Fill a Valid California Earthquake Authority Form

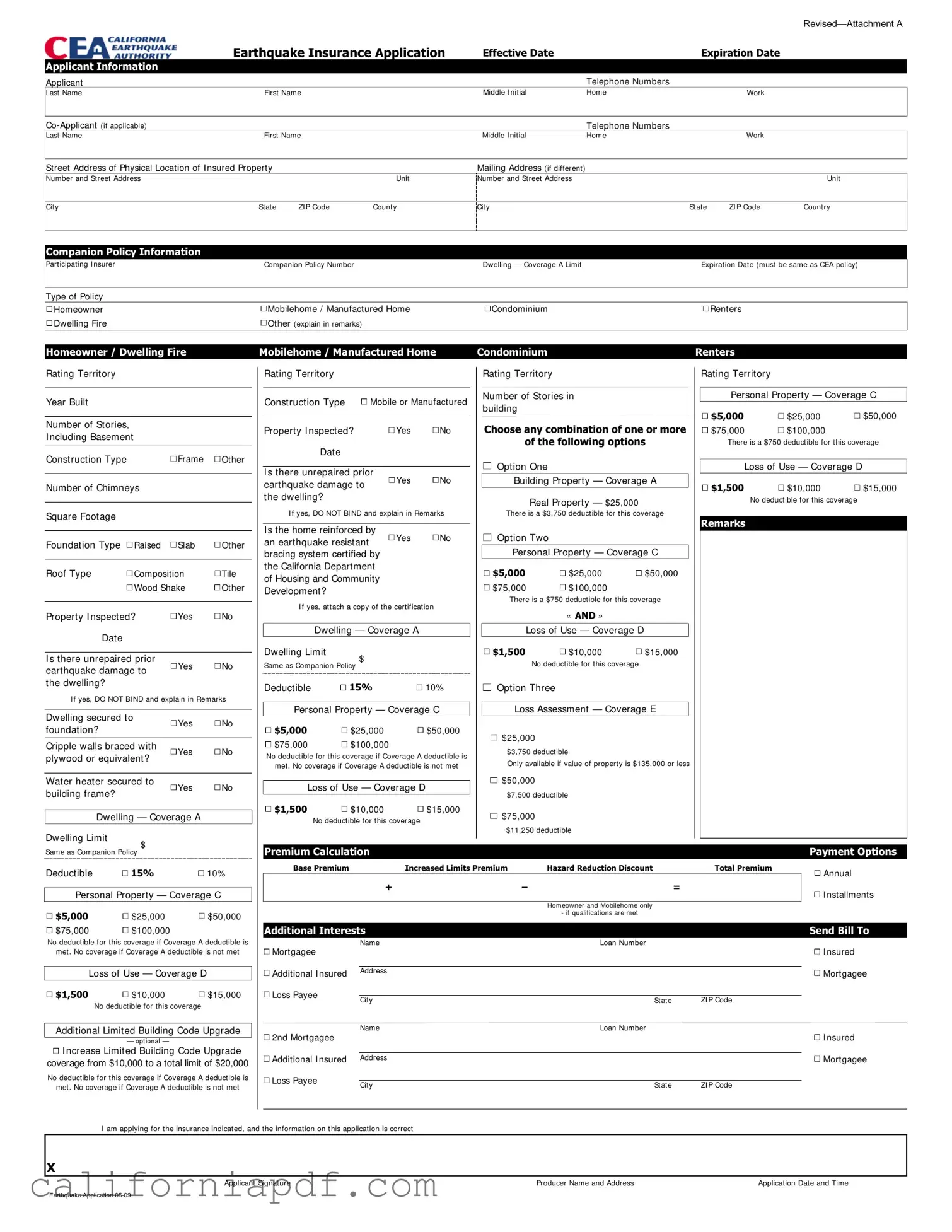

In California, where the ground shakes and the risk of earthquakes is part of daily life, securing the right insurance is crucial for homeowners, renters, and property owners alike. The California Earthquake Authority (CEA) offers a tailored form, revised in its latest iteration, Attachment A, to help individuals apply for earthquake insurance. This document intricately covers the application process, detailing the need for comprehensive information from prospective policyholders, including personal details, property specifics, and desired coverage options. From the basic structure of the application—spanning effective and expiration dates, applicant information, and detailed property descriptions—the form delves into the nuanced needs of coverage for dwellings, personal property, and additional living expenses in the aftermath of a quake. Significantly, it aligns the expiration date of the policy with that of any companion policy the applicant might have, ensuring seamless protection coverage. Options for deductibles and premium calculations offer flexibility, while sections on construction type, year built, and safety features such as earthquake-resistant bracing systems hint at the complex interplay between risk assessment and insurance provisions. Also notable is the inclusion of different coverage limits, deductibles, and the clarification on the inspection status of the property, especially concerning unrepaired damage from previous seismic events. The form is not just an application but a guide through the maze of decisions property owners face in protecting their assets against the unpredictable forces of nature.

