Fill a Valid California 587 Form

In the business and financial landscape of California, understanding the nuances of state tax requirements is crucial, especially for nonresidents engaging in transactions within the state. The California Form 587, formally known as the Nonresident With,holding Allocation Worksheet, for the 2011 tax year stands as a pivotal document in this regard. This form primarily serves withholding agents and nonresident payees by defining the framework within which withholding on payments made to nonresidents for services, rents, royalties, and other California-sourced income is calculated and reported. It underscores the conditions under which withholding is deemed necessary, delineating payments exempt from this requirement based on the nature of services provided or the relationship of the payee with the state. Through a series of structured parts, the form collects comprehensive details about the withholding agent and payee, clarifies the type of payments involved, and mandates an allocation of income derived within and outside California, thereby impacting the withholding obligations. Furthermore, it provides guidelines for situations where withholding may be waived, reinforcing the payee’s responsibility in truthfully reporting changes that might affect their withholding status. With sections dedicated to certifying the accuracy of the provided information under penalties of perjury, Form 587 embodies a critical process in ensuring compliance with California's tax laws for nonresident transactions, compelling both withholding agents and payees to navigate the complexities of state tax obligations with due diligence.

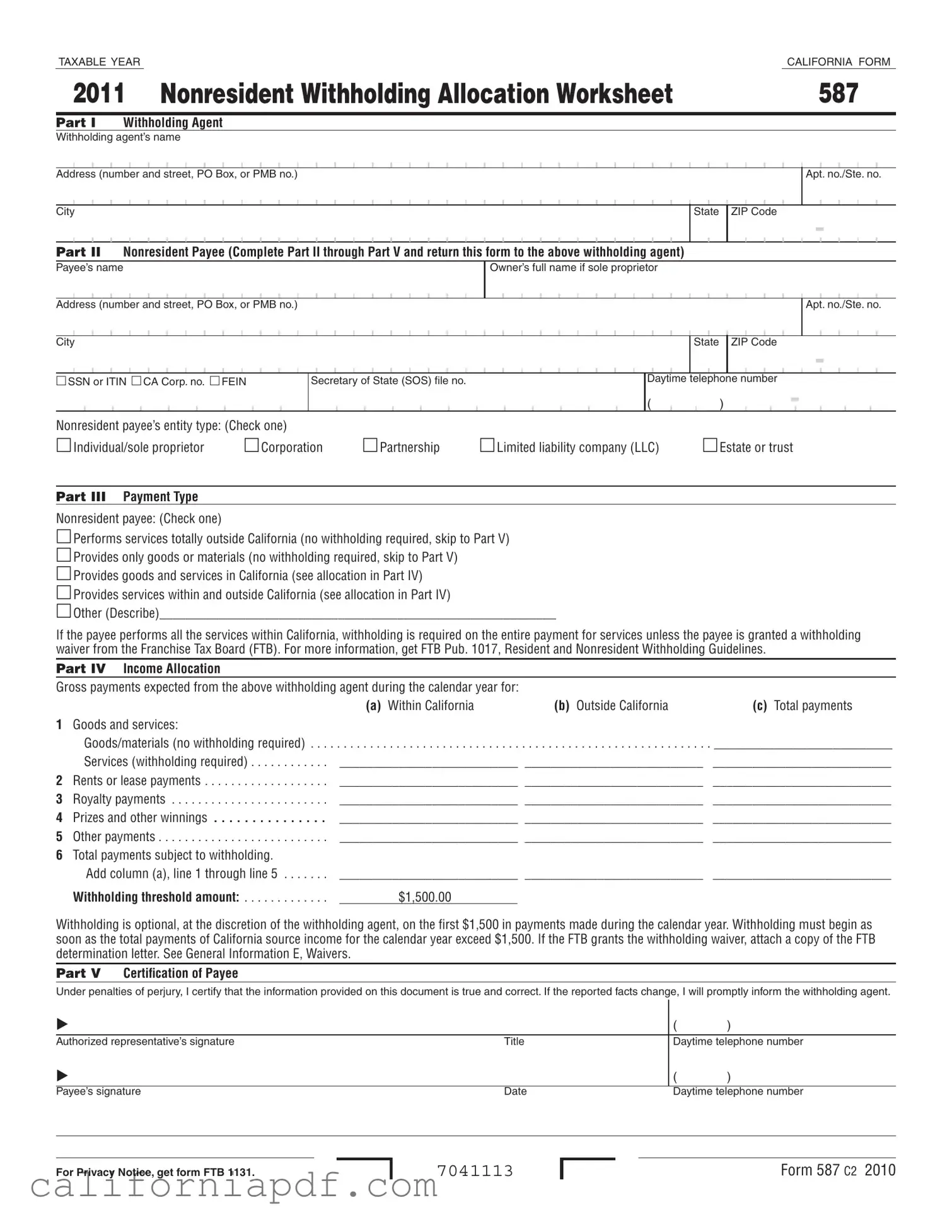

Document Example

TAXABLE YEARCALIFORNIA FORM

2011 Nonresident Withholding Allocation Worksheet |

587 |

Part I Withholding Agent

Withholding agent’s name

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State ZIP Code

-

Part II Nonresident Payee (Complete Part II through Part V and return this form to the above withholding agent)

Payee’s name

Owner’s full name if sole proprietor

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN or ITIN CA Corp. no. FEIN |

Secretary of State (SOS) file no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime telephone number |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

|

|

) |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident payee’s entity type: (Check one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

Individual/sole proprietor |

|

|

|

Corporation |

|

|

|

Partnership |

|

Limited liability company (LLC) |

|

|

Estate or trust |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Part III Payment Type

Nonresident payee: (Check one)

Performs services totally outside California (no withholding required, skip to Part V)

Provides only goods or materials (no withholding required, skip to Part V)

Provides goods and services in California (see allocation in Part IV)

Provides services within and outside California (see allocation in Part IV)

Other (Describe)____________________________________________________________

