Fill a Valid California 597 W Form

The California 597 W form serves as a cornerstone in the state's efforts to regulate tax withholdings on real estate transactions involving nonresident sellers. This comprehensive document is split into two main sections: the Withholding Exemption Certificate and the Nonresident Waiver Request. It starts by gathering essential details from the seller, including their name, social security or corporate number, and the property's information. Crucially, the form poses several questions that sellers must navigate to determine whether they qualify for exemption from the state's withholding requirements, which hinge on criteria such as the total sale price, the seller's residency status, and whether the property sold falls under their principal residence. For those who do not qualify for an exemption, the form transitions into a request for a reduced withholding rate, subject to approval by the Franchise Tax Board (FTB). This entails a detailed disclosure of the seller’s reasons for requesting a reduction, supported by the necessary documentation. The 597 W form thus embodies a pivotal step for nonresidents selling real estate in California, ensuring compliance with state tax obligations while providing avenues for exemptions or reduced withholdings based on specific qualifying conditions.

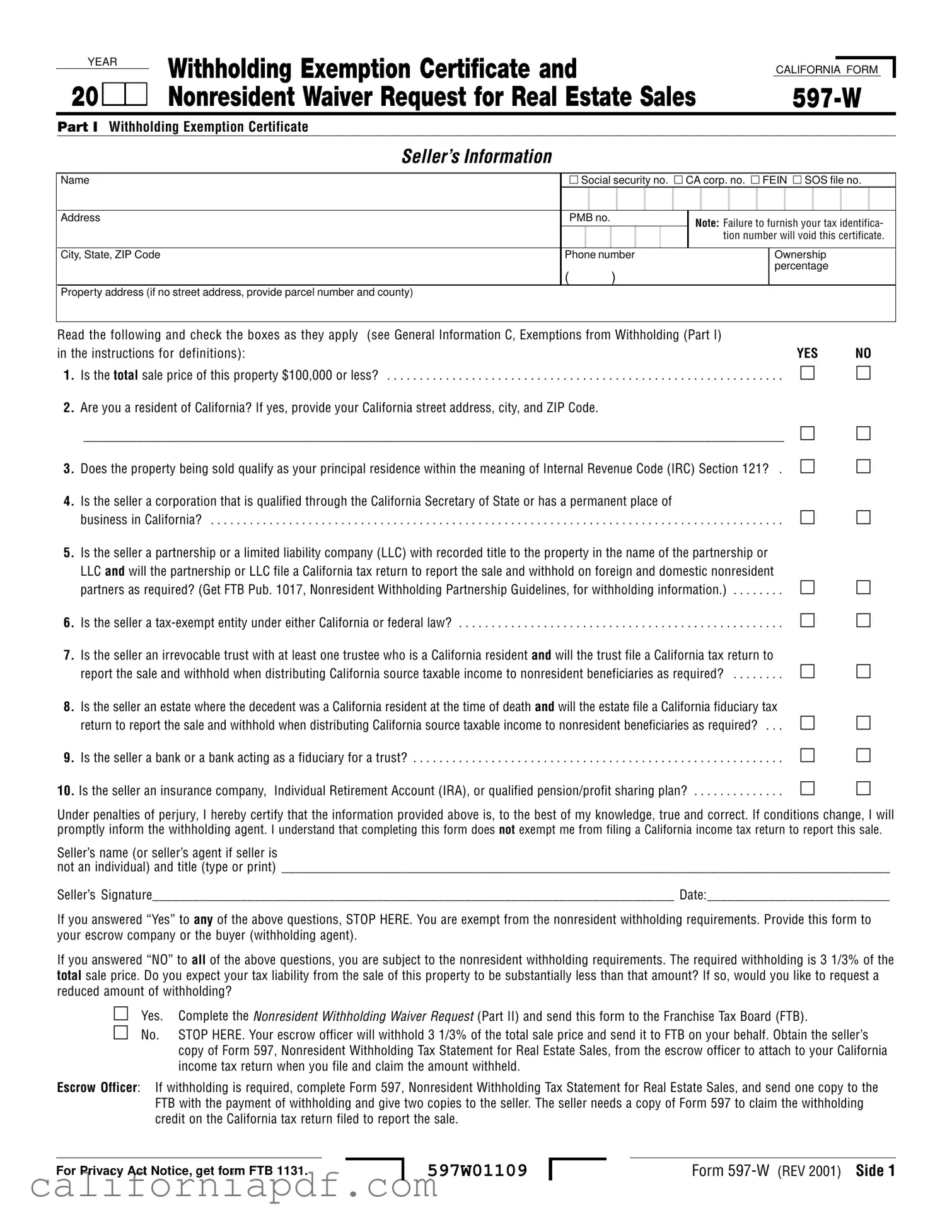

Document Example

YEAR

20

Withholding Exemption Certificate and |

|

|

|

CALIFORNIA FORM |

|||

|

|||

Nonresident Waiver Request for Real Estate Sales |

|||

Part I Withholding Exemption Certificate

Seller’s Information

Name |

|

Social security no. CA corp. no. FEIN SOS file no. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

PMB no. |

|

|

Note: |

Failure to furnish your tax identifica- |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

tion number will void this certificate. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, ZIP Code |

Phone number |

|

|

|

|

|

|

|

Ownership |

|

|

|||||||||

|

( |

) |

|

|

|

|

|

|

|

|

|

|

percentage |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Property address (if no street address, provide parcel number and county) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Read the following and check the boxes as they apply (see General Information C, Exemptions from Withholding (Part I) |

|

|

|

|

|

|

|

|

||||||||||||

in the instructions for definitions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

||

1. Is the total sale price of this property $100,000 or less? |

. |

. . . |

|

. . . . |

. |

. . |

. . |

. . |

. . |

. . |

. . |

. . . . . |

. . . . |

. . |

. . |

|||||

2.Are you a resident of California? If yes, provide your California street address, city, and ZIP Code.

|