Document Example

|

Earthquake Insurance Application |

Effective Date |

|

Expiration Date |

|

|||

Applicant Information |

|

|

|

|

|

|

|

|

Applicant |

|

|

|

|

Telephone Numbers |

|

|

|

Last Name |

First Name |

|

Middle I nitial |

Home |

|

Work |

|

|

|

|

|

|

Telephone Numbers |

|

|

|

|

Last Name |

First Name |

|

Middle I nitial |

Home |

|

Work |

|

|

Street Address of Physical Location of I nsured Property |

|

|

Mailing Address (if different) |

|

|

|

|

|

Number and Street Address |

|

|

Unit |

Number and Street Address |

|

|

|

Unit |

City |

State |

ZI P Code |

County |

City |

|

State |

ZI P Code |

Country |

|

|

|

|

|

|

|

|

|

Companion Policy Information |

|

|

|

|

|

|

|

|

Participating I nsurer |

Companion Policy Number |

|

Dwelling — Coverage A Limit |

|

Expiration Date (must be same as CEA policy) |

|||

Type of Policy |

|

|

|

|

|

|

|

|

Homeowner |

Mobilehome / Manufactured Home |

Condominium |

|

|

Renters |

|

||

Dwelling Fire |

Other (explain in remarks) |

|

|

|

|

|

|

|

Homeowner / Dwelling Fire

Mobilehome / Manufactured Home

CondominiumRenters

Rating Territory

Year Built

Number of Stories,

I ncluding Basement

Construction Type |

|

Frame |

Other |

|

|

|

|

||

Number of Chimneys |

|

|

||

|

|

|

|

|

Square Footage |

|

|

|

|

|

|

|

|

|

Foundation Type |

Raised |

Slab |

Other |

|

|

|

|

||

Roof Type |

Composition |

Tile |

||

|

Wood Shake |

Other |

||

|

|

|

||

Property I nspected? |

Yes |

No |

||

Date |

|

|

|

|

|

|

|

||

I s there unrepaired prior |

Yes |

No |

||

earthquake damage to |

||||

|

|

|||

the dwelling? |

|

|

|

|

I f yes, DO NOT BI ND and explain in Remarks |

||||

|

|

|

|

|

Dwelling secured to |

|

Yes |

No |

|

foundation? |

|

|||

|

|

|

||

|

|

|

||

Cripple walls braced with |

Yes |

No |

||

plywood or equivalent? |

||||

|

|

|||

|

|

|

||

Water heater secured to |

Yes |

No |

||

building frame? |

|

|||

|

|

|

||

Dwelling — Coverage A |

|

|||

Dwelling Limit |

$ |

|

|

|

|

|

|

||

Rating Territory

Construction Type |

Mobile or Manufactured |

|||

|

|

|

||

Property I nspected? |

Yes |

No |

||

Date |

|

|

|

|

|

|

|

||

I s there unrepaired prior |

Yes |

No |

||

earthquake damage to |

||||

|

|

|||

the dwelling? |

|

|

|

|

I f yes, DO NOT BI ND and explain in Remarks |

||||

|

|

|

||

Is the home reinforced by |

Yes |

No |

||

an earthquake resistant |

||||

|

|

|||

bracing system certified by |

|

|

||

the California Department |

|

|

||

of Housing and Community |

|

|

||

Development? |

|

|

|

|

I f yes, attach a copy of the certification |

||||

Dwelling — Coverage A |

|

|||

Dwelling Limit |

$ |

|

|

|

|

|

|

||

Same as Companion Policy |

|

|

||

Deductible |

15% |

|

10% |

|

Personal Property — Coverage C |

||||

$5,000 |

$25,000 |

|

$50,000 |

|

$75,000 |

$100,000 |

|

|

|

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

|

No deductible for this coverage |

|

Rating Territory

Number of Stories in building

Choose any combination of one or more

of the following options

Option One

Building Property — Coverage A

Real Property — $25,000

There is a $3,750 deductible for this coverage

Option Two