If the payee performs all the services within California, withholding is required on the entire payment for services unless the payee is granted a withholding waiver from the Franchise Tax Board (FTB). For more information, get FTB Pub. 1017, Resident and Nonresident Withholding Guidelines.

Part IV Income Allocation

Gross payments expected from the above withholding agent during the calendar year for:

|

|

(a) Within California |

(b) Outside California |

(c) Total payments |

1 |

Goods and services: |

|

|

|

|

Goods/materials (no withholding required) |

___________________________ |

||

|

Services (withholding required) |

___________________________ ___________________________ |

___________________________ |

|

2 |

Rents or lease payments |

___________________________ ___________________________ |

___________________________ |

|

3 |

Royalty payments |

___________________________ ___________________________ |

___________________________ |

|

4 |

Prizes and other winnings |

___________________________ ___________________________ |

___________________________ |

|

5 |

Other payments |

___________________________ ___________________________ |

___________________________ |

|

6 |

Total payments subject to withholding. |

|

|

|

|

Add column (a), line 1 through line 5 |

___________________________ ___________________________ |

___________________________ |

|

|

Withholding threshold amount: |

$1,500.00 |

|

|

Withholding is optional, at the discretion of the withholding agent, on the first $1,500 in payments made during the calendar year. Withholding must begin as soon as the total payments of California source income for the calendar year exceed $1,500. If the FTB grants the withholding waiver, attach a copy of the FTB determination letter. See General Information E, Waivers.

Part V Certiication of Payee

Under penalties of perjury, I certify that the information provided on this document is true and correct. If the reported facts change, I will promptly inform the withholding agent.

|

|

|

( |

) |

Authorized representative’s signature |

Title |

Daytime telephone number |

||

|

|

|

( |

) |

Payee’s signature |

Date |

Daytime telephone number |

||

For Privacy Notice, get form FTB 1131.

7041113

Form 587 C2 2010

Instructions for Form 587

Nonresident Withholding Allocation Worksheet

References in these instructions are to the California Revenue and Taxation Code (R&TC).

General Information

Beginning January 1, 2008, domestic nonresidents may use Form 589, Nonresident Reduced Withholding Request, to request the reduction in the standard seven percent withholding amount that is applicable to California source payments made to nonresidents.

Backup Withholding – Beginning on or after January 1, 2010, with certain limited exceptions, payers that are required to withhold and remit backup withholding to the Internal Revenue Service (IRS) are also required to withhold and remit to the Franchise Tax Board (FTB). The California backup withholding rate is 7% of the payment. For California purposes, dividends, interests, and any financial institutions, release of loan funds made in the normal course of business are exempt from backup withholding.

