Fill a Valid California 5870A Form

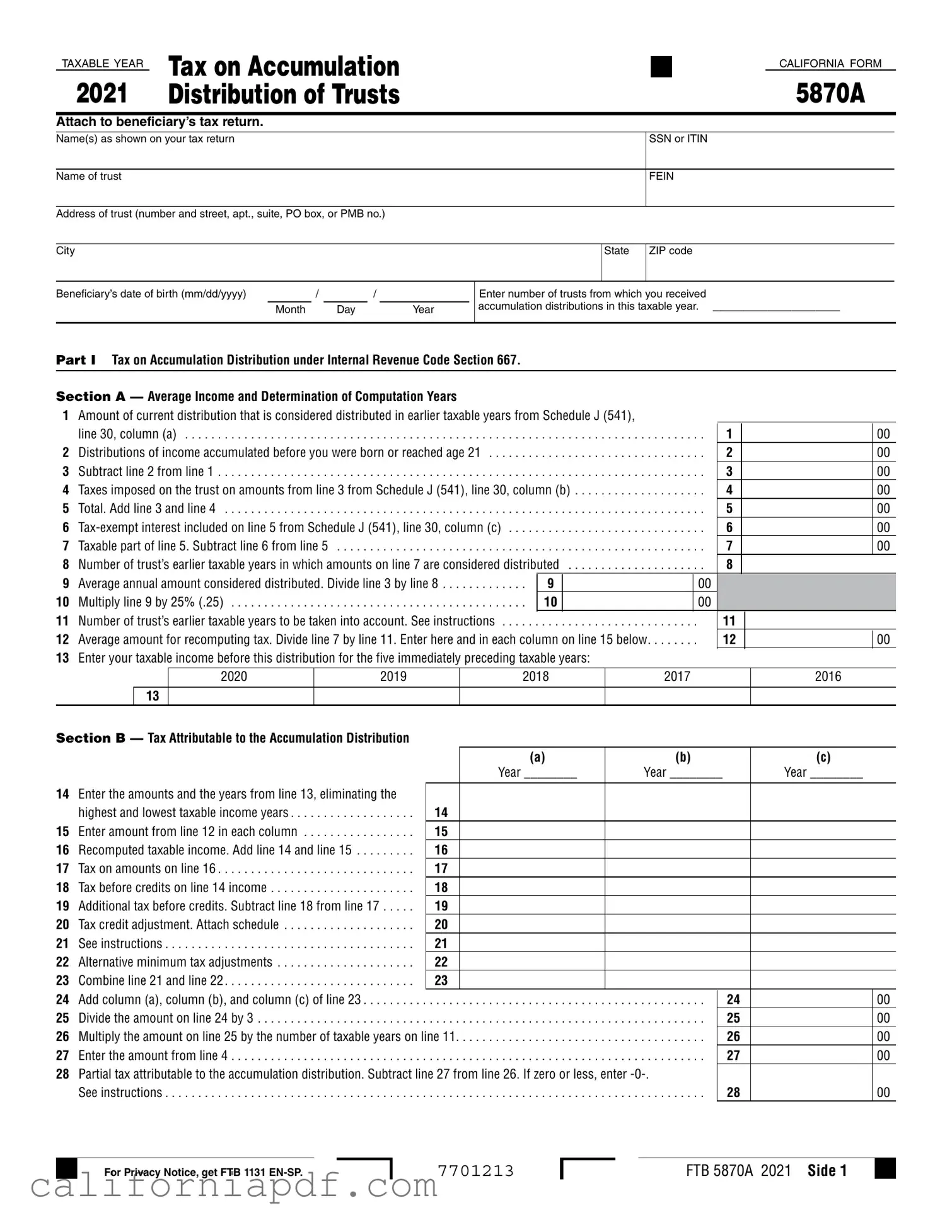

When it comes to understanding the complexities of trust distribution taxes, the California Form 5870A plays a critical role for beneficiaries. Crafted for the 2020 tax year, its main purpose is to address the tax implications regarding the accumulation distribution of trusts, requiring attachment to the beneficiary’s tax return. The form delves into the specifics of how distributions deemed accumulated in previous years impact current tax liabilities, under the guiding principles of the Internal Revenue Code Section 667. Essential components include calculating the average income and determining computation years for the distributions received, with a keen eye on distributions made before the beneficiary’s birth or before they turned 21. Furthermore, it navigates through the nuances of additional taxes, tax credit adjustments, and even alternative minimum tax adjustments if applicable. More so, acknowledging the differentiation in tax treatments based on the period over which the income was accumulated—spanning more or less than five taxable years—it encompasses detailed sections for each scenario. Notably, it also encompasses provisions related to the Mental Health Services Tax for significant incomes, underscoring the form’s broad spectrum of considerations pertinent to beneficiaries of trusts. Through this, California Form 5870A encapsulates an essential process for accurately reporting and addressing the tax responsibilities tied to the accumulation distributions of trusts.