Personal Property — Coverage C

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

There is a $750 deductible for this coverage

«AND »

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

No deductible for this coverage

Option Three

Loss Assessment — Coverage E

$25,000

$3,750 deductible

Only available if value of property is $135,000 or less

$50,000

$7,500 deductible

$75,000

$11,250 deductible

Rating Territory

Personal Property — Coverage C

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

There is a $750 deductible for this coverage

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

|

No deductible for this coverage |

|

Remarks

Same as Companion Policy |

|

|

Deductible |

15% |

10% |

Personal Property — Coverage C |

||

$5,000 |

$25,000 |

$50,000 |

$75,000 |

$100,000 |

|

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met

Loss of Use — Coverage D

$1,500 |

$10,000 |

$15,000 |

No deductible for this coverage

Additional Limited Building Code Upgrade

— optional —

I ncrease Limited Building Code Upgrade coverage from $10,000 to a total limit of $20,000

I ncrease Limited Building Code Upgrade coverage from $10,000 to a total limit of $20,000

No deductible for this coverage if Coverage A deductible is met. No coverage if Coverage A deductible is not met

Premium Calculation |

|

|

|

Payment Options |

Base Premium |

Increased Limits Premium |

Hazard Reduction Discount |

Total Premium |

Annual |

|

|

|

|

|

+ |

|

− |

= |

I nstallments |

|

|

|

|

|

|

|

Homeowner and Mobilehome only |

|

|

|

|

- if qualifications are met |

|

|

Additional Interests |

|

|

Send Bill To |

||

|

Name |

Loan Number |

|

|

|

Mortgagee |

|

|

|

I nsured |

|

|

|

|

|

|

|

Additional I nsured |

Address |

|

|

Mortgagee |

|

|

|

|

|||

Loss Payee |

|

|

|

|

|

City |

State |

ZI P Code |

|||

|

|||||

|

Name |

Loan Number |

|

|

|

2nd Mortgagee |

|

|

|

I nsured |

|

|

|

|

|

|

|

Additional I nsured Address |

|

|

Mortgagee |

||

Loss Payee |

|

|

|

|

|

City |

State |

ZI P Code |

|||

|

|||||

I am applying for the insurance indicated, and the information on this application is correct

X

Applicant Signature |

Producer Name and Address |

Application Date and Time |

Earthquake Application

Attachment A – Page 2

CALIFORNIA EARTHQUAKE AUTHORITY

EARTHQUAKE INSURANCE APPLICATION – 05/09 Edition

INSTRUCTIONS

POLICY EFFECTIVE DATE AND EXPIRATION DATE

Provide CEA policy effective date and expiration date. Expiration date MUST be the same as the expiration date of the companion policy.

APPLICANT

Complete all requested information for applicant(s) including: Name(s)

Telephone number(s)

Street address of physical location of insured property

Mailing address (if different from street address of property’s physical location)

COMPANION POLICY INFORMATION

Complete all requested information for companion policy including: Name of Participating Insurer

Policy number of companion policy

Dwelling limit (i.e., Coverage A) of companion policy (if companion policy has dwelling limit) Expiration date of companion policy

Type of companion policy

POLICY TYPE

•Homeowner (Companion policy must be either a Homeowners

O MOBILEHOME/MANUFACTURED HOME (Written on CEA Homeowner Policy form; however, requires unique rating information.)

