Fill a Valid California 700 U Form

In the landscape of academic research within California's esteemed universities, the Form 700-U emerges as a crucial document underpinning the ethical conduct and transparency required from those at the helm of research projects. Mandated for personnel in key positions within the University of California (UC) and California State University (CSU) systems, this form ensures that any potential financial conflicts of interest are disclosed whenever research projects receive funding from non-governmental sources. By providing a detailed account of financial interests, income, loans, and gifts related to the research initiative, the form plays a pivotal role in maintaining the integrity of the scientific inquiry and its outcomes. Notably, it encompasses a wide range of financial disclosures, including, but not limited to, investments that may influence the researcher's objectivity, income from various sources, and significant gifts or loans from entities funding the research. Additionally, it addresses the specifics of travel payments, distinguishing between those considered as income versus those viewed as gifts, each with its own reporting criteria. The completion and submission of this form not only adhere to the regulations set forth by the Fair Political Practices Commission (FPPC) but also underscore a commitment to transparency and ethical standards within California's academic research environment.

Document Example

Instructions for Completing Form

CALIFORNIAFORM

Who Files Form

This form must be iled by all persons employed by UC or CSU who have principal responsibility for a research

project if the project is to be funded or supported, in

whole or in part, by a contract or grant (or other funds earmarked by the donor for a speciic research project or for a speciic researcher) from a nongovernmental entity.

Reporting requirements are outlined in Regulation 18755.

This regulation provides that research funding by certain nonproit entities will not trigger disclosure. This regulation is available on the FPPC website.

What is an Investment?

“Investment” means any inancial interest in a business entity in which you, your spouse or registered domestic

partner, or your dependent children have a direct, indirect, or beneicial interest totaling $2,000 or more. Reportable investments include stocks, bonds, warrants,

and options, including those held in margin or brokerage accounts and investment funds. Common examples of investment funds are index funds,

What is Income?

“Income” means a payment received, including but not limited to any salary, wage, advance, dividend, interest, rent, proceeds from any sale, gift, including any gift of food

or beverage, loan forgiveness or payment of indebtedness received by the iler, reimbursement for expenses, per diem,

or contribution to an insurance or pension program paid by any person other than an employer, and any community property interest in income of a spouse or registered domestic partner. Income also includes an outstanding loan. Income of an individual also includes a pro rata share of any income of any business entity or trust in which the

individual, spouse, or registered domestic partner owns directly, indirectly, or beneicially, a 10% interest or greater.

Income includes your gross income and your community property interest in your spouse’s or registered domestic partner’s gross income totaling $500 or more. Gross income is the total amount of income before deducting expenses, losses, or taxes. (See Gov. Code Section 82030.)

What is a Loan?

Loans received or outstanding are reportable if they total $500 or more from a single lender. Your community property interest in loans received by your spouse or registered domestic partner also must be reported. (See Gov. Code Section 82030(a).)

What is a Gift?

A gift is anything of value for which you have not provided equal or greater consideration to the donor. A gift is reportable if its fair market value is $50 or more. In addition, multiple gifts totaling $50 or more received from a reportable source must be reported.

It is the acceptance of a gift, not the ultimate use to which it is put, that imposes your reporting obligation. Therefore you must report a gift even if you never used it or if you gave it away to another person.

If the exact amount of a gift is not known, you must make a good faith estimate of the item’s fair market value. Listing the value of a gift as “over $50” or “value unknown” is not adequate disclosure.

Commonly reportable gifts include:

•Tickets/passes to sporting or entertainment events

•Tickets/passes to amusement parks

•Parking passes

•Food, beverages, and accommodations, including that provided in direct connection with your attendance at a convention, conference, meeting, social event, meal, or like gathering, where you did not give a speech, participate in a panel or seminar, or provide a similar service

•Rebates/discounts not made in the regular course of

business to members of the public without regard to oficial status

•Wedding gifts

•An honorarium. You may report an honorarium as income rather than as a gift if you provided services of equal or greater value than the payment received.