Document Example

TAXABLE YEAR |

TAX ON ACCUMULATION |

|

|

|

|

|

|

|

CALIFORNIA FORM |

|||||

2021 |

|

|

|

|

|

|

|

5870A |

||||||

DISTRIBUTION OF TRUSTS |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach to beneficiary’s tax return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name(s) as shown on your tax return |

|

|

|

|

|

|

|

|

|

SSN or ITIN |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name of trust |

|

|

|

|

|

|

|

|

|

|

FEIN |

|||

|

|

|

|

|

|

|

|

|

||||||

Address of trust (number and street, apt., suite, PO box, or PMB no.) |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

City |

|

|

|

|

|

|

|

|

|

State |

ZIP code |

|||

|

|

|

|

|

|

|

|

|

|

|

||||

Beneficiary’s date of birth (mm/dd/yyyy) |

|

/ |

|

/ |

|

|

|

Enter number of trusts from which you received |

||||||

|

|

Month |

Day |

Year |

accumulation distributions in this taxable year. _____________________ |

|||||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I Tax on Accumulation Distribution under Internal Revenue Code Section 667.

SECTION A — Average Income and Determination of Computation Years

1Amount of current distribution that is considered distributed in earlier taxable years from Schedule J (541),

|

line 30, column (a) |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. . |

1 |

|

00 |

|

2 |

Distributions of income accumulated before you were born or reached age 21 |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. . |

2 |

|

|

00 |

3 |

Subtract line 2 from line 1 |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. . |

3 |

|

|

00 |

4 |

Taxes imposed on the trust on amounts from line 3 from Schedule J (541), line 30, column (b) |

. . |

4 |

|

|

00 |

||

5 |

Total. Add line 3 and line 4 |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. . |

5 |

|

|

00 |

6 |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. . |

6 |

|

|

00 |

|

7 |

Taxable part of line 5. Subtract line 6 from line 5 |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. . |

7 |

|

|

00 |

8 |

. . . . . . . . . . . . . . . . . . .Number of trust’s earlier taxable years in which amounts on line 7 are considered distributed |

. . |

8 |

|

|

|

||

9 |

Average annual amount considered distributed. Divide line 3 by line 8 |

9 |

|

00 |

|

|

|

|

10 |

Multiply line 9 by 25% (.25) |

10 |

|

00 |

|

|

|

|

11 |

Number of trust’s earlier taxable years to be taken into account. See instructions |

. . . . |

. . . . . . . . . . . . . . . . . . . |

. |

11 |

|

|

|

12 |

. . . . . . .Average amount for recomputing tax. Divide line 7 by line 11. Enter here and in each column on line 15 below |

. |

12 |

|

|

00 |

||

13Enter your taxable income before this distribution for the five immediately preceding taxable years:

2020 |

2019 |

2018 |

2017 |

2016 |

13

SECTION B — Tax Attributable to the Accumulation Distribution

(a) |

(b) |

(c) |

Year ________ |

Year ________ |

Year ________ |

14Enter the amounts and the years from line 13, eliminating the

|

highest and lowest taxable income years |

14 |

|

|

15 |

Enter amount from line 12 in each column |

15 |

|

|

16 |

Recomputed taxable income. Add line 14 and line 15 |

16 |

|

|

17 |

Tax on amounts on line 16 |

17 |

|

|

18 |

Tax before credits on line 14 income |

18 |

|

|

19 |

Additional tax before credits. Subtract line 18 from line 17 |

19 |

|

|

20 |

Tax credit adjustment. Attach schedule |

20 |

|

|

21 |

See instructions |

21 |

|

|

22 |

Alternative minimum tax adjustments |

22 |

|

|

23 |

Combine line 21 and line 22 |

23 |

|

|

24 |

Add column (a), column (b), and column (c) of line 23 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

24 |

00 |

25 |

Divide the amount on line 24 by 3 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

25 |

00 |

26 |

Multiply the amount on line 25 by the number of taxable years on line 11 |

26 |

00 |

|

27 |

Enter the amount from line 4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

27 |

00 |

28Partial tax attributable to the accumulation distribution. Subtract line 27 from line 26. If zero or less, enter