If a payee has backup withholding, the payee must contact the FTB to provide a valid Taxpayer Identification Number (ITIN) before filing a tax return. The following are acceptable TINs: social security number (SSN); individual taxpayer identification number (ITIN); federal employer identification number (FEIN); California corporation number (CA Corp No.); or California Secretary of State (SOS) file number. Failure to provide a valid TIN will result in the denial of

the backup withholding credit. For more information, go to ftb.ca.gov and search for backup withholding.

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

A Purpose

Use Form 587, Nonresident Withholding Allocation Worksheet, to determine

the amount of withholding required on payments to nonresidents.

The payee completes, signs, and returns Form 587 to the withholding agent. The withholding agent relies on the certification made by the payee to

determine the amount of withholding required, provided the completed and signed Form 587 is accepted in good faith. Retain the completed Form 587 for your records for a minimum of four years and provide it to the FTB upon request.

Do not use Form 587 if any of the following applies:

•Payment to a nonresident is only for the purchase of goods.

•You sold California real estate. Use Form

•The payee is a resident of California or is a

Use Form 590, Withholding Exemption Certificate.

•The payee is a corporation, partnership, or limited liability company (LLC) that has a permanent place of business in California or is qualified to do business in California. Foreign corporations must be qualified to transact intrastate business. Use Form 590.

•The payment is to an estate and the decedent was a California resident. Use Form 590.

B Requirement

California Revenue and Taxation Code (R&TC) Section 18662 and the related regulations require withholding of income or franchise tax on certain payments made to nonresidents of California for personal services performed in California and for rents on property located in California and royalties with activities in California. The withholding rate is seven percent (.07) unless the FTB grants a waiver. See General Information E, Waivers.

C When to File This Form

The withholding agent requests that the payee completes, signs, and returns Form 587 when a contract is entered into or before payment is made to the payee. The withholding agent retains Form 587 for a minimum of four years and must provide it to the FTB upon request.

Form 587 remains valid for the duration of the contract (or term of payments), provided there is no material change in the facts. By signing Form 587, the payee agrees to promptly notify the withholding agent of any changes in the facts.

D Withholding Requirements

Payments made to nonresident payees (including individuals, corporations, partnerships, LLCs, estates, and trusts) are subject to withholding. However, no withholding is required if total payments of California source income to the payee during the calendar year are $1,500 or less.

If the California resident, qualified corporation, LLC, or partnership is acting as an agent for the nonresident payee, the payment is subject to withholding if the nonresident payee does not meet any of the exceptions on Form 590.

Payments subject to withholding include the following:

•Payments for services performed in California by nonresidents.

•Payments made in connection with a California performance.

•Rent paid to nonresidents if the rent is paid in the course of the withholding agent’s business.

•Royalties paid to nonresidents from business activities in California.

•Payments of prizes for contests entered in California.

•Distributions of California source income to nonresident beneficiaries from an estate or trust.

•Other payments of California source income made to nonresidents.

Payments not subject to withholding include payments:

•To a resident of California or to a corporation with a permanent place of business in California.

•To a corporation qualified to do business in California.

•To a partnership or LLC that has a permanent place of business in California.

•For sale of goods.

•For income from intangible personal property, such as interest and dividends, unless the property has acquired a business situs in California.

•For services performed outside of California.

•To a payee that is a

Form 587 Instructions 2010 Page 1

•Representing wages paid to employees. Wage withholding is administered

by the California Employment Development Department (EDD). For more information, contact your local EDD office.

•To a payee that is a government entity.

•To reimburse a payee for expenses relating to services performed in California if the reimbursement is separately accounted for and not subject to federal Form 1099 reporting. Corporate payees, for purposes of this exception, are treated as individual persons.

E Waivers

A nonresident payee may request that withholding be waived. To apply for a withholding waiver, use Form 588, Nonresident Withholding Waiver Request. If the FTB has granted a waiver, you must attach a copy of FTB’s determination letter to Form 587.

FRequirement to File a California Tax Return

A payee’s exemption certification on Form 587, Form 590, or a determination letter from the FTB waiving withholding does not eliminate the requirement to file a California tax return and pay the tax due. For return filing requirements, see the instructions for Long or Short Form 540NR, California Nonresident or

Specific Instructions

Part I – Withholding Agent

The withholding agent must complete Part I before giving Form 587 to the payee.