•Transportation and lodging

•Forgiveness of a loan received by you

(See Gov. Code Section 82028.)

FPPC Form

CALIFORNIA

FAIR POLITICAL PRACTICES COMMISSION

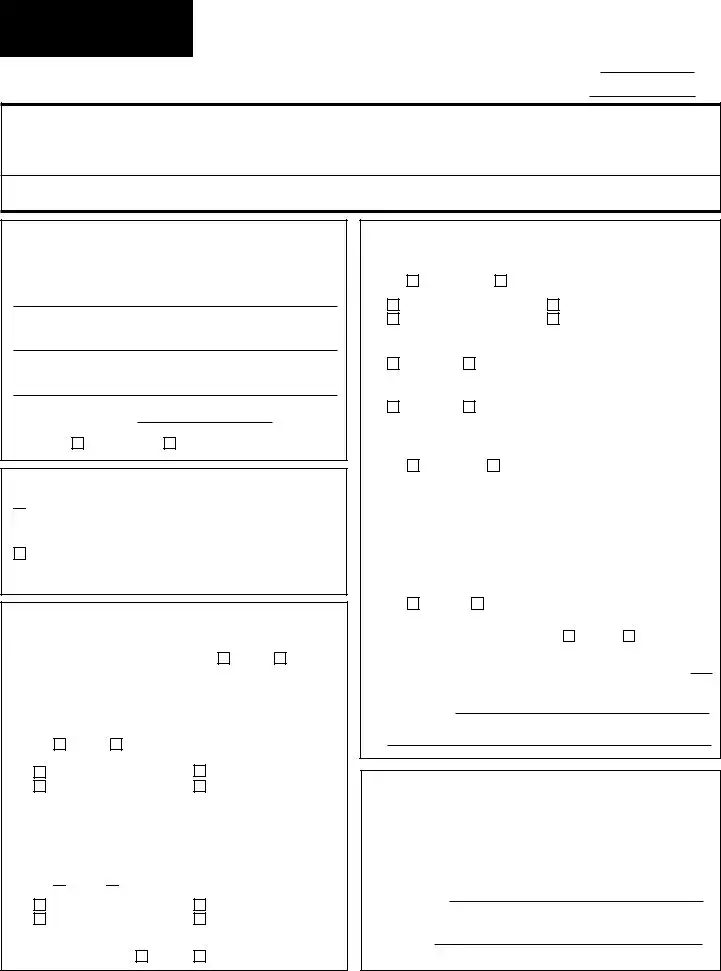

Please type or print in ink.

STATEMENT OF ECONOMIC INTERESTS

FOR

PRINCIPAL INVESTIGATORS

Date Received

Campus Use Only

Campus:

ID No:

NAME (LAST)(FIRST)(MIDDLE)TELEPHONE NUMBER

|

|

( |

) |

|

|

|

|

ACADEMIC UNIT OR DEPARTMENT |

MAIL CODE |

||

TITLE OF RESEARCH PROJECT

1. Information Regarding Funding Entity:

(Use a separate Form

Address of Entity:

Principal Business of Entity:

Amount of Funding: $

Estimated |

|

Actual |

|

|

|

2.Type of Statement (Check at least one box)  Initial (for new funding)

Initial (for new funding)

|

Date of initial funding: |

|

|

/ |

|

|

|

/ |

|

|

|

|

|

Interim (for renewed funding) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

Funding was renewed on: |

|

|

|

/ |

|

|

/ |

|

|

||

3.Filer Information

A.Are you a director, oficer, partner, trustee, consultant, employee, or do you hold a position of management in

the entity listed in Part 1? |

No |

|

Yes |

|

|

|

|

|

|

||||

Title: |

|

|

|

|

|

|

B.Do you, your spouse or registered domestic partner, or

your dependent children have an investment of $2,000 or more in the entity listed in Part 1 above?

