Fill a Valid California 570 Form

Navigating the complexities of tax obligations can be a daunting task, especially when it involves specialized areas such as nonadmitted insurance in California. The California Form 570 plays a pivotal role for entities and individuals engaged in transactions with nonadmitted insurers, guiding the reporting and taxation process of such insurance contracts. Designed for the amended or initial filing pertaining to the Nonadmitted Insurance Tax Return, this form serves as a bridge between policyholders and their tax responsibilities, ensuring compliance with state regulations. It encompasses a broad spectrum of information, from the basics of policyholder identification to detailed tax computation and policy specifics. Given its coverage, the form is segmented into distinct parts, facilitating a structured approach to declaring taxable insurance contracts that took effect or were renewed within a specific quarter of the tax year. Taxpayers are required to detail gross premiums, calculate the applicable tax, and account for previous payments or overpayments, reflecting adjustments such as returned premiums previously taxed. Moreover, it addresses scenarios catering to both domestic risks and those extending beyond California, with an emphasis on maintaining accuracy in premium allocation for home state insureds. Filing deadlines, amended returns guidelines, and specific instructions for agents or brokers filing on behalf of insureds highlight the procedural aspects, ensuring clarity in the submission process. By delving into the provisions of the form, taxpayers can navigate their tax compliance journey with a clearer path, mitigating the potential for errors while aligning with California's legislative framework for nonadmitted insurance taxation.

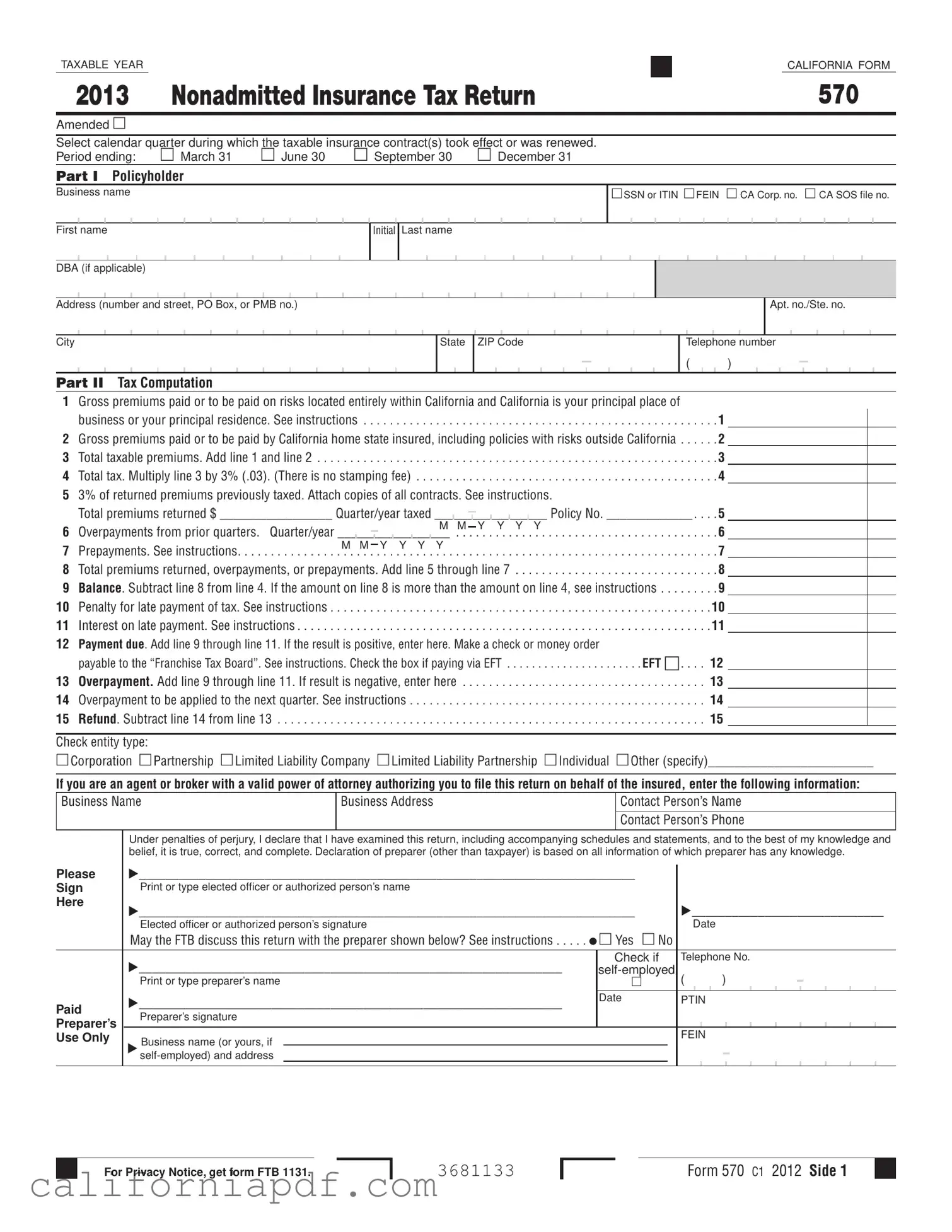

Document Example

TAXABLE YEAR  CALIFORNIA FORM

CALIFORNIA FORM

2013 |

NONADMITTED INSURANCE TAX RETURN |

570 |

|

|

|

Amended |

|

|

|

|

|

Select calendar quarter during which the taxable insurance contract(s) took effect or was renewed. |

|

|

Period ending: |

March 31 June 30 September 30 December 31 |

|

PART I Policyholder

Business name

First name

DBA (if applicable)

SSN or ITIN FEIN CA Corp. no. CA SOS file no.

