Fill a Valid California 592 B Form

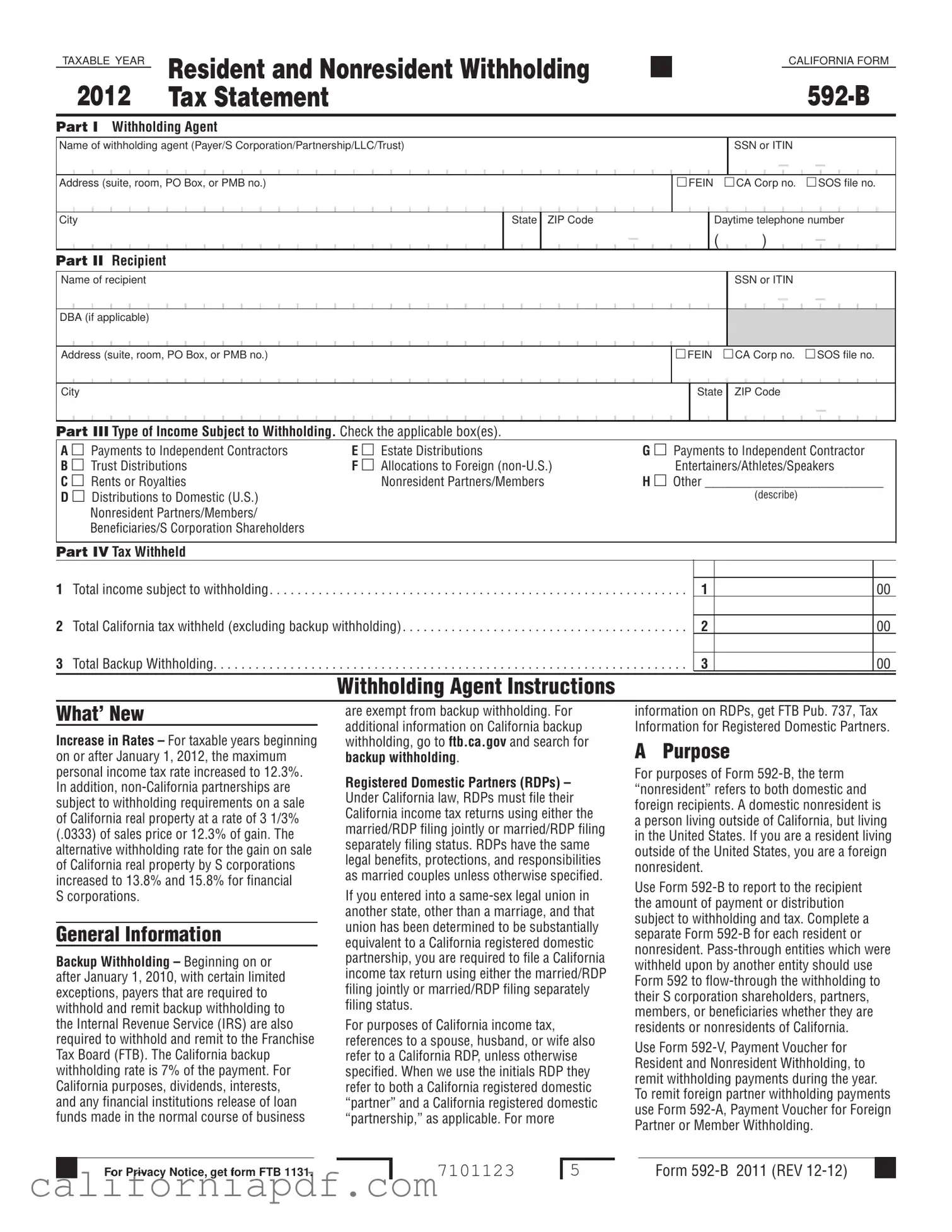

Understanding the intricacies of tax obligations in California, especially for those involved with payments to nonresident individuals or entities, is pivotal. The California Form 592-B serves a crucial role in this realm, acting as a tax statement for the taxable year, which meticulously details the tax withheld on various types of income. As part of a broader withholding requirement, this form covers payments to independent contractors, distributions from estates or trusts, rents, royalties, and even allocations to foreign entertainers, athletes, or speakers. Designed to streamline tax reporting for both withholding agents and recipients, Form 592-B encompasses sections requiring detailed information from the withholding agent and the recipient, alongside categorized income subject to withholding, and the amount of State tax withheld. This form not only aids in fulfilling state tax obligations but also serves as an essential document for recipients to credit against their tax liabilities when filing their own tax returns. With updates including increased rates for personal income tax and specific withholding rates for non-California partnerships and S corporations, it underscores the importance of staying informed about regulatory nuances to avoid penalties for non-compliance or inaccurate reporting. Moreover, the context of registered domestic partnerships and nuances in backup withholding further highlight the tailored approach of California’s tax structure to accommodate a diverse array of individual and business circumstances. The obligations and instructions detailed within underscore the importance of meticulous record-keeping and timely compliance, ensuring both withholding agents and recipients navigate their tax responsibilities effectively.

Document Example

TAXABLE YEAR |

Resident and Nonresident Withholding |

|

|

CALIFORNIA FORM |

|

|

|

|

|

|

|

|

||

2012 Tax Statement |

||||

Part I Withholding Agent

Name of withholding agent (Payer/S Corporation/Partnership/LLC/Trust)

SSN or ITIN

Address (suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

CA Corp no. SOS file no. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

Daytime telephone number |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II Recipient

Name of recipient

DBA (if applicable)

SSN or ITIN

Address (suite, room, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

CA Corp no. SOS file no. |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part III Type of Income Subject to Withholding. Check the applicable box(es). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A Payments to Independent Contractors |

|

E Estate Distributions |

|

G Payments to Independent Contractor |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

