Fill a Valid California Balance Sheet Form

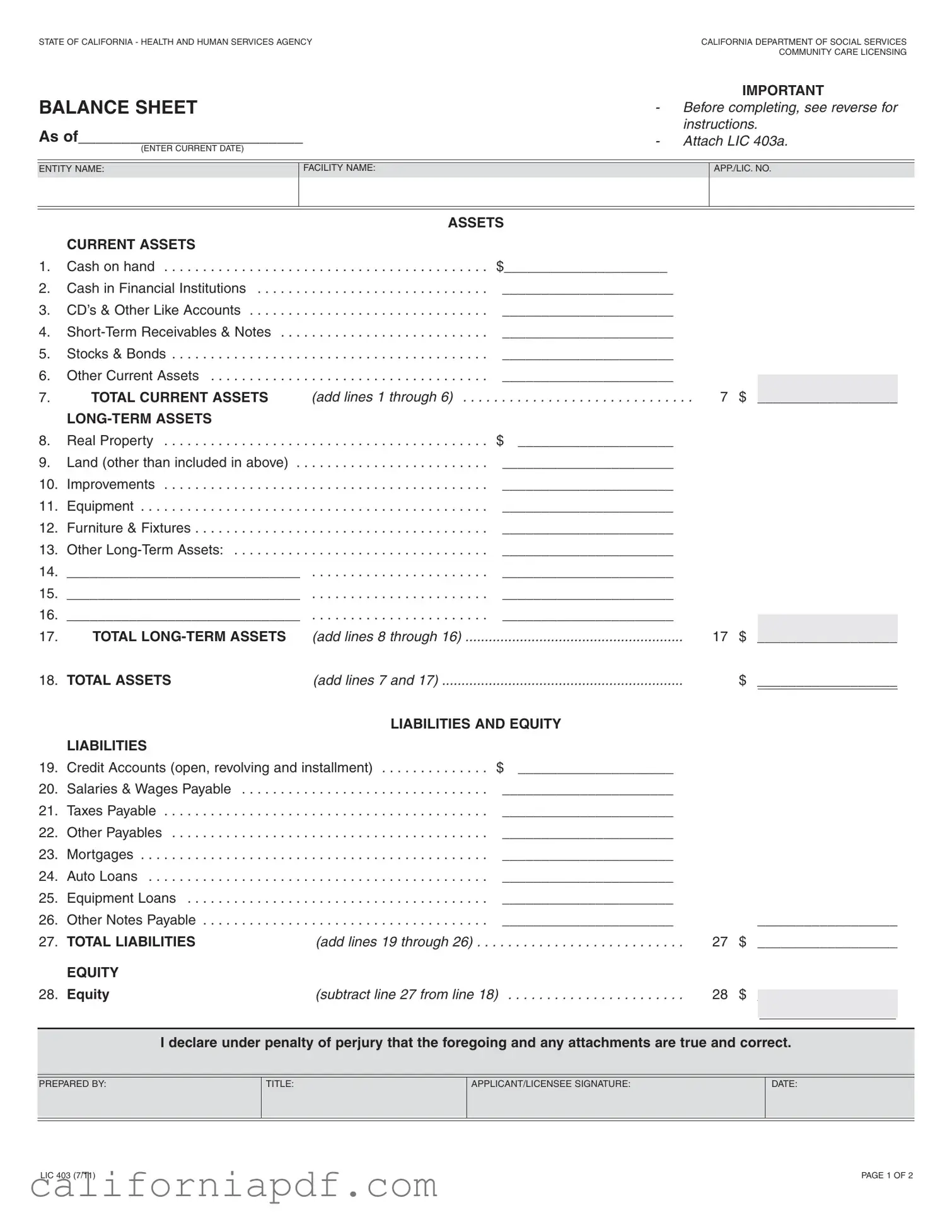

The California Balance Sheet Form, known formally as LIC 403, is a crucial document designed by the State of California's Health and Human Services Agency, specifically the California Department of Social Services' Community Care Licensing division. This form serves as a comprehensive presentation of an entity's financial position at a given time, requiring detailed reporting of both assets and liabilities. Entities, whether they are sole proprietorships, partnerships, or corporations, must submit this form alongside the LIC 403a, a supplemental schedule that helps in gathering detailed financial information. This detailed gathering extends beyond the operational aspects of a care facility to include personal financial data for sole proprietors and each general partner within partnerships. The form categorizes assets into current and long-term, with specifics ranging from cash on hand to real property and equipment. Liabilities are equally detailed, covering everything from credit accounts to mortgages and other notes payable. The final section calculates equity, emphasizing the importance of accuracy in reporting, as the information submitted is subject to verification and essential for compliance. Signing and dating the form attests to the correctness of the information provided, a mandatory step that solidifies the document's validity.

