Fill a Valid California Death of a Joint Tenant Affidavit Form

In California, navigating the legal landscape following the death of a property co-owner can be a complex process, but understanding the essentials of the California Death of a Joint Tenant Affidavit form can significantly ease this journey. This crucial document plays a pivotal role in the seamless transfer of property rights from the deceased joint tenant to the surviving ones without the need for a lengthy probate process. It acts not only as a formal declaration of the death but also as an immediate instrument in the reassignment of ownership, ensuring that the property remains within the intended circle of inheritance. The affidavit, by notifying public records of the change in ownership, stands as a safeguard for the surviving tenant's legal rights, providing a clear and undisputed record of ownership. While the form itself might seem straightforward, the implications and requirements surrounding its proper execution are critical, with specifics varying depending on the nature of the property and the relationship between the joint tenants. A meticulous approach to filling out and filing this affidavit aids in avoiding potential complications and ensures that the transition of ownership honors the deceased's wishes and the law's mandates.

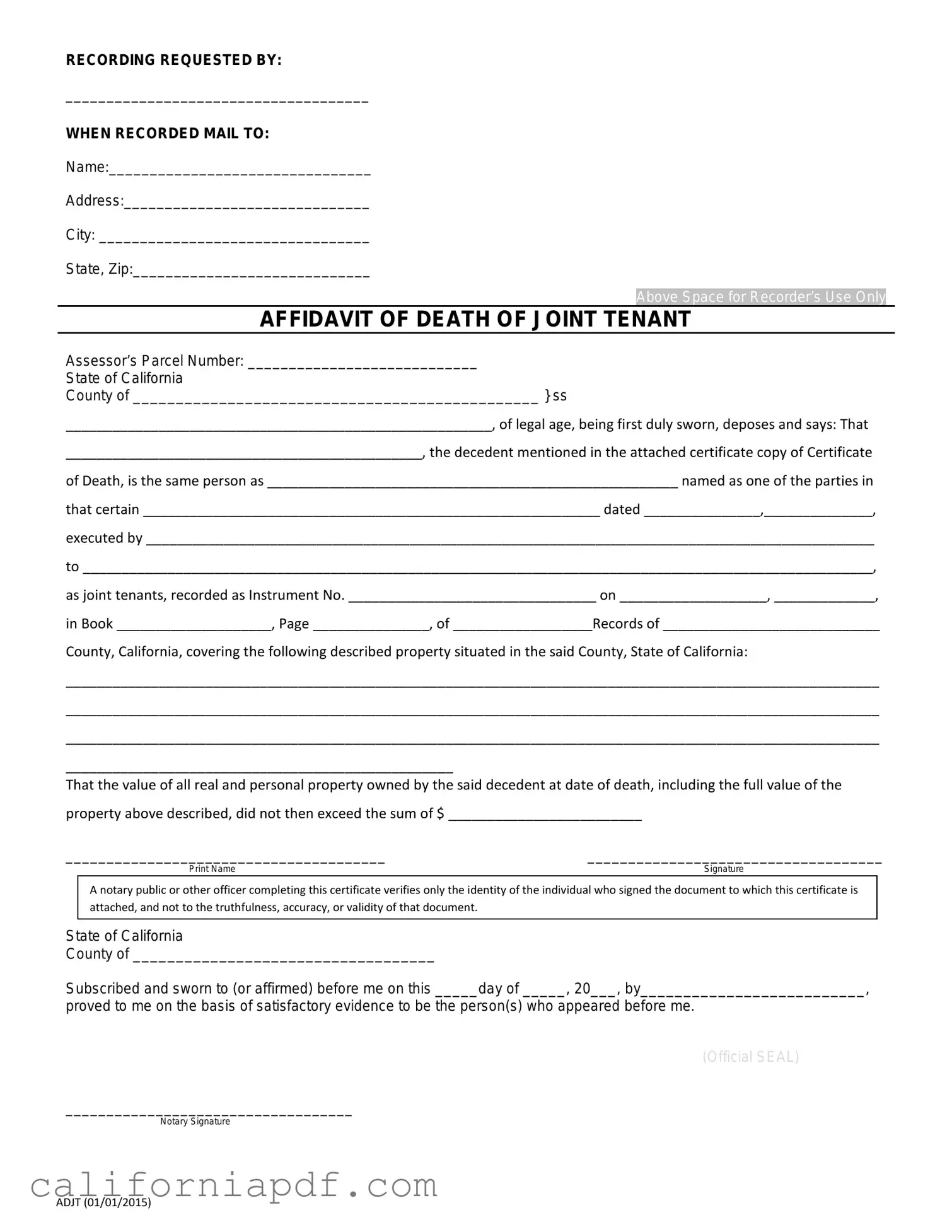

Document Example

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature

ADJT (01/01/2015)