See instructions |

28 |

00 |

For Privacy Notice, get FTB 1131

7701213

FTB 5870A 2021 Side 1

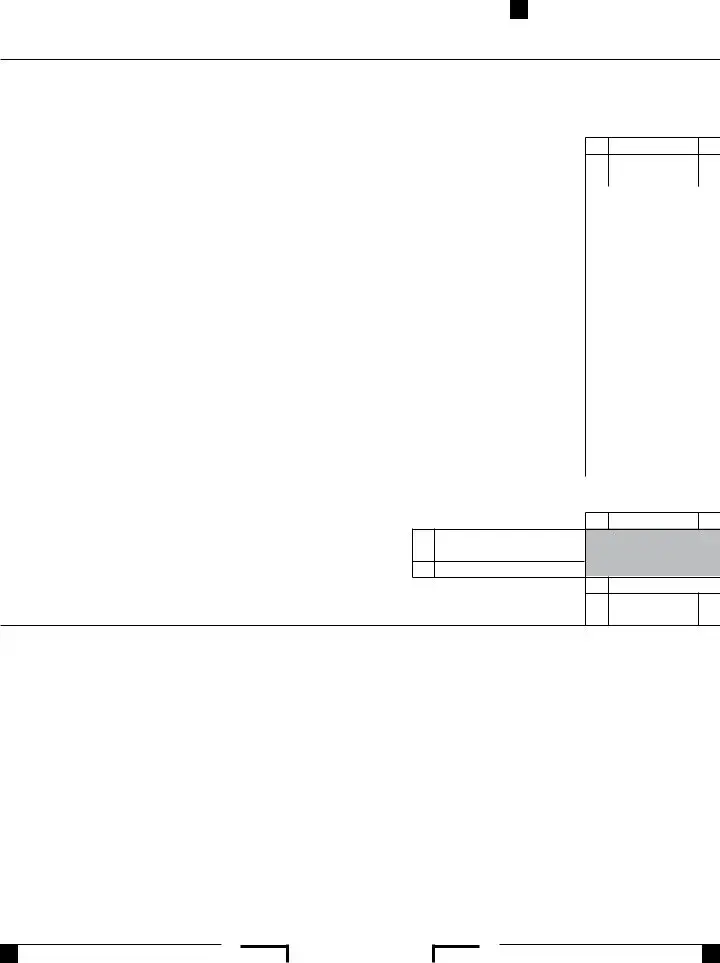

PART II Tax on Distributions of Previously Untaxed Trust Income under Revenue and Taxation Code Section 17745 (b) and (d):

#If the income was accumulated over a period of five taxable years or more, complete Section A.

#If the income was accumulated over a period of less than five taxable years, complete Section B.

SECTION A — See instructions. |

|

|

1 Income accumulated over five taxable years or more |

1 |

00 |

2Divide line 1 by six. Enter here and on Schedules CA (540), Part I, Section B, line 8z, column C,

|

or CA (540NR), Part II, Section B, line 8z, column C |

2 |

|

00 |

|||||

|

|

|

(a) |

(b) |

(c) |

|

(d) |

(e) |

|

|

|

|

2020 |

2019 |

2018 |

2017 |

2016 |

|

|

3 |

Were you a resident or |

3 |

• Yes |

• Yes |

• Yes |

• Yes |

• Yes |

||

|

(Answer “No” for nonresident years.) |

|

• No |

• No |

• No |

• No |

• No |

||

4 |

Enter your taxable income before this distribution for the five immediately |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

preceding years. See instructions |

4 |

|

|

|

|

|

|

|

5 |

Enter the amount from line 2 in col. (a) through col. (e) if the distribution |

|

|

|

|

|

|

|

|

|

is ordinary income. For a capital gain distribution, see instructions |

5 |

|

|

|

|

|

|

|

6 |

Recomputed taxable income. Add line 4 and line 5 |

6 |

|

|

|

|

|

|

|

7 |

Tax on amounts on line 6 |

7 |

|

|

|

|

|

|

|

8 |

Tax before credits on line 4 income |

8 |

|

|

|

|

|

|

|

9 |

Additional tax before credits. Subtract line 8 from line 7 |

9 |

|

|

|

|

|

|

|

10 |

Tax credit adjustment. Attach schedule |

10 |

|

|

|

|

|

|

|

11 |

Subtract line 10 from line 9. See instructions |

11 |

|

|

|

|

|

|

|

12 |

Alternative minimum tax adjustments |

12 |

|

|

|

|

|

|

|

13 |

Add line 11 and line 12 |

13 |

|

|

|

|

|

|

|

14 |

Add line 13, column (a) through column (e) for all taxable years that you checked “Yes” on line 3. Enter here and on |

|

|

|

|

||||

|

Form 540, line 34; Form 540NR, line 41; or Form 541, line 21b. See instructions. . |

. . . . . . . . . . . . |

. . . . . . . . . . . |

. . . . . . . . . . . |

14 |

|

|

00 |

|

SECTION B — See instructions. |

|

|

|

1 |

Income accumulated less than five taxable years |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . 1 |

2 |

Averaging factor: |

|

|

|

a Enter the number of years the trust accumulated the amount on line 1 |

2a |

|

|

b Distribution year |

2b |

1 |

3 |

Add line 2a and line 2b |

. . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . 3 |

4Divide line 1 by line 3. Enter here and on Schedule CA (540), Part I, Section B, line 8z, column C,

or Schedule CA (540NR), Part II, Section B, line 8z, column C |

4 |

00

00

|

|

|

(a) |

(b) |

(c) |

(d) |

|||

|

|

|

2020 |

2019 |

2018 |

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Were you a resident or |

5 |

• Yes |

• Yes |

• Yes |

• Yes |

|||

|

(Answer “No” for nonresident years.) |

|

• No |

• No |

• No |

• No |

|||

6 |

Enter your taxable income before this distribution for the number of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

preceding years entered on line 2a. See instructions |

6 |

|

|

|

|

|

|

|

7 |

Enter the amount from line 4 in col. (a) through col. (d). See instructions . . |

