Fill a Valid California 5805 Form

The California 5805 form, officially titled "Underpayment of Estimated Tax by Individuals and Fiduciaries," serves a critical function in ensuring that individuals and fiduciaries comply with their tax obligations regarding estimated payments. This form is directly attached to the front of various tax returns, such as the Form 540, Form 540A, Form 540NR, or Form 541, indicating the presence of underpaid estimated taxes. It includes provisions for waiving penalties under certain conditions, such as cases involving a significant change in income distribution throughout the tax year, retirement after age 62, disability, or due to casualty, disaster, or other unusual circumstances. Additionally, the form is designed with parts dedicated to calculating the required annual payment and determining if penalties are owed for underpayment. For those with irregular income patterns, the form offers the annualized income installment method as a way to calculate payments and potential penalties, which can be particularly beneficial for commissioned salespeople or those who experience seasonal fluctuations in income. Estates and trusts have specific guidelines detailed on the form, ensuring they meet their required quarterly estimated tax payments, especially vital for estates within two years of the decedent's death. Despite its complexity, the guidance provided in the California 5805 form instructions aims to assist taxpayers in navigating the intricacies of underpayment penalties and to mitigate these charges through calculated exceptions and adjustments.

Document Example

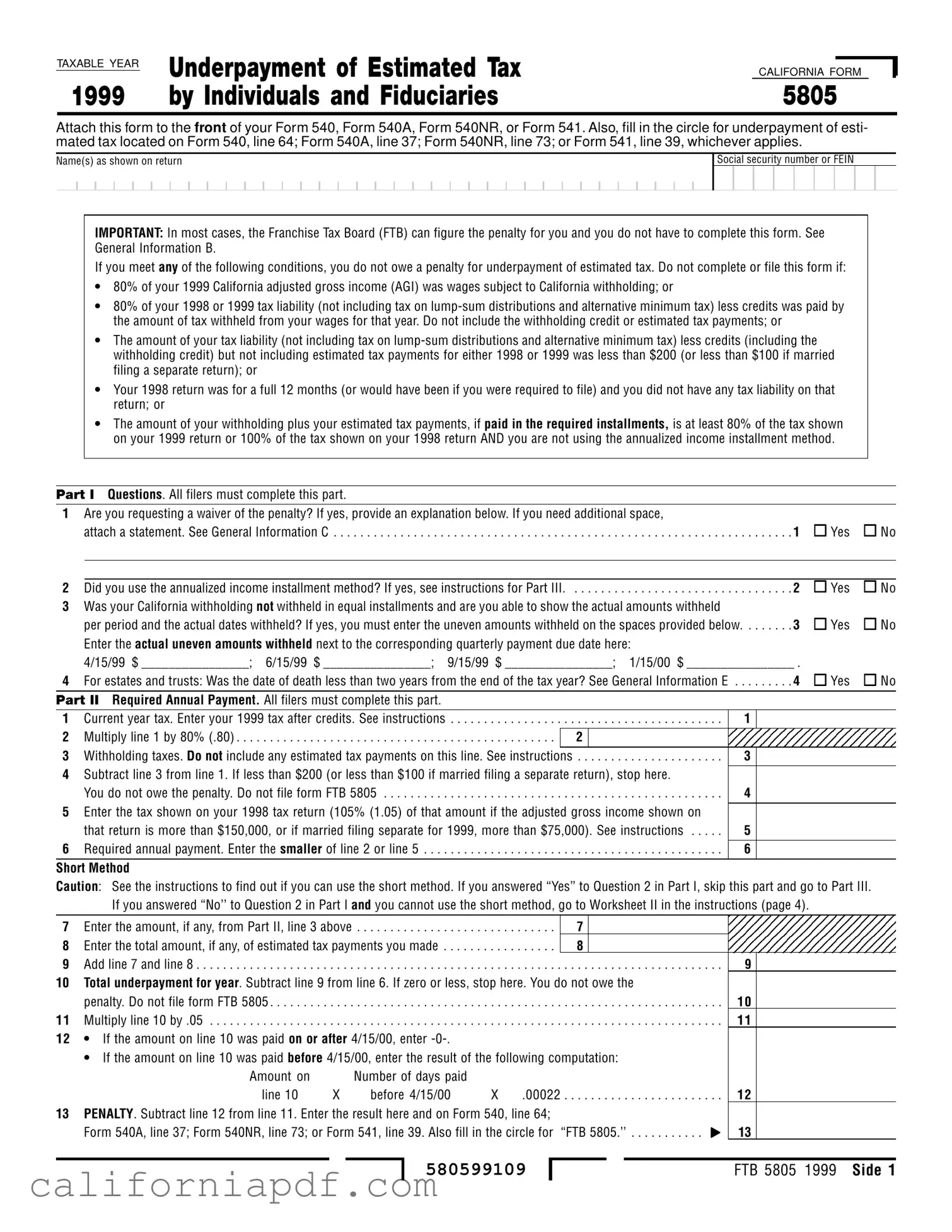

TAXABLE YEAR |

Underpayment of Estimated Tax |

|

|

|

|

CALIFORNIA FORM |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

1999 |

by Individuals and Fiduciaries |

5805 |

|

|

|

|

|

|

|

|

|

Attach this form to the FRONT of your Form 540, Form 540A, Form 540NR, or Form 541. Also, fill in the circle for underpayment of esti- mated tax located on Form 540, line 64; Form 540A, line 37; Form 540NR, line 73; or Form 541, line 39, whichever applies.

Name(s) as shown on return

Social security number or FEIN

IMPORTANT: In most cases, the Franchise Tax Board (FTB) can figure the penalty for you and you do not have to complete this form. See General Information B.

If you meet any of the following conditions, you do not owe a penalty for underpayment of estimated tax. Do not complete or file this form if:

•80% of your 1999 California adjusted gross income (AGI) was wages subject to California withholding; or

•80% of your 1998 or 1999 tax liability (not including tax on

•The amount of your tax liability (not including tax on

•Your 1998 return was for a full 12 months (or would have been if you were required to file) and you did not have any tax liability on that return; or

•The amount of your withholding plus your estimated tax payments, if paid in the required installments, is at least 80% of the tax shown on your 1999 return or 100% of the tax shown on your 1998 return AND you are not using the annualized income installment method.

Part I Questions. All filers must complete this part.

1Are you requesting a waiver of the penalty? If yes, provide an explanation below. If you need additional space,

|

attach a statement. See General Information C |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 Did you use the annualized income installment method? If yes, see instructions for Part III. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 |

Yes |

No |

||

3Was your California withholding not withheld in equal installments and are you able to show the actual amounts withheld

|

per period and the actual dates withheld? If yes, you must enter the uneven amounts withheld on the spaces provided below. |

. . 3 |

Yes |

No |

|||||

|

Enter the actual uneven amounts withheld next to the corresponding quarterly payment due date here: |

|

|

|

|

||||

|

4/15/99 $ ________________; 6/15/99 $ ________________; |

9/15/99 $ ________________; 1/15/00 $ ________________ . |

|

|

|||||

4 |

For estates and trusts: Was the date of death less than two years from the end of the tax year? See General Information E . . |

. . 4 |

Yes |

No |

|||||

|

|

|

|

|

|

|

|

|

|

Part II Required Annual Payment. All filers must complete this part. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Current year tax. Enter your 1999 tax after credits. See instructions |

. . . . . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . |

|

1 |

|

|

|

|

Multiply line 1 by 80% (.80) |

|

|

|

|

|

|

|

|

2 |

. . . . . . . . . . . . . . . . |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Withholding taxes. Do not include any estimated tax payments on this line. See instructions . . . . . . . . . . . . . . . . . . . . . .