Initial Last name

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

Telephone number

()

PART II Tax Computation

1Gross premiums paid or to be paid on risks located entirely within California and California is your principal place of

business or your principal residence. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Gross premiums paid or to be paid by California home state insured, including policies with risks outside California . . . . . . 2 3 Total taxable premiums. Add line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 Total tax. Multiply line 3 by 3% (.03). (There is no stamping fee) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

53% of returned premiums previously taxed. Attach copies of all contracts. See instructions.

|

Total premiums returned $ _________________ Quarter/year taxed _________________ Policy No. _____________ . . . |

. 5 |

|

|

|

M M Y Y Y Y |

|

6 |

Overpayments from prior quarters. Quarter/year _________________ |

. 6 |

|

|

|

M M Y Y Y Y |

|

7 |

Prepayments. See instructions |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 7 |

8 |

Total premiums returned, overpayments, or prepayments. Add line 5 through line 7 |

. 8 |

|

9 |

Balance. Subtract line 8 from line 4. If the amount on line 8 is more than the amount on line 4, see instructions |

. 9 |

|

10 |

Penalty for late payment of tax. See instructions . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

10 |

11 |

Interest on late payment. See instructions |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

11 |

12Payment due. Add line 9 through line 11. If the result is positive, enter here. Make a check or money order

payable to the “Franchise Tax Board”. See instructions. Check the box if paying via EFT . . . . . . . . . . . . . . . . . . . . . . EFT n . . . . 12

13 Overpayment. Add line 9 through line 11. If result is negative, enter here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 14 Overpayment to be applied to the next quarter. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 15 Refund. Subtract line 14 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Check entity type:

Corporation Partnership Limited Liability Company Limited Liability Partnership Individual Other (specify)_________________________

If you are an agent or broker with a valid power of attorney authorizing you to file this return on behalf of the insured, enter the following information:

Business Name |

Business Address |

Contact Person’s Name |

|

|

|

|

|

Contact Person’s Phone |

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please |

___________________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sign |

Print or type elected officer or authorized person’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Here |

___________________________________________________________________________ |

_____________________________ |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

Elected officer or authorized person’s signature |

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

May the FTB discuss this return with the preparer shown below? See instructions . . . . . Yes No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

________________________________________________________________ |

Check if |

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

( |

|

|

|

|

|

|

) |

|

|

- |

|

|

|

|

|

|

||||||||||

|

Print or type preparer’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

________________________________________________________________ |

Date |

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Preparer’s signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Preparer’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Use Only |

Business name (or yours, if |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Notice, get form FTB 1131.

3681133

Form 570 C1 2012 Side 1

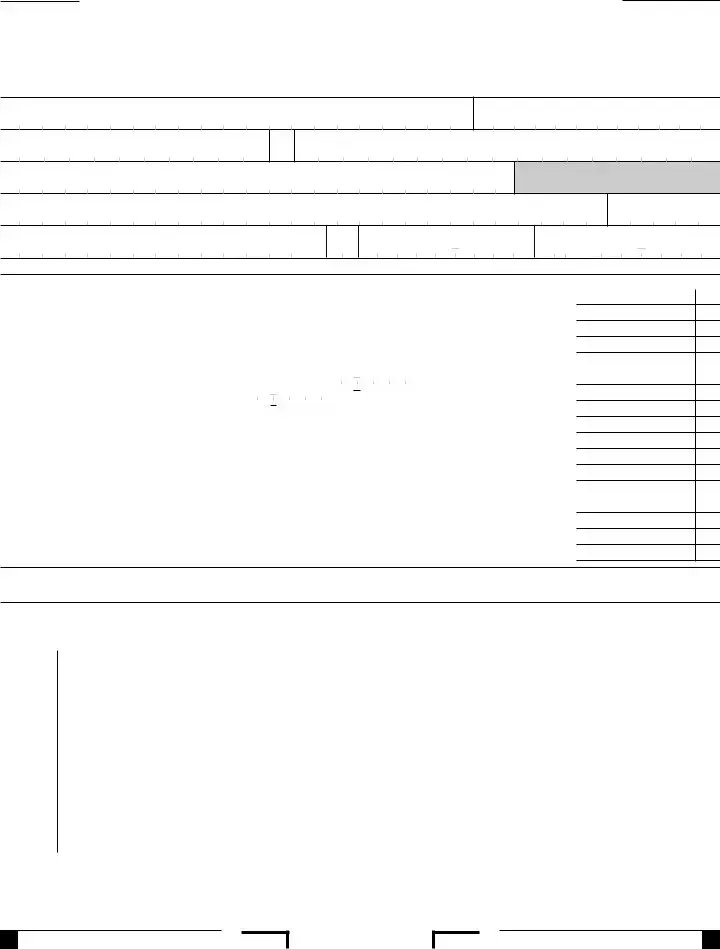

Policyholder Name: ________________________________________________________ Policyholder’s ID No.:________________________