7 |

|

|

|

|

|

|

|

8 |

Recomputed taxable income. Add line 6 and line 7 |

8 |

|

|

|

|

|

|

|

9 |

Tax on amounts on line 8 |

9 |

|

|

|

|

|

|

|

10 |

Tax before credits on line 6 income |

10 |

|

|

|

|

|

|

|

11 |

Additional tax before credits. Subtract line 10 from line 9 |

11 |

|

|

|

|

|

|

|

12 |

Tax credit adjustment. Attach schedule |

12 |

|

|

|

|

|

|

|

13 |

Subtract line 12 from line 11. See instructions |

13 |

|

|

|

|

|

|

|

14 |

Alternative minimum tax adjustments |

14 |

|

|

|

|

|

|

|

15 |

Add line 13 and line 14 |

15 |

|

|

|

|

|

|

|

16 |

Add line 15, column (a) through column (d) for all taxable years that you checked “Yes” on line 5. Enter here and on |

|

|

|

|

|

|||

|

Form 540, line 34; Form 540NR, line 41; or Form 541, line 21b. See instructions. . |

. . . . . . . . . . . . . |

. . . . . . . . . . . . . . . |

. . . . . |

16 |

|

|

00 |

|

Side 2 FTB 5870A 2021

7702213

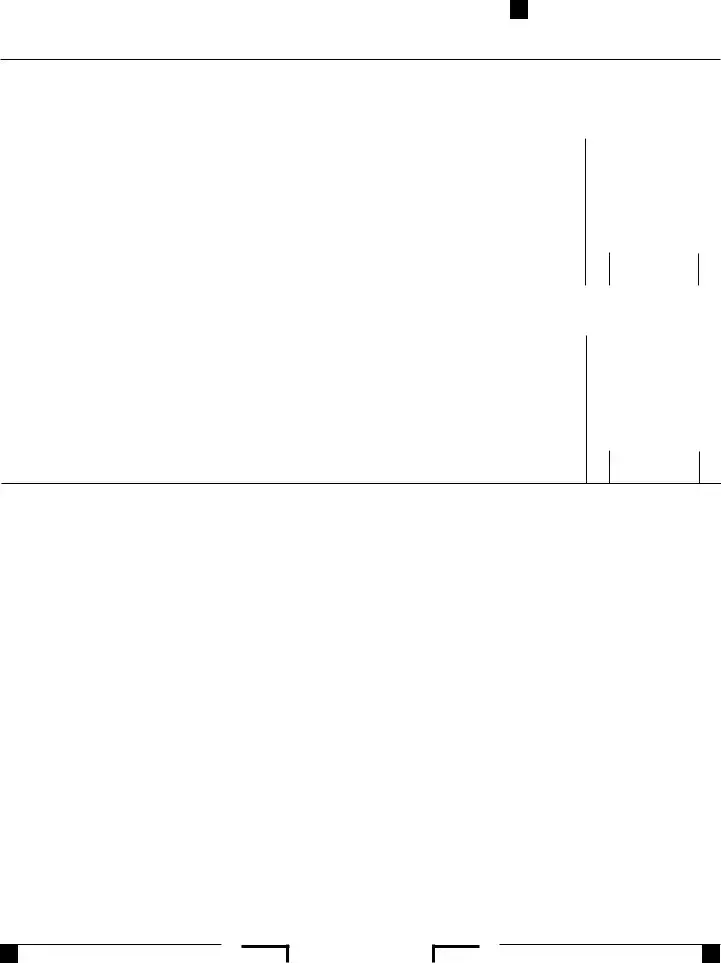

PART III Mental Health Services Tax under Revenue and Taxation Code Section 17043:

#If the income was accumulated over a period of five taxable years or more, complete Section A.

#If the income was accumulated over a period of less than five taxable years, complete Section B.