__________________________________________________________________________________________________________ |

||

3. |

Does the property being sold qualify as your principal residence within the meaning of Internal Revenue Code (IRC) Section 121? . |

||

4. |

Is the seller a corporation that is qualified through the California Secretary of State or has a permanent place of |

|

|

business in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Is the seller a partnership or a limited liability company (LLC) with recorded title to the property in the name of the partnership or LLC and will the partnership or LLC file a California tax return to report the sale and withhold on foreign and domestic nonresident partners as required? (Get FTB Pub. 1017, Nonresident Withholding Partnership Guidelines, for withholding information.) . . . . . . . .

6. Is the seller a

7. Is the seller an irrevocable trust with at least one trustee who is a California resident and will the trust file a California tax return to

report the sale and withhold when distributing California source taxable income to nonresident beneficiaries as required? |

8.Is the seller an estate where the decedent was a California resident at the time of death and will the estate file a California fiduciary tax

return to report the sale and withhold when distributing California source taxable income to nonresident beneficiaries as required? . . .

9. Is the seller a bank or a bank acting as a fiduciary for a trust? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Is the seller an insurance company, Individual Retirement Account (IRA), or qualified pension/profit sharing plan? . . . . . . . . . . . . . .

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. If conditions change, I will promptly inform the withholding agent. I understand that completing this form does not exempt me from filing a California income tax return to report this sale.

Seller’s name (or seller’s agent if seller is

not an individual) and title (type or print) ____________________________________________________________________________________________

Seller’s Signature_____________________________________________________________________________ Date:___________________________

If you answered “Yes” to any of the above questions, STOP HERE. You are exempt from the nonresident withholding requirements. Provide this form to your escrow company or the buyer (withholding agent).

If you answered “NO” to all of the above questions, you are subject to the nonresident withholding requirements. The required withholding is 3 1/3% of the total sale price. Do you expect your tax liability from the sale of this property to be substantially less than that amount? If so, would you like to request a reduced amount of withholding?

