Fill a Valid California De 305 Form

When someone passes away owning real estate in California valued at $55,425 or less, the California De 305 form plays a critical role. Known formally as the Affidavit Re Real Property of Small Value, this legal document simplifies the process of transferring property ownership without the need for a full probate proceeding. It outlines clear steps for individuals or entities claiming to be successors to the decedent's property, allowing them to declare their right to the property provided certain conditions are met. Key aspects of the form include requirements such as attaching a certified copy of the decedent's death certificate, proving no other proceeding for the estate's administration is underway in California, and confirming that all debts and expenses associated with the decedent's final illness and funeral have been settled. Additionally, it necessitates an inventory and appraisal of the decedent's real property to ascertain its value does not exceed the monetary threshold set by the state. This affidavit must be filed in the county where the property is located, accompanied by all necessary documentation, including any wills, trusts, or declarations that substantiate the claimant's entitlement to the property. It streamlines the process for small estate holders, making it an essential tool for efficiently managing the legal dimensions of estate planning and execution in California.

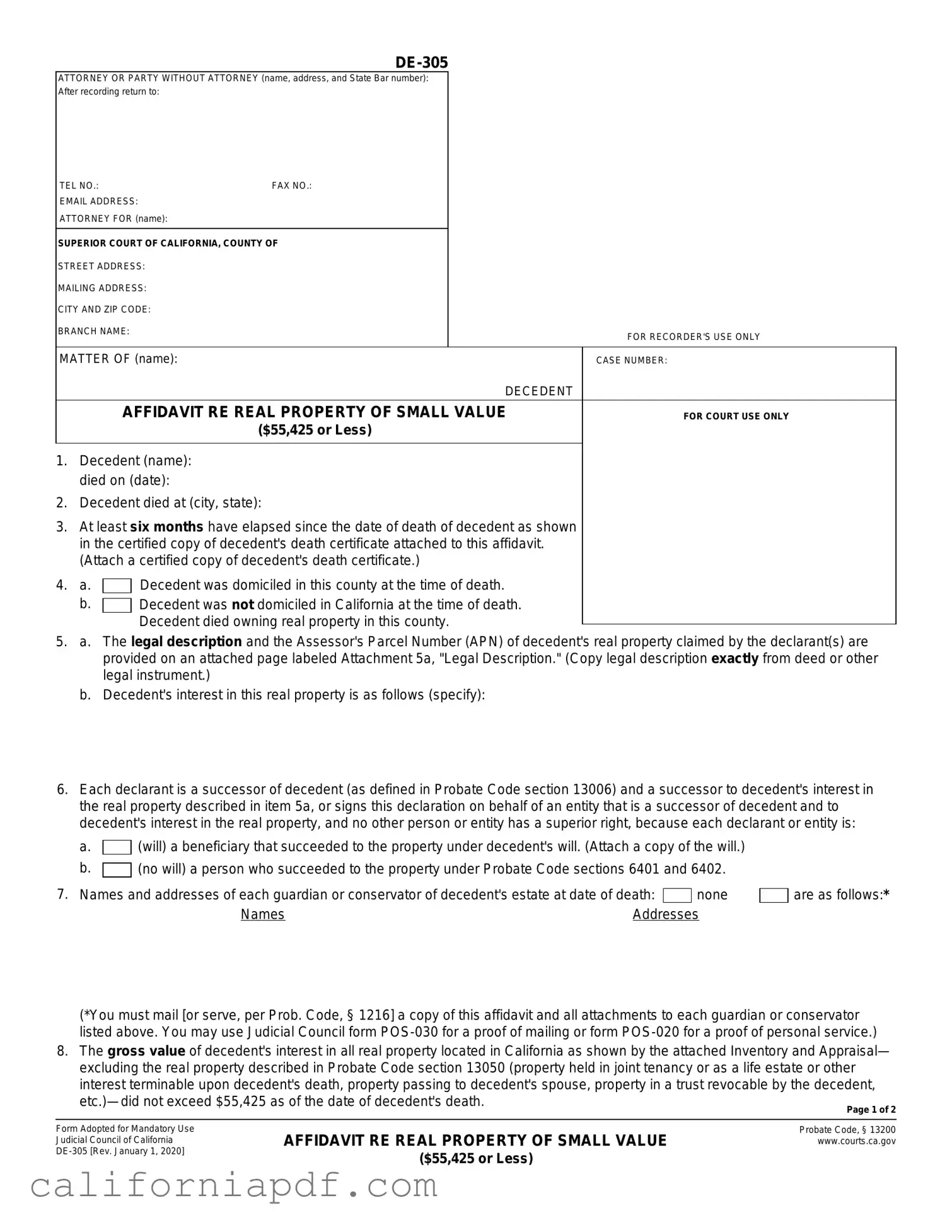

Document Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (name, address, and State Bar number):