Condominium (i.e. Common Interest Development) (Companion policy must be a Condominium Unit Owners

Renters (Companion policy must be a Renters

Complete all information requested under the applicable CEA policy type. Answer all questions and select desired CEA policy limits and coverage options.

PREMIUM CALCULATION

Provide premium calculations.

PAYMENT OPTIONS

Select payment option:

Annual; or

Installments

SEND BILL TO

Select who should receive the bill:

Insured; or

Mortgagee

ADDITIONAL INTERESTS

Complete information requested for each additional interest, including:

Type:

OMortgagee;

OAdditional insured; or

OLoss payee

Name and address

Loan number (if applicable)

REMARKS

Include any additional remarks as needed.

SIGNATURE

Secure the applicant’s signature on the application.

Provide the producer’s name and address.

Provide the date and time the application is completed.

Form Breakdown

| Fact Title | Fact Detail |

|---|---|

| Form Revision | The California Earthquake Authority Earthquake Insurance Application was revised with the edition marked May 2009 (05/09). |

How to Write California Earthquake Authority

Filling out the California Earthquake Authority form requires careful attention to detail to ensure accurate submission. The form addresses various aspects of earthquake insurance, including personal, property, and structural information. Following the outlined steps will help in completing the application correctly.

- Policy Effective Date and Expiration Date: Enter the effective date of the CEA policy and ensure that the expiration date matches that of the companion policy.

- Applicant Information: Fill in the full name, telephone numbers, and address details for the insured property. Include co-applicant details if applicable.

- Mailing Address: If different from the insured property's location, provide the mailing address.

- Companion Policy Information: Input the name of the participating insurer, the companion policy number, and the dwelling coverage limit (Coverage A), along with its expiration date. Specify the type of companion policy.

- Policy Type – Rating and Coverage Information: Identify the type of CEA policy based on the companion policy. Provide information specific to the dwelling, such as year built, construction type, number of stories, and foundation type. Indicate if the dwelling has been inspected, if there's unrepaired earthquake damage, and if earthquake-resistant measures have been taken.

- Dwelling – Coverage A: Specify the dwelling limit and select the desired deductible percentage.

- Personal Property – Coverage C: Choose the amount of personal property coverage and note if the deductible for Coverage A has been met.

- Loss of Use – Coverage D: Select the appropriate option for loss of use coverage, noting there is no deductible if Coverage A's deductible is met.

- Options for Additional Coverage: Based on eligibility, select additional coverage options for building property, personal property, and loss assessment, noting the deductible amounts for each.

- Premium Calculation: Provide the base premium, any increased limits premium, hazard reduction discount, and calculate the total premium. Choose the payment option and specify who should receive the bill.

- Additional Interests: Fill in details for any additional interests, including mortgagees or loss payees, with their respective names, addresses, and loan numbers if applicable.

- Remarks: Enter any additional remarks necessary for clarification or further explanation of coverage and policy details.

- Signature: The applicant must sign the application, and the producer's name, address, date, and time of application completion should be provided.

After completing these steps, review the application for accuracy before submission. Thoroughly checking the form ensures that all necessary information is conveyed clearly and correctly. This meticulous approach aids in the efficient processing of the application, granting peace of mind to the applicant regarding their earthquake insurance coverage.

Listed Questions and Answers

What is the California Earthquake Authority (CEA) form and who needs to fill it out?

The California Earthquake Authority (CEA) form is part of an earthquake insurance application process. It is designed for property owners in California seeking to obtain or renew earthquake insurance coverage. This document must be filled out by individuals or entities that own residential properties or are renters wishing to protect their personal property and financial interests from the risk of earthquake damage. It's applicable for a variety of dwelling types, including homeowners, mobile homes, manufactured homes, condominiums, and renters. Completing this form is a crucial step in securing financial protection against potential earthquake damage.

What information is required when completing the CEA form?

Filling out the CEA form requires the provision of detailed information, sorted into various sections, including:

- Applicant Information: Names and telephone numbers of the applicant and, if applicable, the co-applicant.