PART III Insurance Contracts – If you have more than 24 policies to report, enter the additional policies on another Side 2 of Form 570. Total each Side 2 on the bottom separately. Do not create a schedule to report additional policies. We only accept and process official versions of Side 2 of Form 570.

|

|

|

|

PRINT CLEARLY |

|

|

|

|

|

a |

b |

c |

d |

e |

Policy Number |

Name of each Nonadmitted Insurance Company |

Type of Insurance Coverage |

Location of Risks |

Total Premium |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Side 2 Form 570 C1 2012

3682133

Instructions for Form 570

Nonadmitted Insurance Tax Return

References in these instructions are to the California Revenue and Taxation Code (R&TC) and the California Insurance Code.

What’s New

Do Not Round Cents to Dollars – On this form, do not round cents to the nearest whole dollar. Enter the amounts with dollars and cents.

General Information

A user of this form may have to file up to four Form 570 tax returns in one year if the user purchases nonadmitted insurance contracts in each calendar quarter.

Assembly Bill (AB) 315, effective July 21, 2011, conforms California law to the Nonadmitted and Reinsurance Reform Act (NRRA) that is part of the

is a change from when California only taxed premiums related to California risk. The NRRA only allows one state to tax a home state insured, so proration of premiums among the states for taxation no longer occurs.

For more information, go to ftb.ca.gov and search for nonadmitted insurance tax.

To receive nonadmitted insurance tax information by email, go to ftb.ca.gov and search for subscription services.

Definitions:

•Home state – the state where the insured maintains its principal place of business, or if individual, the individual’s principal residence; if 100% of the insured risk is located in a state outside the insured’s principal place

of business or principal residence, then it is where the greatest percent of the insured’s taxable premium for that insurance contract is allocated.

•Principal place of business – the state where the insured maintains its headquarters and where the insured’s

•Principal residence – the state where the insured resides for the greatest number of days during a calendar year; or if the insured’s principal residence is located outside the U.S., the state to which the greatest percentage

of the insured’s taxable premium for that insurance contract is allocated.

•Home state insured – or “home state insured applicant” – a person whose home state is California and who has received a certificate or evidence of coverage as set forth in Section 1764 of the Insurance Code or a policy as issued by an eligible surplus line insurer, or a person who is an applicant.

•Multistate risk – means a risk covered by a nonadmitted insurer with insured exposures in more than one state.

The total gross premium paid or to be paid for all nonadmitted insurance placed in a single transaction with one underwriter or group of underwriters, whether in one or more policies, in that calendar quarter during which the taxable insurance contract or contracts took effect or were renewed, is now the entire gross premium charged on all nonadmitted insurance for the California home state insured. Enter only premiums for policies related to risks within the U.S.

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

A Purpose

Use Form 570, Nonadmitted Insurance Tax Return, to determine the tax on premiums paid or to be paid to nonadmitted insurers on contracts covering risks. Also, use Form 570 to file an amended return. See Section E, Amended Returns, for more information.

B Who Must Pay Nonadmitted Insurance Tax

The tax is imposed on a home state insured who independently purchases or renews an insurance contract during the calendar quarter from an insurer, including

If you do not know if the insurer is authorized to conduct business in California, call the FTB Nonadmitted Insurance Desk at 916.845.7448.

The tax will not be imposed on any of the following:

•Insurance coverage for which a tax on the gross premium is due or has been paid by surplus line brokers pursuant to Insurance Code Section 1775.5 (surplus lines tax).

•Gross premiums on businesses governed by provisions of Insurance Code Section 1760.5 (reinsurance of the liability of an admitted insurer and marine, aircraft, and interstate railroad insurance).

•Insurance coverage for which a tax on the gross premium is due or has been paid by risk retention groups pursuant to Insurance Code Section 132.

Agents or brokers with a valid power of attorney to file a return on behalf of the insured must enter the requested information in the space below line 15.

C Tax Rate

The tax rate is three percent (.03). This rate is applied to the gross premium paid or to be paid, less premiums returned because of cancellation or reduction of premium on which a tax has been paid. Do not include a stamping fee.

D When and Where to File

File Form 570 on or before the first day of the third month following the close of any calendar quarter during which a nonadmitted insurance contract took effect or was renewed:

Contract effective date |

Return due date |

January - March |

June 1 |

April - June |

September 1 |

July - September |

December 1 |

October - December |

March 1 |

Mail Form 570 and payment to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA

EAmended Returns

Use Form 570 to file an amended return. File an amended return to correct an error on the original return or to claim a refund.