4Subtract line 3 from line 1. If less than $200 (or less than $100 if married filing a separate return), stop here.

You do not owe the penalty. Do not file form FTB 5805 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5Enter the tax shown on your 1998 tax return (105% (1.05) of that amount if the adjusted gross income shown on that return is more than $150,000, or if married filing separate for 1999, more than $75,000). See instructions . . . . .

6Required annual payment. Enter the smaller of line 2 or line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Short Method |

|

|

Caution: See the instructions to find out if you can use the short method. If you answered “Yes’’ to Question 2 in Part I, skip this part and go to Part III. |

||

|

If you answered “No’’ to Question 2 in Part I and you cannot use the short method, go to Worksheet II in the instructions (page 4). |

|

7 |

Enter the amount, if any, from Part II, line 3 above |

7 |

8 |

Enter the total amount, if any, of estimated tax payments you made |

8 |

9 |

Add line 7 and line 8 |

. . . . . . . . . . . . . . . . . . . . . . |

10 |

Total underpayment for year. Subtract line 9 from line 6. If zero or less, stop here. You do not owe the |

|

|

penalty. Do not file form FTB 5805 |

. . . . . . . . . . . . . . . . . . . . . . 10 |

11 |

Multiply line 10 by .05 |

. . . . . . . . . . . . . . . . . . . . . . 11 |

12• If the amount on line 10 was paid on or after 4/15/00, enter

• If the amount on line 10 was paid before 4/15/00, enter the result of the following computation:

Amount on |

|

Number of days paid |

|

|

|

|

|

|

|

line 10 |

X |

before 4/15/00 |

X |

.00022 |

. . . . . . . . . . . . . . . |

|

|||

13 PENALTY. Subtract line 12 from line 11. Enter the result here and on Form 540, line 64; |

|

||||||||

Form 540A, line 37; Form 540NR, line 73; or Form 541, line 39. Also fill in the circle for “FTB 5805.’’ . . . . . . . . . . . |

13 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

580599109 |

|

|

|

23456789012345678901FTB 5805 1999 Side 1 |

||

|

|

|

|

|

|

|

|

|

|

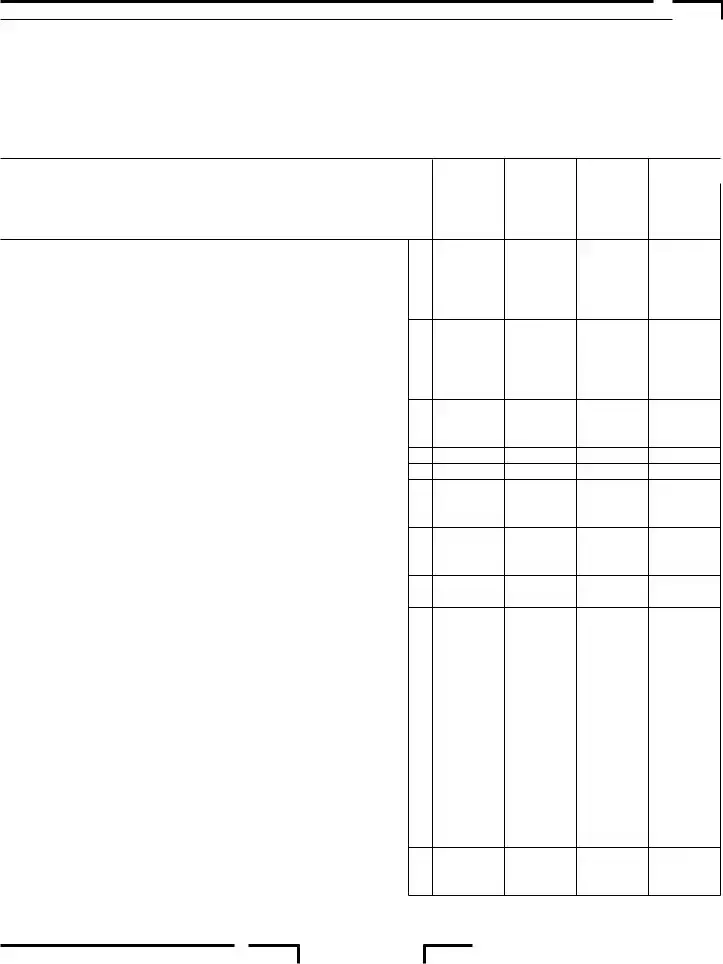

Part III Annualized Income Installment Method Schedule.

Use this schedule ONLY IF you earned taxable income at an UNEVEN RATE during 1999 (See Example A). If you earned your income at approximately the same rate each month (See Example B), then you should not complete this schedule. If you choose to figure the penalty, see the instructions for Worksheet II — Regular Method to Figure Your Underpayment and Penalty, on page 3 of the instructions.

Example A: If you were a commissioned salesperson who earned no income during the first three months of the year, earned most of your income during the following six months, and earned very little during the last three months, you should complete this schedule. You may be able to benefit by using the annualized income installment method. The required installment of estimated tax figured using the annualized method may be less than your required installment figured using the equal installment method.

Example B: If you worked all year and earned a monthly salary that did not change much during the year, you should not complete this schedule.

Note: To complete this schedule correctly, you must first complete Side 1, Part II, |

|

|

|

|

line 1 through line 6. |

|

|

|

|

Estates and trusts, do not use the period ending dates shown to the right. |

(a) |

(b) |

(c) |

(d) |

Instead, use the following: 2/28/99, 4/30/99, 7/31/99, and 11/30/99. |

1/1/99 to |

1/1/99 to |

1/1/99 to |

1/1/99 to |

filers must adjust dates accordingly. |

3/31/99 |

5/31/99 |

8/31/99 |

12/31/99 |

1Enter your adjusted gross income (AGI) for each period. Form 540NR filers, see instructions. Estates or trusts, enter the amount from Form 541, line 20

|

attributable to each period. See instructions |

1 |

|

|

|

|

2 |

Annualization amounts. Estates or trusts, see instructions |

2 |

4 |

2.4 |

1.5 |

1 |

3 |

Annualized income. Multiply line 1 by line 2 |

3 |

|

|

|

|

4Enter your itemized deductions for the period shown in each column. If you do not itemize deductions, enter

|

enter |

4 |

|

|

|

|

5 |

Annualization amounts |

5 |

4 |

2.4 |

1.5 |

1 |

6 |

Annualized itemized deductions. Multiply line 4 by line 5. See instructions |

6 |

|

|

|

|

7Enter your standard deduction from your 1999 Form 540 or Form 540NR, line 18; or Form 540A, line 15. Enter the total standard deduction amount

|

in each column |

7 |

8 |

Enter line 6 or line 7, whichever is larger |

8 |

9 |

Subtract line 8 from line 3 |

9 |

10Figure the tax on the amount in each column of line 9 using the tax table or

the tax rate schedule in the instructions for Form 540, Form 540NR, or Form 541.