- Property Information: The physical and mailing address of the insured property, including details about the dwelling such as year built, number of stories, construction type, number of chimneys, square footage, foundation, and roof type.

- Policy Information: Information about any existing companion policy, including the insurer, policy number, type of policy, and related dwelling coverage.

- Coverage Options: Desired limits and deductibles for dwelling, personal property, loss of use, and optionally, building code upgrades.

- Premium Calculation and Payment Options: Details for calculating the premium and preferred payment method.

- Additional Interests: Information about any additional interests, such as a mortgagee or loss payee, including their name, address, and loan number, if applicable.

It is important to answer all questions accurately and provide comprehensive information to ensure proper coverage.

How does the deductible work on the CEA form?

The deductible on the CEA form refers to the amount the insured must pay out of pocket before the insurance coverage kicks in after an earthquake. Deductibles are expressed as a percentage of the Coverage A limit (Dwelling Coverage) and can vary. Options typically include 15% or 10%. For personal property and loss of use coverages, there is often no deductible if the Coverage A deductible is met. It's essential to choose a deductible that balances affordability with the level of financial protection desired.

Can changes be made to the CEA form once it's submitted?

Yes, changes can be made to the CEA form after submission, but the process for doing so depends on the nature of the changes and the insurance provider's policies. For minor corrections or updates, contacting the insurer directly may suffice. For more significant changes, such as adjustments to coverage limits or adding additional properties, it might be necessary to complete a new application or a specific form for policy changes. It's advisable to review the submission for accuracy before sending it in and to consult with the insurance provider regarding their policies on post-submission changes.

Common mistakes

When filling out the California Earthquake Authority form, applicants frequently make mistakes that could potentially affect the processing and validity of their application. Awareness of these common errors can help ensure that information is submitted correctly and efficiently. Here's a list of seven mistakes to watch out for:

- Failing to match the effective and expiration dates with those of the companion policy can lead to processing delays or issues with policy activation.

- Incorrectly listing applicant information, such as misspelling names or providing outdated telephone numbers, which can complicate communication efforts.

- Not providing a complete address for the insured property, including the unit number when applicable, may lead to inaccuracies in assessing the risk or location of the property.

- Skipping companion policy details such as the insurance provider's name and the policy number can result in incomplete applications that cannot be processed.

- Omitting important details about the dwelling, like the year built, construction type, or number of stories, which are crucial for accurately determining the insurance premium.

- Overlooking to specify if there is unrepaired earthquake damage to the dwelling or if safety features have been implemented, which could either disqualify the application or affect premium calculations.

- Incorrect premium calculation or payment option selection by not accurately adding up the total premium or selecting an unsuitable payment plan can lead to billing issues.

It's imperative for applicants to review their form thoroughly before submission. This ensures that all sections are accurate and complete, helping to expedite the approval process and avoid unnecessary complications with their earthquake insurance coverage.

Documents used along the form

When homeowners in California consider securing their property with earthquake insurance through the California Earthquake Authority (CEA), it is typically part of a broader approach to risk management. To fully prepare for the application process and maintain comprehensive coverage, several additional documents and forms are commonly used alongside the CEA form. These documents play crucial roles in providing detailed information required for policy issuance, ensuring proper coverage, and fulfilling legal or financial obligations.

- Dwelling Policy Form: This document outlines the standard coverage provided under a homeowner's insurance policy excluding earthquake damage. It constitutes the companion policy and serves as a base for the CEA policy, detailing aspects such as coverage limits for the dwelling and personal property, which are essential in determining the corresponding coverage in the earthquake insurance application.

- Proof of Prior Insurance: Applicants may need to provide documentation proving the existence of a prior insurance policy. This shows the property's insurance history and is used to verify eligibility for certain coverage options or discounts available through the CEA for homes with continuous coverage or retrofitting.

- Earthquake Retrofitting Certificate: If the homeowner has made specific improvements to enhance the earthquake resistance of their property, such as securing the foundation or bracing cripple walls, a certificate or official documentation verifying these upgrades can be important. This documentation can qualify the property for reduced insurance premiums or deductible options due to the decreased risk level.

