Fill a Valid California Affidavit of Death of a Trustee Form

When a trustee passes away, navigating the procedural requirements to legally transfer control and ownership of assets held in a trust can be complex and emotionally taxing. In California, the Affidittal Death of a Trustee form serves as a crucial document in this process. This form, specifically designed to streamline the transition, must be filled out accurately and filed with the appropriate county recorder's office. It not only verifies the trustee's death but also initiates the official transfer of responsibilities and assets to the successor trustee. The document plays a fundamental role in ensuring that the assets within the trust are managed and distributed according to the terms laid out by the deceased, without the need for a lengthy probate process. By understanding and correctly utilizing the Affidavit of Death of a Trustee, the successor trustee can navigate these challenges with more ease and less stress, ensuring that the trust's administration continues smoothly and in accordance with the law.

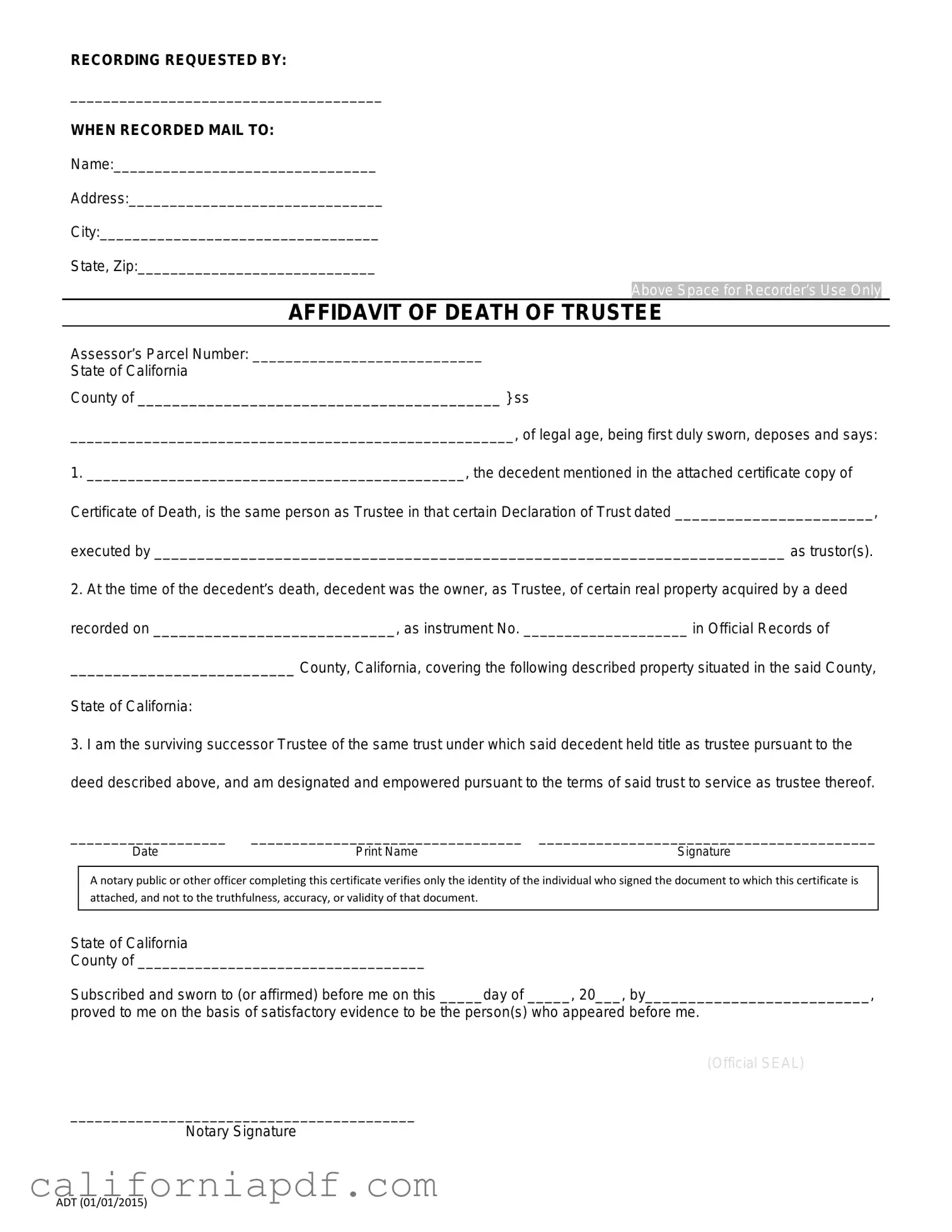

Document Example

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Form Breakdown

| Fact | Description |

|---|---|

| Purpose | Used to officially notify that a trustee of a trust has passed away and to identify the successor trustee. |

| Governing Law | California Probate Code |

| Recording Requirement | Must be recorded with the county recorder's office where the real property is located. |

| Attachments Needed | A certified copy of the death certificate of the deceased trustee must be attached. |

How to Write California Affidavit of Death of a Trustee

When a trustee of a trust passes away in California, it's necessary to officially notify relevant parties and institutions about this change. This process involves filling out the California Affidaction of Death of a Trustee form. This document serves as a formal declaration of the trustee's death and is essential for transitioning control of assets held in the trust. The steps below guide you through filling out this form, ensuring that the transition process is conducted smoothly and in compliance with California law.

- Start by gathering the necessary documents, including the death certificate of the deceased trustee and the trust document. You will need information from these documents to complete the form.

- Enter the full legal name of the deceased trustee at the top of the form where indicated.

- Fill in the date of death exactly as it appears on the death certificate.

- Provide the legal name of the successor trustee who will assume responsibility for the trust. This information should be in accordance with the terms of the trust document.