SECTION A — See instructions. |

|

|

|

|

|

|

|

List the tax year where you selected “Yes” to Part II, Section A, line 3. |

|

(a) |

(b) |

(c) |

(d) |

(e) |

|

|

|

|

Year _____ |

Year _____ |

Year _____ |

Year _____ |

Year _____ |

|

|

|

|

|

|

|

|

1 |

Enter the recomputed taxable income from Part II, Section A, line 6 |

1 |

|

|

|

|

|

2 |

Subtract 1,000,000 from line 1. If zero or less, enter |

2 |

|

|

|

|

|

3 |

Multiply line 2 by 1% |

3 |

|

|

|

|

|

4 |

Mental Health Services Tax paid on taxable income before distribution . . . |

4 |

|

|

|

|

|

5 |

Subtract line 4 from line 3 |

5 |

|

|

|

|

|

6Add line 5, columns (a) through (e). Enter here and on Form 540, line 62; Form 540NR, line 72; or

|

Form 541, line 27. See instructions |

. . . . |

. . . . . . . . . . . |

. . . . . . . . . . . |

6 |

00 |

SECTION B — See instructions. |

|

|

|

|

|

|

List the tax year where you selected “Yes” to Part II, Section B, line 5. |

|

(a) |

(b) |

(c) |

(d) |

|

|

|

|

Year _____ |

Year _____ |

Year _____ |

Year _____ |

|

|

|

|

|

|

|

1 |

Enter the recomputed taxable income from Part II, Section B, line 8 |

1 |

|

|

|

|

2 |

Subtract 1,000,000 from line 1. If zero or less enter |

2 |

|

|

|

|

3 |

Multiply line 2 by 1% |

3 |

|

|

|

|

4 |

Mental Health Services Tax paid on taxable income before distribution |

4 |

|

|

|

|

5 |

Subtract line 4 from line 3 |

5 |

|

|

|

|

6Add line 5, columns (a) through (d). Enter here and on Form 540, line 62; Form 540NR, line 72; or

Form 541, line 27. See instructions |

6 |

00 |

7703213

FTB 5870A 2021 Side 3

Form Breakdown

| Fact | Detail |

|---|---|

| Purpose of Form 5870A | This form is used to calculate the tax on accumulation distributions from trusts, to be attached to the beneficiary's tax return. |

| Relevant Tax Code Sections | The form implements calculations based on Internal Revenue Code Section 667 and California Revenue and Taxation Code Section 17745 (b) and (d). |

| Utilization for Different Durations of Accumulation | It distinguishes between income accumulated over a period of five taxable years or more and income accumulated over a period of less than five taxable years, offering separate calculation instructions for each scenario. |

| Inclusion of Mental Health Services Tax | Includes a section for the calculation of Mental Health Services Tax under California Revenue and Taxation Code Section 17043, applicable to distributions from certain trusts. |

How to Write California 5870A

Filling out California Form 5870A, related to Tax on Accumulation Distribution of Trusts, is a detailed process that requires accurate information from your financial records. This form must be attached to the beneficiary's tax return. It’s designed to calculate the tax on distribution amounts considered to have been distributed in earlier years, and it involves understanding the beneficiary’s past taxable income, the trust’s distributions, and various tax adjustments. Here’s how to accurately complete Form 5870A.

- At the top of the form, fill in the taxable year, then provide the name(s) as shown on your tax return, along with your SSN or ITin.

- Enter the name of the trust, its FEIn, and the trust's address, including city, state, and ZIP code.

- Fill in your date of birth in the format mm/dd/yyyy.

- In the section asking for the number of trusts, enter the number of trusts from which you received accumulation distributions this taxable year.

- Under Part I, Section A, start by entering the amount of the current distribution considered distributed in earlier taxable years.

- Subtract distributions received before your birth or before you reached age 21, then calculate the total by adding certain taxes imposed on the trust.

- Include tax-exempt interest and then calculate the taxable part of your total accumulative distributions.

- Follow through Part I, calculating average annual amount distributed, and applying specific percentages to determine the average amount for recomputing tax.

- Enter your taxable income before this distribution for the past five years.

- Under Part I, Sectib B, calculate the tax attributable to the accumulation distribution by following the instructions for each line closely, including recomputed taxable income and tax adjustments.

- For Part II, depending on whether the income was accumulated over a period of more or less than five taxable here, follows the instructions in Section A or Section B respectively to calculate the tax on distributions of previously untaxed trust income.

- Complete the section that applies to you, including checking whether you were a resident or part-year resident in the specified years and calculating additional tax as directed.

- Part III involves calculating the Mental Health Services Tax if applicable. Choose the correct section based on the duration the income was accumulated and follow the instructions for computing this tax.

After completing all relevant sections of Form 5870A as per the detailed instructions, double-check your calculations for accuracy before attaching the form to your tax return. Accuracy is crucial to ensure the correct tax is assessed on accumulation distribution of trusts for the taxable year.

Listed Questions and Answers

What is the California Form 5870A?

California Form 5870A, also known as the "Tax on Accumulation Distribution of Trusts," is a document that must be attached to the beneficiary’s tax return. It is used to calculate and report the tax on certain distributions received from trusts. These distributions are subject to tax because they consist of income that was accumulated within the trust and then distributed to the beneficiary.

Who needs to file California Form 5870A?

Any beneficiary who receives an accumulation distribution from a trust during the taxable year needs to file California Form 5870A. This form is essential for beneficiaries who are subject to additional taxes due to the distribution being considered as accumulated income from previous years.

When should California Form 5870A be filed?