|

Also, include any tax from form FTB 3803. Estates or trusts, see instructions . . . |

10 |

11 |

Enter the total amount of exemption credits from your 1999 Form 540, line 21; |

|

|

Form 540A, line 18; Form 540NR, line 23; or Form 541, line 22. Enter the total |

|

|

exemption credit amount in each column. See instructions |

11 |

12 |

Subtract line 11 from line 10. Form 540NR filers, complete Worksheet I in the |

|

|

instructions |

12 |

13Enter the total credit amount from your 1999 Form 540, line 33 or Form 541, line 23. Form 540NR filers, see instructions. Enter the total amount of credits

|

in each column |

13 |

|

|

|

|

14 |

Subtract line 13 from line 12. If zero or less, enter |

14 |

|

|

|

|

15 |

Applicable percentage |

15 |

20% |

40% |

60% |

80% |

16 |

Multiply line 14 by line 15 |

16 |

|

|

|

|

COMPLETE LINE 17 THROUGH LINE 23 OF EACH COLUMN BEFORE YOU TO GO TO |

|

|

|

|

|

|

THE NEXT COLUMN. |

|

|

|

|

|

|

17 |

Enter the combined amounts shown on line 23 from all preceding columns . . . . |

17 |

|

|

|

|

18 |

Subtract line 17 from line 16. If zero or less, enter |

18 |

|

|

|

|

19 |

In each column, enter 1/4 of the amount on form FTB 5805, Part II, line 6 |

19 |

|

|

|

|

20 |

Enter the amount from line 22 from the preceding column |

20 |

|

|

|

|

21 |

Add line 19 and line 20 |

21 |

|

|

|

|

22 |

If line 21 is more than line 18, subtract line 18 from line 21. Otherwise, enter |

22 |

|

|

|

|

23Enter line 18 or line 21, whichever is less. Transfer these amounts to Worksheet II — Regular Method to Figure Your Underpayment and

Penalty, line 1 |

❚❚ 23 |

Note: If you use the annualized income installment method for one payment due date, you must use it for all payment due dates. |

||

This schedule automatically selects the smaller of your annualized income installment or your regular installment. |

||

Side 2 FTB 5805 1999 |

580599209 |

234567890 |

Instructions for Form FTB 5805

Underpayment of Estimated Tax by Individuals and Fiduciaries

General Information

A Purpose

Use form FTB 5805 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

B Who Must File

Generally, you do not have to complete this form. The Franchise Tax Board (FTB) can figure the amount of any penalty for you and send you a bill after you have filed your return. If the FTB figures your penalty and sends you a bill, you must pay the penalty within 15 days of the billing to avoid additional interest charges.

Important: If you answered “Yes” to any of the questions in Part I (estates and trusts, see General Information E), you must complete this form and attach it to the front of your return.

C Waiver of the Penalty

You may request a waiver of the penalty if:

•You underpaid an estimated tax installment due to a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty; or

•You retired after age 62 or became disabled in 1998 or 1999 and your underpayment was due to reasonable cause.

To request a waiver:

•Check “Yes” on form FTB 5805, Part I, Question 1, and in the space provided, explain why you are requesting a waiver of the estimate penalty. If you need additional space, attach a statement;

•Complete form FTB 5805 through Part II, line 12 (Worksheet II, line 15 if you use the regular method) without regard to the waiver. Write the amount you want waived in parenthesis on the dotted line next to Part II, line 13 (Worksheet II, line 16 if you use the regular method). Subtract this amount from the total penalty you figured without regard to the waiver, and enter the result on Part II, line 13 (Worksheet II, line 16 if you use the regular method);

•Fill in the circle on Form 540, line 64;

Form 540NR, line 73; or Form 541, line 39; and

•Attach form FTB 5805 to the front of your return on top of any check, money order, Form

D Annualized Income

Installment Method

If your income varied during the year and you use the annualized income installment method to determine your estimate payment requirements, you must complete form FTB 5805, including Side 2. Attach it to the front of your return on top of any check, money order, Form

E Estates and Trusts

Estates and trusts are required to make quarterly estimated tax payments. Estates and grantor trusts, which receive the residue of the decedent’s estate, are required to make estimated income tax payments for any year ending two or more years after the date of the decedent’s death. If you answered “Yes” to Question 4, complete Part I only and attach form FTB 5805 to the front of your return.

Note: Exempt trusts should use form FTB 5806, Underpayment of Estimated Tax by Corporations.

F Nonresidents and New Residents

The penalty for the underpayment of estimated tax applies to nonresidents and new residents. See the conditions listed in the box labeled “Impor- tant” on Side 1 of form FTB 5805.

G Farmers and Fishermen

You are considered a farmer or fisherman if at least

H Due Dates for Estimated Tax Installments

If you are a calendar year taxpayer, the estimated tax installment due dates for 1999 were:

• First quarter |

— April 15, 1999 |

•Second quarter — June 15, 1999

• Third quarter |

— September 15, 1999 |

•Fourth quarter — January 15, 2000

The penalty is figured separately for each due date. Therefore, you may owe a penalty for an earlier installment due date, even if you pay enough tax later to make up the underpayment.

If a due date falls on a Saturday, Sunday, or legal holiday, use the next business day.

I Filing an Early Return in Place of the 4th Installment

If you file your 1999 tax return by February 1, 2000, and pay the entire balance due, you do not have to make your last estimate payment. Fiscal- year filers must file their return and pay their tax before the first day of the 2nd month after the end of their taxable year.

J Amended Return

If you file an amended return:

•On or before the due date of your original return, use the tax, credit and other amounts shown on your amended return to figure your penalty for underpayment of estimated tax.

•After the due date of the original return, you must use the amounts shown on the original return to figure the penalty.

K Penalty Rates

The rates used to determine the amount of your penalty are established at various dates through- out the year. If an installment of estimated tax for any quarter remained unpaid or underpaid for more than one rate period, the penalty for that underpayment will be figured using more than one rate when applicable.

The following rates apply to the 1999 computation period:

•8%

•7%

•8%

Call the FTB’s automated

The automated

From within the |

|

United States, call |

(800) |

From outside the United States,

call (not toll free) . . . . . . . . . . . . (916)

Specific Line Instructions

Part II — Computing the Required Annual Payment

Use this part to figure the amount of estimated tax that you were required to pay.

Certain

Line 1 – Enter your tax liability (excluding any tax on

Form 540NR, line 43; or Form 541, line 25.

