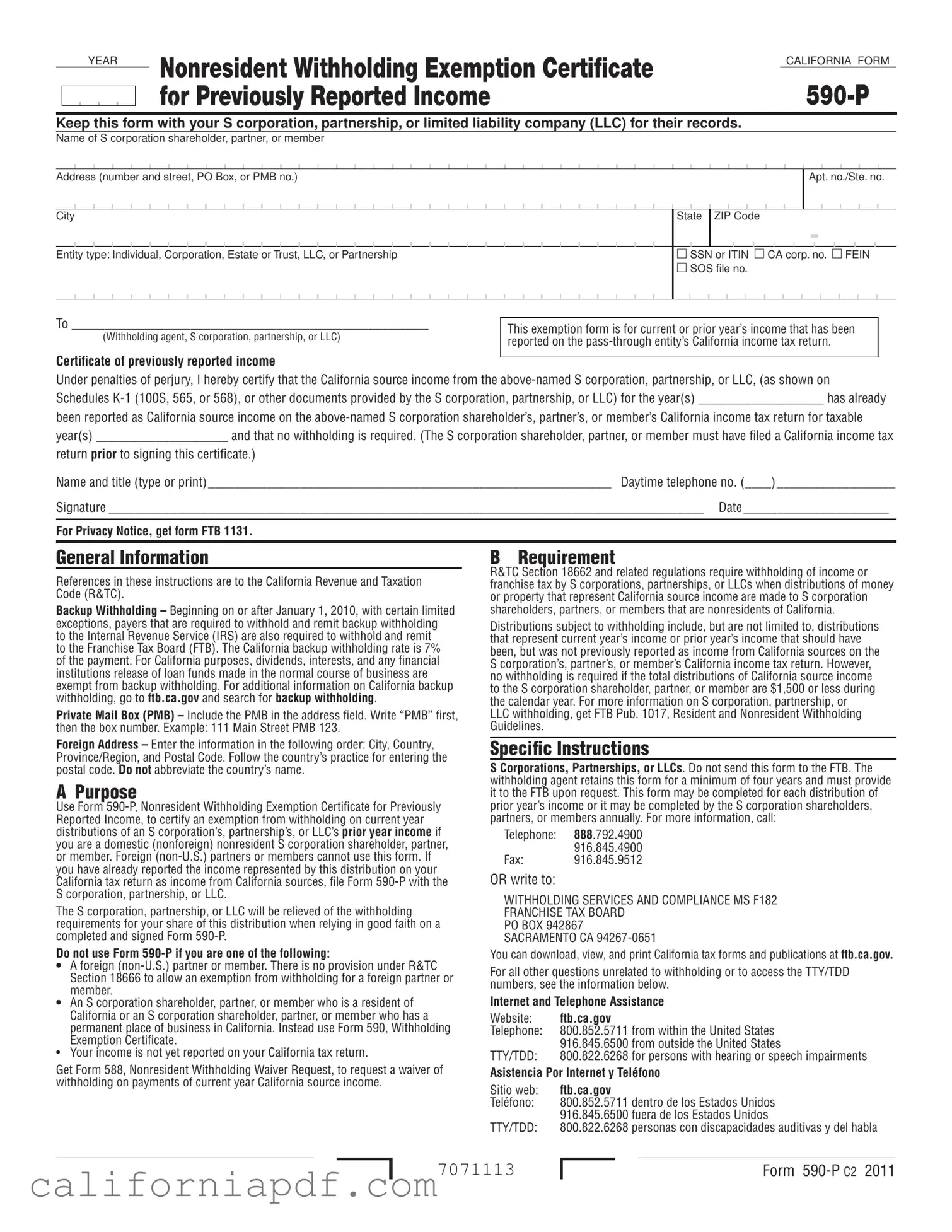

Fill a Valid California 590 P Form

The California Form 590-P serves a critical function in the realm of tax compliance for nonresident shareholders, partners, or members of S corporations, partnerships, or Limited Liability Companies (LLCs) with incomes previously reported. This exemption certificate plays a pivotal role in certifying that certain current year distributions, drawn from a preceding year’s income, have already been accounted for on California tax returns, thereby negating the need for withholding on these distributions. With precision, it addresses the requirements set forth under the California Revenue and Taxation Code Section 18662, delineating who must withhold and report income, and under what circumstances. Specifically designed for domestic nonresident entities, it explicitly excludes foreign partners or members, resident Californians, or those whose income has not yet been reported in their state tax returns. Its proper completion and submission to the distributing entity, not the Franchise Tax Board (FTB), streamline the tax filing process and alleviate the withholding obligation from these entities, conditional upon the belief in the form’s accuracy. The directive for these entities to keep the form on file for no less than four years, with readiness to present it upon request, underscores the form’s importance in ensuring compliance and facilitating oversight. Furthermore, it offers a nuanced understanding of the exemption stipulations for withholdings on Californian source incomes, reflecting the state’s legislative framework for tax obligations and exemptions. This form exemplifies the intricate balance between taxpayer obligations and rights, the operational dynamics of tax law, and the administrative demands on multinational composites operating within California’s borders.