This form should be filed with the beneficiary’s tax return for the year in which the accumulation distribution was received. It's important to adhere to the tax filing deadline to avoid penalties or late fees.

How is the accumulation distribution taxed?

The accumulation distribution is taxed under Internal Revenue Code Section 667. Part I of the form calculates the tax on accumulation distribution by considering the income accumulated before the beneficiary's birth or age of 21, applicable taxes imposed on the trust, and any tax-exempt interest. The process involves identifying the portion of the current year's distribution that is treated as having been distributed in earlier years.

What are the sections of California Form 5870A?

Form 5870A is divided into several key sections:

- Part I: Tax on Accumulation Distribution under Internal Revenue Code Section 667, which focuses on average income and determination of computation years for the distribution.

- Part II: Tax on Distributions of previously untaxed trust income under Revenue and Taxation Code Section 17745 (b) and (d), which calculates the tax owed due to distributions made from the trust’s income.

- Part III: Mental Health Services Tax under Revenue and Taxation Code Section 17043, which applies if the accumulation distribution meets certain criteria.

What information do I need to complete California Form 5870A?

To accurately complete Form 5870A, you will need:

- The amount of the current distribution from the trust.

- Details of any distributions of income accumulated before your birth or before you reached age 21.

- The number of trusts from which you received accumulation distributions in the taxable year.

- Your taxable income before the distribution for the five immediately preceding taxable years.

- Specific information about the trust, including the name and address of the trust and the trustee's data.

What if the accumulation distribution is less than five years?

If the income was accumulated over a period of less than five taxable years, you should complete Section B under Part II of the form. This section requires you to calculate the tax differently than for income accumulated over a longer period. The form provides specific instructions on how to compute the tax for shorter accumulation periods.

Are there any attachments required with California Form 5870A?

Yes, there may be additional schedules or documentation required, including a tax credit adjustment schedule if applicable. Ensure all relevant documents are attached to avoid processing delays or errors in your tax return.

Can Form 5870A impact the Mental Health Services Tax?

Yes, Part III of Form 5870A deals with the Mental Health Services Tax under Revenue and Taxation Code Section 17043. This section is relevant if the recomputed taxable income from certain accumulation distributions meets the criteria for this tax. It calculates the additional tax due or the subtraction from the Mental Health Services Tax already paid.

Who can I contact for help with California Form 5870A?

If you require assistance with completing or understanding Form 5870A, you may contact a tax professional, the administrator of the trust, or the California Franchise Tax Board for guidance. It's crucial to seek advice if you're unsure about any part of the form to ensure accurate filing.

Common mistakes

When filling out the California 5870A form, individuals often make mistakes that can lead to errors in their tax returns. Identifying these common errors can help ensure that the process is completed accurately and efficiently.

- Not attaching the form to the beneficiary's tax return: This form must be attached to the beneficiary’s tax return. Failure to do so can result in processing delays or errors in tax calculations.

- Incorrect Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): Entering an incorrect SSN or ITIN for the beneficiary can cause significant issues with tax return processing.

- Incorrect Federal Employer Identification Number (FEIN) for the trust: Just like with beneficiary identification numbers, entering the wrong FEIN for the trust can lead to mismatches and processing problems.

- Failing to provide the accurate address of the trust: The address of the trust, including specifics like apartment or suite numbers, is crucial for proper form processing and identification.

- Omitting the beneficiary’s date of birth: The beneficiary’s date of birth is essential for determining the appropriate tax considerations and should not be overlooked.

- Miscalculating the number of trusts from which distributions were received: This information impacts the tax calculations and must be accurately reported.

- Errors in PART I calculations: Mistakes in calculating the average income, determination of computation years, and tax on accumulation distribution under Internal Revenue Code Section 667 can lead to incorrect tax liabilities.

- For example, miscalculating the amount considered distributed in earlier taxable years or incorrectly determining the distributions of income accumulated can significantly alter the tax owed.

By paying careful attention to these areas and double-checking all entered information, taxpayers can avoid common pitfalls when completing the California 5870A form.

Documents used along the form

When navigating the California tax landscape, particularly for trust distributions, a plethora of forms and documents complement the California Form 5870A to facilitate accurate reporting and compliance with state tax laws. Each of these documents plays a unique role in the broader context of tax preparation and filing.

- Form 541: This is the California Fiduciary Income Tax Return, integral for trusts and estates to report income, deductions, gains, losses, and taxable distributions.

- Schedule J (541): Part of Form 541, this schedule specifically details the accumulations distributions to beneficiaries, crucial for completing Form 5870A.

- Schedule D (541): Used by trusts to report capital gains and losses. This schedule helps determine the impact of these transactions on the trust's taxable income.

- Schedule K-1 (541): Issued to each beneficiary, this form outlines their share of the trust's income, deductions, and credits, which they then report on their personal tax returns.

- Form 540: The California Resident Income Tax Return, required for beneficiaries who are California residents to report their income, including distributions from trusts.

