Fill a Valid California De 4 Form

Understanding the California DE 4 form is crucial for every employee and employer in the state. This Employee’s Withholding Allowance Certificate plays a pivotal role in determining the correct amount of California state income tax to withhold from paychecks. It requires personal information, such as your name, social security number, and filing status, to tailor withholding to your financial situation. The form offers various statuses such as single, married, or head of household, each affecting the withholding in different ways. Additionally, it includes worksheets to help calculate the number of allowances you’re claiming, along with any additional amounts you wish to withhold, making it a tool for personal tax planning. The possibility of claiming exemption from withholding is also presented, equipped with specific conditions for eligibility. Furthermore, members of the armed forces and their spouses may find particular exemptions applicable to their circumstances. Employers are given instructions on how to process the DE 4, signifying its comprehensive purpose for California Personal Income Tax (PIT) withholding. Ultimately, this form facilitates employees in accurately reflecting their state tax obligation, safeguarding against both underpayment and overpayment of taxes.

Document Example

Clear Form

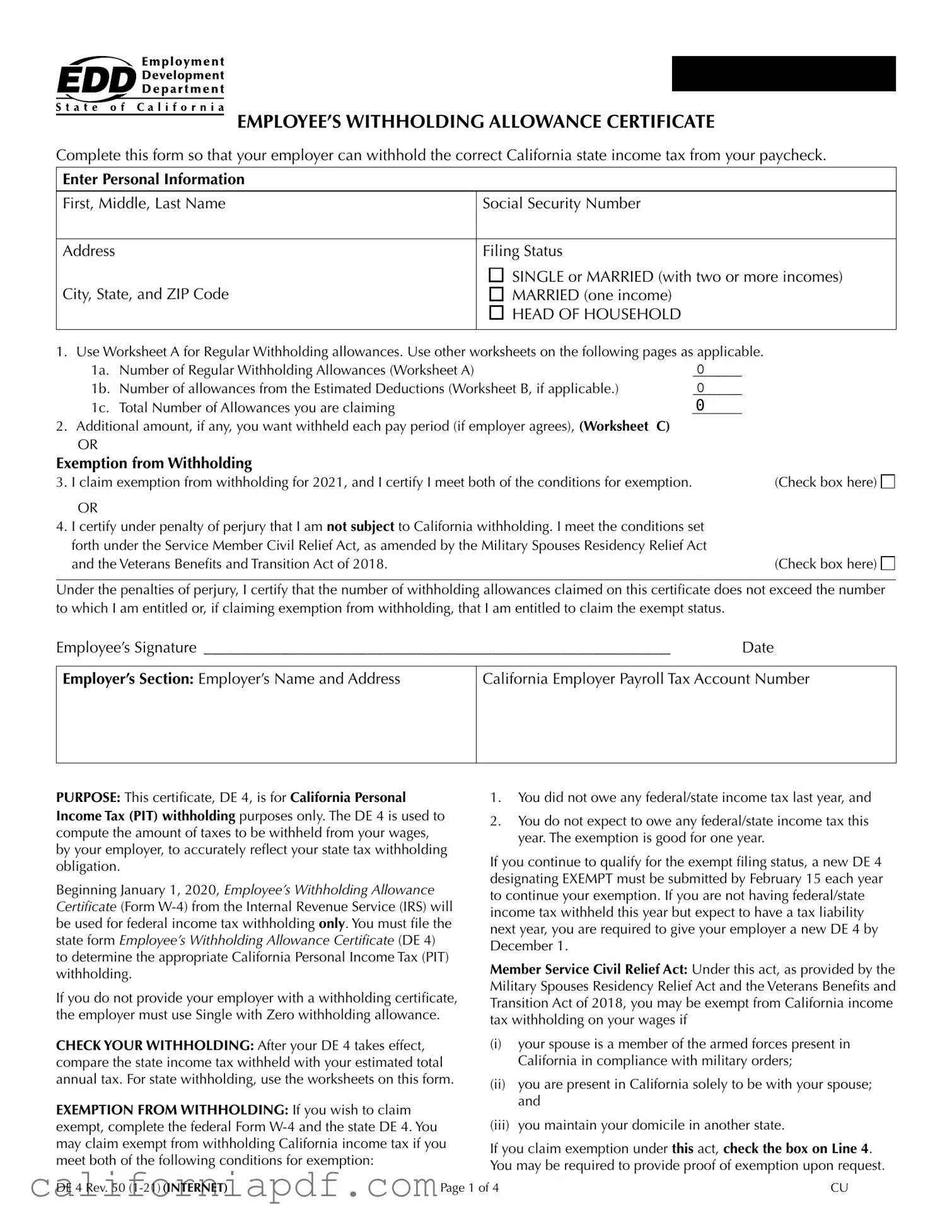

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

Complete this form so that your employer can withhold the correct California state income tax from your paycheck.