- Include the legal description of the real property held in the trust. This description can often be found in the deed by which the property was transferred into the trust. If unsure, you may need to consult with a legal professional.

- Input the assessor's parcel number (APN) of the real property, which is a unique number assigned to parcels of real property by the tax assessor's office for tax purposes.

- Sign the form in front of a notary public. Most forms require notarization, which serves as an anti-fraud measure and confirms that you are the person completing the form.

- Attach a certified copy of the death certificate to the form. This is a crucial step as it provides official evidence of the trustee's death.

- File the completed form and attached death certificate with the county recorder's office in the county where the real property is located. Filing fees may apply, so it's advisable to contact the recorder's office ahead of time to confirm the fee amount and acceptable payment methods.

After submitting the Affidavit of Death of a Trustee form, the record of the deceased trustee's death becomes part of the official property records. This action facilitates the transfer of control and management of the trust's assets to the successor trustee. It is also a crucial step in ensuring that the transition adheres to the legal and procedural requirements of the state of California.

Listed Questions and Answers

What is the California Affidavit of Death of a Trustee?

The California Affididavit of Death of a Trustee is a document used to officially state that a trustee of a trust has passed away. This document is necessary to facilitate the transfer of control over the trust's assets to the successor trustee, as outlined by the terms of the trust agreement.

Who needs to file an Affidavit of Death of a Trustee?

When a trustee dies, the person or entity named as the successor trustee in the trust document is responsible for filing the Affidavit of Death of a Trustee. It’s an essential step in the process of managing and reallocating the assets held in the trust according to the deceased trustee’s wishes.

What information is needed to complete the form?

To properly complete the Affidavit of Death of a Trustee, you'll need several key pieces of information, including:

- The deceased trustee's full name and date of death

- A copy of the death certificate

- The legal description of any real property held in the trust

- The name and details of the successor trustee

- Details about the trust, including its name and the date it was created

Where should the Affidavit of Death of a Trustee be filed?

Once completed, the Affidavit of Death of a Trustee needs to be filed with the county recorder’s office in the county where the real property held by the trust is located. This officially records the change in trusteeship and is necessary for the successor trustee to gain control over the property.

