treated as made by the beneficiaries. The actual distribution of withholding to beneficiaries should not be reported on this form.

- Misconception 4: Filing Form 541-T is optional.

Once the decision is made to allocate estimated taxes to beneficiaries, filing Form 541-T becomes necessary to make the election official. The election itself is irrevocable, underscoring the form's importance.

- Misconception 5: Form 541-T can be filed at any time during the tax year.

The form must be filed by the 65th day after the close of the tax year. Failure to adhere to this deadline can result in the election being invalid, affecting beneficiaries’ tax situations.

- Misconception 6: Any beneficiary’s identifying number is acceptable when allocating estimated tax payments.

For individual beneficiaries, a Social Security Number (SSN) must be used. For other entities, a federal employer identification number (FEIN) is required. Using incorrect or invalid numbers can lead to processing delays and penalties.

- Misconception 7: The amount of estimated tax payment allocated to a beneficiary does not need to be reported elsewhere.

The allocated amount must also be entered on Schedule K-1 (541), reflecting the beneficiary’s share of income, deductions, credits, etc. This ensures proper tax reporting and accountability for the beneficiary.

- Misconception 8: All beneficiaries must be listed on Form 541-T itself.

If there are more than 10 beneficiaries, additional beneficiaries should be listed on an attached sheet that follows the form's format. It's crucial to include all necessary information on these attached sheets.

- Misconception 9: Internet access is required to complete Form 541-T.

While the form and instructions are available online for convenience, fiduciaries without Internet access can obtain them through other means, ensuring that all fiduciaries can comply with filing requirements.

Addressing these misconceptions helps ensure that the use of Form 541-T aligns with California tax law requirements, aiding fiduciaries in accurately completing their duties and beneficiaries in understanding their tax obligations.

Key takeaways

Filling out and using the California 541-T Form, also known as the Allocation of Estimated Tax Payments to Beneficiaries form, plays a crucial role in managing the estimated tax payments for estates and trusts. Understanding how to correctly complete and submit this form is important for fiduciaries and beneficiaries alike. Here are key takeaways regarding this process:

- The purpose of Form 541-T is to allow trusts, or decedent's estates in their final year, to elect to have parts of their estimated tax payments treated as if made by one or more beneficiaries.

- This form should be filed separately from the California Fiduciary Income Tax Return, Form 541. It is critical not to attach Form 541-T to Form 541 to ensure proper processing.

- Form 541-T needs to be mailed to the Franchise Tax Board at PO BOX 942840, SACRAMENTO CA 94240-0002, paying attention to correct addressing to avoid delays.

- To ensure the election is valid, the filing must occur by the 65th day after the close of the tax year. For instance, for a calendar year trust, the deadline would fall in early March of the following year.

- The form covers both calendar year filings and fiscal years that begin in the specified tax year. If the form is for a fiscal year or a short tax year, the specific dates need to be filled at the top of the form.

- Detailed instructions on the form assist in providing the fiduciary's address correctly, including suite or room numbers, and specify the use of a PO Box number if mail is not delivered directly to the street address.

- For beneficiaries, it's important to categorize them into individuals with a Social Security Number (SSN) and other entities with a federal employer identification number (FEIN) and provide these identifiers accurately to avoid processing delays or penalties.

- The amount of the estimated tax payment to be allocated to each beneficiary must be declared, affecting the Income Distribution Deduction on Form 541, Schedule B, line 11.

- If there are more than ten beneficiaries, additional sheets must be attached, following the format of line 2, including the fiduciary's name and FEIN for consistency and clarity.

Once filed, this irrevocable election facilitates the proper allocation of estimated tax payments to beneficiaries, ensuring that these amounts are treated as if paid or credited directly to them. Understanding and carefully following these guidelines helps in the accurate and timely filing of Form 541-T, aiding in the efficient management of tax obligations for estates and trusts.

Different PDF Templates

California 461 - The form plays a critical role in the aggregation of contributions and expenditures by affiliated entities, ensuring comprehensive financial disclosure.

Affidavit of Non-use - Helps California vehicle owners avoid unnecessary registration fees during periods of non-operation.