Line 3 – Enter the amounts from your 1999

Form 540, line 38 and line 41; Form 540A, line 24 and line 27; Form 540NR, line 47 and line 50; or Form 541, line 28.

Line 5 – Enter your tax liability (excluding any tax on

Form 540NR, line 43; or Form 541, line 25.

FTB 5805 Instructions 1999 Page 1

If the adjusted gross income shown on your 1998 California tax return is more than $150,000, or more than $75,000 if married filing separate, then enter 105% (1.05) of the tax liability from your 1998 return on line 5.

Short Method

You may use the short method only if you are a calendar year taxpayer and:

1.You made no estimated tax payments or your only payments were California income tax withheld; or

2.You paid estimated tax in four equal amounts on the due dates.

Note: If any payment was made earlier than the due date, you may use the short method, but using it may cause you to pay a larger penalty than using the regular method. If the payment was only a few days early, the difference is likely to be small.

You may not use the short method if either of the following apply:

1.You made any estimated tax payment late; or

2.You answered “Yes” to Part I, Question 3.

If you can use the short method, complete Part II, line 1 through line 10 to figure your total underpayment for the year, and line 11 through line 13 to figure the penalty.

Part III – Annualized Income Installment Method

If your income varied during the year, you may be able to lower or eliminate the amount of one or more required installments by using the annualized income installment method. Use

Part III to figure the required installment amount to enter on Worksheet II – Regular Method to Figure Your Underpayment and Penalty, line 1 (page 4).

Complete line 1 through line 16 to figure your current year tax, per quarter, based on your income as you earned it. Then, complete line 17 through line 23 to figure your required installment for each quarter. (The total of all amounts entered on line 23 should equal the amount from Part II, line 6.)

If you use the annualized income installment method for any payment due date, you must use it for all payment due dates. To figure the amount of each required installment, Part III automatically selects the smaller of the annualized income installment or the regular installment (increased by the amount saved by using the annualized income installment method in figuring earlier installments).

Note: If you are filing Form 540NR, see

Form 540NR Instructions for Part III at the end of this section.

Line 1 – For the period, figure your total income minus your adjustments to income for the period. Include your share of partnership or S corpora- tion income or loss items for the period.

Line 2 – Form 541 filers. Do not use amounts shown in column (a) through column (d). Instead, use 6, 3, 1.71429, and 1.09091, respectively, as the annualization amounts.

Line 6 – Multiply line 4 by line 5 and enter the result on line 6. Your annualized itemized deductions are limited if, in any quarter, line 3 is greater than:

•$239,628 (married filing joint or qualifying widow(er)); or

•$119,813 (single or married filing separate); or

•$179,720 (head of household).

Use the following worksheet to figure the amount to enter on line 6 for each period line 3 reaches the above amounts.

1Enter the amount from

Part III, line 4 . . . . . . . . . . . . . . . 1_______

2Using California amounts, add the amounts on federal Schedule A, line 4, line 13 and line 19 plus any gambling

losses included on line 27 . . . . . . 2_______

3Subtract line 2 from line 1 . . . . . 3_______

4Enter the number from

Part III, line 5 . . . . . . . . . . . . . . . 4_______

5Multiply the amount on line 1

by line 4 . . . . . . . . . . . . . . . . . . . 5_______

Note: If the amount on line 3 is zero, stop here and enter the amount from line 5 on Part III, line 6.

6Multiply the amount on line 3

by the number on line 4 |

6_______ |

7Multiply the amount on

line 6 by 80% (.80) . . . . . . . . . . . 7_______

8Enter the amount from

Part III, line 3 . . . . . . . . . . . . . . . 8_______

9Enter the amount shown

above for your filing status . . . . . 9_______

10Subtract line 9 from line 8 . . . . . 10_______

11Multiply the amount on

line 10 by 6% (.06) . . . . . . . . . . . 11_______

12Enter the smaller of line 7 or

line 11 . . . . . . . . . . . . . . . . . . . . . 12_______

13Subtract line 12 from line 5. Enter the result here and on

Part III, line 6 . . . . . . . . . . . . . . . 13_______

Line 10 – Form 541 filers. Figure the tax on the amount in each column of line 9 using the tax table or tax rate schedule in your tax booklet. Also, include any tax from:

•FTB 5870A, Tax on Accumulation Distribution of Trusts; or

•IRC Section 453A tax.

Line 11 – If your exemption credits were limited by adjusted gross income (AGI), it may be to your advantage to make a separate computation for each period. If you choose, you may complete the exemption credit worksheet in your tax booklet for each period.

Line 13 – Enter the special credits you are entitled to because of events that occurred during the months shown in the column headings.

Credit Limitation – If your special credits were limited by tentative minimum tax (TMT), it may be to your advantage to make a separate computation for each period. If you choose, you may complete a separate Schedule P (540 or 541) for each period.

Form 540NR Instructions for Part III

Use these instructions only if you are filing Form 540NR.

Line 1 – Enter your total adjusted gross income (AGI) for each period. Your total AGI is your AGI for the period from all sources.

Line 12 – As a nonresident or

California AGI is all of the income you earned while you were a California resident plus any income received from sources within California while you were a nonresident, less applicable income adjustments. For more information, see the instructions for Schedule CA (540NR), California Adjustments – Nonresident or

Line 13 – Refigure Form 540NR, line 31 through line 42 prorating the credits on line 31 through line 36 using the ratio from Line D of Worksheet I below.

Worksheet I – Prorated Tax for Form 540NR Filers |

1/1/99 to |

1/1/99 to |

1/1/99 to |

1/1/99 to |

|

|

|

3/31/99 |

5/31/99 |

8/31/99 |

12/31/99 |

A |

California AGI |

_____________ |

_____________ |

_____________ |

_____________ |

B |

Annualization amounts |

______4______ |

_____2.4_____ |

_____1.5_____ ______1______ |

|

C |

Multiply line A by line B |

_____________ |

_____________ |

_____________ |

_____________ |

D |

Ratio. Divide line C by Part III, line 3 |

_____________ |

_____________ |

_____________ |

_____________ |

E |

Subtract Part III, line 11 from Part III, line 10 |

_____________ |

_____________ |

_____________ |

_____________ |

F |

Multiply line D by line E. Enter the result here and on Part III, |

|

|

|

|

|

line 12 |

_____________ |

_____________ |

_____________ |

_____________ |

|

|

|

|

|

|

Page 2 FTB 5805 Instructions 1999

Instructions for Worksheet II – Regular Method to Figure Your Underpayment and Penalty

Part I — Figure Your Underpayment

Line 1 – Enter in column (a) through column (d) the amount of your required installment. For most taxpayers, this is the amount shown on form FTB 5805, Side 1, Part II, line 6 divided by 4. If you use the annualized income installment method, enter the amount from form FTB 5805, Side 2, Part III, line 23.

Line 2 – Enter the estimate payments made by the date at the top of each column.

Include in column (a) any overpayment of tax from your 1998 return that you elected to apply to the 1999 estimated tax.