Yes. Complete the Nonresident Withholding Waiver Request (Part II) and send this form to the Franchise Tax Board (FTB).

No. STOP HERE. Your escrow officer will withhold 3 1/3% of the total sale price and send it to FTB on your behalf. Obtain the seller’s copy of Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, from the escrow officer to attach to your California income tax return when you file and claim the amount withheld.

Escrow Officer: If withholding is required, complete Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, and send one copy to the FTB with the payment of withholding and give two copies to the seller. The seller needs a copy of Form 597 to claim the withholding credit on the California tax return filed to report the sale.

For Privacy Act Notice, get form FTB 1131.

597W01109

Form

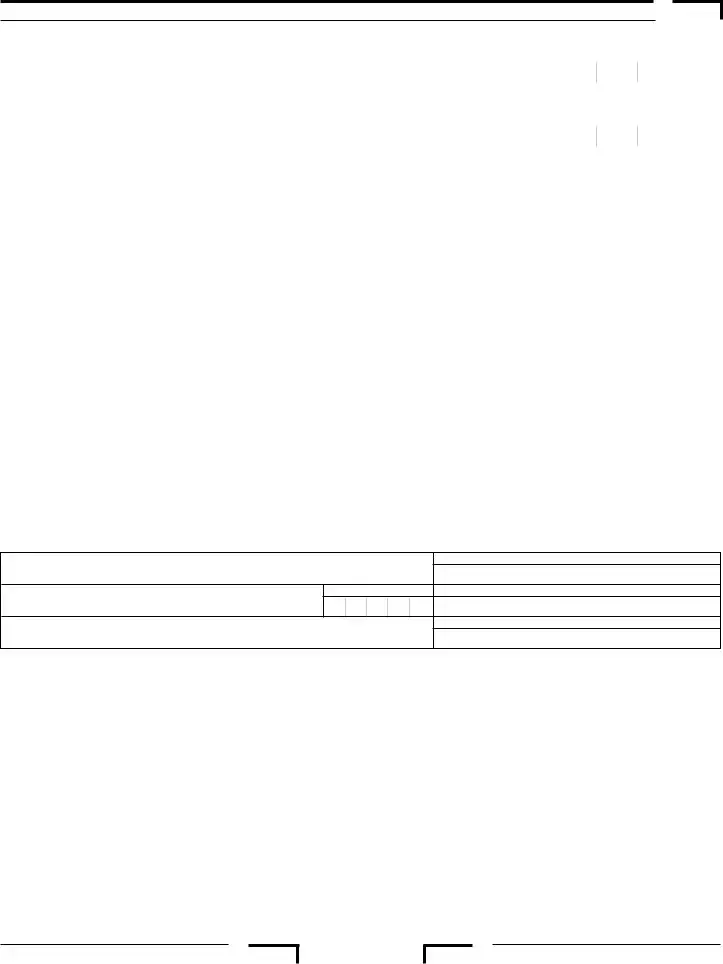

Part II Nonresident Withholding Waiver Request (please print or type)

Seller’s Information

Name of seller (see instructions if more than one) |

|

|

|

|

Seller’s Entity Type |

Seller’s social security number (SSN) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Individual(s) |

|

|

- |

|

- |

|

|

|

||||

Mailing address |

|

|

PMB no. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Corporation |

California corporation no. FEIN |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

S Corporation |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City, state, and ZIP Code (province, country, and postal zone) |

|

|

|

|

|

Seller’s spouse’s SSN (if applicable) |

|||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Estate |

|

|

|

- |

|

- |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Trust |

|

|

|

|

|

|

|

|

|

|

||||||

Phone number |

|

|

Ownership |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Seller’s email address |

||||||||||||||||||

( |

) |

|

|

percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Property Information |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Property Address (if no street address, provide parcel number and county): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Seller acquired property by (check one): |

|

|

|

|

Date seller acquired property: |

|

|

|

|

|

|

|

|

|

|

||||||||

Purchase |

Inheritance |

Foreclosure/Repossession |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Gift |