After recording return to:

TEL NO.: |

FAX NO.: |

|

|

EMAIL ADDRESS: |

|

|

|

ATTORNEY FOR (name): |

|

|

|

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

||

STREET ADDRESS: |

|

|

|

MAILING ADDRESS: |

|

|

|

CITY AND ZIP CODE: |

|

|

|

BRANCH NAME: |

|

|

FOR RECORDER'S USE ONLY |

|

|

|

|

|

|

|

|

MATTER OF (name): |

|

|

CASE NUMBER: |

|

|

DECEDENT |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE |

FOR COURT USE ONLY |

||

|

($55,425 or Less) |

|

|

1.Decedent (name): died on (date):

2.Decedent died at (city, state):

3.At least six months have elapsed since the date of death of decedent as shown in the certified copy of decedent's death certificate attached to this affidavit. (Attach a certified copy of decedent's death certificate.)

4.a.

Decedent was domiciled in this county at the time of death.

Decedent was domiciled in this county at the time of death.

b. Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

5.a. The legal description and the Assessor's Parcel Number (APN) of decedent's real property claimed by the declarant(s) are provided on an attached page labeled Attachment 5a, "Legal Description." (Copy legal description exactly from deed or other legal instrument.)

b.Decedent's interest in this real property is as follows (specify):

6.Each declarant is a successor of decedent (as defined in Probate Code section 13006) and a successor to decedent's interest in the real property described in item 5a, or signs this declaration on behalf of an entity that is a successor of decedent and to decedent's interest in the real property, and no other person or entity has a superior right, because each declarant or entity is:

a. (will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

(will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

b. (no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

(no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

7. Names and addresses of each guardian or conservator of decedent's estate at date of death: |

|

none |

|

are as follows:* |

|

|

|

||||

Names |

Addresses |

|

|

||

(*You must mail [or serve, per Prob. Code, § 1216] a copy of this affidavit and all attachments to each guardian or conservator listed above. You may use Judicial Council form

8.The gross value of decedent's interest in all real property located in California as shown by the attached Inventory and Appraisal— excluding the real property described in Probate Code section 13050 (property held in joint tenancy or as a life estate or other interest terminable upon decedent's death, property passing to decedent's spouse, property in a trust revocable by the decedent,

Form Adopted for Mandatory Use Judicial Council of California

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

MATTER OF (Name):

DECEDENT

CASE NUMBER:

9.An Inventory and Appraisal of all of decedent's interests in real property in California is attached. The appraisal was made by a probate referee appointed for the county in which the property is located. (You must prepare the Inventory on Judicial Council forms

10.No proceeding is now being or has been conducted in California for administration of decedent's estate.

11.Funeral expenses, expenses of last illness, and all known unsecured debts of the decedent have been paid. (NOTE: You may be personally liable for decedent's unsecured debts up to the fair market value of the real property and any income you receive from it.)

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME)* |

|

|

|

|

(SIGNATURE OF DECLARANT) |

Date: |

|

|

|

||

|

|

|

|

|

|

(TYPE OR PRINT NAME)* |

|

|

(SIGNATURE OF DECLARANT) |

||

|

|

|

|

|

SIGNATURE OF ADDITIONAL DECLARANTS ATTACHED |

*A declarant claiming on behalf of a trust or other entity should also state the name of the entity that is a beneficiary under the decedent's will, and declarant's capacity to sign on behalf of the entity (e.g., trustee, Chief Executive Officer, etc.).