No |

|

|

Yes |

|

– value is: |

|

|

|

|

|

|

|

|

||||

|

|

$2,000 - $10,000 |

|

$10,001 - $100,000 |

||||

|

|

|

||||||

|

|

|||||||

|

|

$100,001 - $1,000,000 |

|

Exceeds $1,000,000 |

||||

|

|

|||||||

|

|

|

||||||

If you have sold or divested yourself of investments:

Date Divested: |

|

/ |

|

/ |

|

|

|

|

C.Have you received income of $500 or more from the entity listed in Part 1 during the reporting period?

No

Yes

Yes

|

$500 - $1,000 |

|

$1,001 - $10,000 |

|

|

||

|

$10,001 - $100,000 |

|

Exceeds $100,000 |

|

|

Was income received through your spouse or registered

domestic partner? |

|

No |

|

Yes |

|

|

3. Filer Information - CONT.

D.Have you received loans from the entity in Part 1 for which the balance exceeded $500 during the reporting period?

No |

|

|

Yes |

|

|

– highest balance: |

|||

|

|

|

|||||||

|

|

$500 - $1,000 |

|

|

|

|

$1,001 - $10,000 |

||

|

|

|

|

|

|||||

|

|

$10,001 - $100,000 |

|

|

Exceeded $100,000 |

||||

|

|

|

|

||||||

If you checked “yes,” was the loan:

|

Secured |

|

Unsecured Interest rate: |

|

% |

|

|

||||

|

|

|

|

|

|

Was the loan entirely repaid within the last 12 months?

|

No |

|

Yes |

|

|

E.Have you received gifts from the entity listed in Part 1 within the last 12 months valued at $50 or more?

No |

Yes |

|

– describe below. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||||

Description: |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value: $ |

|

|

|

|

Date Received: |

|

/ |

|

/ |

|

|

|

|

F. Has the entity in Part 1 paid for your travel?

No |

|

|

Yes |

|

– describe below. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Type of Payment: (check one) |

|

|

|

Gift |

|

|

|

|

|

Income |

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

Amt: $ |

|

|

|

date(s): |

|

|

|

/ |

|

/ |

|

|

|

|

|

/ |

|

/ |

||

|

|

|

|

|

|

|

|

|

|

|

|

(If applicable) |

|

|||||||

Description:

4. Veriication

I have used all reasonable diligence in preparing this statement. I have reviewed this statement and to the best of my knowledge the information contained herein and in any attached schedules is true and complete. I certify under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Date Signed

(month, day, year)

Signature

(File the originally signed statement with your university.)

The Form |

FPPC Form |

This statement is a public record under Gov. Code Section 81008(a). |

FPPC |

Instructions for Completing Form

CALIFORNIAFORM

What is a Travel Payment?

Travel payments include advances and reimbursements for travel and related expenses, including lodging and meals.

•Travel payments are gifts if you did not provide services which were equal to or greater in value than the payments received. You must disclose gifts totaling $50 or more from a single source during the period covered by the statement. Gifts of travel are reportable without regard to where the donor is located.

When reporting travel payments which are gifts, you must provide a description of the gift and the date(s) received.

Effective August 15, 2008, Regulation 18946.6 provides new valuation methods for gifts of air transportation.

•Travel payments are income if you provided services which were equal to or greater in value than the payments received. You must disclose income totaling $500 or more from a single source

during the period covered by the statement. The iler has the burden of proving the payments are

income rather than gifts.

When reporting travel payments as income, you must describe the services you provided in exchange for the payment. You are not required to disclose the date(s) for travel payments which are income.

Gifts of travel may be subject to a $420 gift limit. In

addition, certain travel payments are reportable gifts, but are not subject to the gift limit. See the FPPC fact sheet entitled “Limitations and Restrictions on Gifts, Honoraria, Travel, and Loans,” which can be obtained from the FPPC at www.fppc.ca.gov.