- Form 540NR: Nonresident or Part-Year Resident Income Tax Return, for beneficiaries who live outside California or moved during the year, to report income sourced from California.

- Form 3520: Power of Attorney declaration, allowing a designated individual to discuss the return with the California Franchise Tax Board or take certain actions on behalf of the taxpayer.

- Form 3800: Tax Computation for Certain Children with Unearned Income, which may be relevant for beneficiaries who are children with substantial unearned income, impacting the tax considerations of distributions.

- FTB Pub. 1061: Guidelines for Fiduciaries, providing comprehensive instructions and clarifications for trust administrators on various tax obligations and reporting standards in California.

- Form 593: Real Estate Withholding Tax Statement, applicable if the trust has sold California real estate, to report and remit withholding from the sale proceeds.

Together, these documents guide taxpayers through the intricate process of reporting and paying taxes on accumulation distributions from trusts in California. By ensuring each relevant form and document is accurately completed and submitted, taxpayers can maintain compliance with state tax regulations and avoid potential pitfalls in their financial obligations.

Similar forms

The California 5870A form shares similarities with various other tax documents, particularly those involved in the reporting and taxation of trust income and distributions. One such document is the IRS Form 4970, "Tax on Accumulation Distribution of Trusts," which, like the California 5870A, deals with the tax implications of distribution from trusts to beneficiaries. Both forms calculate taxes on distributions that include income accumulated over multiple years, ensuring that beneficiaries pay the appropriate amount of tax on these delayed distributions.

Another related document is the Schedule J (Form 541), "Accumulation Distribution for Certain Complex Trusts," which directly supports the calculations required on the 5870A. Schedule J is used to detail the parts of a distribution considered accumulated income, crucial for determining the tax on accumulation distributions under Section 667 of the Internal Revenue Code. This direct linkage shows the interplay between state and federal guidelines for trust distribution taxation.

Form 1041, "U.S. Income Tax Return for Estates and Trusts," also shares characteristics with the 5870A, as it reports the income, deductions, and income distribution of trusts and estates. While the 5870A focuses on the tax from the beneficiary's perspective, Form 1041 is from the perspective of the trust or estate, indicating a complementary relationship between the forms.

The California Form 541, "California Fiduciary Income Tax Return," is the state counterpart to the federal Form 1041. It details the income and deductions associated with a trust or estate within California. The link between Form 541 and the 5870A is evident in the necessity of information from Form 541 (such as from Schedule J) to accurately complete the 5870A, showcasing their interconnected roles in trust taxation.

Form 540 and Form 540NR, "California Resident and Nonresident or Part-Year Resident Income Tax Returns," respectively, are needed for beneficiaries who file the 5870A, as the tax calculated on the 5870A must be reported as part of the individual's overall state income tax obligation. The connection underscores how trust distributions integrate into broader tax responsibilities.

Schedule CA (540), "California Adjustments – Residents," and its nonresident counterpart are used by individuals to adjust their federal income to California state income, which might include adjustments due to trust distributions reported on the 5870A. These forms bridge federal and state tax reporting, indicating the importance of harmonizing different aspects of tax obligations.

The IRS Form 3520, "Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts," while primarily for foreign trusts, parallels the 5870A in its focus on trust transactions and beneficiary reporting. Both forms ensure compliance with reporting standards and correct taxation of trust distributions, whether domestic or foreign, highlighting the global scope of trust taxation.

Lastly, the IRS Form 709, "United States Gift (and Generation-Skipping Transfer) Tax Return," indirectly relates to the 5870A by covering another aspect of wealth transfer – gifts and generation-skipping transfers. Though focused on different types of transfers, both documents are key components in the landscape of trust and estate taxation, emphasizing the comprehensive approach to tax law regarding wealth transfer.

Dos and Don'ts

When filling out the California 5870A form, there are specific actions you should take to ensure accuracy and compliance with tax laws. Observing these dos and don'ts can help avoid mistakes that might lead to penalties or delays. Below are eight essential points to keep in mind.

- Do ensure all personal information is accurate, including your name, Social Security Number (SSN) or Individual Tax Identification Number (ITIN), and the name, Employer Identification Number (EIN), and address of the trust.

- Do enter your beneficiary’s date of birth in the mm/dd/yyyy format without any errors to prevent processing delays.

- Do calculate the average income and determination of computation years precisely to avoid inaccuracies in Part I of the form.

- Do attach the form to the beneficiary’s tax return as instructed, ensuring that all required documentation is submitted together.

- Don't overlook the instructions specific to whether the income was accumulated over a period of five taxable years or more, or less, as this affects how the form should be completed.

- Don't enter incorrect taxable years in Section B. Misstating the number of years can lead to incorrect tax calculations.

- Don't ignore the need for tax credit adjustments and alternative minimum tax adjustments. Properly addressing these sections is crucial for accurate tax computation.