B Trust Distributions |

|

F Allocations to Foreign |

|

|

|

|

Entertainers/Athletes/Speakers |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C Rents or Royalties |

|

|

|

|

|

Nonresident Partners/Members |

|

H Other ___________________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

D Distributions to Domestic (U.S.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(describe) |

||||||||||||||||||||||||||||||||||||||||||||

|

|

Nonresident Partners/Members/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Beneficiaries/S Corporation Shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Part IV Tax Withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

1 Total income subject to withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Total California tax withheld (excluding backup withholding). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Total Backup Withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

3

00

00

00

Withholding Agent Instructions

What’ New

Increase in Rates – For taxable years beginning on or after January 1, 2012, the maximum personal income tax rate increased to 12.3%. In addition,

S corporations.

General Information

Backup Withholding – Beginning on or after January 1, 2010, with certain limited exceptions, payers that are required to withhold and remit backup withholding to the Internal Revenue Service (IRS) are also required to withhold and remit to the Franchise Tax Board (FTB). The California backup withholding rate is 7% of the payment. For California purposes, dividends, interests,

and any financial institutions release of loan funds made in the normal course of business

are exempt from backup withholding. For additional information on California backup withholding, go to ftb.ca.gov and search for backup withholding.

Registered Domestic Partners (RDPs) – Under California law, RDPs must file their California income tax returns using either the married/RDP filing jointly or married/RDP filing separately filing status. RDPs have the same legal benefits, protections, and responsibilities as married couples unless otherwise specified.

If you entered into a

For purposes of California income tax, references to a spouse, husband, or wife also refer to a California RDP, unless otherwise specified. When we use the initials RDP they refer to both a California registered domestic “partner” and a California registered domestic “partnership,” as applicable. For more

information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

A Purpose

For purposes of Form

Use Form

Use Form

For Privacy Notice, get form FTB 1131.

7101123

5 |

Form |

THIS PAGE INTENTIONALLY LEFT BLANK

visit our website:

ftb.ca.gov

Page 2 Form

B Common Errors/Helpful Hints

•Get taxpayer identification numbers (TINs) from all payees.

