Fill a Valid California Sales Tax Certificate Form

The California Sales Tax Certificate form, specifically the Uniform Sales & Use Tax Exemption/Resale Certificate — Multijurisdiction, is an important document that plays a pivotal role in the transactional dynamics between buyers and sellers across various states, including California. This certificate is acknowledged by a list of states, each with specific instructions and conditions under which the certificate can be used for claiming sales and use tax exemptions. Both the issuer and the recipient bear the responsibility of understanding and complying with the laws that govern the usage of this certificate in their respective states, a crucial aspect given that these laws are subject to changes. The form itself covers a range of designations for the firm or individual making the purchase, including wholesaler, retailer, manufacturer among others, and requires details such as business description and state registration numbers. It underlines that the purchased goods or services are intended for resale, leasing, or as ingredients or components in the production of new products or services within the ordinary course of business. Moreover, the form includes a declaration that all information provided is accurate under penalties of perjury, underscoring the legal implications of the document. The comprehensive instructions further delineate the obligations of sellers to retain properly executed certificates and caution against misuse which could incur legal and financial penalties. While offering a streamlined approach to claiming tax exemptions across multiple jurisdictions, the document also emphasizes the necessity for both parties to exercise due diligence in its application, reflecting the complexity and legal significance of tax exemption certifications in interstate commerce.

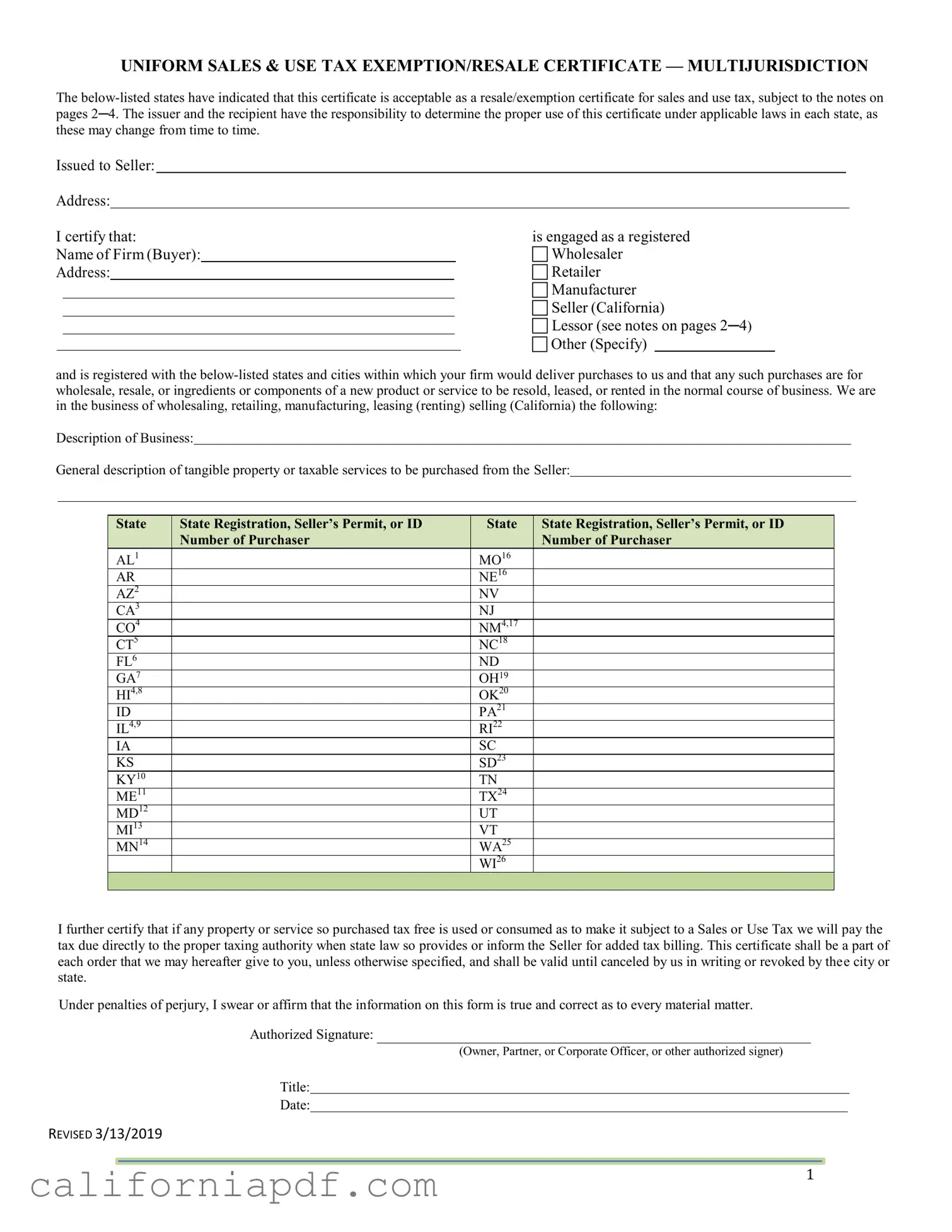

Document Example

UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION

The

Issued to Seller:

Address:

I certify that: |

|

|

is engaged as a registered |

||||

Name of Firm (Buyer): |

|

|

|

Wholesaler |

|||

Address: |

|

|

Retailer |

||||

|

|

|

|

|

|

Manufacturer |

|

|

|

|

|

|

|

Seller (California) |

|

|

|

|

|

|

|

Lessor (see notes on pages 2─4) |

|

|

|

|

|

|

|

Other (Specify) |

|

and is registered with the

Description of Business:

General description of tangible property or taxable services to be purchased from the Seller:

State |

State Registration, Seller’s Permit, or ID |

State |

State Registration, Seller’s Permit, or ID |

|

Number of Purchaser |

|

Number of Purchaser |

AL1 |

|

MO16 |

|

AR |

|

NE16 |

|

AZ2 |

|

NV |

|

CA3 |

|

NJ |

|

CO4 |

|

NM4,17 |

|

CT5 |

|

NC18 |

|

FL6 |

|

ND |

|

GA7 |

|

OH19 |

|

HI4,8 |

|

OK20 |

|

ID |

|

PA21 |

|

IL4,9 |

|

RI22 |

|

IA |

|

SC |

|

KS |

|

SD23 |

|

KY10 |

|

TN |

|

ME11 |

|

TX24 |

|

MD12 |

|

UT |

|

MI13 |

|

VT |

|

MN14 |

|

WA25 |

|

|

|

WI26 |

|

|

|

|

|

I further certify that if any property or service so purchased tax free is used or consumed as to make it subject to a Sales or Use Tax we will pay the tax due directly to the proper taxing authority when state law so provides or inform the Seller for added tax billing. This certificate shall be a part of each order that we may hereafter give to you, unless otherwise specified, and shall be valid until canceled by us in writing or revoked by thee city or state.

Under penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material matter.

Authorized Signature:

(Owner, Partner, or Corporate Officer, or other authorized signer)

Title:

Date:

REVISED 3/13/2019

1

INSTRUCTIONS REGARDING

UNIFORM SALES & USE TAX EXEMPTION CERTIFICATE

To Seller’s Customers:

In order to comply with most state and local sales tax law requirements, the Seller must have in its files a properly executed exemption certificate from all of its customers (Buyers) who claim a sales/use tax exemption. If the Seller does not have this certificate, it is obliged to collect the tax for the state in which the property or service is delivered.

If the Buyer is entitled to a sales tax exemption, the Buyer should complete the certificate and send it to the Seller at its earliest convenience. If the Buyer purchases tax free for a reason for which this form does not provide, the Buyer should send the Seller its special certificate or statement.

Caution to Seller:

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented, or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states or cities. Misuse of this certificate by Seller, lessee, or the representative thereof may be punishable by fine, imprisonment or loss of right to issue a certificate in some states or cities.

Notes:

1.Alabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption.

2.Arizona: This certificate may be used only when making purchases of tangible personal property for resale in the ordinary

course of business, and not for any other statutory deduction or exemption. It is valid as a resale certificate only if it contains the purchaser’s name, address, signature, and Arizona transaction privilege tax (or other state sales tax) license number, as required by Arizona Revised Statutes §

3. California: a) This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Title 18, California Code of Regulations, Section 1668 (Sales and Use Tax Regulation 1668, Resale Certificate).

b)By use of this certificate, the purchaser certifies that the property is purchased for resale in the regular course of business in the form of tangible personal property, which includes property incorporated as an ingredient or component of an item manufactured for resale in the regular course of business.

c)When the applicable tax would be sales tax, it is the Seller who owes that tax unless the Seller takes a timely and valid resale certificate in good faith.

d)A valid resale certificate is effective until the issuer revokes the certificate.

4.Colorado, Hawaii, Illinois, and New Mexico: these states do not permit the use of this certificate to claim a resale exemption for the purchase of a taxable service for resale.

5.Connecticut: This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to Conn. Gen. State

6.Florida: Allows the Multistate Tax Commission’s Uniform Sales and Use Tax Exemption/Resale Certificate –

Multijurisdictional for

number from the Florida Department of Revenue at floridarevenue.com/taxes/certificates, or by calling

7.Georgia: The purchaser’s

purchaser is located outside Georgia, does not have nexus with Georgia, and the tangible personal property is delivered by drop shipment to the purchaser’s customer located in Georgia.

REVISED 3/13/2019

2

8.Hawaii: allows this certificate to be used by the seller to claim a lower general excise tax rate or no general excise tax, rather than the buyer claiming an exemption. The no tax situation occurs when the purchaser of imported goods certifies to the seller, who originally imported the goods into Hawaii, that the purchaser will resell the imported goods at wholesale. If the lower rate or

9.Illinois: Use of this certificate in Illinois is subject to the provisions of 86 Ill. Adm. Code Ch.I, Sec. 130.1405. Illinois does not have an exemption for sales of property for subsequent lease or rental, nor does the use of this certificate for claiming resale purchases of services have any application in Illinois.

The registration number to be supplied next to Illinois on page 1 of this certificate must be the Illinois registration or resale number; no other state’s registration number is acceptable.