Divide by 4 the amount you entered on form FTB 5805, Part II, line 3, and enter the result in each column, unless you can show it was withheld otherwise.

Note: If your California withholding was not withheld in equal installments, and you are able to show the actual amounts withheld per period and the dates withheld, you must answer “Yes” to Part I, Question 3 and enter the uneven amounts withheld on the lines provided on Part I, Question 3.

If you file your return and pay the tax due by February 1, 2000, enter the amount of tax paid with your return in column (d). In this case, you will not owe a penalty for the estimate payment due by January 15, 2000.

Line 8 – If line 8 is zero for all payment periods, you do not owe a penalty. But if you checked “Yes” for any question on form FTB 5805, Side 1, Part I, you must file form FTB 5805 with your return.

Part II — Figure the Penalty

Figure the penalty by applying the appropri- ate rate against each underpayment shown on line 8. The penalty is figured for the number of days that the underpayment remained unpaid.

The rates are established at various times throughout the year. If an underpayment remained unpaid for more than one rate period, the penalty on that underpayment will be figured using more than one rate period.

Use line 10, line 12, and line 14 to figure the number of days the underpayment remained unpaid. Use line 11, line 13, and line 15 to figure the actual penalty amount by applying the rate against the underpayment for the number of days it remained unpaid.

Maximum days in a rate period per quarter:

Installment |

|

Days in Rate |

||

Period 1 |

|

Period 2 |

Period 3 |

|

|

|

|||

1 |

76 |

|

184 |

106 |

2 |

15 |

|

184 |

106 |

3 |

|

|

107 |

106 |

4 |

|

|

|

9 1 |

Payment Application. Your payments are applied to any underpayment balance on an earlier installment. It does not matter if you designate a payment for a later period.

Example: You had an underpayment for the April 15th installment of $500. The June 15th installment required a payment of $1,200. On June 10th, you sent in a payment of $1,200 to cover the June 15th installment. However, $500 of this payment is considered to be for the April 15th installment. The penalty for the April 15th installment is figured to June 10th. The amount of the payment to be applied to the June 15th installment is $700.

Subsequent Payments. For purposes of computing the penalty, it may be helpful to make a list of any payments that you made after the timely payments entered in Part I, line 2. If you made no other payments, follow the

If you made subsequent payments, you may need to make additional computations for the applicable column on the worksheet. However, if the payment reduced the underpayment to zero, there are no further computations to make for that column. In that case, you count the number of days from the installment due date to the date paid.

If a subsequent payment does not reduce the underpayment to zero, you will need to make an additional computation in the column.

•First, count the number of days from the due date to the date paid and use the underpayment amount from Worksheet II, line 8.

•Second, count the number of days from the payment date to the end of the rate period, and subtract the amount of the subsequent payment from the underpay- ment amount from Worksheet II, line 8.

•Then apply the rate for the applicable period.

23456789012345 |

FTB 5805 Instructions 1999 Page 3 |

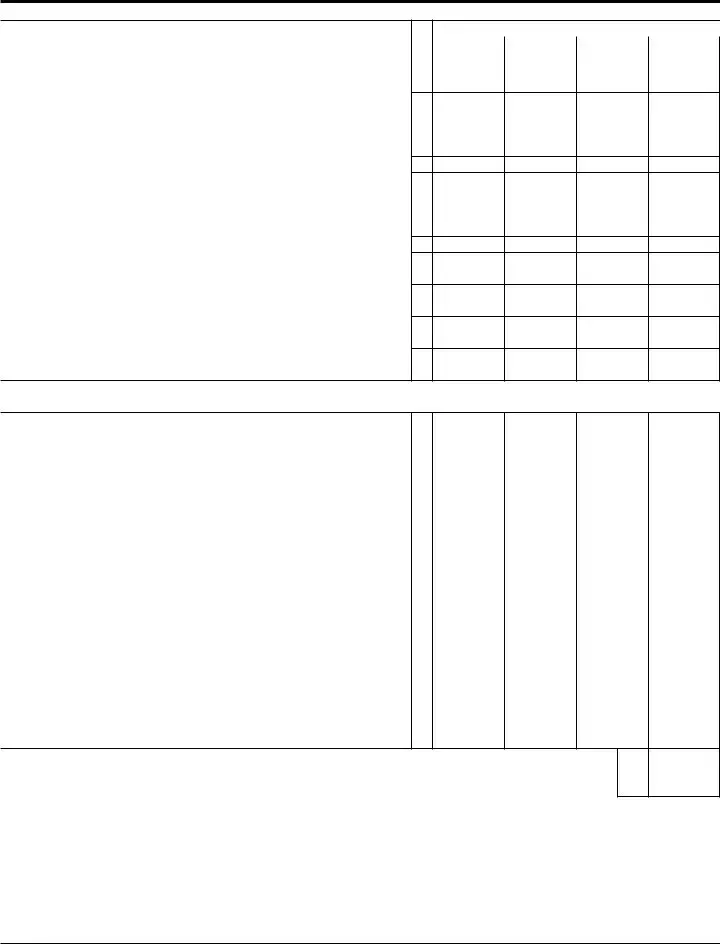

Worksheet II Regular Method to Figure Your Underpayment and Penalty.

|

|

|

Payment Due Dates |

|

|

Part I Figure Your Underpayment |

|

(a) |

(b) |

(c) |

(d) |

|

4/15/99 |

6/15/99 |

9/15/99 |

1/15/00 |

|

|

|

|

|

|

|

1 Required Installments. See instructions |

1 |

|

|

|

|

2Estimated tax paid and tax withheld. See instructions. For column (a) only, also enter the amount from line 2 on line 6. (If line 2 is equal to or more than line 1 for all payment periods, stop here; you do not owe the penalty. Do not file form FTB 5805 unless you answered “Yes’’ to a question in Part I) . . . . . 2

3 Enter amount, if any, from line 9 of previous column |

3 |

COMPLETE LINE 3 THROUGH LINE 9 OF ONE COLUMN BEFORE GOING TO THE

NEXT COLUMN.

4 |

Add line 2 and line 3 |

4 |

5 |

Add amounts on line 7 and line 8 of the previous column |

5 |

6Subtract line 5 from line 4. If zero or less, enter

enter the amount from line 2 |

6 |

7If the amount on line 6 is zero, subtract line 4 from line 5.

Otherwise, enter |

7 |

8Underpayment. If line 1 is equal to or more than line 6, subtract line 6 from

line 1. Then go to line 3 of next column. Otherwise, go to line 9 |

8 |

9Overpayment. If line 6 is more than line 1, subtract line 1 from line 6.

Then go to line 3 of next column |

9 |

Part II Figure the Penalty. Complete line 10 through line 15 of one column before going to the next column.