•Complete all fields.

•Complete all forms timely to avoid penalties.

C Who Must Complete

Form

•Has withheld on payments to residents or nonresidents.

•Has withheld backup withholding on payments to residents or nonresidents.

•Is a

Record Keeping

The withholding agent retains the proof of withholding for a minimum of four years and must provide it to the FTB upon request. Form

D When To Complete

Form

•Each resident or nonresident by January 31 following the close of the calendar year, except for brokers as stated in Internal Revenue Code (IRC) Section 6045.

•A recipient before February 15 following the close of the calendar year for brokers.

•Foreign partners in a partnership or members in a limited liability company (LLC) on

or before the 15th day of the 4th month following the close of the taxable year.

If all the partners in the partnership or members in the LLC are foreign, Form(s)

When making a payment of withholding tax to the IRS under IRC Section 1446, a partnership must notify all foreign partners of their allocable shares of any IRC Section 1446 tax paid to the IRS by the partnership. The partners use this information to adjust the amount of estimated tax that they must otherwise pay to the IRS. The notification to the foreign partners must be provided within 10 days of the installment due date, or, if paid later, the date the installment payment is made. See Treas. Regs. Section

the notification and for exceptions to the notification requirement. For California withholding purposes, withholding agents should make a similar notification. No particular form is required for this notification, and it is commonly done on the statement

accompanying the distribution or payment. However, the withholding agent may choose to report the tax withheld to the payee on a Form

E Penalties

The withholding agent must furnish complete and correct copies of Form(s)

If the withholding agent fails to provide complete, correct, and timely Form(s)

•$50 for each payee statement not provided by the due date.

•$100 or 10 percent of the amount required to be reported (whichever is greater), if the failure is due to intentional disregard of the requirement.

Specific Instructions

Year – Make sure the year in the upper left corner of Form

For foreign partners in a partnership, or foreign members in an LLC, make sure the year in the upper left corner of Form

Private Mail Box (PMB) – Include the PMB in the address field. Write “PMB” first, then the box number. Example: 111 Main Street PMB 123.

Foreign Address – Enter the information in the following order: City, Country, Province/ Region, and Postal Code. Follow the country’s practice for entering the postal code. Do not abbreviate the country’s name.

Part I – Withholding Agent

Enter the withholding agent’s name, tax identification number, address, and telephone number.

Part II – Recipient

Enter the name of recipient, DBA (if applicable), tax identification number, and address for the recipient (payee).

If the recipient is a grantor trust, enter the grantor’s individual name and social security number (SSN) or individual taxpayer identification number (ITIN). Do not enter the name of the trust or trustee information. (For

tax purposes, grantor trusts are transparent. The individual grantor must report the income and claim the withholding on the individual’s California tax return.)

If the recipient is a

enter trustee information.

If the trust has applied for a FEIN, but it has not been received, zero fill the space for the trust’s FEIN and attach a copy of the federal application behind Form

Only withholding agents can complete an amended Form

If the recipients are married/RDP, enter only the name and SSN or ITIN of the primary spouse/RDP. However, if the recipients intend to file separate California tax returns, the withholding agent should split the withholding and complete a separate Form

Part III – Type of Income Subject to Withholding

Check the box(es) for the type of income subject to withholding.

Part IV – Tax Withheld

Line 1

Enter the total income subject to withholding.

Line 2

Enter the total California tax withheld (excluding backup withholding). The amount of tax to be withheld is computed by applying a rate of 7% on items of income subject to withholding, i.e. interest, dividends, rents and royalties, prizes and winnings, premiums, annuities, emoluments, compensation

for personal services, and other fixed or determinable annual or periodical gains, profits and income. For foreign partners, the rate is 8.84% for corporations, 10.84% for banks and financial institutions, and 12.3% for all others. For pass through entities, the amount withheld is allocated to partners, members,

S corporation shareholders, or beneficiaries, whether they are residents or nonresidents of California, in proportion to their ownership or beneficial interest.