NOTARY ACKNOWLEDGMENT |

(NOTE: No notary acknowledgment may be affixed as a rider (small strip) to this page. If addi- |

|

tional notary acknowledgments are required, they must be attached as |

||

|

||

|

|

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA, COUNTY OF (specify):

On (date): |

, before me (name and title): |

personally appeared (name(s)): |

|

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the instrument in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the |

|

(NOTARY SEAL) |

||

State of California that the foregoing paragraph is true and correct. |

|

|

||

WITNESS my hand and official seal. |

|

|

||

|

|

|

|

|

(SIGNATURE OF NOTARY PUBLIC) |

|

|

||

|

|

|

|

|

(SEAL) |

|

|

||

|

|

|

|

CLERK'S CERTIFICATE |

I certify that the foregoing, including any attached notary acknowledgments and any attached legal description of the property (but excluding other attachments), is a true and correct copy of the original affidavit on file in my office. (Certified copies of this affidavit do not include the

(1) death certificate, (2) will, or (3) inventory and appraisal. See Probate Code section 13202.)

Date: |

Clerk, by |

, Deputy |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

Page 2 of 2

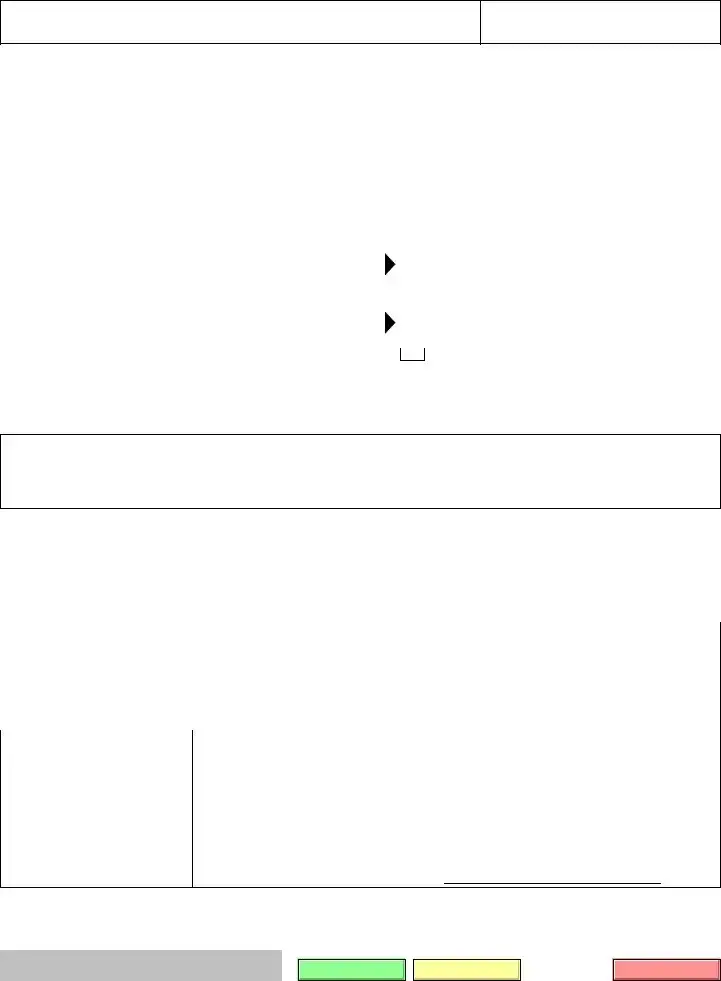

For your protection and privacy, please press the Clear This Form button after you have printed the form.

Print this form

Save this form

Clear this form

Form Breakdown

| Fact Name | Description |

|---|---|

| Form Identification | California DE-305 form is identified as Affidavit re Real Property of Small Value ($55,425 or Less). |

| Purpose | This form is used to transfer real property of small value without formal probate proceedings. |

| Eligibility Criteria | The decedent's real property located in California must have a gross value of $55,425 or less as of the date of the decedent's death. |

| Governing Law | The DE-305 form is governed by the California Probate Code, specifically section 13200. |

How to Write California De 305

Filling out the California DE-305 form is a procedural step taken by individuals to claim real property of small value when dealing with the estate of a deceased person. This specific process is aimed at making the transfer of property valued at $55,425 or less simpler and avoiding a lengthy probate process. To ensure accuracy and compliance with California law, following the required steps carefully is essential. Here's how you can fill out the form:

- Start by entering the required information about the attorney or party without an attorney in the first section, including the name, address, State Bar number (if applicable), telephone number, fax number, and email address.

- In the "After recording return to:" section, indicate where the document should be sent after it is recorded.