- Mortgagee Information and Consent Forms: For properties that have a mortgage, information about the lender must be provided, including consent forms if required. These documents ensure that the mortgagee's interests are protected in the earthquake policy and that they are informed about the coverage on the property they have financed.

Collectively, these documents support the earthquake insurance application process by providing comprehensive information about the property, its current insurance status, and any measures taken to mitigate earthquake damage. Having these documents prepared can facilitate a smoother application process, ensuring that all necessary details are accurately captured for appropriate coverage. It is important for homeowners to work closely with their insurance agents to gather and submit all the required documentation efficiently.

Similar forms

The California Earthquake Authority (CEA) form closely resembles the standard Homeowners Insurance Application in its structure and the type of information it requests. Just like the CEA form, a homeowners insurance application collects detailed information about the applicant, such as names, telephone numbers, and addresses. It also requires details about the insured property, including its location, construction type, year built, and safety features. Both forms aim to assess the risk associated with insuring the property, albeit with a focus on different types of coverage risks—earthquake damage in the case of the CEA form, and a broader range of risks (such as fire, theft, and other damages) for the standard homeowners insurance.

Similarly, the CEA form shares a resemblance with Auto Insurance Applications. Both types of applications require personal information about the policy applicant, details about the property to be insured (a vehicle in one and a residence in the other), and coverage details. Where auto insurance applications inquire about car model, make, year, and driving history to evaluate risk, the CEA form inquires about home construction, foundation type, and earthquake preparedness features. Both forms ultimately calculate a premium based on the risk and coverage options selected.

The CEA application also parallels Renters Insurance Applications in how it addresses the needs of individuals who do not own the homes they live in. Both applications require similar applicant information and coverage details tailored to the applicant's situation—renters insurance focuses on insuring personal property and liability within a rented dwelling, whereas the CEA provides options for renters to protect their belongings against earthquake damage, emphasizing the adaptability of both forms to specific living situations.

Life Insurance Applications are another document that, while covering a vastly different aspect of insurance, shares fundamental similarities with the CEA form in terms of application structure and purpose. Both solicit extensive personal information, including health or property condition, to evaluate risk. The CEA form's questions about earthquake damage and mitigation measures mirror the way life insurance applications assess health and lifestyle factors—to calculate the likelihood of a claim and determine the appropriate premium.

Lastly, the Business Insurance Application is akin to the CEA form, especially when considering policies that cover physical assets and locations. Like the CEA application, a business insurance application requests detailed information about the property in question, including address, structural details, and usage. It also assesses the risk factors associated with the property's location and construction, such as the potential for natural disasters in the case of the CEA form, aiming to tailor the coverage to the specific needs and risks of the business.

Dos and Don'ts

When filling out the California Earthquake Authority form, there are specific do's and don'ts that can help streamline the process and ensure accuracy. Below you'll find a curated list highlighting these points:

Do:- Ensure Consistency: Double-check that the policy effective date and expiration date match the companion policy's expiration date. This alignment is crucial for the validity of the application.

- Complete All Required Fields: Fill in all sections relevant to your application type, including applicant information, companion policy information, and the specific coverage information requested. Leaving sections incomplete can delay processing.

- Answer All Questions Truthfully: Provide honest answers to all questions, especially those related to previous earthquake damage and safety measures taken on the property. Accuracy is key to obtaining the correct coverage.

- Review Payment Options Carefully: Select the payment option—annual or installment—that best suits your financial situation. Understanding these options will help manage the premium payments effectively.

- Overlook Signature Requirements: Failing to provide the necessary signatures at the end of the application can invalidate the entire process. Ensure that both the applicant and the producer sign the form.

- Ignore Additional Interests: If there are mortgagees, additional insureds, or loss payees associated with the property, their details need to be accurately recorded on the form to protect all parties' interests.

- Miscalculate Premiums: When completing the premium calculation section, ensure accuracy in the arithmetic to avoid discrepancies in your coverage or delays in processing.