Document Example

|

|

|

YEAR |

Nonresident Withholding Exemption Certificate |

CALIFORNIA FORM |

|||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

for Previously Reported Income |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Keep this form with your S corporation, partnership, or limited liability company (LLC) for their records.

Name of S corporation shareholder, partner, or member

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Entity type: Individual, Corporation, Estate or Trust, LLC, or Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

m SSN or ITIN m CA corp. no. m FEIN |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mSOS file no. |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To ______________________________________________________

(Withholding agent, S corporation, partnership, or LLC)

Certiicate of previously reported income

This exemption form is for current or prior year’s income that has been reported on the

Under penalties of perjury, I hereby certify that the California source income from the

been reported as California source income on the

return prior to signing this certiicate.)

Name and title (type or print) _____________________________________________________________ Daytime telephone no. (____)__________________

Signature __________________________________________________________________________________________ Date ______________________

For Privacy Notice, get form FTB 1131.

General Information

References in these instructions are to the California Revenue and Taxation Code (R&TC).

Backup Withholding – Beginning on or after January 1, 2010, with certain limited exceptions, payers that are required to withhold and remit backup withholding to the Internal Revenue Service (IRS) are also required to withhold and remit

to the Franchise Tax Board (FTB). The California backup withholding rate is 7% of the payment. For California purposes, dividends, interests, and any inancial institutions release of loan funds made in the normal course of business are exempt from backup withholding. For additional information on California backup withholding, go to ftb.ca.gov and search for backup withholding.

Private Mail Box (PMB) – Include the PMB in the address ield. Write “PMB” irst, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

A Purpose

Use Form

The S corporation, partnership, or LLC will be relieved of the withholding requirements for your share of this distribution when relying in good faith on a completed and signed Form

Do not use Form

•A foreign

•An S corporation shareholder, partner, or member who is a resident of California or an S corporation shareholder, partner, or member who has a permanent place of business in California. Instead use Form 590, Withholding Exemption Certiicate.

•Your income is not yet reported on your California tax return.

Get Form 588, Nonresident Withholding Waiver Request, to request a waiver of withholding on payments of current year California source income.

B Requirement

R&TC Section 18662 and related regulations require withholding of income or franchise tax by S corporations, partnerships, or LLCs when distributions of money or property that represent California source income are made to S corporation shareholders, partners, or members that are nonresidents of California.

Distributions subject to withholding include, but are not limited to, distributions that represent current year’s income or prior year’s income that should have been, but was not previously reported as income from California sources on the S corporation’s, partner’s, or member’s California income tax return. However, no withholding is required if the total distributions of California source income to the S corporation shareholder, partner, or member are $1,500 or less during the calendar year. For more information on S corporation, partnership, or

LLC withholding, get FTB Pub. 1017, Resident and Nonresident Withholding Guidelines.

Specific Instructions

S Corporations, Partnerships, or LLCs. Do not send this form to the FTB. The withholding agent retains this form for a minimum of four years and must provide it to the FTB upon request. This form may be completed for each distribution of prior year’s income or it may be completed by the S corporation shareholders, partners, or members annually. For more information, call:

Telephone: 888.792.4900 916.845.4900

Fax:916.845.9512

OR write to:

WITHHOLDING SERVICES AND COMPLIANCE MS F182 FRANCHISE TAX BOARD

PO BOX 942867 SACRAMENTO CA

You can download, view, and print California tax forms and publications at ftb.ca.gov.

For all other questions unrelated to withholding or to access the TTY/TDD numbers, see the information below.