“Good faith” is not the standard of care to be exercised by a retailer in Illinois. A retailer in Illinois is not required to determine whether the purchaser actually intends to resell the item. Instead, a retailer must confirm that the purchaser has a valid registration or resale number at the time of purchase. If a purchaser fails to provide a certificate of resale at the time of sale in Illinois, the seller must charge the purchaser tax.

While there is no statutory requirement that blanket certificates of resale be renewed at certain intervals, blanket certificates should be updated periodically, and no less frequently than every three years.

10.Kentucky: a) Kentucky does not permit the use of this certificate to claim resale exclusion for the purchase of a taxable service.

b)This certificate is not valid as an exemption certificate. Its use is limited to use as a resale certificate subject to the provisions of Kentucky Revised Statute 139.270 (Good Faith).

c)The use of this certificate by the purchaser constitutes the issuance of a blanket certificate in accordance with Kentucky Administrative Regulation 103 KAR 31:111.

11.Maine: This state does not have an exemption for sales of property for subsequent lease or rental.

12.Maryland: This certificate is not valid as an exemption certificate. However, vendors may accept resale certificates that bear the

exemption number issued to a religious organization. Exemption certifications issued to religious organizations consist of 8 digits, the first two of which are always “29”. Maryland registration, exemption, and direct pay numbers may be verified on the website of the Comptroller of the Treasury at www.marylandtaxes.com.

13.Michigan: This certificate is effective for a period of four years unless a lesser period is mutually agreed to and stated on this certificate. It covers all exempt transfers when accepted by the seller in “good faith” as defined by Michigan statute.

14.Minnesota: a) Minnesota does not allow a resale certificate for purchases of taxable services for resale in most situations.

b)Minnesota allows an exemption for items used only once during production and not used again.

15. |

Missouri: |

a) Purchasers who improperly purchase property or services |

|

|

pay the tax, interest, additions to tax, or penalty. |

b)Even if property is delivered outside Missouri, facts and circumstances may subject it to Missouri tax, contrary to the second sentence of the first paragraph of the above instructions.

16. Nebraska: A blanket certificate is valid for 3 years from the date of issuance.

17.New Mexico: For transactions occurring on or after July 1, 1998, New Mexico will accept this certificate in lieu of a New Mexico nontaxable transaction certificate and as evidence of the deductibility of a sale of tangible personal property provided:

a)this certificate was not issued by the State of New Mexico;

b)the buyer is not required to be registered in New Mexico; and

c)the buyer is purchasing tangible personal property for resale or incorporation as an ingredient or component of a manufactured product.

18.North Carolina: This certificate is not valid as an exemption certificate if signed by a person such as a contractor who intends to use the property. Its use is subject to G.S.

REVISED 3/13/2019

3

19. Ohio: a) The buyer must specify which one of the reasons for exemption on the certificate applies. This may be done by circling or underlining the appropriate reason or writing it on the form above the state registration section. Failure to specify the exemption reason will, on audit, result in disallowance of the certificate.

b)In order to be valid, the buyer must sign and deliver the certificate to the seller before or during the period for filing the return.

20Oklahoma: Oklahoma would allow this certificate in lieu of a copy of the purchaser’s sales tax permit as one of the elements of “properly completed documents” which is one of the three requirements which must be met prior to the vendor being relieved of liability. The other two requirements are that the vendor must have the certificate in his possession at the time the sale is made and must accept the documentation in good faith. The specific documentation required under OAC

a)Sales tax permit information may consist of:

(i)A copy of the purchaser’s sales tax permit; or

(ii)In lieu of a copy of the permit, obtain the following:

*Sales tax permit number; and

*The name and address of the purchaser;

b)A statement that the purchaser is engaged in the business of reselling the articles purchased;

c)A statement that the articles purchased is purchased for resale;

d)The signature of the purchaser or a person authorized to legally bind the purchaser; and

e)Certification on the face of the invoice, bill, or sales slip, or on separate letter, that said purchaser is engaged in reselling the articles purchased.

Absent strict compliance with these requirements, Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid, for whatever reason, unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate.

21.Pennsylvania: This certificate is not valid as an exemption certificate. It is valid as a resale certificate only if it contains the purchaser’s Pennsylvania Sales and Use Tax

22.Rhode Island: Rhode Island allows this certificate to be used to claim a resale exemption only when the item will be resold in the same form. It does not permit this certificate to be used to claim any other type of exemption.

23.South Dakota: Services which are purchased by a service provider and delivered to a current customer in conjunction with the services contracted to be provided to the customer are claimed to be for resale. Receipts from the sale of a service for resalele by the purchaser are not subject to sales tax if the purchaser furnishes a resale certificate which the seller accepts in good faith. In order for the transaction to be a sale for resale, the following conditions must be present:

(a)The service is purchased for or on behalf of a current customer;

(b)The purchaser of the service does not use the service in any manner; and

(c)The service is delivered or resold to the customer without any alteration or change.

24..Texas: Items purchased for resale must be for resale within the geographical limits of the United States, its territories, and possessions.

25.Washington: a) Blanket resale certificates must be renewed at intervals not to exceed four years;

b)This certificate may be used to document exempt sales of “chemicals to be used in processing ann article to be produced for sale.”

c)Buyer acknowledges that the misuse of the tax due, in addition to the tax, interest, and any other penalties imposed by law.