Part II – Nonresident Payee

The payee must complete all information in Part II including the social security number, individual taxpayer identification number, California corporation number, FEIN, or SOS file number, and entity type.

Part III – Payment Type

The nonresident payee must check the box that identifies the type of payment being received.

No withholding is required when payees are residents or have a permanent place of business in California.

Part IV – Income Allocation

Use Part IV to identify payments that are subject to withholding. Only payments sourced within California are subject

to withholding. Services performed in California are sourced in California. In the case of payments for services performed when part of the services are performed outside California, enter the amount paid for performing services within California in column (a). Enter the amount paid for performing services while outside California in column (b). Enter the total amount paid for services in column (c).

If the payee’s trade, business, or profession carried on in California is an integral part of a unitary business carried on within and outside California, the amounts included on line 1 through line 5 should be computed by applying the payee’s California apportionment percentage (determined in accordance with the provisions of the Uniform Division of Income for Tax Purposes Act) to the payment amounts. For more information on apportionment, get California Schedule R, Apportionment and Allocation of Income.

Withholding agent. Withholding is optional, at your discretion, on the first $1,500 in payments made during the calendar year. Withholding must begin as soon as the total payments of California source income for the calendar year exceed $1,500. If circumstances change during the year (such as the total amount of payments), which would change the amount on line 6, the payee must submit a new Form 587 to the withholding agent reflecting those changes. The withholding agent should evaluate the need for a new Form 587 when a change in facts occurs.

Part V – Certification of Payee

The payee and/or the authorized representative must complete, sign, date, and return this form to the withholding agent.

Authorized representatives include those persons the payee authorized to act on their behalf through a power of attorney, third party designee, or other individual taxpayers authorized to view their confidential tax data via a waiver or release.

Additional Information

For additional information or to speak to a representative regarding this form, call the Withholding Services and Compliance automated telephone service at:

888.792.4900, or 916.845.4900 FAX 916.845.9512

OR write to:

WITHHOLDING SERVICES AND COMPLIANCE MS F182 FRANCHISE TAX BOARD

PO BOX 942867 SACRAMENTO CA

You can download, view, and print California tax forms and publications at ftb.ca.gov.

OR write to:

TAX FORMS REQUEST UNIT MS F284 FRANCHISE TAX BOARD

PO BOX 307

RANCHO CORDOVA CA

For all other questions unrelated to withholding or to access the TTY/TDD numbers, see the information below.

Internet and Telephone Assistance Website: ftb.ca.gov

Telephone: 800.852.5711 from within the United States 916.845.6500 from outside the United States

TTY/TDD: 800.822.6268 for persons with hearing or speech impairments

Asistencia Por Internet y Teléfono Sitio web: ftb.ca.gov

Teléfono: 800.852.5711 dentro de los

Estados Unidos 916.845.6500 fuera de los Estados Unidos

TTY/TDD: 800.822.6268 personas con discapacidades auditivas y del habla

By Automated Phone Service: Use this service to check the status of your refund, order California forms, obtain payment and balance due information, and hear recorded answers to general questions. This service is available 24 hours a day, 7 days a week, in English and Spanish.

Telephone: 800.338.0505 from within the United States 916.845.6600 from outside the United States

Follow the recorded instructions. Have paper and pencil available to take notes.

Page 2 Form 587 Instructions 2010

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Title | California Form 587 - Nonresident Withholding Allocation Worksheet |

| Taxable Year | 2011 |

| Purpose | To determine the amount of withholding required on payments made to nonresidents of California. |

| Governing Law | California Revenue and Taxation Code (R&TC) Section 18662 |

| Usage Requirement | Required when making certain payments to nonresidents for personal services performed in California. |

| Withholding Rate | Seven percent (.07) unless the Franchise Tax Board grants a waiver. |

| Exemption | No withholding required if total payments of California source income to a payee during the calendar year are $1,500 or less. |

| Waiver Process | Nonresident payee may request a withholding waiver using Form 588, Nonresident Withholding Waiver Request. |

| Record Retention | The withholding agent must retain the completed Form 587 for a minimum of four years. |

| Certification Requirement | The payee must complete, sign, and return Form 587 to the withholding agent, certifying that the information provided is correct. |

| Backup Withholding | Begins on or after January 1, 2010, with certain limited exceptions; California backup withholding rate is 7% of the payment. |

How to Write California 587

Filling out the California Form 587, the Nonresident Withholding Allocation Worksheet, is an important step for nonresident payees to determine the correct amount of tax withholding from payments received from California sources. Careful completion ensures compliance with the Franchise Tax Board's requirements and may impact the payee's tax obligations to California. Below are the detailed steps to accurately fill out the form.