Document Example

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY |

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES |

|

COMMUNITY CARE LICENSING |

|

|

|

|

IMPORTANT |

|

BALANCE SHEET |

- |

Before completing, see reverse for |

|||

As of__________________________ |

|

instructions. |

|||

- |

Attach LIC 403a. |

||||

(ENTER CURRENT DATE) |

|||||

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

ENTITY NAME: |

|

FACILITY NAME: |

|

APP./LIC. NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

|

1. |

Cash on hand |

. . . . . . . . . . . . . . . . . . . . . . . |

$_____________________ |

|

|

|

|

|

2. |

Cash in Financial Institutions |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

3. |

CD’s & Other Like Accounts |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

4. |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

||

5. |

Stocks & Bonds |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

6. |

Other Current Assets |

|

______________________ |

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

||||

7. |

TOTAL CURRENT ASSETS |

(add lines 1 through 6) . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . . 7 |

$ |

|

__________________ |

|

|

|

|

|

|

|

|

|

|

8. |

Real Property |

. . . . . . . . . . . . . . . . . . . . . . . |

$ |

____________________ |

|

|

|

|

9. |

Land (other than included in above) . . |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

10. |

Improvements |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

11. |

Equipment |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

12. |

Furniture & Fixtures |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

13. |

Other |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

14. |

______________________________ |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

15. |

______________________________ |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

16. |

______________________________ |

|

______________________ |

|

|

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

||||

17. |

TOTAL |

(add lines 8 through 16) |

17 |

$ |

|

__________________ |

|

|

18. |

TOTAL ASSETS |

(add lines 7 and 17) |

|

$ |

__________________ |

|

||

|

|

LIABILITIES AND EQUITY |

|

|

|

|

||

|

LIABILITIES |

|

|

|

|

|

|

|

19. |

Credit Accounts (open, revolving and installment) |

$ |

____________________ |

|

|

|

|

|

20. |

Salaries & Wages Payable |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

21. |

Taxes Payable |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

22. |

Other Payables |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

23. |

Mortgages |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

24. |

Auto Loans |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

25. |

Equipment Loans |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

|

|

|

|

26. |

Other Notes Payable |

. . . . . . . . . . . . . . . . . . . . . . . |

______________________ |

|

__________________ |

|

||

27. |

TOTAL LIABILITIES |

(add lines 19 through 26) |

. . . . . . . . . . . . . . . . . . . . . . 27 |

$ |

__________________ |

|

||

|

EQUITY |

|

|

|

|

|

|

|

28. |

Equity |

(subtract line 27 from line 18) |

28 |

$ |

|

|

|

|

__________________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I declare under penalty of perjury that the foregoing and any attachments are true and correct.

PREPARED BY:

TITLE:

APPLICANT/LICENSEE SIGNATURE:

DATE:

LIC 403 (7/11) |

PAGE 1 OF 2 |

BALANCE SHEET

GENERAL INFORMATION: To complete the Balance Sheet LIC 403, first complete the LIC 403a, Balance Sheet Supplemental Schedule. The LIC 403a is a worksheet to be used in compiling the detailed information which is then totaled and displayed on the Balance Sheet, LIC 403. Submit the LIC 403a attached to the LIC 403.

Each applicant/licensee (sole proprietorship, partnership or corporation) must submit a LIC 403, and a LIC 403a. Information to be reported is to disclose all the entity’s assets and liabilities, not just those related to the operation of the care facility.

FOR SOLE PROPRIETORSHIPS - For a facility operated by a husband or wife individually, information reported must pertain to both, such as individual credit card balances which are listed either solely under one name or under both the husband and wife, and which may be unrelated to the facility’s actual operation or the person who will actually operate the facility.

FOR GENERAL PARTNERS - In addition to financial statements for the partnership, each general partner must file a personal Balance Sheet, LIC 403, accompanied with a LIC 403a, to reflect their individual financial position.

Information shown on the LIC 403 and LIC 403a is subject to verification. Additional documentation may be requested to support any or all of the Balance Sheet amounts reported.