26.Wisconsin: Wisconsin allows this certificate to be used to claim a resale exemption only. It does not permit this certificate to be used to claim any other type of exemption.

REVISED 3/13/2019

4

Frequently Asked Questions

Uniform Sales and Use Tax Certificate – Multijurisdictional

•To whom do I give this certificate?

•Can I register for multiple states simultaneously?

•I have received this certificate from my customer. What do I do with it?

•Am I the Buyer or the Seller?

•What is the purpose of this certificate?

•How do I fill out the certificate?

•What information goes on the line next to each state abbreviation?

•What if I don’t have an ID number for any (or some) state(s)?

•Who should use this certificate?

•Can I use this certificate?

•Which states accept the certificate?

•I am based in, buying from, or selling into Maine. Can I use this certificate?

•I am a drop shipper. Can I use this certificate?

•Do I have to fill this certificate out for every purchase?

•Can this certificate be used as a blanket certificate?

•Who determines whether this certificate will be accepted?

•I have been asked to accept this certificate. How do I know whether I should accept it?

•Is there a more recent version of this certificate?

•To whom should I talk to for more information?

To whom do I give this certificate?

If you are purchasing goods for resale, you will give this certificate to your vendor, so that your vendor will not charge you sales tax.

If you are selling goods for resale, and you have received this certificate from your buyer, you will keep the certificate on file.

Can I register for multiple states simultaneously?

Click on the link for more information: www.sstregister.org

I have received this certificate from my customer. What do I do with it?

Once you have examined the certificate and you have accepted it in good faith, you will keep it on file as prescribed by applicable state laws. The relevant state will generally be the state where you are located, or the state where the sales transaction took place.

Am I the Buyer or the Seller?

If you are purchasing goods for resale, you are the Buyer. If you are selling goods to a buyer who is purchasing them for resale, you are the Seller.

What is the purpose of this certificate?

This certificate is to be used as supporting documentation that the Seller should not collect sales tax because the good or service sold, or the Buyer, is exempt from the tax.

How do I fill out the certificate?

The individual filling out the certificate is referred to as the Buyer. The first two lines, “Issued to Seller” and

REVISED 3/13/2019

5

“Address”, should be filled in with the name and address of the Seller. The rest of the information refers to the Buyer (name and address of Buyer, business engaged in, description of business, property or services to be purchased). The line next to each state abbreviation should be filled out with the relevant state ID number.

What information goes on the line next to each state abbreviation?

The line next to each state abbreviation should be filled in with the relevant state ID number. This will be an identification number issued by the state (see next FAQ for an exception). For example, on the line next to AL, provide the ID number issued by Alabama.) The relevant ID number may be given various names in the various states. Some of the terms for this ID number are State Registration, Seller’s Permit, or ID Number. Regardless of the name, this will be a number that has been issued by the state to the Buyer (see next FAQ for an exception). This number is generally associated with the reseller’s authority to collect and remit sales tax.

What if I don’t have an ID number for any (or some) state(s)?

The states vary in their rules regarding requirements for a reseller exemption. Some states require that the reseller (Buyer) be registered to collect sales tax in the state where the reseller makes its purchase. Other states will accept the certificate if an ID number is provided for some other state (e.g., the home state of the Buyer). You should check with the relevant state to determine whether you meet the requirements of that state.

Who should use this certificate?

A Buyer who is a reseller of tangible property or taxable services from a Seller located in one of the states listed may be able to use this certificate for sales tax exemption. States vary in their policies for use of this certificate. Questions regarding your specific eligibility to use this certificate should be addressed to the revenue department of the relevant state.

Can I use this certificate?

The states vary in their rules for use of this certificate. You should check with the relevant state to determine whether you can use this certificate. The relevant state may be the state where the Seller is located, where the transaction takes place, or where the Buyer is located. The footnotes to the certificate provide some guidance; however, the Multistate Tax Commission cannot guarantee that any state will accept this certificate. States may change their policies without informing the Multistate Tax Commission.

Which states accept the certificate?

States listed on the certificate accepted this certificate as of July, 2000. States may change their policies for acceptance of the certificate without notifying the Multistate Tax Commission. You may check with the relevant state to determine the current status of the state’s acceptance policy. See next FAQ.

I am based in, buying from, or selling into Maine. Can I use this certificate?

Please contact Maine Revenue Services. See: Sales Instructional Bulletin 54

www.maine.gov/revenue/salesuse/Bull5410092013.pdf

I am a drop shipper. Can I use this certificate?

If you are the Buyer and your Seller ships directly to your customers, you may be able to use this certificate because you are a reseller. However, your Seller may be unwilling to accept this certificate if you are not registered to collect sales tax in the state(s) where your customers are located.

If you are the Seller, and you have nexus with the state(s) into which you are shipping to your Buyer’s customers, you may be required by that state(s) to remit sales tax on those sales if your Buyer is not registered to collect sales tax.

REVISED 3/13/2019

6

Do I have to fill this certificate out for every purchase?

In many cases, this certificate can be used as a blanket certificate, so that you will only need to fill it out once for each of your Sellers. Some states require periodic replacement with a fresh certificate (see notes on certificate). To make filling out the certificate easier, you should fill out your information and all information that does not change, then make photocopies, and then fill out the information that is specific to the transaction.