- Part I - Withholding Agent: If you are a withholding agent, enter your name, address, including the Suite and/or Apartment number if applicable, city, state, and ZIP Code in the designated fields.

- Part II - Nonresident Payee: In this section, nonresident payees provide personal or business information including:

- Payee’s name or the owner’s full name if a sole proprietor.

- Complete address, including Apartment no./Suite no., City, State, and ZIP Code.

- Select the identifier type (SSN, ITIN, CA Corp. no., FEIN, or SOS file no.) and provide the corresponding number.

- Provide a daytime telephone number.

- Check the appropriate box for the nonresident payee’s entity type: Individual/sole proprietor, Corporation, Partnership, Limited liability company (LLC), Estate or trust.

- Part III - Payment Type: Nonresident payees must check the appropriate box that corresponds to the type of payment they are receiving. Options include services performed totally outside California, providing only goods or materials, services within California, services both in and outside California, or other. Provide a description if 'Other' is selected.

- Part IV - Income Allocation: This part is for detailing the allocation of income between services and/or goods provided within California and those provided outside. Follow these steps:

- Enter gross payments expected from the withholding agent for the calendar year for each category listed, separated into amounts for within California, outside California, and total payments.

- Add up the column totals for within California in 'a', outside California in 'b', and total payments in 'c'.

- If applicable, attach a copy of the FTB determination letter if a withholding waiver has been granted.

- Part V - Certification of Payee: The form must be signed and dated by the payee or the authorized representative. Enter the title if applicable and provide a daytime telephone number for both the payee and the authorized representative if present.

After completing, signing, and dating the form, it should be returned to the withholding agent. Retaining a copy for personal records is also advisable. The form serves as a key document for both withholding agents and nonresident payees in managing tax responsibilities associated with California source income.

Listed Questions and Answers

What is California Form 587 and who needs to use it?

California Form 587, also known as the Nonresident Withholding Allocation Worksheet, is used to determine the amount of California state income tax withholding required from payments made to nonresident individuals or entities. This form is pertinent for entities that make payments for services performed in California by nonresidents, including individuals, partnerships, corporations, estates, and trusts. The payee—namely, the nonresident earning income from California sources—completes, signs, and returns the form to the withholding agent, the entity making the payment, to communicate the appropriate amount of income subject to withholding based on the service's location and nature.

When should Form 587 be submitted?

Form 587 should be completed, signed, and submitted by the nonresident payee to the withholding agent when entering a contract or before any payment is made. This proactive step ensures that the withholding agent can withhold the correct amount of income tax. Retention of the completed Form 587 by the withholding agent for a minimum of four years is required, and it must be provided to the Franchise Tax Board (FTB) upon request. The form remains valid for the duration of the contract, or term of payment, as long as there are no significant changes in the facts presented.

Are there any exemptions from submitting Form 587?

Yes, exemptions exist under specific conditions. Form 587 is not required in cases where:

- The payment to a nonresident is solely for the purchase of goods.

- The payee is a California resident or a non-grantor trust with a California resident trustee.

- The payee is a corporation, partnership, or limited liability company (LLC) with a permanent place of business or is qualified to do business in California.

- The payment is made to an estate, and the decedent was a California resident.

How does one determine the amount to withhold on payments made to nonresidents?

The specific instructions provided in Form 587 guide nonresident payees in allocating their income between services rendered inside and outside of California. Payments sourced within California are subject to withholding at the rate of seven percent unless a withholding waiver has been granted. Withholding is mandatory as soon as the total payments of California source income for the calendar year exceed $1,500.00, except if a waiver or other exemption applies.

Can withholding be waived on Form 587?

Yes, a nonresident payee can request a withholding waiver by submitting Form 588, Nonresident Withholding Waiver Request, to the FTB. If granted, a copy of the FTB's determination letter must be attached to Form 587. This is an essential step for those seeking relief from the standard withholding requirements due to various qualifying conditions.