- Fill out the court information for the Superior Court of California, including the county, street and mailing addresses, city and ZIP code, and branch name.

- Under "MATTER OF (name):" and "CASE NUMBER:", enter the name of the decedent and the case number, if available.

- For items 1 through 4, provide details about the decedent, including their name, date and place of death, and whether they were domiciled in the county at the time of death or owned real property in the county.

- Attach a page labeled Attachment 5a, "Legal Description," that includes the legal description and Assessor's Parcel Number (APN) of the claimed real property. Make sure to copy the legal description exactly as it appears on the deed or other legal instruments.

- Specify the decedent's interest in the real property as described in item 5a and how each declarant is a successor to decedent's interest, according to Probate Code sections mentioned. Attach copies of the will or other documents as required.

- Provide names and addresses of each guardian or conservator of the decedent's estate at the date of death, if any. Follow the instructions to mail or serve copies of this affidavit and all attachments to them as instructed.

- Verify that the gross value of the decedent's interest in all California real property, excluding certain types as specified, did not exceed $55,425 as of the date of the decedent's death.

- Attach an Inventory and Appraisal of the decedent's real property interests, prepared on the appropriate Judicial Council forms and appraised by a probate referee as instructed.

- Confirm that no proceedings are currently being or have been conducted in California for the administration of the decedent's estate.

- Acknowledge that funeral expenses, last illness expenses, and all known unsecured debts of the decedent have been paid.

- Sign and date the affidavit, declaring under penalty of perjury that the information provided is true and correct. If the declaration is on behalf of an entity, include the entity's name and the declarant's capacity.

- Complete the notary acknowledgment section as per the instructions provided.

After completing these steps, review the form carefully to ensure all information is accurate and correct. Remember, the clarity and correctness of this document are crucial for transferring the property smoothly and efficiently. Once filled out, submit the form to the appropriate county recorder's office along with any required fees or additional documents that may be necessary.

Listed Questions and Answers

What is the DE-305 form used for in California?

The DE-305 form, known as the Affidavit re Real Property of Small Value, is utilized in the state of California to transfer real property when the deceased’s total real estate in California is valued at $55,425 or less, according to the assessment made as of the date of the decedent's death. This procedure provides a simplified way to transfer property without going through a full probate process, intended to make the procedure quicker and less costly for the successors.

Who can file a DE-305 form?

Filing the DE-305 form is restricted to the successors of the decedent, as defined by Probate Code section 13006. These successors could be either individuals who have a beneficiary designation, such as those named in a will, or individuals who are legally recognized to succeed to the property by state law in the absence of a will. Additionally, entities acting as successors, such as trusts, can file this form, assuming they meet the criteria set forth and have a legitimate claim to the decedent's real property.

What documents are required to be attached with the DE-305 form?

When submitting the DE-305 form, several documents must be attached to ensure the affidavit is processed correctly:

- A certified copy of the decedent's death certificate.

- If applicable, a copy of the decedent’s will.

- Attachment 5a, providing the legal description and Assessor's Parcel Number (APN) for the property in question.

- An Inventory and Appraisal form (DE-160 and DE-161), detailing the value of the decedent's real property, excluding certain types of jointly held or transfer-on-death properties.

These documents collectively provide the necessary proof and valuation to support the transfer of property under the DE-305 process.

What steps should be followed after completing the DE-305 form?

Upon completing the DE-305 form and attaching all required documentation, the following steps should be undertaken:

- Ensure that all sections of the form are filled out accurately and that the form is signed by the declarant under penalty of perjury.

- Mail or serve a copy of the completed form and attachments to any known guardian or conservator of the decedent's estate, if applicable.

- Record the original completed form with the county recorder's office in the county where the real property is located.

- Retain a copy of the recorded affidavit for personal records.

It is recommended that individuals consult with a legal professional to ensure that all legal requirements are met during this process.

Common mistakes

Filling out the California DE-305 form, a legal document used to manage the transfer of real property of small value (not exceeding $55,425) of a deceased person, requires attention to detail and a thorough understanding of the instructions. Mistakes in this process can lead to delays or even the inability to transfer property as intended. Here are nine common errors people make:

- Failing to Attach Required Documents: Not attaching a certified copy of the decedent's death certificate, the will (if applicable), and the Inventory and Appraisal forms (DE-160 and DE-161) as required.