Check the “Amended” box at the top of the form. Attach a copy of the original return behind the amended return and write “copy” in red across the face of the original return. When completing line 1 through line 15 of the amended return, use the amounts that should have been reported on the original return.

Amended returns must be filed within four years of the original due date or within one year from the date of the overpayment, whichever period expires later.

Attach copies of all contracts for changes to correct an error on the original return or to claim a refund.

Do not file an amended return to claim returned premiums. See the Specific Line Instructions for line 5.

F Third Party Designee

If the entity wants to allow the FTB to discuss its 2013 return with the paid preparer who signed it, check the “Yes” box in the signature area of the return. This authorization applies only to the individual whose signature appears in the “Paid Preparer’s Use Only” section of the return. It does not apply to the business, if any, shown in that section.

If the “Yes” box is checked, the entity is authorizing the FTB to call the paid preparer to answer any questions that may arise during the processing of its return. The entity is also authorizing the paid preparer to:

Form 570 Instructions 2012 Page 1

•Give the FTB any information that is missing from the return.

•Call the FTB for information about the processing of the return or the status of any related refund or payments.

•Respond to certain FTB notices about math errors, offsets, and return preparation.

•The entity is not authorizing the paid preparer to receive any refund check, bind the entity to anything (including any additional tax liability), or otherwise represent the entity before the FTB.

The authorization will automatically end one year from the date this tax return was filed. If the entity wants to expand the paid preparer’s authorization, get form FTB 3520, Power of Attorney Declaration for the Franchise Tax Board. If the entity wants to revoke the authorization before it ends, notify the FTB in writing or call 800.852.5711.

Specific Instructions

Part I – Policyholder

Enter the business or individual policy holder name, Doing Business As (DBA), if applicable, address, and identification number. Print

all information using CAPITAL LETTERS. If completing Form 570 by hand, enter all the information requested using black or blue ink.

Part II – Tax Computation

Do not show net or negative amounts on line 1 through line 4 to account for returned premiums. See line 5 for returned premiums. Only use line 1 through line 4 to report taxable premiums paid or to be paid during the calendar quarter.

Line 1 – Enter all gross premiums paid or to be paid on risks located entirely within California for policies entered into or renewed during the calendar quarter.

Line 2 – Enter all gross premiums paid or to be paid by California home state insured for all policies issued by a nonadmitted insurer for coverage both inside and outside of California which were entered into or renewed during the calendar quarter. Note: Enter only premiums for policies related to risks within the U.S.

Line 5 – Enter three percent (.03) of the premiums returned during the calendar quarter because of cancellation or reduction of premiums on which nonadmitted insurance tax was paid.

Enter the quarter that the returned premiums were originally taxed. If the returned premiums are from more than one quarter or policy, attach a schedule showing the amount of returned premiums from each quarter and/or policy.

Returned premiums must be claimed on a return for the calendar quarter during which the returned premiums were received. Refunds resulting from returned premiums must be claimed within four years from the original due date of the return, four years from the date the return was filed or one year from the date of cancellation or reduction of premium, whichever is later.

If you are an agent or broker filing this return on behalf of the insured, the refund will be mailed to you in the name of the insured if a signed Power of Attorney is on file allowing the FTB to do so.

Attach copies of all contracts where there was a reduction of premiums returned or cancellation on which nonadmitted insurance tax was paid.

Line 6 – Enter the amount of overpayment you requested to be applied from a prior quarter that was not applied on a previously filed return. These payments may include amounts from an amended Form 570. Enter the calendar quarter and taxable year as

Line 7 – Enter any payments made before filing the return. If the return is being filed after the due date, see the instructions for line 10.

Line 9 – If the amount on line 4 is more than the amount on line 8, subtract line 8 from line 4 and enter the balance on line 9, you have tax due. If the amount on line 8 is more than the amount on line 4, subtract line 4 from line 8 and enter the result in brackets on line 9, your credits exceed your tax.

Line 10 – If you do not pay the tax due by the due date, a penalty of 10% of the amount of tax due will be imposed. Enter 10% of the amount of tax not paid by the due date. (A penalty of 25% of the amount of tax due will be imposed when nonpayment or late payment is due to fraud.)

Line 11 – Interest will be charged on any late payment and penalty from the due date to the date paid. Interest compounds daily and the interest rate is adjusted twice a year. If you do not include interest with your late payment or include only a portion of it, the FTB will compute the interest and bill you for it.

Line 12 – Enter the total amount due. Make your check or money order payable to the “Franchise Tax Board.” Write the calendar quarter (March, June, September, or December), the applicable taxable year, Form 570, and your social security number (SSN), individual taxpayer identification number (ITIN), California corporation number, federal employer identification number (FEIN), or California Secretary of State (SOS) file no. on the check or money order. Check the EFT box if you made your payment by EFT.

Electronic Funds Transfer (EFT) – To submit your nonadmitted insurance tax payment using EFT, use the following tax type code, EFT code 02020. You must use the correct EFT code to ensure proper credit to your FTB account.

Line 14 – Enter the amount of overpayment to be credited to your next quarter’s return.