Enter Personal Information |

|

First, Middle, Last Name |

Social Security Number |

|

|

Address |

Filing Status |

City, State, and ZIP Code |

SINGLE or MARRIED (with two or more incomes) |

MARRIED (one income) |

|

|

HEAD OF HOUSEHOLD |

|

|

1. |

Use Worksheet A for Regular Withholding allowances. Use other worksheets on the following pages as applicable. |

||||

|

1a. |

Number of Regular Withholding Allowances (Worksheet A) |

0 |

|

|

|

1b. |

Number of allowances from the Estimated Deductions (Worksheet B, if applicable.) |

0 |

|

|

|

1c. |

Total Number of Allowances you are claiming |

|

0 |

|

2. |

Additional amount, if any, you want withheld each pay period (if employer agrees), (Worksheet C) |

|

|

||

|

OR |

|

|

|

|

Exemption from Withholding |

|

|

|||

3. I claim exemption from withholding for 2021, and I certify I meet both of the conditions for exemption. |

|

(Check box here) |

|||

OR

4.I certify under penalty of perjury that I am not subject to California withholding. I meet the conditions set forth under the Service Member Civil Relief Act, as amended by the Military Spouses Residency Relief Act

and the Veterans Benefits and Transition Act of 2018. |

(Check box here) |

Under the penalties of perjury, I certify that the number of withholding allowances claimed on this certificate does not exceed the number to which I am entitled or, if claiming exemption from withholding, that I am entitled to claim the exempt status.

Employee’s Signature ____________________________________________________________ |

Date |

Employer’s Section: Employer’s Name and Address

California Employer Payroll Tax Account Number

PURPOSE: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Beginning January 1, 2020, Employee’s Withholding Allowance Certificate (Form

If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.

CHECK YOUR WITHHOLDING: After your DE 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this form.

EXEMPTION FROM WITHHOLDING: If you wish to claim exempt, complete the federal Form

1.You did not owe any federal/state income tax last year, and

2.You do not expect to owe any federal/state income tax this year. The exemption is good for one year.

If you continue to qualify for the exempt filing status, a new DE 4 designating EXEMPT must be submitted by February 15 each year to continue your exemption. If you are not having federal/state income tax withheld this year but expect to have a tax liability next year, you are required to give your employer a new DE 4 by December 1.

Member Service Civil Relief Act: Under this act, as provided by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act of 2018, you may be exempt from California income tax withholding on your wages if

(i)your spouse is a member of the armed forces present in California in compliance with military orders;

(ii)you are present in California solely to be with your spouse; and

(iii)you maintain your domicile in another state.

If you claim exemption under this act, check the box on Line 4. You may be required to provide proof of exemption upon request.

DE 4 Rev. 50 |

Page 1 of 4 |

CU |

The California Employer’s Guide (DE 44) (edd.ca.gov/pdf_pub_ctr/de44.pdf) provides the income tax withholding tables. This publication may be found by visiting Payroll Taxes - Forms and Publications (edd.ca.gov/Payroll_Taxes/Forms_and_ Publications.htm). To assist you in calculating your tax liability, please visit the Franchise Tax Board (FTB) (ftb.ca.gov).

If you need information on your last California Resident Income Tax Return (FTB Form 540), visit the FTB (ftb.ca.gov).

NOTIFICATION: The burden of proof rests with the employee to show the correct California income tax withholding. Pursuant to section

Title 22, California Code of Regulations (CCR) (govt.westlaw. com/calregs/Search/Index), the FTB or the EDD may, by special direction in writing, require an employer to submit a Form

PENALTY: You may be fined $500 if you file, with no reasonable basis, a DE 4 that results in less tax being withheld than is properly allowable. In addition, criminal penalties apply for willfully supplying false or fraudulent information or failing to supply information requiring an increase in withholding. This is provided by section 13101 of the California Unemployment Insurance Code (leginfo.legislature. ca.gov/faces/codes.xhtml) and section 19176 of the Revenue and Taxation Code (leginfo.legislature.ca.gov/faces/ codes).xhtml).

DE 4 Rev. 50 |

Page 2 of 4 |

WORKSHEETS

INSTRUCTIONS — 1 — ALLOWANCES*

When determining your withholding allowances, you must consider your personal situation:

—Do you claim allowances for dependents or blindness?

—Will you itemize your deductions?

—Do you have more than one income coming into the household?

Do not claim the same allowances with more than one employer. Your withholding will usually be most accurate when all allowances are claimed on the DE 4 filed for the highest paying job and zero allowances are claimed for the others.