You are not required to disclose:

•Travel payments received from any state, local, or federal government agency for which you provided services equal or greater in value than the payments received

•Travel payments received from your employer in the normal course of your employment

•Payments or reimbursements for transportation within California in connection with an event at which you gave a speech, participated in a panel or seminar, or performed a similar service

•Food, beverages, and necessary accommodations received directly in connection with an event held inside or outside California at which you gave

a speech, participated in a panel, or provided a similar service (note that payments for transportation outside of California are reportable)

•A travel payment which was received from a nonproit entity exempt from taxation under IRS Code Section 501(c)(3) for which you provided equal or greater consideration

Check the box to indicate if the payment was a gift or income, report the amount, and disclose the date(s) if applicable.

Violations

Failure to ile the required Statement of Economic Interests or failure to report a inancial interest may

subject a principal investigator to civil liability, including ines, as well as University discipline. (Gov. Code Sections

Privacy Information Notice

Information requested on all FPPC forms is used by the FPPC to administer and enforce the Political Reform Act (Gov. Code Sections

Act is a violation subject to administrative, criminal or civil prosecution. All reports and statements provided are public records open for public inspection and reproduction.

If you have any questions regarding this Privacy Notice

or how to access your personal information, please

contact the FPPC at:

General Counsel

Fair Political Practices Commission 428 J Street, Suite 620 Sacramento, CA 95814

(916)

FPPC Form

Form Breakdown

| Fact Name | Detail |

|---|---|

| Who Files Form 700-U | All persons employed by UC or CSU with principal responsibility for a research project funded by nongovernmental entities. |

| Governing Regulation | Regulation 18755. |

| What Constitutes an Investment | Financial interests in a business entity exceeding $2,000. |

| Definition of Income | Payments received, including salary, wage, advance, dividend, interest, etc., totaling $500 or more. |

| Loan Reporting Requirement | Loans received or outstanding totaling $500 or more from a single source. |

| What Is Considered a Gift | Anything of value received without equal consideration, valued at $50 or more. |

| Travel Payments as Gifts or Income | Travel payments are gifts if services provided were not equal to or greater in value than payments received. |

| Required Disclosures | Investments, income, loans, and gifts related to the entity funding the research. |

| Consequences of Non-Compliance | Subject to civil liability, fines, and University discipline. |

How to Write California 700 U

Filling out the California 700-U Form is an essential task for individuals in academia who are involved with research projects funded by non-governmental entities. This form plays a crucial role in maintaining transparency and accountability in financial interests and influences within research settings. The process might seem daunting at first, but by following these straightforward steps, it can be completed with ease and accuracy.

- Gather all necessary information about your research funding, including details about the funding entity and the specifics of the income, investments, loans, gifts, and travel payments related to the research project.

- Locate the section at the beginning of the form titled Date Received and Campus Use Only, where your institution will fill in the relevant information.

- Fill in your personal details, including your NAME (LAST)(FIRST)(MIDDLE), TELEPHONE NUMBER, ACADEMIC UNIT OR DEPARTMENT, MAIL CODE, and E-MAIL ADDRESS.

- In the section titled TITLE OF RESEARCH PROJECT, accurately describe the research project to which this form applies.

- Under 1. Information Regarding Funding Entity, provide the name, address, principal business of the entity, and both the estimated and actual amounts of funding.

- For the Type of Statement, check the appropriate box to indicate whether this is an initial filing for new funding or an interim filing for renewed funding. Include the dates relevant to the funding.

- In section 3. Filer Information, answer the questions regarding your relationship to the funding entity, investments, income received, loans, gifts, and travel payments. Be as detailed and accurate as possible. The form requires you to indicate the monetary value within specified ranges for each category where applicable.

- Complete the verification at the bottom of the form by signing and dating it. This attests to the accuracy and completeness of the information you have provided.

- Finally, submit the form to the designated office or official at your university as per your institution's guidelines.

Once the form is submitted, it will be processed and become a part of public record, contributing to an environment of openness in academic research funding. Keep in mind that accuracy is crucial, as any discrepancies could lead to further scrutiny or penalties. Should you have any questions or require assistance at any point, do not hesitate to contact the FPPC’s Toll-Free Helpline for guidance.