INSTRUCTIONS: Include the required information at the top of this form to identify: 1) current date for the Balance Sheet, 2) entity name, (this is the sole proprietorship, partner, partnership or corporate name for whom the information is being reported) 3) facility name and 4) application/license number. Transfer the totals from the worksheet LIC 403a to the corresponding lines on the LIC 403. Below is a brief description of the type of information to be contained on each line.

ASSETS

Line #

1.Cash on hand, not deposited in a financial institution.

2.Cash in checking accounts.

3.CD’s, savings account(s) and all other like accounts.

4.Revenues receivable and all

5.Stocks, bonds or other securities.

6.Other current assets readily converted to cash, such as the cash surrender value of whole life insurance policies.

7.Add the amounts on lines 1 through 6 and enter here.

8.Real property is buildings, land and structures.

9.Land (developed or undeveloped) not already included on line 8.

10.Improvements to real property or leasehold improvements as appropriate.

11.Business or personal equipment, (other than that being leased).

12.Business or personal furniture and fixtures, as appropriate, (other than that being leased).

17.Add the amounts reported on lines 8 through 16 and enter here.

18.Add the amounts on line 7 and line 17 and enter here.

LIABILITIES

19.Credit Accounts (Open, Revolving and Installment).

20.Salaries, wages, bonuses and other benefits payable.

21.Federal, state or local income, sales or payroll taxes.

22.Other notes or payables not included above.

23.Current balances for all of the outstanding mortgages.

24.Vehicle loans.

25.Loans payable for furniture and equipment.

26.Other

27.Add the amounts on lines 19 through 26 and enter here.

EQUITY

28.The equity is the difference between your total assets and total liabilities. Subtract line 27 from line 18 and enter here.

SIGNATURE BLOCK

The name of the preparer is to be printed in the space provided. The applicant or licensee is required to sign this form attesting to the financial information. Failure to sign, date and attest to the accuracy of the information reported on the Balance Sheet (LIC 403) shall constitute

LIC 403 (7/11) |

PAGE 2 OF 2 |

Form Breakdown

| Fact Number | Detail |

|---|---|

| 1 | The balance sheet is a requirement by the California Department of Social Services Community Care Licensing Division. |

| 2 | The form must be completed for each entity applying for or holding a license to operate a care facility in California. |

| 3 | Both LIC 403 (Balance Sheet) and LIC 403a (Balance Sheet Supplemental Schedule) forms must be submitted together. |

| 4 | Information reported should reflect all the entity's assets and liabilities, not only those pertaining to the care facility operation. |

| 5 | This includes sole proprietorships, partnerships, and corporations. |

| 6 | For sole proprietorships operated by a husband or wife, information must include details that pertain to both individuals. |

| 7 | General partners must file both a personal balance sheet and one for the partnership. |

| 8 | All entries on the form are subject to verification, and additional documentation may be required. |

| 9 | Failure to accurately complete, sign, and date the Balance Sheet (LIC 403) is considered non-compliance. |

| 10 | The balance sheet must include detailed information on current and long-term assets, liabilities, and equity to reflect the financial position accurately. |

How to Write California Balance Sheet

When it comes to compliance and financial reporting, the California Balance Sheet form is a crucial document for entities operating within the Health and Human Services domain, particularly community care licensing. This form is designed to provide a snapshot of the entity's financial health, capturing both assets and liabilities. It is important for ensuring transparency and accountability, factors that are essential in the regulated sector of healthcare and community services. Below you will find step-by-step instructions to fill out this form accurately, facilitating a smoother engagement with regulatory requirements.

- Begin by entering the current date at the top of the form where it says "As of".

- Fill in the Entity Name, which could be a sole proprietorship, partnership, or corporation name.

- Next, enter the Facility Name that is being licensed or applied for.

- Input the Application/License Number (APP./LIC. NO.), if available.

- In the section labeled CURRENT ASSETS, list all liquid assets starting with Cash on hand and proceed through to Other Current Assets, entering the corresponding amounts in the spaces provided.

- Calculate the Total Current Assets by adding lines 1 through 6 and enter the sum on line 7.

- Under LONG-TERM ASSETS, detail assets starting with Real Property through to Other Long-Term Assets, including any additional assets that did not fit in the above categories in lines 14 to 16. Enter the respective amounts.