MARRIED BUT NOT LIVING WITH YOUR SPOUSE: You may check the “Head of Household” marital status box if you meet all of the following tests:

(1)Your spouse will not live with you at any time during the year;

(2)You will furnish over half of the cost of maintaining a home for the entire year for yourself and your child or stepchild who qualifies as your dependent; and

(3)You will file a separate return for the year.

HEAD OF HOUSEHOLD: To qualify, you must be unmarried or legally separated from your spouse and pay more than 50% of the costs of maintaining a home for the entire year for yourself and your dependent(s) or other qualifying individuals. Cost of maintaining the home includes such items as rent, property insurance, property taxes, mortgage interest, repairs, utilities, and cost of food. It does not include the individual’s personal expenses or any amount which represents value of services performed by a member of the household of the taxpayer.

WORKSHEET A |

REGULAR WITHHOLDING ALLOWANCES |

|

|

|

|

|

|

|

|

(A) |

Allowance for yourself — enter 1 |

|

(A) |

|

(B) |

Allowance for your spouse (if not separately claimed by your spouse) — enter 1 |

(B) |

|

|

(C) |

Allowance for blindness — yourself — enter 1 |

|

(C) |

|

(D) |

Allowance for blindness — your spouse (if not separately claimed by your spouse) — enter 1 |

(D) |

|

|

(E) |

Allowance(s) for dependent(s) — do not include yourself or your spouse |

(E) |

|

|

(F) |

Total — add lines (A) through (E) above and enter on line 1a of the DE 4 |

(F) |

0 |

|

INSTRUCTIONS — 2 — (OPTIONAL) ADDITIONAL WITHHOLDING ALLOWANCES

If you expect to itemize deductions on your California income tax return, you can claim additional withholding allowances. Use Worksheet B to determine whether your expected estimated deductions may entitle you to claim one or more additional withholding allowances. Use last year’s FTB Form 540 as a model to calculate this year’s withholding amounts.

Do not include deferred compensation, qualified pension payments, or flexible benefits, etc., that are deducted from your gross pay but are not taxed on this worksheet.

You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by which you expect your estimated deductions for the year to exceed your allowable standard deduction.

WORKSHEET B |

ESTIMATED DEDUCTIONS |

Use this worksheet only if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage income not subject to withholding.

1. |

Enter an estimate of your itemized deductions for California taxes for this tax year as listed in the schedules in the FTB Form 540 |

1. |

|

|

2. |

Enter $9,202 if married filing joint with two or more allowances, unmarried head of household, or qualifying widow(er) |

|

|

|

|

with dependent(s) or $4,601 if single or married filing separately, dual income married, or married with multiple employers |

– |

2. |

|

3. |

Subtract line 2 from line 1, enter difference |

= |

3. |

0 |

4. |

Enter an estimate of your adjustments to income (alimony payments, IRA deposits) |

+ |

4. |

|

5. |

Add line 4 to line 3, enter sum |

= |

5. |

0 |

6. |

Enter an estimate of your nonwage income (dividends, interest income, alimony receipts) |

– |

6. |

|

7. |

If line 5 is greater than line 6 (if less, see below [go to line 9]); |

|

|

|

|

Subtract line 6 from line 5, enter difference |

= |

7. |

0 |

8. |

Divide the amount on line 7 by $1,000, round any fraction to the nearest whole number |

|

8. |

0 |

|

enter this number on line 1b of the DE 4. Complete Worksheet C, if needed, otherwise stop here. |

|

|

|

9. |

If line 6 is greater than line 5; |

|

|

|

|

Enter amount from line 6 (nonwage income) |

|

9. |

|

10. |

Enter amount from line 5 (deductions) |

|

10. |

0 |

11. |

Subtract line 10 from line 9, enter difference. Then, complete Worksheet C. |

|

11. |

0 |

*Wages paid to registered domestic partners will be treated the same for state income tax purposes as wages paid to spouses for California PIT withholding and PIT wages. This law does not impact federal income tax law. A registered domestic partner means an individual partner in a domestic partner relationship within the meaning of section 297 of the Family Code. For more information, please call our Taxpayer Assistance Center at

DE 4 Rev. 50 |

Page 3 of 4 |

WORKSHEET C |

ADDITIONAL TAX WITHHOLDING AND ESTIMATED TAX |

|

|

|

|

|

|

|

|

1. |

Enter estimate of total wages for tax year 2021. |

1. |

|

|

2. |

Enter estimate of nonwage income (line 6 of Worksheet B). |

2. |

|

|

3. |

Add line 1 and line 2. Enter sum. |

|

3. |

0 |

4. |

Enter itemized deductions or standard deduction (line 1 or 2 of Worksheet B, whichever is largest). |