Internet and Telephone Assistance

Website: |

ftb.ca.gov |

Telephone: |

800.852.5711 from within the United States |

|

916.845.6500 from outside the United States |

TTY/TDD: |

800.822.6268 for persons with hearing or speech impairments |

Asistencia Por Internet y Teléfono |

|

Sitio web: |

ftb.ca.gov |

Teléfono: |

800.852.5711 dentro de los Estados Unidos |

|

916.845.6500 fuera de los Estados Unidos |

TTY/TDD: |

800.822.6268 personas con discapacidades auditivas y del habla |

7071113

Form

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Number | California Form 590-P |

| Title | Nonresident Withholding Exemption Certificate for Previously Reported Income |

| Purpose of Form | Used by nonresident S corporation shareholders, partners, or members to certify exemption from withholding on current year distributions of prior year's income that has been reported on a California tax return. |

| Who Cannot Use | Foreign (non-U.S.) partners or members and California residents or those with a permanent place of business in California. |

| Requirement Roots | Based on California Revenue and Taxation Code (R&TC) Section 18662 and related regulations. |

| No Withholding Threshold | No withholding required if the total California source income distributions are $1,500 or less during the calendar year. |

| Record Retention | S corporations, partnerships, or LLCs must retain the completed form for a minimum of four years and provide it to the Franchise Tax Board (FTB) upon request. |

| Backup Withholding | Beginning on or after January 1, 2010, backup withholding rules apply with a rate of 7% for certain payments. Dividends, interest, and loan funds release by financial institutions in the normal course of business are exempt. |

| Additional Resources | For more details, the Franchise Tax Board provides guidelines in Pub. 1017, Resident and Nonresident Withholding Guidelines. |

How to Write California 590 P

Once you've entered into a partnership, S corporation, or LLC in California and you're a nonresident shareholder, partner, or member who has previously reported income from such entities on your California Income Tax Return, you'll need to certify this to avoid duplicate withholding. The Form 590-P is designed for this precise purpose. It's important to remember that this form is used solely to declare income that has already been reported to the California tax authorities, ensuring that no additional withholding is necessary for that income. Below is a guide to help you accurately complete the California Form 590-P.

- Start by entering the YEAR at the top of Form 590-P, which refers to the current calendar year.

- Under the "Name of S corporation shareholder, partner, or member," input your full legal name.

- Provide your "Address (number and street, PO Box, or PMB no.)" along with the "Apt. no./Ste. no." in the designated spaces.

- Fill in the "City," "State," and "ZIP Code" fields with your current address information.

- Select your "Entity type" by marking the appropriate box. Your options include Individual, Corporation, Estate or Trust, LLC, or Partnership.

- Depending on your entity type, provide the corresponding identification number: "SSN or ITIN" for individuals, "CA corp. no." for California corporations, "FEIN" for other corporations, estates, trusts, or LLCs, or "SOS file no." if applicable.

- Address the certificate to your "Withholding agent, S corporation, partnership, or LLC" in the space provided.

- Under "Certificate of previously reported income," fill in the years of income that have already been reported on your California Income Tax Return in the sentence provided.

- Type or print the "Name and title" of the person completing the form in the appropriate field.

- Provide a "Daytime telephone no." including the area code.

- Sign and date the form in the designated areas at the bottom.

After you've completed and signed the Form 590-P, this document should not be sent to the California Franchise Tax Board. Instead, it must be kept by your S corporation, partnership, or LLC for their records. They are obliged to retain this form for a minimum of four years and may be asked to present it to the Franchise Tax Board upon request. By following these steps to correctly complete the form, you help ensure that your income is not subject to unnecessary withholding, maintaining compliance with California's tax laws.

Listed Questions and Answers

What is California Form 590-P?

California Form 590-P, known as the Nonresident Withholding Exemption Certificate for Previously Reported Income, is a document used by nonresident individuals, S corporation shareholders, partners, or members of a limited liability company (LLC) to certify that income from California sources, which they received, has already been reported on their California income tax returns. This form serves to exempt the distributor from having to withhold state income tax on distributions made to the nonresident.

Who needs to file Form 590-P?

Form 590-P should be completed by domestic (nonforeign) nonresident individuals who are shareholders of an S corporation, partners in a partnership, or members of an LLC and have already reported their share of California source income on their California income tax returns. It is not applicable to foreign (non-U.S.) partners or members.

When should Form 590-P be filed?

This form should be filled out and provided to the S corporation, partnership, or LLC whenever distributions of prior year’s income are made and such income has been previously reported on the taxpayer's California income tax return. It can also be completed annually if preferred.

Is Form 590-P required for all nonresidents?

No, Form 590-P is not required for nonresidents who:

- Are foreign partners or members

- Have not yet reported distributed income on their California tax returns

- Are residents of California or have a permanent place of business in the state

What information is required on Form 590-P?

