Fill a Valid California 8454 Form

In the realm of California tax filing, the California 8454 form plays a crucial but often overlooked role, particularly for those who choose or need to opt-out of electronic filing (e-file). Enacted by California law, the mandate for individual income tax returns to be e-filed by certain preparers comes with exceptions, allowing taxpayers to assert their preference or explain the inability to comply due to reasonable cause. This form, officially titled the e-file Opt-Out Record for Individuals, serves as a formal record of such a decision, outlining the taxpayer's choice not to e-file, while also capturing essential information about both the taxpayer and the tax preparer involved. It highlights the various reasons a taxpayer might not e-file, from personal choice to technical constraints faced by the preparer. Notably, it requires signatures from the taxpayer or in the case of joint filings, from one of the spouses or registered domestic partners (RDPs) only. The form also includes a section for the tax preparer to detail the reason for not e-filing, underscoring the importance of accountability and providing a structured way to document these exceptions without needing to mail this form to the Franchise Tax Board (FTB), but rather keeping it for records. It embodies a bridge between traditional and modern filing methods, ensuring all taxpayers can navigate their filing responsibilities efficiently, whether they choose to e-file or opt-out.

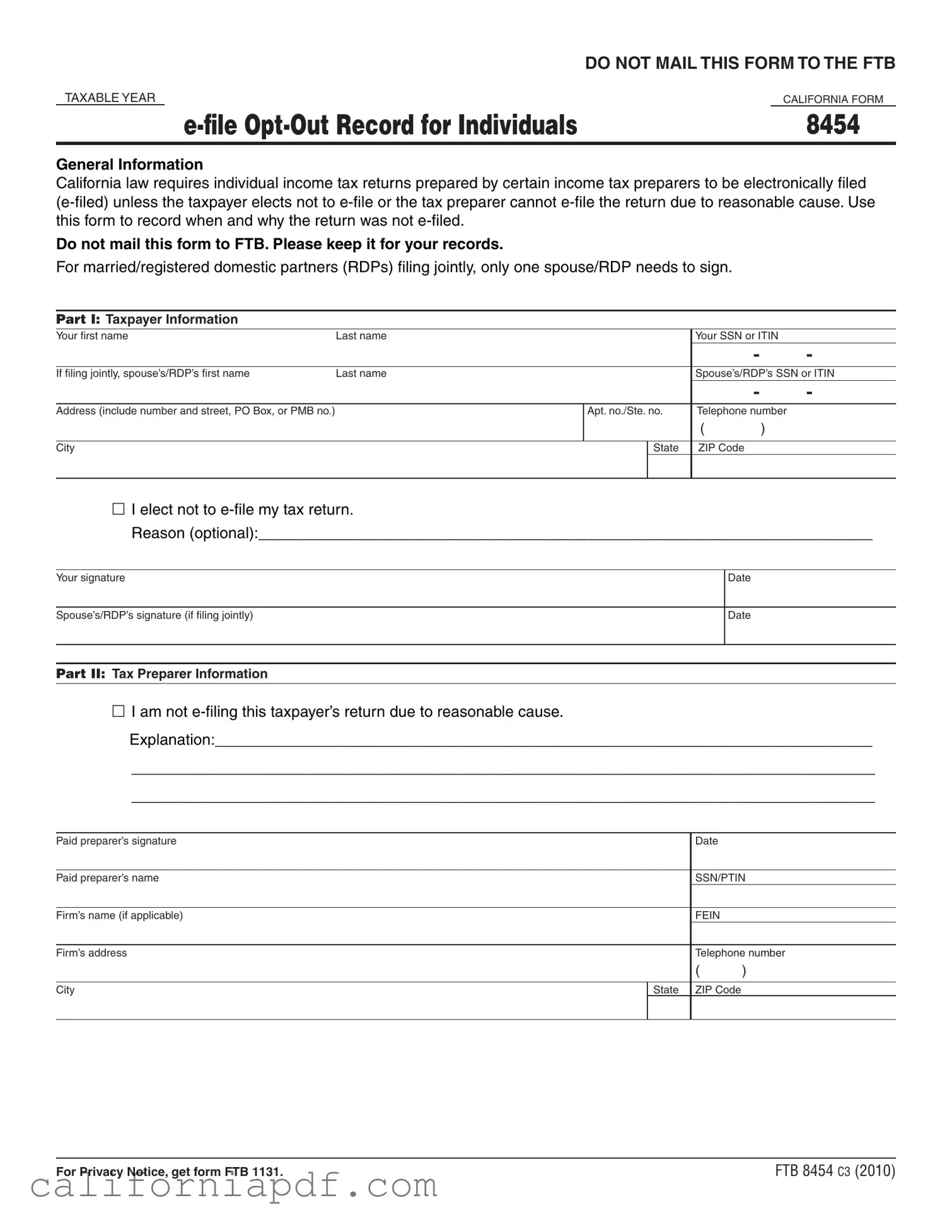

Document Example

|

|

DO NOT MAIL THIS FORM TO THE FTB |

|

TAXABLE YEAR |

|

|

CALIFORNIA FORM |

|

8454 |

||

|

|

|

|

General Information

California law requires individual income tax returns prepared by certain income tax preparers to be electronically filed

Do not mail this form to FTB. Please keep it for your records.

For married/registered domestic partners (RDPs) filing jointly, only one spouse/RDP needs to sign.

Part I: Taxpayer Information

Your first name |

Last name |

|

|

Your SSN or ITIN |

|

|

|

|

|

- |

- |

If filing jointly, spouse’s/RDP’s first name |

Last name |

|

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

|

|

- |

- |

Address (include number and street, PO Box, or PMB no.) |

|

Apt. no./Ste. no. |

Telephone number |

||

|

|

|

|

( |

) |

|

|

|

|

|

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

I elect not to