- Don't forget to review and ensure that all calculations, especially the partial tax attributable to the accumulation distribution and any mental health services tax calculations, are correct before submission.

Accuracy in filling out the California 5870A form is crucial for the proper calculation and reporting of taxes related to accumulation distributions of trusts. Beneficiaries should pay close attention to the requirements and calculations to ensure compliance with state tax regulations.

Misconceptions

When it comes to understanding the nuances of tax forms such as the California 5870A, misconceptions can easily arise. This form, pivotal for reporting the tax on accumulation distribution of trusts, intertwines with complex tax legislation, leading to a wide array of misunderstandings. Let's clarify ten common misconceptions surrounding this form.

- The form is only for the trustees to fill out. In reality, it's meant to be attached to the beneficiary’s tax return, not the trustees. While trustees have a role in providing necessary information, the responsibility to report lies with the beneficiaries.

- Beneficiaries of all trusts need to file this form. Not every trust distribution requires filing Form 5870A. This form specifically targets accumulation distributions, meaning income that was not distributed in the year it was earned by the trust but accumulated and distributed later.

- It’s a straightforward calculation. The math involved in completing Form 5870A is far from simple. It requires detailed historical income information about the trust and complex computations to properly calculate the tax attributable to the accumulation distribution.

- The form only pertains to the current tax year. While it's filed with the current year's tax return, Form 5870A requires a detailed look-back at the trust's income and distributions, possibly spanning several years, to accurately compute the tax owed.

- All distributed income is taxable through this form. Only certain parts of the distribution, specifically the accumulated income distributed beyond the current year's income, are subject to tax under Form 5870A. Regular distributions, such as the trust income of the year being distributed to beneficiaries, are not reported on this form.

- There's no need to consider the beneficiary’s tax history. Part of the calculation involves comparing the additional tax due to the accumulation distribution to the beneficiary’s tax rates over the prior five years. This comparison ensures the beneficiary is taxed fairly, reflective of both current and past incomes.

- Tax credits and deductions do not impact the form. On the contrary, the form has sections dedicated to adjustments for tax credits and alternative minimum tax the beneficiary may be eligible for, which can significantly affect the tax calculation.

- Filing this form means paying more taxes. While it can lead to additional taxes due to previously untaxed accumulated distributions, the actual outcome depends on a variety of factors including the beneficiary’s tax bracket, the amount distributed, and any applicable credits or deductions. It's a nuanced calculation that may not always result in higher taxes.

- There is no privacy notice associated with Form 5870A. Privacy is a significant concern with any tax document, and the California 5870A form is no exception. It explicitly mentions the availability of a privacy notice, designated as FTB 1131 ENG/SP, underscoring the state's commitment to protecting taxpayer information.

- Once filed, the form cannot be amended. Should there be an error or misunderstanding in the filing, amendments are allowed. The process involves refiling the form with the correct information and explaining the reason for the amendment, ensuring accuracy and compliance with tax laws.

Clarifying these misconceptions serves to navigate the complexities of Form 5870A more effectively, offering insights into its purpose, requirements, and the intricacies involved in its preparation. Understanding these aspects is crucial for both beneficiaries and their advisors to ensure accurate reporting and compliance with California’s tax regulations.

Key takeaways

Understanding the California 5870A form is crucial for anyone dealing with the accumulation distribution of trusts. Here are six vital takeaways from the form to help guide you through the process:

- The form must be attached to the beneficiary’s tax return, indicating its direct application to the individual’s tax liabilities concerning distributions from trusts.

- It specifically addresses tax on accumulation distribution under Internal Revenue Code Section 667, signifying its importance for accurate tax calculation for distributions not immediately taxed in earlier periods.

- Section A of Part I requires the calculation of the average income and determination of computation years, highlighting the need to understand past distributions and their implications on the current year's tax obligations.

- The requirement to enter information about distributions accumulated before the beneficiary was born or reached age 21 underscores the form's comprehensive approach to encompass all possible scenarios affecting the taxation of trust distributions.

- For distributions of previously untaxed trust income, the form differentiates between income accumulated over a period of five taxable years or more and less than five taxable years, which affects how the distribution is calculated and taxed.

- Lastly, the inclusion of the Mental Health Services Tax under Revenue and Taxation Code Section 17043 for distributions accumulated over specific periods further illustrates the specialized tax considerations that trustees and beneficiaries must account for when handling such distributions.

By carefully adhering to these guidelines, trustees and beneficiaries can ensure compliance with California’s tax laws, avoiding potential issues and maximizing their understanding of the financial implications of trust distributions.

Different PDF Templates

California 590 P - Facilitates accurate tax reporting by allowing nonresidents to communicate their tax status to withholding agents.

California Department of Health Care Services - The form restricts the use of certain writing tools and correction methods to ensure the legibility and integrity of the provided information.

California Jv 445 - Records the involvement of various parties in the courtroom, including guardians, social workers, and tribal representatives.