The following information is needed to complete Form 590-P:

- Name and address of the S corporation shareholder, partner, or member

- Entity type

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), CA corporation number, Federal Employer Identification Number (FEIN), or Secretary of State (SOS) file number

- Information on the income already reported

- Contact details and signature of the individual certifying the form

Where should Form 590-P be sent?

Form 590-P should not be sent to the Franchise Tax Board (FTB). It must be kept by the withholding agent, S corporation, partnership, or LLC for a minimum of four years. It should be readily available upon request by the FTB.

What are the consequences of not filing Form 590-P?

If Form 590-P is not filed, the S corporation, partnership, or LLC might withhold state income tax on distributions made to the nonresident shareholder, partner, or member unnecessarily. This could result in unnecessary tax payments and require the nonresident to file for a refund.

Can Form 590-P be used by foreign partners or members?

No, foreign (non-U.S.) partners or members cannot use Form 590-P. There is no provision in the Revenue and Taxation Code Section 18666 allowing an exemption from withholding for a foreign partner or member.

How can more information about Form 590-P be obtained?

For more information about Form 590-P, individuals can:

- Call the numbers provided on the form for telephone assistance

- Visit the Franchise Tax Board’s website

- Refer to FTB Publication 1017, Resident and Nonresident Withholding Guidelines

Common mistakes

Filling out California Form 590-P, the Nonresident Withholding Exemption Certificate for Previously Reported Income, is crucial for nonresident S corporation shareholders, partners, or members seeking exemption from withholding on current year distributions of an S corporation's, partnership's, or LLC's prior year income. Mistakes in completing this form can result in unnecessary withholding or complications with the Fruseum Tax Board (FTB). Here are five common mistakes people make when filling out this form:

- Not Including the Private Mail Box (PMB) Number: If you're using a PMB, it's important to include "PMB" followed by the box number in the address field. This detail is often overlooked, leading to incomplete or incorrect addressing information.

- Forgetting to Indicate the Entity Type: The form requires specifying the entity type (Individual, Corporation, Estate or Trust, LLC, or Partnership). Failure to clearly indicate the correct entity type can cause confusion or result in the form being incorrectly processed.

- Incorrect or Missing Identification Numbers: Each entity must provide pertinent identification numbers, such as SSN, ITIN, CA corp. no., FEIN, or SOS file no. Leaving these fields blank or entering incorrect numbers can lead to identification issues.

- Sending the Form to the Wrong Place: The instructions specify that S Corporations, Partnerships, or LLCs should not send this form to the FTB. Instead, it must be retained for four years and only provided to the FTB upon request. Sending it directly to the FTB is a common error.

- Using the Form When Not Eligible: This form is not applicable to foreign partners or members, California residents, or if the income has not been reported on a California tax return yet. Attempting to use Form 590-P in these circumstances is a mistake.

Each of these mistakes can be easily avoided by carefully reading the instructions and requirements outlined in the form and its accompanying documentation. Proper and accurate completion of Form 590-P is essential for ensuring that nonresident entities are correctly exempted from withholding on already reported income, streamlining their financial interactions within California.

Documents used along the form

When handling financial and tax matters in California, particularly for nonresident S corporation shareholders, partners, or LLC members, it’s important to be aware of the various documents and forms that may need to accompany the California Form 590-P. This knowledge ensures compliance with state requirements and smoothens the process of declaring and certifying previously reported income.

- Form 588: Nonresident Withholding Waiver Request. This form is used to request a waiver for withholding on payments of California source income to nonresidents. It's appropriate when certain conditions are met that justify not withholding income tax at the source.

- Form 590: Withholding Exemption Certificate. This form is similar to Form 590-P but is used by residents, or by nonresidents who have a permanent place of business in California, to certify that withholding is not required on their California source income.

- Form 592: Resident and Nonresident Withholding Statement. Used by the withholding agent to report amounts withheld from payments to nonresidents for income sourced in California. It provides a detailed account of the income and the associated withholding.

- Form 592-B: Resident and Nonresident Withholding Tax Statement. This form is given to the payee by the withholding agent and shows the amount of income subject to withholding and the total amount withheld for the tax year.li>

- Form 593: Real Estate Withholding Tax Statement. In the context of real estate transactions, this form is used to report income and withholding information for California real estate sales by nonresidents.

- FTB Pub. 1017: Resident and Nonresident Withholding Guidelines. While not a form, this publication provides comprehensive guidelines on withholding requirements for payments made to residents and nonresidents, helping S corporations, partnerships, and LLCs understand their obligations.