4. |

|

|

5. |

Enter adjustments to income (line 4 of Worksheet B). |

5. |

|

|

6. |

Add line 4 and line 5. Enter sum. |

|

6. |

0 |

7. |

Subtract line 6 from line 3. Enter difference. |

7. |

0 |

|

8. |

Figure your tax liability for the amount on line 7 by using the 2021 tax rate schedules below. |

8. |

|

|

9. |

Enter personal exemptions (line F of Worksheet A x $136.40). |

9. |

0 |

|

10. |

Subtract line 9 from line 8. Enter difference. |

10. |

0 |

|

11. |

Enter any tax credits. (See FTB Form 540). |

|

11. |

|

12. |

Subtract line 11 from line 10. Enter difference. This is your total tax liability. |

12. |

0 |

|

13.Calculate the tax withheld and estimated to be withheld during 2021. Contact your employer to request the amount that will be withheld on your wages based on the marital status and number of withholding allowances you will claim for 2021. Multiply the estimated amount to be withheld by the number of pay

|

periods left in the year. Add the total to the amount already withheld for 2021. |

13. |

|

14. |

Subtract line 13 from line 12. Enter difference. If this is less than zero, you do not need to have additional |

|

0 |

|

taxes withheld. |

14. |

|

15. |

Divide line 14 by the number of pay periods remaining in the year. Enter this figure on line 2 of the DE 4. |

15. |

|

NOTE: Your employer is not required to withhold the additional amount requested on line 2 of your DE 4. If your employer does not agree to withhold the additional amount, you may increase your withholdings as much as possible by using the “single” status with “zero” allowances. If the amount withheld still results in an underpayment of state income taxes, you may need to file quarterly estimates on Form