Line 3

Enter the total backup withholding. Compute backup withholding by applying a 7% rate to all reportable payments subject to IRS backup withholding with a few exceptions. For California purposes dividends, interests, and any financial institutions release of loan funds made in the normal course of business are exempt from backup withholding.

Form

Instructions for Recipient

This withholding of tax does not relieve you of the requirement to file a California tax return within three months and fifteen days (two months and fifteen days for a corporation) after the close of your taxable year.

You may be assessed a penalty if:

•You do not file a California tax return.

•You file your tax return late.

•The amount of withholding does not satisfy your tax liability.

How to Claim the Withholding

Report the income as required and enter the amount from Form

If you have an amount in line 3, backup withholding, you must provide us with your TIN before filing your tax return. Using the information provided on this page, contact us as soon as you receive this form. Failure to provide your TIN will result in a denial of your backup withholding credit.

If you are an S corporation, partnership, or LLC, you may either

If the withholding exceeds the amount of tax you still owe on your tax return, you must

If you do not have an outstanding balance on your tax return, you must

If you are an estate or trust, you must flow- through the withholding to your beneficiaries if the related income was distributed. Use Form 592 to

The amount shown as “Total income subject to withholding” may be an estimate or may only reflect how withholding was calculated. Be sure to report your actual taxable California source income. If you are an independent contractor or receive rents or royalties, see your contract and/or Form 1099 to determine your California source income. If you are an S corporation shareholder, partner, member, or beneficiary of an S corporation, partnership, LLC, estate, or trust, see your California Schedule

Additional Information

For more information or to speak to a representative regarding this form, call the Withholding Services and Compliance’s automated telephone service at: 888.792.4900 or 916.845.4900.

OR write to:

WITHHOLDING SERVICES AND COMPLIANCE FRANCHISE TAX BOARD

PO BOX 942867 SACRAMENTO CA

For all other questions unrelated to withholding or to access the TTY/TDD number, see the information below.

Internet and Telephone Assistance Website: ftb.ca.gov

Telephone: 800.852.5711 from within the United States 916.845.6500 from outside the United States

TTY/TDD: 800.822.6268 for persons with hearing or speech impairments

OR to get forms by mail, write to:

TAX FORMS REQUEST UNIT FRANCHISE TAX BOARD PO BOX 307

RANCHO CORDOVA CA

Asistencia Por Internet y Teléfono

Sitio web: |

ftb.ca.gov |

Teléfono: |

800.852.5711 dentro de los |

|

Estados Unidos |

|

916.845.6500 fuera de los Estados |

|

Unidos |

TTY/TDD: |

800.822.6268 personas con |

|

discapacidades auditivas y del |

|

habla |

Page 4 Form

Form Breakdown

| Fact | Description |

|---|---|

| Governing Law | The form is governed by the State of California Taxation Code and regulations. |

| Form Number | California Form 592-B. |

| Title | Resident and Nonresident Withholding Tax Statement. |

| Taxable Year | 2012. |

| Purpose | Used to report to the recipient the amount of payment or distribution subject to withholding and tax for both residents and nonresidents of California. |

| Who Must Complete | Required to be completed by persons who have withheld on payments to residents or nonresidents, including backup withholding, or are pass-through entities that must flow-through the withholding. |

| Due Date | Must be provided to each recipient by January 31 following the close of the calendar year, with specific exceptions for brokers, foreign partners, and foreign members. |

| Penalties | Failures to provide complete, correct, and timely forms can result in penalties, including $50 for each form not provided by the due date or $100 or 10 percent of the amount required to be reported, whichever is greater, for intentional disregard. |

| Specific Instructions and Errors | Includes reminders for correct and timely completion, ensuring accurate tax identification numbers (TINs) are obtained, and proper addressing, including PMB and foreign addresses. |

How to Write California 592 B

Filling out the California Form 592-B is a necessary step for withholding agents who have conducted transactions involving payments to both residents and nonresidents, including real estate transactions, within the state. This form facilitates accurate reporting of withholding amounts to the recipient and the Franchise Tax Board, ensuring compliance with California's tax laws. Here is a step-by-step guide to help you accurately complete Form 592-B:

- Begin with Part I – Withholding Agent. Enter the withholding agent’s full name and check the appropriate box for the type of identification number used, then fill in the number (SSN, ITIN, FEIN, CA Corp number, or SOS file number) and provide the complete address and daytime telephone number.