Part III – Insurance Contracts

Column a – Enter the policy number for each contract. Enter only policies related to risks within the U.S.

Column b – Enter the name of all the Nonadmitted Insurance Companies for each contract.

Column c – Enter the type of insurance coverage provided by the contract.

Column d – Enter the full name or the two letter abbreviation of the state where the risk is located for each contract. If your policy covers more than one state, then use additional lines to list the locations of the risk separately.

Column e – Enter the total premium amount for each contract.

Total – Enter the total of Form 570, Side 2, column e.

Additional Information

If you have questions, contact: FTB Nonadmitted Insurance Desk at 916.845.7448 or call the Withholding Services and Compliance automated number at 888.792.4900.

OR write to:

WITHHOLDING SERVICES AND COMPLIANCE MS F182 FRANCHISE TAX BOARD

PO BOX 942867 SACRAMENTO CA

You can download, view, and print California tax forms and publications at ftb.ca.gov.

OR to get forms by mail write to:

TAX FORMS REQUEST UNIT MS F284 FRANCHISE TAX BOARD

PO BOX 307

RANCHO CORDOVA CA

For all other questions unrelated to withholding or to access the TTY/TDD numbers, see the information below.

Internet and Telephone Assistance

Website: |

ftb.ca.gov |

Telephone: 800.852.5711 from within the |

|

|

United States |

|

916.845.6500 from outside the |

|

United States |

TTY/TDD: |

800.822.6268 for persons with |

|

hearing or speech impairments |

Asistencia Por Internet y Teléfono |

|

Sitio web: |

ftb.ca.gov |

Teléfono: |

800.852.5711 dentro de los Estados |

|

Unidos |

|

916.845.6500 fuera de los Estados |

|

Unidos |

TTY/TDD: |

800.822.6268 personas con |

|

discapacidades auditivas y del habla |

Page 2 Form 570 Instructions 2012

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Purpose | Form 570 is used for the tax calculation on premiums paid or to be paid to nonadmitted insurers covering risks. |

| Who Must Pay | The tax applies to home state insured individuals or entities purchasing or renewing insurance contracts from nonadmitted insurers. |

| Tax Rate | The tax rate is set at three percent (.03) of the gross premium paid. |

| Filing Deadlines | Form 570 must be filed by the first day of the third month following the close of a calendar quarter during which a contract was effective or renewed. |

| Amended Returns | Use Form 570 to correct an original return or to claim a refund, marking the "Amended" box and attaching the original return. |

| Governing Law | Governed by the California Revenue and Taxation Code (R&TC) and the California Insurance Code, as amended by Assembly Bill (AB) 315. |

| Policyholder Information | Information includes business or individual policyholder name, address, and identification number. |

| Tax Computation | Includes gross premiums paid on risks within California, adjustments for returned premiums, and calculations for tax due or refunds. |

| Payment Instructions | Payment is due with the filing of the form, payable to the "Franchise Tax Board," and can also be made via Electronic Funds Transfer (EFT). |

| Insurance Contracts Details | Requires details of insurance policies, including policy number, company, type of insurance, risk location, and total premium. |

How to Write California 570

After identifying the need to file a California 570 form, which pertains to the Nonadmitted Insurance Tax Return, it's important to proceed methodically. This document is primarily for policyholders who have transactions with nonadmitted insurers within the specified tax year and quarter. Filling out this form accurately ensures compliance with California tax laws related to insurance contracts not offered by insurers authorized in California. The following steps will guide you through completing the form.

- Choose the appropriate taxable year and quarter for which you're filing the return. Mark the box next to the calendar quarter during which the taxable insurance contract(s) took effect or were renewed.

- Under PART I, provide the policyholder's information. Include the business name, first and last name if applicable, and DBA (Doing Business As) name if it's applicable. Choose and fill in either the SSN, ITIN, FEIN, CA Corp. number, or CA SOS file number. Complete the address section, including the apartment or suite number, city, state, and ZIP code. Don't forget to include a contact telephone number.

- Move to PART II for Tax Computation.

- Line 1: Enter gross premiums paid or to be paid on risks entirely within California if California is your principal place of business or your principal residence.

- Line 2: Enter gross premiums for policies covering risks outside California as well, but only if insured by California home state insured.

- Line 3: Add lines 1 and 2 to get total taxable premiums.

- Line 4: Multiply line 3 by 3% to calculate the total tax amount. Note there's no stamping fee included.

- Lines 5 through 7 are for calculating returns from previously taxed premiums, overpayments from prior quarters, and prepayments. Attach any necessary documentation for returned premiums.

- Line 8: Add lines 5 through 7 for total Adjustments.

- Line 9: Subtract line 8 from line 4 for the Balance Due. If line 8 is more than line 4, see the instructions on the form for further details.

- Lines 10 and 11 are for calculating any penalty for late payment and interest on late payment. Follow the detailed instructions provided in the document for accurate calculation.

- Line 12: Add lines 9 through 11 for the Payment Due. If you're making an electronic payment, mark the EFT box.