- Incorrect Information About the Decedent: Providing inaccurate information regarding the decedent’s domicile at the time of death, which is crucial for jurisdictional purposes.

- Overlooking the Real Property Description: Not including a detailed legal description and the Assessor's Parcel Number (APN) of the property on an attached sheet labeled "Attachment 5a." This detail is critical for clearly identifying the property in question.

- Misunderstanding Successor Eligibility: Incorrectly identifying oneself as a successor of the decedent without fully understanding the legal definition of a successor or failing to establish the legal right to the property under the Probate Code sections 6401 and 6402 for cases without a will.

- Omitting Guardian or Conservator Information: Forgetting to list any guardian or conservator of the decedent’s estate at the date of death, or failing to mail (or serve) them a copy of the affidavit as required, which is a critical step for transparency and honoring the rights of those legally responsible for the decedent.

- Underestimating the Property's Value: Incorrectly appraising the value of the decedent's interest in real property, causing it to fall erroneously outside the permissible limits for the DE-305 form’s use.

- Not Addressing Unsecured Debts: Neglecting to state that funeral expenses, expenses of the last illness, and all known unsecured debts of the decedent have been paid, which is necessary to clarify that the estate’s obligations have been settled.

- Improperly Executing the Form: Failing to correctly sign the form, not including the date, or not printing the name(s) of the declarant(s). Each step is essential for the form's legality and authenticity.

- Lack of Notary Acknowledgment: Omitting the required notary acknowledgment or attaching it improperly. This acknowledgment is essential for verifying the identity of the individuals signing the document.

Being meticulous and ensuring that all the required steps are carefully followed can significantly streamline the process of transferring real property under the California DE-305 form. It’s always recommended to consult with a legal professional if there are any doubts or complexities in filling out this form accurately.

Documents used along the form

When dealing with the administration of a decedent's real property of small value in California, specifically under the conditions outlined in the DE-305 form, several supplementary documents and forms are typically used to ensure compliance with state law and streamline the process. These documents support the affidavit by providing necessary details, evidence, and authorizations. Understanding these documents is crucial for anyone involved in the administration of an estate that includes real property of small value.

- Certified Copy of Death Certificate: This document is the official record of death. It is referenced in the DE-305 form where it specifies that at least six months must have passed since the decedent's death. The death certificate is essential for proving the death of the property owner, which is a prerequisite for transferring ownership.

- Inventory and Appraisal (Forms DE-160 and DE-161): These forms are used to list and appraise all real property owned by the decedent in California. The DE-305 form mentions that an inventory and appraisal of the decedent's real property interests, excluding certain exceptions, must not exceed $55,425. A probate referee appointed for the county where the property is located typically conducts the appraisal.

- Copy of the Will: If the decedent left a will, a copy must be attached to the affidavit (DE-305) when a beneficiary is claiming succession to the property under the will. This document is crucial for determining the rightful heirs or beneficiaries as per the decedent's wishes.

- Notice of Proposed Action (Form DE-165): This form is used to notify interested persons of proposed actions concerning the estate's assets, such as the sale of real property. Although not directly mentioned in the DE-305 form, it is often used in the administration of estates to ensure transparency and allow objections to proposed actions.

- Proof of Mailing or Proof of Personal Service (Forms POS-030 or POS-020): These forms document the process of serving or mailing documents to required parties, such as guardians or conservators of the decedent’s estate, as mentioned in the DE-305 form. They are essential for proving that all interested parties have been properly notified of the affidavit and its attachments.

- Change of Ownership Report: While this is not a standardized form like the others listed, a Change of Ownership Report is typically required by the county assessor's office whenever real property changes hands. Even though it is not mentioned in the DE-305 form, this document is instrumental in updating public records to reflect the new property owner's information.

These documents, when used alongside the DE-305 form, create a comprehensive package for the legal transfer of a small value real property under California law. They facilitate the proper execution of duties by the declarant and ensure that the process adheres to the state's procedural requirements. Handling these documents with care and precision is essential for the efficient and effective administration of the decedent's estate.