Can this certificate be used as a blanket certificate?

In many states this certificate can be used as a blanket certificate. You should verify this with the applicable state. A blanket certificate is one that can be kept on file for multiple transactions between a specific Buyer and specific Seller.

Who determines whether this certificate will be accepted?

The Seller will determine whether it will accept the certificate from the Buyer generally according to a good faith standard. The applicable state will determine whether a certificate is acceptable for the purpose of demonstrating that sales tax was properly exempted. The applicable state will generally be the state where the Seller is located or the state where the sales transaction took place, or where the Buyer is located. The Multistate Tax Commission does not determine whether this certificate will be accepted either by the Seller or the applicable state.

I have been asked to accept this certificate. How do I know whether I should accept it?

You should contact your state revenue department if you are not familiar with the policies regarding acceptance of resale exemption certificates.

In order for the certificate to be accepted in good faith by the Seller, Seller must exercise care that the property or service being sold is of a type normally sold wholesale, resold, leased, rented or incorporated as an ingredient or component of a product manufactured by Buyer and then resold in the usual course of its business. A Seller failing to exercise care could be held liable for the sales tax due in some states.

Is there a more recent version of this certificate?

No. The most recent version is posted on our website. You may have seen a version that has been modified in an unauthorized manner. You should not use any version other than the one available on our website.

Whom should I talk to for more information?

For information regarding whether the certificate will be accepted in the applicable state, you should talk to the revenue department of that state. The Multistate Tax Commission’s Member States webpage has links to revenue department websites. For other questions that have not been addressed by these FAQs, you may contact Elliott Dubin at the Multistate Tax Commission,

REVISED 3/13/2019

7

Form Breakdown

| Fact | Description |

|---|---|

| Purpose of Certificate | This certificate is used to document that the seller should not collect sales tax from the buyer because the goods or services, or the buyer, qualify for a tax exemption. |

| California Specifics | In California, this certificate is used as a resale certificate and is subject to provisions of Title 18, California Code of Regulations, Section 1668. It is not valid as an exemption certificate. |

| Validity and Renewal | While a valid resale certificate is effective until canceled by the issuer, other states may require renewal at intervals. |

| Good Faith Requirement | The seller must accept the certificate in good faith, which means ensuring the goods or services sold are eligible for resale by the buyer. |

| Penalties for Misuse | Misuse of the certificate by the seller or buyer can result in penalties such as fines, imprisonment, or loss of the right to issue a certificate in some jurisdictions. |

How to Write California Sales Tax Certificate

When handling the California Sales Tax Certificate form, also applicable in multiple jurisdictions, you are engaging in a process that ensures your business transactions align with state and local tax regulations. This form allows a business to purchase goods without paying sales tax, under the condition those goods are to be resold, or used as a component in a product to be sold. Proper completion and submission of this form exempt you from tax liability at the point of purchase, placing the duty of tax collection onto the final sale to the consumer. Here's how to correctly fill out the form:

- Issued to Seller: Enter the name and address of the seller from whom you are purchasing the goods.

- Name of Firm (Buyer): Write your business name.

- Check the box that corresponds to your role (Wholesaler, Retailer, Manufacturer, Seller (California), Lessor, or Other). If you select "Other," specify your business type.

- Description of Business: Provide a brief description of your business operations.

- General description of tangible property or taxable services to be purchased from the Seller: Describe the items or services you're purchasing for resale.

- State Registration, Seller’s Permit, or ID Number of Purchaser: For each state listed that you are registered in, provide your registration or seller's permit number. If you're not registered in a state or don’t have an ID number, leave the corresponding line blank or enter “N/A.”

- Under the certification statement, which acknowledges your responsibility for reporting and paying tax if the goods are used rather than resold, provide the authorized signature. This must be the owner, partner, corporate officer, or an authorized agent signing on behalf of the purchaser.

- Include the Title of the individual signing the certificate.

- Record the Date when the certificate was completed and signed.

Once the form is filled out, retain a copy for your records and provide the original to the seller. It’s essential to understand that this document must be regularly updated and provided to each supplier to avoid unintentional tax liabilities. If your business operation or registration information changes, or if requested by the seller, you might need to submit a new form to reflect those changes. Complying with these steps not only facilitates your business’s compliance with tax laws but also helps maintain seamless relations with your suppliers.

Listed Questions and Answers

To whom do I give this certificate?

You should give this certificate to the seller when you are purchasing goods that you intend to resell in some form. This tells the seller that they should not charge you sales tax on these purchases because you plan to resell the items, which means sales tax will ultimately be collected when you sell the items to the final consumer. If you are the seller and receive this certificate from a buyer, it is your responsibility to keep it on file according to the specific requirements of your state’s tax authority.

Can I register for multiple states simultaneously?

Yes, you can register for multiple states simultaneously by using a centralized registration website, such as www.sstregister.org . This website is part of the Streamlined Sales Tax Project and allows businesses to register in multiple states where they have a sales tax obligation.

I have received this certificate from my customer. What do I do with it?