THESE TABLES ARE FOR CALCULATING WORKSHEET C AND FOR 2021 ONLY

SINGLE PERSONS, DUAL INCOME

MARRIED WITH MULTIPLE EMPLOYERS

IF THE TAXABLE INCOME IS |

COMPUTED TAX IS |

|

||

|

|

|

|

|

OVER |

BUT NOT |

OF AMOUNT OVER... |

PLUS |

|

|

OVER |

|

|

|

$0 |

$8,932 |

1.100% |

$0 |

$0.00 |

$8,932 |

$21,175 |

2.200% |

$8,932 |

$98.25 |

$21,175 |

$33,421 |

4.400% |

$21,175 |

$367.60 |

$33,421 |

$46,394 |

6.600% |

$33,421 |

$906.42 |

$46,394 |

$58,634 |

8.800% |

$46,394 |

$1,762.64 |

$58,634 |

$299,508 |

10.230% |

$58,634 |

$2,839.76 |

$299,508 |

$359,407 |

11.330% |

$299,508 |

$27,481.17 |

$359,407 |

$599,012 |

12.430% |

$359,407 |

$34,267.73 |

$599,012 |

$1,000,000 |

13.530% |

$599,012 |

$64,050.63 |

$1,000,000 |

and over |

14.630% |

$1,000,000 |

$118,304.31 |

UNMARRIED HEAD OF HOUSEHOLD

IF THE TAXABLE INCOME IS |

COMPUTED TAX IS |

|

||

|

|

|

|

|

OVER |

BUT NOT |

OF AMOUNT OVER... |

PLUS |

|

|

OVER |

|

|

|

$0 |

$17,876 |

1.100% |

$0 |

$0.00 |

$17,876 |

$42,353 |

2.200% |

$17,876 |

$196.64 |

$42,353 |

$54,597 |

4.400% |

$42,353 |

$735.13 |

$54,597 |

$67,569 |

6.600% |

$54,597 |

$1,273.87 |

$67,569 |

$79,812 |

8.800% |

$67,569 |

$2,130.02 |

$79,812 |

$407,329 |

10.230% |

$79,812 |

$3,207.40 |

$407,329 |

$488,796 |

11.330% |

$407,329 |

$36,712.39 |

$488,796 |

$814,658 |

12.430% |

$488,796 |

$45,942.60 |

$814,658 |

$1,000,000 |

13.530% |

$814,658 |

$86,447.25 |

$1,000,000 |

and over |

14.630% |

$1,000,000 |

$111,524.02 |

MARRIED PERSONS

IF THE TAXABLE INCOME IS |

COMPUTED TAX IS |

|

||

|

|

|

|

|

OVER |

BUT NOT |

OF AMOUNT OVER... |

PLUS |

|

|

OVER |

|

|

|

$0 |

$17,864 |

1.100% |

$0 |

$0.00 |

$17,864 |

$42,350 |

2.200% |

$17,864 |

$196.50 |

$42,350 |

$66,842 |

4.400% |

$42,350 |

$735.19 |

$66,842 |

$92,788 |

6.600% |

$66,842 |

$1,812.84 |

$92,788 |

$117,268 |

8.800% |

$92,788 |

$3,525.28 |

$117,268 |

$599,016 |

10.230% |

$117,268 |

$5,679.52 |

$599,016 |

$718,814 |

11.330% |

$599,016 |

$54,962.34 |

$718,814 |

$1,000,000 |

12.430% |

$718,814 |

$68,535.45 |

$1,000,000 |

$1,198,024 |

13.530% |

$1,000,000 |

$103,486.87 |

$1,198,024 |

and over |

14.630% |

$1,198,024 |

$130,279.52 |

If you need information on your last California Resident Income Tax Return, FTB Form 540, visit (FTB) (ftb.ca.gov).

The DE 4 information is collected for purposes of administering the PIT law and under the authority of Title 22, CCR, section

DE 4 Rev. 50 |

Page 4 of 4 |

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of DE 4 Form | Used by employees to determine the correct amount of State Income Tax (PIT) withholding. |

| Governing Law | The administration of the withholding tax programs is under Title 22, California Code of Regulations (CCR), section 4340-1 and the California Revenue and Taxation Code. |

| Effective Date | Beginning January 1, 2020, for determining state PIT withholding separate from federal income tax withholding. |

| Default Withholding Status | If no DE 4 is provided by the employee, the employer must withhold tax as if the employee is Single with Zero allowances. |

| Exemption Qualifications | To claim exemption from withholding, employees must not expect to owe any state or federal income tax for the year. |

| Annual Renewal Requirement | Exempt status must be renewed by February 15 each year by submitting a new DE 4 form. |

| Military Spouse Exemption | Spouses of military service members may be exempt from California income tax withholding if certain conditions are met. |

| Penalty for False Information | Filing a DE 4 with false information or failing to file can result in a $500 fine and additional criminal penalties. |

| Adjustment for Multiple Incomes | Individuals with multiple incomes or dual-income married couples need to accurately calculate and claim allowances to prevent under-withholding. |

How to Write California De 4

When preparing to complete the California DE 4 form, it's essential to understand its purpose and how it impacts your payroll taxes. This form determines the amount of state income tax that your employer will withhold from your earnings, ensuring that the correct amount is deducted throughout the year. Not submitting this form or filling it out incorrectly can lead to having too much or too little tax withheld. Now, let's go through the form step by step:

- Enter personal information: Start by filling in your first, middle, and last name, social security number, and address (including city, state, and ZIP code).

- Select your filing status: Choose from SINGLE or MARRIED (with two or more incomes), MARRIED (one income), or HEAD OF HOUSEHOLD.

- Regular withholding allowances (Worksheet A): Use Worksheet A to calculate the number of regular withholding allowances. Include allowances for yourself, your spouse, blindness, and dependents. Enter the total on line 1a.

- Additional allowances and deductions (Worksheets B and C, if applicable): If you expect to itemize deductions or have a large number of deductions, complete Worksheet B and enter the number of additional allowances on line 1b. If you require additional tax withholding, complete Worksheet C and specify the additional amount on line 2.

- Claim exemption from withholding: If you meet the conditions for exemption, check the appropriate box in section 3. This step is only for those who qualify for a complete exemption from state withholding.

- Service Member Civil Relief Act: If applicable, check the box in section 4 to claim exemption under the Service Member Civil Relief Act.

- Sign and date the form: Certify the information by signing and dating the bottom of the form. This attests that the information is accurate to the best of your knowledge.

- Employer’s section: The last section is for your employer’s use. Make sure to submit the completed form to your employer, who will enter their information and process it accordingly.

Once you've completed these steps, your employer will adjust your payroll withholdings based on the data provided. This ensures that the correct amount of state income tax is withheld from your paycheck, aligning with your actual tax obligations. Remember, it's a good idea to review your withholdings periodically or when your financial situation changes to make sure they remain accurate. This can help prevent surprises during tax season.

Listed Questions and Answers

What is the purpose of the California DE 4 form?

The California DE 4 form, also known as the Employee's Withholding Allowance Certificate, serves a crucial role in determining the correct amount of California state income tax to withhold from an employee's paycheck. This form is specifically designed for California Personal Income Tax (PIT) withholding purposes, ensuring that an employee's state tax obligations are accurately reflected through withholdings from their wages. It is separate from the federal W-4 form, which is used for federal income tax withholdings only.

How do I complete the California DE 4 form?

To properly fill out the California DE 4 form, an employee starts by entering their personal information, including their name, social security number, address, and filing status. The most vital part of the form involves determining the number of allowances to claim, which impacts how much state income tax is withheld from each paycheck. The form includes several worksheets (A, B, and C) to help calculate the number of regular withholding allowances, any additional allowances based on estimated deductions, and any additional tax or estimated tax payments needed. The final step is for the employee to indicate if they are exempt from withholding, under certain conditions, and to sign the form under penalty of perjury.