Rate Period 1: |

4/15/99 |

6/15/99 |

April 15, 1999 — June 30, 1999 |

Days: |

Days: |

10Number of days FROM the date shown above line 10 TO the date the

amount on line 8 was paid or 6/30/99, whichever is earlier . . . . . . . . . . . . . . . . 10 |

|

|

|

|||||

11 Underpayment |

|

Number of |

|

|

|

|

|

|

on line 8 |

X |

days on line 10 |

X |

.08 |

|

|

|

|

(see instructions) |

|

365 |

|

11 |

$ |

$ |

|

|

Rate Period 2: |

|

|

|

|

|

6/30/99 |

6/30/99 |

9/15/99 |

|

July 1, 1999 — December 31, 1999 |

|

|

Days: |

Days: |

Days: |

||

12Number of days FROM the date shown above line 12 TO the date the

amount on line 8 was paid or 12/31/99, whichever is earlier |

. . . . . . . . . . . . . . . 12 |

|

|

|

|

|||||

13 Underpayment |

|

Number of |

|

|

|

|

|

|

|

|

on line 8 |

X |

days on line 12 |

X |

.07 |

|

|

|

|

|

|

(see instructions) |

|

365 |

|

|

13 |

$ |

$ |

$ |

|

|

Rate Period 3: |

|

|

|

|

|

|

12/31/99 |

12/31/99 |

12/31/99 |

1/15/00 |

|

January 1, 2000 — April 15, 2000 |

|

|

|

Days: |

Days: |

Days: |

Days: |

||

14Number of days FROM the date shown above line 14 TO the date the

amount on line 8 was paid or 4/15/00, whichever is earlier |

. 14 |

|

|

|

|

|||||

15 Underpayment |

|

Number of |

|

|

|

|

|

|

|

|

on line 8 |

X |

days on line 14 |

X |

.08 |

|

|

|

|

|

|

(see instructions) |

|

366 |

|

|

15 |

$ |

$ |

$ |

$ |

|

16PENALTY. Add all amounts on line 11, line 13, and line 15 in all columns. Enter the total here, on Form FTB 5805, Side 1, Part II, line 13, and on Form 540, line 64; Form 540A, line 37; Form 540NR, line 73; or Form 541, line 39.

Also fill in the circle on that line |

16 |

$ |

Page 4 FTB 5805 Instructions 1999

Form Breakdown

| Fact Name | Detail |

|---|---|

| Form Purpose | Form 5805 is used to determine if an individual or fiduciary owes a penalty for underpayment of estimated tax in California. |

| Attachment Requirement | This form must be attached to the FRONT of Form 540, Form 540A, Form 540NR, or Form 541, as applicable. |

| Penalty Waiver Conditions | Penalties for underpayment of estimated tax may be waived if the underpayment was due to casualty, disaster, or other unusual circumstances, or upon retiring after age 62 or becoming disabled in the tax year or the preceding tax year. |

| Governing Law | The form is governed by California state law, specifically by the requirements and provisions related to estimated tax payments. |

| Annualized Income Installment Method | If income varied during the year, the form allows for the use of the annualized income installment method to potentially reduce or eliminate penalties for underpaid estimated tax installments. |

How to Write California 5805

Filling out California Form 5805 involves calculating whether you owe a penalty for underpayment of estimated tax. This process might sound daunting, but breaking it down step by step can simplify things. You'll be working out if you've paid enough tax on time during the tax year. Let's go through the key steps you need to complete on this form. Remember, if the Franchise Tax Board (FTB) can calculate the penalty for you, you might not need to fill this out unless you fall into specific categories that require it.

- Start by identifying if you need to complete Form 5805. Check the general information section to see if any exceptions apply to you. If 80% of your income was subject to California withholding, or your previous year's tax liability, after credits, was less than $200, you might not owe a penalty.

- If required to proceed, ensure you attach Form 5805 to the FRONT of your Form 540, 540A, 540NR, or Form 541, as applicable to your tax filing.

- Enter your name and Social Security Number (SSN) or Federal Employer Identification Number (FEIN) as it appears on your return.

- Answer the questions in Part I regarding waiver requests or if you used the annualized income installment method. If you're requesting a waiver for the penalty due to reasonable cause, like retirement after age 62, provide a detailed explanation.

- For uneven California withholding, enter the actual amounts withheld and the dates of withholding next to the corresponding quarterly payment due dates in Part I, if applicable.

- In Part II, calculate your required annual payment by entering your tax after credits for the current year, then the withholding taxes and required annual payment based on those figures.

- If the Short Method is applicable to your situation (e.g., you made no estimated tax payments, or your only payments were California income tax withheld), complete the section as it simplifies the penalty calculation.

- For individuals using the Annualized Income Installment Method because of varied income throughout the year, complete Side 2 of the form. This portion requires detailed calculation by period, including adjusted gross income, taxes, and deductions.

- Finally, calculate any penalty by applying the appropriate rate to the underpayment amounts for each installment period. This step involves detailed calculations outlined in the instructions for Worksheet II — Regular Method to Figure Your Underpayment and Penalty.

- After calculating the penalty (if any), transfer the final penalty amount to the designated line on your income tax return (Form 540, 540A, 540NR, or 541) as instructed.

Completing Form 5805 can seem complex, but by focusing on each step, you can determine whether a penalty is owed and calculate the correct amount, if necessary. If you're not comfortable navigating these steps, consider seeking assistance from a tax professional or utilizing the resources provided by the Franchise Tax Board.

Listed Questions and Answers

Who needs to file California Form 5805?

California Form 5805, titled "Underpayment of Estimated Tax by Individuals and Fiduciaries," must be filed by individuals, estates, and trusts that have underpaid their estimated taxes for the tax year. However, in many instances, the Franchise Tax Board (FTB) can calculate the penalty for underpayment, so the taxpayer may not need to complete this form. Specifically, you do not need to file Form 5805 if your wages, subject to California withholding, make up 80% of your adjusted gross income, or if your tax liability, after credits and excluding tax on lump-sum distributions and alternative minimum tax, is less than $200 ($100 for married filing separately). Other exceptions include having no tax liability for the previous year if your return was for a full 12 months or meeting certain payment thresholds relative to your tax liability for the current or previous year.

Can the penalty for underpayment of estimated tax be waived?

Yes, the penalty for underpayment of estimated tax can be waived under certain circumstances. Situations eligible for a waiver include instances where the underpayment was due to a casualty, disaster, or other unusual circumstances making it unjust to impose the penalty. Additionally, individuals who retire after age 62 or become disabled, and their underpayment is due to reasonable cause, may also have their penalty waived. To request a waiver, you must indicate this on Form 5805, Part I, Question 1, and provide an explanation for the waiver request. If additional space is needed, attach a separate statement detailing the reason for the waiver. However, you must still complete through Part II, line 12 of the form (line 15 if using the regular method) without regard to the waiver, and then note the amount you wish to have waived on the dotted line next to the penalty calculation.

What if I used the annualized income installment method?

If you opted for the annualized income installment method because your income varied throughout the year, you must complete Form 5805, including Side 2 of the form. This method allows taxpayers whose earnings were not evenly distributed over the year to potentially reduce or eliminate underpayment penalties for certain periods. The annualized method takes into account the fluctuating amounts earned, potentially resulting in lower required installment payments. Individuals using this method must attach Form 5805 to the front of their tax return and indicate on the return that they have underpaid estimated tax due to using the annualized income method.