- In PART III, list all insurance contracts if you have more than 24 policies to report. For each policy, provide the policy number, the name of each Nonadmitted Insurance Company, type of insurance coverage, the location of risks, and total premium.

- Check the appropriate Entity Type box that applies to you: Corporation, Partnership, Limited Liability Company, Limited Liability Partnership, Individual, or Other.

- If filing as an agent or broker, enter the business name, business address, and contact information as authorized by a valid power of attorney.

- Sign and date the form, including the preparer's information if applicable. If you'd like the FTB to be able to discuss this return with the preparer, mark "Yes" in the designated section.

After completing these steps, review the form to ensure all information is accurate and no required sections are missed. Attach any required documents and mail the filled-out form to the provided address of the Franchise Tax Board. Timely and accurate submission helps avoid potential penalties or interest on late payments.

Listed Questions and Answers

What is the California 570 form used for?

The California 570 form is used to report and pay tax on premiums paid or to be paid to nonadmitted insurers on contracts covering risks. This form should also be used if you need to file an amended return for previously reported nonadmitted insurance tax. Nonadmitted insurers are insurance companies not authorized to transact insurance business in California but can still provide insurance under specific conditions.

Who is required to file the California 570 form?

The tax is imposed on home state insured persons or entities who independently purchase or renew an insurance contract from a nonadmitted insurer during the calendar quarter. This includes corporations, partnerships, limited liability companies, limited liability partnerships, individuals, and others as specified. If you are unsure whether the insurer is authorized in California, it is recommended you consult with the Franchise Tax Board or a professional.

What is the due date for filing the California 570 form?

Form 570 must be filed on or before the first day of the third month following the close of any calendar quarter during which a nonadmitted insurance contract took effect or was renewed. Specifically, the due dates are:

- For contracts effective January - March: Due by June 1

- For contracts effective April - June: Due by September 1

- For contracts effective July - September: Due by December 1

- For contracts effective October - December: Due by March 1

How is the tax rate on the California 570 form determined?

The tax rate applied is three percent (0.03) of the gross premium paid or to be paid, minus any premiums returned because of cancellation or reduction of premium on which a tax has previously been paid. Importantly, no stamping fee should be included in the computation of tax owed.

How can I file an amended California 570 form?

To file an amended California 570 form, check the "Amended" box at the top of the form. You must attach a copy of the original return behind the amended return and mark "copy" in red across the face of the original return. When completing the form, use the amounts that should have been reported on the original return. Amendments must be filed within four years of the original due date or within one year from the date of overpayment, whichever period expires later.

Can I authorize someone else to discuss my California 570 form with the Franchise Tax Board?

Yes, by checking the "Yes" box in the signature area of the return, you can authorize the Franchise Tax Board to discuss your return with the paid preparer who signed the form. This authorization only applies to the individual preparer and not the business they may represent. It allows the preparer to provide additional information, clarify information on the return, and respond to FTB notices about your return. This authorization automatically ends one year from the return's filing date.

Where should I mail my California 570 form?

The completed California 570 form and any payment due should be mailed to:

- FRANCHISE TAX BOARD

- PO BOX 942867

- SACRAMENTO CA 94267-0651

Common mistakes

Completing the California 570 form correctly is crucial to avoid complications or delays. Here are seven common mistakes to watch out for:

- Incorrect Period Selection: One of the initial steps is to select the calendar quarter for which the taxable insurance contract(s) took effect or was renewed. Failure to accurately choose the correct period can lead to processing delays.

- Failing to Include Premiums for Risks Outside California: It's essential to report gross premiums paid or to be paid by California home state insured, including policies with risks outside California. Overlooking this detail can result in underreported tax liability.

- Inaccurate Gross Premiums Reporting: Gross premiums need to be reported accurately. This includes premiums for risks located entirely within California for businesses based in the state. Incorrect amounts can lead to either overpayment or underpayment of taxes.

- Not Reporting Returned Premiums: If premiums have been returned due to policy cancellation or reduction, this needs to be reported accurately. Incorrectly reporting or omitting these amounts can affect the tax balance.

- Overlooking Overpayments or Prepayments from Prior Quarters: When previous quarters have overpayments or prepayments, these should be accurately reported on the form to correct the current period’s tax balance.

- Incorrect Calculation of Tax Due: Tax is calculated as a percentage of the total taxable premiums. Mistakes in math can lead to errors in the amount of tax reported as due, resulting in penalties or additional interest.

- Omission of Essential Signatures and Dates: The form requires the signature of an elected officer or authorized person and the date. Failing to include these can result in the form being processed as incomplete, delaying any potential refunds or credits.

By avoiding these errors, filers can ensure more accurate and timely processing of their California 570 form, ultimately leading to a smoother experience with state tax obligations.

Documents used along the form

When managing nonadmitted insurance tax returns in California, especially using Form 570, it's crucial to complement this filing with a handful of other documents to ensure compliance and accuracy. These forms play an integral role in providing a holistic financial and legal stance, thus streamlining the process for both policyholders and tax authorities.