Equipped with the right forms and documents, nonresidents can efficiently navigate the complexities of California’s tax requirements. Whether it’s certifying exemption from withholding or addressing other tax obligations, understanding each document's purpose and how it fits into the broader financial landscape is crucial. Proper management and submission of these forms ensure compliance, prevent penalties, and streamline financial operations for nonresidents engaged with California entities.

Similar forms

The California Form 590-P serves a similar purpose as the IRS W-9 form, primarily in verifying a taxpayer's information and avoiding withholding. Both forms are used to certify a taxpayer's identity and taxpayer identification number (TIN), ensuring the correct reporting of taxes. Where Form 590-P specifically certifies that income has been reported to avoid state withholding on previously reported income, the W-9 is utilized more broadly for entities to report accurate information for federal tax purposes, including the avoidance of backup withholding.

Similar to the California Form 590-P, the 593 Form in California is used in real estate transactions to ensure proper withholding and reporting of taxes on income derived from California sources. However, while Form 590-P is focused on certifying previously reported income for S corporations, partnerships, or LLCs to avoid withholding, Form 593 is specifically intended for income or profit generated from the sale or transfer of real estate within California, highlighting the similar principles of tax withholding and reporting within the state.

The California Form 590, akin to the 590-P, is another document used to certify exemptions from nonresident withholding. Unlike the 590-P, which is specifically targeted at income already reported, Form 590 can be used more broadly by nonresidents who can assert that withholding is not necessary for various other reasons, such as being a resident or having a permanent place of business in the state. This illustrates the shared framework of both forms in managing withholding obligations, tailored to address different circumstances under the same umbrella of tax regulation.

The IRS Form 1042-S shares similarity with California's Form 590-P in the context of reporting income and withholding taxes for foreign persons. While the 590-P deals with domestic nonresidents' income within California, the 1042-S is utilized for reporting income paid to foreign individuals or entities, highlighting parallel processes in tax reporting and withholding that cater to different taxpayer groups under varying jurisdictions—federal versus state.

The Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (W-8BEN), parallels the California Form 590-P in its purpose of certifying the taxpayer's status to ensure correct tax handling. Like the 590-P certifies a domestic nonresident's previous income reporting to avoid state withholding, the W-8BEN is employed by foreign individuals to assert their status, affecting withholding rates on U.S. source income at the federal level, thereby reflecting a tailored approach to managing international taxpayer obligations.

Form W-8ECI, similar to California's Form 620-P, is used at the federal level to indicate that all the income linked to the form is effectively connected with the conduct of a trade or business within the United States. This designation allows for the exemption from certain withholdings, akin to how Form 590-P certifies income already taxed to prevent withholding. Both forms facilitate proper tax treatment by identifying specific income categorizations that impact withholding requirements.

The California Form 588, Nonresident Withholding Waiver Request, is directly related to Form 590-P as it serves a purpose within the same spectrum of withholding obligations. Where Form 590-P certifies that income has already been reported to waive withholding, Form 588 can be applied to request a waiver from withholding on payments of California source income not yet reported. Their connection lies in managing withholding obligations to nonresidents, ensuring that only appropriate amounts are withheld based on reported income or granted waivers.

The Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, while primarily focusing on international reporting, shares a compliance-driven similarity with California's Form 590-P. Both forms are integral to a larger regulatory framework designed to ensure proper tax reporting and avoidance of unnecessary withholding, with Form 590-P focusing on state-level income from pass-through entities and Form 5471 encompassing U.S. persons' international corporate engagements.

Dos and Don'ts

When it comes to filling out the California Form 590-P, a Nonresident Withholding Exemption Certificate for Previously Reported Income, there are specific dos and don'ts that one should adhere to. This ensures compliance with the California Franchise Tax Board requirements and avoids common mistakes that could result in penalties or delays. Here are seven crucial points to consider:

Do:

- Ensure you're eligible to use Form 590-P. It is designed for domestic (non-foreign) S corporation shareholders, partners, or members who have already reported their California source income.

- Include your name, address, and entity type correctly as these details are crucial for identification and processing purposes.

- Clearly specify the year(s) for which the income was already reported on your California income tax return to avoid any ambiguity.

- Sign and date the form. Your signature attests under penalty of perjury that the information provided is accurate and complete.

- Keep the form with your S corporation, partnership, or limited liability company records, as it may need to be furnished upon request to the Franchise Tax Board.