Is there a filing fee for the affidavit?

Yes, there is generally a filing fee required to record the Affididavit of Death of a Trustee with the county recorder’s office. The amount of the fee can vary by county, so it's a good idea to contact the local recorder's office directly for the current fee schedule.

How does this affidavit affect property within the trust?

The filing of the Affidavit of Death of a Trustee is a vital step in the process of transferring control over real property from the deceased trustee to the successor trustee. It allows the successor trustee to manage, sell, or distribute the property according to the terms of the trust. Without this affidavit, the successor trustee may not have legal authority over the trust’s assets.

Can an Affidavit of Death of a Trustee be contested?

Yes, like most legal documents, an Affididavit of Death of a Trustee can be contested. If someone believes the affidavit was filed in error or that the successor trustee does not have a legitimate claim, they can challenge the affidavit in court. It's always recommended to seek legal advice if facing a contested affidavit.

What happens after the affidavit is filed?

After the Affidavit of Death of a Trustee is filed with the county recorder’s office, the successor trustee becomes officially recognized as the new trustee. This enables them to take over management of the trust's assets. The successor trustee may then take further actions, such as transferring property titles and assets to beneficiaries, as dictated by the trust document.

Common mistakes

When dealing with the California Affidavit of Death of a Trustee form, it's essential to approach this document with great attention to detail. This form serves a crucial role in transferring property held in a trust following the trustee's death. Unfortunately, mistakes can and do occur, leading to delays and sometimes legal complications. Here are seven common errors people often make when completing this form:

-

Not verifying the correct form is used: There are various forms for different circumstances. Ensuring the exact form that suits the specific situation is critical.

-

Incorrect or incomplete information about the deceased trustee: Every detail about the deceased trustee needs to be accurate and complete, including their full legal name and date of death.

-

Failure to attach a certified copy of the death certificate: A common oversight is not attaching a certified copy of the death certificate or attaching a photocopy, which is not acceptable.

-

Incorrectly identifying the successor trustee: If the form misidentifies the person taking over as trustee or spells their name wrong, it can create confusion and delays.

-

Omitting relevant legal descriptions of the property: Accurate and complete legal descriptions of the property or properties being transferred are crucial. A simple address may not suffice.

-

Overlooking the need for notarization: The form requires notarization to validate the identity of the individual completing it. Skipping this step can invalidate the form.

-

Forgetting to file the form with the appropriate county recorder's office: Once completed, the form needs to be filed with the county recorder's office where the property is located. Failure to do so means the property transfer is not officially recorded.

By avoiding these common mistakes, individuals can ensure a smoother process in transferring property following the death of a trustee. It's always advisable to review the completed form carefully and consult with a legal professional if there are any uncertainties.

Documents used along the form

When dealing with the aftermath of a trustee's death in California, the California Affidavit of Death of a Trustee is a crucial document, but it is often just one of several documents needed to completely handle and settle the deceased trustee's affairs. These documents serve various purposes, from validating the death to ensuring the proper transfer of assets and settling any financial or legal matters associated with the trust or the deceased's estate. Here's an overview of other forms and documents frequently used along with the California Affidavit of Death of a Trustee.

- Certificate of Death: This government-issued document officially confirms the death. It's crucial for legal and financial processes following a death, including transferring the deceased's assets out of their name.

- Trust Document: The original or a certified copy of the trust document is necessary to determine the successor trustee and the instructions for asset distribution upon the trustee's death.

- Successor Trustee Acceptance: This document is a formal acceptance of duty, signed by the person or entity taking over as trustee following the original trustee's death.

- Property Deed: When real estate is involved, a new deed might be required to transfer property as directed by the trust or upon the trustee's death.

- Notice of Trust Administration: This notice is sent to all heirs and beneficiaries informing them of the trustee's death and the commencement of trust administration, potentially mitigating future disputes over the estate.