- Add lines 8 through 16 to find the Total Long-Term Assets and report this amount on line 17.

- The Total Assets value is calculated by adding line 7 and line 17, reporting this figure on line 18.

- Moving to LIABILITIES, report obligations starting with Credit Accounts and concluding with Other Notes Payable, entering values accordingly.

- Add lines 19 through 26 to arrive at the Total Liabilities, and record this on line 27.

- For EQUITY, subtract line 27 from line 18 to find the Equity amount and enter this on line 28.

- Lastly, the form needs to be authenticated by printing the name of the Preparer in the designated space, and having the Applicant/Licensee sign and date the form, attesting to the accuracy of the information provided.

Completion and submission of this form, along with the required LIC 403a (Balance Sheet Supplemental Schedule), are critical steps in the licensing process. The information presented herein enables the California Department of Social Services to assess the financial soundness of facilities and services. It’s essential to ensure accuracy and completeness to prevent delays or regulatory issues. Remember, this form is not just about meeting a regulatory requirement; it's about demonstrating the financial viability and responsibility of your operation to the stakeholders involved.

Listed Questions and Answers

What is the purpose of the California Balance Sheet form?

The California Balance Sheet form, also known as LIC 403, is a financial document required by the California Department of Social Services for Community Care Licensing. Its main purpose is to provide a detailed report of an entity's assets, liabilities, and equity. This helps the department assess the financial standing and capability of entities applying for or renewing a license to operate care facilities within the state.

Who needs to complete the California Balance Sheet form?

The following entities are required to complete and submit the form:

- Sole proprietorships, including operations by a husband or wife individually, where both parties' financial information is reported.

- General partners, where each partner must submit their personal Balance Sheet in addition to the partnership's financial statements.

- Partnerships and corporations seeking licensure or renewal for operating care facilities.

What are the key components of the LIC 403 form?

The key components outlined in the LIC 403 form include:

- Current Assets: This includes cash on hand, in financial institutions, CDs and other similar accounts, short-term receivables and notes, stocks, bonds, and other current assets.

- Long-Term Assets: Covers real property, land, improvements, equipment, furniture, fixtures, and other long-term investments.

- Liabilities: Consists of credit accounts, salaries and wages payable, taxes payable, other payables, mortgages, auto loans, equipment loans, and other notes payable.

- Equity: Calculated by subtracting total liabilities from total assets.

How do you complete the LIC 403a, Balance Sheet Supplemental Schedule?

Before filling out the LIC 403 form, the LIC 403a, Balance Sheet Supplemental Schedule, should be completed. It serves as a worksheet for detailing the information required on the LIC 403. Once completed, the totals from the LIC 403a are transferred to the main balance sheet form. The LIC 403a helps in organizing and summarizing the financial data to ensure accuracy and completeness when reporting on the LIC 403.

Is additional documentation required to be submitted along with the LIC 403 and LIC 403a?

Yes, additional documentation may be requested to verify the information reported on the balance sheet. This could include bank statements, loan documents, property deeds, and other financial records that support the assets, liabilities, and equity listed on the LIC 403 and LIC 403a forms.

What happens if the LIC 403 is not signed or accurately filled out?

Failure to sign the LIC 403 or accurately report financial information may lead to non-compliance and the potential rejection of the report. It is crucial that both the preparer and the applicant/licensee review the form carefully, ensure all information is correct, and provide signatures to attest to the accuracy of the report. This verifies that the financial information represents a true and correct view of the entity's financial position.

Can the balance sheet be used for entities not related to Community Care Licensing?

While the LIC 403 and LIC 407a are specifically designed for use by entities applying for or renewing a license with the California Department of Social Services, Community Care Licensing, the form itself could serve as a model or guide for creating a balance sheet in other contexts. However, its specific purpose is for licensure within the department, and entities not seeking a license through Community Care Licensing would not be required to use this form.

What is the importance of disclosing all assets and liabilities, not just those related to the operation of the care facility?

Disclosing all assets and liabilities, not just those related to the operation of the care facility, is important because it provides a complete picture of the financial health and capabilities of the entity applying for licensure. This holistic view helps the California Department of Social Services assess the entity's overall stability and sustainability, which is critical in ensuring the safety and well-being of those under care.

Are there any tips for ensuring accuracy when completing the LIC 403?

To ensure accuracy when completing the LIC 403, consider the following tips:

- Double-check all figures and calculations, especially when transferring totals from the LIC 403a to the LIC 403.