|

1031 Exchange |

call (888) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Seller’s adjusted basis: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

or (916) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Other____________________ |

|

|

|

|

|

|

Purchase price |

$ |

____________________________ |

|

|

|

|

||||||||||

|

|

|

|

|

|

Add: improvements |

|

____________________________ |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Use of property at time of sale: |

Length of time used for this purpose: |

|

|

|

|

||||||||||||||||||

|

|

|

Less: depreciation |

|

____________________________ |

|

|

|

|

||||||||||||||

Rental / Commercial |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

Adjusted basis |

$ |

____________________________ |

|

|

|

|

|||||||||||

Secondary / Vacation home |

Years ________ Months _________ |

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Vacant land |

|

|

|

|

|

Provide all required documentation listed in the instructions. Attach any other |

|||||||||||||||||

Other (attach explanation) |

|

|

|

|

documents necessary to verify the adjusted basis. |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Escrow Information |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Name and address of Escrow Company: |

|

|

|

|

|

Escrow Company email address |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Name of Escrow Officer: |

|

|

|

|

Escrow number: |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Escrow Company or Officer |

|

|

FAX number: |

||||||||||||

|

|

|

|

|

|

|

|

telephone number: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

( |

) |

|

|

|

( |

|

) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Contract price (total sale price): |

|

Estimated close of escrow date: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buyer’s Information

Name of buyer (see instructions if more than one)

Buyer’s social security number (SSN)

Address (number and street, PO box or rural route)

PMB no. (if applicable)

California corporation no. FEIN

City, state, and ZIP Code (province, country, and postal zone)

Buyer’s spouse’s SSN (if applicable)

State in detail your reason for requesting a withholding waiver or reduced withholding. If there is more than one nonresident seller, attach a separate sheet listing additional nonresident seller’s information. See instructions for examples of situations for which a waiver or reduced withholding is allowed and for the required information and documentation.

Attach additional sheets if needed. The FTB cannot make a determination on your request unless you provide all required information and documentation. See instructions.

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. If conditions change, I will promptly inform the withholding agent. I understand that completing this form does not exempt me from filing a California income tax return to report this sale.

Seller’s name (or seller’s agent if seller is

not an individual) and title (type or print) ____________________________________________________________________________________________

Seller’s Signature ____________________________________________________________________________________ Date: _____________________

Side 2 Form

597W01209

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The California Form 597-W serves as a Withholding Exemption Certificate and Nonresident Waiver Request for Real Estate Sales. |

| Applicability | This form is used when selling property in California, allowing sellers to claim exemption from or request reduced nonresident withholding. |

| Key Requirements | Sellers must provide detailed information including their name, social security number, property address, and the total sale price, among others. |

| Exemptions Criteria | Exemptions from withholding include if the sale price is $100,000 or less, the seller is a resident, or the property qualifies as the seller's principal residence. |

| Governing Law | The form is governed by California state law and the requirements set forth by the California Franchise Tax Board. |

How to Write California 597 W

When it comes to managing real estate transactions in California, particularly for nonresidents, understanding and accurately completing Form 597-W is essential. This form, which encompasses both a Withholding Exemption Certificate and a Nonresident Waiver Request, is critical for ensuring compliance with California's tax withholding requirements on real estate sales. Below, find a step-by-step guide designed to assist sellers in accurately filling out the form, ensuring they meet legal obligations while potentially minimizing unnecessary withholding from the sale proceeds.

- Begin with Part I, focusing on the Withholding Exemption Certificate:

- Fill in the seller’s full name, social security number (SSN), California corporation number (CA corp. no.), Federal Employer Identification Number (FEIN), and Secretary of State file number (SOS file no.) as applicable.

- Enter the complete address, including PMB no. if applicable, city, state, and ZIP Code, alongside the phone number.

- Specify the ownership percentage of the property.

- Provide the address of the property being sold, or if there is no street address, the parcel number and county.