How do I calculate the penalty for underpayment of estimated taxes?

The penalty for underpaying estimated taxes can be calculated using the short method for certain taxpayers or the regular method detailed on Worksheet II of the Form 5805 instructions. The short method may be used by calendar year taxpayers who did not make any estimated tax payments or who made payments in four equal amounts by the due dates. Otherwise, the regular method must be used, which involves a more detailed calculation based on the amount and timing of underpayments and any subsequent payments made. The calculation takes into account various interest rates applied to the period the underpayment remained unpaid.

Are there special rules for estates and trusts regarding Form 5805?

Yes, estates and trusts have specific requirements when it comes to underpayment of estimated taxes and the use of Form 5805. Estates and grantor trusts which have received the decedent's estate are required to make estimated tax payments for years ending two or more years after the decedent's death. If the estate or trust is in a situation where it does not expect to owe a penalty based on the exceptions provided, it should not file Form 5805 unless it meets certain conditions requiring attachment. For instance, if the date of death was less than two years from the end of the tax year, only Part I should be completed. It’s also crucial for estates and trusts to follow the adjusted dates and specific instructions detailed on Form 5805 for their particular situations.

Common mistakes

Filling out California's Form 5805 involves a detailed process, and mistakes can happen easily. Here are some common errors to watch out for:

- Not attaching the form to the front of your Form 540, Form 540A, Form 540NR, or Form 541, leading to processing delays.

- Forgetting to fill in the circle for underpayment of estimated tax on the corresponding form and line number can lead to your underpayment being overlooked.

- Overlooking the waiver conditions in Part I, leading to unnecessary penalty calculations. If you qualify for a waiver, make sure it's clearly requested and explained.

- Misunderstanding when to use the annualized income installment method in Part III can result in incorrect penalty calculations. This method is not for everyone and should only be used if your income varied greatly within the year.

- Failing to include uneven withholding amounts in Part I Question 3. If your withholding was not evenly distributed, this needs to be accurately reported to avoid miscalculating your payments.

- Incorrectly calculating the required annual payment in Part II can lead to either overestimating or underestimating the penalty owed.

- Using the short method incorrectly. This method is not suitable for everyone and can lead to errors in the penalty calculation if not eligible.

- Not attaching additional statements when needed, especially if more space is needed to explain a request for a waiver of the penalty.

To avoid these mistakes, carefully review each part of the form, understand the eligibility criteria for waivers and different calculation methods, and double-check all attached documentation.

Documents used along the form

Accurately managing one's tax obligations, especially those involving potential underpayments, requires a detailed understanding of the relevant forms and documents. In California, Form 5805, a pivotal resource for addressing underpayment of estimated tax by individuals and fiduciaries, is often accompanied by several additional documents to ensure comprehensive tax compliance. These documents address different aspects of the individual or fiduciary’s financial situation, directly impacting the calculation and reporting of estimated taxes.

- Form 540 - California Resident Income Tax Return: This form is for residents who need to report income earned. It's central to determining the amount of state tax owed by an individual or fiduciary.

- Form 540NR - California Nonresident or Part-Year Resident Income Tax Return: Nonresidents or those who have resided in California for only part of the year use this form to declare their California-sourced income.

- Form 540A - California Resident Income Tax Return (Short Form): This simplified version of Form 540 is for residents with straightforward tax situations.

- Form 541 - California Fiduciary Income Tax Return: Trustees and fiduciaries responsible for an estate or trust file this form to report income, deductions, and taxes owed.

- Schedule D (540) - California Capital Gain or Loss Adjustment: Individuals use Schedule D to report capital gains or losses, which could affect their estimated tax liability.

- Schedule P (540) - Alternative Minimum Tax - Individuals: Required for individuals who may be subject to the alternative minimum tax (AMT), Schedule P helps determine the additional tax owed.

The intricacies of tax law necessitate that individuals and fiduciaries in California not only complete Form 5805 but also pay keen attention to a variety of other tax forms and schedules that could affect their tax situation. Accurate completion and timely submission of these documents can prevent underpayments and ensure compliance with state tax obligations, thereby avoiding potential penalties.

Similar forms

The first document similar to the California Form 5805 is the IRS Form 2210, "Underpayment of Estimated Tax by Individuals, Estates, and Trusts." Like Form 5805, Form 2210 is used to calculate penalties for not paying enough estimated tax throughout the year or for paying estimated taxes late. Both forms consider income unevenly earned throughout the year, allowing for the use of annualized income or standard installment methods when calculating potential underpayment penalties.

Another comparable document is Form IT-2106, "Estimated Income Tax Payment Voucher for Individuals," which is used in New York State. Similar to California's Form 5805, this voucher is intended for individuals who must make estimated tax payments. Though Form IT-2106 is primarily a payment voucher rather than a penalty calculation form, it shares the underlying principle of facilitating the payment of estimated taxes throughout the fiscal year to avoid underpayment penalties.

Form 540-ES, "Estimated Tax for Individuals," also serves a similar purpose by providing a way for individuals to calculate and pay their estimated taxes in California. Like Form 5805, it is concerned with ensuring that taxpayers meet their tax obligations throughout the year. However, Form 540-ES is more focused on calculating the estimated payments themselves, rather than penalties for underpayment.

The Federal Form 1040-ES, "Estimated Tax for Individuals," mirrors the function of California's Form 5805 in the federal tax system, allowing taxpayers to estimate their taxes and make payments throughout the year. Both forms encourage making accurate estimated payments to avoid underpayment penalties, though the 1040-ES, like 540-ES, is more focused on the payment of estimated tax rather than penalty calculation.

Form FTB 3519, "Payment for Automatic Extension for Individuals," is used in California when individuals need more time to file their tax returns. While its primary purpose is different, it intersects with Form 5805's objectives by potentially affecting estimated tax calculations and payments, and it highlights the importance of timely tax liability fulfillment to avoid penalties.

Form 540, "California Resident Income Tax Return," is directly linked to Form 5705 since underpayment of estimated taxes impacts the final tax return filing. Individuals use Form 540 to report annual income and calculate taxes owed, with Form 5805 affecting those who did not make sufficient estimated tax payments throughout the year.

Form 1041-ES, "Estimated Income Tax for Estates and Trusts," parallels Form 5805 for fiduciaries, ensuring that estates and trusts meet their tax payment obligations throughout the year. Both documents share the objective of managing estimated payments to avoid underpayment penalties, adjusted to their specific taxpayer groups.

Form FTB 5806, "Underpayment of Estimated Tax by Corporations," is the corporate counterpart to Form 5805, aimed at businesses rather than individuals and fiduciaries. It also calculates underpayment penalties but is tailored to the unique aspects of corporate tax obligations and payment schedules.