- Maintain up-to-date financial records and use them as the basis for completing the balance sheet.

- Seek clarification on any items or instructions that are unclear before filling them out.

- Consider consulting with a financial advisor or accountant to review the form before submission.

Common mistakes

Not following the provided instructions: Each item on the form comes with specific instructions. Neglecting these can lead to errors, such as misreporting assets or liabilities, which could distort the true financial position.

Incorrectly reporting assets: Confusion often arises between current and long-term assets. Current assets should be readily converted to cash within a year, whereas long-term assets cannot. Misclassification can significantly affect liquidity representation.

Misunderstanding the nature of liabilities and equity, leading to incorrect entries. Liabilities should encompass all amounts owed, whereas equity represents the owner's interest in the entity. Confusing these two can result in incorrect totals.

Failing to attach the required LIC 403a: The LIC 403a provides a detailed account necessary to accurately complete the LIC 403. Overlooking its attachment can cause incomplete or inaccurate financial disclosure.

Omitting signatures and dates, which are mandatory for the form’s validity. Unattested forms are considered non-compliant and are outright rejected, delaying your process.

Overlooking the inclusion of personal finances for sole proprietorships and partnerships: The form requires the disclosure of both business and personal finances to provide a comprehensive overview, often missed by applicants.

Providing rounded or estimated figures instead of exact amounts. This can lead to inaccuracies in the reported financial position, affecting both the credibility and the legality of the document.

Ensure you thoroughly read and follow the line-by-line instructions on the reverse of the form.

Accurately categorize your assets and liabilities as current or long-term, based on their liquidity or due date, respectively.

Remember to attach LIC 403a, as it's critical for the completion of the LIC 403 form.

Verify every entry for exactness, resisting the temptation to round up numbers or estimate values.

Documents used along the form

When managing or applying for a California care facility license, understanding and preparing various documents can be crucial. The California Department of Social Services requires a comprehensive financial overview of applicants, which includes but is not limited to the California Balance Sheet. This is a critical document reflecting an entity's financial position at a specific point in time. However, it's just one piece in the complex puzzle of financial documentation and compliance. Below is a list of other forms and documents that are often used alongside the California Balance Sheet, each playing a vital role in providing a complete financial picture or supporting the application process.

- LIC 403a - Balance Sheet Supplemental Schedule: A detailed worksheet supporting the Balance Sheet by breaking down the totals into specific categories, allowing for a more thorough financial analysis.

- Income Statement: Reflects the revenue, expenses, and profits over a specific period, providing insight into the operation's financial performance.

- Cash Flow Statement: Offers details on how cash enters and exits the business, highlighting the operation's liquidity and cash management.

- Statement of Shareholder's Equity: For corporations, this document details changes in equity throughout the reporting period, including retained earnings and paid-in capital.

- Schedule of Assets and Liabilities: A more granular look at the assets and liabilities listed on the balance sheet, often including valuations and additional notes.

- Personal Financial Statement: For sole proprietors or individual partners, this statement reflects personal assets, liabilities, income, and expenses, separate from the business.

- Loan Application Forms: If seeking financing, lenders will require specific forms filled out in conjunction with these financial statements to evaluate borrowing capacity.

- Tax Returns: Recent business and personal tax returns are often required to verify the income and financial status reported in other documents.

- Proof of Ownership Documents: These can include deeds for real property, titles for vehicles, or stock certificates, validating the assets listed on the balance sheet.

- Business Plan: Though not a financial statement, a comprehensive business plan, including financial projections, is frequently requested by lenders and regulatory agencies to understand the operational goals and financial viability.

Together, these documents furnish a panorama of the financial health and operational viability of a care facility, essential for both regulatory compliance and strategic planning. It is advisable for entities and individuals in this sector to maintain meticulous records and understand how each document contributes to their overall financial narrative.

Similar forms

The California Balance Sheet form shares similarities with the Profit and Loss Statement (P&L). Both documents are essential for financial reporting, yet they serve different purposes. The Balance Sheet provides a snapshot of an entity's financial position at a specific point in time, including assets, liabilities, and equity. In contrast, the P&L Statement summarizes revenues, costs, and expenses over a period, showing the entity’s operational performance. Essentially, while the Balance Sheet captures what a business owns and owes, the P&L Statement reflects how well the business performed financially during a period.