Reason (optional):_______________________________________________________________________

Your signature

Date

Spouse’s/RDP’s signature (if filing jointly)

Date

Part II: Tax Preparer Information

I am not

Explanation:____________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Paid preparer’s signature |

|

Date |

|

|

|

|

|

Paid preparer’s name |

|

SSN/PTIN |

|

|

|

|

|

Firm’s name (if applicable) |

|

FEIN |

|

|

|

|

|

Firm’s address |

|

Telephone number |

|

|

|

( |

) |

|

|

|

|

City |

State |

ZIP Code |

|

|

|

|

|

For Privacy Notice, get form FTB 1131. |

FTB 8454 C3 (2010) |

Form Breakdown

| Fact Name | Fact |

|---|---|

| Form Title | California Form 8454 e-file Opt-Out Record for Individuals |

| Purpose | Used to record the decision not to e-file an individual income tax return and the reason for that decision. |

| Governing Law | California law requires individual income tax returns prepared by certain tax preparers to be e-filed unless opted out by the taxpayer or due to reasonable cause by the preparer. |

| Who Must Sign | For married/registered domestic partners filing jointly, only one signature is required, either spouse/RDP. |

| Required Information | Taxpayer's personal information, including names, SSN or ITIN, address, and contact numbers. Option to record the reason for opting out of e-filing. |

| Tax Preparer Information | Section requiring details about the tax preparer if the return is not e-filed due to reasonable cause, including the preparer's signature, name, SSN/PTIN, firm's name, and contact details. |

| Submission | This form is not to be mailed to the Franchise Tax Board (FTB); it is to be retained for record-keeping. |

| Privacy Notice | For the Privacy Notice, individuals are directed to get form FTB 1131. |

| Form Number and Year | FTB 8454 C3 (2010) |

How to Write California 8454

Upon preparing a tax return, certain individuals in California may encounter situations where they prefer, or are required, not to file their tax return electronically. The California Form 8454 serves as an essential record for these instances, allowing taxpayers and their preparers to document the choice or necessity of opting out of electronic filing (e-filing). This documentation, while not submitted to the Franchise Tax Board (FTB), must be retained for personal records. The process of filling out this form is straightforward, provided one follows the outlined steps meticulously.