Listed Questions and Answers

Who needs to file the California Form 700-U?

Form 700-U must be filed by employees of the University of California (UC) or California State University (CSU) who have principal responsibility for a research project. This requirement applies if the project receives funding or support, in whole or in part, from a nongovernmental entity through contracts, grants, or other funds designated for a specific research project or researcher.

What types of financial interests do I need to report on Form 700-U?

You're required to report investments, income, loans, and gifts that meet specific criteria:

- Investments: Any financial interest in a business entity totaling $2,000 or more that belongs to you, your spouse or registered domestic partner, or your dependent children.

- Income: Payments received totaling $500 or more, including salary, rent, proceeds from sales, gifts not provided by an employer, and others.

- Loans: Loans received or outstanding that total $500 or more from a single lender must be reported, including those received by your spouse or registered domestic partner.

- Gifts: Any item or service valued at $50 or more for which you did not provide equivalent value in return.

Are there any exemptions from reporting?

Yes, research funding from certain nonprofit entities does not trigger disclosure requirements. Additionally, travel payments received from government agencies or your employer under particular circumstances, and some types of non-profit organization travel payments provided you offered equal or greater services in exchange, are exempt.

How do I determine the value of gifts or travel payments to report?

For gifts, you must make a good faith estimate of the item’s fair market value and report if it is $50 or more. For travel payments considered gifts, you must describe the gift and report the total value. When travel payments are considered income, describe the services you provided in exchange, without needing to specify the dates of travel.

What happens if I fail to file Form 700-U or report a financial interest?

Failure to file the required Statement of Economic Interests or to report a financial interest may subject the principal investigator to civil liabilities, including fines, as well as University discipline.

What is considered an "investment" for the purposes of Form 700-U?

An investment refers to any financial interest worth $2,000 or more in a business entity, held directly, indirectly, or beneficially by you, your spouse or registered domestic partner, or your dependent children. This includes stocks, bonds, warrants, options, and investments in funds like index funds or venture capital funds.

How do I determine if income needs to be reported?

Income includes a wide range of payments such as salaries, wages, dividends, interest, rent, gifts (other than from an employer), and loan forgiveness, among others. If the total gross income or the community property interest in your spouse's or registered domestic partner's income is $500 or more, it needs to be reported.

Are loans considered as income or a separate category?

Loans are considered a separate category from income. You must report loans received or outstanding that total $500 or more from a single lender. This also applies to loans received by your spouse or registered domestic partner.

How should gifts of unknown value be reported?

If the exact value of a gift is not known, you must provide a good faith estimate of its fair market value. Merely stating "over $50" or "value unknown" is not an adequate disclosure. For reportable gifts, you need to describe the gift and its estimated value.

What constitutes a travel payment, and how is it reported?

Travel payments, which include advances and reimbursements for travel-related expenses, are considered gifts if the value was not offset by services you provided. They are treated as income if services of equal or greater value were provided in return. The distinction between gifts and income affects how these payments are reported, including the need to describe the related services for income reporting.

Common mistakes

One common mistake is failing to report all reportable interests in the section about investments. This oversight includes omitting investments in stocks, bonds, and real estate that meet or exceed the $2,000 threshold. The form requires disclosure of both direct and indirect investments that could potentially influence the filer’s actions regarding the research project.

Another error frequently encountered is the incorrect reporting of income. Individuals often mistakenly report only their salary or wages, omitting other forms of income such as dividends, rents, and gifts that qualify as income under the form's broad definition. This includes any payment received that adds to the filer's wealth, which is to be disclosed if it totals $500 or more.

Incorrectly identifying loans is a third mistake. Individuals sometimes fail to report loans from a single lender that exceed $500 or inaccurately represent their spouse or domestic partner’s loans as their own. It is crucial to disclose the existence of such financial obligations, especially when they originate from the entity funding the research, as this could present a conflict of interest.