- Move to Part II – Recipient. Fill in the name of the recipient and their DBA (Doing Business As) if applicable. Check the appropriate box for their identification number type and enter the number. Include the recipient’s address information in the format given.

- In Part III – Type of Income Subject to Withholding, check the box(es) that apply to the type of income for which withholding occurred. Use the blank space marked “H” to specify any income types not already listed if necessary.

- Complete Part IV – Tax Withheld. For line 1, enter the total amount of income subject to withholding. On line 2, specify the total California tax withheld (excluding backup withholding). If backup withholding applies, indicate the total on line 3.

Before submitting Form 592-B, verify that all provided information is accurate and complete to avoid penalties for omissions or errors. This form should be provided to each recipient of income subject to California withholding by January 31 following the close of the calendar year, or by the alternative deadlines specified for brokers, foreign partners, and members. Keeping a copy of the completed form for records is recommended as it must be available for inspection by the Franchise Tax Board upon request. Careful adherence to these steps facilitates compliance with state tax obligations and supports the correct reporting of taxable income and withholdings.

Listed Questions and Answers

What is the purpose of California Form 592-B?

California Form 592-B is used to report the amount of payment or distribution subject to withholding and tax to the recipient. It includes payments made to both residents and nonresidents of California. This form helps in reporting taxable income and withheld taxes for various types of income, such as independent contractor payments, rent, royalties, trust distributions, and more.

Who needs to complete Form 592-B?

Form 592-B must be completed by any person or entity who has withheld taxes on payments to residents or nonresidents. This includes payments that have backup withholding and instances where the payment is distributed through pass-through entities that were themselves subjected to withholding. Essentially, if you have withheld taxes on payments made to another party, you need to fill out and provide a Form 592-B to them.

When is Form 592-B due?

Form 592-B must be provided to each recipient by January 31 following the close of the calendar year for most cases. However, for brokers as per the Internal Revenue Code Section 6045, the deadline is before February 15 following the close of the calendar year. For foreign partners or members, the form is due by the 15th day of the 4th or 6th month following the close of the taxable year, depending on the situation.

What are the common errors to avoid when completing Form 592-B?

- Not obtaining taxpayer identification numbers (TINs) from all payees.

- Failing to complete all required fields on the form.

- Not filing the form timely, which can lead to penalties.

What penalties exist for failing to provide Form 592-B?

If a withholding agent fails to provide complete, correct, and timely Form 592-B to the recipient, they may face penalties. These include a $50 penalty for each payee statement not provided by the due date, or $100 or 10 percent of the amount required to be reported, whichever is greater, if the failure is intentional.

How does a recipient claim the withholding reported on Form 592-B?

Recipients should report the income as required and enter the amount from Form 592-B, Part IV, line 2, on their California tax return as real estate and other withholding from Form(s) 592-B or 593. It's important to attach a copy of Form 592-B to the California tax return. If reporting backup withholding from line 3, the recipient must also provide their TIN before filing their tax return.

What information is needed to complete Part I and II of Form 592-B?

Part I requires the withholding agent’s name, tax identification number, address, and telephone number. For Part II, enter the recipient's name, DBA (if applicable), tax identification number, and their address. If dealing with a trust, specific rules apply depending on the type of trust (grantor or non-grantor), and whether the recipient is a married/RDP couple intending to file separately may also impact how Part II is filled out.

How can someone get more information or assistance with Form 592-B?