- Begin by providing Taxpayer Information in Part I.

- Enter the taxpayer’s first name and last name.

- Fill in the taxpayer’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If applicable, include the first name and last name of the spouse or Registered Domestic Partner (RDP), along with their SSN or ITIN, for jointly filed returns.

- Provide the complete address, including apartment or suite number if applicable, city, state, and ZIP code.

- Input the telephone number, including the area code.

- Check the box indicating the election not to e-file the tax return and, if desired, specify the reason for this decision in the space provided.

- Sign and date the form. For jointly filed returns, the spouse/RDP must also sign and date.

- Move to Part II: Tax Preparer Information, if a tax preparer was utilized.

- Indicate whether the return is not being e-filed due to reasonable cause by checking the appropriate box.

- Provide a detailed explanation for the decision not to e-file in the space provided.

- The paid preparer should then sign and date the form.

- Include the paid preparer’s name, Social Security Number (SSN) or Preparer Tax Identification Number (PTIN).

- If applicable, write the name of the firm, the Federal Employer Identification Number (FEIN), and the firm’s address.

- Lastly, enter the firm's telephone number, including the area code, city, state, and ZIP code.

Following the completion of California Form 845 frequently reminds taxpayers and preparers to keep a copy of this form for their records. It represents compliance with California law regarding tax filing methods and ensures accurate documentation of the rationale behind not using the e-filing option. This form plays a vital role in maintaining the transparency and integrity of the tax filing process for those involved.

Listed Questions and Answers

What is the California Form 8454?

California Form 8454, known as the e-file Opt-Out Record for Individuals, is a document used to officially record a taxpayer's decision not to e-file their individual income tax return in California. This form should be completed when a taxpayer chooses not to use electronic filing (e-filing) either by personal choice or when a tax preparer is unable to e-file due to reasonable cause. It's important to note that this form is for record-keeping purposes only and should not be mailed to the Franchise Tax Board (FTB).

Who must use the California Form 8454?

In California, certain income tax preparers are required by law to e-file individual income tax returns unless the taxpayer chooses not to or there's a reasonable cause preventing e-filing. Taxpayers who decide against e-filing, either on their own or due to their tax preparer's inability to e-file, must use the California Form 8454 to document this decision.

Do I need to mail the Form 8454 to the FTB?

No, you should not mail Form 8454 to the Franchise Tax Board. This form is meant to be kept for your records. It serves as an official record of the decision not to e-file and the reason behind it, if provided, but the FTB does not require it to be submitted with your tax return or sent to them at any time.

Can both spouses sign on one Form 8454 if filing jointly?

Yes, for married couples or registered domestic partners (RDPs) who file jointly, only one of the individuals needs to sign the Form 8454. This signature indicates that both parties have elected not to e-file their joint income tax return.

What information is required on the Form 8454?

The Form 8454 requires the following information:

- Taxpayer's first and last name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- If filing jointly, the spouse's/RDP's first and last name, and their SSN or ITIN.

- Address, including number and street, P.O. Box, or PMB number, apartment or suite number, telephone number, city, state, and ZIP Code.

- A checkbox to elect not to e-file and an optional area to state the reason for this decision.

- Taxpayer's signature and date, and spouse’s/RDP’s signature and date if filing jointly.

- Tax preparer’s section including a checkbox if not e-filing due to reasonable cause, an explanation area, and the preparer's signature, date, SSN/PTIN, firm’s name, firm’s Federal Employer Identification Number (FEIN), and address.

Is providing a reason for opting out of e-filing mandatory?

No, providing a reason for not choosing to e-file on the California Form 8454 is optional. Taxpayers can simply check the box to elect not to e-file without needing to provide an explanation. The form still needs to be signed and dated to be considered complete.

What does "reasonable cause" mean for tax preparers who can't e-file?