Form Breakdown

| Fact | Description |

|---|

How to Write California Death of a Joint Tenant Affidavit

When someone passes away and owns property jointly, the survivors might need to provide legal documentation to have the property title updated. This is where the California Death of a Joint Tenant Affidavit comes into play. It serves this specific purpose, ensuring that the change in ownership is recognized and recorded properly by legal authorities. To complete this form correctly, follow the steps below. Remember, this important piece ensures the smooth transfer of property ownership, so it's vital to fill it out carefully and accurately. Here's how:

- Start by gathering necessary documents, such as the death certificate of the deceased joint tenant and any deeds or titles related to the property in question. Having these on hand will make the process smoother.

- Fill out the top portion of the form with the county recorder’s office information where the property is located. This typically includes the county name and the address of the recorder's office.

- Under the section titled "Affidavit," print the full legal name of the deceased joint tenant exactly as it appears on the property title or deed.

- Next, enter the date of death of the deceased joint tenant, ensuring the date is accurate as per the death certificate.

- List the property's legal description as found on the deed or title. This might include lot numbers, tract numbers, or street addresses. If unsure, consulting a professional or public records can provide clarity.

- Some forms might ask for the Assessor's Parcel Number (APN) of the property. If this is required, make sure to include it. This number can usually be found on property tax statements or by contacting the local tax assessor's office.

- Sign the affidavit in the presence of a notary public. The form must be notarized to be legally binding and accepted by the county recorder's office. Notaries can often be found at banks, law offices, or public libraries.

- Attach a certified copy of the death certificate to the affidavit. This is a crucial step, as the document serves as legal proof of the joint tenant's death.

- Finally, submit the completed form and attached death certificate to the county recorder’s office. There may be a filing fee, so it's wise to contact the office ahead of time to confirm any costs.

After the form is submitted and processed, the property records will be updated to reflect the change in ownership. This removes the deceased individual's name from the property title, officially recognizing the surviving joint tenant(s) as the sole owner(s). While it's a process that involves careful attention to detail, completing the California Death of a Joint Tenant Affidavit is a fundamental step in ensuring property matters are handled appropriately following the loss of a loved one.

Listed Questions and Answers

What is a California Death of a Joint Tenant Affidavit form?

This is a legal document used in the state of California to officially report the death of a joint tenant and to clarify the real property ownership status. It serves to update property records by removing the deceased individual's name, thereby ensuring that the property ownership reflects the current living joint tenant(s) as the sole owner(s).

Who can file a California Death of a Joint Tenant Affidavit?

The filing of this affidavit can be undertaken by the surviving joint tenant(s) or by a legal representative of the deceased's estate. It is essential that the person filing the affidavit has legal standing and can present evidence of the death, typically through a certified copy of the death certificate.

What documents are needed to accompany the affidavit?

To properly file a California Death of a Joint Tenant Affidavit, several documents must be prepared and submitted together:

- A completed and notarized Death of a Joint Tenant Affidavit form.

- A certified copy of the death certificate of the deceased joint tenant.

- Legal description of the property, which can often be obtained from a current property tax statement or the original deed.

How does filing this affidavit affect property ownership?

Filing the affidavit serves to legally adjust the ownership records, effectively transferring the property entirely into the name(s) of the surviving joint tenant(s). This transfer is significant in California, as it allows for the avoidance of probate for the property in question. The property automatically becomes the sole responsibility and ownership of the surviving joint tenant(s) upon the death of a fellow joint tenant, assuming all procedural steps are correctly followed.

Where should one file the California Death of a Joint Tenant Affidavit?

This affidavit and its accompanying documents should be filed with the county recorder’s office in the county where the property is located. Since property laws can vary slightly from county to county within California, it is advisable to contact the specific county recorder’s office for detailed filing instructions and any county-specific requirements.

Are there any fees associated with filing the affidavit?

Yes, counties in California typically require a filing fee for processing the California Death of a Joint Tenant Affidavit and the accompanying documents. The amount of the fee can vary by county, so it's recommended to contact the local county recorder’s office for the exact amount. Additionally, there might be a fee for making official copies of the filed affidavit.

Common mistakes

Filling out the California Death of a Joint Tenant Affidavit form is an important process that requires attention to detail. When dealing with the complexities of transferring property after a loved one's passing, it's natural for mistakes to occur. However, being aware of common errors can help streamline the process, ensuring a smooth transition of ownership. Below are eight frequent mistakes made during this process:

Not obtaining an official death certificate. An official, government-issued death certificate is necessary to accompany the affidavit. Simply referencing the death or providing an unofficial document isn’t sufficient.

Inaccurately describing the property. It's crucial to provide a legal description of the property. This description often includes lot numbers, tract numbers, and other unique identifiers beyond just the street address.