The "Annualized Income Installment Method Worksheet," often included within the instructions of forms like 5805, is a supplementary document that aids in detailed calculations when income is received unevenly throughout the year. This worksheet complements Form 5805 by providing the calculations necessary to adjust estimated tax payments and potential penalties accordingly.

Lastly, Form 540NR, "Nonresident or Part-Year Resident Income Tax Return," interacts with Form 5805 as nonresidents or part-year residents may also be subject to underpayment penalties. By addressing tax obligations for individuals with more complex residency statuses, Form 540NR expands on the contexts in which underpayment penalties might be assessed, underlining the importance of accurately estimating and paying taxes for all taxpayers.

Dos and Don'ts

Completing the California 5805 form, associated with the underpayment of estimated tax, necessitates careful attention to both detail and procedure to ensure accurate reporting and avoid potential penalties. Presented below are guidelines to aid individuals and fiduciaries in navigating this process effectively.

Do:

- Verify eligibility for filing the form by reviewing the prerequisites mentioned on the form, including income thresholds and specific financial conditions from the previous year.

- Ensure accurate calculation of the tax amounts by thoroughly following the instructions provided, which detail the required computations and relevant line references.

- Include all necessary documentation that supports any claims made on the form, particularly if requesting a waiver of the penalty due to a casualty, disaster, or other unusual circumstance.

- Utilize the annualized income installment method if taxable income was earned unevenly throughout the year, which may result in lower required installments.

- Attach Form 5805 to the front of the California tax return (Form 540, 540A, 540NR, or 541), as specifically instructed, ensuring that it is the first document seen when the return is reviewed.

- Correctly fill out the name(s) and identification number(s) at the top of the form to match the information on the tax return.

- Timely file the form alongside the tax return or by the deadline provided by the Franchise Tax Board to avoid additional penalties and interest.

- Consider consulting with a tax professional if questions arise during the completion of the form, to ensure accuracy and compliance with California tax laws.

- Double-check calculations and the completeness of the form before submission, reducing the likelihood of errors and the need for amendments.

- Keep a copy of the completed form and any supporting documents for personal records and future reference.

Don't:

- File Form 5805 if not required, as specified under certain conditions outlined in the form's instructions, to avoid unnecessary processing.

- Ignore the specific instructions for estates and trusts which may have different requirements or exemptions, particularly concerning estimated tax payments and deadlines.

- Omit required information or provide inaccurate details which could lead to calculation errors and potential underpayment penalties.

- Assume the form is not needed without carefully reviewing all income sources and tax liabilities for the year, including special circumstances that might impact tax obligations.

- Fail to attach the form to the tax return if required, as this could result in the Franchise Tax Board not acknowledging its submission and potentially assessing penalties.

- Miss relevant deadlines for making estimated tax payments, leading to the unnecessary accrual of penalties and interest.

- Underestimate tax liabilities without considering all sources of income and applicable deductions, potentially resulting in underpayment.

- Disregard the importance of documentation supporting waiver requests, as failure to provide adequate proof may result in the denial of the waiver.

- Overlook the guidelines for nonresidents and new residents, as they are also subject to penalties for underpayment of estimated taxes.

- Refuse to seek professional advice when uncertain about the process, risking mistakes that could lead to financial penalties.

By adhering to these dos and don'ts, taxpayers can navigate the completion of the California 5805 form more efficiently, ensuring compliance and minimizing the risk of encountering penalties for underpayment of estimated tax.

Misconceptions

People often misunderstand the California 5805 form, a document required under certain conditions to calculate and report underpayment of estimated tax by individuals and fiduciaries. Let's address some common misconceptions:

Many believe that the form is only for taxpayers who owe a significant penalty. However, Form 5805 is utilized to determine if a penalty for underpayment of estimated taxes is due, regardless of the amount. This includes figuring out small penalties or proving none is owed due to exceptions.

Some think it only pertains to businesses or estates, when in fact, Form 5805 applies to individuals, including self-employed persons, as well as fiduciaries overseeing estates or trusts.

There's a misconception that if you receive a bill from the Franchise Tax Board (FTB), it's too late to file Form 5805. Actually, if the FTB calculates a penalty and bills you for it, you can still complete and submit this form to possibly reduce or eliminate the penalty based on unique circumstances not considered by the board’s automatic calculation.

It's incorrectly assumed that the form is exceedingly complex and always requires professional help. While seeking professional advice can be beneficial, especially in complicated tax situations, the instructions provided with Form 5805 are designed to guide filers through the process step by step.

Another common mistake is thinking that penalties are calculated annually only. Form 5805 actually allows for the calculation of penalties on a quarterly basis, potentially reducing the total amount owed if income varied throughout the year.

Some individuals believe that once you file Form 5805 and determine a penalty, there is no option to reduce or appeal it. However, the form itself offers a section for requesting a waiver of the penalty under certain conditions, such as casualty, disaster, or retirement.

Last, many don't realize that you don't need to complete this form if you meet specific requirements that exempt you from the underpayment penalty, such as having 80% of your adjusted gross income withheld or taxed.

Understanding these points can help individuals and fiduciaries accurately complete their tax responsibilities and potentially save on penalties. It’s essential to carefully read the form instructions and consider your own tax situation or consult with a tax professional if in doubt.

Key takeaways

To determine if a penalty for underpayment of estimated tax is owed, residents and fiduciaries in California should use Form 5805. This form should be attached to the front of your California tax return forms, specifically Form 540, Form 540A, Form 540NR, or Form 541, depending on which applies.

You may not need to fill out Form 5805 if specific conditions are met, such as having 80% of your California adjusted gross income (AGI) from wages subject to California withholding, or if your tax liability, excluding certain taxes and less credits, was less than $200 ($100 for those married filing separately). Other exemptions include having no tax liability on your previous year's return or having already paid a sufficient portion of your tax liability through withholding or estimated tax payments.

For individuals using the annualized income installment method due to uneven earnings throughout the year, the detailed instructions and schedules provided on the form must be completed. This can potentially reduce the amount of estimated tax required to be paid in each installment, beneficial for those whose income fluctuates significantly throughout the year.

Estates and trusts have specific requirements under Form 5805. If the date of death is less than two years from the end of the tax year, certain rules apply. Moreover, required annual payments and the use of annualized income installments also are pertinent to estates and trusts, making it essential for these entities to carefully review the form's instructions for compliance.

Penalties for underpayment can be waived under certain circumstances, such as a casualty, disaster, retiring after age 62, or becoming disabled, and when the underpayment was due to reasonable cause. If seeking a waiver, you must request it by checking "Yes" to the question on the form and providing a detailed explanation. Additionally, calculating the penalty separately for each payment period may reveal that a penalty is due for earlier payments even if later payments compensated for earlier underpayments.

Different PDF Templates

Form 3832 - Legally binding, Form 3832 secures nonresident members' agreement to comply with California's taxation of their LLC income.

California Nonprofit - Understand how the California 149 form provides a pathway for non-compliant vehicles to receive a temporary exemption, avoiding penalties.

Ca Form 541 Instructions 2022 - The voucher is specifically for the 1997 tax year, making it important for filings within that period.