Does completing Form 587 eliminate the requirement to file a California tax return?

No, the completion and submission of Form 587, or even the acquisition of a withholding waiver, do not exempt the payee from filing a California tax return or paying any due tax. Nonresident individuals and entities earning income from California sources are obligated to file the appropriate California tax returns, such as Form 540NR for nonresidents or Part-Year residents, and pay any taxes owed.

Where can additional guidance on Form 587 be obtained?

Further information and resources regarding Form 587 can be found by contacting the Withholding Services and Compliance section of the FTB, either through their automated telephone service or by writing to their office. Additionally, the FTB's official website provides comprehensive guidelines and answers to frequently asked questions surrounding nonresident withholding requirements and processes.

Common mistakes

When individuals fill out the California Form 587, Nonresident Withholding Allocation Worksheet, several common mistakes can lead to potential issues or processing delays. Awareness and careful attention to detail can help avoid these pitfalls.

Not including the Private Mail Box (PMB) number in the address field: If using a PMB, it’s crucial to indicate “PMB” followed by the box number in the address field. This mistake can lead to misrouted or lost correspondence.

Incorrect entity type selection: Payees often mistakenly check the wrong box for their entity type in Part II. It’s important to accurately identify whether you are an individual/sole proprietor, corporation, partnership, limited liability company (LLC), or estate or trust, as this affects the processing of the form.

Entering inaccurate Taxpayer Identification Numbers (TINs): Providing an incorrect Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), Federal Employer Identification Number (FEIN), California Corporation number, or Secretary of State (SOS) file number can result in processing delays or denial for backup withholding credit.

Misreporting payment types in Part III: Payees sometimes incorrectly report the type of payment they are receiving, particularly differentiating between services, goods, or a combination thereof that are provided within and outside of California. This misclassification can affect withholding requirements.

Failing to properly allocate income between services performed inside and outside California in Part IV: Accurate allocation is necessary to determine the correct amount of withholding. Errors here can result in under or over-withholding.

Omitting the withholding threshold amount: The first $1,500 of payments made during the calendar year are optionally subject to withholding at the discretion of the withholding agent. Failing to consider this threshold can lead to unnecessary withholding.

Incomplete or unsigned certification in Part V: The form requires certification under penalties of perjury that the information provided is true and correct. An unsigned or incomplete form is invalid and will not be processed.

By carefully addressing these common mistakes, individuals can ensure smoother processing of their California Form 587 and avoid unnecessary delays or issues with their nonresident withholding allocation.

Documents used along the form

When dealing with the complexities of nonresident taxation in California, particularly with the Form 587 for Nonresident Withholding Allocation, several additional forms and documents may often accompany or be necessary in conjunction with this form to ensure compliance with the state's tax laws and regulations. Understanding these documents can provide a clearer picture of the obligations and procedures for both the withholding agent and the nonresident payee.

- Form 588, Nonresident Withholding Waiver Request: This form is used by nonresident individuals or entities to request a waiver from the mandated withholding requirements. If approved, it significantly alters the withholding obligations on payments made for services, royalties, rents, or other income sources from California sources.

- Form 589, Nonresident Reduced Withholding Request: This form allows nonresident payees to request a reduction in the standard withholding rate. It is particularly useful for those who can demonstrate that the standard withholding rate exceeds their anticipated California state income tax liability.

- Form 590, Withholding Exemption Certificate: Used by payees to certify their California residency status or that they are otherwise exempt from nonresident withholding. This form is crucial for payees who are actually California residents or meet specific criteria making them exempt from nonresident withholding.

- Form 593, Real Estate Withholding Statement: In transactions involving California real property, this form serves to calculate and report withholding on payments made to nonresidents. It is an essential document for real estate transactions, ensuring compliance with state tax obligations for property sales.

- Form 593-C, Real Estate Withholding Certificate: This certificate is completed by the seller of California real property and given to the buyer or other paying agent to withhold a specified amount for state income taxes. The form is critical in real estate dealings to ensure proper withholding and remittance of taxes on real estate transactions involving nonresident sellers.

Each of these forms plays a vital role in the broader context of California's taxation of nonresident income, ensuring both compliance with state tax laws and the proper administration of tax obligations related to payments made to nonresidents. By navigating these forms alongside the Form 587, withholding agents and nonresident payees can more effectively manage their tax responsibilities and reduce the risk of noncompliance with state tax regulations.