- Read each exemption question carefully and check “YES” or “NO” as applicable. If any question is answered with “YES,” then you may be exempt from withholding requirements.

- If exempt, sign and date the certificate at the bottom, providing the seller’s (or seller's agent’s) name and title.

- If you answered “NO” to all questions in Part I, indicating you are subject to nonresident withholding, proceed to Part II, the Nonresident Withholding Waiver Request:

- Start by providing the seller's information again, including name, type of entity, SSN (or FEIN), and mailing address.

- Indicate the seller’s spouse’s SSN if applicable, phone number, email address, and the ownership percentage.

- Detail the property information, including its address or parcel number, how and when the seller acquired the property, and its use at the time of sale.

- Enter the contract price, also known as the total sale price, and the estimated close of escrow date.

- Provide buyer information, including their name, SSN (or FEIN), and address.

- Explain in detail the reason for requesting a withholding waiver or reduced withholding. Attach separate sheets if necessary and include any required documentation or additional information to support your request.

- Sign and date the form, ensuring the seller or the seller's agent provides their name and title.

Once completed, if seeking a waiver or reduced withholding, the form should be sent to the Franchise Tax Board (FTB). Remember, this form does not exempt the seller from filing a California income tax return to report the sale. For those exempt from withholding, provide the completed form to your escrow company or the buyer. It’s essential to consult with a real estate or tax professional if you have questions or if your situation is complex. Properly completing Form 597-W is a crucial step in fulfilling legal requirements and ensuring a smoother sales process.

Listed Questions and Answers

What is California Form 597-W?

California Form 597-W is a document used to certify exemptions from nonresident withholding on real estate sales. It encompasses a Withholding Exemption Certificate and a Nonresident Waiver Request, aiming to clarify whether the seller must have income withheld by the buyer for tax purposes. Sellers must indicate information about the sale and their eligibility for exemption based on specified criteria.

Who needs to complete California Form 597-W?

This form is essential for sellers of California real estate who are not residents of the state but wish to apply for an exemption from or a reduction in the required withholding tax on the sale proceeds. If certain qualifications are met, indicating the seller's ties to California or the nature of the transaction, the seller may not be subject to the standard withholding requirements.

When should I submit Form 597-W?

Submit Form 597-W as early as possible once you enter into an agreement for the sale of California real estate property. The form needs to be provided to the escrow company or the buyer (acting as the withholding agent) if you qualify for an exemption. If requesting a reduced withholding, the part concerning the Nonresident Withholding Waiver Request must be completed and sent to the Franchise Tax Board (FTB) promptly to ensure consideration before the transaction's closure.

What criteria exempt a seller from nonresident withholding requirements?

Several criteria can exempt a seller from the nonresident withholding requirements, including but not limited to:

- The total sale price of the real estate is $100,000 or less.

- The property sold was the principal residence of the seller, as defined by the Internal Revenue Code Section 121.

- The seller is a corporation, partnership, LLC, or trust that meets specific qualifications, such as being registered with the state or committing to file a California tax return and withhold taxes on distributions to nonresident members.

- The seller is a tax-exempt entity under California or federal law.

What if my tax liability from the sale is expected to be less than the withholding amount?

If you anticipate that your tax liability from the sale will be substantially lower than the withholding amount, you may request a reduced amount of withholding. This requires completing the Nonresident Withholding Waiver Request section of Form 597-W and providing detailed documentation to support your request. The Franchise Tax Board (FTB) will review your submission and determine if a reduction is warranted based on the information provided.

How does completing Form 597-W affect my obligation to file a California income tax return?

Completing Form 597-W does not exempt you from the obligation to file a California income tax return. Sellers, regardless of their nonresident status or whether they obtained an exemption or reduction in withholding, must report the sale on a California income tax return. This return allows them to reconcile the actual tax due on the sale and claim any refund of over-withheld amounts.