- Tax Forms: Several tax documents might be necessary, including final income tax returns for the deceased, estate tax returns, and forms related to any income generated by the trust.

- Inventory and Appraisal Forms: These are used to list and value all assets held in the trust at the time of the trustee's death, a necessary step for both tax purposes and asset distribution.

- Claim Forms for Death Benefits: If the deceased was entitled to any benefits, like life insurance or retirement funds, claim forms would need to be submitted to collect these benefits.

- Bank and Brokerage Account Forms:

Each of these documents plays a vital role in the seamless transition of responsibilities and the proper settlement of the deceased trustee's estate. Handling all relevant documents promptly and correctly ensures that the trust's assets are managed and distributed according to the deceased's wishes, minimizing any potential for conflict among beneficiaries or heirs.

Similar forms

The California Affidavit of Death of a Trustee form bears similarities to the Affidavit of Death of a Joint Tenant. Both documents serve the purpose of officially recognizing the death of an individual who holds a significant title or interest in property. While the Affidavit of Death of a Trustee is used to transfer responsibility from a deceased trustee to the successor trustee, the Affidavit of Death of a Joint Tenant is employed to convey the deceased joint tenant's interest in a property to the surviving joint tenants. Both documents require a certified death certificate and are essential in the process of legally transferring property interests upon death.

Similar to the aforementioned affidavit is the Affidavit of Death of a Spouse, which is utilized when a married individual passes away, and there's a need to transfer ownership of assets held in the deceased spouse's name. This document, like the Affidavit of Death of a Trustee, focuses on establishing the death of an individual for the purpose of managing and reallocating assets. It's critical in situations where the deceased spouse owned property that needs to be legally passed on to the surviving spouse or other beneficiaries.

The Declaration of Trust is another document that shares commonalities with the California Affidavit of Death of a Trustee. While the Declaration of Trust is used to establish a trust, naming the trustees and beneficiaries, and outlining the terms, the Affidavit of Death of a Trustee is necessary upon the death of one of those trustees. Both documents are integral to the management and control of trust assets, ensuring that the trustees' responsibilities are clearly defined and transferred appropriately upon death.

The Successor Trustee Acceptance Form is directly related to the Affidavit of Death of a Trustee, as it serves as the formal acceptance of the role of trustee by the successor following the death of the original trustee. This form is a critical next step after the affidavit, providing legal proof that the successor trustee is willing and eligible to take on the responsibilities outlined in the trust documents. It helps in the smooth transition of control over the trust's assets, ensuring that the trust's terms are carried out as intended.

Lastly, the Change of Ownership Form, often required by county recorders or tax assessors, is similar to the California Affidavit of Death of a Trustee because it officially records a change in the legal ownership of property. After the death of a trustee and the subsequent transfer of their role and responsibilities to a successor, this form would be necessary to document the change in ownership of any real property held in the trust. It ensures that property records are updated to reflect the current trustees and avoids potential disputes or confusion regarding property ownership.

Dos and Don'ts

When dealing with the California Affidavit of Death of a Trustee form, understanding the correct process is crucial. This legal document plays a significant role in managing the transition of property held in a trust following the death of a trustee. Given its importance, here are some dos and don’ts to help guide you through filling out this form accurately and effectively.

- Do carefully read all instructions provided with the form before starting. Accuracy in following guidelines is essential to avoid complications.

- Do verify the document’s specific requirements with your county’s recorder office, as they may vary locally.

- Do print clearly using black ink, as this ensures the form is legible and accepted by the recorder’s office.

- Do include all necessary attachments, such as a certified copy of the death certificate and legal descriptions of the property.

- Don’t fill out the form in haste. Take your time to ensure all information is correct and complete.

- Don’t guess on any details. If you’re unsure about any part of the form, it’s better to seek clarification from a legal expert or the county recorder’s office.

- Don’t use white-out or make alterations on the form. Mistakes should be addressed by filling out a new form to maintain a clean and professional document presentation.

- Don’t forget to sign and date the form in the presence of a notary, as this step is required for the affidavit to be legally binding.