Similar forms

The California DE-305 form facilitates the transfer of real property considered of small value (under $55,425) after an individual's death, requiring no formal probate process. A similar document, the Small Estate Affidavit, serves an equivalent purpose for personal property. When a person passes away leaving behind personal assets below a certain threshold, the Small Estate Affidavit allows for the transfer of these assets to the rightful heirs or beneficiaries without navigating through lengthy court procedures. This document significantly simplifies the legalities involved in asset distribution, providing a streamlined pathway for small estates.

Comparable to the DE-305 form, the Transfer on Death Deed (TODD) is another instrument designed to bypass the traditional probate process, specifically for real estate. A TODD allows property owners to name beneficiaries to whom the property will automatically transfer upon their death, without the need for court intervention. While the DE-305 form is used posthumously to transfer property of small value, the TODD is established beforehand, ensuring a smooth transition of property ownership. Both methods alleviate the complexity and expense usually associated with transferring property through probate.

Another akin document is the Affidavit for Collection of Personal Property, often used in situations where the deceased has left behind a minimal amount of personal possessions and assets. Similar to the DE-305, this affidavit allows for the collection and distribution of the decedent's personal property to the rightful inheritors, bypassing probate court. This approach is particularly suited to estates that primarily consist of non-real estate assets, ensuring a direct and less cumbersome means of settling small estates.

The Joint Tenancy with Right of Survivorship Deed shares similarities with the DE-305 form in its avoidance of the probate process for real estate assets. Joint tenancy allows property ownership to be automatically transferred to the surviving co-owner upon one owner's death. While the DE-305 form addresses the post-death transfer of property to successors, the joint tenancy arrangement prevents the property from entering the probate estate at all, ensuring immediate succession.

Likewise, the Payable on Death (POD) or Transfer on Death (TOD) accounts provide a way to pass assets to beneficiaries without going through probate, akin to the DE-305 form's purpose for real property. POD/TOD designations can be applied to bank accounts, securities, and other financial instruments, allowing these assets to bypass the probate process and transfer directly to the named beneficiaries upon the account holder's death. This process mirrors the DE-305's aim of simplifying asset transfer, though it applies to different asset types.

The Gift Deed is another legally binding document that, while active during a person's lifetime, aims to transfer property ownership without financial consideration and can be seen as a proactive counterpart to the DE-305 form. Unlike the DE-305, which facilitates the transfer after death, a Gift Deed provides a way to transfer real property ownership while the giver is still alive, avoiding probate implications by removing the asset from the estate prior to death.

The Living Trust, significantly more comprehensive than the DE-305 form, is a document created during an individual's lifetime to hold ownership of their assets, including real estate, with directions on their distribution upon the individual’s death. Like the DE-305, it serves to bypass the probate process for the assets it covers, offering a unified approach to estate planning and posthumous property transfer. However, unlike the DE-305, which is specific to small-value real property, a living trust can include various assets and offers more control and flexibility over their distribution.

Lastly, the Durable Power of Attorney for Finances parallels the DE-305 form in its facilitation of handling an individual's affairs without court intervention. This document allows a designated agent to manage the financial assets of someone who is unable to do so themselves, potentially including the transfer of assets upon death. While the DE-305 form specifically addresses the posthumous transfer of real property of small value, a Durable Power of Attorney for Finances plays a broader role in estate management and can prevent the need for a probate process during life and after death.

Dos and Don'ts

When completing the California DE-305 form, an affidavit regarding real property of small value ($55,425 or less), it's crucial to adhere to specific guidelines to ensure the process is completed correctly and efficiently. Below are several dos and don'ts to guide you through this process:

- Do ensure that all information provided is accurate. Double-check the details of the decedent, including their name and the date of death, as these are critical for the affidavit's accuracy.

- Do attach a certified copy of the decedent's death certificate as required in section 3 of the form. This document is vital for validating the affidavit.

- Do provide the proper legal description and the Assessor's Parcel Number (APN) of the real property, as specified in section 5a. It's essential to copy this information exactly from the deed or other legal instruments to avoid any issues.

- Do include attachments as necessary, such as a copy of the will if the decedent left one, and any appraisal reports in section 9. These documents support the claims made in the affidavit.

- Don't omit mailing or serving the required notices to guardians or conservators of the decedent's estate, if any exist, as mentioned in section 7. Proper notification is a legal requirement and must be adhered to meticulously.

- Don't guess the value of the decedent's interest in real property. Ensure that section 8 is filled out based on an attached Inventory and Appraisal completed by a probate referee. Guesswork can lead to inaccuracies and potential legal challenges.