Common mistakes

Filling out the California 597 W form, which is the Withholding Exemption Certificate and Nonresident Waiver Request for Real Estate Sales, is a critical step in the process of selling property in California. However, mistakes can easily be made which might complicate the transaction. Here are ten common mistakes to avoid:

- Not Providing the Necessary Identification Numbers: Sellers often forget to include their social security number, CA corporation no., FEIN, or SOS file no. Missing these details can invalidate the certificate.

- Incorrect Property Address: The form requires a property address or, if there's no street address, the parcel number and county. Providing incorrect or vague property details can cause significant issues.

- Failing to Check the Relevant Exemptions: There are specific boxes that need to be checked if certain conditions apply, such as the property being the principal residence or the seller being a resident of California. Overlooking these can lead to unnecessary withholding.

- Ownership Percentage Not Specified: If the property is owned by multiple parties, the form requires each owner's percentage of ownership to be listed. Omitting this information can create complications in the withholding process.

- Not Signing the Form: An unsigned form is invalid. The seller, or the seller's agent if the seller is not an individual, must sign the form to certify that the information provided is, to the best of their knowledge, true and correct.

- Omission of Seller's Contact Information: Sellers sometimes forget to include their address, phone number, or email. This information is essential for communication purposes.

- Incorrect or Incomplete Buyer Information: Just as seller information is crucial, so is the buyer information. Incorrect details here can impact the withholding process.

- Neglecting to Attach Required Documentation: In certain cases, attachments are necessary to verify the adjusted basis of the property or other details. Failing to include these can delay or void the request for a withholding waiver or reduced amount.

- Not Updating the Form if Conditions Change: If any of the situations change after the form is submitted but before the transaction is completed, this needs to be communicated. The form clearly states that conditions must be promptly updated.

- Assuming Completion of the Form Exempts You From Filing a Tax Return: Even if you complete this form and are exempt from withholding, you are still required to file a California income tax return to report the sale. This misunderstanding can lead to legal and financial penalties.

By avoiding these common mistakes, sellers can ensure a smoother transaction process and comply with California's real estate and tax laws. It's always a good idea to review the form carefully and consult with a professional if you have any doubts.

Documents used along the form

In any real estate transaction, particularly those involving the sale of property by nonresidents in California, the California Form 597-W is a pivotal document. It's designed for sellers to claim exemption from nonresident withholding on real estate sales. However, this form does not operate in isolation. Various other forms and documents often accompany it to ensure compliance with legal requirements, provide detailed financial information, and facilitate the real estate transaction smoothly. Below is a list of these forms and documents, each serving a unique purpose in the broader context of the real estate sale process.

- Form 593: Real Estate Withholding Statement - Required to document the amount of state income tax withheld from the sale or transfer of real estate.

- Form 593-E: Certificate of Residence or Domicile - Sellers use this to certify their resident status to potentially reduce or waive state withholding requirements.

- Form 593-C: Real Estate Withholding Certificate - Allows sellers to claim a lower withholding rate based on the expected capital gain from the sale.

- Schedule D (IRS Form 1040): Capital Gains and Losses - Used to report the sale or exchange of capital assets not reported on another form or schedule.

- Form 1099-S: Proceeds From Real Estate Transactions - Issued by the transaction facilitator, this form reports the sale's gross proceeds to the IRS.

- Grant Deed: Transfers real estate ownership from the seller to the buyer, specifying details of the property and parties involved.

- Title Report: Provides a comprehensive history of the property, including any encumbrances, liens, easements, or restrictions affecting the property.

- Preliminary Change of Ownership Report (PCOR): Filed with the county assessor to report a change in ownership, this document helps the assessor determine if a reassessment is required.

- Escrow Agreement: Outlines the terms and conditions between the parties involved in the transaction, handled by a neutral third party.

- Closing Statement: Also known as a HUD-1, this document itemizes all the costs and fees associated with the real estate transaction, provided to both buyer and seller.

Understanding how these documents interact with the California Form 597-W can significantly impact the efficiency and compliance of a real estate sale. Each document serves to clarify, record, or verify details critical to the transaction, ensuring that both the buyer and seller meet their legal and financial obligations. In the context of nonresident sales, this paperwork becomes even more crucial, as it helps navigate the complexities of withholding requirements, preventing potential legal issues post-sale.