Upon receiving this certificate from your customer, you must verify that it is filled out completely and correctly, and that it makes a valid claim of tax exemption or resale. You should then keep the certificate on file. It's important to ensure that you accept this certificate in good faith, which means you have no reason to believe that the purchases are not for resale. The specifics on recordkeeping can vary by state, so it’s wise to check with your state’s tax authority to confirm the precise requirements.

Am I the Buyer or the Seller?

If you are purchasing goods with the intention of reselling them, you are considered the Buyer. As the Buyer, you are responsible for providing the resale certificate to the seller to document that the transaction is exempt from sales tax. If you are the one selling goods to someone who will resell them, you are the Seller. As the Seller, you must retain the certificate as proof that the sale was exempt from sales tax.

What is the purpose of this certificate?

The purpose of this certificate is to document that the buyer is purchasing goods for resale and that these purchases should not be subject to sales tax. It serves as a declaration by the buyer that the goods are being bought for the purpose of being resold in the normal course of business. The certificate helps prevent double taxation of goods – first, when purchased for resale and again when sold to the final consumer.

How do I fill out the certificate?

To properly fill out the certificate, you, as the Buyer, must include the following details:

- Your business name and address.

- The type of business you operate (e.g., wholesaler, retailer).

- A description of the goods you are purchasing.

- Your state resale tax registration or ID number for any state where you will resell the items.

- Your signature, title in the company, and the date of signing.

What information goes on the line next to each state abbreviation?

Next to each state abbreviation, you should enter your state registration, seller’s permit, or ID number as it pertains to that specific state. This number serves as proof that you are registered to collect sales tax or are authorized to purchase items for resale in that state. If you do not have a registration number because you are not registered in a particular state, consult that state's rules, as you might not be eligible to use this certificate for purchases related to that state.

Common mistakes

Filling out the California Sales Tax Certificate form accurately is crucial for businesses to ensure compliance with tax regulations. Common mistakes can lead to penalties or invalidate the exemption. Here are nine mistakes people often make:

- Not providing complete information: Omitting details such as the name of the firm, address, or the type of business (e.g., wholesaler, retailer) can render the certificate incomplete.

- Incorrect identification number: Using an incorrect state registration, seller’s permit, or ID number can lead to the rejection of the certificate.

- Invalid business description: Failing to provide an accurate description of the business or the tangible property or taxable services to be purchased can invalidate the certificate.

- Not specifying the nature of exemption: The certificate requires the buyer to specify the basis for exemption (e.g., resale, ingredients or components). Ambiguities here can cause complications.

- Signing issues: The certificate must be signed by an authorized individual. Unsigned or improperly signed certificates are not valid.

- Outdated certificates: Using an outdated form can lead to compliance issues, as tax laws and certificate requirements change over time.

- Non-specific descriptions: Vague descriptions of items to be purchased or the purpose of purchase can lead to misunderstandings and potential tax liabilities.

- Failure to update: Not updating the certificate regularly or when business information changes can lead to its invalidation.

- Misunderstanding the certificate’s scope: Assuming the certificate covers more types of exemptions or jurisdictions than it actually does can lead to improper use.

To avoid these errors, it is important to:

- Review the certificate thoroughly before submission.

- Consult the latest regulations and guidelines from the relevant tax authorities.

- Ensure that all sections of the certificate are filled out with current and accurate information.

- Seek professional advice if there are any doubts about how to properly complete the form.

By paying close attention to these details, individuals and businesses can better navigate the complexities of tax exemption and resale certification, reducing the risk of penalties and ensuring compliance with state and local tax laws.

Documents used along the form

When dealing with the California Sales Tax Certificate form, specifically the UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE — MULTIJURISDICTION, it is crucial for businesses to understand that this is just one of the essential documents in a suite that facilitates tax compliance and business operations. In California, and indeed in dealing with transactions across multiple jurisdictions, this certificate plays a pivotal role in the resale and exemption process. However, to fully comply with tax laws and streamline the process of tax exemptions or resale operations, several other forms and documents are often used alongside this certificate.

- California Seller’s Permit Application: This document is essential for businesses looking to sell or lease tangible goods that are ordinarily subject to sales tax. It registers the business with the California Department of Tax and Fee Administration (CDTFA), allowing it to collect sales tax from customers and report those amounts to the state.

- Resale Certificate Acceptance Statement (BOE-230): This statement is a declaration by the seller that they are accepting a resale certificate in good faith from the buyer. The document serves as a safeguard, acknowledging that the seller believes the buyer intends to resell the purchased good or service.

- Statement of Delivery Outside California (CDTFA-447): For transactions where goods are shipped to out-of-state destinations, this form details the terms of the sale and delivery. It helps ensure that sales tax is not improperly applied to items not taxable in California due to their delivery location.

- Exemption Certificate for Purchases for Resale (BOE-230A): Similar to the resale certificate, this form is specifically targeted at transactions where the purchaser is buying goods to resell in the same form. It provides a documented claim that the purchase should not be taxed because it is intended for resale, differentiating it from other types of exemptions.

Together, these documents work in conjunction to ensure that businesses can efficiently and accurately navigate the complexities of sales and use tax regulations, both within California and when dealing with multi-jurisdictional transactions. It is the responsibility of businesses to stay informed and compliant with these requirements, as they vary not only by state but often by the specific nature of the transaction involved.