- Don't neglect to check for any proceedings being conducted in California for the administration of the decedent's estate as stated in section 10. This information determines the affidavit's applicability and correctness.

- Don't sign the affidavit without ensuring that all known unsecured debts of the decedent have been paid, as this could lead to personal liability for these debts.

Following these guidelines will assist in completing the DE-305 form correctly, thereby simplifying the legal process involved in handling a decedent's real property of small value in California.

Misconceptions

Understanding the California DE-305 form, which pertains to transferring real property of small value ($55,425 or less), is crucial for anyone dealing with a decedent's estate in California. However, several misconceptions surround this form. Here are seven common ones and the truths behind them:

Misconception: The DE-305 form can be used for transferring any type of property, including personal property.

Truth: The DE-305 form is specifically for the transfer of real property (real estate) and cannot be used for personal property, such as vehicles or household items.

Misconception: You can use the DE-305 form immediately after a person dies.

Truth: At least six months must have passed since the decedent’s death before you can use this form, as stated in the form's instructions.

Misconception: You don’t need to notify anyone when using the DE-305 form to transfer property.

Truth: The law requires you to mail or serve a copy of this affidavit, along with all attachments, to each guardian or conservator of the decedent's estate if any were appointed before death.

Misconception: The value of the property can exceed $55,425.

Truth: The gross value of the decedent’s interest in all real property located in California must not exceed $55,425 as of the date of the decedent's death to qualify for transfer using this affidavit.

Misconception: A notary acknowledgment is not necessary for the DE-305 form.

Truth: A notary acknowledgment is indeed required for this form, ensuring the identity of the individual(s) signing the document.

Misconception: The DE-305 form applies even if the deceased was not a California resident.

Truth: The decedent must have been domiciled in California at the time of death, or owned real property in the county where the affidavit is being filed, for the form to be applicable.

Misconception: There is no need to attach other documents with the DE-305 form.

Truth: You must attach a certified copy of the decedent's death certificate and, if applicable, a copy of the will, legal descriptions of the property, and the Inventory and Appraisal form.

This information highlights the importance of fully understanding the process and requirements for using the DE-305 form in California. It’s always recommended to consult with a professional if you have questions or need assistance with handling a decedent’s estate.

Key takeaways

Filling out and using the California DE-305 form, also known as the Affidavit re Real Property of Small Value ($55,425 or Less), requires attention to several important details. Here are nine key takeaways to consider:

- The form is specifically designed for use when a decedent (the person who has passed away) owned real property in California valued at $55,425 or less, based on the date of death.

- Before filling out the form, one must wait at least six months from the decedent's date of death. This waiting period is mandatory.

- It's crucial to attach a certified copy of the decedent's death certificate to this affidavit as proof of the decedent’s death and the date it occurred.

- If the decedent was not domiciled in California at the time of their death but owned real property in the state, this property could still be transferred using this form.

- The affidavit requires a detailed legal description and the Assessor's Parcel Number (APN) of the property. These details must be copied exactly from the deed or another legal document pertaining to the property.

- Only successors of the decedent (as defined by Probate Code section 13006), or entities representing them with no superior claim to the property, may use this form to claim interest in the real property.

- If applicable, the names and addresses of any guardian or conservator of the decedent's estate at the time of death must be included. Furthermore, these individuals need to be notified about the affidavit.

- An Inventory and Appraisal of the decedent's real property interests in California must be attached, excluding certain properties as outlined in Probate Code section 13050. This appraisal must be done by a probate referee appointed for the county where the property is located.

- The form underscores that there should be no ongoing proceedings for the administration of the decedent's estate in California and that all known debts and expenses, including funeral expenses and last illness expenses, have been paid before filing this affidavit.

It's imperative for users of the DE-305 form to carefully gather all required documents and accurately fill out this affidavit to ensure a smooth process in transferring the real property of a small value. Seeking legal advice is recommended to navigate any complexities or questions that may arise.

Different PDF Templates

California 590 P - It offers peace of mind for nonresident taxpayers, confirming their previously reported income is not double-taxed through withholding.

Which of the Following Expenses Qualifies for the Child and Dependent Care Credit? - A section of the form allows for the inclusion of expenses for care provided outside the taxpayer's home, with specific address details.