Similar forms

The California 593 form, "Real Estate Withholding Statement," shares similarities with the 597-W form as both are integral to the process of real estate transactions in California, specifically concerning the withholding of taxes on the sale of real property. The 593 form is used by the escrow agent to report the amount of tax withheld from the seller's proceeds to the Franchise Tax Board (FTB) and is required in almost all transactions involving the sale of California real estate. Just like the 597-W, it involves declarations related to the seller's tax obligations and residency status.

The "Request for Taxpayer Identification Number and Certification" (Form W-9) is another document related to the 597-W form. It is commonly used across the United States for the purpose of obtaining a taxpayer's identification number, which can include a Social Security Number (SSN) or Employer Identification Number (EIN). For the 597-W form, providing the taxpayer's identification number is essential for validating the exemption status and ensuring the correct reporting and withholding of taxes. Both forms serve to collect crucial information that impacts tax reporting and compliance.

Form 1040, "U.S. Individual Income Tax Return," although more comprehensive, is conceptually connected to the 597-W form. Individuals who sell property in California and claim exemption from withholding on the 597-W still need to report the sale on their Form 1040 if required by federal tax laws. The information provided in Form 597-W, such as the sale's gross proceeds and the seller's taxpayer identification, could be essential for accurately completing the income tax return.

The "Change of Ownership Statement," required by many county assessors in California upon the sale or transfer of real estate, also shares traits with Form 597-W. While the Change of Ownership Statement is used to reassess the property's value for property tax purposes, providing accurate seller's information and sale details, similar to those on Form 597-W, ensures the proper transition of tax responsibilities related to the property.

Last, the "Nonresident Alien Income Tax Return" (Form 1040-NR) parallels the 597-W since it deals with tax obligations for nonresidents with U.S. income. For sellers who are nonresident aliens completing the 597-W form, they might also be required to file Form 1040-NR if they have income from U.S. sources. Both forms address the complexities of tax liability for nonresidents, aiming to ensure compliance with U.S. tax laws.

Dos and Don'ts

When filling out the California 597 W form for Withholding Exemption Certificate and Nonresident Waiver Request for Real Estate Sales, it's essential to provide accurate information to ensure compliance with tax regulations. Here are some dos and don'ts to guide you through the process:

- Do review the entire form before starting to ensure you understand all requirements.

- Do provide accurate information in all fields, including your social security number, address, and details about the property.

- Do check the appropriate boxes in Part I based on your situation to correctly determine if you are exempt from the nonresident withholding requirements.

- Do consult the instructions for definitions and more details if you're unsure about how to answer any questions.

- Do sign and date the form to certify that the information provided is true and correct to the best of your knowledge.

- Do promptly inform the withholding agent if any conditions change after submitting the form.

- Do attach all required documentation listed in the instructions when making a Nonresident Withholding Waiver Request.

- Do provide your email address and phone number to facilitate communication.

- Do ensure that the form is correctly directed to the Franchise Tax Board (FTB) if you are completing Part II for a waiver request.

- Don't leave any required fields blank — failure to furnish your tax identification number, for example, will void the certificate.

- Don't guess on any of the questions; ensure that all the information you provide is accurate and verifiable.

- Don't assume you are exempt from filing a California income tax return to report the sale, even if you complete this form.

- Don't ignore the checkboxes in Part I; answering these accurately determines your withholding requirements.

- Don't forget to check if you expect your tax liability from the sale of the property to be substantially less than the required withholding amount and wish to request a reduced withholding accordingly.

- Don't submit the form without signing and dating it as this is required under penalties of perjury.

- Don't overlook the instructions for examples of situations where a waiver or reduced withholding is allowed, which can be crucial for your submission.

- Don't hesitate to attach additional sheets if needed to provide a detailed reason for requesting a withholding waiver or reduced withholding.