Can I claim exempt on my California DE 4, and if so, how?

Yes, employees can claim an exemption from California state tax withholding on their DE 4 form, but only if they meet two specific conditions for the exemption: they did not owe any federal or state income tax in the previous year, and they expect not to owe any such taxes in the current year. To claim this exemption, complete the federal Form W-4 alongside the DE 4, checking the appropriate box to indicate your exempt status. It's important to note that this exemption is valid for one year at a time, requiring renewal by February 15 each year if the conditions for exemption continue to be met.

What happens if I don’t submit a California DE 4 to my employer?

If an employee does not provide their employer with a completed California DE 4 form, the employer is mandated to withhold state income tax at a default rate. This default is based on the assumption of a single filer with zero withholding allowances. Such a default withholding may not accurately reflect the employee’s actual state tax obligation, potentially leading either to over-withholding, which could reduce take-home pay more than necessary, or under-withholding, which might result in a tax bill and potential penalties at the end of the year.

What are the consequences of filing an inaccurate California DE 4 form?

Filing a California DE 4 form with inaccuracies or fraudulent information can lead to significant repercussions. If an individual knowingly supplies false information or claims allowances they are not entitled to, they may face a fine of up to $500. Moreover, there are criminal penalties for willful submission of false or fraudulent information on this form or for failing to submit a form that would result in increased tax withholdings. These measures underscore the importance of accurately completing the DE 4 form to reflect one's true withholding entitlement based on their financial and personal situation.

Common mistakes

Not choosing the right filing status: People sometimes choose the wrong filing status such as "Single" or "Married" without considering specifics such as living situations, which can lead to incorrect withholding amounts. For those married but not living with their spouse, incorrectly checking “Married (one income)” instead of “Head of Household” can also lead to inaccuracies.

Incorrect number of allowances: A common problem is incorrectly filling out the number of regular withholding allowances on Worksheet A, either by misunderstanding the criteria for dependents or by not properly accounting for additional allowances for blindness.

Misunderstanding multiple incomes: Individuals with more than one source of income or who have a working spouse often mistakenly claim the same allowances with more than one employer or do not adjust their withholding to account for the additional income, causing potential underwithholding.

Overlooking the Exemption from Withholding: Some individuals qualify for exemption from withholding but fail to check the exemption box in Section 3, causing unnecessary tax withholding from their paychecks.

Not claiming exemption under the Service Member Civil Relief Act correctly: Eligible service members or their spouses often miss claiming their exemption under this act by not checking the appropriate box in Section 4 or failing to provide adequate proof when requested.

Failing to submit a new form when necessary: Employees sometimes forget to submit a new DE 4 form by February 15 to continue their exempt status for the new year, leading to automatic default withholding at the Single with Zero allowance rate.

Incorrectly completing the estimated deductions (Worksheet B): Some individuals either overestimate or underestimate their itemized deductions and adjustments to income, leading to claiming an incorrect number of additional withholding allowances.

Incorrect additional amount for withholding (Worksheet C): Those opting to have an additional amount withheld each pay period sometimes miscalculate the amount, either by underestimating or overestimating their tax liability, resulting in either unexpected tax bills or refunds.

Not updating the DE 4 after personal or financial changes: People often forget to update their DE 4 form after major life events such as marriage, divorce, or the birth of a child, or after significant financial changes, failing to align their withholdings with their current tax situation.

Documents used along the form

When navigating through employment in California, particularly in terms of tax withholding, understanding the plethora of related documents and forms is pivotal. The DE 4 form, a critical part of this process for employees to accurately communicate their withholding preferences to employers, doesn't stand alone. There are several forms and documents often used alongside the California DE 4 form, each serving specific purposes in the broader context of employment and tax filing. Here is a brief overview of each:

- Form W-4: The Employee's Withholding Certificate for federal income tax withholding. While DE 4 is for California state taxes, the W-4 form plays a similar role at the federal level, helping employers withhold the correct federal income tax from paychecks.

- Form I-9: The Employment Eligibility Verification form. This document is used by employers to verify an employee's identity and to establish that the worker is eligible to accept employment in the United States.

- Form W-2: The Wage and Tax Statement. Employers must provide this form to employees annually, reporting wages earned, taxes paid, and other pertinent information crucial for filing federal and state tax returns.

- Form 540: The California Resident Income Tax Return. It is the state counterpart to the federal tax return, and it's where employees report their annual income to the California Franchise Tax Board.