For more information or assistance, contact the Withholding Services and Compliance’s automated telephone service at 888.792.4900 or 916.845.4900. Alternatively, for specific inquiries not related to withholding, the Franchise Tax Board's website and other telephone assistance options are available, including services for individuals with hearing or speech impairments.

Common mistakes

Not Collecting or Incorrectly Providing Taxpayer Identification Numbers (TINs)

- Submitting the form without the TINs for both the withholding agent and recipient can lead to incorrect processing of the document. Sometimes, individuals might mistakenly enter an incorrect SSN, ITIN, FEIN, CA Corp number, or SOS file number, causing further confusion and potential processing delays.

Leaving Sections Incomplete

- Every field on the form should be correctly filled out to avoid penalties. However, it's common for individuals to skip sections, especially if they are unsure of the information required. For instance, the address portion requires not only the street address but also suite, room, PO Box, or PMB numbers if applicable.

Failing to Indicate the Correct Tax Year

- The form requires the taxable year to be clearly indicated to ensure the withholding is accounted for in the correct period. An often-overlooked mistake is failing to ensure the year at the top of the form aligns with the year the income was earned or withheld.

Incorrectly Reporting the Type of Income Subject to Withholding

- The confusion between the types of income can lead to incorrectly checked boxes in Part III. Each type of income, whether it's payments to independent contractors, estate distributions, or rents and royalties, has specific reporting requirements, and misclassification can affect tax liability.

Not Properly Reporting Backup Withholding

- Backup withholding rates are distinct and need accurate reporting in Part IV, Line 3. This mistake often occurs because of a misunderstanding of what qualifies for backup withholding and the applicable rate, which for California is 7%.

Improper Handling of Non-Grantor Trust Information

- When the recipient is a non-grantor trust, the form requires the name of the trust and the trust’s FEIN. A common mistake here is entering the trustee's information instead of the trust's, or not providing the FEIN when it hasn't been received yet, which complicates the processing of the withholding credit.

Documents used along the form

When handling California Form 592-B for Resident and Nonresident Withholding, several other forms and documents might be required for comprehensive tax reporting and compliance. Understanding these documents can streamline the process and ensure all necessary information is accurately provided to the relevant parties.

- Form 592: This form is a Report of Withholding, used by pass-through entities to report and remit payments for withholding to the Franchise Tax Board (FTB).

- Form 592-A: Payment Voucher for Foreign Partner or Member Withholding. It's used to remit payments for foreign partners or members, detailing the amounts withheld on their behalf.

- Form 592-V: Payment Voucher for Resident and Nonresident Withholding. This voucher accompanies the payment of withheld taxes to the California FTB.

- Form 593: Real Estate Withholding Statement. This form documents withholding from sales or transfers of real property located in California.

- Form 1099: Miscellaneous Income. Often used in conjunction with 592-B to report various types of payments to non-employees, including independent contractors.

- Form 1042-S: Foreign Person's U.S. Source Income Subject to Withholding. This IRS form reports amounts paid to foreign persons, including rents, royalties, scholarships, and compensation for services.

- Form 541: California Fiduciary Income Tax Return. This is used by estates or trusts to report income, deductions, and credits to the California FTB.

- Schedule K-1 (541, 565, 568, 100S): These schedules report the share of income, deductions, and credits from a partnership, LLC, estate, S corporation, or trust to its beneficiaries, partners, or shareholders.

- Form W-9: Request for Taxpayer Identification Number and Certification. Requested from U.S. persons by the withholding agent to obtain the taxpayer identification number (TIN) necessary for tax reporting purposes.

Understanding and properly utilizing these documents can aid in the accurate and timely reporting of withholding taxes, ensuring compliance with both state and federal regulations. Whether dealing with domestic or foreign recipients, real estate transactions, or distributions from trusts, partnerships, or corporations, these documents form a critical part of the reporting process.