A "reasonable cause" for tax preparers not to e-file a return refers to situations where there are obstacles or specific circumstances that prevent them from submitting a return electronically. This could include technical issues, the unavailability of required electronic forms, or other valid reasons. Tax preparers are expected to provide a detailed explanation of the cause on the Form 8454.

Do I keep a copy of the Form 8454 with my tax records?

Yes, after filling out the Form 8454, it's crucial to keep it with your tax records. This form serves as proof of your election not to e-file and, if ever questioned, can help verify your compliance with the filing requirements.

Where can I get the California Form 8454?

You can obtain California Form 8454 from the Franchise Tax Board's official website. The form may also be available through a professional tax preparer or tax preparation software. Always ensure you're using the most current version of the form to stay in compliance with the latest tax filing regulations.

Common mistakes

Filling out the California Form 8454, "e-file Opt-Out Record for Individuals," requires attention to detail to ensure accuracy and compliance. However, some common mistakes can occur during this process. Recognizing and avoiding these errors can help in maintaining the integrity of the filing process.

-

Not keeping the form for personal records. As explicitly mentioned, this form should not be mailed to the Franchise Tax Board (FTB) but retained by the taxpayer. A common oversight is misplacing or not keeping a copy of Form 8454, which could be problematic if the FTB requests documentation proving the rationale behind opting out of electronic filing.

-

Incorrectly filling out taxpayer information. The first section requires detailed taxpayer information, including Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as similar information for a spouse or registered domestic partner (RDP) if filing jointly. Mistakes in this section, such as inaccuracies in the SSN or ITIN, can lead to issues in taxpayer identification and processing.

-

Forgetting to indicate the reason for not e-filing. While mentioning the reason for opting out of e-filing is optional, providing a clear and valid reason can be crucial for personal records, especially if the need to substantiate the decision arises in the future.

-

Omission of signatures. The form requires the signature of the taxpayer and, if filing jointly, the spouse's/RDP's signature as well. Additionally, if a tax preparer is involved and the decision not to e-file is due to reasonable cause, their signature along with an explanation is necessary. Neglecting these signatures can render the form incomplete.

Understanding the significance of each section of Form 8455 and carefully avoiding these mistakes can help ensure the filing process is smooth and compliant with California tax laws. Always review each part of the form before finalizing to avoid common pitfalls.

Documents used along the form

When handling tax matters in California, the Form 8454, also known as the e-file Opt-Out Record for Individuals, plays a vital role for those who choose not to e-file their tax returns. Alongside this form, there are several additional documents and forms that individuals may need to complete or be aware of during the tax preparation and submission process. Each document serves its unique purpose, assisting taxpayers and tax preparers in ensuring a comprehensive and compliant submission to the Franchise Tax Board (FTB).

- Form 540 - California Resident Income Tax Return: This is the standard form used by California residents to file their state income tax return. It collects information on the taxpayer's income, deductions, and credits to calculate the state tax owed or the refund due.

- Form 540NR - California Nonresident or Part-Year Resident Income Tax Return: For individuals who are not full-year residents of California but have earned income from California sources, Form 540NR is required. This form addresses income, adjustments, and credits specific to nonresidents or part-year residents of California.

- Schedule CA (540) - California Adjustments - Residents: This schedule is an attachment to Form 540. It's used by taxpayers to make adjustments to their federal adjusted gross income and federal itemized deductions. These adjustments are necessary because California tax law differs from federal tax law in certain areas.

- Schedule D (540) - California Capital Gain or Loss Adjustment: Taxpayers who need to report capital gains or losses that differ from their federal tax return will use Schedule D (540). This form is especially relevant for individuals who have sold property or made investments that have realized a capital gain or loss during the tax year.

Understanding the purpose and correct usage of these forms ensures that taxpayers can accurately fulfill their tax obligations while maximizing their entitlements under California law. Each form contributes to the comprehensive assessment of an individual's tax responsibilities and benefits.