- Form FTB 3520 - Power of Attorney Declaration: Enables the policyholder to authorize another person to represent them in matters related to their tax returns, providing the necessary permission to discuss and handle tax-related issues with the Franchise Tax Board.

- Form 1131 - Privacy Notice: Outlines how personal information is utilized by the Franchise Tax Board, ensuring policyholders are aware of their privacy rights in relation to the submitted information.

- Insurance Contracts: Copies of all insurance contracts are vital for supporting documented premiums paid or to be paid on risks, especially when adjustments or claims for refunds are made on the originally filed Form 570.

- Amended Returns Documentation: When filing an amended Form 570, additional documentation highlighting the rationale and details behind adjustments, as well as a copy of the original return marked as 'copy', is required.

- Quarterly Premiums Report: This assists in the compilation of gross premiums paid or to be paid, necessary for accurately completing Part II of Form 570 regarding tax computation.

- Refund Request Forms: Specific forms or letters requesting refunds based on overpayments or cancellations, supporting the claims made on Line 5 or Line 13 of Form 570.

- Overpayment Documentation: Proof of prior overpayments and the request for their application to future filings or refunds.

- Electronic Funds Transfer (EFT) Authorization: If choosing to make payments via EFT, the relevant authorization forms or codes, particularly mentioning the EFT tax type code, are required.

- Cancelled Check Copies: For payments made prior to filing, cancelled checks serve as evidence and must accompany the filing if disputing or rectifying payment records.

- Supporting Schedules or Worksheets: Detailed schedules or worksheets that break down premiums, refunds, or adjustments across multiple policies or periods, supporting the summarized figures entered on the Form 570.

Together, these documents form a comprehensive set that supports the filing of Form 570, ensuring accuracy, compliance, and readiness for any subsequent audits or inquiries. Remember, thorough preparation and documentation can streamline the filing process, reduce potential errors, and ensure timely compliance with California's tax regulations on nonadmitted insurance.

Similar forms

The California Form 100, also known as the Corporation Franchise or Income Tax Return, shares similarities with the California Form 570 in the manner it is structured for calculating tax obligations. Both forms require the taxpayer to provide detailed information about the entity, compute taxable amounts based on specific criteria, and include sections for tax calculation, payments, and adjustments. Form 100 focuses on the income and franchise tax liabilities of corporations operating within California, similar to how Form 570 calculates nonadmitted insurance tax liabilities for policies covering risks within the state.

The California Form 540, the state's individual resident income tax return, parallels the California Form 570 in its approach to specifying periods and calculating tax owed based on detailed financial information. While catering to different tax subjects – individual income for Form 540 and nonadmitted insurance transactions for Form 570 – both require taxpayers to report financial details, calculate tax due, apply payments or credits, and determine amounts owed or refundable. They each have provisions for amended filings and adjustments based on specific criteria defined by California's tax regulations.

California Schedule D (540) is akin to Form 570 in that both deal with specified financial transactions and require detailed reporting for accurate tax computation. Schedule D (540) is used by individuals to report capital gains or losses, necessitating detailed records similar to the insurance contracts listed in Form 570. Though one deals with investment transactions and the other with insurance premiums, both forms require meticulous attention to detail to ensure proper tax treatment of reported items.

The California Form 109, the California Exempt Organization Business Income Tax Return, bears resemblance to the Form 570 in its specificity for a targeted taxpayer group. Form 109 is designed for tax-exempt organizations reporting unrelated business income, paralleling how Form 570 is tailored for entities involved in nonadmitted insurance transactions. Both forms delineate the tax calculation process, starting with gross amounts leading to taxable amounts, and potentially to amounts owed after credits and prepayments are accounted for.

Finally, the California Form BOE-401-EZ, a simplified sales and use tax return used by many businesses in California, shares procedural similarities with the California Form 570. Although serving different types of taxes – sales tax versus insurance tax – both forms require the reporting entity to calculate tax based on specific criteria, adjust for any eligible deductions or credits, and report a final payable or returnable amount. Each form is pivotal for its respective tax reporting entity in compliance with state tax obligations.

Dos and Don'ts

When engaging with the process of completing California Form 570, the Nonadmitted Insurance Tax Return, individuals and businesses should approach the task with diligence and precision. Below are some essential guidelines to follow, as well as common pitfalls to avoid, to ensure the process is conducted correctly and efficiently.

-

Do:

- Read the instructions carefully before you begin to fill out the form. This ensures you understand the requirements and the information you need to provide.

- Enter all information using capital letters if you are filling out the form by hand, using either black or blue ink.

- Include the policy number for every contract on Part III of the form, which helps in identifying each insurance contract accurately.

- Report the total gross premiums paid or to be paid during the calendar quarter accurately, without netting or showing negative amounts.

- Claim refunds for returned premiums on a return for the calendar quarter during which the returned premiums were received.

- File the form and make payment by the due date to avoid penalties and interest for late submission.

-

Don't:

- Round cents to dollars. Enter all amounts with both dollars and cents to ensure precision in tax computation.