Underreporting gifts is the fourth error commonly made on the form. Gifts of any value over $50 received from a single source within the reporting period must be disclosed. Filers often neglect to consider items like travel payments, meal vouchers, or event tickets as gifts, or they may underestimate the value of such gifts, thus failing to provide a good faith estimate of their fair market value.

The fifth mistake involves the improper categorization of travel payments. Researchers sometimes miscategorize payments for travel as income rather than gifts, or vice versa, failing to distinguish between travel compensation for which services were provided and travel benefits received without any service exchange. Accurate classification is essential, as it determines the application of gift limits and influences the overall transparency of the filing.

Documents used along the form

When individuals working for the University of California (UC) or California State University (CSU) have principal responsibility for a research project funded by nongovernmental entities, they are required to file the California Form 700-U. This form is part of a broader suite of documents designed to ensure transparency and compliance with regulations governing economic interests. Alongside the Form 700-U, there are several other forms and documents that may also be pertinent, depending on the specific circumstances of the filer and the research project.

- Form 700: The Statement of Economic Interests, which is required for many public officials and employees, helps to provide transparency about potential conflicts of interest by disclosing investments, income, and other financial interests.

- Form 701: This form is for use when a gift is returned to the donor. It provides a record that helps to ensure compliance with gift limits and regulations.

- Form 702: Designed for donors, this form records information about gifts given to public officials or employees, which is important for compliance with gift limits and disclosure requirements.

- Form 703: This form tracks payments made to agencies, not directly to an individual official or employee, for travel expenses, highlighting scenarios where third parties cover travel costs for officials.

- Form 204: The Statement of No Economic Interests is for individuals who hold positions that the Fair Political Practices Commission (FPPC) considers to have no possibility of influencing their official actions through economic interests.

- Amendment Form: If there are changes or errors in a previously filed Form 700-U or related documents, this form allows filers to correct or update their information.

- Leaving Office Form: When an individual subject to filing Form 700-U leaves their position, this form documents the end of their filing obligations related to that position.

- Assuming Office Form: This form is used by individuals newly assuming a position that requires filing Form 700-U, indicating the start of their obligation to disclose economic interests.

- Conflict of Interest Code: While not a form, many agencies are required to maintain a code that identifies which positions are subject to Form 700-U filing. This document helps individuals and agencies determine filing obligations.

- Schedule A-1: Attached to Form 700, this schedule details investments, including stocks, bonds, and other financial interests, providing a more granular look at potential conflicts of interest.

The completion and accurate filing of these forms and documents play a critical role in maintaining the integrity and transparency of research funded by nongovernmental entities. By providing detailed disclosures about economic interests, individuals and institutions can work to prevent conflicts of interest and promote ethical standards within their research projects.

Similar forms

The Statement of Economic Interests, Form 700, requires public officials in California to annually disclose their financial interests. It is similar to the Form 700-U in that both aim to identify potential conflicts of interest, but Form 700 targets a broader spectrum of public officials beyond those associated with university research projects. Both forms require disclosures about investments, income, loans, and gifts, ensuring transparency and fairness in public office and research funding.

The Confidential Statement of Financial Interests, often required by federal grant agencies such as the National Institutes of Health (NIH), also shares similarities with Form 700-U. This document necessitates disclosures from researchers receiving federal funding to prevent conflicts of interest in the allocation of research funds, akin to how Form 700-U seeks to maintain the integrity of research funded by non-governmental entities in California.

The Foreign Influence Disclosure Form, required by many research institutions, mandates researchers to disclose foreign investments and funding. This form parallels the Form 700-U in its goal to prevent conflicts of interest by ensuring transparency about the source of research funding, although its focus is specifically on foreign interests and influences on research integrity.

The Industry Sponsorship Disclosure Form, commonly used when research projects are backed by corporate entities, resembles Form 700-U closely. Both forms require disclosures regarding the nature and amount of funding, investments, and potential conflicts of interest to maintain the integrity of the research process and ensure that the outcomes are not biased by the financial interests of the sponsors.