Similar forms

The California 8454 form, also known as the e-file Opt-Out Record for Individuals, has similarities with various other tax-related documents in the United States. One such document is the IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. Both forms involve individual tax filings, but while the 8454 form is used for opting out of electronic filing, the 4868 form is used for requesting additional time to file a tax return. They share the purpose of modifying the standard tax filing process based on specific taxpayer needs or circumstances.

Another similar document is the IRS Form 8948, Preparer Explanation for Not Filing Electronically. This form, like the California 8454, is utilized by tax preparers to explain why a tax return was not filed electronically, despite the general expectation or requirement to e-file. Both forms ensure transparency and compliance with respective electronic filing mandates, highlighting scenarios where exceptions to e-filing are necessary and justified.

The W-9 form, Request for Taxpayer Identification Number and Certification, shares similarities with the 8454 form in that both require taxpayer identification information, such as Social Security Numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs). While the W-9 is used primarily for reporting income, payments, and real estate transactions, the 8454 documents the decision to opt-out of e-filing. Each form plays a critical role in the tax filing and reporting process, ensuring accurate identification of taxpayers.

The IRS Form 8879, IRS e-file Signature Authorization, is another document that intersects in purpose with the California 8454 form. Form 8879 is used when taxpayers authorize an electronic return originator to e-file their return with an electronic signature. In contrast, Form 8454 is used when opting out of electronic filing. Both forms deal with the manner and method by which tax returns are submitted, focusing on taxpayer preferences and requirements for e-filing or opting out respectively.

The IRS Form 1040, U.S. Individual Income Tax Return, is the cornerstone document for individual tax filing in the United States, to which the California 8454 form is indirectly related. While the Form 1040 is the primary vehicle for reporting income, deductions, credits, and taxes owed or refunded, the 8454 form serves as a supplementary record when a taxpayer chooses not to file this information electronically. The relationship between these forms underscores the flexibility provided to taxpayers in how they submit their tax returns.

Similarly, the Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship), and the 8454 form have a contextual connection. Business owners use Schedule C to report the income and expenses of their sole proprietorship to the IRS. When a sole proprietor opts out of e-filing their personal tax return, which includes their Schedule C, they would document this decision on the 8454 form. Both forms cater to specific taxpayer circumstances, ensuring that individual needs are met within the tax filing process.

The IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, is akin to the 8454 form in the context of filing extensions. While Form 7004 pertains to businesses seeking more time to file their tax returns, the 8454 form addresses individual taxpayers’ choice to opt out of electronically filing their returns. Each form facilitates a deviation from standard filing deadlines and methods, albeit for different reasons and taxpayer categories.

Lastly, the California Form 3500, Exemption Application, bears resemblance to the 8454 form in that both are specific to California taxpayers and deal with exceptions to standard procedures. Form 3500 is used by organizations seeking tax-exempt status in California, while Form 8454 documents an individual's choice to opt out of e-filing their tax returns. Both forms highlight the diversity of needs among California taxpayers and the mechanisms in place to address these special circumstances.

Dos and Don'ts

Filling out the California Form 8454, also known as the e-file Opt-Out Record for Individuals, is a crucial step for those who choose not to electronically file their tax returns. The importance of accurately completing this form cannot be overstated, as it helps ensure compliance with state regulations and maintains the integrity of one’s tax records. Below are key dos and don'ts to keep in mind when filling out this form:

Do:

- Review the instructions carefully before you start filling out the form to ensure you understand each section.

- Print legibly in black or blue ink to ensure that all the information is readable and there is no misunderstanding.

- Provide complete and accurate information for both the taxpayer and tax preparer sections to avoid any processing delays.

- Specify the reason for opting out of e-filing in the designated section to comply with the requirement for a valid explanation.

- Ensure that the taxpayer and, if applicable, the spouse or Registered Domestic Partner (RDP), sign and date the form. This is crucial for the form to be considered valid.

- Keep a copy of the completed form for your records. It’s important to have a proof of your opt-out choice and for future reference.

- Seek advice from a professional if you are unsure about any part of the form. It's better to get help than to make a mistake.