Similar forms

The California 587 form, a Nonresident Withholding Allocation Worksheet, shares similarities with the Form 593-C, Real Estate Withholding Certificate. Both forms are essential for managing withholdings in California, yet they cater to different transactions. While the 587 form focuses on nonresident payments for services, the 593-C form is specific to real estate transactions, ensuring appropriate withholdings are applied to payments made to nonresident sellers of California property.

Form 590, Withholding Exemption Certificate, is another document with similarities to Form 587. Form 590 is used by individuals or entities to certify their California residency or exempt status, thereby negating the need for withholding on payments. Such a form contrasts with the 587 form, which primarily addresses nonresident withholdings. Both ensure compliance with state taxation laws but from opposite statuses of residency.

The Nonresident Reduced Withholding Request, known as Form 589, serves a similar purpose to the 587 form by addressing withholdings for nonresidents. However, Form 589 specifically allows nonresidents to request reduced withholding rates, compared to the 587 form's broader scope of allocating withholding amounts based on the payment's connection to California activities.

Form 588, Nonresident Withholding Waiver Request, parallels the 587 form as both are used by nonresidents in relation to California source income. While Form 587 helps determine the appropriate amount to withhold, Form 588 can be used to request a complete waiver of withholding, offering a potential path for nonresidents to avoid withholding altogether under specific conditions.

Form 594, Nonresident Withholding Annual Return, and the 587 share a link through the withholding process on payments to nonresidents. Form 594 is used to report and remit withholdings for the year, essentially summarizing the outcomes of individual transactions that might have initially been detailed through Form 587 worksheets over the tax year.

Form W-9, Request for Taxpayer Identification Number and Certification, while a federal form, operates in a complementary fashion to the California-specific Form 587. Form W-9 is often used to collect the taxpayer identification number (TIN) necessary for reporting payments to the IRS, similar to how the 587 form might gather such details for state-level withholding and reporting.

The Backup Withholding form from the IRS showcases a parallel function to the state-level Form 587. Both forms address withholding requirements, albeit in different jurisdictions. Backup withholding at the federal level ensures taxes are collected on certain payments, akin to how Form 587 regulates withholdings on nonresident payments for California source income.

Form 1099, a series of IRS documents for Miscellaneous Income reporting, intersects with the purposes behind Form 587. The 1099 forms report various types of income to recipients and the IRS, which may include payments subject to California withholding per the guidelines established in Form 587, illustrating how federal and state tax obligations often overlap.

Form 541, California Fiduciary Income Tax Return, bears relevance to Form 587 in contexts where trusts or estates make payments to nonresidents. While Form 541 deals with the income reporting and tax liabilities of fiduciaries, Form 587 might be used to determine and process withholdings on payments those entities make to nonresident beneficiaries or contractors.

Form 100S, California S Corporation Franchise or Income Tax Return, relates to Form 587 from a corporate perspective. S corporations might use Form 587 to manage withholding on payments to nonresident shareholders or independent contractors, ensuring adherence to state tax laws similarly to how they report their income and franchise tax obligations through Form 100S.

Dos and Don'ts

When filling out the California Form 587, Nonresident Withholding Allocation Worksheet, there are specific actions you should take and others you should avoid to ensure the process is completed accurately and in compliance with state regulations. The guidelines below can help both withholding agents and nonresident payees navigate the form properly.

Do:- Review the entire form before starting. Understand each section to provide accurate information.

- Ensure the withholding agent completes Part I. This section is crucial for identifying the agent responsible for withholding.

- Check the appropriate boxes in Part II and III. Nonresident payees should accurately identify their entity type and the nature of the payments they're receiving.

- Provide all requested identification numbers. Whether it's an SSN, ITIN, CA Corp. no., FEIN, or SOS file no., these details are essential for proper processing.

- Accurately allocate income in Part IV. Detailing payments expected for services within and outside California helps determine the correct withholding amount.

- Attach a withholding waiver if applicable. If the FTB has granted a waiver, including a copy with Form 587 is necessary.

- Sign and date the certification in Part V. This action attests to the veracity of the information provided.

- Omit any sections or lines that apply. Skipping relevant parts of the form can lead to inaccuracies or processing delays.