Similar forms

The California Sales Tax Exemption Certificate closely parallels a Resale Certificate used in many states. Resale Certificates allow businesses to purchase goods tax-free that will be resold in the normal course of operation. Both documents serve to exempt the buyer from paying sales tax at the point of purchase, emphasizing the responsibility of the buyer to collect and remit sales tax upon the final sale of the goods. Both require the buyer’s registration or permit number and are based on the principle of resale in the course of business.

Another document resembling the California Sales Tax Certificate is the Multistate Tax Commission’s Uniform Sales & Use Tax Exemption Certificate. While the California form is specifically used within the state and for certain multistate purposes, the Multistate Certificate is designed to streamline the exemption process across participant states. Both forms include similar information, such as business and seller details, and the purpose of the exemption, aiming to simplify tax-exemption claims for interstate commerce.

The Exemption Certificate is a document that shares similarities with the California Sales Tax Certificate, particularly in its purpose to exempt organizations from sales tax on eligible purchases. Exemption certificates are often used by non-profit organizations, religious groups, and government agencies. Like the California Sales Tax Certificate, it requires identification of the buyer and the specific reason for exemption, establishing a legal basis for not collecting sales tax at the point of sale.

The Direct Pay Permit is akin to the California Sales WTax Certificate, as it allows the holder to purchase goods or services tax-free with the understanding that the taxpayer will directly remit the tax due to the state. Both documents relieve the seller from the responsibility to collect sales tax at the time of sale and place the onus on the buyer—the direct pay permit holder or certificate holder—to account for the tax. The primary difference is the direct pay permit’s broader application to use tax as well.

The Farmer’s Exemption Certificate also shares similarities with the California Sales Tax Certificate by allowing individuals or entities involved in agricultural production to purchase supplies and equipment without paying sales tax. Both certificates require the buyer to certify the intended use of the purchased goods, underscoring the exempt status of certain goods when used in qualifying activities.

The Streamlined Sales and Use Tax Agreement (SSUTA) Certificate of Exemption mirrors the California Sales Tax Certificate in facilitating tax-exempt purchases for resale or other exempt purposes across participating states. Like the California certificate, the SSUTA Certificate is designed for use in multiple jurisdictions but with a broader range of participating states, emphasizing the harmonization of sales and use tax collection and exemption processes among states.

A Vehicle Exemption Certificate applies to transactions involving vehicles and is conceptually similar to the California Sales Tax Certificate when it comes to tax-exempt purchases or leases. While the California certificate is more general, both forms function to exempt eligible buyers from tax in certain conditions, albeit the Vehicle Exemption is specifically tailored to the automotive sector.

The Use Tax Certificate is akin to the California Sales Tax Certificate, as both are used in situations where sales tax is not collected at the point of purchase. The key difference lies in the application; the Use Tax Certificate is specifically for use tax purposes. Both documents require the buyer to certify their eligibility for the exemption and are integral in ensuring tax compliance.

The Foreign Diplomat Tax Exemption Cards issued by the U.S. Department of State offer a parallel to the California Sales Tax Certificate by providing a tax exemption on purchases made by diplomats and eligible foreign officials in the United States. While the scope is more specific, focusing on individuals rather than business transactions, both exemption forms serve the purpose of identifying transactions that are not subject to sales tax, highlighting the buyer’s responsibility to prove their exemption status.

The Manufacturing Exemption Certificate shares a specific connection with the California Sales Tax Certificate, focusing on exemptions for equipment and machinery purchased for use in manufacturing. Both certificates are critical in identifying business purchases that qualify for exemption from sales and use taxes, based on the role those purchases play in the buyer’s operational activities. The key is the specific use of purchased goods in production or manufacturing, which aligns with the larger role of exemptions in encouraging economic activities within specific sectors.

Dos and Don'ts

When dealing with the California Sales Tax Certificate form, accurately completing and submitting this document is crucial for ensuring compliance with state tax laws, particularly if you're buying or selling goods intended for resale. Here is a comprehensive guide to help you navigate the process smoothly:

Do:

- Read all the instructions carefully before filling out the form to ensure that you understand the requirements and provide accurate information.

- Ensure that you check the appropriate boxes that accurately describe the nature of your business (e.g., wholesaler, retailer, manufacturer).

- Provide a detailed description of the business and the type of tangible property or taxable services to be purchased. This helps clarify the purpose of the purchases.

- Include all necessary state registration, seller’s permit, or ID numbers for states where you are registered. This is critical for multi-jurisdictional compliance.

- Make sure to sign and date the form. An unsigned form is considered incomplete and invalid.

- Keep a copy of the completed form for your records, adhering to the record-keeping requirements in case of any future audits or inquiries.

- Ensure that the form is submitted timely to the seller to avoid unnecessary tax charges.

- Validate the certificate periodically; requirements may change, and it's essential to ensure ongoing compliance.

- If using the certificate for multiple states, confirm its acceptance in each jurisdiction, as rules and acceptance may vary.

- Revise and update the certificate as needed, especially if there are significant changes to your business operations or the law.