The Intellectual Property Disclosure Form, while focused on the disclosure of potentially patentable inventions and intellectual property, aligns with Form 700-U in its underlying principle of transparency. Researchers are prompted to disclose any personal financial interests that may affect research integrity, highlighting the importance of impartiality in academic research.

The Political Campaign Contributions Disclosure Form, required by candidates and political committees, shares the philosophy of transparency with Form 700-U. Though it focuses on political contributions, it ensures that financial influences on decision-making processes are public, minimizing conflicts of interest in a manner similar to that of disclosing financial interests in academic research.

The Financial Conflict of Interest (FCOI) Disclosure Form, required by many universities and research institutions, mandates investigators to disclose any significant financial interests that may affect the research. This parallels the requirements of Form 700-U, aiming to ensure that researchers' financial interests do not bias the research process or outcomes.

The Outside Employment Disclosure Form, often required by government and academic institutions, necessitates staff and faculty to disclose employment outside their primary affiliation. Similar to Form 700-U, this form is designed to identify and manage conflicts of interest, ensuring primary responsibilities are not compromised by outside financial interests.

The Personal Financial Disclosure Form, required by various state officials and employees, seeks to prevent conflicts of interest in public decision-making. Like Form 700-U, it requires the disclosure of personal investments, income, loans, and gifts, aiming to ensure public trust in the integrity of state affairs and academic research funding.

The Lobbying Disclosure Form, necessary for individuals and entities that lobby government officials, mirrors the transparency and conflict-of-interest concerns of Form 700-U. By disclosing financial interests tied to lobbying activities, it aims to maintain the integrity of public decision-making processes in a similar vein to preserving the integrity of academic research.

Dos and Don'ts

When diving into the complexities of the California 700-U form, ensuring accuracy and compliance is pivotal. Whether you're a seasoned researcher or new to the responsibilities this form entails, a clear understanding can significantly influence the integrity of your filing. Bearing this in mind, let's explore key do's and don'ts that serve as essential guidance in navigating this process seamlessly.

- Do thoroughly review the instructions provided before attempting to fill out the form. The detailed guidelines are your roadmap, offering clarity on each section's requirements.

- Do ensure you report all required financial interests, such as investments, income, loans, gifts, and travel payments related to your project's non-governmental funding. These elements are integral to the form's purpose, aiming to maintain transparency and ethics in research funding.

- Do provide accurate and complete information for each required section. In the realm of disclosure, precision is not just beneficial—it's compulsory.

- Do consult with the FPPC's toll-free helpline or visit their website if you face ambiguity or roadblocks. Resources are at your disposal, facilitating a filing experience that's both informed and in compliance.

- Do use a separate Form 700-U for each funding entity. This organizational stride ensures clarity and prevents the conflation of details between different sources.

- Do sign and date the form, certifying the trueness and completeness of the information provided under penalty of perjury. This attestation not only fulfills a legal requirement but also underscores the ethical foundation of your submission.

- Don't overlook the necessity of reporting income or financial interests that either you, your spouse or registered domestic partner, or your dependent children have in relation to the funding entity. Omission can lead to significant repercussions.

- Don't assume all travel payments are exempt from disclosure. While certain conditions apply, distinguishing between reportable and non-reportable items is crucial to maintaining compliance.

- Don't neglect the importance of providing a good faith estimate for gifts when the exact value is unknown. "Over $50" or "value unknown" are not acceptable disclosures, and precise estimates are required.

- Don't hesitate to declare divested investments. If you've sold or divested yourself of investments associated with the funding entity, this information is pertinent and requires accurate reporting.

- Don't leave sections incomplete or provide inaccurate information. Mistakes or omissions can lead to potential fines or disciplinary actions, compromising both your project and professional integrity.

Adhering to these do's and don'ts can significantly impact the seamless and successful submission of your California 700-U form. As a pivotal document in asserting financial transparency in academia, treating the completion process with care and diligence underpins not only regulatory compliance but also the integral value of research integrity. Remember, the goal is to uphold the highest standards of transparency and accountability, safeguard CZU the reputation of your research, and by extension, the institution supporting your work.