- Forget to update the withholding agent with any changes. If circumstances change, promptly inform the withholding agent to adjust withholding accordingly.

Understanding the requirements and diligently following these dos and don'ts can facilitate a smoother process for both withholding agents and nonresident payees dealing with California source income and its associated withholding requirements.

Misconceptions

There are several misconceptions surrounding the California Form 587, officially known as the Nonresident Withholding Allocation Worksheet. Understanding these misconceptions is crucial for individuals and businesses that deal with nonresident payees in California. Here's a look at some common misunderstands and the truths behind them:

- Misconception 1: Form 587 is only for nonresident individuals.

In reality, this form is not solely for individual use. Businesses, estates, trusts, and other entities that make payments to nonresident individuals or entities for services performed in California also use it. This includes corporations, partnerships, and limited liability companies (LLCs).

- Misconception 2: Withholding is optional for all payments to nonresidents.

While it may seem that withholding is discretionary, once payments for California source income exceed $1,500 in a calendar year, withholding becomes mandatory. The initial $1,500 threshold allows for optional withholding at the discretion of the withholding agent.

- Misconception 3: The form is needed for every transaction with a nonresident.

Form 587 is valid for the duration of the contract or series of payments, as long as the facts originally reported do not change materially. Therefore, it's not necessary to submit a new form for every payment unless there's a significant change in the relationship or the nature of the payments.

- Misconception 4: Only payments for physical work done in California require Form 587.

This form also applies to payments for services, rents, lease payments, royalties, prizes and winnings, and other California source income paid to nonresidents. It’s not limited to just physical or manual labor performed within state boundaries.

- Misconception 5: Any type of income paid to nonresidents is subject to withholding.

There are specific types of payments not subject to withholding, such as payments for goods or materials provided to the payor, services performed entirely outside of California, and payments to California residents or entities with a permanent place of business in the state.

- Misconception 6: Form 587 also covers the sale of real property in California by nonresidents.

For transactions involving the sale of California real estate by nonresidents, Form 593-C, Real Estate Withholding Certificate, is used instead of Form 587. This form is specific to real estate transactions and has different requirements.

By clarifying these misconceptions, payors can ensure compliance with California's withholding requirements when engaging with nonresident payees. It's also important for both parties to stay informed about the specific situations that necessitate withholding to avoid penalties and to ensure the correct handling of their tax obligations.

Key takeaways

When completing the California Form 587, it's crucial to understand that it is designed for specifying how much income should be withheld for tax purposes on payments made to nonresidents. Here are some key takeaways to guide you through the process:

- The form is required for allocations of nonresident withholding on payments for services, rents, royalties, and various other income types sourced from California.

- It is the responsibility of the withholding agent (the payer) to complete Part I of the form, which captures the payer’s details.

- Nonresident payees, including individuals and entities, must complete and return the form to the withholding agent before any payment is made, specifying their income allocation in California versus income earned elsewhere.

- No withholding is required if the services are performed entirely outside of California or if the payment is solely for goods.

- The form helps in determining if the payment to a nonresident exceeds the $1,500 threshold, which necessitates withholding.

- If the payee is granted a withholding waiver from the Franchise Tax Board (FTB), this must be attached to the completed Form 587.

- It’s important for the payee to check the correct entity type and payment type on the form to ensure accurate withholding calculation.

- The completed Form 587 must be retained by the withholding agent for a minimum of four years and be available upon request by the FTB.

- Changes in the facts reported on Form 587 require the payee to submit an updated form to the withholding agent, who must assess the need for withholding reassessment.

- Under penalties of perjury, the payee certifies the truth and correctness of the information on Form 587, agreeing to inform the withholding agent promptly should any reported facts change.

- It's also noted that completing Form 587 does not eliminate the necessity for the payee to file a California tax return and pay any taxes owed.

Remember, the instructions for completing and submitting Form 587 offer guidance on how each part should be filled out and detail specific situations that may affect how withholding is calculated. When in doubt, consulting with the FTB or a tax professional can provide clarity and help in complying with California’s tax withholding requirements for nonresidents.

Different PDF Templates

Non Resident Working in California Taxes - Necessary for compliance, it also offers a space for tax preparers to detail reasons for not electronically filing a return on behalf of a client.

Whats Form 540 - Gauge the impact of certain interest on home mortgages not used for purchase, build, or improvement, as stated in Schedule P.