Similar forms

The California Form 592-B is primarily involved in the process of withholding taxes on various types of income earned by residents and nonresidents within the state. This form functions similarly to the IRS Form 1042-S, "Foreign Person's U.S. Source Income Subject to Withholding." Both forms focus on reporting income and tax withheld for nonresident individuals, but where 592-B is for California state tax purposes, Form 1042-S addresses federal tax obligations for foreign persons from U.S. sources, including royalties, rents, compensation, and scholarships.

Another analogous document is the 1099-MISC form, notably used for reporting payments to independent contractors, among other things. Like the 592-B form, the 1099-MISC is crucial for reporting certain types of payments that might not be subject to traditional wage withholding, necessitating the entity paying the income to handle this reporting. Although 1099-MISC captures federal reporting requirements and Form 592-B focuses on California state taxes, both ensure that government bodies are informed about income that might otherwise go unreported.

Form W-2, "Wage and Tax Statement," shares similarities with California's 592-B, especially in the context of withholding and reporting income taxes. While Form W-2 is used by employers to report wages, tips, and other compensation paid to employees, including the tax withheld, Form 592-B accomplishes a similar purpose for other types of income and for a more varied group of recipients, including nonresidents. Both play key roles in the annual tax reporting and reconciliation process for individuals and entities.

The California Form 593, "Real Estate Withholding Statement," also complements the purpose of Form 592-B, though it specifically targets real estate transactions. Form 593 is required for reporting sales or transfers of real property in California and involves withholding state income tax at the time of the sale. Both forms ensure appropriate income reporting and tax withholding in unique situations—Form 592-B in a broad array of non-wage income scenarios and Form 593 in the very specific context of real estate transactions.

Comparable in intent is the IRS Form 8805, "Foreign Partner's Information Statement of Section 1446 Withholding Tax," which, like Form 592-B, is designed for nonresidents. Form 8805 is used to report income and withholding for foreign partners in U.S. partnerships. While it deals with federal tax on an international scale, California’s Form 592-B serves to report similar information but on the state level and across a wider range of income types, including payments to nonresident partners.

Form W-8BEN, "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting," parallels the 592-B by its focus on nonresidential financial aspects, albeit in a distinct manner. Form W-8BEN is a certification form used by foreign individuals to claim exemption from certain withholdings on income, including that potentially reportable on Form 592-B. Essentially, W-8BEN helps establish the correct withholding rate, akin to how income types are identified for withholding on 592-B.

Lastly, the IRS Form 1099-INT, used for reporting interest income, shares a common purpose with California's Form 592-B. Both forms deal with identifying and reporting income that might not otherwise have taxes withheld at the source. While 1099-INT is narrowly focused on interest earned, and part of federal reporting, Form 592-B addresses a broader spectrum of incomes for state tax purposes, showcasing the multifaceted approach of taxation documentation.

Dos and Don'ts

When filling out the California Form 592-B, it's important to get every detail right. Here are some dos and don'ts to help guide you through the process:

Do:- Make sure to use the correct taxable year at the top of the form, matching the year in which the income was subject to withholding.

- Double-check taxpayer identification numbers (TINs) to ensure they match the information for all payees, including SSN, ITIN, FEIN, CA Corp no., or SOS file no.

- Include all required information in each part of the form, from the withholding agent's details to the recipient's information, ensuring no fields are left blank.

- Accurately report the type of income subject to withholding by checking the appropriate box in Part III.

- Calculate the total income subject to withholding and tax withheld correctly, entering these in Part IV, lines 1 and 2, respectively.

- Forget to include the PMB (Private Mail Box) number if applicable. Write "PMB" followed by the number in the address field.

- Ignore the specific instructions for recipients living outside of the United States, ensuring correct foreign address formatting and understanding their status as foreign nonresidents.

- Overlook the backup withholding in Line 3 if applicable, as it should be calculated at a 7% rate on all reportable payments subject to IRS backup withholding.

By following these guidelines, you can help ensure your California Form 592-B is complete and correct, potentially avoiding penalties and making the process smoother for both the withholding agent and recipient.