Forgetting to sign the document in front of a notary public. The affidavit requires notarization to verify the identity of the person completing the form. Signing it without a notary present invalidates the process.

Neglecting to file the form with the county recorder’s office where the property is located. Merely completing the form doesn't effectuate the property transfer. It must be filed correctly to be recognized legally.

Overlooking tax implications. It's important to understand potential property tax reassessments or any inheritance tax liabilities that may arise from the transfer of property.

Not using the most current form. Laws and procedures can change. Using an outdated form can result in delays or the rejection of the affidavit.

Improperly handling multiple joint tenants. If there were more than two joint tenants, the process might be more complicated, requiring additional documents or steps to correctly transfer ownership.

Failing to seek legal advice when unsure about the process. A professional can provide guidance tailored to an individual's specific situation, potentially avoiding costly errors.

Making sure to avoid these errors can greatly assist individuals navigating the affidavit process. It not only streamlines the transfer but also respects the intent of all parties involved.

Documents used along the form

When handling the transfer of property after the death of a joint tenant in California, the Affidavit of Death of a Joint Tenant is a crucial document. This affidavit serves to legally support the change in property ownership. To ensure a smooth and legally sound transfer, several other forms and documents are often used alongside the affidavit. Each document plays a unique role in the overall process, contributing to the lawful and efficient execution of estate matters.

- Death Certificate: An official document issued by the county public health department, confirming the death of the joint tenant. It's required for the validation of the Affidavit of Death of a Joint Tenant.

- Preliminary Change of Ownership Report (PCOR): This form is filed with the county recorder's office alongside the affidavit to notify the assessor's office of a change in ownership. It helps in the assessment of property taxes.

- Quitclaim Deed: Often used to clear up any clouds on title, a Quitclaim Deed can be filed to transfer any remaining interest in the property from the deceased to the surviving joint tenant without any warranty on the title.

- Trust Certification: If the property was held in a trust, this document certifies the trust's existence and the trustees' authority, necessary for the transfer of property according to the trust's terms.

- Spousal Property Petition: For properties held in community property states like California, this court form may be used by the surviving spouse to confirm property ownership without going through the full probate process.

- Notice of Proposed Action: Used in probate cases to inform relevant parties of intended actions regarding the estate’s property, like selling or transferring real estate, ensuring transparency and compliance with probate laws.

- Deed of Full Reconveyance: Upon the payoff of a mortgage or deed of trust, this document is issued by the beneficiary (lender) to clear the title and fully transfer property rights to the owner.

Together, these documents contribute to the comprehensive management of real estate upon the death of a joint tenant. Navigating through them requires attention to detail and an understanding of their individual and collective purposes. Utilizing them correctly ensures that property transfers adhere to California laws, offering peace of mind to all parties involved.

Similar forms

The California Death of a Joint Tenant Affidavit form shares similarities with the Affidavit of Heirship. Both documents serve the purpose of establishing the rightful ownership of property after someone passes away. An Affididavit of Heirship is often used to transfer property when a will is not present, similar to how the Death of a Joint Tenant Affidavit allows the surviving joint tenant to confirm their sole ownership of property after the other tenant's demise. Both require verification of the deceased's passing and aim to simplify the transfer of assets.

Similar in intent and purpose, the Transfer on Death Deed (TODD) is another document closely related to the California Death of a Joint Tenant Affidavit. The TODD allows property owners to name beneficiaries to their property, so that upon their death, the property transfers directly to the named beneficiary without the need for probate. Like the Death of a Joint Tenant Affidavit, it helps avoid the lengthy and complex process of transferring property rights, making the process more straightforward for the surviving party.

The Joint Tenancy Agreement is also akin to the Death of a Joint Tenant Affidavit. This agreement is made between co-owners of property, establishing each party's equal share and right to the whole property. Upon the death of one joint tenant, the Joint Tenancy Agreement implicitly transfers their interest to the surviving joint tenants. The Death of a Joint Tenant Affidavit formalizes this transfer post-death, making it official and recognized by law, just as the agreement intended.

Lastly, the Survivorship Affidavit bears resemblance to the Death of a Joint Tenant Affidavit in its facilitation of property transfer upon death. This legal document is used to confirm the survivorship rights in cases concerning joint tenants with rights of survivorship. It acts as proof that one tenant has died and that the surviving tenant(s) are legally entitled to the deceased's share of the property, similar to the process and outcome facilitated by the Death of a Joint Tenant Affidavit.

Dos and Don'ts

When dealing with the sensitive matter of filing the California Death of a Joint Tenant Affidavit form, it's crucial to handle the process with diligence and respect. Below are some essential dos and don’ts to consider:

- Do ensure all information is accurate. Mistakes can lead to unnecessary delays and complications.