Misconceptions

There are several misconceptions about the California Form 700-U, which is essential for ensuring transparency in financial interests and income related to research projects funded by non-governmental entities. Understanding what this form entails is crucial for all who are required to file it.

- Misconception 1: Only researchers receiving direct financial compensation need to file Form 700-U. Reality: The form must be filed by anyone with principal responsibility for a research project funded in whole or part by a nongovernmental entity, regardless of the direct receipt of funds.

- Misconception 2: Investments do not need to be disclosed if they are not directly related to the research project. Reality: Any financial interest in a business entity totaling $2,000 or more must be disclosed, regardless of its direct connection to the research.

- Misconception 3: Income from any source, as long as it's under $500, is not reportable. Reality: Gross income and community property interest in a spouse’s or registered domestic partner’s gross income totaling $500 or more must be reported.

- Misconception 4: Only cash gifts are required to be reported on the form. Reality: A gift of any value $50 or more, including tickets to events or rebates/discounts not available to the general public, must be reported.

- Misconception 5: Loans under $500 do not need to be disclosed. Reality: Loans received or outstanding totaling $500 or more from a single source during the reporting period must be disclosed.

- Misconception 6: Travel payments need not be reported if they are for business purposes. Reality: Travel payments, including advances and reimbursements for travel-related expenses, are considered gifts or income and must be disclosed if they total $50 or more from a single source.

- Misconception 7: Failure to file Form 700-U has no real consequences. Reality: Failure to file or accurately report financial interests may subject the filer to fines, civil liability, and university discipline.

It is crucial for principal investigators and those with significant responsibility for research projects to familiarize themselves with the requirements of Form 700-U to ensure compliance and avoid potential penalties. Filing accurately and on time supports the transparency and integrity of research endeavors.

Key takeaways

The California 700-U Form is a Statement of Economic Interests for Principal Investigators, designed to maintain transparency in financial matters related to research funding. Here are key takeaways for completing and using this form:

- Individuals employed by the University of California (UC) or California State University (CSU) who hold principal responsibility for a research project must complete this form if the project receives any funding or support, in whole or in part, from a non-governmental entity.

- Research funding by certain nonprofit organizations may not require disclosure, as outlined in Regulation 18755, which can be reviewed on the FPPC website.

- An "Investment" refers to any financial interest in a business entity valued at $2,000 or more. Investments can include stocks, bonds, warrants, options, and interests in investment funds such as index funds or venture capital funds.

- "Income" encompasses a wide range of payments received, including salary, dividends, rent, gifts, loan forgiveness, and any pro rata share of income from a business entity or trust in which a significant interest is held.

- Loans totaling $500 or more from a single lender during the reporting period are reportable, including those made to a spouse or registered domestic partner.

- Gifts with a fair market value of $50 or more are reportable. The obligation to report a gift is based on its receipt, regardless of whether it was ultimately used by the recipient.

- Travel payments are considered gifts unless services of equal or greater value than the payments received were provided. Specific rules apply for reporting travel payments, with certain exclusions for government or employment-related travel.

- Violations for failing to file the form or report an interest could lead to civil liability, fines, or university discipline.

- The Form 700-U is a public document, and all information provided, except for certain specified exclusions, will be open to public inspection and reproduction.

These takeaways underscore the importance of comprehensive and accurate reporting on the Form 700-U to ensure compliance with California's Political Reform Act and maintain the integrity of publicly funded research.

Different PDF Templates

Change Business Address California - Detailed instructions on the form help filers avoid common mistakes and ensure that the change is processed efficiently.

California Tax Form - Includes sections for computing the tax owed based on gross premiums paid and adjustments for returned premiums or overpayments.

Reg 262 Dmv - Form REG 262 facilitates the transparent communication of transaction details, including the monetary aspects of the sale or the stipulated gift value, contributing to a well-informed transfer process.