Comparable to the Cash Flow Statement, the California Balance Sheet details current assets, including cash on hand and in financial institutions. Both documents are concerned with an entity's liquidity. The Cash Flow Statement, however, specifically tracks the flow of cash in and out of the business over time, providing insight into the company's solvency and operational efficiency. Thus, while the Balance Sheet shows the standing cash levels at a moment, the Cash Marientation on Flow Statement illustrates the movement and management of cash over time.

The California Balance Sheet's listing of long-term liabilities parallels the information in a Loan Amortization Schedule. Both documents touch upon the entity’s financial obligations. A Loan Amortization Schedule breaks down loan payments into principal and interest over the loan's life, offering a clear timetable of a liability reduction. The Balance Sheet, by summarizing the outstanding balances under long-term liabilities, provides a broader view of what is owed without detailing the repayment schedule.

The Equity Statement and the California Balance Sheet both include equity-related information, such as the total equity of an entity. However, the Equity Statement goes into detail about changes in equity over a period due to retained earnings, dividends, and other equity adjustments. In contrast, the Balance Sheet shows the equity position at a single point, summarizing the result of these activities rather than providing a movement narrative.

Like the Inventory Report, the California Balance Sheet includes assets that can involve current and long-term assets like inventory. Both are critical for managing and valuing the goods and materials a business holds. However, the Inventory Report offers a detailed list and valuation of each item in stock, whereas the Balance Sheet aggregates this information under current or long-term assets, providing a less detailed but broader financial perspective.

Similar to the Accounts Receivable (AR) Aging Report, the California Balance Sheet includes short-term receivables. The AR Aging Report offers a detailed analysis of outstanding customer debts, categorized by the length of time the invoice has been outstanding. While both documents identify amounts due to the entity, the Balance Sheet presents this as a lump sum under current assets, without detailing the age of these receivables.

Property, Plant, and Equipment (PP&E) Schedules resemble the segment of the California Balance Sheet that lists long-term assets like real property, improvements, and equipment. Both involve the reporting of tangible long-term assets used in operations. A PP&E Schedule, however, provides detailed records of each asset, including purchase date, cost, accumulated depreciation, and net book value. The Balance Sheet summarizes these assets' total value, lacking detailed depreciation and valuation over time.

The California Balance Sheet is akin to the Statement of Shareholder’s Equity in that they both report on equity. The Statement of Shareholder’s Equity provides detailed activities affecting the company's equity, including share issuances, buybacks, and dividends over a period. The Balance Sheet, conversely, offers a single figure for equity at a specific date, consolidating the outcomes of those activities into a snapshot view.

Related to the Tax Return, the California Balance Sheet presents financial positions, including liabilities such as taxes payable. While both documents must accurately reflect the entity’s financial obligations to tax authorities, the Tax Return is a formal document submitted to the government, detailing taxable income and calculating the tax owed. The Balance Sheet, instead, gives a broader overview of all taxes payable at a certain moment without specifying tax calculation details.

Lastly, the California Balance Sheet shares commonalities with the Owners' Equity Statement, particularly for sole proprietorships mentioned in its instructions. Both documents highlight the owner's equity in the business. The Owners' Equity Statement details changes to the owner's equity account, including withdrawals and contributions during the period. The Balance Sheet shows the ending balance of owner's equity at a specific time, summarizing the net result of these transactions.

Dos and Don'ts

When approaching the process of filling out the California Balance Sheet form, it’s essential to give it the attention and accuracy it demands. This document is crucial for providing a comprehensive overview of an entity's financial position to the California Department of Social Services. Below are ten directives to ensure the task is done properly and efficiently.

- Do: Ensure all the information provided is accurate and up to date. Double-check figures for cash, assets, liabilities, and equity to prevent any errors.

- Do: Complete the LIC 403a, Balance Sheet Supplemental Schedule, before starting the LIC 403 form, as it prepares detailed information needed for the balance sheet.

- Do: Include all required identification details at the top of the form — the current date, entity name, facility name, and application/license number.

- Do: Report both current and long-term assets and liabilities comprehensively, ensuring no component of your financial situation is omitted.

- Do: Remember to add and subtract correctly where indicated — especially when calculating total assets and liabilities, and then deriving the equity value.

- Don’t: Leave any fields blank. If a particular section does not apply, it's advisable to enter "N/A" (not applicable) or "0" to indicate that the field was not overlooked.