- Skip Over Remarks: The remarks section is crucial for noting any conditions or explanations that don't fit neatly into the form's other sections. Neglecting to use this space for necessary clarifications can lead to misunderstandings or insufficient coverage.

Misconceptions

When it comes to the California Earthquake Authority (CEA) forms and applying for earthquake insurance, there seem to be a few misconceptions floating around that can cause some confusion. Let's clarify these misconceptions:

- Only homeowners can apply: It's a common misunderstanding that the CEA's insurance is exclusively available to homeowners. In reality, the CEA offers earthquake insurance to a wide variety of residents, including renters, condo unit owners, and mobilehome owners. So, whether you're renting your space or you own it, there's coverage available for you.

- One-size-fits-all coverage: Each property and homeowner's needs are unique, and the CEA recognizes this by offering customizable coverage options. You're not stuck with a pre-determined set of coverages. From choosing deductibles to selecting coverage limits for personal property and loss of use, you can tailor your policy to suit your specific needs.

- Earthquake insurance is too expensive: While the cost of insurance can be a concern, the CEA has made efforts to provide a range of options to fit different budgets. Deductibles can vary, and there are discounts available for homes that are seismically retrofitted, which can make premiums more affordable. Evaluating your potential risk and comparing it against the cost of coverage is key to seeing the value in earthquake insurance.

- Old homes don't qualify: Another myth is that older homes can't get coverage. While it's true that older homes may face higher risks in earthquakes, CEA policies are available for buildings of many ages and types. The important factor is not the age of the house but its compliance with safety standards and the steps taken to reduce earthquake risks, like securing the water heater and bracing cripple walls.

- Coverage is immediate upon application: It's important to note that earthquake insurance policies have a waiting period before the coverage takes effect. This means if you're applying for a CEA policy, there's a short delay from the time you sign up to when your coverage starts. This is a standard practice designed to prevent claims from being filed for damages that occurred before the policy was in effect.

Understanding these facets of the California Earthquake Authority forms and coverage can help you navigate your options more effectively and secure the right protection for your dwelling against earthquakes.

Key takeaways

Filling out the California Earthquake Authority (CEA) form accurately ensures your application for earthquake insurance is considered correctly. Here are key takeaways to guide you:

- Policy Dates: The effective date and expiration date of your CEA policy must align with those of the companion policy. Double-check these dates for accuracy to avoid processing delays.

- Applicant Details: Fully complete the applicant information section, including names, phone numbers, and both the physical and, if different, mailing addresses of the insured property. Incorrect or incomplete information can lead to issues with your application.

- Companion Policy: The form requires information on your current insurance policy, known as the companion policy. Include the participating insurer's name, the policy number, and other details as indicated.

- Type of Dwelling: Specify your property's type - such as a homeowner, mobilehome/manufactured home, condominium, or renters - as this determines the required policy type and coverage details.

- Construction Details: Accurately report details about your dwelling, including the year built, the number of stories, construction type, and if there's any unrepaired earthquake damage. These factors significantly influence your coverage options and premium.

- Coverage Selections: Choose your desired coverage carefully, considering the limits and deductibles for dwelling (Coverage A), personal property (Coverage C), and loss of use (Coverage D). There are options to suit different needs and budgets, but make informed choices.

- Deductible Decisions: Understand that deductibles apply differently across coverages. For some coverages, the deductible must be met before the coverage is effective, while others may not require a deductible.

Premium Calculation and Payment Options: Fill out the section for premium calculation accurately to see your total premium. Then, select your preferred payment option, whether annually or in installments, based on what is most convenient for you. - Additional Interests: If there is a mortgagee, additional insured, or loss payee associated with the property, their details must be provided. This ensures that all parties with a vested interest in the property are noted on the policy.

Completing the CEA form with attention to these details ensures clear communication of your coverage needs and avoids potential issues with your earthquake insurance coverage. Always double-check the information provided for accuracy before submission.

Different PDF Templates

California Business Address Change - After submitting, taxpayers should monitor their mail at the new address for confirmation or any further requests from the Franchise Tax Board.

California 513 026 - Clarifies that the label review fee is non-refundable, emphasizing the importance of accuracy in application.