Don't:

- Do not rush through the form without understanding each requirement. Every section has its importance.

- Do not leave mandatory fields blank, as incomplete forms may be considered invalid.

- Do not mail this form to the FTB (Franchise Tax Board), as it is intended for your records only.

- Do not use pencil or markers as they can smudge or be unreadable, potentially causing unnecessary complications.

- Do not forget to indicate your decision to opt-out of e-filing in the designated part of the form. This is the form's primary purpose.

- Do not neglect the tax preparer’s section if your return is being prepared by a professional. Their information and reason for not e-filing must also be provided.

- Do not ignore the Privacy Notice, which can be obtained with Form FTB 1131. It contains important information about your privacy rights.

Misconceptions

Misconceptions about the California 8454 form are common, stemming from its specific purpose and requirements. Here’s a breakdown to clarify these misunderstandings:

- "The California 8454 form must be mailed to the Franchise Tax Board (FTB)." This is incorrect. The form clearly states, "Do not mail this form to FTB." It is designed to be kept for your records, documenting the reason a tax return was not filed electronically.

- "Filing Form 8454 is optional for taxpayers." While this statement might seem true at first glance, the form serves a crucial purpose for those who decide not to e-file their tax returns despite the California law requiring e-filing in many cases. Hence, if a taxpayer opts out of e-filing, this form becomes necessary to document that choice.

- "Tax preparers don’t need to complete a part of the form." In fact, Part II of the form is specifically designated for tax preparers, asking for their information, including why they are not e-filing the taxpayer’s return due to reasonable cause.

- "Both spouses or registered domestic partners must sign the form if filing jointly." This is a misconception. The instructions clearly stipulate that only one spouse or registered domestic partner needs to sign if filing jointly, simplifying the process for couples.

- "The reason for not e-filing must be disclosed on the form." While the form provides space to explain why the return was not electronically filed, it explicitly states that stating a reason is optional, giving taxpayers freedom not to disclose a reason if they choose not to.

- "Any tax professional can assist with or disregard the need for Form 8454." This is not the case. Only certain income tax preparers are subject to the e-filing mandate from which taxpayers can opt-out using this form. Furthermore, tax preparers must have reasonable cause not to e-file a return, aligning with the law’s requirements and ethical tax preparation practices.

Understanding these key points about the California 8454 Form is vital for taxpayers and tax preparers alike to adhere to state requirements and ensure proper tax filing procedures are followed.

Key takeaways

The California Form 8454, titled "e-file Opt-Out Record for Individuals," serves an important function in the state's tax filing process. Below are key takeaways regarding its completion and utilization:

- The purpose of Form 8454 is to document the taxpayer's decision to opt-out of electronically filing (e-filing) their income tax return, along with the reason behind this choice.

- California law mandates the e-filing of individual income tax returns by certain tax preparers unless the taxpayer decides against e-filing or the preparer is unable to e-file due to reasonable cause.

- Form 8454 does not need to be mailed to the Franchise Tax Board (FTB); instead, it should be retained for the taxpayer's records.

- For couples who are married or registered domestic partners filing jointly, only one signature is required on the form, either from one spouse or one registered domestic partner.

- The form includes sections for both taxpayer information and tax preparer information, highlighting the collaborative aspect of tax filing between the taxpayer and their preparer.

- Taxpayers have the option to provide a reason for choosing not to e-file, though providing a reason is optional.

- In cases where a tax preparer indicates they are not e-filing due to reasonable cause, an explanation of the circumstances is required on the form.

- The form includes a space for privacy notice information, directing users to Form FTB 1131 for more details on privacy rights and protections.

This straightforward form is a critical document for those electing out of the e-filing process, requiring careful completion to ensure compliance with California tax laws.

Different PDF Templates

California Department of Health Care Services - Instructions included in the form stress the importance of submitting a complete and accurate Medi-Cal Disclosure Statement.

How to Pay My Llc Fee - When filling out Form FTB 3588, verify preprinted information such as LLC Name, DBA, address, and payment amount is correct before submission.