- Don’t: Use estimates or rough figures. The information provided needs to be supported by documentation, and estimations can lead to discrepancies.

- Don’t: Forget to sign and date the form. An unsigned form might be considered incomplete and could lead to the rejection of your submission.

- Don’t: Overlook the instruction to attach the LIC 403a form to the LIC 403. The supplemental schedule is an integral part of the balance sheet submission.

- Don’t: Neglect the requirement for additional documentation. Be prepared to provide further evidence to support the figures and claims made within your balance sheet.

By adhering to these guidelines, one ensures the process of filling out the California Balance Sheet form is both accurate and compliant with the regulations set forth by the state's Department of Social Services. Proper documentation and precision in reporting are the keystones to a successful submission, thereby facilitating a smoother and more efficient review process.

Misconceptions

There are several common misconceptions about the California Balance Sheet form that need to be addressed to ensure that individuals and entities accurately complete and submit this document as part of their licensing requirements with the California Department of Social Services.

- Misconception 1: Only assets and liabilities related to the care facility need to be reported.

Many believe that the form requires only the assets and liabilities related to the operation of the care facility. However, the instructions clarify that all the entity's assets and liabilities must be disclosed, not just those associated with the care facility's operations. This includes personal financial information for sole proprietorships and for each general partner in partnerships.

- Misconception 2: The Balance Sheet form (LIC 403) is the only document required for submission.

Some may think that completing and submitting the LIC 403 form is sufficient. In reality, the LIC 403a, the Balance Sheet Supplemental Schedule, must also be completed and attached. This worksheet helps compile detailed financial information, which is then totaled and displayed on the LIC 403 form.

- Misconception 3: Real property only includes buildings.

A common misunderstanding is that real property refers solely to buildings. The form specifies that real property encompasses buildings, land, and structures, indicating a broader spectrum of assets than some might assume.

- Misconception 4: Salaries and wages payable do not include bonuses and other benefits.

It's often overlooked that 'Salaries & Wages Payable' also encompasses bonuses, benefits, and other forms of compensation payable, not just regular salaries or hourly wages. This highlights the need for a comprehensive accounting of all forms of remuneration owed.

- Misconception 5: Equity is an arbitrary number that the applicant/licensee can determine.

There's a misconception that the equity figure can be arbitrarily determined or estimated. However, equity must be calculated by subtracting total liabilities from total assets as specified on the form, ensuring it accurately reflects the entity's financial standing.

- Misconception 6: The signature and date confirm submission only.

Some might wrongly believe that signing and dating the form are mere formalities of submission. The required signature and date serve as a legal attestation to the accuracy and completeness of the financial information reported, under penalty of perjury, stressing the significance of the information's veracity.

Understanding these misconceptions is crucial for accurately completing the California Balance Sheet form, ensuring compliance with the California Department of Social Services' requirements. The accuracy of this document reflects the financial health and integrity of the entity or individual applying for or renewing a license, underscoring the importance of careful and thorough preparation.

Key takeaways

- Before submitting the California Balance Sheet form, ensure the LIC 403a, Balance Sheet Supplemental Schedule, is fully completed as it aids in compiling detailed information which is summarized on the main Balance Sheet.

- All requested details at the top of the form, including the current date, entity name, facility name, and application/license number, must be accurately provided to ensure proper processing and identification.

- The form requires a comprehensive disclosure of all the entity’s assets and liabilities, encompassing not just those tied directly to the care facility's operations but also personal or unrelated business finances, particularly in the case of sole proprietorships and partnerships.

- Accuracy is crucial when filling out both current and long-term assets sections, as it involves listing cash on hand, financial accounts, receivables, and physical assets like real property, equipment, and more, which requires careful documentation and calculation.

- Liabilities section demands detailed reporting of all debts and obligations including open credit accounts, salaries payable, taxes, loans, and other payables, ensuring a complete financial liability snapshot is presented.

- Equity calculation, the difference between total assets and total liabilities, is a critical step in the form’s completion process, and it provides insight into the financial health and value of the entity.

- The form concludes with a mandatory signature block to be filled by the preparer and signed by the applicant or licensee, serving as a declaration under penalty of perjury that all information provided is true and accurate, emphasizing the legal accountability tied to the form’s submission.

Different PDF Templates

California Schedule X - Form 540X is used to amend a previously filed California state income tax return.

California Sales License - Details on how to complete and submit additional information for sections requiring extensive details, like past convictions, are provided.