Don't:

- Assume the form applies universally for all states without verifying each state’s acceptance and requirements.

- Use the form for purchases not intended for resale or exempt purchases unless absolutely sure it meets the state's specific exemption criteria.

- Fill out the form hastily without verifying all the information, particularly the accuracy of the state registration or ID numbers.

- Forget to specify the role (e.g., buyer or seller), as this clarifies the responsibility and use of the certificate.

- Overlook the details related to the description of the goods or services being purchased. Vagueness can lead to the form being questioned or invalidated.

- Ignore expiration dates or renewal requirements for the certificate. Some states require periodic renewal or updating.

- Dismiss the importance of keeping the signed form on file. Adequate record-keeping is essential for compliance.

- Neglect to inform the seller if the form becomes invalid or requires updating due to changes in business operations.

- Use an outdated form, as laws and regulations frequently change. Always check for the most recent version.

- Rely solely on the certificate to avoid tax liability without understanding the full extent of your tax obligations.

By following these guidelines, businesses can ensure that they properly use the California Sales Tax Certificate form, thereby maintaining compliance with sales and use tax laws while fulfilling their resale certification responsibilities efficiently.

Misconceptions

Understanding the California Sales Tax Certificate can be complex, with several misconceptions surrounding its use and applicability. Here's a detailed look at six common myths and clarifications for each:

- Misconception 1: The California Sales Tax Certificate form grants an automatic exemption from sales tax. The reality is that this certificate allows for the purchase of items without paying sales tax at the point of sale, but only under specific conditions such as for resale, manufacturing, or as components in new products sold. The buyer has the responsibility to sell, lease, or rent the items in the normal course of their business.

- Misconception 2: The certificate is applicable for all transactions in California. While the California Sales Tax Certificate form is widely utilized, its application is only valid when the buyer is purchasing items for resale. The form cannot be used for personal purchases and is only applicable to certain types of business transactions.

- Misconception 3: Once issued, the certificate never needs to be renewed. Contrary to this belief, the certificate does not have a permanent validity. It remains effective until the issuing business cancels it in writing or a revocation is made by the city or state. Validity can also depend on compliance with state regulations, which may change.

- Misconception 4: All states accept the California Sales Tax Certificate. While many states recognize the uniform sales and use tax exemption certificate, each state has its own rules and regulations regarding tax-exempt transactions. It is important to consult the specific requirements of each state where transactions occur.

- Misconception 5: The certificate can be used to purchase any goods or services tax-free. In fact, the use of this certificate is limited to the purchase of tangible personal property or taxable services that will be resold in the normal course of business. Items or services utilized in any way outside of resale, lease, or rental, even if indirectly related to the business, may not qualify under the terms of the certificate.

- Misconception 6: Any business can use the California Sales Tax Certificate form. To use this certificate, the business must be engaged in selling, leasing, or renting tangible personal property or taxable services that are eligible under the state law. Furthermore, the business must be registered with the states and cities listed on the certificate where they intend to deliver purchases. Simply operating a business does not automatically qualify the owner to use this certificate.

It's crucial for buyers and sellers to understand these stipulations to ensure compliance with state and local tax laws, thereby avoiding penalties. Always consult current tax regulations and possibly a tax professional when using the California Sales Tax Certificate form to ensure proper use and adherence to legal requirements.

Key takeaways

When using the California Sales Tax Certificate form, it's important to keep the following key takeaways in mind:

- This form is recognized across multiple jurisdictions and is essential for businesses that operate in or sell to customers in states accepting this certificate.

- It's the responsibility of both the issuer (the buyer) and the recipient (the seller) to ensure the proper use of this certificate under the laws of each relevant state, which may change.

- The form specifically caters to businesses such as wholesalers, retailers, manufacturers, lessors, and sellers, among others, allowing them to purchase goods without paying sales tax if those goods are meant for resale.

- Accurate business information, including the nature of the business and a description of the tangible property or taxable services to be purchased, must be detailed on the form.

- State registration, seller’s permit, or ID numbers of the purchaser are crucial elements of the form, ensuring that transactions are tracked and legitimized by state authorities.

- The certificate must be signed by an authorized individual, such as an owner, partner, corporate officer, or someone with legal authority to sign on behalf of the business, asserting the truthfulness of the information provided under penalty of perjury.

- This document serves as a part of each order placed by the purchaser until it's canceled in writing or revoked by the state or city.

- Sellers must exercise due diligence when accepting this certificate to ensure that the sale fits the criteria for tax exemption. Failing to do so could result in tax liabilities.

- Misusing the certificate can lead to serious consequences, including fines, imprisonment, or the loss of the right to issue such certificates in some states or cities.

- Certain states have specific conditions and limitations on the use of this certificate for claiming tax exemption or resale, highlighting the importance of understanding and complying with state-specific regulations.

Understanding these critical points can help sellers and buyers navigate sales and use tax laws more effectively, ensuring compliance and avoiding any legal issues that may arise from improper use of the California Sales Tax Certificate form.

Different PDF Templates

Affidavit of Non-use - REG 5090 form allows California residents to report a vehicle as not in use to the DMV.

Ca 109 - Add-on taxes or recapture of credit adjustments are also reported, with specific instructions for different scenarios.