- Form 1099-MISC: This form is used to report miscellaneous income. For independent contractors or freelancers operating in California, this form details earnings that are not salaried wages, which might affect their tax obligations.

- Form 1099-NEC: A replacement for Form 1099-MISC as of the tax year 2020 for reporting non-employee compensation. It's specifically used for independent contractors to report earnings of $600 or more.

- Form 592-B: Nonresident Withholding Tax Statement. This form is for income reported to nonresidents of California, crucial for those administering or receiving payments subject to state withholding.

- Form 588: Nonresident Withholding Waiver Request. If a nonresident believes they are exempt from California state withholding, they can use this form to request a waiver.

- Form 590: Withholding Exemption Certificate. This form is for residents and nonresidents who receive California source income but claim exemption from state withholding.

Each of these documents intertwines within the payroll and tax compliance ecosystem, ensuring that employees and employers alike can navigate their obligations with greater ease and accuracy. Making sense of these forms, within the context of the DE 4, allows individuals and businesses to better manage their fiscal responsibilities, thereby streamlining the process of income reporting and tax withholding in California. Understanding the role and usage of each form can significantly reduce the complexities involved in tax compliance, ensuring employees are well-prepared to fulfill their obligations come tax season.

Similar forms

The Internal Revenue Service (IRS) Form W-4, Employee's Withholding Certificate, serves a purpose akin to the California DE 4 form, but on the federal level. Both forms are crucial for determining the amount of income tax to be withheld from an employee’s paycheck. The information provided by employees on these forms, such as their filing status, number of dependents, and other adjustments, guides employers in setting aside the correct amount of tax, ensuring compliance with state and federal regulations, respectively. Additionally, these forms allow employees to claim exemption from withholding if they meet specific conditions.

The Federal Form W-4P, Withholding Certificate for Pension or Annuity Payments, is similar to the DE 4 form but is specifically designed for retirees receiving pension or annuity payments. Like the DE 4 form, which guides withholding for employees, the W-4P enables pensioners and annuitants to control the tax withheld from their retirement payments. By indicating their tax situation and desired number of allowances, retirees can ensure that the withheld amount closely matches their eventual tax liability, thus avoiding either underpayment or overpayment of taxes.

Form 540-ES, Estimated Tax for Individuals, is related to the DE 4 in its focus on regulating an individual’s tax obligations to the state of California. While the DE 4 form is used to adjust withholdings from an employee’s salary based on their estimated tax liability, Form 540-ES is utilized by individuals to pay estimated taxes directly, usually because their income is not subject to automatic withholding. This could include earnings from self-employment, interest, dividends, and rent. Both forms aim to help individuals manage their tax liability to avoid underpayment penalties.

The California New Employee Registry Reporting Form is another document relevant to the process initiated by the DE 4. Although not directly related to tax withholding, it is a crucial part of the hiring paperwork that employers must complete. This form is used by employers to report new or rehired employees to the state, including essential information such as the employee’s name, address, Social Security Number, and start date. This registry assists in ensuring that employees comply with their child support obligations and facilitates the state's calculation of unemployment insurance.

Lastly, the Request for Federal Income Tax Withholding from Sick Pay Form is analogous to the DE 4 form in the realm of tax withholding, but it specifically deals with sick pay. Employees receiving sick pay from a third party, like an insurance company, use this form to determine the federal income tax to be withheld from these payments. Similar to the DE 4's role in standard employment relationships, this form helps ensure that the correct amount of tax is withheld from sick pay benefits to reflect the recipient's tax obligations accurately.

Dos and Don'ts

When completing the California DE 4 form, understanding the do's and don'ts can ensure accurate state income tax withholding from your paycheck. Here's an essential guide to help you navigate this important task with confidence.

Do:

- Accurately provide personal information. Ensure your full name, social security number, address, and filing status are correctly filled in to avoid any issues with your tax withholding.

- Use the worksheets provided. These are designed to help you calculate the appropriate number of allowances and any additional amount you want withheld. They cater to various scenarios including dependents, multiple incomes, and estimated deductions.

- Check the exemption boxes only if applicable. If you meet the specific conditions for exemption from withholding, such as the provisions under the Service Member Civil Relief Act, or if you didn't owe any state income tax last year and expect not to this year, then and only then should you check these boxes.

- Review your withholding. After your DE 4 is submitted and processed, compare your new state income tax withholding amount to your estimated total annual tax liability to ensure it's accurate. Adjust if necessary.

Don't:

- Claim the same allowances with more than one employer. If you have multiple jobs or a working spouse, claim all allowances on the DE 4 form for the highest paying job to prevent under-withholding.

- Forget to submit a new DE 4 if your situation changes. Any change in your personal or financial situation, such as marriage, divorce, or a new child, can affect your tax withholding needs. Update your DE 4 accordingly.