Adhering to these guidelines will not only help in the smooth processing of your document but also safeguard the interests of all parties involved. It’s always a good practice to consult with a legal advisor to ensure compliance with the latest laws and regulations pertaining to the affidavit of death of a trustee in California.

Misconceptions

The California Affidavit of Death of a Trustee form plays a crucial role in the seamless transition of property ownership when a Trustee passes away. Despite its importance, several misconceptions exist about its purpose and use. Understanding the truth behind these misconceptions enables individuals to effectively manage estate planning and transitions.

It's Only Necessary for Large Estates: Many people believe that this form is only required for the transfer of large estates. However, the size of the estate does not dictate the need for this document. It serves as a legal tool to facilitate the transfer of property held in a trust, regardless of the estate's value.

The Process is Complicated: There is a common misconception that filing an Affidavit of Death of a Trustee is a complex and tedious process. In reality, the form is straightforward. Completing it correctly and submitting it to the relevant authority, usually the county recorder's office, can be done efficiently with proper guidance.

Legal Representation is Always Required: While legal advice can be invaluable, especially in complex situations, it's not always necessary to hire an attorney to complete this form. Many individuals successfully navigate the process with self-help resources or minimal legal guidance.

The Form Transfers All Types of Property: Another common misunderstanding is that the Affidavit of Death of a Trustee allows for the transfer of all types of property held within a trust. In fact, this document is specifically used to transfer title of real property. Other assets held in the trust may require additional steps and documentation for transfer.

It's the Only Document Needed: Believing that the Affidavit of Death of a Trustee is the sole document needed to effectuate the transfer of trust property is a misconception. Often, other documents, such as a new deed or a certificate of trust, are also required to complete the process and ensure the accurate transfer of ownership.

Dispelling these misconceptions about the California Affidavit of Death of a Trustee form is essential for anyone involved in managing a trust or estate planning. Accurate knowledge and understanding of the form’s purpose, requirements, and process help in executing a trustee's duties effectively and ensuring a smooth transition of property ownership.

Key takeaways

Filling out and using the California Affidavit of Death of a Trustee form is a critical step in managing the seamless transition of property upon the death of a trustee. This document serves as a formal notification of the trustee's death and is essential for the lawful transfer of control and ownership within a trust. Here are five key takeaways to understand when dealing with this specific document:

- The form must be completed accurately and in detail, ensuring that all information about the deceased trustee and the successor trustee is thoroughly documented. This includes full legal names, dates, and the specific property or assets under the trust.

- Legal documentation proving the death of the trustee, such as a certified death certificate, must accompany the affidavit when it is submitted for filing. This evidence is mandatory for the document to be considered valid and enforceable.

- It is essential to include a complete legal description of the property being transferred. This often requires referencing the deed under which the trustee held the property. Precision in detailing the property ensures that the transfer process is conducted without legal ambiguities.

- The completed form needs to be notarized. A notary public must witness the signing of the affidavit, verifying the identity of the individual completing the form. The notarization process adds a layer of legal acknowledgment and authentication to the document.

- Once notarized, the affidavit, along with any other required documentation, must be filed with the appropriate county recorder’s office. This filing is a public declaration of the transfer of trusteeship and the property affected, making it a part of the public record. It is crucial for the successor trustee to ensure that this step is completed promptly to avoid potential legal complications.

Understanding and following these guidelines can help individuals navigate the complexities of transferring trusteeship and property. It’s important for successor trustees to approach this process with diligence and attention to detail, as proper completion of the California Affidavit of Death of a Trustee form is key to a smooth and lawful transition.

Different PDF Templates

California Gypsy Moth Checklist - This legal mandate aims to protect U.S. forestry and agriculture from the destructive impact of the gypsy moth, an invasive species.

California Form 541 Instructions - The preparer's declaration section underscores the fiduciary's responsibility for the accuracy of the tax payment allocation to beneficiaries.