Misconceptions

When discussing the California 592-B form, it's crucial to clarify common misconceptions that can lead to confusion and errors. Dispelling these myths ensures accurate compliance with withholding tax requirements for those dealing with, or responsible for, payments to both residents and nonresident entities.

- Misconception 1: The 592-B form is only for non-California residents.

This is not accurate. While the term “nonresident” is indeed referenced, it applies broadly to both domestic entities operating outside California and foreign entities. Therefore, both domestic nonresidents and foreign nonresidents are required to be considered when preparing this form.

- Misconception 2: Form 592-B is a tax return.

Form 592-B is not a tax return. Instead, it serves as a tax statement that reports amounts paid or distributed subject to withholding. Recipients use this information to file their own state tax returns, providing a detailed summary of California source income and withheld taxes.

- Misconception 3: The withholding agent decides the type of income subject to withholding.

While withholding agents do hold responsibility for determining and withholding taxes on certain types of payments, the classification of income types subject to withholding is defined by law. The form lists specific income categories, such as payments to independent contractors or estate distributions, guiding agents on applicable scenarios.

- Misconception 4: Withholding is optional at the discretion of the payer.

The decision to withhold is not arbitrary or at the discretion of the payer. California law mandates withholding on various payments to nonresidents if they exceed certain thresholds. Compliance is necessary, and failure to withhold accurately can result in penalties.

- Misconception 5: Backup withholding is the same as normal withholding.

Although both are forms of withholding, they serve different purposes. Backup withholding might be required when the payee fails to furnish a Taxpayer Identification Number (TIN). It applies to specific scenarios outlined by the state and is separately reported on the form. It's essential to understand the distinction to ensure proper reporting and compliance.

Understanding these key points regarding Form 592-B eliminates common misunderstandings and aids in correctly fulfilling tax obligations in California. Proper awareness and accuracy in tax matters help avoid unnecessary penalties and ensure compliance with state requirements.

Key takeaways

Understanding the California 592-B form is crucial for withholding agents and recipients alike, as it outlines the tax withheld on various types of income. Below are key takeaways to help navigate filling out and using this form effectively:

- The California Form 592-B is designed to report amounts subject to withholding and tax amounts to the recipient for a specific taxable year.

- It is important for withholding agents, who can be individuals or entities such as partnerships, LLCs, or S Corporations, to issue this form when they have withheld taxes on payments made to both residents and non-residents.

- The form categorizes the type of income subject to withholding, which includes, but is not limited to, payments to independent contractors, estate distributions, rent, or royalties.

- Withholding agents are required to provide complete and accurate taxpayer identification numbers (TINs) and must ensure all fields are filled to avoid penalties for incomplete forms.

- The deadline for distributing Form 592-B to recipients is January 31 following the close of the calendar year for most cases, with specific exceptions for certain types of recipients such as foreign partners.

- Recipients use the information provided on Form 592-B to file their state tax returns, claiming the withholding amount against their tax liabilities. They must attach a copy of the form to their California tax return.

- For withholding purposes, “nonresident” refers to both "domestic nonresidents" (those living outside California within the US) and "foreign nonresidents" (those living outside the United States).

- The withholding agent retains proof of withholding for a minimum of four years and must furnish these records to the Franchise Tax Board upon request.

- Backup withholding is also required in certain cases, with the rate set at 7% for California purposes, mirroring the federal requirement but exempting specific types of payments like dividends and interest from this withholding.

- Penalties may be imposed for failure to provide complete, correct, and timely Form(s) 592-B, highlighting the importance of adhering to the reporting and documentation requirements.

Taking these points into consideration will facilitate compliance and ensure that both the withholding agent and the recipient understand their responsibilities and the implications for their tax obligations in California.

Different PDF Templates

Ca Form 541 Instructions 2022 - Mailing your tax return with the attached Form 540-V to the correct address is crucial for timely processing.

What Is a Dismissal Order - Used to demonstrate the applicant's successful reintegration into society post-conviction.

Form 100s - By highlighting federal tax reform changes and their impact on California taxes, the booklet ensures S corporations are well-informed.