- Do verify you have the legal authority to file this affidavit. Typically, this falls to immediate family members or legal representatives.

- Do include a certified copy of the death certificate. This is a necessary document for the process.

- Do check if you need to submit any additional documents specific to your county. Requirements can vary.

- Do contact a professional if you're unsure about any part of the process. Advice from a legal advisor can prevent errors.

- Don’t leave any sections incomplete. Every part of the affidavit is important for the record.

- Don’t guess if you're unsure about an answer. Incorrect information can invalidate the document.

- Don’t use informal language or abbreviations. The form is a formal legal document and must be treated as such.

- Don’t delay in submitting the form. Timely filing is important to settle the deceased's estate and affairs.

Taking the time to carefully prepare the California Death of a Joint Tenant Affidavit form will help ensure the process goes smoothly and respects the deceased’s joint tenancy arrangements. This thoughtful approach will assist in minimizing stress during a challenging time.

Misconceptions

Understanding the nuances of legal forms is crucial for accurately managing one's affairs, particularly when it involves sensitive topics such as the passing of property upon death. One form that comes up in this context in California is the "Death of a Joint Tenant Affidavit." While it serves an essential function in the transfer of property rights, there are several misconceptions surrounding it that merit clarification.

Misconception #1: It automatically transfers property to the surviving joint tenant.

While it's true that the form is used to notify that a joint tenant has passed away, it's not enough by itself to transfer property. The surviving joint tenant must file this affidavit with the appropriate county recorder's office to update the title and remove the deceased's name from the property record.

Misconception #2: It's a complicated form that requires an attorney to fill out.

The form is straightforward and typically requires basic information about the deceased, the surviving joint tenant, and the property. However, consulting with an attorney can ensure everything is in order and provide peace of mind.

Misconception #3: It can be used for any type of property ownership.

It specifically applies to joint tenancy situations and not other types of property ownership, such as tenants in common or community property. It's essential to understand the nature of the property ownership at hand.

Misconception #4: It eliminates the need for probate.

While filing this affidavit does help in transferring ownership without probate for the property held in joint tenancy, it doesn't eliminate the need for probate for other assets the deceased may have.

Misconception #5: It's only necessary if the joint tenants were married.

Joint tenancy can exist between any two or more persons, regardless of marital status. The affidavit is required whenever a joint tenant passes away to clear title, irrespective of the relationship.

Misconpreception #6: There are no tax implications.

While the form facilitates the transfer of property, it's important to be aware that there might be tax implications for the surviving joint tenant, such as property tax reassessments or capital gains taxes upon eventual sale.

Misconception #7: A copy of the deceased’s death certificate is not needed.

Actually, a certified copy of the death certificate usually must accompany the affidavit when it's filed with the county recorder's office. This document is crucial for verifying the death of the joint tenant.

Key takeaways

Filling out and using the California Death of a Joint Tenant Affidavit form is an important process for those dealing with the property matters of someone who has passed away. This document is crucial for the proper transfer of property ownership from the deceased to the surviving joint tenant. Here are five key takeaways to keep in mind:

- Accuracy is crucial: When completing the affidavit, every detail matters. It's important to cross-check the information you provide against official documents to ensure accuracy. This includes the full names of the deceased and surviving tenant, the property address, and any identifying document numbers.

- Understanding Joint Tenancy: This form is specifically for properties held in joint tenancy, meaning the property is owned by two or more people together. In California, this arrangement allows the property to pass automatically to the surviving owner(s) without going through probate, but this form is a necessary step in that process.

- Documentation is key: Along with the affidavit, you will need to attach a certified copy of the death certificate of the deceased joint tenant. This serves as official proof of death and is required to process the transfer of property.

- Legal advice can help: While filling out the form might seem straightforward, legal nuances can arise. Consulting with a legal advisor familiar with California property law can provide guidance and help avoid errors that could delay or complicate the transfer of property.

- Filing the form: Once the form is completed and the necessary documents are attached, it must be filed with the county recorder’s office in the county where the property is located. This step is crucial to officially remove the deceased’s name from the property title and complete the transfer to the surviving joint tenant.

Handling the particulars of this form with care and understanding can ease the transition period after a joint tenant's death, ensuring the property is transferred smoothly and legally.

Different PDF Templates

Form 500x - Carryover provisions allow taxpayers to benefit from unused credits in subsequent years, enhancing the credit's value.

California Fnp 004 - With the FNP-004, California medical practitioners have a direct line to the state Medical Board for all matters related to fictitious name permits, ensuring operations remain within legal bounds.

Form 540 Instructions 2023 - Accurately calculate and adjust your total income for California tax purposes with Schedule CA (540), paying the right amount to the state.