- Forget to check the "Amended" box at the top of the form if you are filing an amended return. Attach a copy of the original return and mark it as "copy".

- Leave the policyholder information section incomplete. Provide the full name, address, and identification number to avoid processing delays.

- Exclude returned premiums previously taxed from your calculations. If there's a premium reduction or cancellation, adjust your tax computation accordingly.

- Ignore to check the box if paying via Electronic Funds Transfer (EFT) when making a payment in this manner.

Adhering to these dos and don'ts will help ensure the form is completed accurately, leading to the proper computation of taxes owed on nonadmitted insurance contracts. It’s important to remember that precision and attention to detail are crucial in all financial reporting to avoid any unnecessary complications with the Franchise Tax Board.

Misconceptions

Understanding the intricacies of the California Form 570, the Nonadmitted Insurance Tax Return, can often lead to misconceptions owing to its specialized nature and the specificity of its requirements. Dispelling these misconceptions is vital for ensuring accurate and compliant tax filings. Below are seven common misconceptions about the California Form 570 and the clarifications to help rectify these misunderstandings.

- Misconception 1: All insurance policies are subject to the tax reported on Form 570.

Clarification: Only premiums paid or to be paid for insurance contracts with nonadmitted insurers covering risks located entirely within California or policies where California is the home state of the insured are subject to this tax. Exemptions apply as per specific guidelines outlined by the California Revenue and Taxation Code and the California Insurance Code.

- Misconception 2: Form 570 applies to both admitted and nonadmitted insurance companies.

Clarification: Form 570 specifically pertains to nonadmitted insurers—those not authorized to transact insurance business directly in California.

- Misconception 3: The tax rate is variable and changes based on the policy amount.

Clarification: The tax rate is a fixed percentage (3%) applied to the gross premiums paid or to be paid, less any premiums returned due to cancellation or reduction of premium on which tax has been paid. This rate does not vary based on the amount of the policy.

- Misconception 4: Premiums paid for policies covering risks outside the United States are taxable.

Clarification: Only the gross premiums paid for policies related to risks within the United States are subject to taxation under Form 570. Policies covering risks outside the United States are not subject to this tax.

- Misconception 5: The entire amount must be paid upfront at the time of filing.

Clarification: Taxpayers can report overpayments from prior quarters and prepayments, which may reduce the balance due at the time of filing. Additionally, if the amount from line 8 exceeds the tax calculated on line 4, this may result in a refund or credit towards future quarters.

- Misconception 6: Amendments to a previously filed Form 570 cannot be made.

Clarification: Amendments are allowed to correct errors or claim refunds for overpayments. The process includes checking the "Amended" box on the form and attaching a copy of the original return alongside the amended return.

- Misconception 7: Form 570 filings can be rounded to the nearest dollar for simplicity.

Clarification: As per the recent update, forms should include amounts with both dollars and cents, without rounding to the nearest dollar. This ensures accuracy in reporting and calculating the tax due.

It is of paramount importance for individuals and businesses subject to the Nonadmitted Insurance Tax to fully understand the specific regulations and requirements of Form 570 to ensure accurate reporting and compliance with California tax laws.

Key takeaways

When filing the California Form 570 for Nonadmitted Insurance Tax Return, there are key takeaways to ensure accuracy and compliance with the state's requirements. Observing these points can help avoid common mistakes and fulfill obligations more efficiently.

- The form is meant for taxpayers to report and pay taxes on premiums paid to nonadmitted insurers for contracts covering risks within the taxable year and applicable quarters.

- Taxpayers must select the correct calendar quarter during which the taxable insurance contract(s) took effect or was renewed, as the form accommodates returns for different periods throughout the year.

- It's vital to include accurate information about the policyholder, including the business name, identification numbers, and contact details, to prevent delays or issues with the tax return processing.

- Tax computation on the form includes gross premiums paid, with specific lines for premiums on risks located entirely within California and for California home state insured policies with risks inside and outside California.

- The tax rate applied to the total taxable premiums is fixed at 3%, and the form explicitly instructs not to include any stamping fee in the computation.

- Adjustments for overpayments from prior quarters, prepayments, and returned premiums previously taxed are facilitated through specific lines on the form, allowing for accurate reflection of the tax liability.

- In cases of late payment, penalties and interest will apply, necessitating careful attention to deadlines for filing and tax payment to avoid unnecessary charges.

- The form also includes sections for the declaration of the preparer and policyholder, affirming the correctness and completeness of the information under penalties of perjury. This underscores the importance of double-checking entries before submission.

Compliance with the instructions provided in the form, including the specific line instructions and provisions for amended returns, helps ensure that taxpayers correctly report their nonadmitted insurance tax liabilities and receive any due refunds. Understanding these key takeaways can make the process smoother and more efficient, reducing the likelihood of errors and the need for amendments.

Different PDF Templates

Can You Get a Default Judgement Reversed - A doctrine encouraging the courts to err on the side of letting parties defend themselves rather than penalizing them for procedural lapses.

Whats Form 540 - Calculate your tentative minimum tax by applying specific percentages as illustrated in the Schedule P form.