Don't:

- Use Form 590-P if you are a foreign partner, member, or if your income has not yet been reported on your California tax return. There are other forms specifically designed for those situations.

- Send this form to the Franchise Tax Board. This form should be kept with the entity's records and provided to the withholding agent or entity where you are a shareholder, partner, or member.

By following these guidelines, you can ensure the proper handling of Form 590-P and stay compliant with California's taxation requirements. If you have any questions or need clarification, it's always best to consult directly with the Franchise Tax Board or a tax professional.

Misconceptions

Understanding the California Form 590-P, Nonresident Withholding Exemption Certificate for Previously Reported Income, is crucial for individuals and entities involved in financial activities within the state. Several misconceptions, however, often cloud the form's purposes and requirements. Below are eight common misunderstandings and the realities behind them:

- Misconception 1: Form 590-P applies to all nonresidents of California.

Reality: This form is specifically for domestic (U.S.-based) nonresidents owning shares in S corporations, partnerships, or limited liability companies (LLCs) who have already reported income from these entities on their California tax returns. Foreign partners or members cannot use this form.

- Misconception 2: The form exempts all types of income from withholding.

Reality: Form 590-P only exempts previously reported income from current year distributions by an S corporation, partnership, or LLC. Other income types might still be subject to withholding.

- Misconception 3: Submission of Form 590-P exempts the shareholder, partner, or member from all California tax obligations.

Reality: The exemption specifically concerns withholding on certain distributions and does not exempt the individual or entity from filing a California income tax return or from other tax liabilities.

- Misconception 4: Form 590-P must be submitted to the California Franchise Tax Board (FTB) directly.

Reality: This form should be given to the withholding agent, S corporation, partnership, or LLC, not sent to the FTB. The entity will retain the form and provide it to the FTB upon request.

- Misconception 5: There is no need to annually update Form 590-P.

Reality: Although it can cover multiple years, it is advisable to complete a new Form 590-P annually or for each distribution to ensure all information remains current and accurate.

- Misconception 6: Resident shareholders or members of S corporations, partnerships, or LLCs can use Form 590-P for exemptions.

Reality: Residents, or those with a permanent place of business in California, should use Form 590, Withholding Exemption Certificate, instead of Form 590-P.

- Misconception 7: Form 590-P withholds backup withholding requirements.

Reality: The requirement for backup withholding is separate, and entities required to withhold for the IRS must also withhold for the FTB, with specific exemptions.

- Misconception 8: All addresses, including foreign, are written in the same format on Form 590-P.

Reality: For foreign addresses, the order is city, country, province/region, and postal code, adhering to the country's practice for postal codes. In contrast, domestic addresses include a street number, city, state, and ZIP code.

Dispelling these misunderstandings ensures compliance with the California tax laws and aids in accurately fulfilling withholding obligations. With the complexities of tax regulations, maintaining a clear and accurate understanding of forms like the 590-P is imperative for all parties involved.

Key takeaways

Filling out and using the California 590-P form correctly is crucial for nonresident S corporation shareholders, partners, or members to certify exemptions from withholding on income already reported. Here are key takeaways to remember:

- The Form 590-P is specifically designed for domestic (nonforeign) nonresident shareholders, partners, or members of S corporations, partnerships, or LLCs to claim an exemption from withholding for income reported in prior years.

- It is important to keep the completed form with the S corporation, partnership, or LLC records, as it must be retained for a minimum of four years and presented to the Franchise Tax Board (FTB) upon request.

- Do not use the Form 590-P if you are a foreign (non-U.S.) partner or member, a resident of California, or if the income has not yet been reported on a California tax return. Alternative forms such as Form 590 for residents or Form 588 for requesting a waiver on current year income are available.

- The form includes certifying that the income has already been included on your California tax return, thereby eliminating the need for further withholding by the S corporation, partnership, or LLC.

- To ensure compliance and avoid potential penalties, it is critical to accurately complete and sign the Form 590-P, including all required details such as the type of entity, identification numbers, and the specific year(s) of income being certified.

Always refer to the latest instructions available on the Franchise Tax Board's website for any updates or changes to the requirements or procedures for filing Form 590-P.

Different PDF Templates

California 3500 - Organizations must meticulously fill out the Form 3500, as incomplete or inaccurate submissions may delay or deny their exemption request.

Estate & Trust - Trustees must declare under penalty of perjury that the information provided in the form is true, accurate, and complete.

Section 179 California 2023 - Form 3540: The essential guide to leveraging past tax credits today in California.