- Fail to submit by deadlines if claiming exempt. If you qualify for exemption, remember to submit a new DE 4 by February 15 each year to maintain your exempt status.

- Overlook potential fines for improper filing. Filling out the DE 4 without reasonable basis, resulting in less tax being withheld than your obligation, may lead to a fine. Always ensure the information you provide is accurate and truthful.

Correctly completing the DE 4 form can save you from unexpected tax bills and penalties. Paying attention to the fine details and following these guidelines will help you navigate the process smoothly. If you're ever in doubt, consulting with a tax professional can provide additional clarity and guidance tailored to your specific situation.

Misconceptions

Understanding the California DE 4 form can be challenging, and many employees hold misconceptions about its purpose and how it should be completed. Let's clarify some common misunderstandings:

- Misconception #1: The DE 4 form is the same as the Federal W-4 form.

While both forms relate to tax withholding from your paycheck, the DE 4 is specifically for California state income tax, whereas the W-4 form is for federal income tax. Employers in California require the DE 4 to determine the correct amount of state tax to withhold.

- Misconception #2: You only need to complete the DE 4 form once.

Changes in your personal or financial situation, such as marriage, divorce, or the birth of a child, can affect your tax liability. It's advisable to review and, if necessary, update your DE 4 form annually or after any significant life events to ensure the correct amount of tax is being withheld.

- Misconception #3: Claiming more allowances will always result in more take-home pay.

While increasing your allowances can increase your paycheck amount, it may also lead to underpayment of taxes and a potential bill when filing your annual tax return. It's essential to claim the correct number of allowances based on your actual financial situation.

- Misconception #4: Married couples must use the same withholding rate.

Married individuals can choose to withhold at a higher single rate or claim allowances differently depending on their combined income and deductions. This flexibility can help optimize tax withholding to better match the couple's overall tax liability.

- Misconception #5: Non-wage income should not be considered when filling out the DE 4.

If you have a significant amount of non-wage income, such as dividends or interest, it may be beneficial to account for this on the DE 4. This consideration can help avoid underpayment penalties by adjusting your withholdings to cover the tax liability from all sources of income.

- Misconception #6: The DE 4 exempts you from federal tax withholding.

The DE 4 form specifically relates to California state tax and does not affect federal tax withholdings. Employees need to handle federal and state withholdings separately, ensuring they meet obligations for both.

- Misconception #7: Filing a new DE 4 requires approval from your employer.

While your employer must process a new DE 4 form upon receipt to adjust your withholdings, they do not need to approve the changes you make. The form is a tool for you to communicate your withholding preferences based on your individual tax situation.

By understanding these key aspects of the California DE 4 form, employees can better navigate their tax withholding, leading to a more accurate and less stressful tax experience.

Key takeaways

The California DE 4 form plays a crucial role in determining the correct amount of state income tax withheld from employees' paychecks. It's essential for employees to accurately complete and submit this form to their employers to ensure the appropriate California Personal Income Tax (PIT) withholding. This process requires a clear understanding of the instructions and worksheets provided within the form to accurately reflect an employee's withholding allowance and, if applicable, additional withholding amounts.

Completing the DE 4 form starts with providing personal information, such as name, social security number, address, and filing status. This foundational step is critical for the accurate and lawful processing of the form.

Understanding and utilizing the provided worksheets (A, B, and C) on the DE 4 form is instrumental for employees. These worksheets assist in calculating regular withholding allowances, estimated deductions, and additional tax withholding, respectively. An accurate calculation ensures that the correct state income tax amount is withheld, tailored to the employee's financial and personal circumstances.

For employees wishing to claim exemption from withholding, the DE 4 form stipulates specific conditions that must be met. These include not owing any federal/state income tax in the previous year and expecting not to owe any federal/state income tax in the current year. It's crucial for employees to carefully assess their eligibility for exemption to avoid potential legal or financial complications.

The form also accommodates special situations, such as exemptions under the Service Member Civil Relief Act and related acts. Employees qualifying under these acts due to military service and residency considerations can claim exemption from California income tax withholding by adequately marking the relevant section on the DE 4 form.

It's imperative for employees to be meticulous in filling out the DE 4 form, taking advantage of the instructions and worksheets provided. This ensures the correct withholding amount is calculated, reflecting each individual's tax situation accurately. Furthermore, complying with state tax laws through the proper completion of the DE 4 form is essential for both employees and employers to avoid penalties associated with underpayment of taxes.

Different PDF Templates

California Bar Exam - The structured requirements underscore the importance of transparency, accountability, and professional conduct.

Inconsistent Father Visitation - Requires personal service to ensure all parties are properly notified of the petition unless it's filed within an existing case.