- Don't forget to provide the form to your escrow company or the buyer if you are exempt from nonresident withholding requirements.

- Don't fail to obtain the seller's copy of Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, from your escrow officer if withholding is required.

Misconceptions

When dealing with real estate transactions in California, the Form 597-W, being the Withholding Exemption Certificate and Nonresident Waiver Request for Real Estate Sales, can be quite complex. Several misconceptions surround its use and requirements. Let's clarify four common misunderstandings:

Misconception 1: Only nonresidents of California need to complete Form 597-W.

This is not accurate. While the form is indeed crucial for nonresidents to possibly exempt themselves from withholding requirements on the sale of real property in California, certain residents may also need to fill out the form under specific conditions. For example, residents selling property that doesn't qualify as their principal residence might still engage with this form to report exemptions under different criteria listed.

Misconception 2: Filling out Form 597-W automatically exempts the seller from the nonresident withholding tax.

Merely completing the form does not guarantee exemption. The seller must meet specific criteria outlined in the form's questions, such as the property being sold for $100,000 or less, or the property being the seller's principal residence, among others. The appropriate documentation and truthful responses must support claims for exemptions.

Misconception 3: If a seller is exempt, they do not need to file a California income tax return for the sale.

This belief is incorrect. Even if a seller qualifies for exemption and does not have withholding taken from the sale proceeds, they are still required to file a California income tax return to report the sale. The form explicitly states that completing it "does not exempt me from filing a California income tax return to report this sale."

Misconception 4: The form is only relevant at the time of sale closing.

Although Form 597-W is crucial at the closing of the sale, its relevance extends beyond that point. For instance, conditions related to the sale or the seller's qualifications for exemption may change, necessitating the seller to promptly inform the withholding agent. Furthermore, the seller needs a copy of Form 597, which is derived from the information on Form 597-W, to claim the withholding credit on their state tax return.

Understanding these aspects of the California Form 597-W can significantly smooth the process of real estate transactions within the state, ensuring compliance with tax obligations while possibly benefiting from exemptions when applicable.

Key takeaways

Filling out and using the California Form 597-W, a crucial document for certain real estate transactions, involves specific steps and understandings to ensure compliance and avoid penalties. Here are key takeaways to keep in mind:

- The form serves dual purposes: as a Withholding Exemption Certificate and a Nonresident Waiver Request related to the sale of real estate in California.

- For sellers, providing accurate information, particularly the tax identification number, is essential; failure to do so voids the certificate.

- Exemptions from nonresident withholding are detailed and contingent upon various factors, such as the sale price being $100,000 or less, residency status, and the nature of the entity selling the property.

- Affirmative answers to any of the exemption questions in Part I of the form indicate the seller's exemption from nonresident withholding requirements. Consequently, the form should then be provided to the escrow company or buyer.

- If a seller does not qualify for any exemptions, they are subject to a withholding rate of 3 1/3% of the total sale price, unless a reduced withholding is approved via Part II of the form.

- Sellers expecting their tax liability to be substantially less than the standard withholding amount may request a reduced withholding by completing Part II, which necessitates sending the form to the Franchise Tax Board (FTB).

- Completion of this form does not absolve the seller of the obligation to file a California income tax return to report the sale. Form 597, Nonresident Withholding Tax Statement for Real Estate Sales, obtained from the escrow officer, must be attached to the seller's tax return to claim the withheld amount.

This overview emphasizes the importance of filing Form 597-W accurately and timely. Understanding and navigating these requirements can significantly affect the financial aspects of real estate transactions for nonresident sellers in California.

Different PDF Templates

California Form 541 Instructions - Estate and trust fiduciaries use the 541-T to make irrevocable elections, impacting how estimated tax payments are credited to beneficiaries.

California 5870A - Crucial for correctly reporting and adjusting tax credits related to trust distribution income.

Edd New Employee Registry Benefit Audit - Take advantage of the DIR's commitment to privacy and report any mishandling of your workers’ compensation claim.